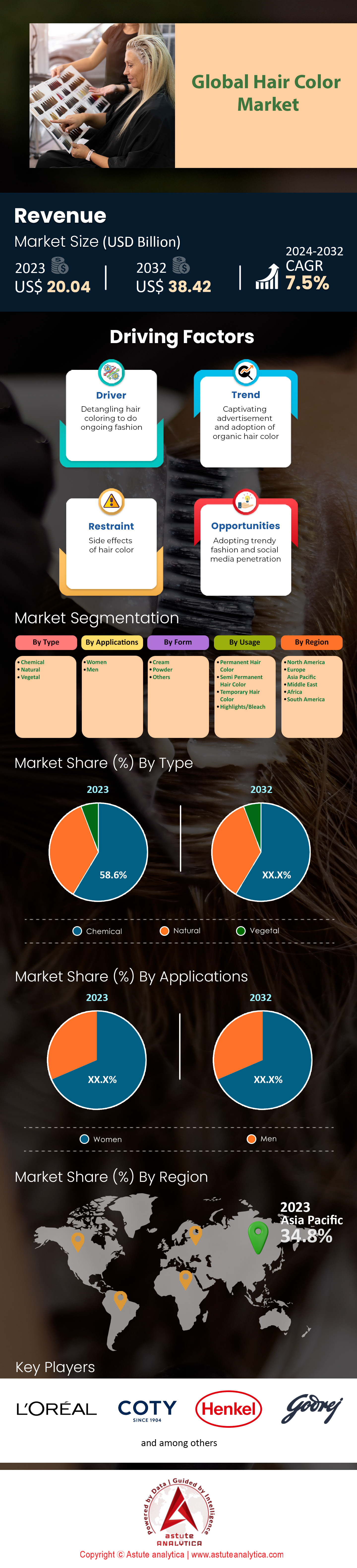

Hair Color Market: By Type (Chemical, Natural, Vegetal); By Application (Women, Men); By Form (Cream, Powder, Others); By Usage (Permanent Hair Color, Semi-Permanent Hair Color, Temporary Hair Color, Highlights/Bleach); By Region— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Nov-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0622258 | Delivery: 2 to 4 Hours

| Report ID: AA0622258 | Delivery: 2 to 4 Hours

Market Scenario

Hair color market generated a revenue of US$ 20.04 billion in 2023 and is estimated to reach the valuation of US$ 38.42 billion by 2032 at a CAGR of 7.5% during the forecast period, 2024–2032.

The global hair color market is poised for substantial growth due to the cutthroat competition that is rooted in both beauty and practicality. One of the dominant factors influencing hair color usage is the fact that the population is getting older – as of 2023, nearly 753 million of the world’s population was aged 65 years and above, with a considerable number of them using hair dye to hide their grey hair and have a youthful look. Gray hair has a negative connotation when it comes to grooming especially for women. Furthermore, social media channels coupled with the emergence of social media influencers have heightened consumer attention towards grooming and fashion. Considering the fact that there were over 4.9 billion internet users in 2023, many customers have begun to see different kinds of hair colors trends on Instagram and TikTok, which influenced them to try them and increased the demand. The global hair color market was estimated at US$ 23.3 billion in the year 2022 and in the coming years it is also expected to grow because of these factors.

Black, brown, and blonde color hues still remain among the most dominant preferred color tones by consumers looking for coverage of their gray hair over natural shades. There is, however, an observable trend for younger consumers to opt for more daring colors such as pink, blue, and purple. This pattern is particularly pronounced for Millennial and Gen Z consumers with more than 60% of them belonging to the global population that is under 40 years of age. These two generations tend to use hair colors for both self-expression as well as identity purposes. In addition cost effective shave gels have been a big winner as well in the market. It is also observed that after the covid 19, most families were forced to stay at home without going to the barber, giving rise to this strong trend in the DIY segment. As per data provided by Retail Measurement in 2023, this segment is estimated at 1.9 billion unit sales globally.

The hair color market has seen giants such as L'Oreal Group with revenues of about EUR 41.18 billion in 2023 thanks to having an active hair color portfolio that includes L'Oreal Paris and Garnier. Another important company is Henkel AG & Co. which is famous for Schwarzkopf and had sales worth EUR 21.5 billion in the same year. They have led the way and developed products with more natural and organic substances to meet increasing consumer needs for safer and greener alternatives. For example, the organic hair color market is estimated to be valued in excess of US$ 1.3 billion in 2022 which points to a considerable boom in the chemical free hair color market. Other more recent changes include the use of advances in technology such as virtual try-on using Augmented Reality - L’Oréal ModiFace technology has been used globally over 10 million times which helps customers to select the right shade of colors before making the purchase. Such developments make the hair coloring process easier and more interactive and hence increase the demand as the consumers turn towards custom made and easy to use solutions.

To Get more Insights, Request A Free Sample

Market Dynamic

Driver: Increasing consumer emphasis on personal grooming and self-expression across all age groups

An essential driver significantly contributing to the growth of the hair color market is a rising global focus on self-grooming and self-expression regardless of the age brackets. The beauty and personal care market grew to approximately US$ 564 billion in 2023 which shows a great deal of focus on appearance. In a survey by Mintel, it was reported that hair coloring products garnered uptake by approximately 76 million consumers over a 6 months in the United States alone. There is a hair color appetence and uptake in the USA. The willingness to color ones hair for the simple reason of self-expression cuts across the nature of population segments. From the consumer perspective, a Astute Analytica’s research report stated that Gen Z, Millennials or Zillennials roughly 2.8 billion across the globe prefer changing hair color due to individuality. Moreover, this trend is not only common among the younger people, quite an interesting development comes from the AARP, which stated that over 50’s Americans, are 52 million who are willing to experiment on their hair colors. This desire has developed into a trend which is why brands have to keep up and meet this diverse market’s needs by expanding their product range suitable for different ages.

Development of cultural shifts is the driver that underscores hair color market growth. The global developments, for instance the events related to the Pride Month, involved around an estimated 150 million people in 2023, many of whom have hair coloring as a means of identity and cause support. Furthermore, the tendency to work from home and through social media has increased appearance awareness; Zoom registered more than 300 million participants to the daily meetings in 2023, resulting people to pay more attention to their personal cleanliness. In transitional economies, the size of the Chinese hair care universe reached US$ 20 billion according to Euromonitor International, among hair care products those concerned with hair coloring enjoyed exponential growth. All these factors highlight grooming and self-image as the key drivers of the hair color market.

Trend: Growing demand for natural, organic hair colors with safer, eco-friendly ingredients

The global hair color is expected to grow tremendously over the next four to five years. Increased consumer demand for “more natural and organic products” has had a profound effect on the development of almost every industry, including cosmetics. Statistics have not been shy in emphasizing the growth. On a similar note, the Organic Trade Association conducted its research and found out that “approximately 82 million Americans are actively looking for organic personal care products” while the Environmental Working Group did have their own claim, which concerned roughly 1200 different types of hair coloring products as containing “potentially harmful chemicals”. In this fashion, “they” began seeking safer alternatives.

Social conditioning has also affected what consumers are continuously courting. A survey concluded that 27% of American grocery shoppers would be willing to pay up to $10 more for products that have been deemed environmentally friendly. Recognizing this “shift”, companies began emphasizing practice of introducing socially responsible and eco-friendly hair dye color products. A good example of one such social responsible organization is Aveda, whose developments have reported earnings of US$ 3.8 billion in 2021 simply for introducing plant based hair color products. In the competitive landscape of hair cosmetics that segment showed tremendous growth from 2015 onwards, ending the year “2021” with revenue at approximately US$ 36 billion, reinforcing the effectiveness of Aveda's marketing strategies.

This trend in the hair color market is being pushed forward by innovation, according to the World Intellectual Property Organization (WIPO), over 500 applications were made globally in 2023 for hair color formulations. Brands are engaging in more research and development in order to devise solutions that are beneficial yet chemical free. The proliferation of henna based products saw sales reach more than US$ 200 million worldwide. Furthermore, social media corroborates this interest; over 5 million posts were tagged with #naturalhaircolor on Instagram in 2023. Putting these facts together shows how natural and organic hair colors are turning into a considerable trend in the market moves.

Challenge: Health concerns over chemical ingredients causing skepticism toward traditional hair color products

In 2023, using conventional hair color products has turned out to be a significant health challenge in the hair color market, as people started worrying about their chemical ingredients. Reports and literature are documenting allergies and other illnesses. Only in the US, the American Contact Dermatitis Society reported more than 38,000 cases of hair dye allergy. IARC has put some compounds of hair dyes into the list of possibly carcinogenic substances. Subsequently, investigational efforts have been directed towards the substances. In particular, in the US, the Food and Drugs Administration reported that 15,000 complaints about hair color products have been received during the period of growing anxiety of consumers.

Increased public anxiety is online information sharing. The report published in 2023 revealed that 93 million Americans used the internet for self-research concerning health issues, one of which was whether hair dye is safe. Meanwhile, the film "Toxic Beauty", which has gathered 20 million views around the world, demonstrated the dangers of everyday beauty products, particularly hair dyes. This practice in the hair color markethas triggered actions; in fact 65 million consumers did not buy the products according to a survey by BeautyCounter.

Shrinking the scope of adverse impacts caused by such products is now the focus of regulatory authorities. European Chemicals Agency indicates that due to the new restrictions implemented by the European Union the number of formulations that can be used has tappered to over 100 hair dye formulations. U.S. Congress decided that it is time to introduce a new act. The Safe Cosmetics and Personal Care Products Act of 2023 intends to set rules for the use of various ingredients in hair coloring products.

Segmental Analysis

By Type

Due to their applicability and long-lasting effects, chemical hair color leads the hair color market with around share of 59%. These items are top sellers among do-it-yourselfers and professional hairdressers because they provide a wide range of over 200 colors to suit different client needs. The fact that these hair dyes can completely mask grey tresses explains why they are so widespread. Approximately 80% of hair bleaching treatments at the hair salon incorporate chemical in them, highlighting their usefulness and effectiveness. Among the most common ingredients in these dyes are ammonia, hydrogen peroxide, and p-phenylenediamine (PPD). Ammonia helps with color application within the hair strand while hydrogen peroxide helps with lifting the natural color. A wide range of shades is provided because of PPD dyes which are used as a primary colorant.

The positive change brought about by these chemicals is their ability to ensure the vibrant and permanency of a particular color, with the manufacturer claiming a 15% reduction in cost of production as compared to natural products. This is important in light of the fact that the average price of a chemical hair dye is reasonable so that it does not discourage consumer uptake. Besides, over 70% of the consumers in the hair color market indicate that they are happy with the results, mainly because the outcome is both dramatic and predictable. Moreover, the availability of synthetic components makes production of chemical hair colors cheaper and economical. The world market for ammonia, PPD continues to be in equilibrium. This tends to lead to low production cost. Additionally, the average selling price for chemical hair dyes is relatively lower when compared to natural hair dyes, making it available for larger audiences. This lower price, together with the effective outcome, helps chemical hair colors further consolidate their place as the most effective options in the market.

By Application

Over 68% of the sales of hair color products are attributed to women in hair color market. This could be due to the beauty standards that hair is associated with many women in society. The beauty industry claims that younger women between the ages of 18-34 are a true force of the market as they have the habit of repetitively changing their colored hair at least once in a year. Hair fashionistas as such tend to be more influenced by fashion and want to express themselves better than their male counterparts. Women all over the world are changing their hair colors with the help of media social networks like Instagram and Tik Tok. New hair colors are popular on social platforms with new colors introduced by an influencer or a celebrity – new colors that millions of followers want to try themselves. Clips and posts featuring hair color changes generate more than a billion views per year which is astonishing to say the least. Brands cash in on these insights by creating campaigns with relevant female influencers who promote their products and experience a rise in engagement rates by 25%.

The widespread availability of tutorials and user-content in the hair color market also enables women to try new colors themselves contributing to a noticeable difference in the consumption rate. To meet such expectations, manufacturers are developing women-oriented products and marketing them as their focus is on offering women a range of shades and formulas that reduce hair damage. In 2023, more than 150 new shades were launched targeting women’s issues like dryness and sensitivity. According to retail figures, women’s hair color products bring in three times more sales volume than those intended for men. Salons further state that around 75% women approach hair coloring as clients, demonstrating once again the imbalance in the use of hair color. Mass of educational materials and tutorials are mostly directed towards females suggesting that women are the leading group of hair color users.

By Form

According to estimates, hair cream occupies a staggering 62.3% of the hair color market globally which makes it the most sought after hair color type. Data from retail sales in 2023 show that creams are more popular than powders by almost 3 to 1 ratio. Due to this, it’s not surprising that creams enable clean application with even coverage and minimal dripping. Thus, these can be particularly advantageous for individuals wishing to dye their hair at home without professional tools or skills, as their smooth texture enables easier and cleaner applications or ‘coloring in between the lines’ if we may. The shocking reality however is that over 80 percent of hair colors shown on TV are cream-based, which is indicative of the extent these have taken over the market.

Interestingly, around 70 percent of the individuals that used cream-dyed colorants revealed that the texture of their hair improved. A major boon to the hair dying industry is the ability for cream based dyes to hold more oil and color pigments than powder based ones, increasing their appeal. Not only this but manufacturers have also recalled a boost of 20 percent improvement in client satisfaction rates when compared with powder formulations. The studies in the hair color market reported the comfort, effectiveness, and value addition in the products as the highest determinants of consumer behavior. According to them, hair color creams satisfy these needs and hence are more popular than the powders. The shift towards self-hair dying especially among the younger generation stimulates the need for further more of the creams. In line with this, companies have diversified their product portfolios to encompass cream products with over two hundred different shades to target a wide range of consumers’ preferences.

By Usage

Permanent hair colors are the most used category globally, with companies in the hair color market deriving over 60.4% of their revenue from these products. The appeal of permanent dyes lies in their efficiency of use. Once applied, they do not have to be reapplied quite frequently. Such durability is particularly valuable to those who want to change their grey hair or most of the time their natural hair color even once a short period of time it is cost effective and also eliminates the need for much more effort in the process. The major customers of permanent hair color are people aged 25 and above particularly because this their most likely to have begun suffering from grey bald spots on their scalp. This segment helps boost demand, further establishing global aging populations as major contributors of growth to this market. Customers who want to very boldly change their hair styles use permanent dyes. Makeup salons are highly dependent on permanent hair colors as 85% of color services rely on their application because these provide effective and high-grade end results.

Some of the popular hair color products in 2023 across the global hair color market include L’Oreal’s Excellence Crème, Garnier’s Nutrisse Nourishing Color Crème and Clairol’s Nice’n Easy. Such products contain ingredients with technologies that hold color well while reducing the damage done to the hair which compounds the effect of care along with efficacy that the consumers seek. More than 250 shades to choose from and different formulations for different hair types increase the choice for the consumers. The marketing strategy focuses on the durability and cleanliness features of the permanents hair colors and have thus made the consumption of these substantial on a continuous basis.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The Asia Pacific with over 35% market share is undoubtedly leading and expanding its market share due to its young population willing to try new hairstyles. It comes from the prominent impact of social media networks such as TikTok and Instagram, and the growing penetration of quality and professional hair coloring services. In particular, e-commerce has expanded very rapidly, and in 2023, online sales of hair color products outpaced retail channels by 20 million units. The emergence of the local manufacturers, targeting the region has increased the competition such that South Korea and Japan have turned out to be centers of innovation for ammonia free and damage repair hair colors. In 2023, South Korea saw the rise in sales of hair products containing traditional herbal medicine ingredients by 15% as such products have gained a big market among health-conscious people. Moreover, men’s grooming is a booming branch, where men’s hair color has contributed up to 10 million units of sales in the region.

North America retains its position as the second largest hair color market, with the United States at the forefront. The U.S. beauty industry is known for quite a considerable customer expenditure as well as a degree of willingness for customizing. The year 2023 witnessed the advent of more than 200 tailored kits for hair coloring that were designed for different hair types and preferences. The consumption for organic and sulfate free hair dyes is also increasing steadily as there are now more than 400 manufacturers producing eco-friendly products. Professional salon services represent a good share of the market, for there are more than 50,000 clinics in the country that use advanced techniques of hair coloring.

In North America, the multicultural population increases the demand for various hair color solutions because the products are designed according to different ethnic groups and different hair types. The men's hair color market segment has also witnessed tremendous growth having sold over 5 million units in 2023 as their grooming norms tend to change. Digital marketing, influence of celebrities and social media affect consumer buying behavior where 10% of sales are attributed to on-target advertising campaigns by influencers. A desire to appeal to health-conscious consumers with the help of damaged hair protection formulas as well as long-lasting colors assisted in maintaining North America’s position in the global hair coloring market which is also enhanced by the advancements in technology for hair coloring.

Top Companies in Hair Color Market

- Henkel Corp.

- Kao Corp.

- L’Oréal

- Coty, Inc.

- Developlus, Inc.

- HOYU Corp Ltd.

- Godrej

- Revlon

- World Hair Cosmetics (Asia) Ltd.

- Amorepacific

- SHISEIDO CO., LTD.

- Unilever Group

- The Estee Lauder Companies Inc.

- Combe Inc.

- Other Prominent Players

Market Segmentation Overview:

By Type

- Chemical

- Natural

- Vegetal

By Application

- Women

- Men

By Form

- Cream

- Powder

- Others

By Usage

- Permanent Hair Color

- Semi-Permanent Hair Color

- Temporary Hair Color

- Highlights/Bleach

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The U.K.

- Germany

- France

- Italy

- Spain

- Poland

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 20.04 Billion |

| Expected Revenue in 2032 | US$ 38.42 Billion |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Bn) |

| CAGR | 7.5% |

| Segments covered | By Type, By Application, By Form, By Usage, By Region |

| Key Companies | Henkel Corp., Kao Corp., L’Oréal, Coty, Inc., Developlus, Inc. , HOYU Corp Ltd., Godrej, Revlon, World Hair Cosmetics (Asia) Ltd., Amorepacific, SHISEIDO CO., LTD., Unilever Group, The Estee Lauder Companies Inc., Combe Inc., Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0622258 | Delivery: 2 to 4 Hours

| Report ID: AA0622258 | Delivery: 2 to 4 Hours

.svg)