India UPS Market: By UPS Type (Standby/Offline UPS, Line-Interactive UPS, On-Line UPS, Double Conversion UPS, Solar UPS, Roof Top Inverter, Commercial Inverter, Others); Power Capacity (Low Power (Up to 600VA), Medium Power (600VA - 1500VA), High Power (Above 1500VA)); Phase Type (Single Phase and Three Phase); Battery Type (Lead Acid, Nickel Cadmium, Lithium-Ion and Flow Batteries); Location (Urban and Rural); End Users (Residential (Home Use, Smart Homes), Commercial (BFSI, Retail, Hotels and Hospitality, Office Buildings, Others); Industrial (Warehouses, Distribution Centres, Utilities, Others), Government & Public Sector (Government Buildings, Emergency Centres, Others), Education (Research Institutes, Schools & Universities), Telecommunications (Data Centres, Telecom Networks, Others), Healthcare (Hospitals, Clinics, Diagnostic Laboratory, Others); Country—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Mar-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA03251217 | Delivery: Immediate Access

| Report ID: AA03251217 | Delivery: Immediate Access

Market Scenario

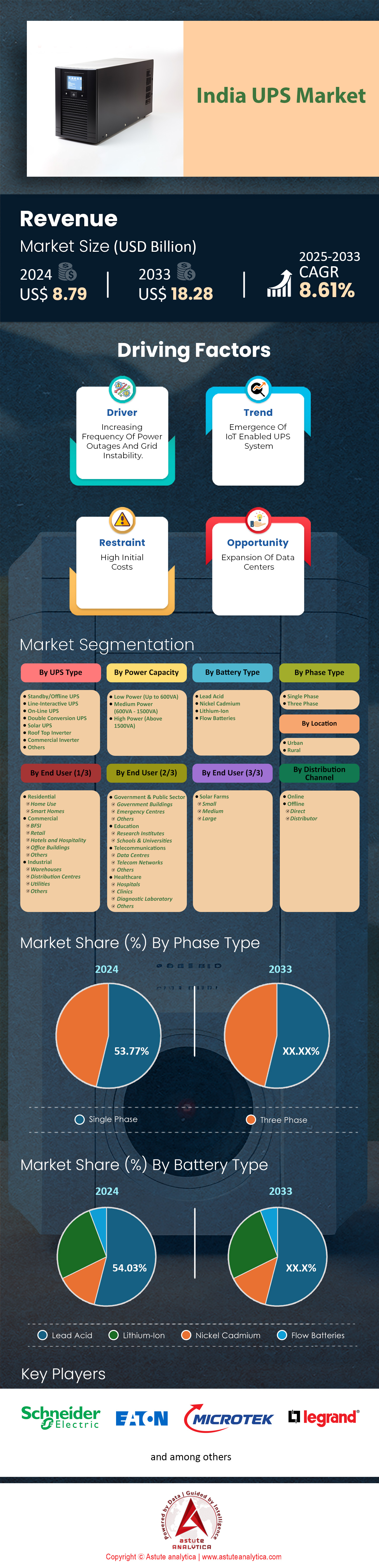

India UPS market was valued at US$ 8.79 billion in 2024 and is projected to hit the market valuation of US$ 18.28 billion by 2033 at a CAGR of 8.61% during the forecast period 2025–2033.

The Uninterruptible Power Supply (UPS) market in India is experiencing rapid growth, driven by the country’s increasing reliance on digital infrastructure and the need for reliable power solutions. One of the primary catalysts for this growth is the expansion of data centers, which has surged to support India’s burgeoning digital economy. In 2024, the country has seen a 15% year-over-year increase in data center capacity, necessitating robust UPS systems to ensure uninterrupted operations. This growth is further fueled by the government’s smart city initiatives, which have led to the development of over 100 smart cities, each requiring advanced power backup solutions for their integrated digital systems. Additionally, the telecommunications sector’s expansion, particularly with the rollout of 5G technology across 50 major cities, has created a demand for 10,000 new cell towers, all of which rely on reliable UPS systems to maintain network stability.

The industrial sector’s digital transformation is another significant driver of UPS market growth. Manufacturing facilities are increasingly adopting Industry 4.0 technologies, with over 5,000 factories implementing smart manufacturing solutions that depend on continuous power supply. The healthcare sector has also emerged as a major consumer of UPS systems, with 1,000 new hospitals and medical facilities being established in 2024, each equipped with critical medical devices that demand uninterrupted power. Moreover, the rise of remote work and online education has led to a 30% increase in residential UPS installations, as households seek to ensure consistent power for their digital devices. The renewable energy sector’s growth, with India aiming to reach 500 GW of installed renewable capacity by 2030, has created opportunities for UPS systems integrated with solar and wind energy sources, leading to the installation of 10,000 hybrid UPS units in various applications.

Technological Advancements in India’s UPS Market in 2024

Recent advancements in India’s UPS market as of 2024 have further accelerated its growth and adoption across sectors. One of the most notable trends is the widespread adoption of lithium-ion batteries, which offer a 40% longer lifespan compared to traditional lead-acid batteries. This shift has been particularly beneficial for industries requiring long-term reliability, such as data centers and healthcare facilities. The integration of IoT and AI technologies has also enhanced UPS functionality, with 70% of new installations featuring remote monitoring capabilities that allow for real-time performance tracking and predictive maintenance. This has significantly reduced downtime and improved operational efficiency for businesses relying on UPS systems.

Another key advancement is the rise of modular and scalable UPS market, which have gained traction, particularly in data centers. These systems allow for 50% faster deployment and a 30% reduced footprint, making them ideal for space-constrained environments. Energy efficiency has also become a major focus, with the latest UPS systems achieving efficiency rates of up to 97%, compared to the previous standard of 88%. This improvement not only reduces energy consumption but also lowers operational costs for businesses. Additionally, the market has seen the introduction of eco-friendly UPS solutions, with 20% of new installations utilizing recyclable components and biodegradable materials, aligning with global sustainability goals.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Government Initiatives for Renewable Energy Promoting UPS Market Growth

The Indian government’s renewable energy initiatives have become a powerful driver for the growth of the UPS market. With a commitment to achieving 500 GW of non-fossil fuel power by 2030, the government has implemented policies that directly and indirectly benefit the UPS sector. One such initiative is the Production Linked Incentive (PLI) Scheme, which has boosted domestic manufacturing of renewable energy components, including those used in UPS systems. In 2024, this scheme led to the establishment of 50 new manufacturing units for solar modules and cells, reducing dependency on imports and strengthening the local supply chain for UPS manufacturers. Additionally, the imposition of basic customs duties on solar photovoltaic cells and modules has further incentivized local production, resulting in a 30% increase in domestically manufactured solar components used in UPS systems.

The government’s focus on clean energy deployment has also attracted significant investment from both domestic and international players in the India UPS market. In 2024, this has led to the development of 100 large-scale renewable energy projects across India, each requiring robust UPS systems to ensure uninterrupted power supply and efficient energy management. The Green Energy Corridor project, aimed at strengthening grid infrastructure for renewable energy integration, has seen the installation of 5,000 new UPS units in critical grid locations to manage power fluctuations and ensure seamless energy distribution. Furthermore, the deployment of 10,000 smart grid systems nationwide has increased the demand for advanced UPS technologies that offer stability and reliability. These initiatives not only create a conducive environment for UPS market growth but also drive innovation, with manufacturers developing more efficient and renewable energy-compatible UPS systems to meet the growing demand.

Trend: Adoption of Lithium-Ion Batteries is On the Rise for their Efficiency and Longevity

The adoption of lithium-ion batteries in India’s UPS market has surged due to their superior efficiency and longevity compared to traditional lead-acid batteries. Lithium-ion batteries offer energy conversion efficiencies of up to 95%, significantly higher than the 80-85% efficiency of lead-acid batteries. This translates to reduced energy losses and lower operational costs, making them an attractive option for businesses. In 2024, a leading IT services company in Bangalore reported a 30% reduction in energy consumption after switching to lithium-ion UPS systems, showcasing the tangible benefits of this technology. The healthcare sector has also embraced lithium-ion batteries, with a major hospital chain in Mumbai equipping 50 of its facilities with these systems, resulting in a 40% increase in backup time and improved reliability for life-saving medical equipment.

Technological advancements have further accelerated the adoption of lithium-ion batteries. Innovations like advanced battery management systems (BMS) have enhanced safety and reliability, addressing concerns such as thermal runaway and overcharging. In 2024, Indian manufacturers in the UPS market have developed smart BMS capable of monitoring 1,000 individual battery cells simultaneously, providing real-time data on battery health and performance. This has led to a 50% reduction in unexpected battery failures in large-scale UPS installations. Additionally, the declining cost of lithium-ion batteries, which has dropped by approximately 90% over the past decade, has made them more accessible. Educational institutions and data centers have been early adopters, with a prominent university in Delhi achieving a 40% increase in backup time and a 20% reduction in energy costs after upgrading to lithium-ion UPS systems. Similarly, a major data center in Mumbai reported a 30% improvement in operational efficiency post-transition, underscoring the growing confidence in lithium-ion technology and its transformative potential in the UPS sector.

Restrain: Frequent Battery Replacements Increase Operational Costs and Complexity

Despite advancements in battery technology, limited battery life remains a significant challenge in India’s UPS market, leading to frequent replacements that increase operational costs and complexity. Traditional lead-acid batteries, still widely used in UPS systems, typically have a lifespan of 3-5 years, necessitating regular replacements to ensure uninterrupted power supply. For businesses, this translates to substantial long-term costs. In 2024, a medium-sized enterprise in Delhi reported an annual expenditure of ₹500,000 on battery replacements for their UPS systems. Beyond financial implications, frequent replacements cause operational disruptions. A survey of 500 Indian businesses revealed that companies experience an average of 24 hours of downtime per year due to battery-related UPS failures, leading to significant productivity and revenue losses.

The complexity of battery replacement processes further exacerbates the challenge. Many UPS installations, particularly in older buildings or remote locations, are not designed for easy battery access, making replacements time-consuming and labor-intensive. A manufacturing plant in Gujarat UPS market reported that each battery replacement operation required an average of 8 hours of work by specialized technicians, leaving the facility vulnerable to power disruptions during the process. Additionally, the environmental impact of frequent battery replacements is a growing concern. In 2024, India generated 500,000 tons of battery waste, with a significant portion attributed to UPS battery replacements. The lack of widespread recycling facilities exacerbates the environmental risks associated with battery disposal. To mitigate these issues, some companies are investing in advanced battery management systems that optimize charging and discharging cycles to extend battery life. For example, a tech company in Hyderabad implemented an AI-driven battery management system in 2024, increasing their UPS battery lifespan by 30% and reducing replacement frequency and associated costs.

Segmental Analysis

By UPS Type

The online UPS segment has emerged as the leader in the India UPS market, capturing over 51.62% of the market share, primarily due to its ability to provide zero transfer time and continuous power supply. This feature is critical in a country like India, where power outages are frequent, with urban areas experiencing an average of 8.5 outages per month and rural areas facing up to 12.3 outages monthly. Online UPS systems are particularly favored in sectors such as IT, healthcare, and manufacturing, where even a momentary power interruption can lead to significant operational disruptions and financial losses. For instance, in the IT sector, where data centers require uninterrupted power for 24/7 operations, online UPS systems are indispensable. The Indian data center UPS market is projected to grow from US$ 144.77 million in 2023 to US$ 368.05 million by 2032, reflecting the increasing demand for reliable power solutions in critical applications.

Moreover, the rise of green and energy-efficient UPS solutions has further bolstered the dominance of online UPS systems in the India market. Globally, the market for energy-efficient UPS solutions was valued at over US$ 11.6 billion in 2023, and this trend is mirrored in India, where businesses are increasingly adopting eco-friendly power backup solutions. The online UPS market is expected to grow at a CAGR of 9.94% between 2024 and 2033, driven by technological advancements and the need for high-quality power backup in critical applications. Additionally, the growing adoption of modular UPS systems, which offer scalability and flexibility, has also contributed to the segment’s growth. Modular UPS systems are particularly popular in the industrial sector and small-scale businesses, where they provide a cost-effective solution for power backup. The combination of reliability, energy efficiency, and scalability has made online UPS systems the preferred choice for businesses and industries across India.

By Power Capacity

The Medium Power (600VA - 1500VA) segment controls over 46.39% of the India UPS market, driven by its suitability for both residential and small commercial applications. This segment caters to the needs of households, small offices, and retail establishments, which constitute a significant portion of the Indian economy. The affordability and functionality of medium-power UPS systems make them ideal for regions with frequent power fluctuations, where outages can last up to 6.2 hours daily in some states. The segment’s growth is also fueled by the increasing penetration of electronic devices, with over 750 million smartphone users in India as of 2024, all requiring reliable power backup.

Furthermore, the rise of small and medium enterprises (SMEs), which account for over 30% of India’s GDP, has further fueled demand for medium-power UPS systems in the India UPS market. SMEs often operate in environments with unstable power supply, making UPS systems essential for business continuity. The medium-power segment is projected to grow at a CAGR of 9.40% over the next 10 years, supported by the increasing need for power stability in both urban and rural areas. Additionally, the segment’s dominance is reinforced by the growing trend of home automation and the increasing use of smart devices, which require uninterrupted power for optimal performance. The combination of affordability, functionality, and the growing demand from both residential and commercial sectors has solidified the Medium Power segment’s position as a market leader in India.

By Phase

Single-phase UPS systems hold a dominant share of over 53% in the India UPS market, primarily due to their widespread use in residential and small commercial settings. These systems are cost-effective and easy to install, making them ideal for households and small businesses. With over 65% of India’s population residing in rural areas, where power infrastructure is often unreliable, single-phase UPS systems provide essential backup for basic appliances. The segment’s growth is also driven by the increasing electrification of rural areas, with over 99% of villages now connected to the grid. However, power quality remains a concern, with voltage fluctuations occurring in over 40% of households, necessitating the use of UPS systems for stable power supply.

Moreover, the affordability and availability of single-phase UPS systems have made them the preferred choice for small-scale businesses and retail establishments. The segment’s growth in the UPS market is further supported by the increasing adoption of home automation systems and smart devices, which require uninterrupted power for optimal performance. Additionally, the rise of e-commerce and the growing number of small businesses operating from home have also contributed to the demand for single-phase UPS systems. The combination of cost-effectiveness, ease of installation, and the growing need for power stability in both residential and small commercial settings has solidified the dominance of single-phase UPS systems in the India market.

By End User

Commercial users are the largest consumers of UPS market in India, capturing more than 28.55% of the market share. This dominance is driven by the need to protect sensitive equipment and ensure business continuity in a country where power outages cost businesses an estimated US$ 6.5 billion annually. Commercial establishments, including SMEs, retail stores, and offices, require reliable power backup to prevent disruptions in operations and protect critical equipment.

Moreover, the rise of e-commerce and the increasing number of small businesses operating from home have also contributed to the demand for UPS market among commercial users. The growing adoption of digital technologies and the increasing reliance on electronic devices in commercial settings have further fueled the demand for reliable power backup solutions. Additionally, the need for uninterrupted power supply in sectors such as healthcare, education, and retail has also contributed to the dominance of commercial users in the India. The combination of the need for business continuity, the protection of sensitive equipment, and the growing reliance on digital technologies has solidified the position of commercial users as the largest consumers of UPS systems in India.

By Battery Type

Lead-acid batteries are the most prominent type of batteries used in UPS systems across India UPS market, capturing over 54% of the market share. This dominance is primarily due to their cost-effectiveness and widespread availability. Lead-acid batteries offer a reliable and affordable solution for power backup, making them the preferred choice for both residential and commercial users. In a country where power outages are frequent, with urban areas experiencing an average of 8.5 outages per month and rural areas facing up to 12.3 outages monthly, lead-acid batteries provide a cost-effective solution for ensuring uninterrupted power supply. The Indian UPS battery market is expected to grow significantly, driven by the increasing demand for reliable power backup solutions.

Furthermore, the long-standing presence of lead-acid battery manufacturers in India UPS market has contributed to their widespread adoption. These batteries are also relatively easy to maintain and recycle, making them an environmentally friendly option compared to other battery types. The life expectancy of lead-acid batteries in UPS systems is typically around 3-6 years, which is sufficient for most residential and small commercial applications. Additionally, the growing demand for UPS systems in sectors such as healthcare, education, and retail has further fueled the demand for lead-acid batteries. The combination of affordability, reliability, and ease of maintenance has solidified the dominance of lead-acid batteries in India.

To Understand More About this Research: Request A Free Sample

Top Players in India UPS Market

- ABB Ltd.

- Cyber Power Systems

- Delta Electronics Inc.

- Eaton Corporation plc

- Emerson Electric Co.

- Enersys

- Hitachi Ltd.

- Legrand

- Luminous Power Technologies

- Microtek International

- Mitsubishi Electric Corporation

- Numeric Power Systems Ltd.

- Riello Electtronica SPA

- Shneider Electric SE

- Socomec Innovative Power

- Su-Kam Power Systems Ltd.

- Toshiba Corp.

- Zebronics

- Other Prominent Players

Market Segmentation Overview:

By UPS Type

- Standby/Offline UPS

- Line-Interactive UPS

- On-Line UPS

- Double Conversion UPS

- Solar UPS

- Roof Top Inverter

- Commercial Inverter

- Others

By Power Capacity

- Low Power (Up to 600VA)

- Medium Power (600VA - 1500VA)

- High Power (Above 1500VA)

By Phase Type

- Single Phase

- Three Phase

By Battery Type

- Lead Acid

- Nickel Cadmium

- Lithium-Ion

- Flow Batteries

By Location

- Urban

- Rural

By End User

- Residential

- Home Use

- Smart Homes

- Commercial

- BFSI

- Retail

- Hotels and Hospitality

- Office Buildings

- Others

- Industrial

- Warehouses

- Distribution Centers

- Utilities

- Others

- Government & Public Sector

- Government Buildings

- Emergency Centers

- Others

- Education

- Research Institutes

- Schools & Universities

- Telecommunications

- Data Center

- Telecom Networks

- Others

- Healthcare

- Hospitals

- Clinics

- Diagnostic Laboratory

- Others

- Solar Farms

- Small

- Medium

- Large

By Distribution Channel

- Online

- Offline

- Direct

- Distributer

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA03251217 | Delivery: Immediate Access

| Report ID: AA03251217 | Delivery: Immediate Access

.svg)