India Bearings Market- (By Bearing Type (Roller Bearings (Tapered Roller Bearings, Spherical Roller Bearings, Cylindrical Roller Bearings, Crossed Roller Bearings, Needle Roller Bearings, Gear Bearing), Ball Bearings (Deep Groove Ball Bearings, Angular Contact Ball Bearings), Back-up Rollers, Spherical Plain Bearings, Others); Material (Chrome Steel, Specialty Steel, Plastic); Size (30 to 40 mm, 41 to 50 mm, 51 to 60 mm, 61 to 70 mm, 71 mm to 100 mm, 101 to 150 mm); Industry (Automotive (2 or 3 Wheelers, Passenger Vehicle, Commercial Vehicle), Industrial (Aerospace, Agriculture, Machine Tools, Mining, Railways, Energy and Power, Others); Distribution Channel (OEMs, Aftermarket); Country – Market Size, Industry Dynamics, Opportunity Analysis and Forecast For 2024-2032

- Last Updated: Apr-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA1220024 | Delivery: 2 to 4 Hours

| Report ID: AA1220024 | Delivery: 2 to 4 Hours

Market Scenario

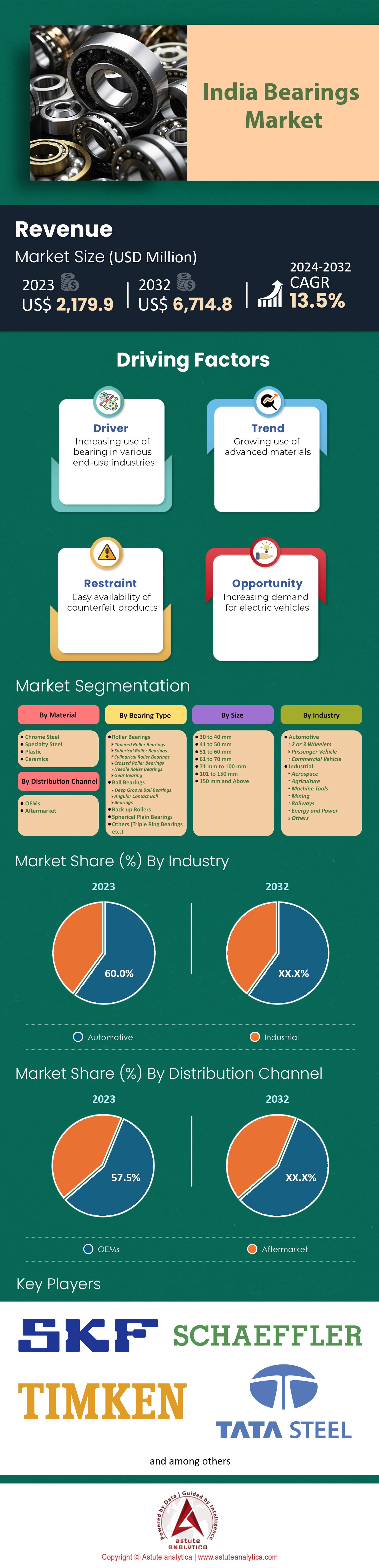

India bearings market size was valued at US$ 2,179.9 million in 2023 and is projected to reach US$ 6,714.8 million by the end of 2032. The market is registering growth at a CAGR of 13.5% during the forecast period 2024-2032.

India's bearings market is driven by its large vehicle fleet (over 340 million registered vehicles, including 227 million two-wheelers) and a thriving automotive manufacturing industry that produced 25.93 million vehicles in FY 2023. The sector accounts for more than 60% of the country’s bearing demand. The market is highly consolidated, with the top five players — Schaeffler India Limited, SKF India, Timken India Ltd, Tata Steel, and NRB Bearings — controlling 68% of revenue.

SKF and Schaeffler are the leading players in the market with a combined share of 37%. Schaeffler India has the highest net profit (around INR8.99bn [0m] in FY2023), while SKF India has the largest market share at over 19%. Roller bearings are currently the most widely used type (38.8%), but ball bearings are gaining popularity and set to overtake them with a revenue share of 34.1%. Chrome steel is the preferred material (64.9%), while bearings in the size range from 30mm to 40mm are most sought after (32.9%).

OEMs account for most sales (57.0%) but aftermarket is growing at an impressive CAGR of about 14.7% in the India bearings market, driven by an aging vehicle fleet, poor road conditions and price-sensitive customers. To meet this demand, India imported bearings worth 1.2bn in FY2023 — low-cost aftermarket parts accounted for a substantial part. Among key trends driving growth are increasing adoption of high-precision and smart bearing solutions; growing demand for aftermarket and remanufactured bearings; expansion within automotive sector; among others. Key risks include competition from low-cost imports and inadequate maintenance practices leading to premature bearing failures.

To Get more Insights, Request A Free Sample

Market Dynamics

Trend: Rising Popularity of Remanufactured Bearings in India

The Indian automotive bearings market is witnessing a significant shift toward remanufactured bearings. This trend is majorly fuelled by the demand for cost-effective aftermarket solutions. In addition, economic and environmental factors also contribute to the shift to remanufactured bearings. Remanufacturing is the process of restoring used bearings to their original specifications, which extends their lifespan and reduces the need for new ones. There are several reasons why consumers prefer remanufactured bearings in India, with schemes like 'Make in India' and 'Aatmanirbhar Bharat' further boosting the market.

Remanufactured bearings are attractive due to a number of reasons, including their sustainability benefits and compliance with environmental regulations. Consumers who are sensitive to prices also favor them because they cost less than new bearings. Remanufactured bearings have enhanced quality and performance, which translates into operational efficiency benefits. The adoption of additive manufacturing techniques in the production of remanufactured bearing components will likely reduce costs, speed up manufacturing time, and minimize waste in the India bearings market — all of which should give the segment more advantages over new bearing options. The ongoing focus on making lighter and more efficient bearing designs also supports remanufacturing since it often involves upgrading to newer industry standards.

India accounts for less than 5% of global demand for bearings, but its domestic production currently meets about 71% of its needs. As vehicles transition from fossil fuels toward electric powertrains — a change that would reduce overall demand for new bearings — it might be necessary to prioritize efforts on remanufacturing existing ones for targeted applications. Market leaders such as SKF India could play a significant role in pushing this endeavour forward given that they already specialize in small and lightweight bearing designs. By large part driven by industrial activity and a thriving automotive sector, India's local bearing industry is positioned well for revenue growth overall.

Challenge: Intense Competition from Low-Cost Imported Bearings, Especially from China

India bearings market is heavily reliant on bearing imports, with more than $1.2 billion worth of bearings imported in 2023. A major chunk of these imports involves low-cost aftermarket parts, and China’s dominance is evident here: Chinese suppliers accounted for 44.5% of India’s total bearing imports, valued at about $467 million (bearing industry data). Between FY2016-17 and FY2021-22, the value of Chinese bearing exports to India rose from Rs. 2,155.56 crore ($289 million) to Rs. 3,826.45 crore ($512 million), at a compound annual growth rate (CAGR) of 12.3%, highlighting their popularity among cost-sensitive customers.

Market surveys carried out by trade bodies such as All-India Motor Transport Congress (AIMTC) have found that affordability is the main reason why truck owners opt for low-cost Chinese bearings for replacements even if they might be dubious about the quality; AIMTC's nationwide survey in 2021 showed that 68% of respondents chose Chinese over costlier Indian-made bearings (ATI January). These surveys also reflect how Chinese competition has eaten into the market shares of domestic Indian bearings market players such as SKF India, Schaeffler India and NEI Bearings in the OEM segment.

In India's huge two-wheeler segment too, cheap Chinese bearings are preferred by replacement customers: they account for 35% share there against overall Indian production. The influx of low-priced Chinese supplies has hit hard Indian manufacturers' ability to sell their own products at higher prices: falling realisations due to pricing pressure forced them cut prices by around 15%-20% in the past five years in the replacement market where cost-sensitivity is high; this has resulted in loss of local market share within this segment from about three-fourths to less than two-thirds during this period. Aftermarket sales make up around half of the major Indian manufacturers' total revenues.

Opportunity: Increasing consumption of anti-friction bearings across various industries

India’s industrial landscape is making a lot of headway when it comes to the consumption of anti-friction bearings in various sectors, which is driving up the overall demand for bearings market. So far, this growth has been driven by an expanding industrial sector, technology innovations and increased use with a variety of new applications. Ball and roller bearing solutions are becoming more popular due to their ability to reduce friction, improve efficiency and extend equipment lifespan. One of the biggest parts of this increase in consumption is coming from the automotive sector. However, as India slowly starts transitioning into electric vehicles (EVs), their high-tech demands could actually end up being great news for manufacturers who produce them. EVs typically need fewer bearings than traditional vehicles do but tend to come with specialized smart bearings that go much faster than others on top of that.

The national implementation of Bharat Stage VI emission norms last year may have also played a role in the surge for anti-friction bearings lately in the India bearings market. These norms push for a reduction in vehicle weights, therefore changing up bearing designs and altering demand patterns. Anti-friction bearings are already heavily used outside of the automotive industry as well. They’re frequently found in manufacturing plants, construction sites, mines and farms to name a few examples. As these industries continue to grow across India at large, so will their machinery and equipment usage which will benefit anti-friction bearing consumption even more.

However, Indian manufacturers are getting hit hard by increasing raw material costs lately which could hinder growth within some sectors if it continues.

Segmental Analysis

By Type

The Indian bearings market is segmented into different types, such as roller bearings, ball bearings, and others. The roller bearing segment held the highest share of 38.8% in the market in 2023. These types of bearings are equipped with cylindrical rollers that offer high radial load capacity, which makes them suitable for various industrial applications. The demand for roller bearings is directly proportional to the growth in production of high-performance industrial equipment and machinery. Tapered roller bearings, a sub-segment of roller bearings have been gaining traction due to their ability to handle combined radial and thrust loads which makes them ideal for usage in gearboxes and wheel hubs.

As for the ball bearing segment, it is expected to witness the highest CAGR of 14.4% during the forecast period in the India bearings market. Ball bearings are widely used due to their versatility, low friction, and ability to handle both radial and thrust loads. The reason behind increasing demand for ball bearing can be attributed to growth in the automotive sector, general engineering, and other industries as well. In November 2021 RBC Bearings Incorporated completed its USD 2.9 billion acquisition of Asea Brown Boveri Ltd.’s DODGE mechanical power transmission segment which clearly highlights how important this market is. Amongst all types, the deep groove ball bearings account for a significant share owing to widespread use across electric motors, pumps, and other rotary equipment.

Increasing adoption of sensor-integrated bearings especially in ball bearing segment is expected drive market growth as these smart bearings enable real-time monitoring of bearing health reducing downtime and maintenance cost

By Material

The Indian bearings market can also be segmented based on the material used to make them. The chrome steel sector accounted for the largest share of 64.9% in 2023, making it the most dominant player. Chrome steel is widely preferred because it’s super hard, wear-resistant and capable of withstanding heavy loads. During the forecast period, the CAGR of this segment is expected to be highest at 13.8%, meaning their dominance will continue as time goes on. The increasing demand for high-powered bearings in both automotive & industrial sectors is what’s driving this growth.

Some other materials that make up bearings include specialty steel alloys, stainless steel, carbon, plastics, and ceramics. Specialty steel alloys have been gaining popularity due to their enhanced properties and by 2032 are projected to grow at a significant CAGR of 13.4%. Material choice varies depending on a few factors such as: load-bearing capacity, corrosion resistance and operational environment. Ceramic bearings don’t hold much market share at all but are slowly growing in popularity within high temperature & corrosive environments due to their superiority over steel bearings.

As time passes, India bearings market is projected to witness more advanced materials being developed such as high-nitrogen steels and titanium alloys which are known for having higher strength-to-weight ratios and improved corrosion resistance suitable for demanding applications.

By Size

The bearings market in India is segmented by bearing size. In 2023, the 30 to 40 mm segment accounted for the largest share of 32.9% in the market. This segment includes bearings that are used in electric motors, pumps and gearboxes, which are widely used in various industries. The increased demand for automation and manufacturing has driven the demand for bearings of this size range. Bearings smaller than 10 mm have also been gaining attention due to their compactness and light weight, mainly because they are being used in aerospace and medical equipment.

However, it is expected that during the forecast period, the 51 to 60 mm segment of the bearings market is projected to grow at the highest CGR of 14.8%. Bearings of this size are used in heavy industrial machines such as wind turbines, construction machinery and large industrial equipment. The increase in renewable energy and infrastructure investments is anticipated to increase the demand for bearings in this segment. Furthermore, as diameters exceed over a thousand millimeters, larger bearings are being applied in heavy industries such as mining and steel production. The rising demand for custom-made bearing solutions is projected to drive market growth, especially with large-sized segments. Manufacturers collaborate with end-users to create application-specific bearing designs that offer better performance and longer life-service spans.

By Industry

In 2023, the Indian bearings market was dominated by the automotive sector, which accounted for almost 60.0% of the total share. A significant boost in auto production and demand for cars with advanced technology has led to this segment’s high percentage. For cars to run smoothly in any capacity, wheel bearings, transmission bearings, and engine bearings are essential. Whereas the aftermarket industry's growth is also a factor in increased demand for bearings. Low-friction bearings like ceramic ball and hybrid bearings will continue to grow as electric vehicles become more popular.

The automotive industry in the India bearings market is also predicted to have the highest growth rate at 13.8%, keeping its dominance throughout the forecast period. As electric vehicles become widespread and vehicle performance increases further, we’ll see a higher demand for good-quality bearings in this specific sector. General engineering, mining and construction, railways, aerospace, shipping, agriculture and wind energy sectors are also contributors to the market’s overall growth. Predictive maintenance and condition monitoring are two other factors driving smart bearing solutions’ popularity across various sectors in India. They allow real time monitoring of bearing performance which can decrease downtime that occurs unexpectedly while increasing overall equipment effectiveness.

By Distribution Channel

OEMs dominate the India bearings market—over 57% of it, to be exact. But that's not all they dominate. Bearing manufacturers in India work hand-in-hand with OEMs (Original Equipment Manufacturers). Pioneering bearing producer SKF India has built plants in Pune, Bangalore, and Haridwar to cater for Indian OEMs; and Timken India, a subsidiary of its namesake American company, has been operating Jamshedpur and Raipur facilities for almost three decades to supply the local needs of Indian OEMs. Menon Bearings, which exports much of its output through its US branch in Indianapolis, boasts a global client base comprising many leading companies for whom it claims to have been an approved supplier for over two decades.

Established in 1946, National Engineering Industries (NBC Bearings) is among the longest-established and most significant producers of bearings in India. Their extensive network of five factories ensures they can provide customized bearing solutions across various industries. Additionally, leading bearing manufacturers from India, including SKF, Timken, and Menon Bearings, have expanded their operations globally, establishing manufacturing and distribution networks in international markets.

Automotive OEMs in the bearings market have long demanded bearings. And they always will as vehicles rely on various types. With India becoming an increasingly important automotive manufacturing hub — automobile producers like Tata Motors have been expanding plants around the country — the demand from automotive OEMs within India will only increase further. If this wasn't good enough news for bearing manufacturer, the anticipated growth in electric vehicles could boost demand even higher than measured so far.

Regional Analysis

West India, especially Maharashtra and Gujarat, plays a key role in India’s bearings market by contributing 54.5% of market revenue in 2023. This dominance can be credited to its position as a major automotive manufacturing hub. Leading automotive companies such as Tata Motors, Mahindra & Mahindra, and Bajaj Auto are located in Maharashtra, while Maruti Suzuki, Ford, and Honda have plants in Gujarat. Since more than 60% of bearing revenue comes from the automotive sector in India, this concentration creates a lucrative business for bearing manufacturers.

Furthermore, the region's close proximity to major ports — Jawaharlal Nehru Port Trust (JNPT) in Maharashtra and Mundra Port in Gujarat — makes it even more attractive. These ports facilitate the importation of raw materials and the exportation of finished bearings by integrating with global markets and supply chains. The area also benefits from a well-developed industrial infrastructure that serves industries other than the automotive sector; chemicals, pharmaceuticals, textiles, engineering are examples. All of these industries depend on bearings for their machinery and equipment which generates additional demand for them.

Maharashtra is home to several prestigious engineering colleges and technical institutes that produce an abundance of skilled engineers and technicians. This skilled workforce is necessary if companies in the India bearings market want to make high-quality precision bearings. The favorable government policies followed by West Indian states have allured many investors aiming to establish themselves within the region’s borders too. Policies like developing industrial parks or offering tax benefits have accelerated this growth across various sectors including the bearing industry specifically.

Top Players in India Bearings Market

- JTEKT India Limited

- MBP Bearings Ltd

- Menon Bearings Ltd

- National Engineering Industries Ltd (NEI)

- NRB Bearings Limited

- NTN Corporation

- Schaeffler India Limited

- SKF

- Tata Steel

- Timken India Ltd.

- Other Prominent Players

Market Segmentation Overview:

By Bearing Type

- Roller Bearings

- Tapered Roller Bearings

- Spherical Roller Bearings

- Cylindrical Roller Bearings

- Crossed Roller Bearings

- Needle Roller Bearings

- Gear Bearing

- Ball Bearings

- Deep Groove Ball Bearings

- Angular Contact Ball Bearings

- Back-up Rollers

- Spherical Plain Bearings

- Others (Triple Ring Bearings etc.)

By Material

- Chrome Steel

- Specialty Steel

- Plastic

- Ceramics

By Size

- 30 to 40 mm

- 41 to 50 mm

- 51 to 60 mm

- 61 to 70 mm

- 71 mm to 100 mm

- 101 to 150 mm

By Industry

- Automotive

- 2 or 3 Wheelers

- Passenger Vehicle

- Commercial Vehicle

- Industrial

- Aerospace

- Agriculture

- Machine Tools

- Mining

- Railways

- Energy and Power

- Others

By Distribution Channel

- OEMs

- Aftermarket

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 2,179.9 Mn |

| Expected Revenue in 2032 | US$ 6,714.8 Mn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Mn) |

| CAGR | 13.5% |

| Segments covered | By Bearing Type, By Material, By Size, By Industry, By Distribution Channel |

| Key Companies | JTEKT India Limited, MBP Bearings Ltd, Menon Bearings Ltd, National Engineering Industries Ltd (NEI), NRB Bearings Limited, NTN Corporation, Schaeffler India Limited, SKF, Tata Steel, Timken India Ltd., Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA1220024 | Delivery: 2 to 4 Hours

| Report ID: AA1220024 | Delivery: 2 to 4 Hours

.svg)