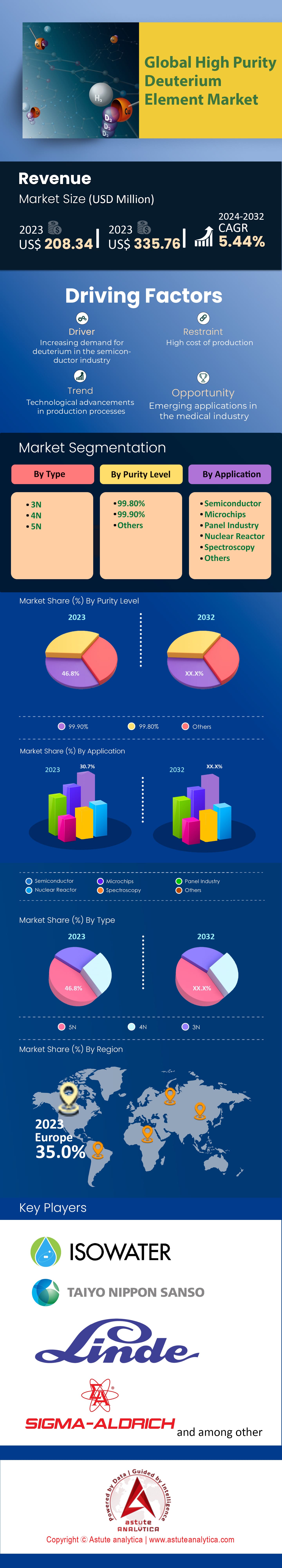

Global High Purity Deuterium Element Market: By Type (3N, 4N, 5N); Purity Level (99.80%, 99.90%, Others); Application (Semiconductor, Microchips, Panel Industry, Nuclear Reactor, Spectroscopy, Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Dec-2023 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA1223699 | Delivery: 2 to 4 Hours

| Report ID: AA1223699 | Delivery: 2 to 4 Hours

Market Scenario

Global High Purity Deuterium Element Market was valued at US$ 208.34 million in 2023 and is projected to surpass the market valuation of US$ 335.76 million by 2032 at a CAGR of 5.44% During the Forecast Period 2024–2032.

In recent years, the market has witnessed a remarkable surge in the demand for high purity deuterium, primarily fueled by its critical applications in sectors such as pharmaceuticals, nuclear fusion research, and semiconductor manufacturing. This upswing is a reflection of deeper shifts in technological developments and industrial needs. The pharmaceutical industry, for instance, increasingly relies on deuterium due to its ability to enhance the metabolic stability of drugs, leading to more effective and safer medications. Similarly, the push towards sustainable energy solutions has catapulted nuclear fusion research, where deuterium plays a pivotal role, to the forefront.

Today, the high purity deuterium element market is grappling with intricate supply chain challenges, accentuated by the element’s unique storage and transportation requirements. These logistical complexities are further compounded by a regulatory landscape that is both stringent and variable across different geographies. Navigating these regulations, which encompass safety standards, environmental considerations, and international trade laws, requires not only compliance but also strategic foresight. The companies that will emerge as leaders in this market are those that can adeptly balance operational efficiency with regulatory adherence.

In the years to come, the potential of high purity deuterium element market would extend beyond its current applications. Emerging technologies and uncharted applications are poised to open new frontiers. The semiconductor industry, for instance, stands on the brink of a transformative leap with the advent of deuterium-enhanced chips, which promise not only greater efficiency but also longevity. In the realm of nuclear fusion, deuterium’s role is set to become even more central as we inch closer to achieving sustainable fusion reactions, a goal that has long been the holy grail of energy research.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Demand in Nuclear Fusion Research

The high-purity deuterium element market is primarily driven by escalating demands in nuclear fusion research. Deuterium, a hydrogen isotope, plays a pivotal role in fusion reactions, which are central to future sustainable and clean energy solutions. This isotope's unique properties make it an ideal candidate for fusion reactions, which aim to mimic the sun's energy generation process on Earth. With the increasing focus on renewable energy sources, nuclear fusion research has gained significant attention and funding worldwide.

Projects like ITER and various national research initiatives underscore the need for high-purity deuterium. In fusion reactors, deuterium is used in combination with another hydrogen isotope, tritium, to create a plasma that can generate immense energy. The purity of deuterium is critical in these processes, as impurities can drastically affect the efficiency and safety of the fusion reaction. Moreover, the global push towards reducing carbon emissions and finding long-term sustainable energy solutions has accelerated investment in fusion technology. Governments and private entities are investing in research to overcome the technological barriers associated with nuclear fusion. These efforts ensure a continuous and growing demand for high-purity deuterium, significantly impacting the market.

Trend: Technological Innovations in Purification Processes

A prominent trend in the high-purity deuterium element market is the continuous advancement in purification technologies. The stringent purity requirements for applications in nuclear fusion and pharmaceuticals have spurred technological innovations. These advancements focus on improving the efficiency and effectiveness of deuterium purification, reducing costs, and minimizing environmental impacts. New purification methods are being developed, including advanced distillation techniques and catalytic exchange processes. These methods aim to achieve higher levels of purity while being more energy-efficient. For instance, multi-stage distillation processes are being optimized to remove impurities more effectively, ensuring that the deuterium used in sensitive applications like nuclear fusion meets the highest purity standards.

Additionally, the adoption of automation and digital technologies in the purification process is gaining traction. Automation helps in monitoring and controlling the purification process more accurately, leading to consistent product quality. Digital technologies, like AI and machine learning, are being integrated to predict and optimize purification outcomes, further enhancing the efficiency of the process. The push towards greener and more sustainable practices in industrial processes also influences the trend in deuterium purification. There is an increasing focus on reducing the environmental footprint of purification facilities by adopting cleaner technologies and recycling waste products.

Restrain: High Cost and Complexity of Production

Producing deuterium to the required purity levels is a technologically intensive and expensive process in the global purity deuterium element market. The initial setup cost for purification facilities is significant, and the ongoing operational costs, including energy consumption and maintenance, add to the financial burden. The complexity of the purification process also poses challenges. Deuterium is extracted from heavy water (D2O), which is already a rare and expensive resource. The extraction and purification process requires sophisticated equipment and technology, making it inaccessible to many potential users. This complexity limits the number of suppliers capable of producing high-purity deuterium, which can lead to supply constraints and higher prices.

Apart from this, the need for specialized knowledge and skilled personnel to operate and maintain purification facilities adds to the cost. This requirement can be a barrier for new entrants into the market, limiting competition and innovation. The environmental impact of deuterium production is also a concern. The process can generate waste products that need to be managed and disposed of safely, adding to the operational challenges and costs.

Not only high cost, regulatory and environmental concerns also act as restraints in the high-purity deuterium element market. The production and use of deuterium, especially in nuclear applications, are subject to stringent regulations and oversight. Compliance with these regulations requires significant investment in safety measures, quality control, and environmental protection, which can increase the cost and complexity of deuterium production.

Segmental Analysis

By Type

Based on type, 5N segment is projected to capture more than 54% revenue share of the global high purity deuterium element market. Its dominance is not surprising. This ultra-refined grade is indispensable in fields where even trace impurities can disrupt results or hinder performance. Its dominance stems from several factors. The semiconductor industry's insatiable appetite for 5N deuterium fuels a consistent demand base: microchip fabrication relies on its purity for precise etching and creation of smaller, more powerful components. Cutting-edge scientific research, especially techniques like NMR spectroscopy, depend on 5N deuterated solvents for clear, high-resolution results. Beyond that, fusion energy projects require extremely pure deuterium fuel, driving demand even higher. This convergence – spanning nanotechnology, life sciences, and the frontiers of physics – ensures 5N deuterium holds a commanding position within the market.

By Purity Level

In the high-purity deuterium element market, the 99.90% purity level segment holds the largest share at 46.8%. This dominance is linked to the stringent purity requirements in key applications, particularly in the fields of nuclear fusion, pharmaceuticals, and semiconductor manufacturing. The high purity level ensures optimal performance and efficiency, which is crucial in these sensitive applications. The segment is also projected to keep growing at the fastest CAGR of 6%, which reflects the increasing demand for high-quality and reliable deuterium across various industries. In nuclear fusion research, for example, the high purity level of deuterium is critical for achieving efficient and safe fusion reactions. Similarly, in the pharmaceutical industry, the purity of deuterium directly impacts the efficacy and safety of deuterated drugs.

The trend towards higher purity levels is also driven by advancements in purification technologies. As these technologies become more sophisticated and cost-effective in the global purity deuterium element market, it becomes feasible to produce deuterium at higher purity levels, meeting the growing demand from industries that require exceptionally pure materials. Moreover, the push for innovation and quality in sectors like aerospace, defense, and healthcare further solidifies the market position of the 99.90% purity level segment. The demand for high-purity deuterium in these sectors is not just a matter of quantity but also of quality, making the 99.90% purity level increasingly desirable and vital for future advancements.

By Application

In terms of application, the semiconductor segment is contributing the highest 30.7% revenue to the global high-purity deuterium element market and is also expected to grow at the highest CAGR of 6.07% during the forecast period. The ongoing technological advancements and the increasing complexity of semiconductor devices necessitate the use of high-purity deuterium. Its application in processes like oxide layer formation and plasma etching is crucial for the production of smaller, more efficient, and more reliable semiconductor devices. As consumer electronics, computing devices, and telecommunications equipment continue to evolve, the demand for advanced semiconductors—and by extension, high-purity deuterium—rises correspondingly.

In addition, the growing trends towards IoT, AI, and automation across various industries create a substantial need for sophisticated semiconductor components. These technologies rely heavily on the efficiency and miniaturization of semiconductors, which in turn depends on the quality of deuterium used in their production. The semiconductor industry's push towards innovation and higher performance standards also plays a critical role in the increased demand for high-purity deuterium. As the industry seeks to meet the rising consumer and industrial demands for faster, smaller, and more powerful electronic devices, the reliance on high-purity deuterium becomes more pronounced.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America leads the global high purity deuterium element market with a substantial revenue contribution of over 35%. This dominance is primarily due to the region's advanced technological infrastructure and strong focus on research and development, especially in the United States and Canada. The presence of leading pharmaceutical and semiconductor companies, along with significant investments in healthcare and technology sectors, plays a crucial role in driving the demand for high-purity deuterium. Additionally, the region's commitment to nuclear research and space exploration, particularly in the U.S., bolsters the demand for high-purity deuterium, given its critical applications in propulsion systems and energy generation.

Europe high purity deuterium element market follows North America closely in the market share, characterized by a robust research infrastructure and high environmental and quality standards. The demand in this region is majorly fueled by the pharmaceutical sector, coupled with growing investments in renewable energy, including nuclear fusion. Countries like Germany, France, and the UK contribute significantly, backed by advanced technological capabilities and strong research institutions. The supportive government policies and funding dedicated to scientific research in Europe, particularly in the fields of nuclear physics and medical research, ensure a steady and sustained market growth.

However, it's the Asia Pacific region that is witnessing the fastest growth in the high purity deuterium element market, projected to encroach over 2% of Europe's market share by the end of the forecast period. This rapid expansion is a result of the rising technological adoption and expanding industrial base in countries like China, Japan, and South Korea. These nations are making substantial investments in technology sectors, such as semiconductors and pharmaceuticals, which extensively utilize high-purity deuterium. Furthermore, the region's economic development, marked by increased healthcare spending and advancements in medical technology, amplifies the demand for high-purity deuterium in medical applications. Government initiatives in the Asia Pacific, aimed at boosting scientific research and technological innovation, have also been instrumental in propelling the market growth.

Top Players in the Global High Purity Deuterium Element Market

- Cambridge Isotope Laboratories, Inc.

- Guangdong Huate Gas

- Heavy Water Board (HWB)

- Isowater Corporation

- Linde plc

- Sigma-Aldrich (Merck KGaA)

- Sumitomo Seika Chemicals Company, Ltd.

- Taiyo Nippon Sanso Corporation

- Zeochem (Chemie+Papier Holding AG)

- Other Prominent Players

Market Segmentation Overview:

By Type

- 3N

- 4N

- 5N

By Purity Level

- 99.80%

- 99.90%

- Others

By Application

- Semiconductor

- Microchips

- Panel Industry

- Nuclear Reactor

- Spectroscopy

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 208.34 Mn |

| Expected Revenue in 2032 | US$ 335.76 Mn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Mn) |

| CAGR | 5.44% |

| Segments covered | By Type, By Purity Level, By Application, By Region |

| Key Companies | Cambridge Isotope Laboratories, Inc., Guangdong Huate Gas, Heavy Water Board (HWB), Isowater Corporation, Linde plc, Sigma-Aldrich (Merck KGaA), Sumitomo Seika Chemicals Company, Ltd., Taiyo Nippon Sanso Corporation, Zeochem (Chemie+Papier Holding AG),Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA1223699 | Delivery: 2 to 4 Hours

| Report ID: AA1223699 | Delivery: 2 to 4 Hours

.svg)