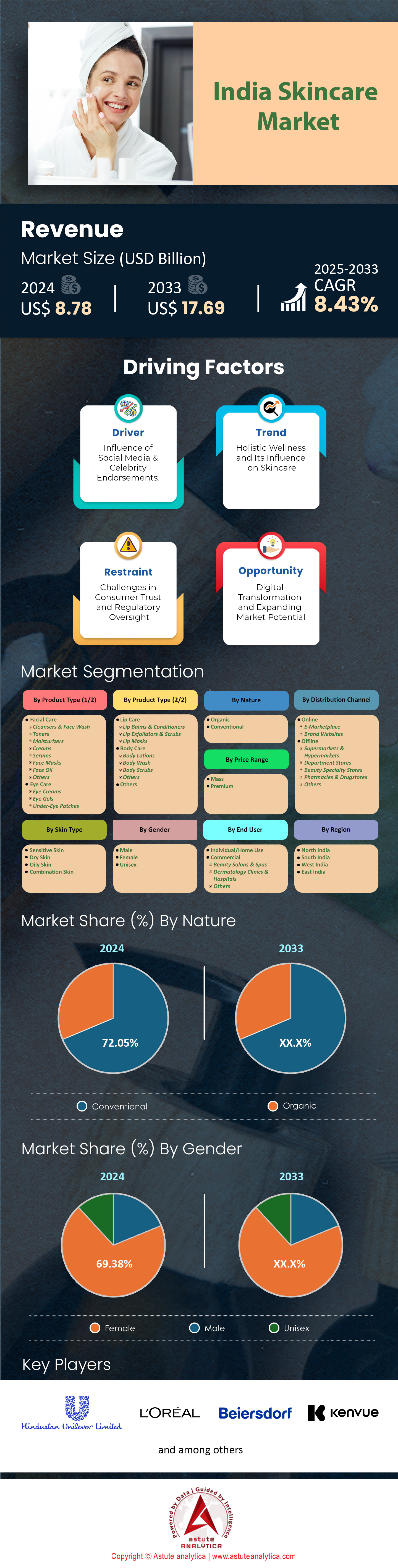

India Skincare Market: By Product Type (Facial Care (Cleansers & Face Wash, Toners, Moisturizers, Creams, Serums, Face Masks, Face Oil, Others), Eye Care (Eye Creams, Eye Gels, Under-Eye Patches), Lip Care (Lip Balms & Conditioners, Lip Exfoliators & Scrubs, Lip Masks), Body Care (Body Lotions, Body Wash, Body Scrubs, Others), Others); Nature (Organic and Conventional); Skin Type (Sensitive Skin, Dry Skin, Oily Skin, Combination Skin); Gender (Male, Female, Unisex); Price Range (Mass and Premium); End Users (Individual/Home Use, Commercial, Beauty Salons & Spas, Dermatology Clinics & Hospitals, Others); Distribution Channel (Online (E-Marketplace and Brand Websites), Offline (Supermarkets & Hypermarkets, Department Stores, Beauty Specialty Stores, Pharmacies & Drugstores, Others)); Country— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Mar-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA03251228 | Delivery: Immediate Access

| Report ID: AA03251228 | Delivery: Immediate Access

Market Scenario

India skincare market was valued at US$ 8.78 billion in 2024 and is projected to hit the market valuation of US$ 17.69 billion by 2033 at a CAGR of 8.43% during the forecast period 2025–2033.

The Indian skincare market is a dynamic and rapidly evolving landscape, driven by shifting consumer preferences, technological advancements, and a growing emphasis on sustainability. One of the most significant trends is the rise of clean beauty, with 59% of Indian consumers now prioritizing skincare products made from natural or organic ingredients. This has led to the success of brands like Mamaearth and Plum, which have capitalized on the demand for toxin-free, eco-friendly products. Mamaearth’s Onion Hair Oil and Plum’s Green Tea Range have seen 40% year-over-year growth, reflecting the strong consumer shift towards clean and sustainable beauty solutions.

The Ayurvedic skincare segment is another key driver, with a projected CAGR of 27.2% from 2024 to 2030. Brands like Forest Essentials and Kama Ayurveda dominate this space, with Forest Essentials’ Soundarya Radiance Cream and Kama Ayurveda’s Kumkumadi Brightening Face Scrub experiencing 35-40% growth in sales. The men’s grooming segment is also gaining traction in the India skincare market, with Forest Essentials’ Men’s Collection seeing a 30% year-over-year growth, indicating a growing awareness of skincare among male consumers.

E-commerce continues to reshape the market, with online sales accounting for 42% of total skincare sales in 2024. Platforms like Nykaa and Purplle have become key players, offering personalized recommendations and a wide range of products. Nykaa’s AI-powered skin analysis tool has driven a 35% increase in customer engagement, highlighting the growing role of technology in the skincare industry. Sustainability is another critical factor, with 65% of Indian consumers willing to pay more for eco-friendly packaging. Brands like The Body Shop and L’Occitane have introduced refillable and biodegradable packaging, aligning with consumer demand for environmentally responsible products.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Urbanization's Impact on Skincare Demand in India

The rapid urbanization in India has become a pivotal driver of the India skincare market, reshaping consumer behaviors and product preferences. As cities expand and modernize, urban dwellers face unique environmental challenges that directly impact their skin health. Increased exposure to pollution, stress, and UV radiation has created a pressing need for specialized skincare solutions. This is evident in the surge in demand for anti-pollution skincare products, with sales reaching 12 million units in 2025. The urban lifestyle has also led to a shift in consumer priorities, with time-pressed city dwellers seeking multifunctional skincare products that offer convenience without compromising efficacy. For instance, all-in-one products like BB creams and tinted moisturizers with SPF have seen a 40% increase in sales volume since 2023, highlighting the growing demand for streamlined routines.

Moreover, urbanization has facilitated greater access to skincare information and products through digital channels. The proliferation of smartphones and high-speed internet in urban areas has enabled consumers to research skincare ingredients and techniques, leading to more informed purchasing decisions. This digital savviness is reflected in the fact that 66% of urban Indian consumers now use their smartphones to compare prices and read reviews before buying skincare products. The urban skincare market has also witnessed a surge in demand for premium and specialized products, driven by rising disposable incomes and a growing emphasis on personal grooming. Luxury skincare brands have expanded their presence in tier 1 and 2 cities, with over 500 new store openings in 2025 alone, underscoring the urbanization-driven growth in the India skincare market.

Trend: Shift towards Natural and Organic Skincare Product Trend in India

The preference for natural and organic skincare products has become a dominant trend in the India skincare market, reflecting a broader shift towards clean beauty and sustainability. Consumers are increasingly seeking products free from harmful chemicals, with a strong emphasis on ingredients derived from natural sources. This trend is driven by growing awareness of the potential long-term effects of synthetic ingredients on skin health and the environment. The demand for natural and organic skincare products is evidenced by the fact that 7 out of 10 new skincare product launches in India now feature natural or organic claims. Brands are responding to this trend by innovating with biotech-derived actives and plant-based ingredients, offering sustainable alternatives to traditional formulations.

The natural skincare trend has also led to the revival of traditional Indian ingredients and Ayurvedic formulations, adapted for modern consumers. Products featuring ingredients like turmeric, neem, and ashwagandha have gained significant traction, with sales of Ayurvedic skincare products reaching 18 million units in 2025. This trend extends beyond product formulations to encompass packaging and manufacturing processes, with consumers showing a preference for brands that demonstrate a commitment to sustainability. The rise of waterless beauty products, which reduce water consumption and extend shelf life, is a notable example of this shift, with sales growing by 300% since 2023. The natural and organic skincare trend is not just a passing fad but a fundamental shift in consumer values, presenting significant opportunities for brands that can authentically align with these principles in the India skincare market.

Challenge: High Competition in Fragmented Market

The India skincare market in 2025 is characterized by intense competition and fragmentation, presenting both challenges and opportunities for brands. The market is populated by a diverse array of players, ranging from global conglomerates to local startups, each vying for consumer attention and loyalty. This high level of competition has led to rapid product innovation and diversification, with brands constantly seeking to differentiate themselves through unique formulations, packaging, and marketing strategies. The competitive landscape is evidenced by the launch of over 1,000 new skincare products in India in 2025 alone, a 50% increase from 2023. This proliferation of products has made it increasingly challenging for brands to stand out and capture market share.

The fragmented nature of the skincare market is further complicated by the diverse consumer preferences across different regions and demographics in India. Brands must navigate a complex web of cultural nuances, skin types, and beauty ideals to create products that resonate with specific consumer segments. This has led to the rise of niche and targeted skincare solutions, with the number of specialized skincare clinics in urban areas growing by 200% since 2023. The competitive pressure has also driven a shift towards omnichannel strategies, with brands investing heavily in both online and offline presence to maximize reach and engagement. E-commerce has become a critical battleground, with online sales of skincare products in India reaching 30 million units in 2025, a threefold increase from 2023. In this highly competitive and fragmented India skincare market, success hinges on a brand's ability to innovate, adapt to changing consumer preferences, and create a strong, differentiated brand identity.

Segmental Analysis

By Product Type

The facial care segment's commanding 52.72% market share in India's skincare market is a testament to the growing emphasis on facial aesthetics and skincare routines among Indian consumers. This dominance is driven by several factors, including increasing awareness of skincare benefits, rising disposable incomes, and the influence of social media and beauty influencers. The facial care market encompasses a wide range of products, including cleansers, moisturizers, serums, masks, and sunscreens, catering to diverse consumer needs from basic cleansing to advanced anti-aging solutions.

Leading brands in this segment of the skincare market include Hindustan Unilever Limited, L'Oréal India, and Procter & Gamble India, which have established a strong presence through extensive product lines and strategic marketing campaigns. These brands leverage their global expertise and local insights to offer products that resonate with Indian consumers. For instance, L'Oréal's Garnier brand is popular for its affordable yet effective skincare solutions, while Hindustan Unilever's Lakmé brand is renowned for its innovative products tailored to Indian skin types. The popularity of facial care products in India is further fueled by the cultural emphasis on appearance and the impact of urbanization and media. Many Indians view clear and healthy skin as a sign of social and professional success, driving the demand for products that promise to improve skin appearance and health. Additionally, the rise of natural and organic skincare products, incorporating Ayurvedic and herbal formulations, has captured a significant market share, with brands like The Himalaya Drug Company and Dabur India Limited capitalizing on this trend.

By Skin Type

The significant 30% market share of oily skin products in India's skincare market is primarily attributed to the country's tropical climate, which often results in oily skin conditions. This climate-driven demand is further amplified by the prevalence of oily skin among a large portion of the Indian population, particularly in urban areas where pollution and stress contribute to increased sebum production. Key products driving demand in this category include oil-control cleansers, mattifying moisturizers, and anti-acne treatments, which cater to the specific needs of consumers with oily skin. Major brands like Himalaya and Biotique have established themselves as leaders in this segment, offering specialized products for oily skin that target both men and women. These brands leverage natural ingredients known for their oil-absorbing and anti-inflammatory properties, such as tea tree oil, salicylic acid, and clay, to develop effective formulations.

The key buyers for oily skin products in the India skincare market are predominantly young adults and teenagers, who are more prone to acne and oily skin issues. This demographic is highly influenced by social media and beauty influencers, shaping their skincare preferences and purchasing decisions. International brands like Neutrogena, L'Oréal, and The Body Shop have also made significant inroads in this segment, offering a range of products specifically formulated for oily skin. The competitive landscape is further enriched by emerging brands focusing on niche markets and providing personalized skincare solutions through e-commerce platforms, catering to the growing demand for targeted skincare products among Indian consumers with oily skin.

By Gender

The dominance of female consumers in India's skincare market, accounting for more than 70% of the revenue, is a reflection of the evolving beauty standards, increasing disposable incomes, and growing awareness of skincare benefits among Indian women. This significant market share is driven by women's higher spending on skincare products and their greater focus on beauty and personal care routines. Female consumers in India are increasingly prioritizing skincare as part of their daily regimen, with a particular emphasis on products that offer specific benefits such as anti-aging, hydration, and sun protection. The purchasing patterns reveal a strong preference for products perceived to be of high quality and offering visible results, with quality often outweighing price considerations in the decision-making process.

Brands across the India skincare market are catering to this segment through a variety of strategies, including the development of targeted product lines, personalized marketing campaigns, and leveraging digital platforms for engagement. Popular products among female consumers include anti-aging creams, brightening serums, and sun protection lotions. Brands like Lakmé and L'Oréal are particularly favored by women for their diverse product offerings and effective marketing strategies. International brands such as Estée Lauder and Clinique have also gained popularity, alongside strong domestic players like Himalaya, Biotique, and Forest Essentials. These brands have successfully positioned themselves by offering a range of products that cater to the diverse needs of Indian women, from fairness creams to anti-aging serums. The success of these brands can be attributed to their ability to adapt their product offerings to local preferences and their strategic use of marketing channels, including social media influencers and celebrity endorsements, which play a crucial role in shaping consumer perceptions and driving brand loyalty.

By Price Range

The mass segment's control over 74.16% of India's skincare market revenue is primarily driven by the affordability and accessibility of mass-market products, which appeal to a broad consumer base. This dominance is a reflection of India's price-sensitive market, where consumers are highly value-conscious and often seek the best deals without compromising on quality. The higher penetration and demand for skincare products in the mass price range can be attributed to several factors, including the large population of middle and lower-income consumers, the widespread availability of these products across various retail channels, and effective marketing strategies that emphasize value for money.

The average consumer spending on skincare in India skincare market remains relatively low, making price a critical factor in purchasing decisions. Brands in the mass segment focus on offering value-for-money products that cater to essential skincare needs. Companies like Hindustan Unilever and Procter & Gamble employ multi-tiered pricing strategies to capture different consumer segments within the mass market, offering a range of products under various sub-brands, each targeting specific consumer needs and price points. This approach not only maximizes market penetration but also ensures that brands can cater to diverse consumer preferences and spending capacities. The success of this strategy is evident in the widespread adoption of products like Fair & Lovely and Ponds, which have become household names across India. Brands appeal to buyers by emphasizing the efficacy and safety of their products through marketing campaigns, often leveraging local ingredients and traditional beauty practices to resonate with Indian consumers.

To Understand More About this Research: Request A Free Sample

State-wise Analysis

West India, encompassing Maharashtra, Gujarat, Goa, and Rajasthan, has solidified its position as India’s largest skincare market, commanding a significant 36.44% share. This dominance is driven by a unique interplay of economic, demographic, and environmental factors specific to the region. Maharashtra, home to Mumbai, India’s financial hub, boasts a GDP per capita of up to US$ 23,000 (as of 2024), highlighting the region’s economic strength. This affluence translates into higher disposable incomes, with per capita expenditure on packaged food surging from US$24.9 in 2018 to US$43.6 in 2023. Urban centers like Mumbai, Pune, Ahmedabad, and Jaipur have cultivated a cosmopolitan culture, fostering heightened brand awareness and a preference for premium skincare products. The region’s robust retail infrastructure, including both physical stores and e-commerce platforms, has further amplified product accessibility. The skincare sector, the largest category within the beauty industry, accounted for 44% of the market in 2023, growing at 6%, underscoring West India’s strong inclination toward skincare solutions.

The demand for skincare products in West India skincare market is also propelled by distinct climatic challenges and lifestyle dynamics. Coastal cities like Mumbai and Goa grapple with high humidity, leading to increased oil production and acne-related issues. In contrast, arid regions like Rajasthan face low humidity, causing skin dryness and irritation, necessitating tailored skincare solutions. Furthermore, cities such as Mumbai and Ahmedabad experience high UV radiation levels, driving demand for sun protection products. Urban pollution in major cities exacerbates skin concerns, fueling the market for anti-pollution skincare. These diverse environmental factors, combined with the region’s economic prosperity and consumer awareness, have created a fertile ground for skincare innovation and growth. The region’s unique blend of economic strength, climatic diversity, and evolving consumer preferences cements its status as the epicenter of India’s burgeoning skincare industry.

Top Players in India Skincare Market

- Beiersdorf AG

- Oriflame Holding AG

- Procter & Gamble

- L'OREAL S.A.

- Estée Lauder Companies

- Kenvue Inc

- Emami Limited

- Zydus Wellness

- Vicco Laboratories

- Hindustan Unilever Limited (HUL )

- HCP Wellness Private Limited

- VLCC Health Care Ltd

- Brunch Beauty Pvt. Ltd (D’you)

- Onesto Labs Private Limited

- Other Prominent Players

Private Label Companies

- Naturis Cosmetic

- Cosmetify

- Aura Herbal

- Vasa Cosmetics

- AG Organica

- Zoic Cosmetic

- Invision Pharma Limited

- HCP Wellness

- Clarion Cosmetics

- Other Prominent Players

Market Segmentation Overview:

By Product

- Facial Care

- Cleansers & Face Wash

- Toners

- Moisturizers

- Creams

- Serums

- Face Masks

- Face Oil

- Others

- Eye Care

- Eye Creams

- Eye Gels

- Under-Eye Patches

- Lip Care

- Lip Balms & Conditioners

- Lip Exfoliators & Scrubs

- Lip Masks

- Body Care

- Body Lotions

- Body Wash

- Body Scrubs

- Others

- Others

By Nature

- Organic

- Conventional

By Skin Type

- Sensitive Skin

- Dry Skin

- Oily Skin

- Combination Skin

By Gender

- Male

- Female

- Unisex

By Price Range

- Mass

- Premium

By End User

- Individual/Home Use

- Commercial

- Beauty Salons & Spas

- Dermatology Clinics & Hospitals

- Others

By Distribution Channel

- Online

- E-Marketplace

- Brand Websites

- Offline

- Supermarkets & Hypermarkets

- Department Stores

- Beauty Specialty Stores

- Pharmacies & Drugstores

- Others

By State

- North India

- Uttar Pradesh

- Delhi

- Haryana

- Punjab

- Rajasthan

- Himachal

- J&K

- South India

- Tamil Nadu

- Karnataka

- Kerala

- Andhra Pradesh

- Telangana

- West India

- Gujarat

- Goa

- Madhya Pradesh

- Maharashtra

- Chhattisgarh

- East India

- West Bengal

- Bihar

- Assam

- Jharkhand

- Odisha

- Rest of East India

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 8.78 Billion |

| Expected Revenue in 2033 | US$ 17.69 Billion |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Bn) |

| CAGR | 8.43% |

| Segments covered | By Product, By Nature, By Skin Type, By Gender, By Price Range, By End User, By Distribution Channel, By State |

| Key Companies | Beiersdorf AG, Oriflame Holding AG, Procter & Gamble, L'OREAL S.A., Estée Lauder Companies, Kenvue Inc, Emami Limited, Zydus Wellness, Vicco Laboratories, Hindustan Unilever Limited (HUL ), HCP Wellness Private Limited, VLCC Health Care Ltd, Brunch Beauty Pvt. Ltd (D’you), Onesto Labs Private Limited, Naturis Cosmetic, Cosmetify, Aura Herbal, Vasa Cosmetics, AG Organica, Zoic Cosmetic, Invision Pharma Limited, HCP Wellness, Clarion Cosmetics, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA03251228 | Delivery: Immediate Access

| Report ID: AA03251228 | Delivery: Immediate Access

.svg)