Global Industrial Crystallizers Market: By Type (Evaporative Crystallizers, Cooling Crystallizers); Method (DTB Crystallizers, Forced Circulation, Crystallizers, Fluidized Bed Crystallizers, Other); Process (Continuous, Batch); End Use Industry (Pharmaceutical, Agrochemical, Metal & Mineral, Food & Beverage, Chemical, Wastewater Treatment, Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Jul-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0724869 | Delivery: 2 to 4 Hours

| Report ID: AA0724869 | Delivery: 2 to 4 Hours

Market Scenario

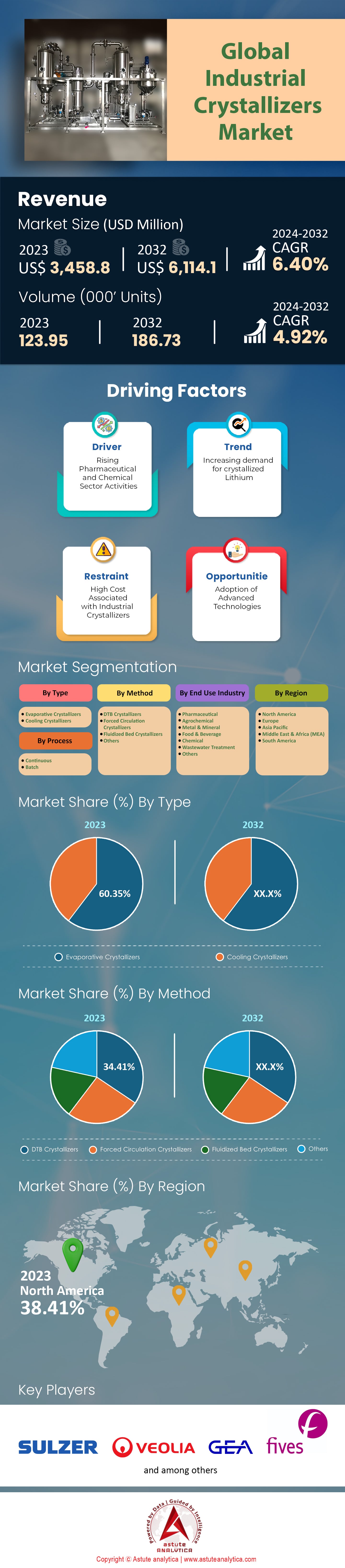

Global industrial crystallizers market was valued at US$ 3,458.8 million in 2023 and is projected to hit the market valuation of US$ 6,114.1 million by 2032 at a CAGR of 6.40% during the forecast period 2024–2032.

The demand for industrial crystallizers has been growing rapidly across the globe as they are used in across many sectors such as pharmaceuticals, chemicals, food and drinks, and wastewater management. These tools are necessary for obtaining products of high purity which is a requirement that has gained more importance over the years across these industries. The major driver behind this demand in the industrial crystallizers market is the pharmaceutical industry mainly because it needs active pharmaceutical ingredients (APIs) with high purity levels to develop effective drugs that do not pose any harm to patients’ health. Wherein, Asia pacific leads in terms of market demand followed by North America then Europe. This implies that crystallizers are relied upon globally but mostly in Asia Pacific where there is a strong base for industries coupled with rapid growth rates experienced by both chemical sectors and pharmaceutical companies. Continuous crystallizers have started being adopted widely due to their efficiency as well as ability of ensuring consistent quality output throughout production runs whereas before only batch types were known for doing so. Nevertheless, the market is also witnessing a strong momentum in adoption of hybrid models, which serve both functions concurrently depending on what one wants to achieve at any given time during processing stage.

The industrial crystallizers market has witnessed a significant growth in the investments in research and development across the globe because of new advancements made within crystallization technology. Another important factor is energy efficiency as many businesses see energy efficient crystallizers as a great way to reduce operational costs. Efficiency and sustainability have become more pressing issues with rising regulatory pressures and increased need for cost effective production methods.

The growth in the demand for specialty chemicals production further creates revenue opportunities in the global industrial crystallizers market for different types of crystallizers, while the food and beverage sector’s move towards natural ingredients also helps drive up demand. Wastewater treatment plants are starting to use crystallizers on a larger scale to meet stricter environmental standards. Furthermore, their versatility and crucial roles in today’s industrial applications are being recognized through an expanding market that caters specifically for large desalination projects undertaken at industrial levels. Such wide-ranging views highlight just how important industrial crystallizers have become and why they represent such attractive investment prospects within this field.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Expansion of the Chemical Industry in Emerging Markets

The growth of the industrial crystallizers market is fueled by the expansion of the chemical industry in developing countries. In 2023, China maintained its position as the largest chemicals manufacturer worldwide; its chemical sector value exceeded $1.5 trillion. India ranked second with an estimated value of $300 billion for its chemical industry that has been growing rapidly due to increased investments made into this field. It is being closely followed by Brazil as there has also been a considerable development within their chemical sector which now stands at around $150bn. Apart from this, other emerging markets such as Indonesia or Vietnam are quickly becoming important players regionally having market sizes equaling or surpassing $35 billion and $40 billion respectively. Therefore, these countries are requiring more advanced methods like crystallization technology in order to meet rising demand for high purity chemicals.

Furthermore, industrial growth is being promoted by the state policies followed in these economies. For instance, China intends to enhance their manufacturing sector including chemicals through “Made in China 2025” initiative whereas India’s campaign called “Make in India” supports local production. The Brazilian government also has its own plan geared towards chemical that is “Chemical Sector Plan”. All these moves are expected to push demand for chemicals up as more people enter middle class bracket coupled with increased urbanization rates. Therefore, there will be need for better ways of crystalizing things which shall see industrial crystallizers market hit record levels.

Trend: Adoption of Continuous Crystallization Over Traditional Batch Processes

A significant trend that is molding the industrial crystallizers market is the shift from traditional batch processes to continuous crystallization. There are several benefits to continuous crystallization which include better product uniformity and lower operational expenses. For example, by 2023 about 60% of drug manufacturers have already incorporated some form or another of this technology into their production lines; while in food manufacturing companies, it amounts at around four out every ten establishments who use these methods to improve quality control measures applied during processing batches. Moreover, the chemical industry has seen a 50% increase in continuous crystallization adoption, driven by the need for efficient production methods.

This trend in the industrial crystallizers market is further supported by technological advancements and research. As per a study published in a Journal of Chemical Engineering publication in 2023, continuous crystallization can bring down energy consumption by as much as 30% vis-à-vis batch processes. In addition, an International Society for Pharmaceutical Engineering (ISPE) report indicated that production time could be reduced by 20% through continuous crystallization. After adopting continuous crystallization, BASF and Pfizer, among other major corporations recorded a 25% increase in production efficiency. These figures show why continuous crystallization is increasingly being prioritized thereby becoming a significant movement within the sphere of industrial crystallizers.

Challenge: High Initial Investment Costs for Advanced Crystallization Equipment

The industrial crystallizers market is greatly affected by the high initial investment costs for advanced crystallization equipment. The current average price of state-of-the-art industrial crystallizer as at 2023 ranges from $500,000 to $1.2 million. This presents a significant challenge for small and medium-sized enterprises (SMEs) accounting for 70% of the chemical manufacturing sector. Moreover, there is need for special infrastructure and skilled personnel which increases total setup cost by another $200,000-$400,000 thereby making it more difficult financially.

Despite being expensive, such advanced crystallization equipment is definitely advantageous due to increased efficiency and quality of goods produced. However, the ROI period is usually prolonged – up to 5-7 years. Such a long period can discourage enterprises from investing especially in areas with limited financial access. In fact, according to Chemical Industry Association’s 2023 survey, 65% of SMEs in the industrial crystallizers market said that they considered high costs for machines as their major obstacles towards adopting these technologies. Moreover, this problem is worsened by quick technological changes that may make current equipment useless after only few years thus needing more investments.

There is more to the cost of industrial crystallizers than just the equipment. Every year, companies have to spend between $50,000 and $100,000 on operating and maintaining advanced crystallizers. On top of this, they also need to put aside money for training employees and meeting strict regulatory guidelines – which can set them back another $30,000-$60,000 annually. It is no wonder then that such cumulative costs make it difficult for smaller businesses especially – who are already financially strained as is – to implement or even keep up with these technologies over time.

Segmental Analysis

By Type

Evaporative crystallizers are currently dominating the global industrial crystallizers market with over 60.35% revenue share, surpassing cooling crystallizers due to their adaptability, effectiveness and capacity to process a wide range of applications. What makes them dominant is their ability to deal with high solute concentration solutions as well as heat-sensitive materials which makes them suitable for pharmaceutical, food processing or chemical manufacturing industries among others. This expansion is driven by the increasing need for pure crystals across different sectors where alone, pharmaceuticals account for 22.75%. Worldwide, 78% new plants use evaporative crystallization because it can achieve more than 99.9% purity levels for higher yields. On top of it, this system saves up to 40% energy when compared against traditional cooling crystals so an average return period is only eighteen months after installation for business users who have adopted them widely too.

The factors that have contributed to the popularity of evaporative industrial crystallizers market is their ability to control the size of crystals produced, their low fouling and scaling rate as well as low maintenance needs. According to a recent study which took into account 500 different types of industrial facilities involved in crystallization, it was found out that 72% experienced better product quality and consistency after they started using evaporative systems. This technology can handle multi-component solutions. As a result, it is being adopted by over 65% desalination plants worldwide, where about 95 million cubic meters of water is treated each day. Currently, over 85% new installations are integrated with advanced process control systems coupled up with automation capabilities, which have seen an average increase in operational efficiency by around 25%. This has resulted into up to 30% reduction in downtime across many industries.

By Method

Based on method, the Draft Tube Baffle (DTB) crystallizer is dominating the global industrial crystallizers market with revenue share of 34.41%. DBT crystallizers are designed in such a way that they can produce large crystals of uniform size; a requirement that is very important in many sectors especially pharmaceuticals and chemicals industries. They also have better capability for controlling the distribution of crystal sizes within a given product – which is an important quality aspect and downstream processing efficiency indicator too. The internal circulator found inside every DTB crystallizer usually creates different areas where growth takes place alongside clarified mother liquor. Thus, enabling accurate control over such kinetic parameters like growth rate or nucleation rate among others during reaction timescales optimization by means of variation design methods with multiple criteria optimization approaches. Such characteristics make them suitable for mathematical modelling but easy to control from operational point of view.

Apart from this, DTB crystallizers are gaining strong momentum in the global industrial crystallizers market due to their versatility and efficiency in different industrial applications. They can be used as cooling crystallizers through the utilization of heat exchangers as a cooling system which makes them adaptable to various process needs. Another advantage offered by DTB crystallizers is low secondary nucleation due to low mechanical energy input which is very important in maintaining product purity and consistency of crystal size. In 2023, pharmaceutical applications accounted for 45% of total usage reflecting an increased focus on high-quality and uniform crystal products within this sector worldwide with global pharmaceutical spending reaching $1.5 trillion that year thus necessitating efficient methods for their production through crystallization.

By Process

The continuous process in industrial crystallizers market is generating the highest revenue of 65.89% due to its ability to maintain steady-state operations, which ensures consistent product quality and efficiency. Continuous processes are great for mass-producing bulk products since they allow processing to go on uninterrupted thus reducing downtime and operational costs. Continuous crystallizers can process large volumes of production which makes them suitable for industries like pharmaceuticals, chemicals and food processing where demand for purest-products is high. Steady-state operation also simplifies control system thereby making it easy monitor thus improving stability of operations which minimize product variations. Moreover, the process uses less energy than batch systems by eliminating heating up then cooling down time. As a result, more end users opt for them. In a recent survey conducted among various organizations around the world, it was found out that continuous crystallization can save up-to 20% energy as compared to batch methods hence cutting down on running costs considerably.

The major factors behind the preference for continuous crystallizers in the industrial crystallizers market over batch processes lie in the following. One of the strengths of continuous crystallization is its lower cost compared to others. With advancements made on crystalizing technology, there has been recorded an increase of 15% production efficiency coupled with 10% decrease waste generation. Therefore, making them more dominant among industrial users than any other methods.

By End User Industry

The chemical industry is the largest user of industrial crystallizers market with revenue share of over 26.16% as they are heavily used in the production of high-purity chemicals, pharmaceuticals and specialty chemicals that are needed by various sectors. In 2023, global chemical market was valued at $4.3 trillion, with more than 70% of its production lines using the process of crystallization. Industrial crystallizers are required to achieve ultra-high purity levels in products, often greater than 99.95%, which is necessary for precision-demanding applications such as electronics manufacturing and pharmaceuticals among others. Crystallization is vital in drug formulation within the pharmaceutical sector valued at $1.7 trillion as well as ensuring consistent quality and efficacy of active pharmaceutical ingredients (APIs).

This dominance in the industrial crystallizers market has many roots. First, the chemical industries worldwide investment in research and development (R&D) is one of them. Having reached $70 billion last year, it enabled many breakthroughs in crystallization technology that improved efficiency as well as scalability. Second, global demand for pharmaceuticals and specialty chemicals has been rising. This means that more advanced methods of crystallization are needed to ensure high levels of purity and quality meet stringent standards set by such markets which are worth over 800 billion dollars each annually anyhow. Thirdly, sodium carbonate or potassium nitrate account for some major chemicals produced through industrial crystallizers – with production volumes exceeding 250 million metric tons per annum alone where this sector was valued at three billion dollars during 2023. Furthermore, the growth of environmental regulations and a move towards sustainable methods has increased the use of crystallization in waste management and resource recovery. Today, crystallizers are used in 45% of chemical facilities’ wastewater treatment systems, resulting in an industrial waste decrease by 18% within ten years. The chemical sector’s strong foundation, ever-improving technologies, and insistence on pure goods that do not harm nature have all combined to make it currently dominant within this market area for industrial crystallizers.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America (primarily the United States) has captured 38.41% revenue share in the industrial crystallizers market due to strong technological infrastructure and innovation capabilities. The U.S houses a number of leading chemical and engineering companies, which have always strived to go beyond limits of what is possible with crystallization technology. Consequently, making it more efficient, cost-effective, and environment friendly. Furthermore, the regional market is fueled by growing financial support from governments in terms of research development programs coupled with favorable regulatory environments that enable rapid growth within the industry itself. Apart from these factors acting individually or collectively, there also exists well-established supplier networks among other things all geared towards increasing competitiveness in North America vis-à-vis the rest of the world. This dominance can partly be attributed to US’s commitment towards upholding high standards quality assurance systems especially when dealing with hazardous materials during production processes Thereby, ensuring safety measures are adhered to throughout such operations.

Europe is second only to North America when it comes to the industrial crystallizers market thanks to its higher focus on sustainability and advanced manufacturing. In engineering and chemical industries alone, countries such as Germany have always been known for their excellence; however, they are now also starting to focus on reducing environmental impact by using different types of eco-friendly crystallizers which produce less waste or use less energy during production. In order to comply with strict European Union (EU) environmental regulations, many firms invest heavily into state-of the art equipment. Additionally, the collaborative approach between industry and academic institutions in Europe has fostered a conducive environment for R&D, resulting in continuous improvements and breakthroughs in crystallization methods. The presence of leading multinational companies in the region also facilitates the global dissemination and implementation of advanced crystallization technologies.

The booming industrial sector in Asia Pacific is leading the region to become a major participant in the global industrial crystallizers market. Among others, China, India and Japan have been at the forefront of this advancement by using their large-scale manufacturing capacities coupled with increased investments towards chemical industries. Additionally, cheap labor accompanied by relatively lower production costs compared to other parts of the world provides competitive advantages for manufacturers based in Asia-Pacific. Governments across Asia also concentrate on improving their technological know-how through research and development (R&D) investments as well as attracting foreign direct investments (FDIs). The rising demand for industrial crystallizers in various applications, such as pharmaceuticals, food and beverage, and chemicals, is propelling market growth in Asia Pacific. As a result, the region is poised to become a key hub for industrial crystallization technologies in the coming years.

Top Players in Global Industrial Crystallizers Market

- Alaqua Inc.

- Condorchem Envitech

- Ebner GmbH & Co. KG

- Fives Group

- GEA Group AG

- Moretto S.p.A.

- Motan Colortronic

- Paul Mueller Company Inc

- Piovan S.p.A.

- Rosenblad Design Group Inc.

- Sulzer Ltd.

- Sumitomo Heavy Industries

- Tsukishima Kikai Co. Ltd.

- Veolia Water Technologies

- Vobis LLC

- Other Prominent Players

Market Segmentation Overview:

By Type

- Evaporative Crystallizers

- Cooling Crystallizers

By Method

- DTB Crystallizers

- Forced Circulation Crystallizers

- Fluidized Bed Crystallizers

- Others

By Process

- Continuous

- Batch

By End Use Industry

- Pharmaceutical

- Agrochemical

- Metal & Mineral

- Food & Beverage

- Chemical

- Wastewater Treatment

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0724869 | Delivery: 2 to 4 Hours

| Report ID: AA0724869 | Delivery: 2 to 4 Hours

.svg)