Italy Gambling Market: By Type (Sports (Fixed Odds Sports Betting, Pari-Mutuel Betting (Horse and Dog racing), In-Play/Live Betting, Exchange Betting, Spread Betting, Others), Casino (Blackjack, Baccarat, Teen Patti, Three Card Poker, Four card poker, Red Dog, Others), Lottery Games (Scratch-offs, Bingo, Keno), Electronic Gaming Machines and Others); Channel Type (Offline (Casinos, Betting shops/halls, Arcades, Bookmakers), Online, Virtual Game); Payment Method (Credit and debit cards, E-wallets, Prepaid cards and Vouchers, Bank Transfers, Cryptocurrencies, Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Mar-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA03251254 | Delivery: Immediate Access

| Report ID: AA03251254 | Delivery: Immediate Access

Market Scenario

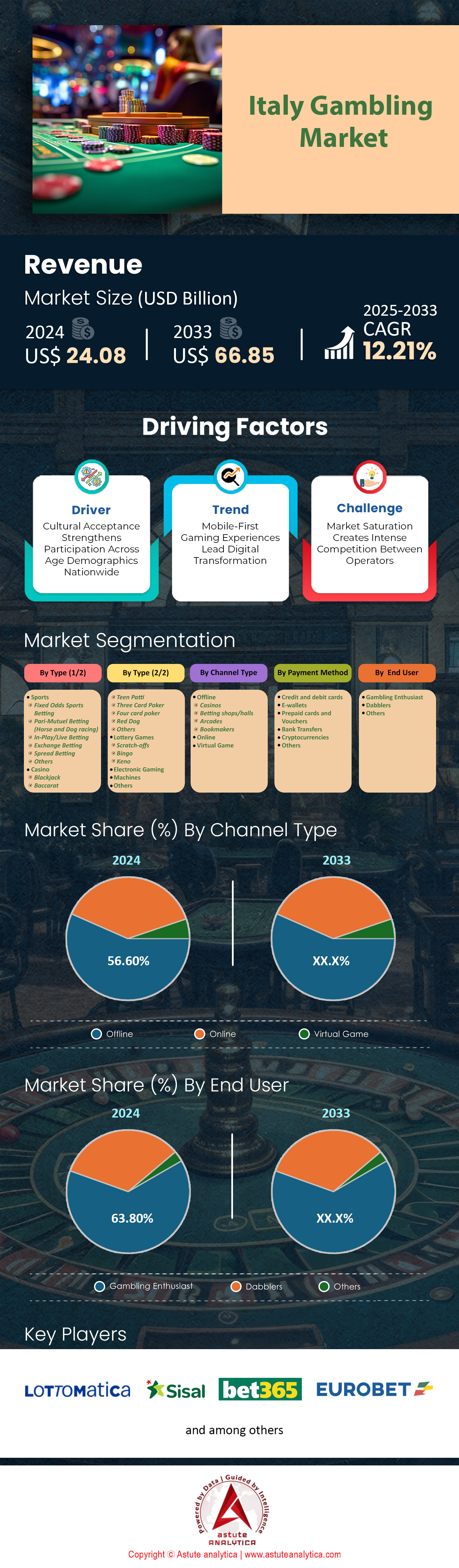

Italy gambling market was valued at US$ 24.08 billion in 2024 and is projected to hit the market valuation of US$ 66.85 billion by 2033 at a CAGR of 12.21% during the forecast period 2025–2033.

The Italy gambling market, deeply rooted in centuries-old traditions and cultural hubs like Venice and Sanremo, continues to evolve at the intersection of heritage and modern innovation. With 42 licensed casinos—often situated near iconic tourist sites—Italy’s elite gaming sector claims a dominant revenue share, attracting 2.1 million annual visitors who blend luxury hospitality with high-stakes play. These venues, recording over 9.2 million annual gaming sessions in 2024, thrive by offering premium amenities, including 200+ slot machines per site, top-tier dining, and VIP services that cater to both domestic elites and international tourists. Regulatory oversight by the ADM (Customs and Monopolies Agency) underpins reliability, with 1,200 monthly audits ensuring fair play and transparency. As tourism remains a key driver, partnerships with travel operators—200 now bundling cultural tours with casino visits—are reinforcing casinos’ role as pillars of Italy’s economy, contributing 2.3 billion euros in yearly Gross Gaming Revenue.

While casinos dominate, the gambling market in Italy balances modern and traditional dynamics. Online gambling has surged, with digital platforms attracting 12.2 million users by 2019 and projected $2 billion in revenue by 2024, driven by mobile adoption (71% penetration) and user-friendly interfaces. Credit and debit cards, used in 43.73% of transactions, secure their ascendancy through speed and security, amplified by low fraud rates (0.018 per 1,000 transactions). Yet offline gambling persists as a social cornerstone: 3,800 betting shops recorded 7.5 million offline visits in 2023, reflecting Italy’s preference for face-to-face interaction and communal excitement. Physical venues, bolstered by live sports viewing, premium hospitality, and loyalty programs, retain a loyal base of over-35-year-olds who value tangible engagement, ensuring the offline sector’s stable, 1.2% growth trajectory despite online competition.

Looking ahead, Italy’s gambling market faces opportunities and challenges shaped by technology, regulation, and cultural relevance. VR/AR immersion and skill-based games (projected to grow with younger demographics) will compete with traditional offerings. Responsible gambling frameworks, supported by self-exclusion programs (85,000 users) and 50 million euros annually for awareness initiatives, aim to ensure sustainability. Tax contributions of 11 billion euros will continue funding public programs, while tourism-driven revenue—projected to add 2.4 million annual casino visits by 2027—will remain vital. Regulatory updates on advertising and data privacy will determine the sector’s agility in balancing innovation with ethical governance. By preserving its cultural appeal, refining tech solutions, and leveraging its blend of modern and historical charm, Italy’s gambling industry is poised to sustain growth, maintaining its title as a European leader in both tradition and innovation without compromising the values that anchor its success.

Economical Impact of Italy’s Gambling Market

Economically, the industry is a major contributor, with tax revenues exceeding EUR 11 billion annually in recent years, a figure likely to grow with tightened regulations and increased inspections planned for 2025-2027. Employment in the sector supports around 150,000 workers, reinforcing its societal footprint. Innovations like virtual reality gaming and esports are also gaining traction, broadening the industry's appeal and ensuring its relevance in a digital age.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Cultural Acceptance Strengthens Participation Across Age Demographics Nationwide

Italy's deeply ingrained gambling culture stems from centuries of social acceptance, evidenced by the presence of 42 licensed casinos and 3,800 betting shops nationwide. This cultural embrace in the gambling market is quantifiably demonstrated through participation rates, with approximately 18% of the adult population actively engaging in gambling activities. The South leads in participation with 27% of residents gambling regularly, compared to 18% in the North-West and 13% in the North-East. This regional variation reflects how cultural attitudes toward gambling differ across Italy's diverse geographical landscape.

The multi-generational acceptance is further illustrated by demographic data showing that 35% of new digital bettors are under 30, while traditional venues maintain a loyal base of players aged 35-55. This broad age spectrum of participation has led to the development of 200 dedicated tour operators combining cultural experiences with gaming entertainment, capitalizing on Italy's unique position as both a historical destination and a gambling hub. The cultural integration is so profound that 76% of international visitors consider gambling "culturally intertwined" with Italy's heritage, contributing to the sector's sustained growth and social legitimacy.

Trend: Mobile-First Gaming Experiences Lead Digital Transformation

The shift toward mobile-first gambling in Italy gambling market is revolutionizing the sector, with 71% mobile penetration for gambling apps in 2021 driving unprecedented access and engagement. This transformation has resulted in 2.6 million active monthly mobile bettors by 2023, showcasing the platform's growing dominance. The convenience of mobile access has particularly resonated with younger demographics, leading to a significant surge in real-time wagering, with 64% of online sports bets now placed "in-play" through mobile devices.

The mobile revolution extends beyond mere accessibility, as evidenced by 74% of surveyed users preferring platforms offering live video streams of events, merging real-time engagement with digital spontaneity. The technology infrastructure supporting this trend is robust, with Italy's internet penetration reaching 92% in 2023 and smartphone adoption hitting 78%, creating a fertile environment for mobile gambling innovation. This has led to 85% of gambling sites implementing instant bank transfer capabilities alongside traditional payment methods, streamlining the mobile betting experience. The trend is further reinforced by operators investing up to 7% of revenue in mobile-specific data analytics and user experience improvements, ensuring platforms remain responsive and user-friendly across all devices.

Challenge: Market Saturation Creates Intense Competition Between Operators

The Italian gambling market's maturity has led to unprecedented competition among operators, with 850 licensed gambling operators vying for market share in 2024. This saturation is particularly evident in the online sector, where 47 dedicated digital operators entered the market between 2020 and 2023 alone, intensifying competition for customer acquisition. The pressure to differentiate has resulted in significant investments, with operators allocating 50 million EUR annually toward customer experience improvements and responsible gambling initiatives.

The competitive landscape has forced operators to innovate continuously, evidenced by 320 dispute resolution centers established nationwide to maintain customer trust and satisfaction. Market data reveals that 87% of local gamblers now base their platform choices on official license seals and reputation, making brand differentiation increasingly challenging. The saturation effect is further demonstrated by licensing fees reaching 250,000 EUR per operator, creating significant barriers to entry while ensuring only well-capitalized entities can compete effectively. Despite these challenges, the market maintains a 90% operator renewal rate, indicating that while competition is intense, the sector remains profitable for established players who can effectively differentiate their offerings and maintain customer loyalty through innovative services and promotions.

Italy’s Gambling Market Evolution: Reforms, Mergers, and Investments

- Legal Reforms Driving Demand

In 2024, Italy introduced a significant reorganization of its online gambling framework, with a new nine-year licensing regime launched in late 2024. This regime, managed by the Agenzia delle Dogane e dei Monopoli (ADM), tendered 50 new online gaming licenses at €7 million each, requiring operators to pay an annual fee of 3% of Gross Gaming Revenue (GGR) net of taxes and invest 0.2% of GGR in responsible gaming initiatives. This reform, effective as of 2025, aims to increase oversight, reduce market fragmentation, and maximize tax revenue. The high entry cost and stringent suitability criteria are pushing smaller operators out, consolidating the market among larger, financially robust players. This shift is increasing demand by fostering a more secure and transparent environment, appealing to players who value regulated platforms over the black market, which still accounts for an estimated €25 billion annually. Additionally, discussions in early 2025 about potentially revising the 2019 Dignity Decree’s advertising ban—part of Phase 2 reforms targeting land-based gambling—could further boost demand by allowing operators to market legally, making it easier for players to distinguish licensed sites, thus potentially reducing reliance on unregulated options.

- Funding and Investments Fueling Growth in Italy Gambling Market

Investment activity is another key driver shaping demand. In November 2024, Betski, an emerging iGaming platform, secured $345,000 in pre-seed funding from multiple investors, signaling strong interest in Italy’s online gambling potential. This funding is directed toward mobile gaming, esports, and AI-driven personalization—segments with high growth potential that resonate with younger demographics like Millennials and Gen Z. Such investments enhance platform quality and accessibility, directly increasing player interest and participation. Additionally, major operators like Lottomatica and Sisal are channeling funds into technological upgrades, such as virtual reality (VR) gaming and improved online infrastructure, as noted in market analyses from 2023-2024 with effects carrying into 2025. These enhancements elevate the gaming experience, driving demand by attracting tech-savvy users and retaining existing players. The focus on esports and digital innovation aligns with projections of the online gambling market reaching 4.3 million users by 2029, reflecting sustained investment momentum into 2025.

Segmental Analysis

By Type

Casinos in Italy gambling market have established a remarkable foothold in the gambling sector with over 46.48% market share, driven by a resilient tradition that dates back centuries. Currently, there are 42 licensed casinos operating within key tourist destinations, aligning gaming with cultural experiences for both residents and visitors. In 2024, officials recorded a notable 9.2 million gaming sessions across these land-based establishments, reflecting the consistent demand for in-person entertainment. Major cities such as Venice, Campione d’Italia, and Sanremo house some of the country’s most iconic casinos, drawing a collective influx of 2.1 million tourists annually who specifically visit for gaming activities. The synergy between heritage sites and glamorous casino offerings has bolstered the industry’s reputation, making casino-going a staple of Italian nightlife. This deep-rooted cultural acceptance, coupled with ongoing innovations in gaming technology, has created a market setting where brick-and-mortar casinos thrive, showcasing a large variety of table games, slot machines, and exclusive VIP rooms.

Aside from historical allure, the key factors underpinning casino dominance in the gambling market center on strict regulations, premium hospitality standards, and strong links to tourism. In 2023, the average daily footfall at top-tier properties reached 2,300 patrons, underscoring consistent player engagement throughout the year. An estimated 14,000 employees currently work in the casino segment, catering to the operational demands of table games, culinary services, and live entertainment. The blend of attentive service and diverse game portfolios has proven particularly attractive, with some venues featuring over 200 slot machines and 20 card tables to accommodate a variety of play styles. Moreover, local government bodies collaborate with tourism boards to promote casino regions, resulting in well-curated packages that merge cultural exploration with high-end gaming. By uniting entertainment, hospitality, and regulation, casinos firmly anchor themselves as the largest revenue contributors within Italy’s gambling scene.

By Channel Type

Offline gambling in Italy gambling market maintains a strong lead by capturing nearly 56.60% market share within the overall market, reinforced by the enduring attraction of retail betting shops, gaming arcades, and lotteries scattered across 200 provincial locales. In 2024, there were around 3,800 licensed betting shops nationwide, accommodating the preferences of players who value social interaction and real-world gaming experiences. Observers noted that gaming arcades witnessed 7.5 million walk-in visits in the first half of 2023, underscoring Italians’ affinity for communal gambling activities. These physical venues deliver a sense of camaraderie, allowing patrons to share victories, discuss strategies, and forge personal connections. Additionally, operators continually invest in modernizing offline spaces by introducing innovative slot machines and interactive terminals, thereby offering technology-driven enhancements without compromising the immersive, face-to-face atmosphere. The tangible nature of receiving physical betting slips and immediate payouts deepens trust and fosters long-standing loyalty among offline enthusiasts.

Another critical driver behind offline leadership in the gambling market is the strategic presence of multi-service establishments that combine sports viewing, dining, and gambling under one roof. In 2023, Italy boasted approximately 1,200 multifunctional betting cafés, each recording an average of 180 wagers per day during peak sporting events. Bettors who relish a social ambiance and the thrill of cheering on their teams in real-time find these venues particularly appealing. Furthermore, lottery stands, which totaled 6,500 units in 2024, continue to attract loyal weekly participants seeking instant wins. The cohesion of convenience, personal interaction, and immediate payouts has withstood the rapid expansion of online platforms, affirming that offline gambling aligns well with Italy’s communal culture. While digital channels are indeed on the rise, the pull of in-person engagement and shared excitement underscores why offline gambling remains a formidable force, retaining a dedicated customer base across diverse age groups.

By Payment Method

Credit and debit cards have ascended to prominence as the primary payment instruments in Italy’s gambling market with over 43.73% market share, fueled by user-friendly banking infrastructure and widespread financial literacy. Over 84 million active cards circulated among residents in 2024, signifying a broad consumer base familiar with electronic transactions. In the same year, Italy’s card-based transaction volume in retail settings surpassed 9.7 billion, bolstered by government incentives for digital adoption across multiple sectors. Within brick-and-mortar gambling venues, card terminals are strategically placed at entrance counters and cashier stations, enabling quick deposits and withdrawals that eliminate the need for cash handling. Players also appreciate the clarity offered by electronic statements, which facilitate budget planning and responsible gambling. Moreover, banks collaborate with major casino operators to provide loyalty programs, with 470 promotional tie-ups recorded in 2023, encouraging more patrons to opt for card payments when placing wagers or buying lottery tickets.

Beyond convenience, security enhancements have significantly shaped the dominance of card transactions within the gambling space. In 2022, Italy reported a fraud rate of only 0.018 incidents per 1,000 card transactions, reflecting robust measures like EMV chip technology and two-factor authentication. Such protections reassure players and sustain trust in card usage for gambling purchases. Financial institutions further bolster this trust by offering chargeback options, with 320 dedicated dispute resolution centers operating throughout the country. The consistent reliability of card payments benefits both operators and players, reducing operational costs tied to handling cash while speeding up transaction processes. Additionally, the ability to set daily spending limits or block gambling-related transactions gives users heightened control over their betting habits. Through a blend of robust authentication protocols, loyalty incentives, and simple integration into both online and offline platforms, credit and debit cards remain the go-to payment methods in Italy’s gambling market.

By End Users

Gambling enthusiasts with over 63.80% market share form the core driving force behind Italy’s betting environment, contributing substantial revenue through frequent participation and elevated bet sizes. In 2024, an estimated 3.5 million active enthusiasts engaged in at least one gambling activity monthly, showcasing a dedicated player base that invests time and resources into varied gaming formats. Many enthusiasts display a notable preference for table games, with 620 competitive poker events and 300 blackjack tournaments conducted nationwide over the past year. This appetite for structured competitions fosters a sense of prestige and community within gambling circles, amplifying the sector’s overall value. Additionally, regional studies indicate that a single enthusiast spends an average of 16 hours per month on gambling-related pursuits, spanning everything from electronic slot machines to in-person sports wagers. Such sustained engagement underscores how deeply ingrained gambling is within the social fabric of numerous Italian communities.

Tourism further amplifies enthusiasts’ influence in the Italy gambling market, as many visitors integrate gambling into their itineraries while exploring Italy’s cultural heritage. In 2023, approximately 7.6 million international arrivals included a casino visit during their stay, revealing the cross-pollination between travel and wagering interests. These gambling-minded tourists often exhibit higher spending power, with on-site surveys indicating an average gaming budget of 340 euros per trip. The presence of 200 dedicated tour operators offering casino-themed packages in major cities like Rome and Milan has expanded entertainment options for sightseers. Domestic enthusiasts, on the other hand, maintain a steady flow of activity even outside peak travel seasons, generating consistent monthly revenue for operators. This active layer of local and visiting gambling enthusiasts drives continual innovations, prompting operators to introduce new game titles, high-end dining experiences, and promotional events targeting loyal patrons. Through a synergy of tourism and dedicated play, enthusiasts remain the foundation of Italy’s gambling economy.

To Understand More About this Research: Request A Free Sample

Top Players in the Italy Gambling Market

- Bet365

- Lottomatica

- Sisal Group

- Eurobet

- Skybetting & Company

- Snai

- Other Prominent Players

Market Segmentation Overview

By Type

- Sports

- Fixed Odds Sports Betting

- Pari-Mutuel Betting (Horse and Dog racing)

- In-Play/Live Betting

- Exchange Betting

- Spread Betting

- Others

- Casino

- Blackjack

- Baccarat

- Teen Patti

- Three Card Poker

- Four card poker

- Red Dog

- Others

- Lottery Games

- Scratch-offs

- Bingo

- Keno

- Electronic Gaming Machines

- Others

By Channel Type

- Offline

- Casinos

- Betting shops/halls

- Arcades

- Bookmakers

- Online

- Virtual Game

By Payment Method

- Credit and debit cards

- E-wallets

- Prepaid cards and Vouchers

- Bank Transfers

- Cryptocurrencies

- Others

By End User

- Gambling Enthusiast

- Dabblers

- Others

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA03251254 | Delivery: Immediate Access

| Report ID: AA03251254 | Delivery: Immediate Access

.svg)