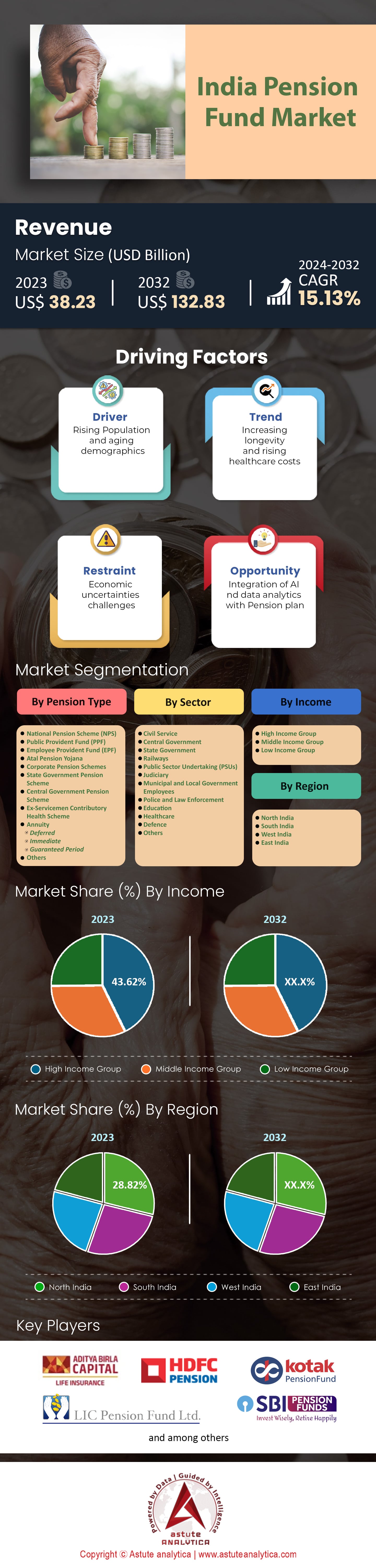

India Pension Fund Market: By Pension Type (National Pension Scheme (NPS), Public Provident Fund (PPF), Employee Provident Fund (EPF), Atal Pension Yojana, Corporate Pension Schemes, State Government Pension Scheme, Central Government Pension Scheme, Ex-Servicemen Contributory Health Scheme, Annuity (Deferred, Immediate, Guaranteed Period, and Others); Income (High Income Group, Middle Income Group, Low Income Group); Sector (Civil Service, Central Government, State Government, Railways, Public Sector Undertaking (PSUs), Judiciary, Municipal and Local Government Employees, Police and Law Enforcement, Education, Healthcare, Defense, Others)— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 22-Jun-2024 | | Report ID: AA0624856

Market Scenario

India pension fund market was valued at US$ 38.23 billion in 2023 and is projected to hit the market valuation of US$ 132.83 billion by 2032 at a CAGR of 15.13% during the forecast period 2024–2032.

India's pension fund industry is experiencing a period of robust growth and transformation, driven by regulatory changes, demographic shifts, and evolving investment strategies. The National Pension System (NPS) has been a significant contributor to this growth, with a 21.6% increase in subscriptions for NPS and Atal Pension Yojana (APY) in 2024. The total assets under management (AUM) for these schemes have reached ₹8.98 lakh crore, reflecting the system's growing popularity. This surge is largely attributed to the increasing participation of young investors, with 23% of NPS subscribers falling within the 18-25 age bracket.

Investment strategies within the NPS in India pension fund market have also evolved, with a notable shift towards equity investments. This trend indicates a growing preference among investors for higher-risk, long-term growth options. The performance of NPS funds across various asset classes has been competitive, offering a unique combination of flexibility, transparency, and cost-effectiveness. The ability of the NPS to provide regular pension payments and flexible withdrawal options further enhances its attractiveness as a retirement savings option.

Regulatory and market dynamics are also playing a crucial role in shaping the future of India's pension fund industry. There is a strong focus on sustainable and net-zero investments, with pension funds actively considering sovereign green bonds and expanding investments in the renewables sector. India aims to achieve 500 GW of renewable energy capacity by 2030, with significant investments planned in sustainable infrastructure, mobility, and energy transition. This strategic focus aligns with India's goal of achieving net-zero carbon emissions by 2070, positioning the pension fund industry as a key player in the country's sustainability efforts.

Despite the positive outlook, the India’s pension fund market faces several challenges. Expanding the reach of the NPS, increasing the average AUM per subscriber, and enhancing regulatory frameworks are critical areas that need attention. The regulatory fragmentation across different pension schemes and the disparity in benefits add complexity and uncertainty for consumers. However, ongoing efforts to harmonize the pension system and expand the regulatory role of the Pension Fund Regulatory and Development Authority (PFRDA) are expected to address these issues. With a working-age population set to peak at 68.9% by 2030 and an ageing population projected to exceed 227 million by 2050, the focus on improving medium-term economic growth is crucial for ensuring old-age income security.

To Get more Insights, Request A Free Sample

Key Dynamics of India's Pension Fund Market

India's pension fund industry is a complex and fragmented system characterized by a variety of schemes catering to different segments of the population. The primary pension schemes include the Employees' Provident Fund (EPF) and the New Pension System (NPS). The EPF, a mandatory plan for workers in the organized private sector, is managed by the Employees' Provident Fund Organisation (EPFO) and currently holds assets amounting to EUR 40.1 billion, with an anticipated yearly growth rate of at least 14.9% until 2050. On the other hand, the NPS, introduced in 2004, is a defined contribution scheme targeting a replacement rate of 50% of the final wage. This scheme, regulated by the Pension Fund Regulatory and Development Authority (PFRDA), has expanded to cover all Indian citizens, corporates, and non-resident Indians on a voluntary basis. Additionally, there are various voluntary private pensions available for self-employed individuals and workers in both the organized and unorganized sectors, as well as specific schemes like the Atal Pension Yojana (APY) and the Pradhan Mantri Shram Yogi Maandhan (PMSYM) for low-income unorganized workers.

Regulatory Landscape and Economic Challenges

The regulatory landscape of India's pension fund market is evolving, with an increasing emphasis on transparency and accountability. The PFRDA plays a pivotal role in regulating the NPS and other pension products, and there is a growing consensus on the need for a unified regulatory approach to streamline the diverse schemes under a single regulator. This is particularly important given the demographic shifts and economic challenges India faces. By 2050, India's elderly population is expected to exceed 227 million, highlighting the urgent need for robust pension frameworks to ensure old-age income security. Additionally, economic uncertainties and a low-interest-rate environment present challenges for pension funds in generating sufficient returns to meet their long-term obligations. Technological advancements, such as artificial intelligence and data analytics, are increasingly being leveraged to enhance investment decision-making processes, optimize portfolio management, and personalize retirement solutions, thereby providing significant growth opportunities for the pension funds market.

Market Trends and Future Prospects

Market trends indicate that the pension fund market in India is driven by demographic shifts and regulatory changes. In 2022, the government segment dominated the pension funds market in terms of revenue and is projected to grow at the fastest CAGR during the forecast period. The Asia-Pacific region, in particular, is expected to experience the highest CAGR, reflecting the region's increasing focus on pension reforms. The fragmented nature of India's current pension system necessitates urgent reforms to harmonize the various schemes and enhance their efficiency. The modernization of the industry, driven by technological advancements and regulatory changes, is crucial to ensuring financial security for India's growing elderly population. As the industry continues to evolve, it is imperative to address the challenges and leverage the opportunities to build a sustainable and inclusive pension system for the future.

Segmental Analysis

Pension Type: National Pension Scheme Dominate in India's Pension Market

The National Pension Scheme (NPS) has cemented its position as a leading retirement savings option in India pension fund market, driven by its comprehensive tax benefits, flexible contribution options, and low costs. It accounted for 19.4% market share of India pension fund market in 2023. Contributions to NPS qualify for tax deductions up to Rs 2 lakh under Sections 80C and 80CCD (1B). This makes it an attractive choice for individuals looking to reduce their taxable income while saving for retirement. The NPS also offers professional fund management and transparent investment norms, ensuring that investments are handled efficiently and with accountability.

The scheme's growth is evident through several key metrics. As of March 31, 2023, the total number of NPS and Atal Pension Yojana (APY) subscribers stood at 7.36 crore, reflecting a 16.28% increase from the previous year. NPS assets under management (AUM) reached ₹11.73 lakh crore in 2023-24, marking a 30.5% year-on-year growth. The non-government sector saw an impressive 41.67% year-on-year growth in NPS assets, amounting to ₹2.27 lakh crore. Additionally, NPS funds delivered competitive returns, with an average annual return of 35.42% as of March 31, 2023, showcasing strong performance across asset classes.

Several dynamics further highlight NPS's dominance in pension fund market. A significant 23% of NPS subscribers are young investors aged 18-25, indicating early adoption of retirement planning. The scheme's reach extends beyond urban centers, with non-metro areas being strongholds for NPS subscribers. Corporate participation is also on the rise, with many companies offering NPS as part of their employee benefits package. The ease of online account opening and regulatory support from the Pension Fund Regulatory and Development Authority (PFRDA) enhance the scheme's credibility and accessibility. These factors collectively ensure that NPS remains a dominant force in India's pension fund market.

By Sector, Railway Remains Top Choice Among India's Pension Fund Operators

The Indian railway sector has emerged as a dominant force in the pension fund market with over 12.9% market share, driven by substantial government support and promising growth prospects. The Union Budget 2024-25 allocated ₹2.55 lakh crore to the Ministry of Railways, marking a 5.8% increase from the previous year. This consistent rise in funding signifies robust governmental backing, ensuring the sector's stability and attractiveness for long-term investments. Furthermore, the sector is expected to achieve a revenue CAGR of 17% from FY23 to FY26, underpinned by ambitious projects like the indigenous production of 400 energy-efficient Vande Bharat trains and the introduction of high-speed bullet trains, which enhance operational efficiency and service quality.

Indian Railways' role as the largest employer in the country, with over 1.4 million employees, underscores its socio-economic impact and further solidifies its investment appeal. A major portion of the railway's internal revenue comes from freight (69%) and passenger traffic (24%), ensuring diversified and stable revenue streams. Government reforms, including the establishment of a regulatory body and changes in haulage rates, along with 100% FDI allowance in the sector, have improved financial health and attracted substantial private investments. The sector's commitment to becoming a Net Zero Carbon Emitter by 2030 aligns with global ESG investment trends, adding another layer of appeal for pension funds.

The railway sector's historical performance and future potential are highlighted by significant budget increases and infrastructure investments over the years in pension fund market. Ongoing safety enhancements, modernization projects, and the development of three economic rail corridors, alongside 434 projects with an investment of ₹11 lakh crore, demonstrate the sector's growth trajectory and its importance in the national economy. These factors collectively underscore the dominance of the railway sector in India's pension fund market, making it a stable, profitable, and socially impactful investment option.

By Income Level, High-Income Individuals in India are Key Contributors

High-income individuals in India are the primary beneficiaries of pension funds due to several interrelated factors. In 2023, the high-income individual segment contributed more than 43.6% market share. The National Pension System (NPS) offers significant tax benefits that are particularly advantageous for high-income earners. Contributions up to Rs 1.5 lakh under Section 80CCC are eligible for tax deductions, making it an attractive option for those in higher tax brackets. Additionally, the tax treatment of NPS contributions follows an Exempt-Exempt-Taxed (EET) model, where contributions and accumulations are tax-exempt, but withdrawals are taxed, further incentivizing high-income individuals to invest in these schemes. The ability to invest in a mix of government securities, debt, and equity allows these individuals to tailor their investment strategies to maximize returns, which is crucial for maintaining their standard of living post-retirement.

The structure and regulation of pension fund market in India also play a significant role in this dynamic. The NPS is designed to be transparent and cost-effective, with the value of investments being trackable on a day-to-day basis. This transparency appeals to high-income individuals who are more likely to have the financial literacy to understand and manage these investments effectively. Moreover, the fragmented nature of the Indian pension framework, characterized by various regulators and guidelines, adds complexity that high-income individuals are better equipped to navigate. The Pension Fund Regulatory and Development Authority (PFRDA) has been pushing for unified regulatory standards, which could further streamline the process and make it more accessible to a broader audience.

High-income individuals are also key contributors to pension funds due to their higher disposable incomes and greater financial literacy. They are more likely to start investing early, which significantly impacts the returns they can expect from their pension plans. The willingness to pay for pension schemes is influenced by factors such as income, trust in the system, and the quality of administration, all of which are more favorable for high-income earners. Additionally, the potential for higher returns through riskier investment options, such as equities, is more appealing to those with higher incomes who can afford to take on more risk. This combination of tax benefits, regulatory structure, and financial capability makes high-income individuals the primary beneficiaries and key contributors to pension funds in India.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Diversified Investment Opportunities

Pension fund operators in India are increasingly exploring direct investments across various sectors such as asset management, healthcare, film and entertainment, and renewable energy. This diversification is driven by favorable government policies and incentives, including tax benefits for startups and investments from sovereign wealth or pension funds until March 31, 2025. Initiatives like Make in India, Production-Linked Incentive Schemes, and the liberalization of FDI rules have created a conducive environment for investment in pension fund market. Moreover, India’s inclusion in global bond indexes and improved market performance as per the MSCI Index are attracting significant passive foreign flows, further enhancing the appeal of the Indian market to pension funds.

Robust Growth in National Pension System

The National Pension System (NPS) has witnessed substantial growth, with assets under management (AUM) increasing by 29% year-on-year, reaching ₹11.26 lakh crore. Of this, ₹2 lakh crore is invested in equities, reflecting a shift towards equity investments driven by changing investor preferences. With 6.7 lakh new subscribers joining NPS, the total number of NPS and APY subscribers has increased to 7.13 crore, up 16% from the previous year. This growth is also seen in the younger demographic, with 23% of NPS subscribers in the 18-25 age bracket. The competitive performance of NPS funds across asset classes, combined with flexibility, transparency, and cost-effectiveness, has made NPS a preferred retirement savings option.

Attractive Returns and Sovereign Wealth Fund Interest

Pension fund market in India have recorded an impressive average annual return of nearly 30% from their equity investments, driven by robust market performance. This high return rate is attracting more investments into equities, boosting the growth of pension funds further. Sovereign wealth funds from major economies are also showing keen interest in India's business ecosystem. Notable investments include the Norway Sovereign Wealth Fund’s portfolio, which reached nearly US$24 billion by the end of 2023, and the UAE's ADIA operating through the tax-neutral finance hub of GIFT City. These strategic investments and diverse investment plans, including Public Provident Fund (PPF), Government Bonds, Sovereign Gold Bonds (SGBs), and Equity Mutual Funds, provide pension fund operators with a range of options to cater to different risk appetites and investment goals.

Top Players in India Pension Fund Market

- Aditya Birla Sun Life Insurance Company Ltd.

- Aviva Life Insurance Company India Ltd.

- HDFC Life Insurance Company

- HDFC Pension Management Company Limited

- ICICI Prudential Pension Funds Management Company Ltd.

- JP Morgan

- Kotak Mahindra Pension Fund

- LIC Pension Fund Limited

- Reliance Nippon Life Insurance Company Ltd.

- SBI Pension Funds Private Limited

- TATA AIA Life Insurance Company Limited

- UTI Retirement Solutions Limited

- Other Prominent Players

Market Segmentation Overview:

By Pension Type

- National Pension Scheme (NPS)

- Public Provident Fund (PPF)

- Employee Provident Fund (EPF)

- Atal Pension Yojana

- Corporate Pension Schemes

- State Government Pension Scheme

- Central Government Pension Scheme

- Ex-Servicemen Contributory Health Scheme

- Annuity

- Deferred

- Immediate

- Guaranteed Period

- Others

By Income

- High Income Group

- Middle Income Group

- Low Income Group

By Sector

- Civil Service

- Central Government

- State Government

- Railways

- Public Sector Undertaking (PSUs)

- Judiciary

- Municipal and Local Government Employees

- Police and Law Enforcement

- Education

- Healthcare

- Defence

- Others

By Region

- North India

- Uttar Pradesh

- Delhi

- Haryana

- Punjab

- Rajasthan

- Himachal

- J&K

- South India

- Tamil Nadu

- Karnataka

- Kerala

- Andhra Pradesh

- Telangana

- West India

- Gujarat

- Goa

- Madhya Pradesh

- Maharashtra

- Chhattisgarh

- East India

- West Bengal

- Bihar

- Assam

- Jharkhand

- Odisha

- Rest of East India

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)