Hygienic Valves Market: By Component (Control Valves (Hygienic Ball Valves, Hygienic Check Valves, Hygienic Butterfly Valves, Powder & Granule/ Tablet Discharge Valves, Ultra-High Airtight Dampers, Diaphragm Valves, Seat Valves, Other Valves (Ball Valves, Vacuum Breakers, Plug Valves and Keofitt Aseptic Sampling Valve)); Function (Aseptic applications, Diverting, Mix-Proofing, Single-Seat Stop); Material (Stainless steel, Brass, Copper, Plastics); Operation (Manual and Air-Actuated); Operations (Bio-chemical processing, Brewing, Dairy, Food and beverage, Fragrance and cosmetics, Medical equipment and supplies, Pharmaceuticals, Sterilizing equipment, Wine and spirits, Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Dec-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0221073 | Delivery: 2 to 4 Hours

| Report ID: AA0221073 | Delivery: 2 to 4 Hours

Market Scenario

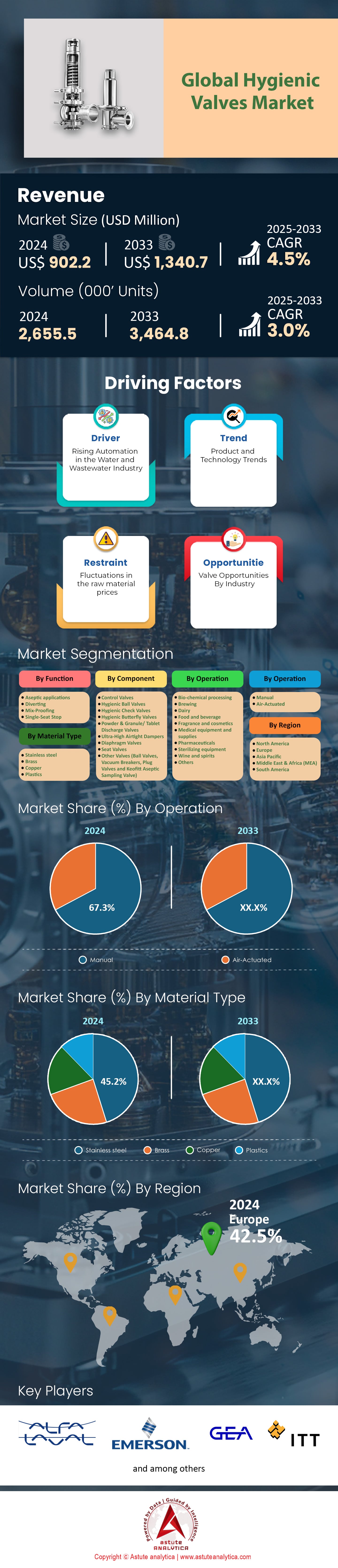

Hygienic valves market was valued at US$ 902.2 million in 2024 and is projected to hit the market valuation of US$ 1,340.7 million by 2033 at a CAGR of 4.5% during the forecast period 2025–2033.

Hygienic valves are essential components in industries where cleanliness and hygiene are critical to product quality and safety. They are specifically designed to prevent contamination in processes that require sterile conditions, such as in the food and beverage, pharmaceutical, cosmetics, personal care, and life sciences industries. In 2023, the demand for hygienic valves continues to surge due to increased regulatory standards and a growing emphasis on consumer safety. Businesses are seeking valves that ensure the highest levels of hygiene to comply with stringent health regulations and prevent costly contamination incidents.

The demand for hygienic valves is on the rise as companies strive to enhance competitiveness through world-leading sustainable solutions. The focus on eco-friendly and energy-efficient valves is driving innovation in the market, with businesses aiming to reduce water usage and minimize environmental impact. In 2023, this has led to a significant shift towards valves that not only meet hygiene requirements but also support sustainability goals. Major types of hygienic valves in the market include butterfly valves, shutter valves, and aseptic valves, which are key components within process plants, allowing for flexibility and control from manual to fully automated systems. These valves are employed in manufacturing, handling, and packaging applications requiring sterile conditions. The primary consumers are the food and beverage industry, pharmaceuticals, cosmetics, and personal care sectors, all of which rely heavily on maintaining strict hygiene standards.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Regulatory Standards for Hygiene in Critical Industries

The amplification of regulatory standards for hygiene within critical industries is a significant driver influencing the demand for hygienic valves. Industries such as food and beverage, pharmaceuticals, cosmetics, and personal care are under stringent scrutiny to maintain sterile conditions during manufacturing, handling, and packaging processes. In 2023, the global emphasis on consumer safety and product integrity has intensified, compelling companies to invest in advanced hygienic valve technologies. These valves are engineered to ensure the highest levels of cleanliness and hygiene, which are critical to product quality and safety. Manufacturers are aligning their operations with international hygiene standards, and the adoption of hygienic valves is a fundamental part of this compliance. Companies are increasingly incorporating valves that prevent contamination and support sterile processing environments.

Businesses are seeking solutions that not only meet regulatory requirements but also enhance energy efficiency and reduce water usage. This dual focus on compliance and sustainability is shaping procurement decisions in 2023. The heightened regulatory landscape is, therefore, a pivotal factor driving the market for hygienic valves forward.

Trend: Adoption of Automated Hygienic Valves for Improved Process Control

The trend towards automation in hygienic valves is reshaping the industry in 2023. Companies are increasingly adopting automated valves to enhance process efficiency, control, and flexibility within manufacturing plants. Automated hygienic valves allow for precise regulation of flow and pressure, which is essential in maintaining sterile conditions and product quality.

This adoption is driven by the need to reduce human error and contamination risks in critical processes. In industries where hygiene is paramount, such as pharmaceuticals and food and beverage, automation ensures consistent adherence to strict hygiene protocols. Manufacturers have introduced innovative automated valve solutions that integrate with advanced control systems, offering real-time monitoring and adjustments. Furthermore, the integration of automation supports scalability and adaptability in production lines, accommodating increased demand and diverse product ranges. The move towards automated hygienic valves is a response to both technological advancements and the pressing need for improved operational efficiency in maintaining hygiene standards.

Challenge: Addressing Contamination Concerns Amid Increased Production Demands

As industries scale up to meet global demand, maintaining sterile conditions becomes more complex. Hygienic valves play a crucial role in preventing contamination, but the surge in production volumes tests the limits of existing systems. Businesses are actively seeking hygienic pumps and valves that are not only efficient but also eco-friendly, aiming to reduce water usage and energy consumption. This dual requirement adds complexity to the selection and implementation of hygienic valves. Contamination incidents have significant repercussions, including product recalls and damage to brand reputation, making contamination prevention a critical focus area in 2023.

Additionally, the integration of new hygienic valve technologies must align with existing infrastructure without causing significant downtime. Companies are investing in training and updating protocols to ensure that staff can effectively manage advanced valve systems. Balancing the demands of increased production while maintaining stringent hygiene standards is a persistent challenge impacting the industry in 2023.

Segmental Analysis

By Component

Control valves dominate the hygienic valves market with 24.3% market share due to their critical role in regulating fluid flow, pressure, and temperature in industries requiring stringent hygiene standards. These valves are essential in maintaining product quality and safety in sectors like food and beverage, pharmaceuticals, and biotechnology. Their ability to ensure precise control in aseptic and sterile processes makes them indispensable in these industries. The demand for control valves is driven by their applications in aseptic processing, sterilization, and clean-in-place (CIP) systems. These valves are widely deployed in the production of dairy products, beverages, and injectable pharmaceuticals, where contamination control is paramount. The sanitary valves market, which includes control valves, is expected to grow by US$ 603.86 million from 2022 to 2027, with the pharmaceutical sector holding the largest market share. Their ability to meet regulatory requirements and ensure sterility makes them a preferred choice in critical applications.

The growth of control valves is further supported by advancements in automation and control technologies, which enhance operational efficiency and sustainability. The global valves market is driven by increasing demand for hygienic and energy-efficient solutions. Additionally, the rising focus on product safety and quality in regulated industries continues to propel the adoption of control valves, ensuring their leadership in the hygienic valves market.

By Application

Hygienic valves are primarily used in aseptic applications and is controlling over 50.4% market share because they are designed to prevent contamination and ensure sterility in critical processes. Industries like pharmaceuticals, food and beverage, and biotechnology rely on aseptic conditions to maintain product safety and efficacy. The need for hygienic valves in these applications stems from their ability to withstand sterilization processes and prevent microbial growth. The global sanitary valves market, which heavily caters to aseptic applications, is expected to grow significantly, with the pharmaceutical sector being a key driver.

Aseptic applications dominate the hygienic valves market because contamination in these industries can lead to severe financial losses, product recalls, and reputational damage. The industrial valves market, which includes hygienic valves, is projected to reach US$ 110.5 billion by 2031, driven by the increasing demand for contamination-free processes. The high cost of contamination and stringent regulatory requirements make aseptic applications a priority, ensuring their significant revenue share in the hygienic valves market.

Key industries driving demand for aseptic hygienic valves include pharmaceuticals, food and beverage, and life sciences. These sectors require sterile processing for products like injectable drugs, dairy products, and beverages. The global industrial valve market is reflecting the increasing investment in aseptic processes. The emphasis on sterility and hygiene in these industries ensures that aseptic applications will continue to dominate the market.

By Material

Stainless steel is the most widely used material for hygienic valves market and is holding over 45.2% market share due to its superior properties, including corrosion resistance, durability, and ease of cleaning. These characteristics make it ideal for industries like food and beverage, pharmaceuticals, and biotechnology, where hygiene and sterility are critical. The global industrial valves demand is projected to grow steadily, driven by the demand for high-quality materials. Stainless steel's ability to withstand harsh cleaning processes and maintain structural integrity ensures its dominance in the hygienic valves market.

The high adoption of stainless steel in hygienic valve production is also attributed to its compliance with stringent regulatory standards. Industries requiring aseptic conditions prefer stainless steel valves because they can endure sterilization processes like steam cleaning and CIP systems without compromising performance. The sanitary valves market highlights the increasing demand for stainless steel valves in critical applications. Their non-reactive nature ensures product safety, making them a preferred choice for end-users. End-users opt for stainless steel hygienic valves more prominently than other materials due to their long lifespan and cost-effectiveness. This reflects the growing preference for durable and reliable materials like stainless steel. Additionally, the material's ability to resist contamination and maintain sterility in demanding environments ensures its continued dominance in the production of hygienic valves.

By Operation

Manual operations currently lead the hygienic valves market due to their simplicity, cost-effectiveness, and reliability in low-complexity applications. The segment control over 67.3% market share. These valves are widely used in industries like food and beverage and pharmaceuticals, where manual control is sufficient for certain processes. Their ease of use and low maintenance requirements make them a preferred choice for many end-users. The higher share of manual operations compared to air-actuated valves is driven by their affordability and suitability for small-scale operations. While air-actuated valves are essential for automation and high-precision tasks, manual valves remain dominant in applications where automation is not a priority. Their ability to provide reliable performance without the need for complex systems ensures their popularity.

The growth of manual operations in the hygienic valves market is also supported by their versatility and adaptability to various applications. The reflects the sustained demand for manual valves in industries prioritizing cost-efficiency and simplicity. Additionally, the increasing focus on sustainability and reducing energy consumption further drives the adoption of manually operated hygienic valves, ensuring their leadership in the market.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Europe stands as the most lucrative and largest hygienic valves market globally, primarily due to its advanced industrial base and stringent regulatory environment that emphasizes high hygiene standards across key sectors. The demand is significantly driven by industries such as food and beverage, pharmaceuticals, and biotechnology, where hygiene is paramount. The top four countries propelling this dominance are Germany, France, Italy, and the United Kingdom. Germany's robust pharmaceutical and chemical industries necessitate advanced hygienic valves to comply with strict national and European Union (EU) regulations. France's substantial food and beverage sector, renowned for its quality and safety standards, relies heavily on hygienic valves to meet both domestic and international requirements. Italy's strong presence in food processing and pharmaceuticals, along with the UK's advanced biotechnology and life sciences industries, contribute significantly to the regional demand for hygienic valves.

Europe's position as both the largest consumer and producer of hygienic valves market is rooted in its commitment to maintaining high manufacturing standards and continuous innovation in hygienic technologies. The region is home to leading manufacturers specializing in hygienic valves and equipment, supplying both the European market and exporting globally. In 2023, the European food and beverage industry continued to expand, with thousands of processing facilities implementing hygienic valves to ensure compliance with rigorous food safety regulations and to maintain consumer trust. Furthermore, Europe's pharmaceutical industry, valued at hundreds of billions of euros and representing a significant share of the global market, requires strict hygiene controls in manufacturing processes, thereby driving substantial demand for high-quality hygienic valves.

Stringent regulatory guidelines significantly impact the demand for hygienic valves market in Europe. The EU enforces rigorous standards such as the European Hygienic Engineering & Design Group (EHEDG) guidelines and Good Manufacturing Practice (GMP) regulations, which mandate the use of hygienic equipment to prevent contamination and ensure product safety. In 2023, the EU introduced updates to its regulatory framework, further tightening hygiene requirements in manufacturing industries, which led to a noticeable increase in demand for hygienic valves. These regulations not only ensure high product quality but also stimulate innovation in valve technology, as manufacturers strive to meet evolving standards. The economic impact on Europe's hygienic valves demand is profound, leading to sustained growth in the manufacturing sector, increased investment in hygienic technologies, and reinforcing Europe's leading position in industries where hygiene is critical.

Top Players in Hygienic Valves Market

- Adamant Valves

- Alfa Laval AB

- Cashco Inc.

- Emerson Electric Co.

- GEA Group Aktiengesellschaft,

- Habonim Industrial Valves & Actuators Ltd.

- KRONES AG

- Lumaco

- SPX FLOW Inc.

- The Dixon Group Inc.

- Other prominent players

Market Segmentation Overview:

By Component

- Control Valves

- Hygienic Ball Valves

- Hygienic Check Valves

- Hygienic Butterfly Valves

- Powder & Granule/ Tablet Discharge Valves

- Ultra-High Airtight Dampers

- Diaphragm Valves

- Seat Valves

- Other Valves (Ball Valves, Vacuum Breakers, Plug Valves and Keofitt Aseptic Sampling Valve)

By Function

- Aseptic applications

- Diverting

- Mix-Proofing

- Single-Seat Stop

By Material Type

- Stainless steel

- Brass

- Copper

- Plastics

By Operation

- Manual

- Air-Actuated

By Operation

- Bio-chemical processing

- Brewing

- Dairy

- Food and beverage

- Fragrance and cosmetics

- Medical equipment and supplies

- Pharmaceuticals

- Sterilizing equipment

- Wine and spirits

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0221073 | Delivery: 2 to 4 Hours

| Report ID: AA0221073 | Delivery: 2 to 4 Hours

.svg)