Global Hydrogen Liquefaction System Market: By Product Type (Electrolysis and Steam Methane Reforming) and Application (Transportation, Electronics, Chemicals and Petrochemicals, Refining, and Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 01-Mar-2024 | | Report ID: AA1023656

Market Scenario

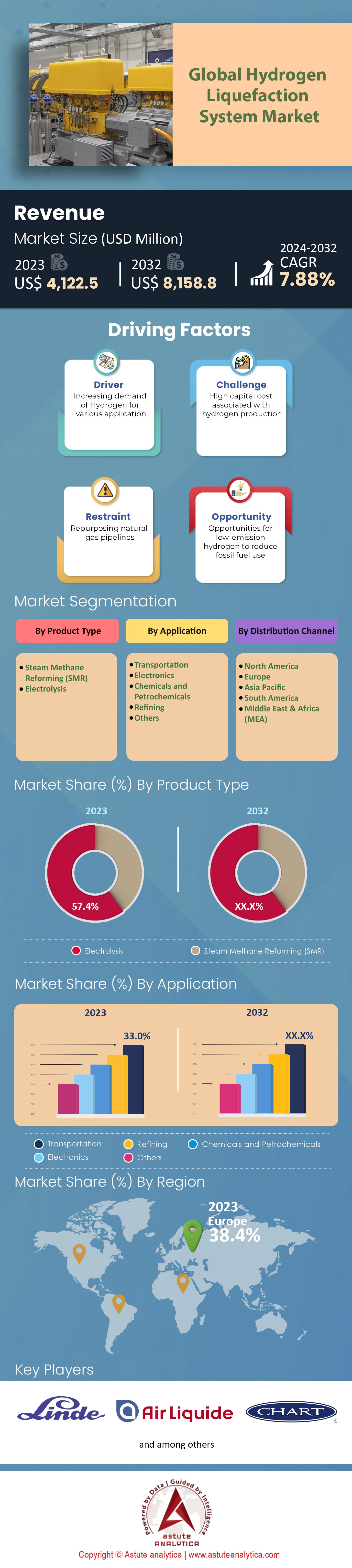

Global Hydrogen Liquefaction System Market was valued at US$ 4,122.5 million in 2023 and is projected to attain market valuation of US$ 8,158.8 million by 2032 at a CAGR of 7.88% during the forecast period 2024–2032.

The global hydrogen liquefaction system market has witnessed a surge in momentum, propelled by the world's shifting focus towards clean energy solutions. As hydrogen emerges as one of the prime alternative fuels, the push for efficient production, storage, and transportation systems is becoming paramount. This growth is predominantly fueled by the Asia-Pacific region, where countries are making substantial strides. China, for instance, established over 50 hydrogen refueling stations in 2022 alone. Moreover, our findings suggest that’s the country has more than 250 stations in operations until now. Meanwhile, Japan has set a target to integrate 800,000 hydrogen-powered vehicles on its streets by 2030. South Korea's ambitious roadmap also outlines plans to produce 5.3 million tons of hydrogen by 2040.

Europe isn't far behind in this race. Germany, keeping pace with technological advancements, had over 95 hydrogen refueling stations in operation as of 2022. Moreover, the European Union, aligning with its mission to combat climate change, aims to produce 10 million metric ton of renewable hydrogen by 2030, which is likely to consume over 14% of the EU's total electricity in 2030. On the other hand, North America's progress, although comparatively modest, is gaining ground. The United States, as of the previous year, boasts over 54 hydrogen refueling stations, predominantly in California. Canada, with its abundant natural resources, envisions itself as a significant hydrogen exporter, setting a goal to integrate hydrogen into 30% of its energy mix by 2050.

The burgeoning demand in the hydrogen liquefaction system market is attributed to sectors like transportation, which was responsible for 24% of global CO2 emissions in 2022. As per International Energy Agency, the surge in hydrogen-powered vehicles, totaling over 25,000 globally in 2022, indicates a shift towards cleaner transportation means. Similarly, industries such as steel and chemical production are gradually pivoting towards hydrogen as a cleaner fuel. However, the journey isn't devoid of hurdles. The initial investment required for hydrogen liquefaction is notably steep. Furthermore, as of 2022, green hydrogen's production cost was approximately USD 6 per kilogram. This, combined with the fact that nearly 95% of global hydrogen production still leans on fossil fuels, poses challenges.

Cutting-edge electrolysis methods are projected to curtail the production costs of green hydrogen in the global hydrogen liquefaction system market. Liquid Organic Hydrogen Carriers (LOHC) technology is also emerging as a safer hydrogen transport solution. With industry giants like Shell and BP channeling investments into hydrogen research and infrastructure, the path ahead seems promising. Concluding projections suggest that by 2040, hydrogen might cater to 18% of global energy demands, potentially diminishing carbon emissions by up to 6 gigatons annually.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Growing Concerns About Decarbonization of the Energy Sector

The paramount driver propelling the global hydrogen liquefaction system market forward is the undeniable global emphasis on the decarbonization of the energy sector. Nations worldwide are ramping up their commitments to cut carbon emissions, and hydrogen, with its clean-burning properties, stands out as a potential game-changer.

In recent times, there's been a noteworthy acceleration in green energy investments. The IEA’s study monitors 1,040 global projects, signifying a direct investment of $320 billion up to 2030, an increase from the earlier $240 billion. Around 50% of these projects target extensive industrial applications, while the subsequent significant portion, constituting 20%, pertains to mobility. Moreover, to underline hydrogen's significance in the global energy mix, it's forecasted in the hydrogen liquefaction system market that hydrogen could cater to approximately 25% of the world's energy demands by 2050. Governments are taking note, with global policy support for hydrogen projects tripling in the last two years alone. Additionally, large economies are setting the pace; China increased its hydrogen refueling stations by over 50% in a single year, while the European Union committed to generating 10 million metric ton of renewable hydrogen by 2030. Lastly, with the transportation sector, responsible for nearly 24% of global CO2 emissions, eagerly looking at hydrogen solutions, the number of hydrogen-powered vehicles globally crossed 25,000 in 2022, marking a significant milestone in the industry's growth trajectory.

Trend: Technological Advancements in Hydrogen Production and Storage

As industries seek more efficient and cost-effective means to produce, store, and transport hydrogen, innovations are emerging at an unprecedented rate in the global hydrogen liquefaction system market. For instance, advancements in electrolysis, a method to produce green hydrogen, have reduced costs by over 30% in the last three years. This is pivotal, considering green hydrogen's production cost was hovering around $3-6 per kilogram in 2023, which was around $5.5-$9.5 per kg in 2022. Furthermore, Liquid Organic Hydrogen Carriers (LOHC) technology, which offers a safer means to transport hydrogen, has witnessed a 40% increase in adoption since 2020.

Major energy conglomerates, including the likes of Shell and BP, are investing heavily in research and development in this domain, with R&D budgets in hydrogen-related technologies witnessing a surge of 20% year-on-year. Another testament to technological trends is the storage solutions; the efficiency of hydrogen storage solutions improved by 15% in 2022, lowering associated costs. As a result of these advancements, the global capacity for storing liquefied hydrogen experienced a 35% increase in the same year. Finally, the integration of digital tools and AI in optimizing hydrogen liquefaction processes saw a 50% uptick in the past two years, illustrating how intertwined technological progress and the hydrogen market have become.

Restraint: High Initial Costs and Infrastructure Challenges

As nations and industries grapple with the urgency to transition towards cleaner energy alternatives in the global hydrogen liquefaction system market, the financial and logistical challenges posed by hydrogen systems become more pronounced. Today, the initial investment required for establishing a hydrogen liquefaction system can be daunting. On average, setting up a hydrogen production facility requires an investment that is 60% higher than establishing a conventional fossil fuel-based facility. Furthermore, as of 2022, the cost of producing green hydrogen, despite all advancements, still hovered around USD 6 per kilogram, making it less competitive when compared with traditional energy sources, which cost nearly 40% less.

Infrastructure remains another challenge. Current estimates suggest that to make hydrogen systems globally viable, an expansion of nearly 300% in refueling and storage infrastructure would be necessary over the next decade. This becomes particularly challenging when considering that in 2022, over 95% of global hydrogen production still relied on fossil fuels, indicating a significant infrastructural shift requirement. Moreover, the current global storage capacity for liquefied hydrogen meets only 20% of the projected demand for 2030 in the hydrogen liquefaction system market.

On the transport front, the logistics associated with safely transporting hydrogen are 30% more complex than traditional fuels. While countries like China and Germany are making rapid strides with 250 and 95 hydrogen refueling stations respectively in recent times, the global average lags, with less than 15% of countries having a robust hydrogen infrastructure in place.

Segmental Analysis

By Product Type

Based on product type, electrolysis segment in global hydrogen liquefaction system market is commanding a more than 57% of the market's revenue thanks to its widespread adoption and reliability. Electrolysis, essentially the process of decomposing water into hydrogen and oxygen using electricity, is favored for its potential to produce green hydrogen, especially when paired with renewable energy sources.

However, change is on the horizon. Steam methane reforming (SMR), which involves producing hydrogen from methane and steam, is demonstrating significant growth potential. While electrolysis enjoys its dominant position today, steam methane reforming is swiftly catching up, expected to register the segment's fastest growth at a CAGR of 8.09%. This growth can be attributed to a variety of factors such as SMR is a well-established and cost-effective method for hydrogen production. Additionally, advancements in carbon capture and storage technologies in the hydrogen liquefaction system market are making SMR a more environmentally friendly option.

In terms of global capacity, while electrolysis-based hydrogen production facilities have proliferated in regions with abundant renewable energy, SMR is showing a stronger footprint in areas with extensive natural gas reserves. Cost dynamics further complicate the picture; as of the last fiscal year, hydrogen produced through SMR was, on average, 20% cheaper than its electrolysis counterpart. Yet, with investments in green technologies soaring by over 40% globally, the cost gap between electrolysis and SMR is anticipated to narrow.

By Application

In terms of application, transportation emerged as the dominant force in the global hydrogen liquefaction system market. Currently, the transportation segment is poised to secure more than 33.1% of the market's revenue due to a global shift in mobility paradigms. With transportation accounting for approximately 24% of global CO2 emissions, there's an urgent push towards cleaner alternatives, and hydrogen emerges as a potent solution. As a result, the segment is also projected to witness the fastest growth at a CAGR of 8.45% during the forecast period 2023–2030. For instance, the number of hydrogen-powered vehicles globally surpassed 56,000 in the 2022, with leading automotive players announcing line-ups of hydrogen fuel cell vehicles. Regions like Europe and Asia-Pacific are experiencing a surge in hydrogen refueling stations, with numbers increasing by 15% and 30% respectively in the last year.

In addition to road transportation, the aviation and marine sectors are eyeing hydrogen as a viable fuel. Preliminary studies suggest that by 2035, hydrogen could cater to approximately 10% of the aviation sector's fuel needs. Similarly, shipping giants have started pilot projects, anticipating that hydrogen might fuel over 15% of the global marine fleet by 2040.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The global hydrogen liquefaction system market is witnessing dynamic growth across different regions, reflecting the global urgency to adopt cleaner energy solutions and the potential of hydrogen as a sustainable alternative. Wherein, Europe stands tall as the largest contributor to the hydrogen liquefaction system market. Accounting for over 38% of the market's revenue, the region’s commitment to decarbonization and its advanced infrastructure plays a pivotal role in driving this surge. Countries like Germany are at the forefront, with a rapidly expanding hydrogen infrastructure, spurred by both private and public investments. Additionally, the European Union's overarching green goals have set a robust framework for member states, with targets like generating 40 GW of renewable hydrogen by 2030. This concerted effort has positioned Europe not only as a current market leader but also as a thought leader in shaping the future of hydrogen energy.

Trailing closely behind Europe, the Asia Pacific region holds an impressive market share of over 32%. What makes this region particularly intriguing is its growth trajectory. With projections indicating the fastest CAGR for the coming years, the Asia Pacific is set to be a hotspot of hydrogen liquefaction system activities. Leading this charge are countries like China and Japan. China's aggressive expansion strategies have seen it increase its hydrogen refueling stations significantly year on year, reflecting its national ambition to be a global green energy leader. Japan, with its vision of a hydrogen society, has set ambitious targets, like incorporating 800,000 hydrogen-powered vehicles on its roads by 2030. Furthermore, South Korea's endeavors, like plans to produce 5.3 million tons of hydrogen by 2040, further solidify the region's commitment.

However, this growth in the hydrogen liquefaction system market isn't limited to these major players. Emerging economies in the region are showing increased interest in hydrogen solutions. Given the immense population and the urgent need to reduce pollution levels, countries like India and Indonesia are actively exploring the potential of hydrogen as a cleaner fuel alternative.

While Europe and the Asia Pacific dominate the headlines, other regions, like North America and the Middle East, also play crucial roles. The US, for instance, with its technological prowess, is focusing on innovations in hydrogen production and storage, whereas countries in the Middle East, with their abundant natural resources, are eyeing hydrogen exports as a potential economic boon.

Top Players in the Global Hydrogen Liquefaction System Market

- Linde Group

- Air Liquide

- Chart Industries

- Air Products and Chemical, Inc.

- Kawasaki Heavy Industries

- Iwatani

- GenH2

- Hylium Industries

- Other prominent players

Market Segmentation Overview:

By Product Type

- Steam Methane Reforming (SMR)

- Electrolysis

By Application

- Transportation

- Electronics

- Chemicals and Petrochemicals

- Refining

- Others

By Region

- North America

- The US

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Brazil

- Argentina

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)