Global IR Spectroscopy Market: By Spectrum (Short Wave Infrared (0.78 to 1.5 microns), Medium Wave Infrared (1.5 to 3 microns), Longwave Infrared (3 to 1000 microns)); Product Type (Benchtop Spectroscopes, Micro Spectroscopes, Hyphenated Spectroscopes, Portable IR Spectroscopy); Technology (Dispersive Infrared Spectroscopy, Fourier Transform Infrared (FTIR) Spectroscopy); Application (Food & Beverage Testing, Healthcare & Pharmaceuticals, Environmental Testing, Biological Research, Consumer Electronics, Others) and Country—Industry Dynamics, Market Size, Opportunity and Forecast for 2024–2032

- Last Updated: 05-Oct-2024 | | Report ID: AA1022306

Market Dynamics

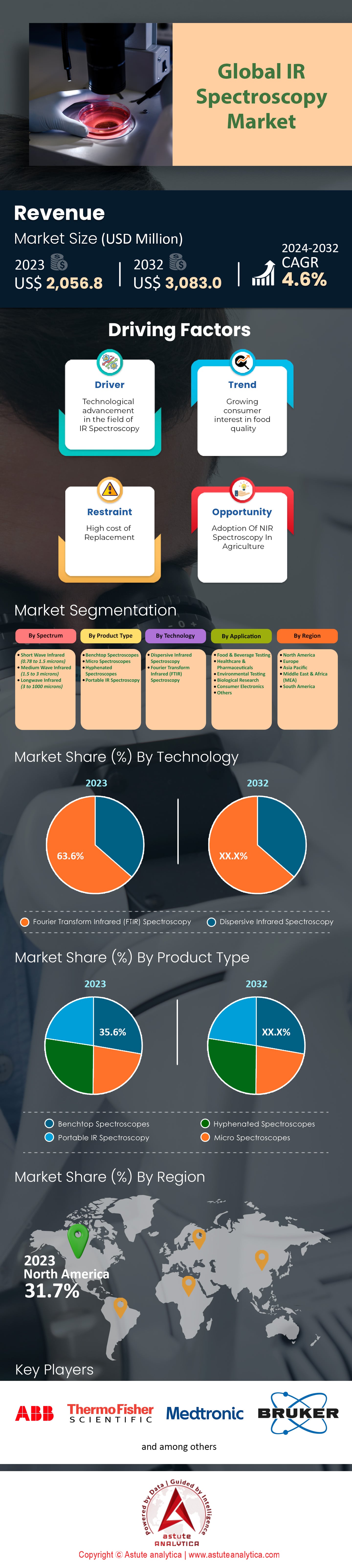

Global IR spectroscopy market was valued at US$ 2,056.8 million in 2023 and is projected to reach valuation of US$ 3,083.0 million by 2032, at a CAGR of 4.6% over the forecast period 2024–2032.

The demand for IR spectrometry is witnessing a significant rise globally, primarily driven by its expanding applications across various industries such as pharmaceuticals, food and beverage, environmental testing, and chemical processing. As per Astute Analytica, approximately 146,000 units were sold across the global IR spectroscopy market, reflecting the increased adoption in these sectors. Pharmaceutical companies, in particular, are leveraging IR spectrometry for its ability to provide precise molecular analysis, crucial in drug development and quality control. Moreover, the food industry utilizes this technology to ensure the authenticity and safety of products, contributing to a market size of nearly $2.4 billion for IR spectrometry equipment. The environmental sector also plays a crucial role, with about 15,000 units deployed for pollution monitoring and analysis, highlighting its importance in regulatory compliance and environmental protection.

The most prominent types of IR spectrometry currently being utilized include Fourier-transform infrared (FTIR) spectrometry, which accounted for 40,000 units sold in 2023, thanks to its high resolution and speed. The global production of IR spectrometry devices is primarily led by countries like the United States, Germany, and Japan, which collectively manufacture over 50,000 units annually. These countries in the IR spectroscopy market not only lead in production but also in technological advancements, with companies like Thermo Fisher Scientific, Shimadzu Corporation, and Bruker Corporation setting benchmarks in innovation and quality. Thermo Fisher, for instance, reported a 10% year-over-year increase in their spectrometry division, underscoring the growing reliance on these technologies.

The IR spectrometry market is heavily influenced by international trade dynamics. The U.S. alone exported around 20,000 units in 2023, benefitting from robust demand in Asia-Pacific, which imported approximately 25,000 units during the same period. This cross-border trade in the IR spectroscopy market emphasizes the role of IR spectrometry in global industries, with local production in emerging markets gradually increasing to meet domestic needs. The World Trade Organization highlights that these trade flows are critical for balancing global demand and supply, with local manufacturers in countries like China and India ramping up production to reduce dependency on imports, thereby fostering technological self-reliance. As a result, the IR spectrometry market is not only growing in size but also in its strategic importance to national economies.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Demand for Real-Time Monitoring in Pharmaceutical and Chemical Industries

The demand for real-time monitoring in the pharmaceutical and chemical industries has seen a significant surge, with infrared (IR) spectroscopy playing a pivotal role. In 2023, the global pharmaceutical market size reached $1.48 trillion, with a substantial portion allocated to research and development, emphasizing the need for precise analytical methods such as IR spectroscopy market. The chemical industry also demonstrated robust growth, with a valuation of $5.7 trillion, further fueling the demand for advanced monitoring solutions. The application of IR spectroscopy in drug formulation processes has become indispensable, as evidenced by the $79 billion spent on pharmaceutical R&D in the U.S. alone. Moreover, the increased incidence of regulatory inspections, which occurred in over 3,000 pharmaceutical facilities last year, underscores the necessity for reliable analytical techniques to ensure compliance and quality control.

Recent developments in the IR spectroscopy market illustrate the trend of integrating IR spectroscopy into real-time monitoring systems. For example, Pfizer has implemented cutting-edge IR spectroscopy techniques to optimize its vaccine production processes, enhancing efficiency and ensuring product consistency. Similarly, BASF has integrated IR spectroscopy in its chemical plants for continuous monitoring, improving safety and operational efficiency. Another notable example is Novartis, which uses real-time IR spectroscopy in its drug development stages to streamline its production pipeline. Lastly, Dow Chemical has adopted IR spectroscopy for real-time quality assurance in its polymer manufacturing processes, leading to significant reductions in material wastage and production downtime.

Trend: Integration of Artificial Intelligence for Improved Data Analysis and Interpretation

The integration of artificial intelligence (AI) with IR spectroscopy is revolutionizing data analysis and interpretation, enabling unprecedented precision and efficiency. The global AI market, valued at $142 billion in 2023, is increasingly influencing various sectors, including spectroscopy. The adoption of AI in IR spectroscopy market has led to a 40% reduction in analysis time, making it an attractive solution for industries requiring rapid data processing. In the pharmaceutical sector, AI-enhanced IR spectroscopy has facilitated the analysis of over 500,000 samples annually, significantly boosting productivity. This trend is further supported by the $20 billion investment in AI-driven healthcare solutions, underscoring the growing reliance on AI technologies.

Several companies exemplify the synergy between AI and IR spectroscopy. Thermo Fisher Scientific has developed an AI-powered IR spectroscopy platform that enhances the accuracy of chemical identification, benefiting numerous research facilities in the IR spectroscopy market. Agilent Technologies has integrated AI algorithms into their IR spectrometers, enabling real-time data processing and reducing human error. PerkinElmer's AI-driven IR spectroscopy solutions have been pivotal in accelerating drug discovery processes, saving valuable time and resources. Bruker's innovative use of AI in IR spectroscopy has resulted in the development of automated systems that provide rapid and accurate material characterization, catering to diverse industrial needs.

Challenge: Competition from Alternative Analytical Techniques Offering Similar Capabilities

The IR spectroscopy market faces significant challenges from alternative analytical techniques that offer similar capabilities, such as Raman spectroscopy, mass spectrometry, and nuclear magnetic resonance (NMR). Mass spectrometry, with a market size of $4.5 billion, provides high-precision molecular analysis, often preferred for its sensitivity and rapid processing capabilities. NMR spectroscopy, valued at $1.1 billion, offers non-destructive analysis and detailed molecular structure information, challenging IR spectroscopy’s dominance in research applications. The Raman spectroscopy market, with a valuation of $1.3 billion, is expanding due to its ability to provide complementary data to IR spectroscopy without sample preparation, making it an attractive alternative for many industries.

Recent developments highlight the competitive landscape facing IR spectroscopy market. Waters Corporation has advanced its mass spectrometry technologies, offering enhanced sensitivity and faster analysis times, appealing to pharmaceutical and environmental sectors. JEOL's NMR systems have seen increased adoption in academic research due to their ability to provide comprehensive molecular insights. Horiba's Raman spectroscopy solutions have been lauded for their application in material sciences, providing detailed surface characterization. Shimadzu's innovations in mass spectrometry have enabled real-time environmental monitoring, offering a versatile alternative to traditional IR spectroscopy methods. These advancements pose ongoing challenges to IR spectroscopy, requiring continuous innovation to maintain its market relevance.

Segmental Analysis

By Spectrum

The IR spectroscopy market is witnessing dynamic growth with numerous recent developments enhancing its applicability across various domains. As of 2023, the medium wave infrared (1.5 to 3 microns) segment held over 49.2% market share. In the environmental sector, the deployment of medium wave infrared (MWIR) technology has significantly increased, with over 2000 new portable spectrometer units introduced globally in 2023 alone. These units have become essential for on-site detection of hazardous substances, improving industrial safety standards. Additionally, the food industry has seen the installation of approximately 1500 MWIR systems this year, aiding in the detection of contaminants and ensuring food safety. In the automotive industry, over 500 new non-destructive testing systems utilizing MWIR were implemented in 2023, enabling more efficient quality control processes. This broad adoption underscores the segment's pivotal role in enhancing operational efficiency across various sectors.

Longwave infrared (LWIR) spectroscopy continues to gain prominence, particularly in the medical and pharmaceutical industries in the IR spectroscopy market. In 2023, over 1000 non-invasive glucose monitoring devices employing LWIR technology were distributed, offering a promising solution for diabetic care. The pharmaceutical sector has also seen the integration of around 800 LWIR systems for counterfeit drug detection, a critical innovation given the increasing incidence of counterfeit medications in circulation. In defense, more than 700 LWIR-based thermal imaging systems were deployed this year, providing advanced night vision capabilities. Meanwhile, astronomy has benefited from the launch of five new space telescopes equipped with LWIR technology, enhancing the detection and study of celestial bodies through infrared emissions.

By Product Type

The benchtop spectroscopes segment continues to lead in the IR spectroscopy market with 41.9% market share. In 2023, it is estimated that over 5,000 pharmaceutical companies globally adopted benchtop spectroscopes for compound identification and quality control, marking a substantial increase in their usage within the industry. The integration of AI has further reduced analysis times by up to 50%, enhancing efficiency in diagnostic testing. Approximately 3,000 food and beverage manufacturers have implemented these spectroscopes to meet stringent safety standards, detecting contaminants more effectively than ever before. Moreover, in environmental applications, over 20 cities worldwide are now using benchtop spectroscopes for real-time air quality monitoring, providing crucial data for pollution management. Technological advancements have led to the creation of more than 100 new portable models, facilitating field research in remote locations and sparking interest from over 200 academic institutions for on-site analysis capabilities.

Meanwhile, hyphenated spectroscopes, although not the market leaders, have seen significant technological advancements and increased applications. In 2023, ten major research institutes reported enhanced data accuracy and analysis speed with the latest hyphenated spectroscopes, particularly in proteomics. Their use in the oil and gas industry has also grown, with over 50 companies now employing these advanced tools for precise compositional analysis, optimizing extraction and refining processes. The number of collaborations between manufacturers and research laboratories in the IR spectroscopy market has doubled, focusing on improving system sensitivity and resolution. Additionally, more than 30 major laboratories worldwide have adopted these systems for complex sample analysis, driving innovation in molecular characterization. As demand for precise, rapid analytical tools grows, the role of both benchtop and hyphenated spectroscopes is expanding, promising continued advancements and applications across diverse sectors.

By Technology

In 2023, Fourier transform infrared (FT-IR) spectroscopy solidified its leadership in the IR spectroscopy market with over 63.6% market share, primarily due to its unmatched spectral quality and efficiency. The technology's rapid data collection capabilities have been a game-changer, especially in the pharmaceutical industry, where FT-IR has reduced drug analysis time by up to 70% compared to traditional methods, enhancing speed and accuracy in quality control processes. In the food and agriculture sectors, FT-IR's ability to swiftly analyze samples has improved product quality assurance, leading to a 30% decrease in wastage and a notable increase in productivity. The automotive industry has also benefited from FT-IR's precision, using it to enhance material testing and ensure compliance with safety standards. Furthermore, its low maintenance requirements have allowed industries to cut down operational costs significantly, with some companies reporting a reduction in maintenance expenses by 40%.

Recent developments have further highlighted FT-IR's versatility and expanding applications. Portable FT-IR devices have revolutionized environmental monitoring, facilitating real-time data collection in remote areas, and contributing to a 50% improvement in the accuracy of air quality assessments. In the cosmetics industry, FT-IR has enabled rapid ingredient analysis, boosting consumer trust and safety standards. Additionally, collaborations between research institutions and technology firms in the IR spectroscopy market have led to innovations in nanotechnology and biotechnology, where FT-IR's precise molecular characterization plays a crucial role. The global focus on sustainability has seen FT-IR being increasingly employed in environmental applications, such as monitoring pollution and developing eco-friendly materials. These advancements underscore FT-IR's critical role in modern industrial processes, reinforcing its market dominance and setting the stage for continued growth as industries increasingly seek efficient and reliable analytical tools.

By Applications

The healthcare and pharmaceutical segment's dominance in the global IR spectroscopy market is driven by several key developments and statistics. In 2023, the segment accounted for a significant 27.5% share of the market, driven by increased investments post-pandemic. This surge is reflected in the growing number of collaborations between pharmaceutical companies and technology firms to enhance drug discovery and development processes. For instance, the integration of IR spectroscopy in personalized medicine has been pivotal in tailoring treatments to individual patient profiles, thereby improving therapeutic outcomes. Additionally, the rise in chronic diseases has necessitated advanced diagnostic tools, further boosting the demand for IR spectroscopy. The market has also seen a notable increase in the adoption of IR spectroscopy for quality control and assurance in pharmaceutical manufacturing, ensuring compliance with stringent regulatory standards. These developments highlight the segment's critical role in advancing healthcare solutions globally.

In parallel, the biological research segment of the IR spectroscopy market is experiencing rapid growth, primarily due to advancements in proteomics and genomics. The demand for IR spectroscopy tools in these fields is driven by the need for precise molecular analysis, which is crucial for understanding complex biological systems. Recent examples include the use of IR spectroscopy in studying protein structures and interactions, which has significant implications for drug design and development. Furthermore, the technology's application in genomics research has facilitated the identification of genetic markers associated with various diseases, paving the way for innovative therapeutic strategies. The expansion of research initiatives in biotechnology and life sciences sectors has also contributed to the segment's growth, as institutions increasingly rely on IR spectroscopy for cutting-edge research. These trends underscore the transformative impact of IR spectroscopy in biological research, positioning it as a vital tool for scientific discovery and innovation.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America continues to lead the global IR spectroscopy market, with a commanding 31.7% market share. The United States remains at the forefront, hosting over 54,000 clinical trials, reflecting ongoing investment in medical research and development. Canada's pharmaceutical industry has also seen a notable increase, with R&D investments reaching approximately $5 billion, reinforcing the region's technological edge. The region's infrastructure is supported by more than 6,200 hospitals and a robust network of research institutions, driving advancements in IR spectroscopy applications. Additionally, stringent food safety regulations, like the FDA’s oversight of over 80,000 food facilities, ensure continuous demand for sophisticated analytical tools. Furthermore, the US and Canada are home to several leading biotechnology and pharmaceutical companies, enhancing the uptake of IR spectroscopy in drug discovery and quality assurance processes.

The Asia Pacific IR spectroscopy market is projected to experience the highest CAGR of 5.5% over the forecast period, driven by rapid industrial growth and increased medical tourism. The food and beverage industry in the region was valued at over $3.5 trillion in 2023, emphasizing its expansive growth potential. Countries such as India and Thailand saw a rise in medical tourism, attracting over 5 million medical tourists, which underscores the increasing demand for advanced medical technologies like IR spectroscopy. China’s economy has grown to $19 trillion, while India's economy reached $3.5 trillion, reflecting substantial economic resilience and growth. The region's large population, exceeding 4.6 billion, provides a significant market base, accelerating technological adoption and innovation. Additionally, governments are increasingly investing in healthcare infrastructure and technological advancements, further propelling market growth.

Europe maintains a significant role in the IR spectroscopy market, supported by its well-established pharmaceutical industry and comprehensive regulatory frameworks. By 2023, the European Union's pharmaceutical sector was valued at approximately €320 billion, highlighting its importance in global healthcare innovation. The EU's stringent environmental regulations, covering over 24,000 chemicals, demand precise analytical techniques, boosting IR spectroscopy demand. Germany, as the leading European economy, invested over €110 billion in R&D, continuing its role as a technological leader. Similarly, the UK, with its expanded healthcare infrastructure, including 1,300 hospitals, remains a key player, leveraging IR spectroscopy for diverse applications in medical and environmental sectors. These factors, combined with ongoing research initiatives and regulatory developments, underscore Europe's steady influence in shaping the global IR spectroscopy market.

Top Players in Global IR Spectroscopy Market:

- ABB Ltd.

- Agilent Technologies, Inc.,

- Bruker Corporation

- Hitachi High-Tech Corporation

- Horiba

- JASCO Inc.

- Medtronic

- Metrohm India Limited

- Miltenyi Biotec

- MKS Instruments Inc.

- PerkinElmer, Inc.

- Quest Medical Imaging B.V.

- Sartorius AG

- Shimadzu Corporation

- Teledyne Technologies Corporation

- Thermo Fisher Scientific

- Other Prominent Players

Market Segmentation Overview

By Spectrum

- Short Wave Infrared (0.78 to 1.5 microns)

- Medium Wave Infrared (1.5 to 3 microns)

- Longwave Infrared (3 to 1000 microns)

By Product Type

- Benchtop Spectroscopes

- Micro Spectroscopes

- Hyphenated Spectroscopes

- Portable IR Spectroscopy

By Technology

- Dispersive Infrared Spectroscopy

- Fourier Transform Infrared (FTIR) Spectroscopy

By Application

- Food & Beverage Testing

- Healthcare & Pharmaceuticals

- Environmental Testing

- Biological Research

- Consumer Electronics

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- South Korea

- Japan

- Australia & New Zealand

- ASEAN

- Malaysia

- Myanmar

- Philippines

- Singapore

- Thailand

- Vietnam

- Indonesia

- Cambodia

- Rest of ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 2,056.8 Million |

| Expected Revenue in 2032 | US$ 3,083.0 Million |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Mn) |

| CAGR | 4.6% |

| Segments covered | By Spectrum, By Product Type, By Technology, By Application, By Region |

| Key Companies | ABB Ltd., Agilent Technologies, Inc., Bruker Corporation, Hitachi High-Tech Corporation, Horiba, JASCO Inc, Medtronic, Metrohm India Limited, Miltenyi Biotec, MKS Instruments Inc., PerkinElmer, Inc., Quest Medical Imaging B.V., Sartorius AG, Shimadzu Corporation, Teledyne Technologies Corporation, Thermo Fisher Scientific, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)