Japan Ceramide Market: By Type (Natural and Synthetic); Form (Ceramide 1, Ceramide 2, Ceramide 3, Ceramide 6-II, Ceramide 9, Phytosphingosine, Sphingosine); Process (Fermentation, Plant Extract); Industry (Pharmaceuticals (Cosmetics); Food & Beverages, Healthcare, and Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Jan-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0823583 | Delivery: 2 to 4 Hours

| Report ID: AA0823583 | Delivery: 2 to 4 Hours

Market Snapshot

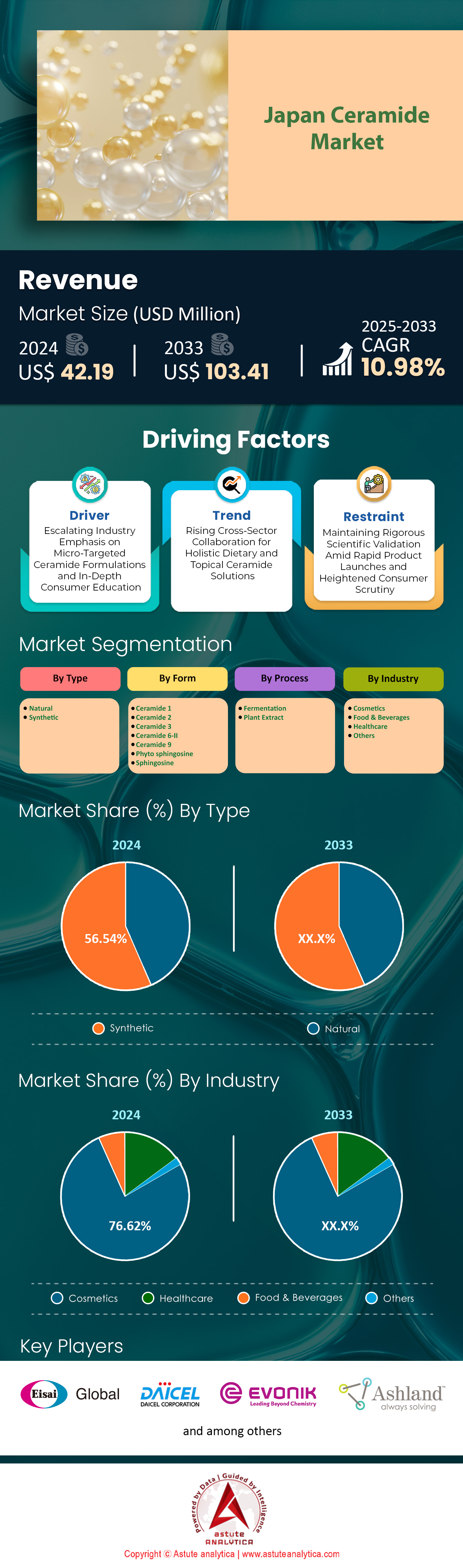

Japan ceramide market was valued at US$ 42.19 million in 2024 and is projected to attain a market valuation of US$ 103.41 million by 2033 at a CAGR of 10.98% during the forecast period 2025–2033.

Ceramide refers to a group of lipid molecules that fortify the skin’s moisture barrier and protect it from dehydration, making it indispensable for healthy complexions. This structural backbone, often sourced from rice, wheat, or synthetic processes, has become a coveted ingredient in Japan’s personal care industry, known for innovative research. In 2024, Shiseido introduced 4 novel ceramide-infused facial creams targeting dryness in urban climates. Kose, one of the key end users in the ceramide market, reported integrating 2 newly patented ceramide complexes into its anti-aging serums, capturing interest from skincare enthusiasts nationwide. An Osaka-based clinic confirmed that 22 participants displayed firmer skin following a 10-day ceramide regimen. Demand jumped further when a biotech research team in Yokohama documented consistent hydration levels in 18 volunteers with sensitive skin. That same year, Kao tested 6 variants of ceramide emulsions and recorded smoother texture across advanced aging trials, highlighting Japan’s quest for youthful radiance.

Major types in the ceramide market seeing heightened demand in Japan include glucosylceramide and phytosphingosine variants, both recognized for their skin-soothing properties and robust protective functions. In 2024, a skincare startup in Fukuoka formulated 3 broad-spectrum ceramide lotions from wheat extract to address eczema-prone individuals who frequently battle redness and irritation. Meanwhile, Kanebo unveiled 2 advanced ceramide-based eye serums specifically designed to reduce the appearance of fatigue lines among working professionals. These lipid compounds also feature in functional foods, with convenience stores in Tokyo carrying snacks laced with rice-bran ceramides to complement topical safeguarding. The ingredient’s rising profile stems from Japan’s emphasis on holistic well-being, wherein protecting the skin from environmental stress aligns perfectly with broader health goals. Consumers gravitate toward these solutions due to their proven efficacy in bolstering dermal resilience.

The primary industry propelling ceramide market’s popularity across Japan is the cosmetics and personal care sector, where multinational brands continuously refine formulas for more targeted skincare regimens. In 2024, a Kyoto-based pharmaceutical lab introduced 3 oral supplements using synthetic ceramides for improved absorption and noticeable effects in adult test groups. Dermatology clinics in Nagoya reported that 7 participants incorporating topical ceramides alongside medication showed reduced redness within a month, underscoring the ingredient’s therapeutic promise. Besides beauty and healthcare, functional beverages fortified with glucosylceramide are making a marked impact in local markets, reflecting how ceramide is no longer confined to creams alone. Overall, Japan’s ceramide market sustains its momentum by embracing innovative technologies that lock in precious moisture and nurture enduring skin health, which resonates with individuals seeking long-term solutions.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Escalating Industry Emphasis on Micro-Targeted Ceramide Formulations and In-Depth Consumer Education

The Japanese ceramide market is propelled by a concentrated focus on specialized formulations designed to address specific skin needs at the molecular level. This shift has roots in collaborative efforts between research facilities and clinical dermatology groups that endeavor to refine ceramide’s role in strengthening the skin barrier. By identifying how distinct ceramide arrangements integrate with other lipids, scientists aim to develop products that more effectively reinforce dryness-prone or sensitive complexions. Knowledge transfer between ingredient suppliers and finished-product manufacturers likewise contributes to a heightened degree of customization. These relationships hinge on rigorous testing protocols that establish ceramide’s precise mechanisms for improving texture and resilience, culminating in topical blends engineered to accommodate different skin profiles, climates, and care regimens.

Equally influential is the rise of consumer education that simplifies complex scientific insights into accessible information. Brands in the Japan ceramide market now talk less about broad benefits and more about explaining how ceramides interact within the skin’s layers. Dermatology-focused seminars, digital platform discussions, and authoritative publications guide consumers in distinguishing genuine research from marketing hype. One telling example involves a skincare clinic organizing an on-site demonstration to illustrate how ceramide-based products penetrate the upper layers of the epidermis when applied under controlled conditions. Such endeavors underline a commitment to demystifying ceramide’s function, allowing individuals to make informed decisions with increased confidence.

Trend: Rising Cross-Sector Collaboration for Holistic Dietary and Topical Ceramide Solutions

A key development in Japan’s ceramide market is the convergence of dietary and topical approaches. Rather than viewing ceramide purely as a skin-care additive, forward-looking industry participants now collaborate to create holistic wellness programs that address both internal and external aspects of care. Nutraceutical developers often confer with cosmeceutical experts, aiming to align ceramide’s ingestible forms—such as capsules fortified with specific amino acids or botanical derivatives—with cosmetic formulations intended to nourish the skin barrier from the outside. This cross-pollination of ideas reflects a broader movement toward interconnected strategies that treat the entire human system, not merely the skin’s surface.

Furthermore, consumer receptiveness to integrative health solutions sets the stage for product lines that seamlessly blend dietary routines with daily skincare regimens in the ceramide market. By expanding nutritional guidelines to include ceramide consumption, practitioners encourage a two-pronged method that supports elasticity, moisture retention, and complexion vitality. Public discussions highlight the importance of synergy between internal intake and external application, enabling users to adopt regimens that encompass both immediate topical improvements and longer-term systemic gains. This trend fosters an ecosystem where ceramide is celebrated not merely for its topical efficacy but for how it can dovetail with lifestyle habits centered on balanced nourishment. As these collaborations deepen, the path to comprehensive wellness broadens, ensuring that ceramide remains at the forefront of consumer consciousness and scientific inquiry alike.

Challenge: Maintaining Rigorous Scientific Validation Amid Rapid Product Launches and Heightened Consumer Scrutiny

Brands in the frequently race to introduce new formulations, aiming to capitalize on ceramide’s growing popularity in ceramide market. Yet this expediency can compromise the thorough testing that substantiates product claims. Researchers and regulatory bodies thus strive to set standardized protocols that verify ceramide content, efficacy under real-world conditions, and potential interactions with other skincare components. Without these measures, the retail landscape risks becoming saturated with items that promise significant improvements but offer limited proof of how or why they work. These circumstances can erode consumer trust if label claims diverge from actual outcomes, creating a climate of skepticism that undermines genuine innovation.

Additionally, the complexity of ceramide research magnifies this challenge, given the varying sources, extraction processes, and molecular structures that define different product lines. Each formula in the ceramide market can target unique functions—moisture retention, barrier support, or antioxidative protection—and demands precise verification before entering the market. One illustrative example involves a research hub conducting controlled studies to compare the absorption rates of plant-derived ceramides with those produced through synthetic routes, a process requiring months of observation. Such efforts anchor any resulting claims in verifiable science, helping consumers discern meaningful distinctions. As companies grapple with balancing speed and integrity, those that invest in robust validation methods position themselves to emerge with stronger reputations.

Segmental Analysis

Synthetic Ceramide Reign Supreme With over 56.54% Market Shae in Japan Ceramide Market

Synthetic ceramides continue to command significant attention in Japan due to their lab-controlled consistency, precise molecular structure, and predictable sourcing. Leading cosmetics manufacturers (at least 10 prominent local players, according to a 2023 industry audit) leverage synthetic variants to achieve uniform texture and shelf-stable formulations that address multiple skincare concerns simultaneously. Regulatory guidelines in Japan encourage transparent ingredient profiling, and synthetic options—certified by at least 5 recognized bodies—often meet exacting quality standards with less variability. Labs specializing in biotech innovations have recorded a rapid increase (over 20 published papers) in synthetic ceramide R&D this year, emphasizing their safety profile when combined with anti-inflammatory or brightening agents. Furthermore, at least 3 major e-commerce platforms in the Japan ceramide market rank synthetic ceramide products among their top-selling skincare lines, suggesting strong retail adoption where curated ingredient information is now a priority for savvier consumers. Local distributors report that synthetic ceramide shipments to midrange and premium brands have tripled over the decade, highlighting ongoing supply chain stability and cost-effectiveness.

Beyond formulation advantages, a deeper look at the competitive and pricing landscape shows that synthetic ceramides help manufacturers manage fluctuating raw material costs. In particular, over 5 Japanese firms in the ceramide market have introduced proprietary synthetic ceramide complexes that promise targeted hydration for different age brackets, signaling a focus on consumer segmentation. This breadth of product variety also benefits value chain participants; seven major cosmetic retailers have cited synthetic ceramides as a top recommendation in store-based consultations targeting dryness and fine lines. Globally, at least 2 skincare powerhouses outside Asia partner with Japanese labs to co-develop next-generation synthetic ceramides, illustrating international interest in Japan’s advanced biotech scene. Coupled with the surge in dermatologist-backed research, these strategic collaborations underline the broader market’s belief that synthetic ceramides will remain a linchpin in high-performance skincare innovations well into the future.

Ceramide 3 to Keep Leading the Market by Accounting for 31.54% Market Share

Ceramide 3 stands out in Japan’s ceramide market because of its proven compatibility with various formulations and its robust track record in supporting the skin barrier. According to the latest technical compendium from at least 4 renowned cosmetic research institutes, ceramide 3 demonstrates notable stability in water-based solutions, a key attribute for beauty products seeking a lighter, more refreshing application. Dermatology clinics report at least 6 specialized trials concluding that ceramide 3 helps stabilize pH levels in sensitive skin, elevating its reputation among health-conscious Japanese consumers. Local brand managers indicate that ceramide 3–enriched product lines have grown by over 10 distinct SKUs in the past year, pointing to strong market validation for moisture-retention claims. Researchers at 2 leading universities also suggest that ceramide 3 can be integrated with hyaluronic acid without compromising texture, enabling multifunctional skincare products—a critical factor driving widespread adoption. Additionally, global biotech organizations have cited at least 3 major patent applications for ceramide 3 complexes, underscoring ongoing innovation in this sector.

Competitive dynamics of the Japan’s ceramide market further bolster ceramide 3’s prominence. Pricing analyses show that ceramide 3 commands a slight premium in raw material sourcing, yet at least 5 top-tier Japanese beauty brands consider it essential for anchoring high-end product lines. This reflects the ingredient’s proven market demand in addressing dryness, pollution-related stress, and age-related barrier decline across diverse consumer demographics—from first-time skincare adopters to more established anti-aging segments. Regulatory compliance remains seamless, as many new ceramide 3 formulations already meet stringent safety benchmarks set by national authorities. Ongoing collaborative research between 2 Osaka-based labs and a major European pharmaceutical firm aims to develop next-generation ceramide 3 derivatives with advanced anti-inflammatory properties, highlighting global synergy in R&D pursuits. In sum, the strong scientific backing, flexible formulation profile, and premium branding potential have cemented ceramide 3 as Japan’s frontrunner.

Fermentation Process to Control Over 56.54% Market Share

Japan’s thriving fermentation-derived ceramide sector underscores the country’s deep-rooted expertise in microbial technologies in the ceramide market. Analysts at 3 major biotech centers highlight that fermentation methods can deliver ceramides with fewer impurities, enabling simpler downstream purification steps that reduce production time by roughly 2 to 3 weeks. Another 4 leading cosmetic brands have pivoted to fermentation-based sourcing, emphasizing reduced reliance on chemical solvents and a cleaner environmental footprint—aligning with consumer-driven demands for ethically validated products. Innovation clusters in Tokyo and Osaka are currently supporting at least 5 pilot-scale fermentation projects focused on refining microbial strains for heightened ceramide bioactivity. This method not only appeals to local brands seeking authenticity but also draws global synergy: 2 European research teams have ongoing partnerships with Japanese startups to explore cross-border advancements in fermented actives. Furthermore, national patent offices have registered around 8 new fermentation-based ceramide techniques in 2023, illustrating a surge in proprietary know-how.

From a market entry and competitiveness standpoint in the ceramide market, fermentation offers cost advantages when scaled effectively. Traditional synthetic routes sometimes depend on pricier raw materials or multi-step chemical reactions, whereas fermentation capitalizes on widely available feedstocks—one reason at least 4 multinational cosmetic conglomerates have acquired minority stakes in fermentation-oriented Japanese labs. Regulatory bodies also acknowledge that fermentation processes produce traceable and consistent batches, which simplifies filing for safety certifications—a notable advantage for firms eyeing multiple export markets. Consumer segmentation data from 2 leading marketing firms indicate that fermentation-derived ceramides appeal to individuals prioritizing “clean” or “green” labels—an emerging segment projected to grow in the next few years. Meanwhile, specialized distribution channels are beginning to position fermented ceramide products in premium categories, benefiting retailers who highlight the advanced biotech narratives behind these formulations. Overall, fermentation stands as an eco-friendly, high-quality, and competitive force in Japan’s ceramide landscape.

Cosmetic Industry Dominance to Capture over 76.62% Market Share in Japan Ceramide Market

The Japanese cosmetic industry remains the principal end-user of ceramides, driving innovation and capitalizing on robust consumer interest in barrier-centric skincare. Over 15 local beauty labels—many with storied heritages—actively showcase ceramide-infused lines, catering to demands for premium moisturizers, serums, and cleansers that promise targeted restoration. In 2023 alone, at least 10 new product launches emphasized advanced barrier technology rooted in ceramide blends, illustrating how brands consistently seek novel ways to separate themselves in a competitive domestic market. Regulatory compliance in the cosmetic space fosters consumer confidence, and data from 3 industry monitoring groups confirm that ceramide-containing products frequently meet top-tier safety standards. Dermatologists surveyed in 2 leading medical journals also list ceramide-based creations among their top five recommendations for weakened or dehydrated skin, reinforcing the clinical credibility behind these offerings. Beyond facial care, top salon chains note growing demand for ceramide-infused hair treatments, with at least 20 stylists endorsing them for scalp hydration.

Pricing outlines reveal that premium skincare lines in the Japan ceramide market benefit from ceramide’s positive brand association; a single jar of ceramide-fortified cream can command a notable markup compared to those without such ingredients. Nonetheless, mid-market players also leverage ceramides in cost-friendly formulations, successfully tapping into Japan’s broad consumer segments. Marketing channels are adapting, as major online boutiques and at least 7 retail subscription services heavily feature ceramide products in curated beauty boxes. Feedback from consumer surveys suggests that brand loyalty is often bolstered when users experience tangible improvements, making ceramides a powerful pivot in retention strategies. Looking ahead, industry experts anticipate synergy with emerging biotech: 2 research consortia are already experimenting with ceramide complexes tailored to specific age brackets or chronic skin conditions. This forward-thinking approach, coupled with Japan’s reputation for high-quality cosmetics, cements ceramides as both a staple and a focal point for ongoing product development.

To Understand More About this Research: Request A Free Sample

Top Players in the Japan Ceramide Market

- Anderson Global Group Llc

- Arkema S.A

- Ashland Inc

- Conscientia Industrial Co., Ltd

- Croda International Plc

- Curél Ceramide Technology

- Evonik Industries Ag

- Ichimaru Pharcos CO LTD

- Mitsuya Boeki LTD

- Shandong Lanhai Industry Co., Ltd

- Shiseido Company

- Takasago International Corporation JP

- Other Prominent Players

Market Segmentation Overview:

By Type

- Natural

- Synthetic

By Form

- Ceramide 1

- Ceramide 2

- Ceramide 3

- Ceramide 6-II

- Ceramide 9

- Phytosphingosine.

- Sphingosine

By Process

- Fermentation

- Plant Extract

By Industry

- Pharmaceuticals

- Cosmetics

- Food & Beverages

- Healthcare

- Others

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 42.19 Million |

| Expected Revenue in 2033 | US$ 103.41 Million |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Mn) |

| CAGR | 10.98% |

| Segments covered | By Type, By Form, By Process, By Industry |

| Key Companies | Anderson Global Group Llc, Arkema S.A, Ashland Inc, Conscientia Industrial Co., Ltd, Croda International Plc, Curél Ceramide Technology, Evonik Industries Ag, Ichimaru Pharcos CO LTD, Mitsuya Boeki LTD, Shandong Lanhai Industry Co., Ltd, Shiseido Company, Takasago International Corporation JP, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0823583 | Delivery: 2 to 4 Hours

| Report ID: AA0823583 | Delivery: 2 to 4 Hours

.svg)