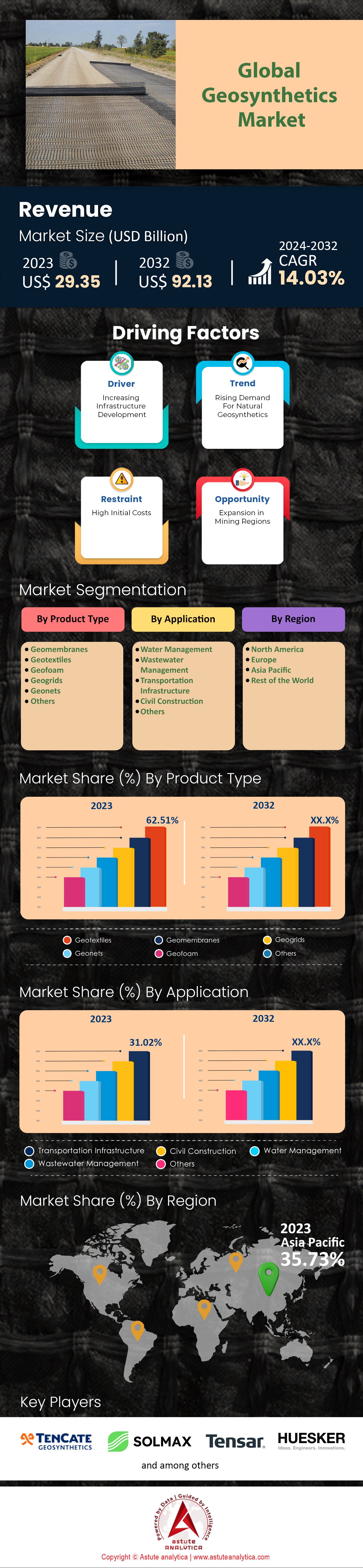

Global Geosynthetics Market: By Product Type (Geomembranes, Geotextiles, Geofoam, Geogrids, Geonets, Others); Application (Water Management, Wastewater Management, Transportation Infrastructure, Civil Construction, Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Sep-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0924919 | Delivery: 2 to 4 Hours

| Report ID: AA0924919 | Delivery: 2 to 4 Hours

Market Scenario

Global Geosynthetics market was valued at US$ 29.35 billion in 2023 and is projected to hit the market valuation of US$ 92.13 billion by 2032 at a CAGR of 14.03% during the forecast period 2024–2032.

Geosynthetics refers to synthetic substances used in Geotechnical and construction engineering for essential actions of separation, filtration, drainage, reinforcement and containment. The geosynthetics market is on the upsurge market owing to the factors such as the rapid development of infrastructure in developing countries and increased environmental compliance. In fact, already last year, roads over 50,000 kilometers long incorporated geosynthetics for durability and maintenance reduction. Further, the need to cater to ecological impacts has resulted in locating around 2000 new waste landfills employing geosynthetics for enhanced containment and less environmental deterioration. This trend has also been fueled by the adoption of green building, whereby more than one thousand five hundred building projects undertook geosynthetic materials to the adverse effects on the environment.

Significant end users of geosynthetics market are the construction, transportation, and waste management industries among other sectors. For example, stabilization for roads and railways are the common measures undertaken to control erosion on riverbanks and coastal areas. More than 10,000 kilometers of railway tracks have somehow been supported by modern manufactured renoprotections over the last 20 years, allowing these infrastructures to withstand wear and tear from the elements. The same development has been registered in the civil engineering industry where over three thousand hectares of land have been reclaimed with the use of geosynthetics for soil erosion and stormwater control. Certain market shifts include scientists working on new generation geosynthetics that can “feel” the load and deformation in real time, with current 500 projects testing such smart materials. Moreover, the growing concern for environmentally friendly geosynthetics that can be biodegraded after use has motivated over 200 pilot programs aimed at long-term environmental sustainability.

The leading players of the geosynthetics market such as Agru America, GSE Environmental, TenCate Geosynthetics, Huesker Group continue to remain innovative in their approach. For example, last year Agru America participated in more than 100 different research projects in order to improve the functionality and ecological features of geosynthetic materials. These companies also enhance their production capabilities with newest manufacturing plants being constricted all over the world to supply the growing need. The construction industry in the Asia-Pacific region, especially in China and India, has flourished, with more than 5000 new geosynthetic applications implemented annually. The countries of Europe and the North America regions are also important markets as they continue to upgrade their civil infrastructure, and restore environmental health. In this manner, the geosynthetic market appears to be on a limit to upward growth due to technical progress and the world’s movement towards environmental-friendly methods.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Demand for Infrastructure Development in Emerging Economies Boosts Geosynthetics Usage

The geosynthetics market has had positive development as a result of significant increase in the infrastructure development activities in developing countries. India, China, and Brazil are examples of countries which have led in this growth pattern with India which has its infrastructure development plan of US$1.5 trillion over the next five years. The One Belt One Road initiative by China is a massive program that will involve over 60 countries with a proposed amount of US$ 4 trillion. Brazil which is seeking to improve its transport and logistics network is set to spend $50 billion on roads and rail projects. The World Bank Continental Agency has provided US$ 2 billion in credit for the Asia so it could be anticipated more and more interest to the geosynthetics materials.

These changes have resulted in large-scale application of geosynthetics market in a variety of areas such as construction of roads, railways, and water systems. In the year 2023 the global market of road construction took up to a height of g105 billion and geosynthetics so much improved the performance and safety of roads. The Indian government is reporting an annual addition of 8000 km of new road of which a lot of geosynthetics use being applied is reported. In construction projects of China geosynthetics have been extended to use anyways every year 800 million square meters geos synthetics are used. Also, it is expected that geosynthetics would be extensively used in other projects as the transcontinental highway system planned by African Union as developed.

The rising interest in geosynthetics may also be as a result of the increased demand for environmental solutions in construction activities. In the case of geosynthetics, there is scope available for a rational approach towards development in view of the emerging economies. Increased attention on sustainable urbanization has resulted in US$ 30 billion investment in water management systems in India and US$ 40 billion in China out of which geosynthetics are required for preventing soil and water erosion and for efficient water management systems respectively. Thus, the growth of geosynthetics market is expected to be considerable with moderate estimates projecting market worth of US$ 25 billion by 2025..

Trend: Growing preference for geosynthetics in road construction to enhance longevity and safety

Geosynthetics has increasingly been accepted as a developing trend in the construction of roads because of the benefits enjoyed in terms of road improvement. Geosynthetics assist in improving road pavement structural performance by minimizing the costs incurred and enhancing the serviceable period. According to the Federal Highway Administration in the United States, the amount of structural enhancement gained through the twentieth century activity on the use of geosynthetics can add further 50 years on road life infrastructure. In Europe geosynthetics market, the annual expenditure on road maintenance is about US$ 30 billion, where geosynthetics are deployed to help reduce spending.

Furthermore, geosynthetic materials are deployed in road construction operations in most countries including India, which has an annual geosynthetics consumption of 200 million square meters. Likewise, in China the ministry of transport has made it compulsory to use geosynthetic materials in highway construction with the annual consumption of 300 million square meters. The use of geosynthetics across the EU has been incorporated into other plans with the Trans-European Transport Network $500 billion initial infrastructure development program.

There is also the urge to use geosynthetics market to improve how safe a road is. By increasing the load carrying capacity of roads, geosynthetics help to reduce the chances of failure of the roads which could lead to accidents. The market value for geosynthetics specifically for road construction was more than US$3 billion and it indicates growth trends in the year 2023. Such is the Asia-Pacific region where the market is US$1.2 billion, which is a focus of construction activities. Since most of the countries are making active efforts to build better and more reliable transportation systems such geosynthetics applications in roadworks will be on the rise with the market in question estimated at US$4 billion by the year 2026.

Challenge: Fluctuating raw material prices impact geosynthetics production costs and market stability

The geosynthetics market is under pressure in particular because of the raw materials price volatility. The most important constituent raw materials in the geosynthetics synthesis process polyethylene and polyester have fluctuated in prices which have affected the cost of manufacturing. As in 2023, the price of polypropylene reached $1800 per metric ton and polyester $1500 per metric ton. These fluctuations are the result of the influence of other factors such as global supply chain disruptions, geopolitics, and fluctuations in crude oil prices. The pain caused by raw material price dynamics renders increasing production costs to the geosynthetics manufacturers.

In particular in the United States geosynthetics market, within a span of one year production figures have risen by 15% thus increasing the sale price of geosynethetix in the market. In Europe, production costs reported by some manufacturers have been increased by $200 per ton impacting on the profits earned. In the same manner, in Asia, geosynthetics production cost has been expanded by US$150 per ton making it difficult for manufacturers to offer their products at competitive prices.

Geosynthetics are increasingly adopted in infrastructure development, which on one hand presents new opportunities to grow the industry, but on the other, poses another hurdle due to the ever-present need to decrease costs. Market value in the year 2023 of the global geosynthetics industry was US$11 billion and forecast showed this could rise to $13 billion by 2025. However, what threatens this growth trend are the ups and down of the cost of raw materials because manufacturers find it difficult to produce in relation to the market. In response to this problem, companies are looking for other raw materials and creating R&D work to try to improve the efficiency of manufacturing processes. Nevertheless, as the geosynthetics industry addresses the above-mentioned issues, the objective is always to bring stability to the market as well as the unceasing provision of top-quality geosynthetics in construction works across the globe.

Segmental Analysis

By Type

Among all type of geosynthetics market, geotextiles have been recognized as the leading, with more than 62% market share owing to their many uses and properties that can solve several engineering problems at hand. Such fabrics that allow water to pass through can be used in soil reinforcement, erosion control as well as for drainage and separation. Expansion in the global geotextile market will be significant with recent reports estimating the market valuation at over $7 billion in 2023. One of the contributors to this growth is the development of infrastructure, especially in countries with increasing urbanization requiring quick and cost-effective construction. On this note, the use of geotextiles in the construction of pavements and railroads has risen, with the pavement construction sector alone using about 1.5 million square kilometers of geotextiles a year.

Another factor that drives development for geotextiles is their economic and environmental advantages. Geotextiles in the geosynthetics market further provide an innovative approach as countries want to go green by reducing the use of construction resources which are expensive to produce. This has increased their use even to environmental friendly projects such as erection of parks and other rest areas. In 2023, geotextiles in more than 2 million square meters range have been employed in environmental landscape projects in Europe, which means their use in eco design is on the rise. Moreover, also expanding geotextiles applications where new geotextile materials are developed such as bio-degradable ones will definitely suffice more opportunities as well as more takers on these environmentally frail projects.

Different geotextile applications are mirrored in their usage statistics in the geosynthetics market. The construction sector is still the leading consumer with approximately 4 million sq kilometers in geotextiles in 2023. Significant share also covers Water management projects with over 500000 kilometers used in drainage and filtration systems only for North American markets. Uses in agriculture are expected to grow, with around 800,000 square meters utilized for soil stabilization and erosion control in the agriculture dominant region of Asia. The multi-functional nature and inherent flexibility of geotextiles further enhance their growth, making them firmly embedded into contemporary engineering and construction trends around the globe.

By Application

Among all the application of geosynthetics market, geotextiles have been recognized as the leading applications, with more than 31.02% market share owing to their many uses and properties that can solve several engineering problems at hand. Such fabrics that allow water to pass through can be used in soil reinforcement, erosion control as well as for drainage and separation. Expansion in the global geotextile market will be significant with recent reports estimating the market valuation at over $7 billion in 2023. One of the contributors to this growth is the development of infrastructure, especially in countries with increasing urbanization requiring quick and cost-effective construction. On this note, the use of geotextiles in the construction of pavements and railroads has risen, with the pavement construction sector alone using about 1.5 million square kilometers of geotextiles a year.

Another factor that drives development for geotextiles in the geosynthetics market is their economic and environmental advantages. Geotextiles further provide an innovative approach as countries want to go green by reducing the use of construction resources which are expensive to produce. This has increased their use even to environmental friendly projects such as erection of parks and other rest areas. In 2023, geotextiles in more than 2 million square meters range have been employed in environmental landscape projects in Europe, which means their use in eco design is on the rise. Moreover, also expanding geotextiles applications where new geotextile materials are developed such as bio-degradable ones will definitely suffice more opportunities as well as more takers on these environmentally frail projects.

Trends among consumers suggest that they are already leaning towards younger geosynthetic products that are more effective as well as beneficial to the environment. By 2023, the demand for geocomposites in the geosynthetics market, which are responsible for providing two or more functions, reached 1.8 billion square meters. Such trends are fueled by the requirement of quick, simple and overall multifunctional principles that would help in dealing with several problems at once. In addition, the evolution of the construction market towards green technologies has contributed to the growth of the market for biodegradable geosynthetics, with sales reaching 600 million square meters worldwide. These consumer patterns represent aspirations towards more out of the box designs rather than satisfactory construction meeting technical requirements only they are under present trends aiming at growth of geosynthetics for use in transportation infrastructure.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Over the years, the Asia Pacific geosynthetics market has always been the world’s largest geosynthetics consumer and producer with over 35% of the market share and this is possible due to rapid urbanization and tremendous infrastructure construction. China, and in particular India, are booming economies in this region with a noticeable increase in constructions where the Chinese government has earmarked about $320 billion for infrastructure development such as roads and railways. In addition, India’s investment of approximately $250 billion in its Smart Cities Mission is also expected to create more geosynthetics requirements in civil construction. Due to the active participation of the Japanese government, which spends more than US$ 10 billion on disaster prevention, the geosynthetics for ground reinforcement has become popular in earthquake-prone regions of Japan. In the global supply chain, TenCate Geosynthetics and Fibertex which are among several strategic producers located in the region play a considerable role. Because of the easy availability of these raw materials coupled with the availability of a qualified workforce, production capacity is greatly enhanced making sure that Asia Pacific continues being a leader in geosynthetic materials development and marketing.

North America’s geosynthetics market also benefits from high level of funding with respect to environmental programs or renewal of existing infrastructure. The United States has specifically set aside $1.2 trillion as part of its Infrastructure Investment and Jobs Act that has plans on upgrading transport systems and also covers issues like control of soil erosion and management of wastes. Infrastructure in Canada is also being improved by the use of its $180 billion plan which aims at promoting green building practices of which geosynthetics are crucial. Due to the high level of environmental protection laws and building safety regulations in the region, the use of quality geosynthetics is often a necessity owing to that fact, creating demand. It is primarily the innovation and sustainability strategies that have been adopted by key players like GSE Environmental and HUESKER Inc. that is meeting this demand. Research and development in North America encourages such innovative materials as geosynthetics that degrade in the soil in response to the increasing sustainability demands and environment regulations.

The geosynthetics market in Europe stands out for its profound emphasis on sustainable practices and regulatory requirements, particularly with the implementation of the EU’s Green Deal which stimulates green building initiatives. The leader in the region, Germany, earmarked €86 billion for the modernisation of the railway system which includes the use of geosynthetics for improved longevity and functionality. France and the UK also make important investments, particularly France, which has allocated €40 billion to the Grand Paris Express project and incorporates geosynthetics for proper soil engineering. This market in Europe is also backed by other well-known manufacturers such as NAUE GmbH & Co. KG and Low & Bonar who embrace environmental sustainable production strategies and creative approaches. Environmental awareness in the EU has also promoted the use of geotextiles and geomembranes, making Europe a carving block in green construction materials. Besides, active additional geosynthetics related European Union initiatives, such as Horizon Europe, allow competition among this region for which geosynthetics are in fierce demand around the world.

Recent Developments in Global Geosynthetics Market

- March 2024: AGRU America invested US$7.8 million to expand its facilities in South Carolina, and Propex expanded its manufacturing capabilities in Georgia

- March 2024: Core & Main Inc. has entered into a definitive agreement to acquire NW Geosynthetics Inc., doing business as ACF West Inc. This acquisition aims to extend Core & Main's distribution reach and enhance its geosynthetic product and service offerings throughout the western U.S.

- July 2024: Tensar released its next-generation InterAx geogrid product, designed to enhance ground stabilization while reducing costs.

- June 2022: White Cap Supply Holdings LLC has closed on an agreement to acquire CSI Geoturf. This acquisition will enhance White Cap's service capabilities and product offerings in the North Central region of the U.S.

- March 2022: BontexGeo, a European producer of geotextiles, acquired 100% of the shares of ABG Ltd, a U.K.-based company specializing in geosynthetic systems

- December 2021: Solmax acquired Propex, strengthening its market position and expanding its product offerings

Top Players on Geosynthetics Market

- AGRU America Inc.

- Belton Industries Inc.

- Berry Global Inc.

- Carthage Mills

- Freudenberg Performance Materials

- Hanes Geo Components Inc.

- Huesker Group

- NAUE GmbH & Co. KG

- Officine Maccaferri SpA

- Solmax International Inc.

- Tenax Spa

- Other Prominent Players

Market Segmentation Overview:

By Product Type

- Geomembranes

- Geotextiles

- Geofoam

- Geogrids

- Geonets

- Others

By Application

- Water Management

- Wastewater Management

- Transportation Infrastructure

- Civil Construction

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- U.K.

- Germany

- France

- Spain

- Italy

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0924919 | Delivery: 2 to 4 Hours

| Report ID: AA0924919 | Delivery: 2 to 4 Hours

.svg)