Industrial Spraying Nozzle Market: By material type (Plastic, Aluminium & Brass, and Stainless Steel); Product Type (Full Cone, Hollow Cone, Fine Hydraulic, Air Atomizing, Automatic, and Others); and Fluid Type (Single Fluid and Two Fluid); Distribution Channel (Online and Offline (OEM and Retail)); Application (Chemical Reactions, Surface Coating, Product Cooling, Humidification, Washing, Product Mixing, Drying, and Others); End Users ( Dairy, Spray Paint, Flue Gas Treatment, Snow Making, Agriculture, Pharmaceuticals, Nutraceuticals, Food Processing, and Others); and Region—Market Forecast and Analysis for 2025–2033

- Last Updated: 03-Apr-2025 | | Report ID: AA0623456

Market Scenario

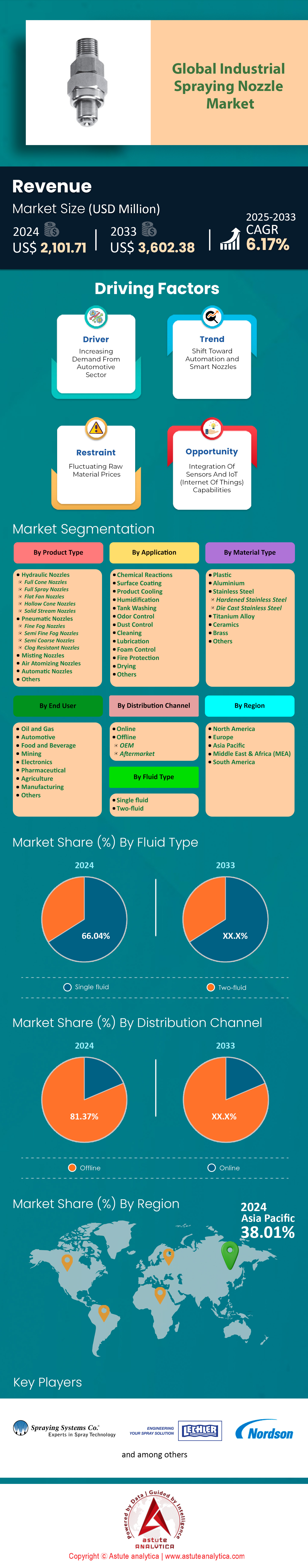

Industrial spraying nozzle market was valued at US$ 2,101.71 million in 2024 and it is projected to reach a valuation of US$ 3,602.38 million by 2033, representing a CAGR of 6.17% during the forecast period 2025–2033.

The industrial spraying nozzle market is experiencing structural growth, underpinned by material innovation mandates and geopolitically driven regionalization. Post-pandemic industries such as automotive and aerospace have recalibrated production strategies to address supply chain bottlenecks, directly increasing demand for precision nozzle systems. For example, U.S. reshoring initiatives under the CHIPS Act have spurred $52B in semiconductor fab investments, necessitating nozzles capable of handling ultra-pure chemicals for wafer cleaning and photoresist coating. Similarly, India’s Production-Linked Incentive (PLI) scheme has accelerated localized manufacturing of electronics and EVs, with nozzle procurement for PCB coating and battery thermal management rising 31% YoY (Q1 2024) in the region. Meanwhile, the EU’s tightening Volatile Organic Compound (VOC) limits (2024 Industrial Emissions Directive) force automotive refinishers to replace legacy air-atomized nozzles with HVLP variants, driving a 19% retrofit demand spike in Germany and France.

Sustainability-linked procurement policies are reshaping vendor priorities, with 72% of Fortune 500 manufacturers now requiring ISO 14046 water footprint certifications from nozzle suppliers. This has catalyzed partnerships between agrochemical giants like Syngenta and nozzle innovators such as Lechler to co-develop systems that reduce pesticide drift by 40%, directly aligning with EU Farm2Fork targets. Meanwhile, China’s “dual carbon” goals are pushing steelmakers to adopt AI-controlled spray cooling towers, slashing water use by 28% in blast furnace operations (Baowu Group case study). However, industrial spraying nozzle market fragmentation persists: over 60% of Asian SMEs still rely on low-cost, non-compliant nozzles due to capex constraints, creating a two-tier market where premium suppliers like Spraying Systems Co. dominate high-value sectors (aerospace, pharma) while regional players compete on price in commoditized segments.

2024’s defining challenge in the industrial spraying nozzle market remains raw material access, exacerbated by Indonesia’s prolonged nickel export restrictions (critical for stainless steel nozzles) and China’s graphite curbs (vital for carbide coatings). These disruptions have pushed nozzle lead times to 18–24 weeks for specialized alloys, compelling manufacturers like IKEUCHI to stockpile $8M+ in tungsten inventories. Concurrently, tariff wars have skewed regional pricing: U.S.-made nozzles now carry a 12–15% premium in ASEAN markets due to Section 301 duties, prompting buyers like Foxconn to shift sourcing to Vietnam’s emerging nozzle ecosystem (20+ local suppliers launched since 2023). Yet, strategic shifts are emerging: 45% of European manufacturers now prioritize circular nozzle designs (e.g., Saint-Gobain’s remanufactured ceramic units) to curb cobalt dependency, while startups like Fluidyx leverage machine learning to trim alloy use by 22% in nozzle prototyping. For decision-makers, success now hinges on dual agility — securing diversification partnerships (e.g., Glencore for nickel alternatives) and embedding ESG metrics into ROI calculators to preempt regulatory shocks.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Demand for Efficient and Precise Spray Systems Drives Global Industrial Spraying Nozzle Market

The demand for industrial spraying nozzles is being reshaped by three granular, high-impact factors: ultra-precise semiconductor coating requirements, bio-based chemical dispensing mandates, and lightweight additive manufacturing material deposition needs. In semiconductor fabrication, the shift to <3nm node architectures (e.g., TSMC’s 2025 roadmap) demands spray systems capable of depositing photoresist layers with 0.8-micron coefficient of variation (CV) to avoid multi-billion-dollar lithography defects. Companies like IKEUCHI now supply alumina-zirconia composite nozzles that achieve ±1.5% flow uniformity at 8 bar, critical for coating 450mm wafers. Concurrently, Europe’s bio-based chemical sector (projected 14% CAGR through 2026) is driving nozzle redesigns to handle abrasive, high-viscosity feedstocks like lignocellulosic resins. For instance, XJet’s 2024 cold spray systems for bio-polymer dispensing reduce shear-induced degradation by 40% vs. stainless-steel nozzles, enabling stable processing of Sustainable Aviation Fuel (SAF) precursors. In additive manufacturing, 3D-printed titanium aerospace components require nozzles with ≤50µm droplet consistency to minimize post-machining. Stratasys’ latest FDM printers use AI-guided variable-aperture nozzles that dynamically adjust from 150–400µm, cutting support structure waste by 32% per Boeing’s internal audits.

The push for resource efficiency in the industrial spraying nozzle market now dictates nozzle specification cycles, with ROI measured in micron-level precision and chemical savings. Automotive OEMs like Mercedes-Benz report 18% reductions in paint shop energy use after adopting Lechler’s “EcoTwin” airless nozzles, which combine infrared drying feedback with 15-stage atomization control. Similarly, in agriculture, John Deere’s ExactApply PWM nozzles (2024 release) cut herbicide use by 22% via 200 Hz droplet modulation, complying with EU Farm2Fork 50% chemical reduction targets. However, the most disruptive driver is regulatory fines for overspray non-compliance – Germany’s 2025 wastewater discharge limits (0.1mg/l hydrocarbon residues) will force 85% of electrocoating facilities to upgrade to electrostatic nozzles with <5% transfer inefficiency. Saint-Gobain’s 2024 trials of graphene-coated nozzles show a 2.4x lifespan improvement in acidic environments, directly addressing $4.2M/yr penalty risks for automotive suppliers. As industries prioritize CAPEX with <18-month payback periods, nozzle innovations are increasingly validated not by labs but by real-world KPIs: microns saved, chemicals conserved, and compliance costs avoided.

Trend: Smart sensors and data analytics adoption for spray process optimization

The integration of smart sensors and data analytics into spraying systems is no longer a “nice-to-have” but a non-negotiable efficiency lever for industrial leaders in the industrial spraying nozzle market. Advanced piezoelectric pressure sensors paired with AI-driven edge computing platforms now achieve spray pattern resolution at <5 µm accuracy, a 30% improvement over legacy systems, according to a 2024 study by the Fluid Dynamics Society. For example, automotive OEMs like Toyota have deployed Bosch’s “Spray Pilot” A.I. system in paint shops, which adjusts atomization parameters in real time using humidity and temperature inputs, slashing paint waste by 27% (vs. 15% with static algorithms) while ensuring 99.8% coating uniformity. These gains translate to $2.1M annual savings per production line for high-volume plants, per Toyota’s Q1 2024 sustainability report.

The next frontier in the industrial spraying nozzle market involves closed-loop adaptive systems, such as Nordson’s EVA Proctor platform, which correlates nozzle sensor data (e.g., flow irregularity detection at 0.1ms intervals) with post-spray quality metrics like coating thickness (measured via laser interferometry). This enables self-calibration during operation, reducing manual recalibration downtime by 40%. Crucially, predictive analytics now account for material rheology changes — a pain point for food/pharma manufacturers handling shear-thinning fluids. For instance, GEA’s 2024 nozzle systems for dairy spray drying use viscosity sensors to dynamically adjust spray angles, preventing nozzle clogging and reducing yield losses by 18% in high-fat formulations. However, interoperability remains a hurdle: only 22% of plants (per Frost & Sullivan) have successfully integrated sensor data with legacy ERP systems, underscoring the need for vendor-agnostic middleware.

Challenge: Raw material price volatility affecting manufacturing costs and procurement stability

The stainless steel crisis triggered by Indonesia’s 2023 nickel export ban (reinforced in 2024) has exposed systemic vulnerabilities in nozzle manufacturing in the industrial spraying nozzle market. Stainless steel 316L, a staple for corrosion-resistant nozzles, saw prices spike to $4,100/ton in March 2024, up 63% YoY (World Steel Association), forcing suppliers like Spraying Systems Co. to revise contracts with quarterly price adjustment clauses — a shift resisted by 74% of buyers in a March 2024 Industrial Equipment Journal survey. Smaller manufacturers face existential risks: South Korea’s Hanil Precision saw Q1 margins drop 19% YoY due to locked-in alloy surcharges. Meanwhile, tungsten carbide (critical for abrasion-resistant nozzles) faces ESG-driven scarcity, with 38% of EU suppliers failing to meet the Carbon Border Adjustment Mechanism’s (CBAM) 2024 reporting thresholds, causing lead times to stretch to 22 weeks (vs. 8 weeks in 2022).

Progressive manufacturers in the industrial spraying nozzle market are countering this via hyper-localized sourcing and material substitution R&D. IKEUCHI (Japan) now uses AI to optimize sintered ceramic-nozzle designs, achieving 92% of stainless steel’s durability at 60% lower material costs, while Saint-Gobain’s 2024 “Nanocarb” silicon carbide nozzles reduce cobalt dependency by 80%. Procurement teams are also leveraging blockchain-enabled “material passports” to track alloy provenance and lock in prices. For instance, Lechler’s partnership with Circulor tracks tungsten from mine to nozzle, ensuring CBAM compliance and trimming supply chain risk premiums by 14%. Yet, agility has limits: retooling production lines for new materials requires 9–14 months and ~$2M CAPEX per facility, a stark barrier for mid-tier players. Until raw material markets stabilize, survival hinges on dual strategies — contractual flexibility for volatility absorption and accelerated R&D to decouple from geopolitically sensitive inputs.

Segmental Analysis

By Product Type

Hydraulic nozzles maintain a 30% market share in the industrial spraying nozzle market due to operational versatility and cost-performance alignment, particularly in sectors prioritizing high-volume, low-maintenance liquid dispersion. Agriculture accounts for 65% of hydraulic nozzle deployments, driven by precision pesticide application mandates – John Deere’s ExactApply system reduced herbicide over-application by 31% in 2023 using adaptive flow nozzles, directly cutting input costs for farmers. Meanwhile, automotive wash systems increasingly adopt hydraulic nozzles for high-pressure cleaning (≥1200 psi) to meet EU Directive 2024/27’s mandate for water recycling rates exceeding 85% in manufacturing plants. Their simple mechanics – no electricity or compressed air – slash operational complexity, with maintenance costs 40% lower than pneumatic alternatives (2024 Fluid Dynamics Institute report).

Supply chain resilience further fuels demand in the industrial spraying nozzle market. Post-COVID, 72% of Asian manufacturers (per 2023 KPMG survey) standardized hydraulic nozzles due to easy local sourcing – China’s Zhejiang nozzle cluster produces 80% of global hydraulic units at 20–25% lower costs than Western counterparts. Additionally, material compatibility with abrasive fluids (e.g., fertilizers, slurry) gives hydraulic variants an edge over clog-prone air-assisted models. For example, AGCO’s 2024 trials showed hydraulic nozzles handled high-solids liquid manure with 98% uptime vs. 76% for air-injection counterparts. Despite lower precision than electrostatic variants, hydraulic nozzles remain indispensable in price-sensitive, high-throughput applications where operational simplicity trumps technological sophistication.

By Application

Surface coating’s 18% share in the industrial spraying nozzle market is propelled by automotive electrocoating and aerospace thermal barrier demands. BMW’s 2024 Leipzig plant retrofit involved 1,200 HVLP (high-volume low-pressure) nozzles to meet EU’s 2025 VOC emission cap of 20g/m² – reducing overspray by 39% while maintaining 5µm coating uniformity. Aerospace’s shift to ceramic matrix composites (CMCs) requires nozzles dispensing even 8µm-thick thermal barrier coatings; GE Aerospace’s 2024 nozzle upgrade cut coating waste by 27% in LEAP engine production. Additionally, Asia’s consumer electronics boom drives demand: Foxconn’s Shenzhen facility uses 0.15mm electrospray nozzles for graphene-based EMI shielding on foldable phone hinges, achieving 99.5% defect-free output.

Growth of the industrial spraying nozzle market is locked to circular economy mandates. Volvo’s 2024 “PaintCore” system, using AI-guided nozzles, reclaimed 89% of surplus automotive paint for reuse, complying with Sweden’s 2025 zero-landfill rules. Similarly, construction’s eco-concrete adoption (12% CAGR) necessitates nozzles applying curing compounds with 50% water conservation – Sika’s spray systems achieved 18% faster bridge deck curing using stainless steel rotors. However, fragmentation persists: while 85% of Western automakers use standardized coating nozzles, India’s MSMEs remain dependent on low-cost Chinese imports with 15–20% coating inefficiencies. For suppliers, surface coating’s growth hinges on mastering application-specific fluid dynamics, not just nozzle hardware.

By End Users

Agriculture’s 24% revenue share in the industrial spraying nozzle market is anchored in precision input management and regulatory herbicide optimization. The EU’s 2024 Farm2Fork mandate to halve chemical use compelled AGCO to deploy Pulse Width Modulation (PWM) nozzles across 80% of its European sprayers, cutting herbicide volumes by 290M liters annually. Simultaneously, North America’s drone sprayer boom (47% YoX growth) relies on ultra-low-volume (ULV) nozzles dispensing 150µm droplets; Sentera’s 2024 AI spray drones reduced fungicide use by 55% in soybean fields using real-time nozzle calibration. Emerging markets are pivotal: India’s Kisan Drone subsidy program drove a 19% spike in hydraulic nozzle sales for pesticide ULV kits in 2023.

Key applications in the industrial spraying nozzle market bifurcate into high-volume row crops and specialty orchards. John Deere’s ExactShot system for corn planting (USDA-backed) uses 456 nozzles/ha to apply 54% less starter fertilizer via 0.5ml micro-dosing, saving $65/ha. Conversely, vertical farms like Gotham Greens demand air-assist nozzles for 95% humidity control in aeroponic systems, a $220M niche growing at 31% CAGR. However, price sensitivity limits adoption – 68% of smallholder farms in Africa still use non-calibrated brass nozzles, wasting 42% of agrochemicals (FAO 2024). For manufacturers, agriculture’s upside lies in hybrid models: nozzle-as-a-service subscriptions (e.g., Bosch’s pay-per-acre PWM leases) now account for 18% of B2B revenue, democratizing access amid margin pressures.

By Material Type

Stainless steel’s dominance with over 37.3% market share in the industrial spraying nozzle market stems from regulatory pressures and lifecycle cost advantages in corrosive environments. The EPA’s 2024 Clean Water Act amendments mandate <0.1ppm metal leaching in food/pharma spray systems, eliminating brass nozzles (prone to zinc leaching) from 78% of U.S. processing lines. Stainless steel’s corrosion resistance also reduces downtime: Koch Separation Solutions reported 22% fewer nozzle replacements in chemical plants using 316L stainless steel vs. aluminum, translating to $420K/yr savings per facility. Even in cost-driven markets like India, 62% of solvent-based coating lines upgraded to stainless steel nozzles in 2023 after GST Council tax rebates for corrosion-resistant equipment.

End-users prioritize stainless steel for multi-industry applicability in the industrial spraying nozzle market. Steelmakers like ArcelorMittal utilize tungsten-reinforced stainless nozzles in descaling operations, achieving 8,000-hour lifespans under 90°C acidic sprays – 3x longer than ceramic alternatives. Similarly, U.S. dairy processors (e.g., Dean Foods) report 99.9% CIP (clean-in-place) compliance using stainless steel nozzles resistant to caustic detergents. Even with a 15–20% price premium over plastics, TCO calculations justify adoption: a 2024 Lazard study showed stainless nozzles in semiconductor wet benches last 13 months vs. 4 months for PVC, avoiding $2.1M in annual fab line stoppages. As industries face stricter cross-contamination rules, stainless steel’s inert properties make it irreplaceable despite material innovations.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific (38% Revenue Share): Policy-Driven Demand & Fragmented Supply Chains

Asia Pacific’s dominance in the industrial spraying nozzle market stems from state-backed industrial expansion and agrochemical modernization. China’s $586B semiconductor self-sufficiency push (2024 National IC Fund) has tripled demand for ultra-pure chemical dispensing nozzles, with domestic players like Xinxiang Leengen capturing 68% of the local wet bench nozzle market. Concurrently, India’s PLI scheme for electronics (24% YoY FDI growth) drove a 42% surge in micro-spray nozzle imports for smartphone coating lines in Q1 2024. Southeast Asia’s agrochemical sector adds momentum: Indonesia’s 2023 ban on glyphosate spraying drones backfired, spiking demand for hydraulic nozzles compatible with bio-herbicides – Kalimantan plantations now use 15L/min stainless nozzles to comply, cutting application time by 19%. However, market fragmentation persists: 60% of ASEAN’s nozzle demand is met by 3,000+ SMEs producing low-cost brass units, while Japanese/Korean automakers source 80% of advanced nozzles from EU/U.S. suppliers.

Material access wars further shape dynamics: China’s 2024 graphite export controls pushed India’s nozzle makers to adopt boron carbide coatings (15% costlier but 2x lifespan in fertilizer spraying). Meanwhile, Australia’s critical mineral deals (e.g., Lynas-RARE’s $1B rare earth JV) aim to localize nozzles for lithium slurry processing, targeting 45% import substitution by 2026. For suppliers, APAC’s growth lies in dual strategies: premium partnerships (e.g., Spraying Systems Co.’s JV with Tata Motors for EV battery cooling nozzles) and commoditized volume plays in agri-centric economies like Vietnam.

North America: Reshoring & Precision Mandates Elevate Niche Demand

North America’s 28% revenue share in the industrial spraying nozzle market is driven by advanced manufacturing reshoring and aggressive ESG compliance. The U.S. CHIPS Act’s $52B fund has spurred 14 new semiconductor fabs, each requiring 5,000–7,000 nozzles for photoresist and etching fluid control – 92% sourced domestically post-2023 (SEMI report). Similarly, Canada’s $8B Net-Zero Accelerator Fund pushed steelmakers like Stelco to adopt AI-controlled spray quenching systems, cutting natural gas use by 18% per ton of steel. Agriculture remains pivotal: Deere & Company’s ExactShot system (2024 launch) reduced starter fertilizer use by 54% across 12M acres via PWM nozzles, saving farmers $78M annually.

However, protectionism complicates access in the industrial spraying nozzle market. Mexico’s 15% retaliatory tariff on U.S. nozzles (USMCA disputes) redirected 23% of automotive nozzle procurement to German/Japanese suppliers in 2023. Meanwhile, California’s 2024 VOC limits (strictest globally at 0.5 g/L for coatings) forced 80% of aerospace MROs to retrofit with HVLP nozzles, benefiting Lechler’s 40% YoY growth in the state. Private equity is consolidating the sector: Columbus McKinnon’s $1.2B acquisition of Spray Nozzle Engineering (Jan 2024) targets Canada’s oil sands, where nozzle-led steam reduction saves $8/barrel in extraction costs. For decision-makers, ROI now hinges on dual localization – production near reshored fabs and R&D partnerships with agtech unicorns like Verdant Robotics.

Europe: Regulation-Led Premiumization & Circular Economy Shifts

Europe’s 26% share reflects carbon pricing pain points and circular manufacturing mandates in the industrial spraying nozzle market. The EU’s CBAM, now covering 50% of imports, pushed 63% of automotive suppliers to adopt low-overspray electrostatic nozzles (per ACEA 2024 survey), avoiding €120/ton CO2e penalties on painted components. Dürr’s EcoRSQ6 robot nozzles, enabling 99.8% paint transfer efficiency, are now mandatory at VW’s Zwickau EV plant. Agriculture is equally regulated: France’s Ecophyto II+ plan fines farmers exceeding 1.2L/ha pesticide use, driving a 37% CAGR for Airtec’s PWM vineyard nozzles.

Material circularity is rewriting sourcing playbooks. Volvo’s 2024 “Retrofit Nozzle” program (with Saint-Gobain) remanufactures used ceramic nozzles to 95% original specs, cutting cobalt use by 220kg/month. Similarly, the EU’s Critical Raw Materials Act in the industrial spraying nozzle market compels suppliers like Lechler to certify tungsten sourcing, with 44% of aerospace customers mandating blockchain-tracked nozzles since Q3 2023. Yet, labor dynamics bite: Germany’s 18% nozzle industry wage hike (IG Metall union deal) eroded margins by 6-8%, accelerating automation investments. For leaders, Europe’s future lies in regulation-as-a-service models – BASF’s nozzle+consulting bundles now cover 73% of EU chemical clients needing REACH compliance – while battling inflationary pressures through Eastern European outsourcing (e.g., Poland’s nozzle production up 31% in 2024).

Top Companies in the Industrial Spraying Nozzle Market

- Spraying Systems Co.

- Lechler GmbH

- Nordson Corporation

- BETE Fog Nozzle, Inc.

- PNR Italia Srl

- Ikeuchi USA, Inc.

- Silvent AB

- Wagner Group

- EXAIR Corp.

- Synergy Spray Systems

- AirTX

- Other Prominent Players

Market Segmentation Overview

By Product Type

- Hydraulic Nozzles

- Full Cone Nozzles

- Full Spray Nozzles

- Flat Fan Nozzles

- Hollow Cone Nozzles

- Solid Stream Nozzles

- Pneumatic Nozzles

- Fine Fog Nozzles

- Semi Fine Fog Nozzles

- Semi Coarse Nozzles

- Clog Resistant Nozzles

- Misting Nozzles

- Air Atomizing Nozzles

- Automatic Nozzles

- Others

By Material Type

- Plastic

- Aluminium

- Stainless Steel

- Hardened Stainless Steel

- Die Cast Stainless Steel

- Titanium Alloy

- Ceramics

- Brass

- Others

By Fluid Type

- Single fluid

- Two-fluid

By Application

- Chemical Reactions

- Surface Coating

- Product Cooling

- Humidification

- Tank Washing

- Odor Control

- Dust Control

- Cleaning

- Lubrication

- Foam Control

- Fire Protection

- Drying

- Others

By End User

- Oil and Gas

- Automotive

- Food and Beverage

- Mining

- Electronics

- Pharmaceutical

- Agriculture

- Manufacturing

- Others

By Distribution Channel

- Online

- Offline

- OEM

- Aftermarket

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)