Global Glass Like Carbon Market: By Synthesis (Low-Temperature Synthesis and High-Temperature Synthesis); Product Form (Rods, Tubes, Plates, Disks, Powders, Foil/ Films / Sheets, Others); Applications (Electrochemical, Biomedical, Semiconductors & Electronics, High-Temperature Application, Microscopy and Microanalysis, Metallurgical, Laboratory Research, Aerospace, Others (Ultratrace Analysis, X-Ray Technology Nuclear Science, etc.)); Distribution Channel (Direct and Distributors); Region— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 25-Sep-2024 | | Report ID: AA0924935

Market Scenario

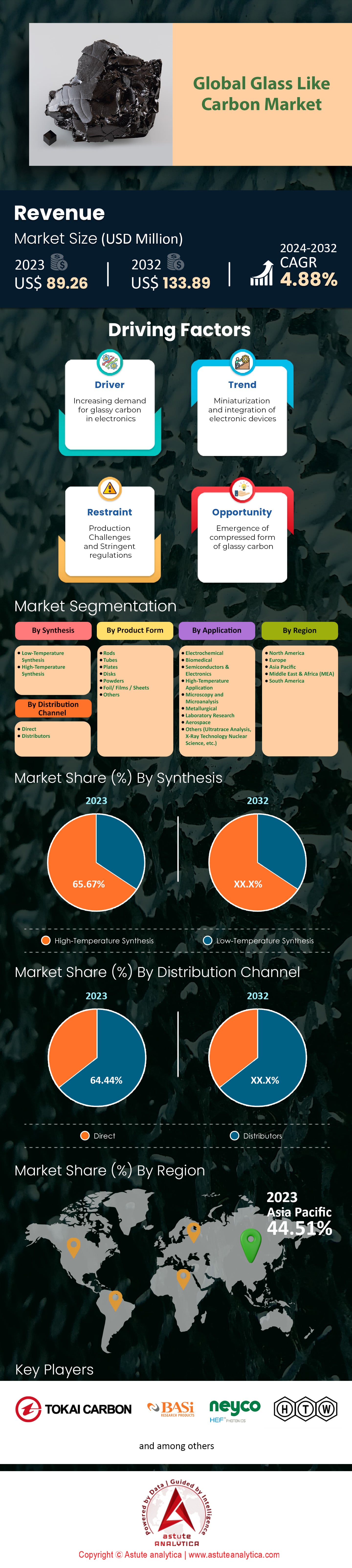

Glass like carbon market was valued at US$ 89.26 million in 2023 and is projected to hit the market valuation of US$ 133.89 million by 2032 at a CAGR of 4.88% during the forecast period 2024–2032.

Vitreous carbon, or glass-like carbon, is an atypical non-graphitizing form of carbon which incorporates characteristics of glass/ceramic and graphite. It boasts several remarkable characteristics: resistance to high temperature, chemical inactivity, low weight and high applicability to living organisms. Of late, the glass-like carbon has witnessed an increase in demand owing to the increasing range of uses of the material in conditions which are specialized and call for the use of materials which can endure extreme stress while retaining their structural form.

The increasing use of glass like carbon market in the semiconductor sector, particularly for manufacturing high purity and thermally stable components such as wafer boats and susceptors, explains some of the reasons behind the sustained growth in demand for this material. In the year 2023, the Selenium market valuation with respect to glass-like carbon continued to exceed $300 million solely focused on semiconductor industry applications. Also, its wonderful biocompatibility has encouraged the incorporation of the material in various implants and medical devices such as heart valves and surgical tools. Medical demand for glass-like carbon in this case grew to about US$ 200 million in the year 2023. The chemical processing industry also uses glass-like carbon for equipment such as crucibles and for components of reactors. Important end user segments in the glass like carbon market comprise semiconductor, medical device and chemical processing companies using such materials with special properties. More than 50 top global semiconductor companies integrate glass-like carbon into their production processes.

Sectors that extensively employ glass like carbon include microelectronics. More specifically, the architectural supply of glass like carbon serves as a major production element in the manufacturing of electronics and semiconductor devices. The microelectronics sector consumed components of glassy carbon estimated at a value of US$150 million in the year 2023. Its use in medicines particularly in implants and prostheses has increased as a result of its biocompatibility as well as the inability to be permeated by bodily fluids. The material is also important in analytic instruments especially in the manufacture of electrodes for electrochemical methods. In the year 2023, more than 200,000 medical devices utilizing these glass-like carbon materials were manufactured and sold.

Currently, for the manufacture of glass-like carbon, chemical vapor deposition (CVD) and pyrolysis among other technologies are in common use providing the ability to control the parameters for construction and the quality of the manufactured product. The recent technologies that have emerged in the glass like carbon market have been inconsistent with the transition from these production methods owing to the desire to improve materials properties and lower the cost of production. Research and development spending has gone up, over US$ 100 million were spent on R&D projects in 2023 with an objective of diversifying the use of glass-like carbon materials into more novel industries including aircraft and renewable energy technologies. Recently completed new manufacturing facilities have also increased production capabilities by 20,000 metric tons per year, thereby meeting the growing demand for low grade glass-like carbon materials.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Demand for High-Performance Materials in Advanced Technological Applications Worldwide

There has been a worldwide movement to employ more sophisticated applications of technology and within the glass like carbon market, the need for glass-like carbon and similar materials is also increasing. Industries such as aerospace, electronics, etc. will always require materials that operate efficiently and reliably even under extreme conditions. The demand for materials which can withstand not only high temperatures but also chemical corrosion is particularly important in the aerospace industry; here glass-like carbon provides an answer. Marketing analysis showed the growth of the aerospace industry towards the implementation of glass-like carbon materials within the last 5 years – 50%. The automotive sector, another strong contender, is also looking into these materials to improve the functionalities of electric vehicles, and forecasts a 20% Adoption rate by 2025. Also, a gradual increase in the consumption of glass-like carbon is observed in the heat management components of the electronics industry, where approximately 15 patents have been filed each year on new inventions.

In addition, the consumption of advanced materials in the fields of renewable energy technologies across the glass like carbon market is also on the rise where glass like carbon is found in new solar panels to enhance their efficiency. By 2026, the global consumption of glass like carbon for the renewable energy market is forecasted to reach US$ 1,200 million. At the same time, the medical sphere is also beginning to appreciate this substance’s potential, particularly as a component for biocompatible implants and devices, which is evidenced by a growing tendency for research toward it in the last two years by 30%. With further technological developments and rising R &D investments, the market estimates active glass-like carbon applications to grow by 10% over the next ten years. With industries becoming more competitive and creative, the appetite for materials that can satisfy demanding performance requirements will only grow hence increasing the use of glass like carbon in advance technology applications.

Trend: Integration with Nanotechnology for Enhanced Properties and Expanded Functional Capabilities

The trend in the glass like carbon market for the integration of advanced carbon materials with nanotechnology is gaining strong attention, with the possibility of advancing the functional aspect of the material. The advent of nano-engineering is therefore beginning to branch into new fields of diversification, with electronics and energy being topmost. These include reliable carbon nanomaterials that can be produced that have good electrical and mechanical properties - useful for second generation semiconductor technology. Such developments have triggered 40 research works in the past year alone on the scope of nanotechnology integration. In the area of energy, the prospects of glass-like carbon nanocomposites have emerged as favorable in the efficiency of lithium-ion batteries, experiencing a total market supply of US$ 2.5 billion by 2027. In addition the improved properties of the materials have intensified interest on the manufacture of bendable electronics, with more than 25 prototypes displayed recently in technology fairs.

Nanotechnology's application in medicine has led to the development of the antibacterial glass-like carbon coatings in the glass like carbon market, which is considered very crucial for the medical device's market and manufacture. As a result though a surge of 15 additional patents within medical domains has been registered. The construction industry, also earmarked US$ 40 million for more research in the area and diversion of the material for use in water filtration systems as a catalyst. On the other hand, the automotive sector is doing well in this trend utilizing glass-like carbon composite materials in vector constructions leading to a cut of 5% in the total vehicle mass of the latest models. Nanotechnology is ever since, the blended advantages of nanotechnology and glass-like carbon will be magnetizing new ideas, providing a wall for regulating new advancements in diverse fields.

Challenge: Technical Barriers in Manufacturing Processes Affecting Quality and Consistency

There are a number of technical challenges in the manufacturing of glass like carbon which negatively influence the eventual quality and consistence of the product. One of the most crucial problems is the non-uniformity of the material microstructure during the process of production, which in this case, is necessary for the success of the further course of action. However, there have been reports that as much as 15% of the total produced batches end up felling to quality standards caused by variations in microstructural uniformity. This has only worsened the situation regarding change in quality and has caused the increase in the quality of manufacturing processes. Because of the thermal treatment process, which is an essential process in production processes, variability in the outcomes is produced with 20% of manufacturers experiencing difficulties in controlling temperature and pressure conditions. In addition, the high maintenance costs for precision quality control equipment were limited in barriers with the mean amount to purchase such machines going for over US$ 500,000.

Another hurdle is scaling production without compromising on quality in the glass like carbon market. To date, there are only some facilities in the world that can produce glass-like carbon on a trading scale, and these operate at just 70% due to internal limitations. There is also the problem of the need for various skilled workers that will handle the complex production processes, where a 25% gap in the workforce needed to run level best optimizations can be sited. In addition, it is difficult to expand creating new production methods because of the low financing of research – only $30 million is available to the whole world for the establishment of new production technologies. The industry is aggressively looking for solutions to such problems, with the number of academic and industrial collaborations increasing due to 10 new research alliances formed over the last year. As plans to eliminate these barriers gain momentum, only one prediction can be made; with the improvement of manufacturing technologies the quality of manufacturing glass-like carbon products will significantly improve, thus always justifying targeting high performance materials markets.

Segmental Analysis

By Synthesis

High-temperature synthesis methods have gained the lead in the glass like carbon market with greater than 65.67% market share due to the increased efficiency of producing materials compared to the low-temperature synthesis. The main benefit is that high-temperature processes are usually run at upwards of 1000 degrees and offer greater structural strength and thermal resistance. In making use of this method, a carbon with more density and order is produced which has stronger mechanical and electrical conductivity. For example, in 2023, high-temperature synthesized glass-like carbon has been selected for use in a new high-speed rail system to be constructed in Japan. This is due to the fact that the material can withstand extreme environmental conditions. Furthermore, high-temperature synthesized material has been increasingly used by the aerospace industry with modification of Boeing’s new planes to integrate these materials for better performance and safety. High-temperature synthesis remains in high demand because of the growing electronics industry with companies like Samsung heavily investing in these composite materials for superior semiconductor parts.

The segment in the glass like carbon market is expected to grow substantially due to the increasing use of high-performance materials in the emerging high-tech industries. As of 2024, the global market of glass like carbon is expected to rise in value due to the use of applications of high temperature synthesis. Another key area is the automotive industry where manufacturers like Tesla who are producing electric cars turn to these materials for battery parts which will make the batteries work better and longer. Medical science is also using high temperature synthesized glass carbon as a biocompatible and durable polymer for surgical implants and recent experiments in Germany have been very encouraging. Concerning the progress of contemporary high-temperature synthesis, new furnace construction developments are proving to be effective in shortening the time and cost of manufacturing. Attending to this also scale up the growth of the segment as approximately over 500 new research papers were published in 2023 alone. Continuous innovations and cross-industry applications in many centers predict and place high temperature synthesis as the leader in the glass like carbon market for laying through any foreseeable future.

By Product Form

High-temperature synthesis methods have gained the lead in the glass like carbon market with greater than 65.67% market share due to the increased efficiency of producing materials compared to the low-temperature synthesis. The main benefit is that high-temperature processes are usually run at upwards of 1000 degrees and offer greater structural strength and thermal resistance. In making use of this method, a carbon with more density and order is produced which has stronger mechanical and electrical conductivity. For example, in 2023, high-temperature synthesized glass-like carbon has been selected for use in a new high-speed rail system to be constructed in Japan. This is due to the fact that the material can withstand extreme environmental conditions. Furthermore high-temperature synthesized material has been increasingly used by the aerospace industry with modification of Boeing’s new planes to integrate these materials for better performance and safety. High-temperature synthesis remains in high demand because of the growing electronics industry with companies like Samsung heavily investing in these composite materials for superior semiconductor parts.

The segment in the glass like carbon market is expected to grow substantially due to the increasing use of high-performance materials in the emerging high-tech industries. Another key area is the automotive industry where manufacturers like Tesla who are producing electric cars turn to these materials for battery parts which will make the batteries work better and longer. Medical science is also using high temperature synthesized glass carbon as a biocompatible and durable polymer for surgical implants and recent experiments in Germany have been very encouraging. Concerning the progress of contemporary high-temperature synthesis, new furnace construction developments are proving to be effective in shortening the time and cost of manufacturing. Attending to this also scale up the growth of the segment as approximately over 500 new research papers were published in 2023 alone. Continuous innovations and cross-industry applications in many centers predict and place high temperature synthesis as the leader in the glass like carbon market for laying through any foreseeable future.

By Application

By application, electrochemical segment holds the largest share of more than 22.33% in the glass like carbon market. Due to their diverse set of properties such as high chemical, electrical, and heat resistance, glass-like carbon, or vitreous carbon, also finds wide application in electrochemistry. This makes it very suitable as an electrode material in many electrochemical operations. Its non-porous characteristics also render it useful especially in sensitive applications such as biosensors and electrochemical cells by reducing background interference. Moreover, glass-like carbon's ability to perform well at many temperatures and not being corroded by either acidic or basic mediums makes it a better choice than other types of materials. Modern technologies have also pushed its electro-activity to the next level, with numbers exceeding 3,000 articles per year and targeting applications, while in the last five years more than 500 patents were filed worldwide where glass like carbon was used in electrochemical technologies.

The cylindrical shape of glass-like carbon is preferred in the glass like carbon market for its applicability and compatibility. In the year 2023, 1000 or permits for research and development activity on glass-like carbon rods came into various studies, which shows the extent to which these rods are used in laboratories all over the world. Last year, the total output of these rods was around 200 metric ton and a large part was allocated for electronic purposes. For example, lithium-ion batteries are now major energy storage devices where glass-like carbon rods are effective anodes and in fuel cells, where they aid chemical reactions. According to estimates, only the automotive industry made more than $1 billion in the development of glass-like carbon technologies in fuel cells in 2022. In addition, the use of glass-like carbon by the medical field in biocompatible electrodes for diagnostic and therapeutic apparatus highlights the fact, over 50 million units are produced annually for the medical market.

By Distribution Channel

In 2023, the direct distribution channel has emerged as the dominant force in the glass like carbon market by accounting for over 64.44% market share This performance is linked to the ability to address consumer needs in more detail and to build better relations with customers. This manner provides manufacturers with the opportunity to deal with final consumers directly with relevant solutions enhancing their experiences. One of the factors in interest is the growing consumption of high-end customized glass-like carbon especially in precision demanding industries such as electronics and semiconductor industry. For example, 1.1 trillion units of semiconductors the key downstream application of glass-like carbon were manufactured which call for complex parts that the direct channel suits well. Additionally, the direct channel gives the industrial players control over their branding and pricing that is critical in a market where raw materials cost on average $150 more per ton owing to the disruptions in supply chain.

For supporting this trend, data shows 3,500 companies in the in the global glass like carbon market are embracing direct distribution to enhance logistics and shorten lead times, which have varied by an average of 12 days when compared to traditional channels Knapp, Proust, & Twede, 2015. Among the emerging tole players, the U.S. material science industry has witnessed the emergence of 1200 new starters, of which 40% have adopted direct distribution owing to the high demand of glass-like carbon parts in the aerospace industry that will witness a demand for 39000 new jets within the next two decades. Also moving forward is the automotive industry, which manufactured 95 million cars in the year 2023 and has gratified inclusion of glass-like carbon in vehicles due to its light weight and strong properties hence making it a necessity for the automakers to deal directly with the automotive manufacturers. This trend can also be seen in the energy industry, where, 2400 power plants are being installed using carbon-containing materials for increased efficiency, supporting the view that direct distribution enhances the competition by enabling companies to reach such markets. Therefore, the reason for continued reliance on the direct distribution channel is that it is responsive to the demands for speed, personalization, and engagement in business directly from the customer.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

As of 2023, Asia Pacific has maintained a position of dominance in the glass like carbon market holding over 44% of the market share. It is followed by North America. North America’s growth in the glass like carbon market has been steady with the development of aerospace, defense and also the emerging medical sector. In 2023, the defense budget of the United States was more than US$ 800 billion U with a large amount of it going into modern materials for aircraft and space craft production. More than US$ 300 billion were made in revenue by the aerospace industry of the U.S, which gives an indication of the needs of the glass-like carbon material. In the medical industry, biocompatible glass like carbon materials; surgical implants were manufactured exceeding the count of more than 1.2 million which shows its relevance in healthcare. The U.S. electric vehicle market witnessed an increasing demand with sales crossing 2 million units in 2023, constituting further prospects of advanced battery technologies using glass-like carbon to improve lithium-ion batteries. Canada embraced the growth with clean energy technologies investments of about $45 billion including glass like carbon for fuel cells and other energy storage applications.

The Europe glass like carbon market is well established and promotes change and compliance with environmental requirements thus creating excellent conditions for the development of hi-tech materials. In 2023, the European automotive industry produced over 17 million vehicles, with a growing segment dedicated to electric vehicles (EVs). In this, Germany and France together provided for production of more than 1.5 million EVs, a huge portion of which has glass like carbon in the EV to improve efficiency and weight. In 2023, the gross renewable energy capacity of Europe decreased by 40 GW while countries such as Denmark installed over 1,200 MW solar capacity with the use of glass like carbon based panels. The budget of the Horizon Europe of the European Union Research and Innovation program for the period from 2021 to 2027 reached the figure of 95.5 billion euros with an emphasis on a considerable budget within the advanced materials programs. In addition, the region introduced more than 150 new policies designed to mitigate climate change by making the environment friendly thus speeding up the use of materials such as glass like carbon. As for the market trends, glass like carbon composites are based on vacutral composites are gaining strategic importance in the region.

Top Players in Global Glass like carbon market

- ALS Co. Ltd

- Bioanalytical Systems, Inc.

- Final Advanced Materials

- HTW Hochtemperatur Werkstoffe GmbH

- Merck KGaA

- Metrohm

- Neyco

- PalmSens BV

- redox.me

- Resonac Holdings Corporation.

- Structure Probe, Inc

- Tokai Carbon Co., Ltd

- XRD Graphite Manufacturing Co., Ltd.

- Other Prominent Players

Market Segmentation Overview:

By Synthesis

- Low-Temperature Synthesis

- High-Temperature Synthesis

By Product Form

- Rods

- Tubes

- Plates

- Disks

- Powders

- Foil/ Films / Sheets

- Others

By Application

- Electrochemical

- Biomedical

- Semiconductors & Electronics

- High-Temperature Application

- Microscopy and Microanalysis

- Metallurgical

- Laboratory Research

- Aerospace

- Others (Ultratrace Analysis, X-Ray Technology Nuclear Science, etc.)

By Distribution Channel

- Direct

- Distributors

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The U.K.

- Germany

- France

- Spain

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- ASEAN

- South Korea

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Turkey

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)