Household Insecticides Market: By Product Form (Foams and Sprays, Liquid Vaporizer, Plug-in Mats, Coils, Baits, Essential Oils, Others); Composition (Natural, Synthetic); Active Ingredients (Allethrin, Bifenthrin, Boric Acid, Cyfluthrin, Cypermethrin, Deltamethrin, Diatomaceous Earth, D-limonene, Esfenvalerate, ETOC, Fipronil, Metafluthrin, Permethrin, Pyrethrin, Resmethrin, Sumithrin, Tetramethrin, Tralomethrin, Transfluthrin, D trans allethrin/ Esbiothrin, Meperfluthrin, Dimefluthrin, Profluthrin, Empenthrin, Alpha cypermethrin, cyphenothrin, Heptafluthrin , Momfluorothrin, Others); Application (Cockroaches, Ants, Files & Moths, Mosquitoes, Termites, Rodents, Bedbugs & Beetles, Others); Distribution Channel (Online, Offline) and By Region - Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025-2033

- Last Updated: 19-Oct-2025 | | Report ID: AA0423422

Market Snapshot

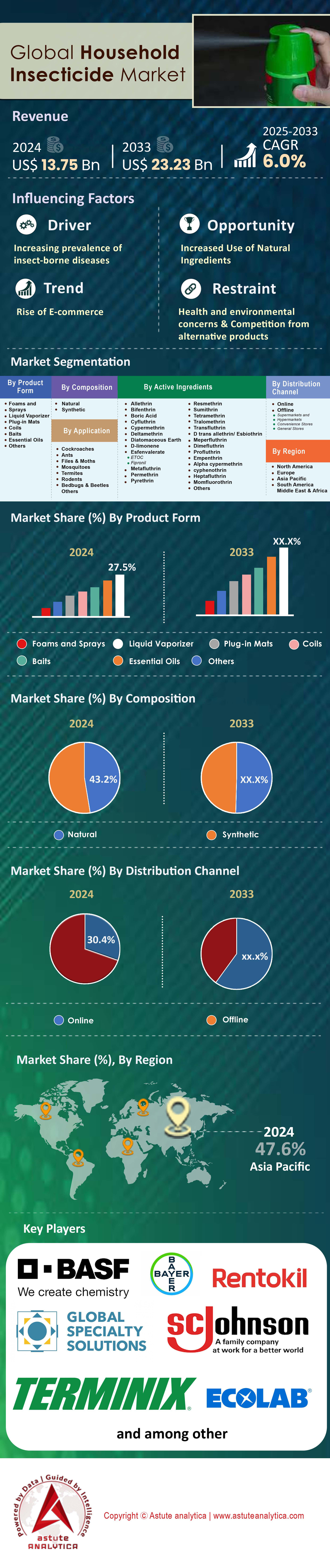

Household insecticides market to generate a revenue of US$ 23.23 billion by 2033 from US$ 13.75 billion in 2024 at a CAGR of 6.0% during the forecast period 2025–2033.

Key Findings Shaping the Market

- Based on product form, essential oils segment has emerged as a largest within the household insecticides market. This segment is projected to lead the market in terms of growth at a CAGR of 7.6% in the years to come.

- Based on composition, synthetic insecticides have emerged as the frontrunners in the composition segment of the household insecticides market, overshadowing their natural counterparts. The segment held over 56.8% market share.

- Based on active ingredients, permethrin, a prominent pyrethroid, is increasingly becoming the cornerstone of the household insecticides market with the largest market share of more than 8.5%.

- Based on application, household insecticides are heavily consumed to control mosquito. In line with this, it capture over 25.0% market share.

- Asia Pacific is projected to remain the key contributor with over 47.60% market share.

- Household insecticides market is set to surpass US$ 23.23 billion by 2033.

An evolving set of consumer and environmental pressures is actively shaping the household insecticides market. Public health imperatives form a strong foundation for demand. For instance, global reported cases of Chikungunya surpassed 400,000 in the first half of 2024, creating a clear need for mosquito control. This necessity is coupled with a powerful movement toward product safety. A 2025 analysis of consumer purchasing habits revealed that households with children under five are three times more likely to purchase a botanical-based insecticide over a conventional one. The market for natural formulations is robust, projected to add over 900 million in new revenue by 2026.

Modern lifestyles and urbanization add another layer of demand. Over 80 million people are expected to move to cities globally in 2025, increasing housing density and pest pressure. Urban sanitation departments in major hubs logged over 3 million rodent-sighting calls in 2024 alone. In response, consumers seek convenient, fast-acting solutions. Ready-to-use formats now make up more than 6 out of every 10 units sold. Furthermore, technology is creating a new segment, with shipments of smart pest traps on track to exceed 500,000 units in 2025, catering to a demand for automated, low-interaction pest management.

The complex demand profile requires a sophisticated response from industry players in the household insecticides market. The market now rewards a dual portfolio that includes both high-efficacy products, featuring next-generation pyrethroids for rapid knockdown, and a growing range of green alternatives. Distribution channels reflect this shift, as direct-to-consumer online sales saw an addition of over 1.2 million new households in the past year. Navigating the 2025 landscape requires a precise balance of potent chemical solutions, trusted botanical ingredients, and user-centric product design to meet the needs of a diverse and well-informed consumer base.

To Get more Insights, Request A Free Sample

Beyond the Spray: Capturing Untapped Revenue in Specialized household insecticides market Niches

- A significant opportunity is materializing in insecticides developed specifically for pet-owning households: With consumers treating pets as family members, the demand for "pet-safe" pest control has grown substantially. Over 45 new insecticide products with prominent "pet-safe" labeling launched in 2024. This niche requires formulations that are non-toxic upon incidental contact or ingestion by common household animals. Consumer inquiries for pet-friendly formulations to brand call centers rose to over 250,000 last year. Products that use active ingredients like geraniol, cedar oil, or food-grade diatomaceous earth, and which carry veterinary endorsements, can command premium pricing and foster immense brand loyalty among this dedicated consumer group.

- Creating lifestyle-specific insecticide solutions for modern hobbies and home activities: The boom in indoor plant ownership has created a distinct need for products that control fungus gnats, spider mites, and aphids without harming delicate ornamental plants. Sales of insecticides formulated for houseplants in the household insecticides market grew to over 50 million units. Similarly, the popularity of outdoor living has spurred demand for long-lasting area repellents for patios and decks, with pre-summer order volumes increasing by 200,000 units for these items. Addressing these targeted needs—from protecting sensitive electronics in a home office to ensuring food-safe pest control in a pantry—moves beyond generic solutions and captures high-value, specific-use markets.

The Concrete Jungle Effect: How Urban Living Fuels Insecticide Demand

Increasing global urbanization is a primary force creating sustained demand within the household insecticides market. As populations concentrate in cities, high-density living environments become hotspots for pest proliferation. In 2024, over 150 new residential towers with more than 40 floors were completed globally, adding millions of residents to vertically integrated living spaces. Reports of pests traveling through shared utility conduits and ventilation systems in these buildings rose to over 80,000 separate incidents. A 2025 study found detectable cockroach allergens in 7 out of 10 urban apartment buildings, creating a clear health-based need for intervention.

The infrastructure supporting these dense areas further compounds the issue in the household insecticides market. Major cities collectively managed over 1.3 billion tons of municipal solid waste in 2024, providing a consistent food source for pests. The rise of app-based food delivery, responsible for over 2 billion orders, created additional waste pressure on residential buildings. This environment directly contributes to infestations, with calls to 311 municipal hotlines for pest-related issues exceeding 4 million. Furthermore, bed bug incident reports from multi-family dwellings surpassed 600,000 in 2024. This constant pest pressure, inherent to the structure of modern urban life, establishes a high, non-negotiable baseline of demand for effective household insecticides.

The Label Revolution: Educated Consumers Demand Transparency and Safer Formulas

A revolution in consumer health literacy is fundamentally altering demand in the household insecticides market. Today’s buyers are proactive researchers who scrutinize ingredients and prioritize safety. In 2024, online searches for the term "permethrin side effects" exceeded 3 million, indicating deep consumer investigation into common active ingredients. This digital empowerment translates directly into purchasing behavior. Sales of products explicitly marketed as "DEET-Free" grew by over 2 million units last year. Social media is a powerful educator in this space, with video tutorials on non-toxic pest control methods garnering over 500 million views across major platforms in 2025.

The demand for transparency is forcing brands to adapt in the household insecticides market. An estimated 10 million consumers used mobile apps to scan insecticide barcodes for ingredient safety ratings and potential health warnings. In response, at least 75 new insecticide products were launched with "clean label" marketing, and major retailers dedicated an additional 12,000 linear feet of shelf space nationally to natural and organic alternatives. Manufacturer hotlines received over 300,000 inquiries about specific active ingredients, a clear signal that vague marketing is no longer sufficient. This empowered, health-conscious consumer base now expects not just efficacy, but also verifiable safety and complete ingredient transparency.

Segmental Analysis

Essential Oils Propel Growth in the Household Insecticides Market

The household insecticides market is witnessing a significant shift towards natural solutions. Essential oils have become the largest product segment, projected to grow at a remarkable CAGR of 7.6%. This surge is driven by a strong consumer preference for products perceived as safer and more environmentally friendly. In a 2024 study, 74 out of 100 consumers favored essential oil-based repellents over synthetic alternatives. The appeal of pleasant scents and the willingness of consumers to invest more for natural products, with 58 out of 100 indicating they would pay a premium, further fuel this growth. This trend is a direct response to growing concerns about the potential health risks associated with chemical-based products, making plant-derived options particularly popular among families and pet owners.

Leading companies are actively innovating within this space. For instance, BASF launched its SUWEIDA natural pyrethrin aerosol in May 2024, derived from the pyrethrum herb. In July 2024, Godrej Consumer Products created a new proprietary chemical, "Renofluthrin," for its mosquito repellent line. The demand for these natural solutions is global. A 2025 survey highlighted that 74 out of 100 North American consumers prefer EPA-registered natural products, while 71 out of 100 European consumers seek organic-certified options. This clear consumer mandate is pushing manufacturers to focus on botanical ingredients and transparent sourcing, reshaping the future of the household insecticides market.

- By June 2025, Google Trends search interest for "organic pesticides" escalated from a normalized value of 24 to 40.

- A 2025 survey found 65 out of 100 Asian consumers look for multi-functional repellents that offer additional skincare benefits.

- Certain natural ingredients offer proven, extended effectiveness; one study confirmed citronella oil provides up to 8 hours of protection from mosquitoes.

Permethrin's Efficacy Cements Its Leadership in Active Ingredients

Permethrin, a powerful synthetic pyrethroid, has become the cornerstone of the active ingredients segment, capturing the largest market share at more than 8.5% of the household insecticides market. Its widespread adoption is due to its dual functionality as both a potent insecticide and an effective repellent. Permethrin acts swiftly by disrupting the nervous systems of insects, proving highly effective against a broad spectrum of pests including mosquitoes, ticks, and cockroaches. A key reason for its popularity in households is its low toxicity to mammals combined with high efficacy against insects. Furthermore, its persistence is a significant advantage; with an indoor degradation rate of just 10% after three months, it offers long-lasting protection and can be detected in homes years after application.

The versatility of permethrin is demonstrated by its wide range of applications. The U.S. and British armies treat all new soldier uniforms with a 0.5% permethrin solution, a testament to its reliability. Globally, its use is extensive, with approximately 600 tonnes utilized annually for various purposes, from public health to wood preservation. However, its effectiveness has led to challenges, as a 2023 study found that some mosquito populations in Dhaka are developing high-intensity resistance, with mortality rates as low as 2-24%. This development underscores the need for strategic use within the household insecticides market to maintain its long-term viability.

- Permethrin was first synthesized in 1973 and has since become a globally essential insecticide.

- A low-concentration 5% permethrin formula is FDA-approved for the medical treatment of scabies and lice.

- The EPA classifies permethrin as "Likely to be Carcinogenic to Humans" only through oral ingestion, not topical or fabric application.

Mosquito Control Remains the Top Priority in Consumer Demand

The application to control mosquitoes is the most significant driver of consumption, enabling this segment to capture over 25.0% of the market share. The primary reason behind the household insecticides market growth is the profound and direct threat mosquitoes pose to human health. Annually, mosquito-borne diseases are responsible for more than 700,000 deaths worldwide, making effective control a non-negotiable aspect of home hygiene and safety. Rising global temperatures, which have increased by 0.32°F per decade since 1981, are creating more favorable breeding conditions for these pests, further heightening the urgency for effective solutions.

Recent events highlight the escalating threat. In early 2024, Brazil experienced a massive dengue outbreak with over 1 million cases in just two months and projections of up to 4.2 million cases by year-end. By September 2024, the global count of dengue cases had surpassed 11.5 million. In response, public health bodies are taking action; the WHO launched a new strategic plan on October 3, 2024, to combat these diseases. With the global population projected to reach 10 billion by 2050, increased urbanization will create more breeding grounds, ensuring sustained demand within the household insecticides market.

- French Guyana reported over 8,000 confirmed cases of dengue as of August 2024.

- Since the beginning of 2024, the island of La Reunion has recorded 1,265 dengue cases.

- Malaria remains a significant global health issue, with the WHO reporting 241 million cases in a single year.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

Synthetic Formulations Continue Their Reign in Household Pest Control

Despite the rise of natural alternatives, synthetic insecticides remain the frontrunners in the household insecticides market, holding a commanding market share of over 56.8%. Their dominance is rooted in their proven effectiveness, affordability, and fast-acting nature. Consumers often prioritize immediate results and long-lasting protection, which synthetic products reliably deliver. Synthetics also benefit from a longer shelf life and are available in a wide array of convenient formats, including sprays and aerosols, solidifying their position. Their cost-effectiveness is a major advantage, with initial costs for home garden applications as low as $20-50, making them highly accessible.

The innovation pipeline for synthetic products remains active, with companies consistently introducing more advanced formulations. In May 2024, BASF launched its new Efficon insecticide in India, followed by FMC unveiling three new crop protection solutions in August 2024. China registered three new chemical active ingredients on September 17, 2024, including Pyraquinate and Flusulfinam. However, the segment faces challenges from regulatory scrutiny. On October 22, 2024, the U.S. EPA announced the final cancellation of the pesticide DCPA. Despite such actions, the inherent advantages of synthetics ensure their continued importance in the household insecticides market.

- Synthetic pesticides are highly efficient, often requiring 2-3 times fewer applications compared to their organic counterparts.

- In 2023, Bayer ceased using glyphosate in its consumer-grade Roundup products within the United States.

- Syngenta’s Mainspring Xtra, a 2025 launch, combines two potent synthetic ingredients, thiamethoxam and cyantraniliprole, for broad-spectrum control.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific A Region Shaped by Climate and Public Health Imperatives

The Asia Pacific region commands the household insecticides market with a dominant share of over 47.60%. This leadership is fundamentally driven by pressing public health needs and environmental factors. Endemic vector-borne diseases create a consistent, high-stakes demand for protective products. For instance, India reported over 230,000 cases of dengue in 2024 alone, while Indonesia recorded more than 110,000 cases in the same year. Similarly, Malaysia’s Ministry of Health registered over 45,000 dengue cases in the first five months of 2024. The threat of malaria also looms large, with health ministries across the region distributing millions of insecticide-treated mosquito nets annually as part of national control programs.

Rapid urbanization across Southeast Asia further concentrates populations, amplifying pest pressures in dense residential areas in the household insecticides market. Government initiatives play a crucial role; Thailand’s Department of Disease Control launched over 5,000 public health campaigns in 2024 focused on mosquito breeding site elimination. The market also sees high sales volumes for specific product formats, with mosquito coil shipments to the Philippines exceeding 800 million units. Furthermore, consumer spending on home care and hygiene in China saw a substantial increase. The introduction of over 150 new insecticide product SKUs in Japan in 2024 caters to a demand for innovation, while Vietnam’s public health authorities issued 5 separate high-level alerts regarding mosquito-borne illnesses.

North America A Mature Market Driven by Ticks and Technology

The North American household insecticides market is defined by specific regional pest threats and high consumer adoption of technology. Public health concerns are a significant driver, with the U.S. Centers for Disease Control and Prevention tracking tens of thousands of Lyme disease cases annually, a tick-borne illness. Similarly, instances of West Nile virus, transmitted by mosquitoes, were confirmed in over 45 U.S. states in 2024. The region also shows a strong preference for do-it-yourself (DIY) pest control; U.S. consumer spending on DIY ant and roach control products surpassed 900 million dollars.

Innovation is a key characteristic, with shipments of smart, IoT-enabled rodent and insect traps exceeding 600,000 units in 2024. There is also a pronounced shift toward natural ingredients; sales of plant-based repellents containing oil of lemon eucalyptus grew substantially. Specific pest outbreaks, such as the continued spread of the spotted lanternfly, prompted over 200,000 homeowner inquiries for control solutions in Pennsylvania alone. Bed bug incidents in major metropolitan hubs like New York and Toronto remain a persistent issue, driving sales of specialized mattress encasements and sprays.

Europe A Market Defined by Regulation and Eco-Conscious Consumers

The European household insecticides market operates under a strict regulatory framework and strong consumer demand for sustainable products. The Biocidal Products Regulation (BPR) governs the sale of active substances, leading to the re-evaluation of over 25 insecticidal compounds since its implementation. This regulatory pressure fosters innovation in eco-friendly alternatives. Sales of biocontrol solutions and natural-based insecticides in France and Germany saw significant growth in 2024. The spread of invasive species, particularly the tiger mosquito, is a growing concern, with the insect now established in over 15 European countries, prompting localized public health advisories.

Consumer preferences lean heavily toward safety and low chemical exposure in the household insecticides market. In the UK, over 30 new insecticide products with certified organic or plant-based labels were introduced in 2024. Spending on home hygiene products remains high across the continent. There is also a notable demand for non-lethal solutions, such as ultrasonic repellents, with over 2 million units sold. Specific issues, like moth infestations, drive a niche but valuable market for fabric-safe insecticides in countries like Italy. The EU’s focus on a circular economy has also spurred the development of insecticide packaging from recycled materials by at least 10 major brands.

Strategic Investments and Acquisitions Reshaping the Global Household Insecticides Market Landscape

- June 2025, Anticimex Group Continues U.S. Consolidation by acquiring SafeHaven Pest Control, Abby’s Pest & Termite Services, and Metro Guard Termite & Pest Control.

- Oct 2025, CERTUS Pest has strengthened its Southwest Florida operations by acquiring Certified Pest Control, which operates in Fort Myers and nearby Collier and Lee counties. This acquisition enhances CERTUS’s reach in important markets including Bonita Springs, Cape Coral, Marco Island, and Naples.

- Plunkett’s Pest Control has expanded its Midwest footprint by acquiring PureHome Pest Control, an Oklahoma City-based provider. This strategic move marks Plunkett's entry into the Oklahoma City metro, reinforcing its mission to deliver high-quality, customer-centric pest management services.

- Berkshire Hathaway Inc. acquired rodent-control specialist Bell Laboratories on July 31, 2025. The move is set to broaden Bell's international footprint by leveraging Berkshire Hathaway's extensive global network.

List of Key Companies Profiled:

- BASF SE

- Bayer AG

- FMC Global Specialty Solutions

- Johnson & Son

- Natural INSECTO Products, Inc.

- Spectrum Brands Holding

- Sumitomo Chemical Co.

- Shogun Organics Ltd.

- Terminix

- Rentokil

- Ecolab

- Rollins, Inc.

- Other Prominent players

Market Segmentation Overview:

By Product Form

- Foams and Sprays

- Liquid Vaporizer

- Plug-in Mats

- Coils

- Baits

- Essential Oils

- Others

By Composition

- Natural

- Synthetic

By Active Ingredients

- Allethrin

- Bifenthrin

- Boric Acid

- Cyfluthrin

- Cypermethrin

- Deltamethrin

- Diatomaceous Earth

- D-limonene

- Esfenvalerate

- ETOC

- Fipronil

- Metafluthrin

- Permethrin

- Pyrethrin

- Resmethrin

- Sumithrin

- Tetramethrin

- Tralomethrin

- Transfluthrin

- D trans allethrin/ Esbiothrin

- Meperfluthrin

- Dimefluthrin

- Profluthrin

- Empenthrin

- Alpha cypermethrin

- cyphenothrin

- Heptafluthrin

- Momfluorothrin

- Others

By Application

- Cockroaches

- Ants

- Files & Moths

- Mosquitoes

- Termites

- Rodents

- Bedbugs & Beetles

- Others

By Distribution Channel

- Online

- Offline

- Supermarkets and Hypermarkets

- Convenience Stores

- General Stores

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 13.75 Bn |

| Expected Revenue in 2033 | US$ 23.23 Bn |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Bn) |

| CAGR | 6.0% |

| Segments covered | By Product Form, By Composition, By Active Ingredients, By Application, By Distribution Channel, By Region |

| Key Companies | BASF SE, Bayer AG, FMC Global Specialty Solutions, Johnson & Son, Natural INSECTO Products, Inc., Spectrum Brands Holding, Sumitomo Chemical Co., Shogun Organics Ltd., Terminix, Rentokil, Ecolab, Rollins, Inc., Other Prominent players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)