India Refrigerator Market: By Model Type (Mini Freezers, Top Freezer, Bottom Freezer, Side by Side, French Door and Merchandizers); Retail Format (Online, Offline); Capacity (<200 L, 200 – 499 L, 500 – 700 L, > 700 L); Technology (Direct cool, Frost Free); End User (Residential, Commercial (HoReCa)); Region (North India, South India, West India and East India)—Industry Dynamics, Market Size, and Opportunity Forecast for 2025-2033

- Last Updated: 14-Jan-2025 | | Report ID: AA0121026

Market Scenario

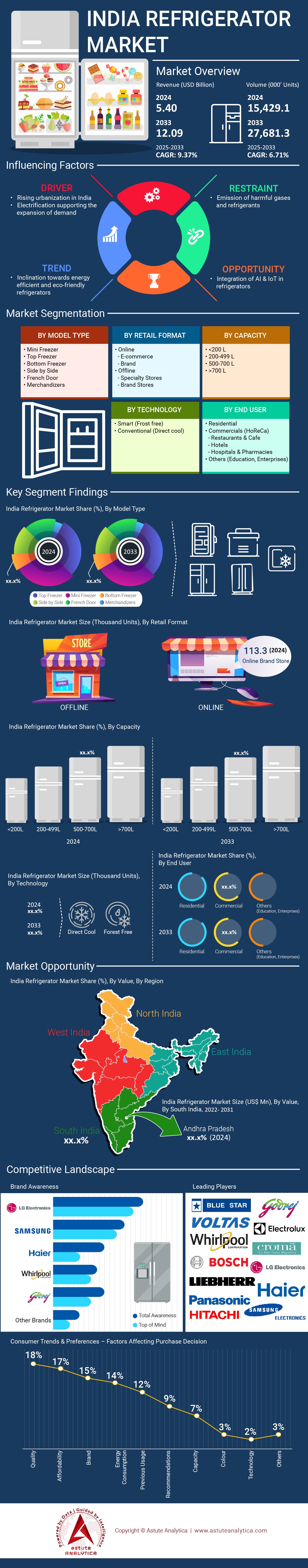

India refrigerator market was valued at US$ 5.40 billion in 2024 and is projected to hit the market valuation of US$ 12.09 billion by 2033 at a CAGR of 9.37% during the forecast period 2025–2033.

The demand for refrigerators in India continues to expand steadily, driven by lifestyle upgrades, broader electrification in semi-urban regions, and a rising inclination toward premium home appliances. Single-door and double-door models dominate the market, with top-freezer variants remaining popular among cost-conscious consumers who prioritize energy efficiency and durability. Meanwhile, high-end French-door and side-by-side refrigerators are increasingly sought by urban families in the India refrigerator market looking for advanced cooling technologies, frost-free features, and smart connectivity. Leading brands such as LG and Samsung distinguish themselves by consistently innovating with better compressor warranties and intuitive user interfaces, which resonate with Indian buyers seeking long-term value. These multinational giants also invest heavily in local manufacturing and service infrastructures, further cementing their presence in key metros and tier-two cities.

Beyond residential use, small businesses like beverage stores and pharmacies rely on specialized commercial chillers offering larger storage volumes and robust cooling systems. In 2023, refrigerator market in India recorded 18 million refrigerator unit sales across major Indian cities, reflecting widespread adoption in both homes and shops. The current market outlook remains optimistic, driven by new product launches with advanced door cooling, flexible freezer compartments, and digital temperature controls. At the same time, emerging local brands are steadily strengthening their foothold through regional marketing and competitive pricing strategies.

India’s consumer behavior is gradually shifting toward premium models featuring inverter technology and enhanced aesthetics that blend seamlessly into modern kitchens. As incomes rise, buyers are leaning toward brands with strong after-sales support, transparent warranties, and easy financing options. In 2023, eight e-commerce platforms introduced one-click exchange programs for old refrigerators, fueling online purchases across rural belts. This expansion of digital marketplaces is reducing logistical barriers, making branded products accessible to remote areas, and spearheading significant growth in the India refrigerator market. Online platforms play a major role in bridging geography-induced gaps, providing detailed product comparisons, and hosting flash sales that encourage impulsive yet informed buying. More recently, trends such as eco-conscious refrigerants, IoT-enabled temperature monitoring, and voice-control integrations are reshaping consumer expectations. Going forward, the market is poised to witness sharper competition among established manufacturers, rising local contenders, and technology-focused newcomers—making refrigeration an increasingly vibrant segment in India refrigerator market.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Expanding cold-chain networks amplify residential and commercial fridge usage nationwide in unprecedented supply synergy

The backbone of modern food preservation and pharmaceutical distribution in the refrigerator market rests on robust cold-chain infrastructure. Across India, this network has expanded to include 4,500 specialized storage depots as of 2023, each designed to maintain consistent low temperatures for extended periods. In the same year, 22 states launched logistics corridors to facilitate faster transport of perishable goods, ensuring minimal wastage and better profitability for producers. These corridors utilize advanced refrigerated trucks—nearly 2,800 newly commissioned vehicles now make daily runs between agricultural belts and retail hubs. This seamless transit of temperature-sensitive commodities encourages commercial buyers, including supermarkets and pharmacies, to invest in larger refrigerator models for optimal stock management.

In parallel, the consumer side in the refrigerator market experiences a push from improved connectivity in semi-urban and rural areas. During 2023, 900 new retail outlets in tier-three towns have introduced upgraded freezers to maintain product freshness, especially in local dairy and poultry segments. This trickle-down effect has motivated more families to embrace modern refrigeration as an essential household requirement rather than a luxury. It also supports a safer and more hygienic lifestyle in line with evolving national quality standards. Notably, 20 regional microfinance institutions this year began offering refrigerator-specific purchase schemes, driving further penetration of appliances in previously underserved districts within the India refrigerator market.

As cold chains strengthen further, the market sees rising demand for higher-capacity machines capable of sustaining uniform temperatures. Manufacturers are responding by designing refrigerators tailored for commercial endurance, extending warranties from the usual one year to three years. Additionally, 15 specialized repair centers have opened recently, focusing on commercial fridge maintenance to reduce downtime. Collectively, these developments underscore the role that cold-chain expansions play in driving both the commercial and residential segments, positioning refrigeration as a cornerstone of economic vitality.

Trend: Shift toward smart, IoT-enabled models revolutionizes user customization possibilities across diverse Indian consumer segments

The rise of Internet-of-Things (IoT) technology has stimulated a new era in fridge design in the India refrigerator market. As of 2023, eight leading appliance manufacturers have introduced Wi-Fi-enabled refrigerators that allow remote temperature control via smartphones. Consumers can receive alerts for open doors and power fluctuations, a feature especially useful in localities where electricity supply can be inconsistent. In fact, 14 cities, including key metros and fast-growing tier-two regions, have seen the rollout of interactive showrooms showcasing these futuristic fridge models. With each demonstration, manufacturers emphasize how connected technologies streamline daily routines—for instance, real-time ingredient tracking or integrated grocery list management.

Even households in smaller towns are beginning to embrace such innovations, aided by 12 consumer finance companies offering installment plans with minimum initial outlays. Many families find these appliances useful for temperature-specific food storage, ensuring produce stays fresh longer, and critical medications remain at stable temperatures. This functional transformation aligns closely with broader smart home trends in the refrigerator market, where refrigerators talk to smart assistants for daily meal planning or nutritional suggestions. Meanwhile, 6 cross-industry collaborations have emerged between telecom operators and appliance brands, ensuring seamless Internet solutions in synergy with fridge connectivity, further fueling the India refrigerator market.

Moreover, as consumer awareness grows, the concept of “fridge as a service” gains ground, with 3 pilot subscription models launched in NCR (National Capital Region). Subscribers can upgrade to advanced versions without a hefty lump-sum purchase—similar to smartphone leasing arrangements. Such versatility is appealing to tech-savvy buyers who prefer continuous access to the latest features. The shift toward smart fridges is also driving manufacturers to enhance their R&D capabilities, with 10 newly established engineering labs focusing on IoT-related refrigeration solutions. This confluence of technology, finance, and consumer aspiration is set to transform how Indian households interact with their refrigerators, ultimately reshaping the appliance market’s future.

Challenge: Rural inclusion remains difficult despite technological and logistical delivery improvements across expanding hinterland regions

Reaching remote areas in a country as vast as India remains a complex challenge for fridge manufacturers. Even though 4 major courier and logistics companies introduced specialized last-mile delivery vans for perishable goods in 2023, transporting bulky appliances over rough terrain is still fraught with delays. As a result, 600 rural localities in India refrigerator market have reported limited access to modern refrigerator models, sticking to outdated or second-hand cooling solutions. The central government’s rural electrification drive has improved the availability of electricity in many regions, yet the unpredictable nature of power supply in certain belts deters potential buyers, who worry about potential damage to sophisticated appliances.

Additionally, the cost factor influences adoptability. Although 9 membership-based rural cooperatives partnered with national banks to fund fridge purchases at concessional rates, the overall maintenance expenses remain high for many lower-income families. Spare parts for advanced models are not easily available outside major towns, and only 3 specialized workshops exist in each of India’s four largest states. This scarcity inflates repair costs and discourages more widespread adoption within the India refrigerator market.

Manufacturers attempting to bridge these gaps face hurdles in scaling. Outsourcing distribution to smaller traders can lead to inconsistent after-sales service, and brand reputation sometimes suffers from improper installations. Moreover, suboptimal road infrastructure in hilly or flood-prone regions hampers marketing campaigns and product demonstrations—critical elements in generating consumer trust. The result is a slower-than-expected penetration rate among communities that could significantly benefit from reliable refrigeration, such as farmers needing cold storage for produce or households looking to preserve nutritional quality of food. In response, 5 philanthropic initiatives have emerged in 2023, aiming to subsidize solar-powered units for off-grid villages. However, more collaborative effort from both public and private sectors is essential to surmount these persistent barriers and ensure inclusive growth.

Segmental Analysis

By Model Type

The top freezer segment has firmly established its dominance in the India refrigerator market, holding a substantial 51% share in 2024. A key reason for this leadership is the unit’s ability to combine freezer and shelf storage without occupying excessive space, making it especially appealing for households seeking practical design with affordability at the forefront. Unlike models that require more precise kitchen layouts, top freezer refrigerators fit seamlessly into a range of floor plans, allowing homeowners to prioritize both functionality and prudent use of space. This user-friendly approach aligns well with the typical needs of Indian consumers, who often aim to maximize usable capacity while minimizing cost per unit. Additionally, many of these top freezer models also incorporate energy-efficient features, giving them a further edge in a price-sensitive market eager for appliances that strike the right balance between performance and long-term savings.

However, emerging consumer preferences are gradually steering substantial growth for side-by-side and French door refrigerators, which are lauded for spacious interiors and enhanced visibility. As families become increasingly conscious of aesthetics and convenience, the demand for these high-end designs is on the rise. The bottom freezer segment has also seen a supportive upswing, particularly catering to households that desire easy access to fresh foods stored at eye level, yet do not want to compromise on freezer space. This ongoing evolution points toward a market landscape where multifunctionality and user-centric features will sustain growth in all refrigerator categories. Still, the top freezer segment is expected to retain its leading position by consistently adapting to local preferences and enhancing user experiences through innovative additions such as adjustable door shelves and convertible freezers. These targeted refinements underscore how the top freezer remains a robust choice for Indian consumers, reaffirming its well-entrenched dominance in the refrigerator market. As many experts highlight, addressing consumer demand for both functionality and economic value cements brand loyalty.

By Capacity

The 200-499 liter capacity segment’s dominant position, controlling over 63.68% share of the India refrigerator market, reflects how crucial mid-range capacities are to the Indian consumer base. Families in this region often require a refrigerator that comfortably accommodates weekly grocery needs without excessively inflating electricity bills or monopolizing kitchen space. Consequently, models within this range strike the ideal balance between price, capacity, and energy efficiency. Many Indian homes have two to five family members, making the 200-499 liter refrigerators particularly suitable for storing fresh produce, leftovers, and diverse meal preparations, a hallmark of Indian cuisine. Additionally, manufacturers frequently offer compressor warranties, frost-free features, and adjustable compartments in this capacity, adding to the segment’s robust appeal. In a nation where affordability and functionality reign supreme, these mid-capacity models remain the preferred choice for consistent performance and practical design.

Another factor fueling dominance in the refrigerator market is the widespread availability of 200-499 liter refrigerators across various retail channels. Local distributors and online marketplaces heavily stock these models, ensuring easy accessibility and competitive pricing. Brands also invest significantly in advertising and promotional offers within this capacity range, reinforcing the perception that these refrigerators are the go-to solution for middle-income households seeking a reliable yet cost-conscious option. Furthermore, the segment’s momentum is bolstered by evolving technological modifications, such as convertible compartments and digital temperature controls, which are increasingly introduced into mid-range models. By catering precisely to the lifestyle patterns and budget priorities of India’s diverse population, the 200-499 liter capacity category is set to maintain its commanding share in the market. As industry data consistently shows, the blend of practicality, moderate pricing, and feature-rich design continues to secure this segment’s leadership, thereby highlighting the fundamental reasons behind its enduring prominence.

By End Users

Residential consumers form the backbone of refrigerator market in India, commanding a staggering 87.68% market share. The pivotal reason for this dominance is the sheer scale of the population living in rapidly expanding urban and semi-urban centers, where home appliance purchases reflect an ongoing pursuit of convenience and modern living standards. Refrigerators, once considered a luxury, have become a near-essential appliance in middle-class homes, driven by a growing appetite for fresh produce, dairy, and other perishable goods. India’s familial culture, characterized by communal cooking and shared meals, further elevates the need for robust storage solutions that accommodate diverse eating habits. Factors such as rising disposable incomes, government-led electrification programs, and increasing consumer awareness about food preservation techniques also boost adoption rates in residential segments. Collectively, these elements continuously reinforce the grip of household buyers in the india refrigerator market, reflecting a deep-rooted cultural inclination toward convenience and healthy living.

Moreover, the substantial market influence wielded by residential consumers can be credited to the variety of refrigerator offerings available, from compact single-door units to advanced multi-door variants. Manufacturers strategically tailor these models to address the diverse storage requirements, budget sensitivities, and style preferences typical of Indian homes. Even as commercial and industrial segments also rely on refrigeration, they represent a smaller slice of overall demand when juxtaposed with the everyday usage in households renowned for frequent meal prepping and robust ingredient rotation. Consequently, brands have been swift to introduce energy-efficient features, digital connectivity, and user-friendly modular compartments that cater to evolving customer aspirations. These ongoing innovations, combined with higher disposable incomes and a steady rise in new home construction, further secure the residential segment’s hold on the market. This enduring sway asserts that household buyers remain a key growth catalyst, fueling technological refinement and competitive pricing across the India refrigerator market.

By Technology

Direct Cool refrigerators have long reigned as the most favored choice in Indian refrigerator market in, capturing an impressive 77.7% revenue share in the market. One fundamental reason behind this dominance is their relatively lower cost compared to Frost Free alternatives, making them accessible to a broad consumer base seeking affordability without compromising basic functionality. Additionally, Direct Cool models require minimal upkeep, as they lack the complex mechanisms used in Frost Free systems. This simplicity appeals massively to families who prioritize ease of installation and straightforward maintenance. Over time, manufacturers have optimized designs to incorporate better insulation, improved compressors, and streamlined exteriors, further reinforcing the foothold of Direct Cool technology in the refrigerator market. However, as lifestyles evolve and consumers demand convenience features like automatic defrosting, a forecasted shift toward Frost Free systems emerges. Still, the inherent advantages of Direct Cool technology ensure its foothold, particularly within cost-conscious segments of the india refrigerator market.

In contrast, Frost Free refrigerators are rapidly gaining attention among upwardly mobile consumers who value enhanced convenience and improved cooling capabilities. These models employ electric fans and specialized sensors to regulate temperature, effectively preventing ice build-up and ensuring even air distribution. This innovation delivers the added benefit of prolonged food freshness, especially vital for households managing varied dietary needs or frequently entertaining guests. Although Frost Free units typically command a higher price point and require more sophisticated components, modern technology has helped mitigate operational costs through energy-saving compressors and inverter-based functionalities. Consequently, this segment is projected to achieve robust expansion, driven by growing brand awareness and rising incomes in urban centers. By bridging practicality with technological sophistication, the Frost Free category has effectively broadened its audience. Nevertheless, given the entrenched popularity of Direct Cool designs, it is clear that both technologies will continue to carve out sizable portions of the India refrigerator market.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

State wise Analysis

State wise, the market is segmented into North, East, West, and South. South India is the largest refrigerator market, accounting for almost 33% market share. South India is currently the largest market for refrigerators in India and is expected to continue its growth trend in the coming years. The region's high disposable income, growing urbanization, presence of major cities, high literacy rate, and large consumer base are contributing factors to this growth. With increasing demand for consumer durables and improved infrastructure, South India presents a promising market opportunity for companies operating in the Indian refrigerator industry. To capitalize on this opportunity, companies may consider expanding their presence in the region and offering products that cater to the specific needs and preferences of South Indian consumers.

It is important for companies to understand the local nuances of the South Indian market when catering to this segment. Companies should focus on understanding the needs of the consumers and their preferences, as well as the competitive landscape in order to effectively target the South Indian refrigerator market. Furthermore, companies should invest in marketing and promotional activities that are tailored to the local market, such as using regional language advertisements, offering exclusive deals and discounts, and providing customer service in the local language. This will help companies to better reach and engage with their target audience in South India.

Top Companies in India Refrigerator Market:

- Blue Star Limited

- Robert Bosch GmbH

- Croma

- Godrej Group

- Tropicool India

- Voltas, Inc.

- Electrolux AB

- Samsung Electronics Co., Ltd.

- LG Electronics Inc.

- Whirlpool Corp.

- Liebherr-International Deutschland GmbH

- Haier Group Corp.

- Panasonic Corp.

- Hitachi Ltd.

- Other Prominent Players

Market Segmentation Overview:

By Model Type

- Mini Freezers

- Top Freezer

- Bottom Freezer

- Side by Side

- French Door

- Merchandizers

By Retail Format

- Online

- E-commerce

- Brand

- Offline

- Specialty Stores

- Brand Stores

By Capacity

- <200 L

- 200 – 499 L

- 500 – 700 L

- > 700 L

By Technology

- Frost Free

- Direct Cool

By End-User

- Residential

- Commercials (HoReCa)

- Restaurants & café

- Hotels

- Hospitals & Pharmacies

- Others (Education, Enterprises)

By Country

- North India

- Uttar Pradesh

- Delhi

- Haryana

- Rajasthan

- Punjab

- Himachal

- J&K

- South India

- Tamil Nadu

- Kerala

- Karnataka

- Andhra Pradesh

- Telangana

- West India

- Gujarat

- Goa

- Madhya Pradesh

- Maharashtra

- Chhattisgarh

- East India

- West Bengal

- Bihar

- Assam

- Jharkhand

- Odisha

- Rest of East India

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 5.40 Bn |

| Expected Revenue in 2033 | US$ 12.09 Bn |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Bn) |

| CAGR | 9.37% |

| Segments covered | By Model Type, By Retail Format, By Capacity, By Technology, By End-User, By State Wise |

| Key Companies | Blue Star Limited, Robert Bosch GmbH, Croma, Godrej Group, Tropicool India, Voltas, Inc., Electrolux AB, Samsung Electronics Co., Ltd., LG Electronics Inc., Whirlpool Corp., Liebherr-International Deutschland GmbH, Haier Group Corp., Panasonic Corp., Hitachi Ltd., Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)