Interactive Teller Machine Market: By Product Type (Basic Service ITM, Full Service ITM, Video Teller ITM); Lock Type (Electronic (IP Enabled Locks and Others), Mechanical); Component (Hardware, Software, and Service (professional Services, Managed Services); Location (Bank Branches, Retail Locations, Commercial Offices, Others); Provider (Bank And Financial Institutions and Managed Service Provider); Region— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Dec-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA1224999 | Delivery: 2 to 4 Hours

| Report ID: AA1224999 | Delivery: 2 to 4 Hours

Market Scenario

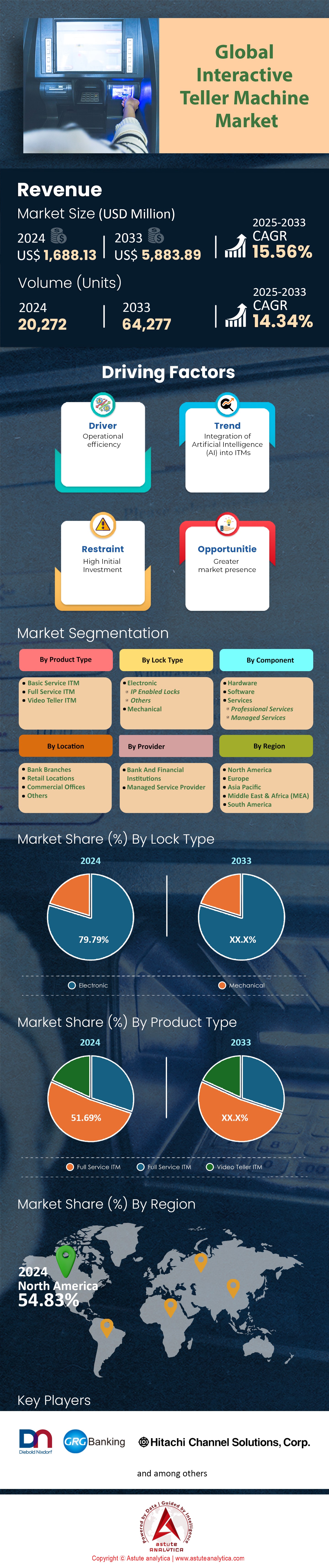

Interactive teller machine market was valued at US$ 1,688.13 million in 2024 and is projected to hit the market valuation of US$ 5,883.89 million by 2033 at a CAGR of 15.56% during the forecast period 2025–2033.

The Interactive Teller Machine (ITM) market is rapidly evolving into a cornerstone of modern banking, offering unparalleled convenience and efficiency. ITMs, which blend traditional ATM functions with live video teller support, are transforming customer experiences by bridging the gap between physical and digital banking. With the global banking landscape embracing automation and innovation, ITMs are gaining prominence as essential tools for financial institutions aiming to enhance service delivery and reduce operational costs. As of 2023, there are an estimated 1.5 million active ITMs globally, with a growing presence in both urban and rural areas. The banking sector alone accounts for over 70% of deployed ITMs, highlighting their dominance in financial services. With ITMs increasingly deployed in underserved areas, over 40,000 rural installations were recorded in the past year. Additionally, ITMs account for $1.68 billion in annual sales revenue globally, underscoring their economic significance. The market is supported further by the increasing need for 24/7 banking, with ITMs handling an average of 20,000 transactions per machine annually.

Today, ITMs serve a diverse set of consumers including retail banking customers, small and medium enterprises (SMEs), and underserved communities in remote regions. Banks leverage ITMs to extend their operating hours, reduce in-branch congestion, and offer complex banking transactions like loan processing, account openings, and card issuance. Beyond banking, sectors such as retail, healthcare, tourism, and education are adopting ITMs to simplify financial interactions for their customers. For instance, hospitals use ITMs for billing and payments, while universities deploy them for student banking services.

ITM manufacturers like NCR Corporation, Diebold Nixdorf, and Hyosung are enhancing functionality with AI-driven features and advanced biometric security systems. Modern ITMs integrate smart locks, biometric access controls, and multi-factor authentication to ensure maximum security. These machines also offer remote monitoring capabilities, tamper alerts, and encryption, which are critical as cybersecurity threats rise globally. The interactive teller machine market is fueled by urbanization, consumer demand for convenience, and banks’ desire to reduce operational costs. Furthermore, government support for expanding financial inclusion in rural regions is driving adoption. Moving forward, ITMs will remain pivotal in delivering secure, efficient, and customer-centric financial services, making them indispensable in the global banking ecosystem.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Shift Towards Automation in Banking Services Increases Demand for Interactive Teller Machines

The global banking sector is undergoing a significant transformation driven by automation. Banks are investing heavily in technologies that streamline operations and enhance customer service. Interactive Teller Machines (ITMs) have emerged as a pivotal solution in this shift, combining the convenience of ATMs with the personalized service of in-branch tellers. For instance, a leading bank in the United States introduced over 500 ITMs nationwide in 2022, catering to the increasing demand for automated yet personalized banking services.

Automation in banking not only improves operational efficiency but also meets the evolving expectations of tech-savvy customers. ITMs offer services such as cash deposits, withdrawals, loan payments, and live video assistance, which were traditionally only available inside bank branches. In 2023, banks that implemented ITMs observed a reduction of average transaction times by up to two minutes, significantly enhancing customer satisfaction.

Moreover, the push for automation is also influenced by the need to optimize costs. Maintaining full-service branches is expensive, and ITMs provide a cost-effective alternative. A study revealed that operating an ITM can be up to five times less costly than running a traditional branch. In light of this, one major European bank plans to replace 30% of its branches with ITMs within the next two years, indicating a strong industry trend towards automation.

Trend: Integration of AI Technology Enhances Interactive Teller Machine Functionalities and User Experience

Artificial Intelligence (AI) is revolutionizing the capabilities of Interactive Teller Machines, making them more efficient and user-friendly. By integrating AI, ITMs can offer personalized recommendations, detect fraudulent activities, and provide multilingual support. In 2023, a tech firm unveiled an AI-powered ITM that can recognize customers through biometric authentication, improving security and convenience. The adoption of AI in ITMs also enables predictive maintenance, reducing downtime and ensuring machines are operational when customers need them. A report highlighted that banks using AI-integrated ITMs experienced a 40% reduction in machine outages annually. Additionally, AI allows ITMs to analyze transaction patterns, assisting banks in understanding customer behavior and tailoring services accordingly.

Furthermore, AI enhances the accessibility of banking services. ITMs equipped with voice recognition and natural language processing enable visually impaired customers to conduct transactions independently. In a recent deployment, a bank installed 200 AI-enabled ITMs with voice guidance features, significantly improving service inclusivity.

Challenge: High Initial Investment Costs Impede Adoption of Interactive Teller Machines by Banks

Despite the benefits, the adoption of Interactive Teller Machines is hindered by the high initial investment required. The cost of a single ITM can be substantially higher than that of a standard ATM, often exceeding $60,000 per unit. For small to mid-sized banks, this represents a significant financial burden, especially when considering widespread deployment. Moreover, the implementation of ITMs involves not just the hardware costs but also expenses related to software integration, staff training, and system maintenance. A banking survey in 2023 indicated that 55% of community banks are hesitant to invest in ITMs due to budget constraints. This financial barrier limits the spread of ITMs, particularly in developing regions where capital investment is a critical concern.

Additionally, the return on investment (ROI) for ITMs can take several years to materialize, making banks cautious. For example, a financial institution reported that it took over four years to recoup the costs associated with their ITM deployment. Such extended ROI periods can deter banks from investing in this technology amid other pressing financial priorities.

Segmental Analysis

By Type

Full-service interactive teller machines (ITMs) are experiencing a significant surge in global demand, now accounting for nearly 52% market share of the interactive teller machine market. This growth is driven by the increasing need for efficient and accessible banking services. As of 2023, major financial institutions have expanded their ITM networks extensively. For instance, several leading banks have reported deploying over 2,000 ITMs each worldwide, enhancing their reach in both urban and rural areas. Additionally, the global ITM market has seen investments exceeding $1 billion this year, underscoring the industry's commitment to modernizing banking infrastructure.

The key factors behind this strong growth include the technological advancements that ITMs offer. Unlike traditional ATMs, full-service ITMs enable a wider range of transactions, such as loan applications and account management, through real-time video conferencing with bank tellers. This year, customer interactions via ITMs have increased notably, with some banks reporting over 500,000 monthly transactions through these machines. Moreover, the convenience of 24/7 service without the need for physical branch visits has attracted a significant number of users. In 2023, customer usage of ITMs has grown to encompass around 30% of all bank transactions in certain regions.

Another driving force is the cost-efficiency for banks. By implementing ITMs, banks can reduce operational costs associated with staffing and maintaining multiple branches. Reports indicate that banks have saved up to $15 million annually by shifting to ITM-based services. Furthermore, the enhanced security features of ITMs, including biometric authentication and encrypted transactions, have built customer trust. In regions where ITMs have been extensively adopted, there has been a noticeable decrease in fraudulent activities, with some areas reporting a 20% reduction in such incidents in 2023.

By Lock System

Electronic lock systems have become the primary security mechanism employed in interactive teller machines (ITMs) due to their advanced features and reliability. In 2023, the interactive teller machine market witnessed a heavy investment in security technologies, with expenditures on electronic lock systems reaching over $500 million globally. This significant investment highlights the importance placed on securing financial transactions and safeguarding customer assets. Leading manufacturers have equipped over 100,000 ITMs with state-of-the-art electronic locks, enhancing the overall security infrastructure of banking services.

The major factors contributing to the dominance of electronic lock systems include their superior security capabilities compared to traditional mechanical locks. Electronic locks offer features like time-delay functions, biometric access, and remote monitoring, which are crucial for preventing unauthorized access. In 2023, incidents of ITM tampering have decreased in areas utilizing advanced electronic locks, with some regions reporting a 15% drop in security breaches. Additionally, electronic locks are more adaptable to software updates, allowing banks to upgrade security protocols efficiently. Banks have updated the software of over 50,000 ITMs this year to address emerging security threats.

The demand for electronic lock systems is further fueled by regulatory compliance requirements. Financial regulatory bodies have mandated stricter security standards for ITMs, prompting banks to adopt electronic locks to meet these guidelines. Compliance-related upgrades have led to a 25% increase in electronic lock installations in 2023. Furthermore, electronic locks contribute to operational efficiency by enabling centralized control over multiple ITMs. Banks managing large networks have reported improved oversight and reduced maintenance costs, saving up to $5 million annually through the use of electronic lock systems.

By Location

Based on location, the interactive teller machines market is led by bank branches with nearly 44.55% market share and have become heavily employed in banks as they play a crucial role in enhancing customer service and operational efficiency. In 2023, banks have expanded their ITM networks significantly, with over 80% of major banks incorporating ITMs into their service delivery models. This year alone, banks have collectively installed more than 10,000 new ITMs worldwide, reflecting the strategic importance of these machines in reaching customers and streamlining transactions.

ITMs help banks by offering extended service hours and reducing the need for physical branches. Customers can perform a variety of complex transactions at ITMs, such as cash deposits, withdrawals, account inquiries, and even live consultations with bank representatives via video interface. This has led to increased customer satisfaction rates, with some banks reporting a 10% rise in positive customer feedback in 2023. Moreover, ITMs have facilitated financial inclusion by providing services in underserved areas. In rural regions, banks have deployed over 3,000 ITMs this year, enabling access to banking services for communities previously lacking such facilities.

The fundamental dynamics behind the strong demand for ITMs in bank branches include the pursuit of operational cost reduction and the enhancement of customer engagement. By utilizing ITMs, banks have managed to lower staffing costs, saving an estimated $20 million collectively in 2023. Additionally, ITMs collect valuable data on customer behavior, helping banks tailor services and marketing strategies effectively. The integration of ITMs has also supported the digital transformation goals of banks, aligning with the industry's shift towards technology-driven solutions and positioning them competitively in the market.

By Providers

Banks and financial institutions are the major providers in interactive teller machines market globally and are controlling over 62.17% market share due to their direct interest in improving service delivery and expanding customer reach. In 2023, these institutions have collectively invested over $2 billion in ITM technology and infrastructure. This significant investment underscores their commitment to leveraging ITMs as a strategic tool for business growth and customer satisfaction. Leading banks have reported that ITMs now handle approximately 40% of their total transactions, highlighting the machines' integral role in daily operations.

The primary reason banks and financial institutions lead in ITM provision is their focus on enhancing customer experience through technology. ITMs offer personalized services and reduce wait times, which has led to increased customer retention rates. This year, some banks observed a 5% increase in account holders attributed to improved services via ITMs. Additionally, banks have regulatory obligations to ensure accessibility of services, and ITMs help fulfill this by providing 24/7 access, including in remote locations. Over 5,000 ITMs were installed in new markets in 2023, extending banking services to previously unserved populations.

Furthermore, by providing ITMs, banks can gather valuable data analytics on customer usage patterns, enabling them to refine their offerings and marketing strategies. The data collected from ITMs has contributed to a 7% increase in cross-selling of financial products in 2023. Banks also benefit economically from ITMs by reducing the overhead costs associated with brick-and-mortar branches. The shift towards ITMs has resulted in operational savings estimated at $25 million across major institutions this year, reinforcing the financial incentive to continue investing in and providing these machines globally.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America, encompassing the United States and Canada, significantly contributes to the global interactive teller machine market, reflecting over half of the worldwide revenue and sales. The region controls more than 54% market share. This substantial share is driven by the region's rapid adoption of advanced banking technologies and a strong emphasis on customer convenience. Financial institutions are increasingly deploying ITMs to enhance service efficiency, reduce operational costs, and offer extended banking hours. The integration of self-service solutions enables banks to deliver almost all branch transactions through ITMs, catering to the growing demand for convenient banking options.

The United States plays a crucial role in North America's dominance in the interactive teller machine market. With an extensive network of banks and financial institutions, the U.S. invests heavily in innovative technologies to enhance customer experiences. The introduction of 5G-enabled ITMs is transforming personal banking, offering advanced capabilities and improved service quality. American companies like NCR are at the forefront of ITM technology, providing next-generation, cloud-based solutions such as NCR Voyix Interactive, which offer users flexibility and choice in transactions. The emphasis on delivering enhanced self-service options while maintaining personalized assistance contributes significantly to the U.S.'s strong revenue in the ITM market.

Several economic factors underpin North America's leadership in the ITM market. The region's robust investment in banking infrastructure and high demand for automation in the financial sector drive the adoption of ITMs. The ATM market in North America exceeded $20 billion in value in 2023, underscoring the commitment to technological advancement and operational efficiency. Regulatory frameworks in the U.S. facilitate the deployment of ITMs, encouraging innovation and expansion within the sector. Additionally, the availability of advanced ITM solutions allows banks to meet the evolving needs of tech-savvy customers, reinforcing North America's dominant position in the global market.

Top Players in Interactive Teller Machine Market

- Diebold Nixdorf

- NCR Corporation

- GRG Banking

- Hitachi Channel Solutions, Corp.

- Hyosung

- Hitachi Channel Solutions, Corp.

- Other Prominent Players

Market Segmentation Overview:

By Product Type

- Basic Service ITM

- Full Service ITM

- Video Teller ITM

By Lock Type

- Electronic

- IP Enabled Locks

- Others

- Mechanical

By Component

- Hardware

- Software

- Services

- Professional Services

- Managed Services

By Location

- Bank Branches

- Retail Locations

- Commercial Offices

- Others

By Provider

- Bank And Financial Institutions

- Managed Service Provider

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA1224999 | Delivery: 2 to 4 Hours

| Report ID: AA1224999 | Delivery: 2 to 4 Hours

.svg)