India Deep Freezer Market: By Type (Chest Deep Freezer and Upright Deep Freezer); Capacity (Up to 250 Liters, 250 - 500 Liters, 500 - 750 Liters, Above 750 Liters); Temperature (Up to -30 Degree Celsius, -30 to -60 Degree Celsius, Above -60 Degree Celsius); Doors (Single Door, Double Door, and Triple Door); End Users (Residential, Commercial (HoReCa (Hotel/Restaurants & Cafes), Supply chain & Logistics, Storage Service Providers, Others); Industrial (Food & Beverage, Pharmaceutical, Chemical, Agriculture, Retail, Others); Sales Channel (OEMs and Aftermarket); Distribution Channel (Online and Offline); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Mar-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA1023634 | Delivery: 2 to 4 Hours

| Report ID: AA1023634 | Delivery: 2 to 4 Hours

Market Scenario

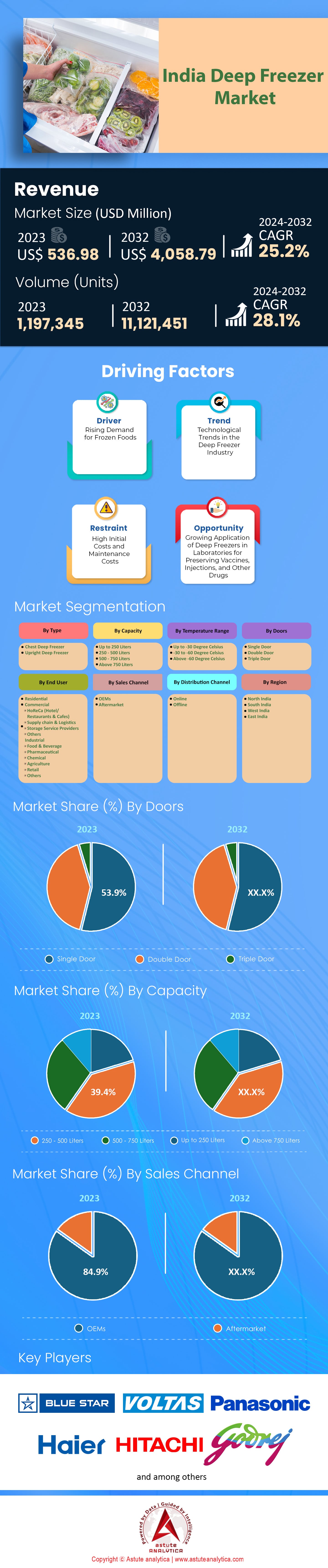

India Deep Freezer Market was valued at US$ 536.98 million in 2023 and is projected to surpass the market size of US$ 4,058.79 million by 2032 at a CAGR of 25.2% during the forecast period 2024–2032.

The Indian deep freezer market has experienced significant growth and shifts in recent years. In 2022, the market reached a landmark with the sale of approximately 1.3 million units, which represents a burgeoning demand across households and commercial establishments alike. This growth was propelled by both domestic and international brands, with three top brands recording combined sales of over 800,000 units. These figures underscore the increasing competitiveness and market dynamism. Wherein, the average price of household deep freezers floated around $188, providing a cost-effective solution for consumers. Meanwhile, commercial entities, often requiring larger storage capacities, faced an average price tag of INR 625. This price differentiation also reflects the diverse functionality and feature sets offered in the market.

A nationwide survey on deep freezer market with a sample of 10,000 participants revealed that energy efficiency and brand reputation stood out as the prime determining factors in purchasing decisions. In line with this, the average energy consumption statistic of 500 kWh annually for household deep freezers became a pivotal selling point for many. Today, e-commerce platforms have emerged as significant players in the distribution chain, boasting sales of around 400,000 units, especially spiking during festive seasons. While online sales continue to burgeon, it's worth noting that India's import-export balance for deep freezers indicates a domestic dominance. The nation imported an estimated 200,000 units while exporting about 50,000, suggesting a considerable internal production capacity and a rising export potential.

The market's inclination towards sustainability and adaptability is evident. Approximately 30,000 old units underwent recycling or refurbishing, and sustainable solar-powered models, though still in a nascent stage, found 10,000 buyers. Meanwhile, the rental market carved its niche, especially in metropolitan regions, with around 20,000 units rented out, predominantly catering to a transient urban populace and event-centric demands.

Brands didn't limit their outreach to sales alone in India deep freezer market. Over 50 new deep freezer models were introduced to the Indian consumer, each addressing unique market segments and needs. This proliferation of choice was complemented by brands establishing over 2,000 service centers, especially emphasizing tier-2 and tier-3 cities, acknowledging the country's vast geographical and demographic expanse. Yet, the number of complaints lodged, around 10,000 primarily about after-sales services, indicates areas where brands can further refine their customer service. With the digital wave sweeping India deep freezer market, transactions for deep freezers amassing to $118 million were carried out via digital means. This trend, combined with around $2.5 million worth of discounts during festive promotions, indicates an evolving consumer behavior, seamlessly blending the traditional with the digital.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rapid Urbanization and Growing Middle Class

India's urban landscape is undergoing a rapid transformation and its population is set to touch a staggering 600 million by 2030. This surge in urban population not only exemplifies the nation's demographic transition but also signifies a potential boom in the demand for modern appliances like deep freezers. The expansion of the Indian middle class, growing at a consistent rate of 10% annually, brings with it augmented purchasing power, and as a consequence, a larger consumer base for home appliances in the India deep freezer market. One of the notable urban trends is the rise in nuclear families, which has seen a growth rate of 15%. This shift, driven by both socio-cultural changes and migration patterns, calls for enhanced food storage solutions, placing deep freezers at the forefront of urban household needs. Moreover, with an impressive investment of approximately $666.7 million in urban infrastructure projects over the recent five years, the groundwork for a broader appliance market has been strengthened. The realty sector too showcases promise, boasting a 20% increase in urban housing ventures.

Annually, about 9 million individuals migrate to metropolises, forming new urban household units and broadening the market. A notable shift in consumer behavior reveals that 70% of these urbanites, due to their bustling lifestyles, resort to bulk-buying and storage, further catalyzing the growth of deep freezers market. Furthermore, the availability of consumer durable loans has expanded by 25%, offering enhanced buying power for appliances. Retail landscapes in urban areas, especially supermarkets and hypermarkets, are expanding at a 15% annual rate, inadvertently encouraging bulk purchases. Significantly, urban electrification rates nearing a full 100% at 98% ensure that almost every household can operate electrical appliances without hindrance.

Trend: Rise of Sustainable and Smart Appliances

Sustainability and technological integration are becoming cornerstones of consumer appliances in India. The demand for eco-friendly deep freezers, utilizing green refrigerants, has been witnessing a steady annual growth of 20%. With the digital revolution taking India by storm, the market saw the introduction and sale of 50,000 smart deep freezers equipped with Internet of Things (IoT) and Artificial Intelligence (AI) capabilities in 2022 alone. Furthermore, energy efficiency is becoming a prime concern for Indian consumers, with a majority, about 60%, now diligently checking for energy star ratings before any purchase, marking a profound shift in purchasing paradigms.

New freezer models introduced lately are not just about cooling but about smart management in India deep freezer market. Around 10% of these models flaunted self-diagnosis and maintenance reminders, indicating a move towards intelligent appliances. Grassroots movements and workshops promoting sustainable appliances have been gaining momentum, with a 30% rise in participation over two years. Aligning with global green initiatives, the Indian government increased its rebate budget for eco-friendly appliances by 20% in 2022, amounting to a significant $2.67 million. Additionally, with tech integration becoming paramount, 15% of freezers sold in 2022 were accompanied by mobile applications enabling remote operations. While solar-compatible freezer sales saw a 12% growth, top brands also elevated their commitment to sustainability, with an R&D investment surge by roughly $2.67 million in the preceding three years.

Restrain: Inconsistent Power Supply and Infrastructure Challenges

India's deep freezer market, despite its immense potential and growth trajectory, grapples with the substantial challenge of inconsistent power supply. The country faces a daunting average of 300 power outages annually. Some regions, particularly remote and underdeveloped areas, bear the brunt of this inconsistency with outages stretching up to 8 hours. This unreliability, understandably, deters households from investing in electrical appliances like deep freezers, which require a consistent power source to function efficiently.

Another facet of this challenge lies in rural electrification. While there have been commendable strides in electrifying the vast expanse of the nation, 20% of rural households are still in the dark, devoid of a consistent power connection. Even in areas with electricity, voltage fluctuations are a common menace in the deep freezer market. Approximately a quarter of Indian towns and villages face this issue, jeopardizing the longevity of electrical appliances and causing potential losses to consumers.

Infrastructure isn't solely about electricity. The logistical challenge of delivering deep freezers to tier-3 and tier-4 markets poses a significant barrier. Nearly a third of manufacturers cite inadequate distribution networks as a major hurdle in tapping into the potential of these markets. Coupled with this is the scarcity of service networks. For every multitude of units sold, the availability of service centers in semi-urban regions is strikingly sparse. Apart from this, cost and space also play crucial roles. A significant portion of the potential rural deep freezer market, about 40%, finds the upfront cost of deep freezers to be a deterrent. Urban regions, grappling with population density, often face space constraints. In such areas, a notable 35% of households point out a lack of space as their reason for not purchasing large appliances. Moreover, awareness remains a challenge. Half of rural India remains unaware of the advantages of owning a deep freezer, indicating a massive opportunity for market expansion if this information gap can be bridged.

Segmental Analysis

By Type:

The deep freezer market in India displays an unmistakable preference for the chest deep freezer category. Capturing a whopping 99.4% of the market, the dominance of this segment speaks volumes about its perceived efficiency, durability, and value proposition in the eyes of Indian consumers. Delving into numbers, with such a commanding market share, it means that out of every 100 deep freezers sold in India, approximately 99 are Chest Deep Freezers. Looking into the future, the segment's dominance is not waning; in fact, it's intensifying. A projected CAGR of 25.2% signifies that the market size for chest deep freezers in India could surge impressively in the coming years. If this growth rate holds, it implies that the market for chest deep freezers might witness an approximate quarter increase year-on-year, further solidifying its grip on the Indian consumer market.

By Capacity:

The segment of 250 – 500 Liters emerges prominently, accounting for a significant 39.4% of the India deep freezer market revenue. In numerical terms, this means that nearly 4 out of every 10 deep freezers sold in the country belong to this capacity bracket. The preference for this particular capacity range can be attributed to its versatility. It strikes a perfect balance, catering to the requirements of both domestic households and commercial entities, such as medium-sized retailers and eateries. The future seems equally promising for this segment, as its dominance is not only expected to remain intact but also to grow. With an anticipated CAGR of 26.4%, this suggests that the demand for deep freezers in the 250–500 liters capacity will increase by roughly a quarter annually. The convergence of affordability, functionality, and size efficiency makes this capacity range a preferred choice in the diverse Indian market landscape.

By Temperature Range:

By temperature range, the deep freezer market in India sees a pronounced preference for units that can reach up to -30 Degree Celsius. Holding a significant 48.1% of the market, this segment’s dominance is indicative of the diversified needs of the Indian consumer, spanning from medical and pharmaceutical applications to specialized food storage requirements. Given this robust market share, it can be inferred that nearly half of the deep freezers sold in India operate within this temperature threshold. Furthermore, the segment's bright future trajectory is underscored by its projected CAGR of 25.9%. If this growth metric in India deep freezer market is realized, it means that the demand for these specific freezers will experience an approximate quarterly surge year-on-year. Such a temperature range is not just a luxury but a necessity in sectors like healthcare, where certain vaccines and medicines mandate stringent storage conditions. Additionally, with the Indian summer known for its intensity, a deep freezer that can achieve such low temperatures is deemed more efficient in preserving perishables for longer durations. This need is further augmented by regions that experience frequent power outages, emphasizing the freezer's capacity to maintain its internal temperatures for extended periods.

By Doors:

Based on door, the single door segment is projected to keep dominating the India deep freezer market by securing a 53.8% market share. It means that a little more than every 1 in 2 deep freezers sold in India boasts a single door configuration. Its prevalence in the market might be rooted in its simplicity, ease of use, and potential energy savings. Looking to the future, the single door segment’s reign seems set to continue, underlined by its projected CAGR of 25.8%. Such a growth rate in India deep freezer market denotes that the demand for single door deep freezers is poised to see roughly a quarter increase on an annual basis. This preference can be attributed to a myriad of reasons. A single door freezer typically ensures more uniform cooling, reduced energy consumption due to lesser open-close actions, and offers optimal space utilization without the hindrance of partitions or multiple compartments. Moreover, the maintenance and after-sales service for single door units might be more streamlined, given their market prevalence. All these factors coalesce, making the Single Door variant a prime choice for the discerning Indian consumer.

To Understand More About this Research: Request A Free Sample

Top Players in India Deep Freezer Market

- AB Electrolux

- Birla Aircon

- Haier Group

- Himalaya Refrigeration

- Hindustan Apparatus Mfg. Co.,

- Hitachi Limited

- HMG India

- Industrial Refrigeration Pvt Ltd

- Khera Instruments Pvt. Ltd.

- Newtronic

- Panasonic Corporation

- Polfrost Air-con Pvt. Ltd.

- Remi Lab World

- Rockwell Industries Limited

- Singhla Scientific Industries

- Thermo Fisher Scientific Inc.,

- Universe Surgical Equipment Co.

- Western Refrigeration Pvt. Ltd.

- Whirlpool Corporation

- Other Prominent Players

Market Segmentation Overview:

By Type

- Chest Deep Freezer

- Upright Deep Freezer

By Capacity

- Up to 250 Liters

- 250 - 500 Liters

- 500 - 750 Liters

- Above 750 Liters

By Temperature Range

- Up to -30 Degree Celsius

- -30 to -60 Degree Celsius

- Above -60 Degree Celsius

By Doors

- Single Door

- Double Door

- Triple Door

By End User

- Residential

- Commercial

- HoReCa (Hotel/Restaurants & Cafes)

- Supply chain & Logistics

- Storage Service Providers

- Others

- Industrial

- Food & Beverage

- Pharmaceutical

- Chemical

- Agriculture

- Retail

- Others

By Sales Channel

- OEMs

- Aftermarket

By Distribution Channel

- Online

- Offline

By Region

- North India

- Uttar Pradesh

- Delhi

- Haryana

- Punjab

- Rajasthan

- Uttarakhand

- Himachal Pradesh

- J&K

- South India

- Tamil Nadu

- Karnataka

- Kerala

- Andhra Pradesh

- Telangana

- West India

- Gujarat

- Goa

- Madhya Pradesh

- Maharashtra

- Chhattisgarh

- East India

- West Bengal

- Bihar

- Assam

- Jharkhand

- Orissa

- Northeast India

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 536.98 Mn |

| Expected Revenue in 2032 | US$ 4,058.79 Mn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Mn) |

| CAGR | 25.2% |

| Segments covered | By Type, By Capacity, By Temperature Range, By Doors, By Sales Channel, By Distribution Channel |

| Key Companies | AB Electrolux, Birla Aircon, Haier Group, Himalaya Refrigeration, Hindustan Apparatus Mfg. Co.,, Hitachi Limited, HMG India, Industrial Refrigeration Pvt Ltd, Khera Instruments Pvt. Ltd., Newtronic, Panasonic Corporation, Polfrost Air-con Pvt. Ltd., Remi Lab World, Rockwell Industries Limited, Singhla Scientific Industries, Thermo Fisher Scientific Inc.,, Universe Surgical Equipment Co., Western Refrigeration Pvt. Ltd., Whirlpool Corporation, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA1023634 | Delivery: 2 to 4 Hours

| Report ID: AA1023634 | Delivery: 2 to 4 Hours

.svg)