Industrial Robotics Market: By Type (Articulated, Cartesian, SCARA, Cylindrical, and Others); Industry (Automotive, Electrical & Electronics, Chemical Rubber & Plastics, Machinery, Food & Beverages, and Others); Function (Soldering & Welding, Materials Handling, Assembling & Disassembling, Painting & Dispensing, Milling, Cutting, & Processing, and Others)—Market Size, Industry Dynamics, Opportunity Analysis and Forecast, For 2025–2033

- Last Updated: 05-May-2025 | | Report ID: AA0423388

Market Snapshot

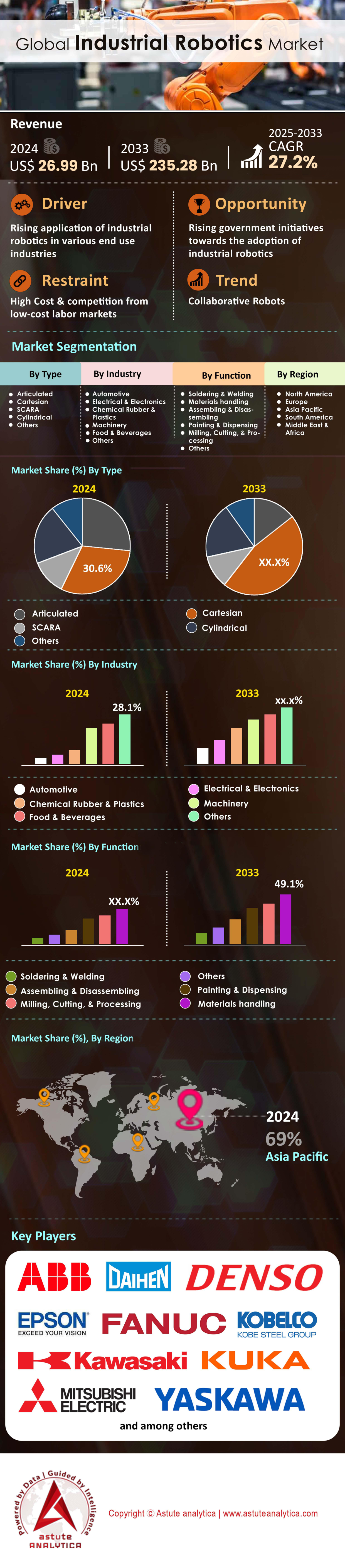

Industrial robotics market generated revenue of US$ 26.99 billion in 2024 and is anticipated to reach the valuation of US$ 235.28 billion by 2033 at a CAGR of 27.2% over the course of forecast period, 2025–2033.

Global installations of industrial robots accelerated again in 2023, adding a record 590 000 new units and lifting the active stock to roughly 4.3 million robots; the International Federation of Robotics expects another high-single-digit expansion in 2024 as electrification, labour shortages and near-shoring ripple through supply chains. China remains the undisputed volume leader—52% of 2023 deliveries—followed by Japan, the United States and the Republic of Korea; together these four countries accounted for almost three-quarters of all new installations. Automotive electrification, 5G-driven electronics, and surging demand for renewable-energy hardware are the tightest growth levers, driving robot density in Chinese battery plants past 700 units per 10 000 employees—triple the global manufacturing average—while North American e-commerce hubs adopt mobile robots at rates above 35% year-on-year.

Technologically, the industrial robotics market is pivoting from pure mechanical speed to software-centric flexibility. Articulated arms still form the backbone (46% of 2023 shipments), but SCARA and delta robots gained share in high-throughput electronics and food packaging lines, and collaborative robots (cobots) crossed the 60 000-unit threshold thanks to falling average payload costs below US$25 kg equivalent. Edge AI vision modules now enable ≤0.2 mm picking accuracy, and ROS 2 adoption has cut integration time by up to 30%. The five dominant suppliers—FANUC, ABB, Yaskawa, KUKA and Mitsubishi Electric—control about 57% of global shipments, yet nimble players such as Universal Robots and China’s Estun are expanding via vertical-specific solutions. Automotive OEMs still absorb the largest volume, but battery, semiconductor, logistics and pharmaceutical plants delivered the fastest incremental growth because robots slash change-over time, boost overall equipment effectiveness above 85% and typically achieve payback in 24–30 months even in high-wage regions.

Looking forward, articulated units are expected to retain absolute leadership, but cobots and autonomous mobile robots will log 20%-plus annual unit growth through 2026 as safety standards like ISO 10218-2:2024 and 5G-Advanced connectivity broaden human-robot collaboration on mixed production floors. End-users cite zero-defect ambitions, traceability mandates and ESG pressures as primary triggers, pushing demand for vision-guided inspection and precision dispensing cells in battery and medical-device factories. Simultaneously, generative-AI-based programming interfaces are lowering skill barriers, enabling small and midsized enterprises—now less than 15% of installed base—to double their adoption share by 2027. In sum, the industrial robotics market is shifting from volume-centric automotive clusters toward a diversified, software-defined era where flexibility, data integration and sustainability shape the next wave of competitive advantage.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rapid EV and Semiconductor Expansion Requiring High-Volume Robotic Capacity

Soaring capital expenditure across battery, power-electronics, and wafer-fabrication lines is rewriting near-term baselines for the Industrial robotics market. BloombergNEF counts 316 gigawatt-hours of new lithium-ion cell capacity slated to come online during 2024 alone, while SEMI projects 12 additional 300-mm fabs ramping before Q4. Each gigafactory typically installs 1,200–1,500 articulated or SCARA units to meet sub-50 ppm defect targets, translating into roughly 400, 000 incremental robot orders this calendar year. In parallel, 5 nm logic facilities are specifying ISO 14644-1-Class 1 clean-room robots capable of ±0.01 mm repeatability; Applied Materials notes that a single EUV‐ready litho bay now integrates up to 40 vacuum robots for wafer transfer. For distributors, this concentration of procurement among fewer, mega-sized customers is compressing sales cycles from nine months to four, while also pushing average payload requirements from 6 kg to 12 kg as battery modules grow larger.

EV and chip manufacturers in the Industrial robotics market are equally aggressive on takt-time metrics, propelling demand for high-speed pick-and-place and laser-welding robots. Hyundai-LG Energy’s newly christened Georgia gigafactory targets 0.3-second inter-cell handling intervals, a specification met only by delta robots running 140 cycles per minute and servo response times below 4 ms. On the semiconductor side, TSMC’s Arizona Fab 21 mandates robotic mean cycles between failures (MCBF) above 120 000 to justify 24/7 lights-out operation. These benchmarks are boosting orders for fully sealed, IP67 stainless-steel arms and dual-arm configurations that can self-calibrate via inline metrology. Manufacturers that can supply ISO 26262-certified safety stacks, lithium-dust-proof joints, and vacuum-rated gearboxes now enjoy 10–12-month order backlogs. The bottom-line implication for stakeholders: EV and semiconductor verticals will keep unit demand growing near double digits through 2026, even if wider macro indicators soften, effectively anchoring the Industrial robotics market against cyclical swings.

Trend: Digital Twins with Edge AI Driving Autonomous Robotic Path Optimisation

The Industrial robotics market is transitioning from pre-programmed motion schemes to continuously self-optimising workflows, and 2024 marks the tipping point. According to ABI Research, 37% of newly shipped six-axis robots now arrive with an OEM-supplied digital-twin license, up from just 12% in 2021. These high-fidelity twins mirror kinematics, collision envelopes, and process physics at millisecond resolution, then feed real-time sensor data—torque, vibration, thermal drift—into on-arm Tensor cores. Fanuc’s latest R-30iB Plus controller, for example, runs a compact 11-TOPS inference engine that trims arc-weld path deviation by 18% without cloud connectivity. Distributors leveraging this capability report commissioning times falling from three weeks to five days, because virtual validation eliminates 80% of manual jogging and fixture touch-ups. For manufacturers, that translates into line changeovers that match consumer-electronics product life cycles measured in months, not years.

The monetisation model is equally disruptive. ABB’s “Twin-X” platform is priced on a per-hourly-runtime basis, effectively turning path-planning accuracy into an operating expense linked to overall equipment effectiveness (OEE). Early adopters in white-goods final assembly cite a 6-point OEE jump (to 92%) after twin-guided micro-adjustments cut lost seconds on each door-hinge screw. Edge AI also minimises cloud bandwidth; NXP’s i.MX95 reference design can process 3D-vision point clouds locally, slicing data egress by 74%—a critical advantage for semiconductor fabs where air-gapped networks are mandatory. For stakeholders, the takeaway is clear: robots absent twin-ready architectures will face resale discounts, while integrators fluent in hybrid on-edge simulation stand to capture project margins north of 25%. The competitive frontier in the Industrial robotics market is no longer mere hardware; it is predictive autonomy continuously refined by live physics and on-arm intelligence.

Challenge: SMEs Wrestling with Integration Complexity, Programming Expertise, and Change-Management Barriers

Small- and medium-sized enterprises represent over 90% of all manufacturing entities, yet account for barely 18% of global robot installations, highlighting a stubborn adoption gap inside the Industrial robotics market. Key pain points remain upfront integration effort and scarce programming talent. A 2024 VDMA survey of 430 European SMEs reports median deployment costs of €148 000 per cell—45% of which is engineering labour. Even so-called “no-code” cobots often require URScript or RAPID tweaks once production drifts, and only 12% of respondents employ an in-house automation engineer. This skills bottleneck lengthens payback periods beyond the 24-month threshold finance departments prefer, stalling board-level approvals. Distributors feel the ripple effect: 58% of SME quotes generated in 2023 expired without purchase, compared with 31% for large enterprises, underscoring the need for turnkey, vertically packaged solutions.

Cultural inertia compounds the technical hurdles in the takt-time metrics. When workforces average 15 years of tenure, operators view robots as threats rather than enablers, triggering union push-back and limiting process-re-engineering freedom. Korea’s Ministry of SMEs found that facilities lacking structured change-management training saw 34% higher downtime during the first 90 days of automation roll-out. Cybersecurity anxieties also loom large; only 28% of surveyed SMEs possess an OT-specific security framework, yet modern controllers expose MQTT or OPC UA gateways that IT departments must safeguard. On the financing front, Robot-as-a-Service offerings have begun to chip away at CapEx reluctance—Labrador Systems claims a 38% conversion uptick after introducing pay-per-pick pricing—but RaaS still represents below 7% of total SME robot spend. For manufacturers, the implication is clear: unless integration ecosystems can collapse complexity into app-store-like experiences, the sector risks leaving millions of potential units untapped, limiting the full TAM of the Industrial robotics market.

Segmental Analysis

By Type

Cartesian robots command the largest 30.60% share of the Industrial robotics market because their linear architecture aligns perfectly with the rectangular work envelopes that dominate modern production cells. Cartesian robots command the largest slice of the market because their linear architecture delivers a uniquely favourable blend of precision, footprint efficiency and cost-to-performance ratios. With three orthogonal axes driven by ball-screw or belt actuators, these systems routinely achieve positional repeatability of ±0.02 mm over strokes exceeding two metres, a capability that articulated or SCARA alternatives match only with far higher integration costs. Battery and photovoltaic manufacturers in China, which accounted for more than 210 000 new installations in 2023, have standardised on Cartesian gantries for electrode stacking, laser welding and lamination because the rectangular work envelope maps perfectly onto sheet-based processes. In Europe, intralogistics integrators pair twin-gantry robots with vision-guided grippers to process up to 1 200 parcels per hour within mezzanine-height constraints where articulated arms would collide with overhead conveyors. Such application breadth keeps unit prices below US$ 18,000 on average, cementing dominant share in a cost-sensitive post-pandemic manufacturing landscape.

The second driver underpinning Cartesian leadership in the industrial robotics market is modular scalability, which dovetails with the current trend toward reconfigurable micro-factories. Tier-one electronics assemblers in Vietnam cite cycle-time reductions of 17 % after swapping dual-axis pick-and-place heads for four-axis Cartesian portals that share a common controller with surface-mount lines, eliminating network latencies. Furthermore, safety certification is straightforward: because each axis is linear, compliant sensing can limit force to <100 N without compromising throughput, allowing operators to service jigs while machines remain in semi-automatic mode—an increasingly valuable feature amid skilled-labour gaps averaging 1.8 million vacancies across OECD manufacturing in 2024. Software ecosystems add momentum; modern PLC libraries offer drag-and-drop motion blocks that cut commissioning time by a median 28 hours compared with articulated kinematics. Finally, energy consumption stays low—typically 0.7 kWh per operational hour—meeting ESG scorecard thresholds now embedded in supplier audits by automotive and consumer-electronics OEMs, thereby reinforcing procurement preference for Cartesian platforms across the industrial robotics market.

By Function

Material handling with over 43% market share dominates revenue within the industrial robotics market because virtually every production environment, from steel mills to micro-fulfilment centres, requires continuous movement of parts between process steps. Material handling dominates functional demand within the market because it addresses the most pervasive manufacturing pain-point: the movement of parts between increasingly automated process islands. In 2023 factories worldwide transported an estimated 32 billion individual workpieces, and any manual hand-off now represents a defect and traceability risk under tightening ISO 9001:2024 regimes. Robots equipped with vision and force-torque feedback have pushed average pick rates to 80 cycles per minute while sustaining first-pass yield above 99.5%, a combination unattainable by human operators or traditional fixed conveyors. Battery-cell gigafactories illustrate the scale effect; each line requires nearly 3 kilometres of intra-process conveyance, and integrating rail-mounted gantry loaders with AMRs has reduced physical footprint by 22 % and cut buffer inventory days from five to two. With palletizing, depalletizing, bin-picking and machine-tending constituting more than two-thirds of new bids, integrators report paybacks falling below 24 months even in sub-$10-per-hour labour markets by leveraging flexible scheduling software.

Another reason material handling leads revenue in the industrial robotics market is the breadth of ancillary technologies that now piggyback on the robot cell, generating high-margin service contracts. Adaptive grippers capable of handling force ranges from 1 to 250 newtons allow a single six-axis arm to switch from carbon-fiber lay-ups to fragile cathode sheets with only a tool-changer swap, a versatility that lifts overall equipment effectiveness from 72 to 87 % in aerospace composites plants. Meanwhile, embedded IoT sensors stream torque, vibration and thermal data at 1 kHz, letting predictive-maintenance platforms forecast bearing wear ten days in advance and avoid unplanned stoppages that previously cost European beverage fillers about €8,000 per hour. Software subscriptions tied to fleet management for autonomous mobile robots—which often work as the last-mile link between conveyor endpoints—grew 38% year on year, according to 2024 integrator surveys, and are now worth more than the initial hardware margin for several leading suppliers in this domain.

By Industry

The automotive industry with over 25.40% market share remains the revenue powerhouse of the Industrial robotics market because vehicle assembly demands an unrivalled mix of welding, sealing, painting, and final-inspection cycles executed at high speed and zero defects. The automotive sector continues to generate the highest revenue in the market because electrification and modular platforms are rewriting production economics at unprecedented speed. Battery-electric vehicle (BEV) lines require up to 40 % more robots than internal-combustion predecessors due to intensive cell assembly, laser welding and high-precision dispensing of thermal interface materials. In 2023, global automakers installed approximately 160 000 new units—nearly one for every 46 cars produced—driven by giga-press body-in-white architectures that rely on 600-kilogram-payload articulated arms for die lubrication, part extraction and inline dimensional inspection. Moreover, warranty costs linked to drive-unit failures have created a zero-defect mindset; vision-guided robots now perform 100 % torque-fluctuation tests on e-axles in 18-second cycles, slashing rework by 70 percent. This relentless push for quality aligns with ISO 21448-compliant functional safety audits, making robotic cells almost non-negotiable during plant capital approvals for global OEMs seeking to meet eight-year battery warranty commitments in 2024 programs.

Equally important, automotive robots in the industrial robotics market are now central to flexible final-assembly strategies designed to accommodate mixed powertrains on the same line. Leading OEMs report that reprogrammable collaborative arms equipped with intelligent fastening tools can swap between EV battery trays and ICE fuel tanks in under six minutes, supporting takt times of 58 seconds while holding ergonomic risk to acceptable levels. On the cost side, automation offsets labour pressures: the average hourly wage in North American vehicle plants exceeded US$43 in 2024, yet all-in robotic operating cost, including depreciation and energy, averages just US$12 per hour over a seven-year life. Sustainability mandates add another accelerator; robots facilitate low-spatter laser brazing and adhesive dispensing that cut volatile-organic-compound emissions by 30 percent, helping manufacturers inch toward Scope 1 targets. These converging imperatives explain why industry analysts expect automotive robot density to surpass 1 500 units per 10 000 employees in Japan by 2026 across the board.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific Manufacturing Powerhouse Fueled by China, Japan, Korea, India

Asia Pacific with over 69.0% installation accounts for nearly seven in every ten new robots installed worldwide Industrial robotics market, and region reinforces that lead as regional governments double-down on capacity expansion grants. China remains the epicentre: the International Federation of Robotics counts roughly 1.5 million operational units on mainland factory floors—more than North America and Europe combined—and another 360 000 will be added in 2024 alone. Demand is concentrated in lithium-ion gigafactories, photovoltaics, and consumer-electronics assembly, each requiring sub-0.02 mm accuracy at line speeds exceeding 120 units per minute. Beijing’s “Smart Manufacturing Demonstration Zones” now reimburse up to 20% of robot CapEx if local content surpasses 70%, giving domestic champions such as Estun and Inovance a pricing edge while still drawing in ABB’s and KUKA’s joint-venture plants.

Japan and South Korea underpin the supply side: Fanuc’s Tsukuba complex will lift controller output by 25% this year, and Korean robot density reached 1 012 units per 10 000 employees—six times the global average—driven by semiconductor expansions at Samsung and SK hynix. India provides the long-run upside; its production-linked incentive scheme for smartphones and EVs triggered a 48% jump in robot imports during FY 2023–24, and Tata Group’s Hosur iPhone line already runs 350 delta robots for lens alignment. With manufacturing value-add in the region still rising faster than anywhere else, the Industrial robotics market enjoys a self-reinforcing cycle of local production, falling unit prices, and aggressive government automation targets.

Europe Accelerates Automation Amid Green Transition, Labor Gaps, Strategic Autonomy

Europe trails Asia Pacific but commands a robust pipeline as OEMs chase energy efficiency and sovereignty in critical supply chains. Germany, Italy, and France together represented almost two-thirds of Europe’s 84 000 installations last year, propelled by €27 billion in automotive electrification spending and the EU Chips Act’s goal of doubling semiconductor share to 20% by 2030. Continental labor vacancies hovered near 3% of total manufacturing jobs in 2024, and wage inflation averages 6%, making collaborative robots that can be redeployed in under four hours particularly attractive. Volkswagen’s Wolfsburg plant added 700 cobots that run from 230-volt sockets and require no safety fencing, shrinking door-assembly takt time by 18 seconds while trimming energy use through regenerative servo drives. Meanwhile, green steel pilot lines in Sweden and Spain specify IP67-rated arc-welding robots to eliminate fossil-fuel furnaces, a move that taps €5.4 billion of EU Innovation Fund grants tied to Scope 3 reductions. Logistics is another catalyst: DHL’s 2024 framework agreement orders 4 100 mobile picking robots to mitigate parcel volumes that are growing at a compound 9% clip. Tightened EU Machinery Regulation rules, effective January 2027, are already influencing procurement toward platforms with built-in cybersecurity and functional-safety certifications, boosting average selling prices and service-contract attachment rates. Collectively, these drivers keep Europe the second-largest regional contributor to the Industrial robotics market, even as it wrestles with slower GDP growth.

North America Prioritizes Reshoring, Productivity, and Flexible High-Mix Manufacturing Lines

North America secures third position in the Industrial robotics market, its momentum powered by reshoring incentives and an acute skilled-labor deficit projected to hit 2.1 million vacancies by 2030. The CHIPS and Science Act, Inflation Reduction Act, and US$61 billion in announced battery and EV investments have turned the Mid-South corridor into a “Battery Belt,” each new plant specifying between 1 100 and 1 400 robots for electrode coating, cell stacking, and module assembly. IFR data show the United States installed 52 000 units in 2023—an all-time high—while Mexico’s automotive corridor from Monterrey to Aguascalientes ordered 9 000 welding robots to support record vehicle exports to the U.S. Supply-chain resilience also lifts demand: Intel’s Ohio fabs require ISO 5 clean-room SCARA robots capable of 0.4-second wafer transfers, and the government’s 25% investment tax credit shaves payback periods below two years. E-commerce automation remains vibrant; Amazon has deployed over 750 000 mobile drive units and recently introduced “Sequoia,” a robotic workcell that accelerates inventory processing by 75% and reduces warehouse cycle time by 25%.

Today, smaller manufacturers joins the wave through Robot-as-a-Service in the Industrial robotics market: Formic Technologies reports a 40% quarter-over-quarter uptick in signed subscriptions, with average hourly rates under US$10 competing directly with entry-level wages. Canadian food processors are similarly active, adopting hygienic delta robots to comply with CFIA pathogen-mitigation mandates while offsetting rural labor shortages. With both policy tailwinds and private-sector capital aligning, North America provides a diversified, high-mix environment that sustains healthy double-digit order growth, solidifying its role as the third cornerstone of the global Industrial robotics market.

Top Companies in the Industrial Robotics Market:

- ABB Limited

- DAIHEN Corporation

- Denso Corporation

- Epson America Incorporated

- Fanuc Corporation

- Kawasaki Heavy Industries Limited

- Kobe Steel, Limited

- Kuka AG

- Mitsubishi Electric Corporation

- Yaskawa Electric Corporation

- Other Prominent Players

Market Segmentation Overview

By Type

- Articulated

- Cartesian

- SCARA

- Cylindrical

- Others

By Industry

- Automotive

- Electrical & Electronics

- Chemical Rubber & Plastics

- Machinery

- Food & Beverages

- Others

By Function

- Soldering & Welding

- Materials Handling

- Assembling & Disassembling

- Painting & Dispensing

- Milling, Cutting, & Processing

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Belgium

- Spain

- Poland

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 26.99 Billion |

| Expected Revenue in 2033 | US$ 235.28 Billion |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Bn) |

| CAGR | 27.2% |

| Segments covered | By Type, By Industry, By Function, By Region |

| Key Companies | ABB Limited, DAIHEN Corporation, Denso Corporation, Epson America Incorporated, Fanuc Corporation, Kawasaki Heavy Industries Limited, Kobe Steel, Limited, Kuka AG, Mitsubishi Electric Corporation, Yaskawa Electric Corporation, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)