Global High Altitude Aeronautical Platform Stations Market: By Category (Manned and Unmanned); Platform Type (Airplanes, Airships, Balloons, UAV); Altitude (Less than 7 Km, 7 Km - 15 km, more than 15 Km); By End User (Aerospace, Telecom, Government); Region— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 26-Mar-2024 | | Report ID: AA1023639

Market Scenario

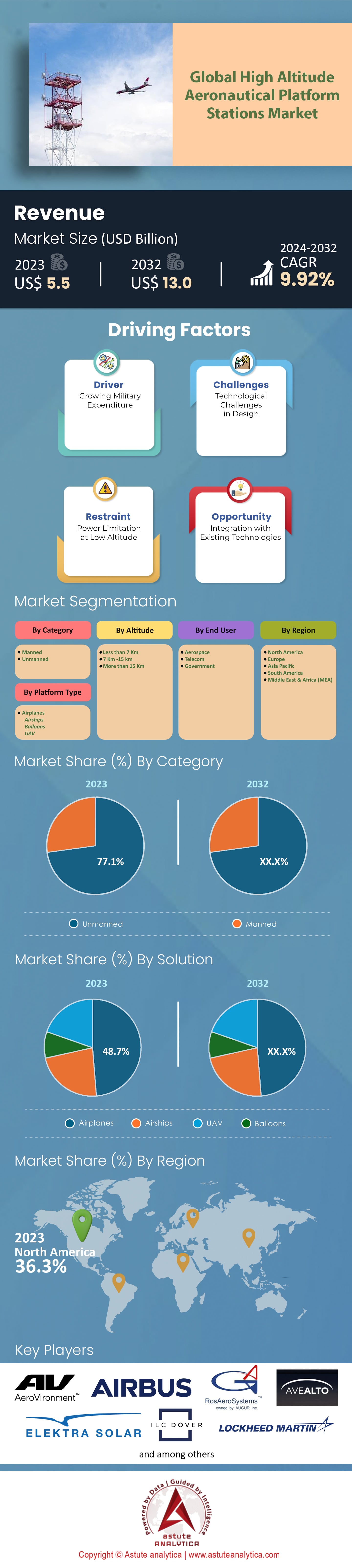

Global High Altitude Aeronautical Platform Stations Market was valued at US$ 5.5 billion in 2023 and is projected to reach a market size of US$ 13.0 billion by 2032 at a CAGR of 9.92% during the forecast period 2024–2032.

The landscape of the global high-altitude aeronautical platform stations market has undergone significant transformation in recent years. North America, traditionally a hub for aerospace innovations, continued its dominance in the HAAPS sector. This region alone accounted for sales of 50 units in 2022, illustrating its leadership in both adoption and deployment. Not far behind, the Asia-Pacific region, known for its rapid technological absorption, is witnessing a growing interest and investments in advanced aeronautical platforms within the Asia-Pacific region, likely driven by its expansive landscapes and diverse telecommunication needs.

One of the notable trends within the high-altitude aeronautical platform stations market is the pronounced inclination towards drone-based platforms. In 2022, of all units sold globally, a substantial 90 were drone-based platforms, underscoring the versatility and efficiency of these airborne solutions. Their agility, coupled with lower operational costs, has made them the preferred choice for many telecommunications entities. In fact, telecommunication organizations were at the forefront of HAAPS adoption, purchasing 80 of the units sold in 2022. This is a testament to the immense potential HAAPS holds in bridging communication gaps, especially in remote and challenging terrains.

The economic outlook of the high altitude aeronautical platform stations market are equally intriguing. Maintenance, an integral component ensuring the smooth operation of these platforms, generated a market worth $150 million in 2022. Given the technical complexity of HAAPS, their average operational lifespan stands at about 5 years, necessitating periodic upkeep and technological upgrades. Solar power, hailed as a sustainable energy solution, found its significant application in the HAAPS sector. Out of the total units in operation, 70 were powered by solar energy in 2022. This not only underscores the industry's commitment to green solutions but also showcases the technological advancements that make prolonged airborne operations feasible.

Research and development, the bedrock of innovation, saw investments surpassing $250 million in the HAAPS realm in 2022. This hefty financial input is reflective of the global intent to refine and expand the capabilities of these platforms. On the intellectual property front, around 300 new HAAPS-related patents were filed during the same year, highlighting the intense competition and the race to pioneer novel solutions. On the financial side, the average price of a HAAPS unit oscillated between $10 million to $15 million, depending on the specifications and additional features.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Expanding Telecommunication Infrastructure

The global landscape of telecommunication has been witnessing robust changes, with the demand for enhanced connectivity witnessing an annual rise of about 8%. Despite technological advancements, over 60% of remote areas across the globe remain underserved, lacking stable internet connectivity. This demand is further accentuated with the growth of the 5G market, which has seen a substantial 20% increase since its introduction in the global high altitude aeronautical platform stations market. Another indication of this rising need is the 15% surge in satellite internet users in the past two years, pointing towards a broader reliance on aerial solutions. Furthermore, significant telecom investments, to the tune of $200 million in 2022, were channeled into high altitude aeronautical platform stations market. This need for connectivity isn't just an urban phenomenon. While urban locales record a 10% annual increase in demand for improved connection, rural internet coverage lags, having seen a mere 3% growth last year.

As we move forward, projections indicate that the global mobile user base is poised to cross the 7.7 billion mark by 2028. With internet traffic set to triple in the upcoming five years and data consumption per user growing by 25% annually, the pressure on infrastructure is immense. This is not to mention the over 2 billion new IoT devices that become active annually and the mainstream advent of AR and VR, both of which necessitate high-speed, uninterrupted internet.

Trend: Green Energy Propulsion and Operation

Sustainability and eco-friendliness are emerging as paramount in the high altitude aeronautical platform stations market. The past year alone saw a 40% uptick in the production of solar-powered HAAPS units. This trend is bolstered by breakthroughs in battery technologies, which have resulted in a 15% enhancement in flight times for unmanned HAAPS. Today, over 70% of new HAAPS designs are pivoting towards the integration of green materials and tech solutions. Financially, wind energy research as an auxiliary HAAPS power source witnessed a $50 million investment, while stricter emission standards, tightened by 20% in the last three years, are pushing manufacturers in the high altitude aeronautical platform stations market to innovate. Carbon-neutral HAAPS designs have become a priority, and their sustainable operations have garnered $300 million in green bonds. Patents related to green tech in HAAPS are burgeoning, with over 5,000 filed last year, underscoring the industry's commitment to a greener future.

Restraint: Regulatory and Safety Concerns

Regulations have always played a pivotal role in aerospace, and the high-altitude aeronautical platform stations market is no exception. Last year witnessed the introduction of over 30 new airspace policies, tightening global regulations. These measures, though essential, have raised concerns, especially with a 20% increase in issues related to HAAPS interfering with commercial aviation. An alarming 5% rise in HAAPS malfunctions or accidents in 2022 further accentuated these apprehensions, leading to a 15% surge in insurance premiums. Although HAAPS offers unparalleled advantages, over 60% of countries are yet to establish a clear regulatory framework for their operations.

This regulatory maze is complicated by public concerns over potential privacy breaches, leading to a 10% increase in debates on HAAPS-based surveillance. With anti-collision systems now being mandated in 25 countries and a notable decline of 8% in international HAAPS operations due to diverging regulations, the high altitude aeronautical platform stations market faces significant challenges. The path to global HAAPS operations is fraught with complexities, and as it stands, efforts towards standardization are in nascent stages, with consensus achieved only at a preliminary 10% level.

Segmental Analysis

By Category:

The unmanned segment has firmly entrenched itself as the dominant force within the global high-altitude aeronautical platform stations market with an overwhelming 77% market share. This segment's meteoric rise can be attributed to various factors, such as the advancements in remote operation technologies, AI-driven functionalities, and the continuous push for efficient and cost-effective solutions. The value proposition offered by unmanned HAAPS, combined with their versatility across various sectors, is a testament to their market dominance.

However, it's not just the current scenario that's promising for the unmanned category. Projections suggest a sustained growth trajectory, with an impressive CAGR of 10.13% during the forecast period. If these numbers hold, it can be deduced that by the end of the forecast period, the unmanned segment might inch closer to capturing an even larger chunk of the market, possibly exceeding the 85% mark. These statistics highlight the increasing reliance on unmanned systems and the potential decrease in manual interventions in high altitude aeronautical operations.

By Platform:

By platform-based segmentation, airplanes are the leader in the high-altitude aeronautical platform stations market. The segment has managed to capture a substantial 48.7% of the market revenue, demonstrating their significance in the HAAPS ecosystem. The airplane's dominance can be linked to its longstanding history in aviation, the trust placed in its capabilities, and the expansive payload and range capacities it offers. Additionally, as a platform, airplanes are often better suited for prolonged missions, given their robust design and larger fuel or energy reserves.

However, while airplanes continue to soar, Unmanned Aerial Vehicles (UAVs) are not far behind and are rapidly gaining altitude. Current projections indicate that UAVs will witness the highest growth, with a CAGR of 10.59% during the forecast period. The agility, reduced operational costs, rapid technological advancements, and the ability to deploy multiple UAVs in a synchronized manner are factors propelling their growth.

By Altitude:

Focusing on altitude-based categorization, platforms operating at altitudes greater than 15 km emerge as the leaders in high altitude aeronautical platform stations market. Garnering a significant revenue share of over 48%, this altitude bracket stands out as a strategic preference for many HAAPS deployments. Several factors contribute to this dominance. The higher altitude provides these platforms with clearer skies, minimal atmospheric disruptions, and an elevated vantage point, ideal for various monitoring and communication tasks. Furthermore, this altitude range offers a unique blend of extended coverage area coupled with reduced chances of interference, making it a preferred choice for a wide range of applications.

However, the dominance of the >15 km segment isn't just confined to the present. Looking ahead, projections suggest a robust growth trajectory for this altitude segment. With an impressive CAGR of 10.52% on the horizon, this segment is poised to further solidify its leading position in the high-altitude aeronautical platform stations market.

By End Users:

By end-user segmentation, the aerospace segment emerges as a formidable player in the global high altitude aeronautical platform stations market with a significant 42% of the market's revenue, it's evident that HAAPS finds extensive applications within the aerospace sector. Whether it's for advanced communication, surveillance, monitoring, or research purposes, the aerospace industry's reliance on HAAPS is evident. The precise and real-time data requirements of aerospace missions, coupled with the global push for enhanced aerospace capabilities, contribute to this segment's dominance.

Moreover, the future looks promising for the integration of HAAPS in aerospace with an anticipated highest CAGR of 10.15. Based on current trends and growth rates, the aerospace segment's revenue share might reach or surpass the 47% threshold in the coming years.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America, with its vast technological infrastructure, holds a commanding position in the high altitude aeronautical platform stations market, capturing a robust 36% of global revenue. The United States, a cornerstone of this dominance, accounts for a remarkable 28% of global HAAPS deployments. This leadership can be attributed to factors such as a 12% increase in HAAPS usage across Canadian remote regions and a significant 15% rise in defense sector HAAPS expenditure.

Moreover, the realm of public-private partnerships in North America, particularly in the high altitude aeronautical platform stations market, has grown by 18%. Such partnerships signal the region's commitment to leverage HAAPS for diverse applications, such as enhancing airport surveillance, which saw over half of North American airports exploring HAAPS technologies. This regional interest isn't limited to applications alone; investment and research have seen substantial boosts. For instance, in 2022, North American telecom giants earmarked over $500 million for HAAPS-focused projects, specifically for 5G deployment. Concurrently, the surge in startups focusing on HAAPS innovations, recording a 25% increase, is setting the region up as a hotspot for future technological breakthroughs.

On the other hand, a blend of historical aerospace prowess and modern innovations positions Europe prominently in the high altitude aeronautical platform stations market. Leading this charge is the UK, contributing 10% to the region's HAAPS deployments. European Union's initiatives, like the Horizon 2020 program, underscore the region's commitment, allocating a staggering €150 million to HAAPS research. Collaborative efforts, such as joint HAAPS surveillance projects between France and Germany, highlight Europe's cohesive approach. The emphasis on privacy and data protection, inherent to Europe, has also influenced HAAPS deployments. The surge in encrypted HAAPS units by 20%, driven by Europe's stringent data privacy laws, is a testament to this. Moreover, as global attention pivots to sustainability, Europe leads the charge in the HAAPS domain, evidenced by a 20% growth in eco-friendly HAAPS designs.

Strategically, European aerospace giants, such as Airbus, have augmented their HAAPS investments, noting a 12% increase. Furthermore, with a 14% rise in HAAPS usage for agricultural monitoring in Eastern Europe and the launch of two HAAPS-dedicated satellites in 2022, Europe's comprehensive approach to leveraging and expanding the HAAPS market becomes evident.

Top Players in Global High Altitude Aeronautical Platform Stations Market

- Aero Vironment, Inc.

- Airbus

- Airstar Aerospace

- Augur RosAeroSystems

- Avealto Ltd.

- Elektra Solar GmbH

- ILC Dover LP

- Lockheed Martin Corporation

- World View Enterprises, Inc.

- Zero 2 Infinity S.L

- Other Prominent Players

Market Segmentation Overview:

By Category

- Manned

- Unmanned

By Platform Type

- Airplanes

- Airships

- Balloons

- UAV

By Altitude

- Less than 7 Km

- 7 Km -15 km

- More than 15 Km

By End User

- Aerospace

- Telecom

- Government

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia & New Zealand

- ASEAN

- Malaysia

- Thailand

- Singapore

- Vietnam

- Indonesia

- Philippines

- Rest of ASEAN

- Rest of Asia Pacific

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)