Global Hi-Rel DC-DC Converter Market: By Type (Isolated DC-DC Converters and Non-isolated DC-DC Converters); Technology (Mil-Spec, COTS, Space); Output Voltage (<5V, 12V, 15V, 24V, 48V, >48V); Input Voltage (<28V, 28-75V, 75-270V, 270-800V, >800V); Output Number (Single, Dual, Triple, Multiple); Aircraft Type (Fixed Wing (Commercial and Defense), Rotatory Wing (Commercial and Defense), Unmanned Aerial Vehicles (Commercial and Defense), Air Taxis (Commercial and Defense); Form Factor/Mount (Chassis Mount, Encapsulated, Brick (Full brick – 4.6 x 2.4 x 0.5 inches, Half brick – 2.3 x 2.4 x 0.35 inches, Quarter brick – 2.3 x 1.45 x 0.35 inches, 8th Brick – 1/8, 16th Brick – 1/16, 32nd Brick – 1/32), Others); Application (Avionics, Telemetry, Aircraft Acuation, Weapon Systems, Missiles and Defense, Flight Control System, Surveillance System, Environmental Control System, Energy Storage System, Power Delivery Network, Space Systems (Launch Vehicles, Digital Loads, EMI Filters, LEO Satellite (Micro and Mini), Electronic Warfare and Others); End Users (Aircraft Manufacturers, Defense Manufacturers, Maintenance, repair, and overhaul (MRO), Others)— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2033

- Last Updated: 20-Feb-2024 | | Report ID: AA1123664

Market Scenario

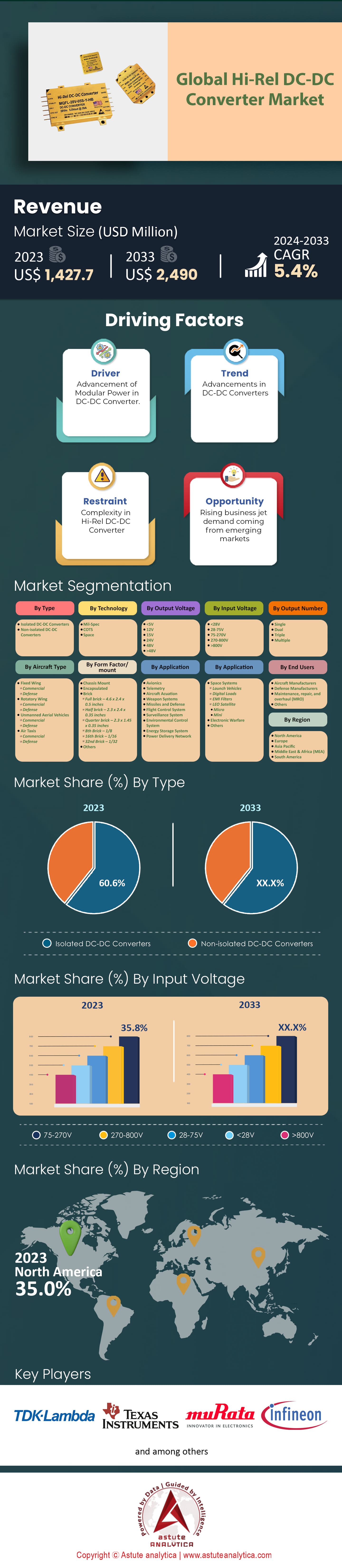

The Global Hi-Rel DC-DC Converter Market was valued at US$ 1,427.7 million in 2023 and is projected to surpass the market valuation of US$ 2,490.9 million by 2033 at a CAGR of 5.4% during the forecast period 2024–2033.

The Hi-Rel DC-DC converter market has always been a niche, yet a critical component in several high-end applications, especially in aerospace, defense, and satellite communications. Today’s manufacturing processes for Hi-Rel DC-DC converters are highly sophisticated due to the stringent reliability and quality standards required for their applications. Advanced facilities, often in regions with technological prowess such as Silicon Valley and Shenzhen, are leading in production capabilities. In 2023, approximately 19.84 million units of Hi-Rel DC-DC converters were manufactured globally. This production volume is expected to increase by a projected around 1,200 units annually for the next three years, driven mainly by increasing demands in space exploration and defense sectors. A trend observed in manufacturing is the integration of AI-driven quality assurance systems, with over 60 facilities adopting it last year to ensure unmatched reliability.

The demand for Hi-Rel DC-DC converters stems largely from the defense and aerospace sectors. Last year, avionics accounted for 35% of the total Hi-Rel DC-DC converter units, which were followed by defense procurements accounted for a significant more than 15% of the total produced units. The supply chain, being multifaceted, is increasingly leaning towards vertical integration, allowing companies to have better control over the quality and timelines. This shift has led to reduced lead times, with the average down to 45 days from the 60 days observed three years ago. Value chain optimization, focusing on reducing waste and increasing efficiency, saved the industry an estimated $340 million in potential losses in 2022. However, challenges still persist, especially in securing rare materials, which saw a price hike of approximately $15 per kilogram for specific components.

Trade activities in the Hi-Rel DC-DC converter market are robust. Countries like the USA and China are both significant importers and exporters, given their manufacturing capabilities and the requirements of their defense and space sectors. In 2022, the USA imported roughly 600,000 units while exporting about 750,000 units, resulting in a positive trade balance. China, on the other hand, with its expanding space program, imported a staggering 1.2 million units and exported about 900,000 units. Europe, as a collective, emerged as a net importer, with Germany leading the demand, importing approximately 400,000 units.

Government projects, primarily in space exploration and defense, are primary drivers for the Hi-Rel DC-DC converter market. Recently, the European Space Agency announced a budget allocation of $17.6 billion for space projects for the upcoming three years, indirectly influencing the market. Additionally, a notable $500 million has been earmarked by various governments globally for R&D in this sector, ensuring technological advancements and pushing the envelope of possibilities. Private sector investment, drawn by the promise of high ROIs, has surged, with venture capitals infusing an estimated $1.1 billion into startups and innovations in this space. Forecasting the next five years, given the increasing investments, technological advancements, and steady government projects, the global Hi-Rel DC-DC converter market looks promising.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Rising Defense Modernization Efforts is Shaping the Market Momentum

As countries globally prioritize strengthening their defense capabilities, modernization efforts have seen a significant surge. These advancements inevitably lead to an increased reliance on sophisticated electronics, which makes Hi-Rel DC-DC converters crucial due to their ability to provide stable power in critical applications. The past three years have borne witness to considerable hikes in defense budgets across the board. Notably, India announced a whopping $75 billion defense budget in 2022, a substantial chunk of which is dedicated to electronic warfare systems and sophisticated equipment. Japan, keeping pace with its neighboring countries, increased its defense expenditure by $7 billion compared to the previous year, channeling a portion of this into modernizing its naval and aerial fleets. In addition, the country is planning to allocate more than $52 billion in 2024 for defense. South Korea is not far behind, earmarking an impressive $9 billion out of $44.2 billion solely for enhancing its defense electronics over the next two years. Moreover, the United Arab Emirates signed defense contracts worth around $6 billion with Emirati defense firms in 2022, reflecting a clear focus on state-of-the-art military equipment.

There's also a global emphasis on indigenous defense production, propelling nations to invest in internal resources. Australia's initiative to locally produce its fleet of next-generation submarines is a testament to this, with a budget allocation of $10 billion over five years. Furthermore, France and Germany's joint endeavor, the Future Combat Air System project, boasts a preliminary budget of $65 billion, with significant attention on cutting-edge electronics and onboard systems. Such modernization endeavors and significant budgetary allocations are undeniable drivers for the Hi-Rel DC-DC converter market. The exponential growth in defense spending, coupled with a focus on electronic advancement, underscores the irreplaceable role these converters play in the defense sector's landscape.

Trend: Electrification of Transportation: The Uptick in Hi-Rel DC-DC Converter Adoption

The global march towards sustainable energy has catapulted the transportation sector into an era of rapid electrification. As vehicles increasingly transition from traditional fossil fuels to electric power, the demand for efficient and reliable power management components, such as Hi-Rel DC-DC converters, has witnessed an unprecedented spike. The past year saw the global electric vehicle (EV) sales reach a record-breaking 7 million units, signaling a transformative shift in consumer preferences. In response to this demand in the Hi-Rel DC-DC converter market, major automotive manufacturers ramped up their production. Tesla's factory expanded its annual production capacity to 650,000 vehicles. Notably, the surge isn't limited to personal vehicles; electric buses have marked their territory, with China leading the way. Furthermore, the marine sector, historically powered by diesel engines, welcomed its first large-scale electric ferry in Norway, capable of carrying 200 vehicles and 600 passengers.

Battery management and efficiency have been at the forefront of this electrification drive. The average capacity of EV batteries grew to 75 kWh in 2022, up from 60 kWh two years prior. Charging infrastructure developments have kept pace, with global installations of fast-charging stations surpassing the 500,000-mark last year. These stations, to handle high input voltages and deliver rapid charge times, increasingly incorporate Hi-Rel DC-DC converters. The electrification trend in transportation undeniably positions Hi-Rel DC-DC converters as pivotal components, ensuring efficient energy transition and optimizing battery performance. As vehicles continue their green evolution, this trend is poised to further entrench the significance of these converters in the transportation paradigm.

Restrain: Supply Chain Disruptions: The Drag on Hi-Rel DC-DC Converter Growth

The global economy has been grappling with significant supply chain disruptions, mainly stemming from logistic challenges, trade tensions, and raw material shortages. This has inherently placed a damper on the swift growth trajectory of the Hi-Rel DC-DC converter market. In the wake of the pandemic in 2020 and 2021, international shipping faced immense hurdles. The Suez Canal blockage alone, which lasted a week, held up over $9 billion worth of goods each day. Ports worldwide, including major hubs like Los Angeles and Rotterdam, reported average wait times of 8 days for offloading, nearly quadruple from the standard 2-day wait in previous years. This lag affected the delivery of critical components, including semiconductors, for which demand surpassed supply by almost 40%. The shortage of semiconductors, essential for Hi-Rel DC-DC converter manufacturing, led to a backlog, with some industries like automotive reporting a production reduction of nearly 3 million units due to this singular challenge.

Trade tensions added another layer of complexity. U.S.-China trade disagreements resulted in tariffs impacting over $500 billion worth of goods, escalating production costs across multiple sectors. The rare earth minerals, vital for Hi-Rel DC-DC converters, experienced a price surge, with Neodymium witnessing a 25% price hike in just six months during 2022. Labor shortages further compounded the problem, with major manufacturing hubs reporting a 20% drop in available skilled workers, leading to production delays and, subsequently, elongated delivery times.

These multifaceted supply chain disruptions represent a substantial restraint for the Hi-Rel DC-DC converter market. Despite the robust demand, the inability to source components timely and cost-effectively has created a ripple effect, stifling potential growth and advancements.

Segmental Analysis

By Type

When the global Hi-Rel DC-DC converter market is segmented by type, Isolated DC-DC Converters captured over 60.6% of the market share in 2023, and its continued prominence is projected to remain the same. Isolated DC-DC converters owe their market leadership to their superior performance characteristics, a claim substantiated by their consistency in terms of efficiency, regulation, and repeatability from component to component. Unlike their non-isolated counterparts, they maintain a distinct edge: the dual transformers in isolated converters produce outputs that mirror each other, eliminating variations. This meticulous design allows for efficiencies between 55 and 85%, especially when operating at full capacity. Given these specs, it's unsurprising that they've become the preferred choice for many applications, especially those requiring precision and reliability.

The growing CAGR of 6.0% for Isolated DC-DC Converters indicates not just their current market supremacy but also their potential as the fastest-growing segment. A critical factor behind this growth is their indispensable role in scenarios demanding strict electrical separation between input and output voltages, adhering to stringent safety and regulatory considerations. As industries evolve and regulatory frameworks become even more rigorous, the reliance on isolated converters is set to intensify, solidifying their market position for years to come.

By Technology

Space technology has dominated the Hi-Rel DC-DC converter market, taking up 71.8% of it. This is because the aerospace industry requires highly reliable power systems that can cope with harsh space conditions. The costs and time needed to develop space tech are high, so it’s understandable that COTS solutions have been limited in this segment. It may cost hundreds of millions or billions of dollars to build and launch satellites and spacecrafts, but DC-DC converters are relatively inexpensive when compared to those figures. However, these converters’ reliability is paramount to mission success, which is why the industry is willing to pay a premium for them.

However, by 2033, COTS technology segments are expected to experience the biggest growth rate (CAGR) ever and take significant market share from military-space technologies and space itself. Developments in planar magnetics and miniature SMD components are making COTS smaller and more performant than ever before. Their increased performance makes COTS solutions viable for hi-rel applications — they’re getting better at what they do overall. With a shorter development cycle and ability to adapt quickly to changing requirements, these converters offer cost-effectiveness in addition to their technical prowess. Telecommunications, defense, medical - all industries outside of aerospace - need high-reliability power solutions too.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

By Output Voltage

The Hi-Rel DC-DC converter market, when segmented by output voltage, shows prominence of 15V segment. As of 2023, this segment has an impressive hold on the market, boasting a 30.3% share. Several underlying factors and industry dynamics have played instrumental roles in propelling this segment to its leading position. Today, 15V output voltage DC-DC converter is widely utilized in Electronic Engine Controllers (EEC). These controllers, which play pivotal roles in regulating engine operations, demand precise and reliable voltage for optimum performance. The 15V converters effectively bridge the gap between the power source and the specific needs of these controllers, ensuring smooth functioning without compromising on efficiency or safety.

Another influential factor is the emergence and evolution of sophisticated electronics in military vehicles in the Hi-Rel DC-DC converter market. While these high-tech components are often designed to run on 24/28VDC, there are scenarios where they are incompatible with the common 12VDC systems found in non-tactical vehicles. Enter the 15V DC-DC converters, which provide a harmonizing middle-ground, facilitating the operation of these advanced systems without necessitating a complete overhaul of the vehicle's electrical architecture.

However, while the 15V segment is the market leader, the 12V segment is projected to keep growing at the fastest CAGR of 6.3% in the years to come. The segment is witnessing a strong inflow of demand, especially from the automotive and military sectors. Legacy truck models in the military and a proliferation of comfort appliances in the automobile industry are catalyzing this growth.

By Application

Based on application, the global Hi-Rel DC-DC converter market is led by avionics sector, accounting for an impressive 35.8% share as of 2023 due to the exponential growth in the avionics industry across both developed and developing economies. The segment is also projected to keep growing at the fastest CAGR of 6.53% in the years to come. A notable increase in the number of people utilizing aircraft for travel and the burgeoning space of tourism have been instrumental in this growth. Avionics systems, with their expansive range encompassing communications, navigation, engine controls, flight control systems, lighting systems, threat detection mechanisms, flight recorders, fuel systems, weather radar, electro-optic (EO/IR) systems, display systems, and various performance-enhancing monitors, are paramount to modern aviation. These components ensure the safety, efficiency, and precision required in contemporary flight operations. Further cementing the avionics segment's significance is the increasing interest in space exploration. With numerous companies investing heavily in space tourism and enhanced satellite communication, the demand for advanced avionics systems is skyrocketing. These ventures require robust and reliable systems, making the role of Hi-Rel DC-DC converters even more crucial in these applications.

Regional Analysis

North America, with its robust technological ecosystem, commands a significant stake in the global Hi-Rel DC-DC converter market, capturing over 35.0% of the total revenue. Wherein, the U.S. plays a monumental role, holding a remarkable 72% of the region's market share in 2022. This dominance is fortified by the U.S. being the world's largest aircraft and spacecraft manufacturing nation. Furthermore, the presence of the world's most formidable air forces in the U.S. contributes massively to the burgeoning DC-DC converter market. The decade-long forecast also suggests a promising CAGR of 5.5% for North America, emphasizing its continued significance in the global market.

Shifting the spotlight to Europe, this region, with its rich industrial history and advanced technological infrastructure, accounts for more than 27% of the global market share. Europe's position is a testament to its progressive approach towards aerospace, defense, and technological advancements. While exact country-specific details for Europe aren't explicitly provided, one can infer from its 5% projected CAGR for the period 2023-2033 that the continent is poised for steady growth. The magnitude of investment in research and development, coupled with the presence of some of the world's leading aerospace and defense companies, underpins Europe's substantial contribution to the market.

Top Players in the Global Hi-Rel DC-DC Converter Market

- Abbott Technologies (US)

- Advanced Energy (US)

- BrightLoop Converters (France)

- Cincon Electronics Co., Ltd. (US)

- Crane Holdings, Co. (US)

- ECRIM (Institute 43) (US)

- FDK CORPORATION (Japan)

- Gaia (US)

- Infineon Technologies AG (Germany)

- IR (International Rectifier)

- Martek Power (US)

- Murata Manufacturing Co., Ltd. (Japan)

- PICO Electronics, Inc. (US)

- RECOM Power GmbH. (Gmunden)

- Synqor (US)

- TDK-Lambda Corporation. (Japan)

- Texas Instruments Incorporated. (US)

- Vicor Corporation (US)

- Weiking (China)

- VPT (Heico) (US)

- Other prominent players

Market Segmentation Overview:

By Type

- Isolated DC-DC Converters

- Non-isolated DC-DC Converters

By Technology

- Mil-Spec

- COTS

- Space

By Output Voltage

- <5V

- 12V

- 15V

- 24V

- 48V

- >48V

By Input Voltage

- <28V

- 28-75V

- 75-270V

- 270-800V

- >800V

By Output Number

- Single

- Dual

- Triple

- Multiple

By Aircraft Type

- Fixed Wing

- Commercial

- Defense

- Rotatory Wing

- Commercial

- Defense

- Unmanned Aerial Vehicles

- Commercial

- Defense

- Air Taxis

- Commercial

- Defense

By Form Factor/mount

- Chassis Mount

- Encapsulated

- Brick

- Full brick – 4.6 x 2.4 x 0.5 inches

- Half brick – 2.3 x 2.4 x 0.35 inches

- Quarter brick – 2.3 x 1.45 x 0.35 inches

- 8th Brick – 1/8

- 16th Brick – 1/16

- 32nd Brick – 1/32

- Others

By Application

- Avionics

- Telemetry

- Aircraft Acuation

- Weapon Systems

- Missiles and Defense

- Flight Control System

- Surveillance System

- Environmental Control System

- Energy Storage System

- Power Delivery Network

- Space Systems

- Launch Vehicles

- Digital Loads

- EMI Filters

- LEO Satellite

- Micro

- Mini

- Electronic Warfare

- Others

By End Users

- Aircraft Manufacturers

- Defense Manufacturers

- Maintenance, repair, and overhaul (MRO)

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- Thailand

- Vietnam

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Turkey

- Israel

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)