Global Insoluble Sulfur Market: By Category (Organic and Inorganic); Grade (Regular Grades, High Stability Grades, Special Grades); Application (Tire Manufacturing, Footwear, Rubber Pipe, Cable and Wire Insulating Materials, Latex, Rubber Belt, Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 29-Apr-2024 | | Report ID: AA0823569

Market Scenario

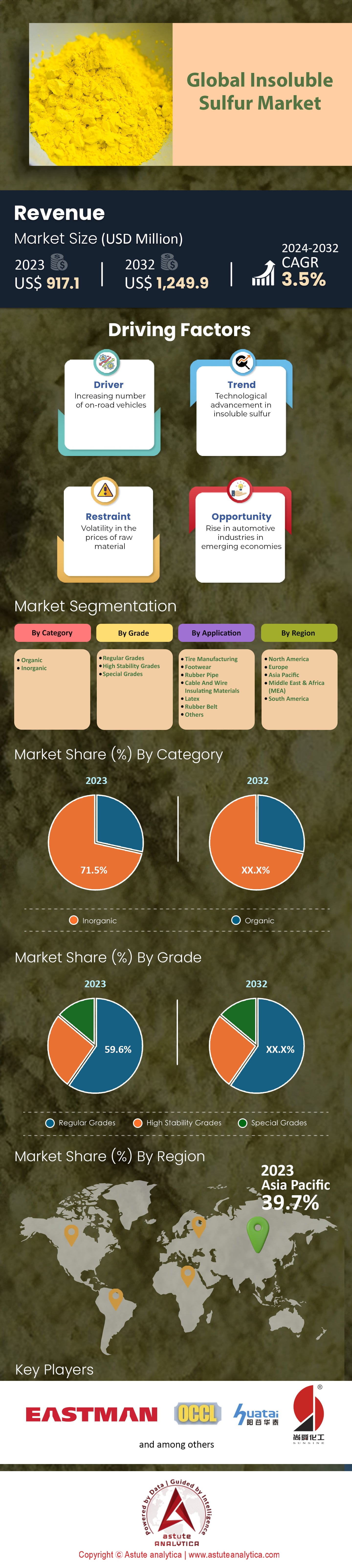

Global insoluble sulfur market is projected to attain a market size of US$ 1,249.9 million by 2032 from US$ 917.1 million in 2023 at a CAGR of 3.5% during the forecast period 2024–2032.

The global insoluble sulfur market has been under continuous evolution over the past few years, shaped by several factors. A compound pivotal for the rubber industry, especially in tire manufacturing, insoluble sulfur's demand has directly influenced by the growth of the automobile industry. With the onset of sustainable transportation solutions, electric vehicles (EVs), and heightened quality standards, the tire sector's demands have substantially transformed, impacting the dynamics of the insoluble sulfur market directly. Wherein, one significant development that has shaped recent market trends is the rise in environmental consciousness. As governments across the globe introduce stringent norms around sustainable transportation and waste reduction, tire manufacturers are increasingly compelled to adopt higher standards of production. This, in turn, translates to a heightened demand for quality raw materials, including insoluble sulfur. Besides, the transition towards EVs has prompted a re-imagination of tire designs, directly influencing the requirements from raw materials.

On the other hand, understanding the consumers' role in this changing landscape is imperative in the global insoluble sulfur market. Modern consumers are majorly influenced by global discussions around environmentalism and are displaying an inclination towards sustainable, long-lasting, and eco-friendly product. This translates to a demand for those with enhanced lifespans, superior performance, and minimal environmental footprints. As a result, it hold a significant potential to influence the tire manufacturers' strategies, who in turn place different demands on the market.

Government policies and regulations are playing an ever-critical role. In regions like Europe and North America, stringent environmental norms are pushing companies towards sustainable production practices. In the Asia-Pacific region, rapid industrialization and urbanization, juxtaposed with evolving environmental norms, present a unique challenge and opportunity for market players. Countries like China and India, with their burgeoning automobile markets, are central to the future of insoluble sulfur, but their regulatory landscape remains a terrain that businesses must navigate with astute agility.

The future outlook for the insoluble sulfur market appears promising. The ever-increasing demand for high-performance tires, combined with global shifts towards sustainable transportation, assures a sustained need for insoluble sulfur. However, in the coming years, the market players need to be more cognizant of shifting consumer preferences and a dynamic regulatory landscape. Innovations in the field, focusing on enhancing product efficiency while reducing environmental impact, might emerge as the critical differentiator for businesses in the coming years.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Demand from the Tire Industry

As one of the main raw materials for tire production, insoluble sulfur's market has always been directly proportional to the demands of the tire industry. Over the last decade, global vehicle production has been on an upward trajectory. According to the International Organization of Motor Vehicle Manufacturers (OICA), global vehicle production surpassed 90 million units annually in the years leading up to 2020. This, coupled with the average life span of tires and the constant need for replacements, indicates an immense demand for tires, thereby driving the need for insoluble sulfur.

The tire industry's drive for innovation further accentuates this demand. For instance, the pursuit of creating more sustainable, durable, and eco-friendly tires has become paramount. As tires have been evolving to provide better fuel efficiency and longevity, the need for high-quality raw materials, such as insoluble sulfur, has been on the rise. In 2022, a report by the World Business Council for Sustainable Development (WBCSD) noted that sustainable and efficient tires could account for fuel savings of up to 6%, further highlighting the industry's shift towards quality-focused production.

Trend: Tightening Environmental Regulations and Shifting Focus to Green Manufacturing

The increasing focus on sustainability and the planet's ecological well-being has imprinted a deep mark on global industries, and the insoluble sulfur market is no exception. A monumental shift towards environmentally-friendly manufacturing practices is not just a trend, but is rapidly becoming the norm. Governments, organizations, and consumers worldwide are recognizing the irreversible damage done to the environment and are advocating for a greener, more sustainable future.

European countries, known for their strict adherence to environmental standards, have been at the forefront of this transition. The European Union's REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulations introduced in 2018 have set a benchmark. Designed to protect human health and the environment from potential risks associated with chemicals, these regulations have a cascading effect on industries connected with chemicals. Manufacturers and suppliers are now more accountable than ever, being compelled to identify and manage the risks linked to the substances they manufacture and market in the EU. By 2022, REACH aimed to ensure that substances of very high concern are replaced by less harmful alternatives, where feasible, thereby directly influencing the strategies and production processes of the insoluble sulfur market.

This environmental trend transcends regulatory frameworks, extending deeply into consumer behavior and preferences. Eco-consciousness is no longer confined to a niche group of environmentally aware individuals but has emerged as a mainstream consumer trend. According to a study conducted in 2022, a staggering 30% of global consumers displayed a willingness to pay more for eco-friendly tires. This significant percentage is indicative of a profound shift in consumer attitudes towards products that are sustainable from cradle to grave. Such preferences are driving tire manufacturers to revamp their production methodologies and choose raw materials that adhere to green protocols. As a result, the insoluble sulfur market is pivoting towards producing and providing products that are in alignment with this green wave.

Moreover, the trend's ripple effect can be observed in the R&D sectors of major industry players. With the environmental trend gaining traction, significant resources are being channeled into research to develop more sustainable variants of insoluble sulfur. Collaborations between academic institutions, research facilities, and industry leaders are becoming common, aimed at discovering innovative methods of production that reduce waste, minimize carbon footprints, and optimize energy consumption. By 2021, several patents were filed related to the green manufacturing of insoluble sulfur, reflecting the industry's collective drive towards a sustainable future.

Challenge: Volatility in Raw Material Prices and Supply Chain Disruptions

One of the major challenges haunting the global insoluble sulfur market is the unpredictability and fluctuation in raw material prices. As insoluble sulfur is primarily derived from petroleum-based raw materials, its price is intrinsically linked to the global crude oil prices. According to the US Energy Information Administration (EIA), crude oil prices experienced significant fluctuations, with Brent crude averaging around $64 per barrel in 2019, only to plummet to an average of $41 per barrel in 2020 due to the COVID-19 pandemic. In 2022, it reached $89.12. Such fluctuations have a direct bearing on the production costs for insoluble sulfur, making it challenging for manufacturers to maintain consistent pricing and profitability.

Supply chain disruptions further exacerbate this challenge. Events like trade tensions, geopolitical disturbances, and, more recently, the global pandemic, have highlighted the vulnerabilities in the supply chain. A survey in 2021 by elucidated that nearly 73% of businesses faced detrimental supply chain issues due to the pandemic, with chemical industries being significantly impacted. For the insoluble sulfur market, these disruptions not only mean an unstable supply of raw materials but also potential challenges in catering to the demands of the tire industry, thus posing significant hurdles to consistent market growth.

Segmental Analysis

By Category

The inorganic segment, holding a dominant share of 71.5% in the global insoluble sulfur market, showcases the industry's heavy reliance on inorganic sources. One primary reason behind this dominance is the chemical stability provided by inorganic sources, essential for industries like tire manufacturing. Inorganic insoluble sulfur offers consistent quality, allowing manufacturers to maintain the desired product standards with little variability. The purity levels of inorganic variants are typically higher, making them a preferred choice for critical applications.

Our research indicates that the cost-effectiveness of inorganic production methods also plays a role in its supremacy. The production processes for inorganic insoluble sulfur are well-established, scalable, and can be optimized for large-scale manufacturing. This ensures that suppliers can meet the high global demand without significant price fluctuations. Additionally, the robust supply chain for inorganic sources further cements its position in the market. With industries striving for consistency and reliability, the inorganic segment, with its proven track record, emerges as the natural frontrunner.

By Application

The tire manufacturing sector's colossal share of 81.1% in the global insoluble sulfur market is indicative of the symbiotic relationship between the two industries. Insoluble sulfur's unique properties, such as its ability to prevent sulfur migration and ensure a uniform vulcanization process, are indispensable to tire manufacturers. This ensures that tires produced meet the rigorous safety and performance standards set by regulatory bodies worldwide.

It was found that the global automobile industry's expansion, coupled with the increasing emphasis on tire longevity and performance, directly correlates with the high demand for insoluble sulfur. The rise of electric vehicles, which demands tires with specific characteristics to handle increased torque and weight, further fuels the demand. Moreover, as tire recycling becomes a focal point in sustainability efforts, manufacturers are leaning more towards quality raw materials, ensuring that tires can withstand multiple recycling processes without degradation. Insoluble sulfur, especially of high quality, is pivotal in this regard, establishing its dominant position in tire manufacturing.

By Grade

By grade, the global market is dominated by regular grade with over 59.6% market share in 2023. The dominance of the regular grades segment in the insoluble sulfur market can be attributed to multiple factors. Primarily, regular grades of insoluble sulfur cater to a vast array of applications across different industries, not limited to high-spec requirements. Their versatile nature ensures they are the default choice for various manufacturing needs, be it in the rubber industry for conveyor belts, footwear, or even non-rubber applications.

The production process for regular grades is relatively straightforward and less resource-intensive compared to higher or specialized grades. This translates to more competitive pricing and broader availability. Manufacturers, especially in developing economies, prioritize regular grades due to their cost-effectiveness and ease of procurement. While specialized grades cater to niche applications, the sheer volume and diversity of applications served by regular grades ensure their continued dominance in the market.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

In the global insoluble sulfur market, the Asia Pacific region stands out prominently, holding an influential market share. As of 2023, the region accounted for approximately 39.7% of the global market, and projections suggest a further rise, with an anticipated market share of 42.2% by the end of the forecasted period. Several key factors underpin this dominance, with a few countries in particular propelling Asia Pacific to its leading position.

Central to Asia Pacific's dominance is the robust automotive sector present within the region. Asia, traditionally a hub for manufacturing, has over the years entrenched itself as a powerhouse in the global automotive industry. Given the intrinsic relationship between tire manufacturing — a significant consumer of insoluble sulfur — and the automotive sector, it is hardly surprising that the region's demand for insoluble sulfur has soared.

Statistically, China has emerged as the world's largest car market, producing over 25 million vehicles in 2021 alone. India, on the other hand, clinched the fourth position globally with a production of around 4 million vehicles the same year. South Korea and Japan, with their long-standing automotive legacy, further bolster the region's stature. Japan, home to automotive giants like Toyota, Honda, and Nissan, consistently ranks among the top three automobile producers worldwide. South Korea, with its significant exports and brands like Hyundai and Kia, only adds to this demand in the regional insoluble sulfur market. Given this immense production scale, the requirement for high-quality tires is a natural consequence, driving the demand for insoluble sulfur. Considering that the tire manufacturing process necessitates the use of insoluble sulfur to ensure durability, performance, and safety, the direct correlation between the automotive boom in the Asia Pacific and the rise in demand for insoluble sulfur becomes evident.

Apart from this, the region's strategic positioning in terms of supply chains is adding fuel to strengthening its dominance in the global insoluble sulfur market. With a strong network of suppliers, producers, and consumers, the region has a streamlined supply chain that ensures consistent availability and delivery of raw materials, including insoluble sulfur around the globe. As a result, the interconnectedness provides an added impetus to the region's market share. Furthermore, the ongoing investments in infrastructure and R&D in countries like China and India signal a favorable environment for the growth of industries dependent on insoluble sulfur. The region's governmental policies, which often emphasize manufacturing and export-led growth, coupled with incentives for industries, create a conducive ecosystem for sustained demand.

Top Players in the Global Insoluble Sulfur Market

- Oriental Carbon & Chemical Ltd

- Flexsys

- Henan Kailun Chemical Co., Ltd.

- Leader Technologies Co., Ltd

- LIONS INDUSTRIES, s.r.o.

- Luoyang Sunrise Industrial

- Nynas AB

- Sennics Co. Ltd.

- Shanghai Shangyi Chemical Technology Co. Ltd.

- Shikoku Chemicals Corporation

- Weifang Jiahong Chemical Co. Ltd.

- China Sunsine Chemical Holdings

- Willing New Materials Technology Co., Ltd.

- Shandong Yanggu Huatai Chemical Co., Ltd.

- Eastman Chemical Company

- Other Prominent Players

Market Segmentation Overview:

By Category

- Organic

- Inorganic

By Grade

- Regular Grades

- High Stability Grades

- Special Grades

By Application

- Tire Manufacturing

- Footwear

- Rubber Pipe

- Cable And Wire Insulating Materials

- Latex

- Rubber Belt

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)