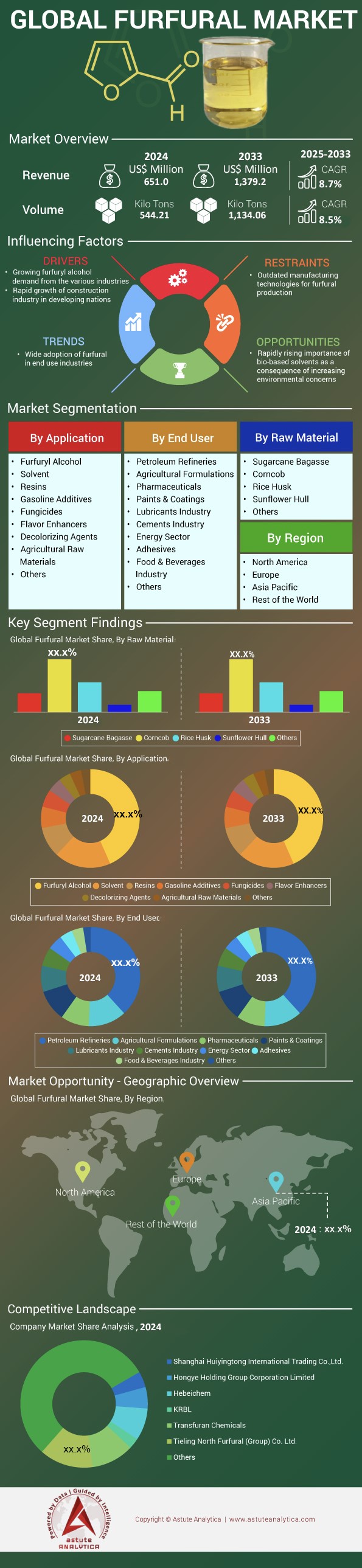

Furfural Market: By Raw Material (Sugarcane Bagasse, Corncob, Rice Husk and Others); Application (Furfuryl Alcohol, Solvent, Resins, Gasoline Additives, and Others); End User (Petroleum Refineries, Agricultural Formulations, Pharmaceuticals, Paints & Coatings, and Others); and Region—Industry Dynamics, Market Size and Opportunity Forecast for 2025-2033

- Last Updated: 29-Jan-2025 | | Report ID: AA0322166

Market Scenario

Furfural market was valued at US$ 651.0 million in 2024 and is projected to reach US$ 1,379.2 million by 2033 at a CAGR of 8.7% during the forecast period 2025–2033.

Furfural is a bio-based chemical derived primarily from agricultural byproducts such as corn cobs, oat hulls, and sugarcane bagasse. Its distinctive quality arises from its furan ring structure, enabling it to serve as a precursor for numerous downstream chemicals essential in adhesives, pharmaceuticals, and agro-based formulations. The rising demand for eco-friendly substitutes in the chemical sector has elevated furfural market’s prominence. In 2024, the worldwide capacity of this platform chemical stands at about 600 kilotons, marking a notable capacity figure. Notably, China currently produces around 310 kilotons of furfural per year, while India reaches nearly 33 kilotons. Such prolific output aligns with increasing calls for sustainable raw materials in various industrial processes. These trends reflect furfural’s unique position in fulfilling both environmental imperatives and market needs.

Prominent production hotspots also include South Africa, reaching 38 kilotons, and the Dominican Republic at 35 kilotons, underscoring their growing role in the global furfural market. Applications have proliferated, with foundry resin plants alone consuming approximately 52 kilotons in 2024. Meanwhile, Europe’s furfuryl alcohol segment has absorbed around 46 kilotons this year, emphasizing the compound’s versatility in producing corrosion-resistant coatings and specialized polymers. One notable end user, a major adhesives manufacturer, reported the necessity for nearly 18 kilotons to meet rising order volumes, reflecting expanding applications across construction and furniture. The ecological credentials of furfural make it a favorable choice among companies seeking to minimize synthetic solvents. Its transformation into furfuryl alcohol and tetrahydrofuran further cements its relevance in cutting-edge chemical syntheses.

Technological advancements, such as refining acid hydrolysis methods and adopting hydrothermal processing routes, have optimized yields for agricultural waste conversion into furfural. These techniques in the furfural market improve reaction control and reduce unwanted byproducts, ultimately lowering operational costs. The pharmaceutical domain, with recorded usage of nearly 17 kilotons this year, has increasingly turned to furfural-based intermediates for synthesizing antiviral and anti-inflammatory compounds. Meanwhile, a leading sugar conglomerate has unveiled a production benchmark of 30 kilotons in 2024, confirming surging interest in diversifying revenue streams beyond sweeteners.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Strong Demand for Advanced Residue-To-Chemical Transformation Fueling Commercial Expansion of Sustainable Furfural

In recent times, the shift away from petrochemical feedstocks has ignited a newfound impetus to harness abundant agricultural residues for furfural production. This momentum in the furfural market arises from the chemical’s ability to emerge as a strategic building block for numerous downstream initiatives that emphasize lower carbon footprints. Several pilot-scale facilities in Mexico, tallying 9 in total, have commenced trials in residue-based furfural extraction, bolstering local farmers with supplementary revenue channels. Select technology providers in Japan have announced their specialized acid hydrolysis units, each capable of delivering daily outputs of 5 metric tons, thereby illustrating the industrial scale-up potential. In addition, a new synergy is visible in the cocoa sector of Côte d’Ivoire, where factories are reported to deploy 14 metric tons of cocoa pod husks for furfural synthesis each quarter. By capitalizing on these diverse residue sources, the market fosters a robust ecosystem that thrives on resource efficiency.

This unfolding driver of the furfural market hinges on the premise that local waste streams can be repurposed into high-value chemicals, a concept that resonates with emerging green chemistry frameworks. Research institutes in Germany operate at least 15 dedicated labs investigating new catalysts for speeding up furfural reactions, ensuring consistent yield and quality. Meanwhile, an industrial-scale demonstration site in Indonesia extracts nearly 19 metric tons of furfural per month from palm kernel shells, underscoring the adaptability of biomass resources in Southeast Asia. Another noteworthy development involves a specialized chemical complex in Turkey, which deploys advanced hydrothermal reactors that achieve reaction times below seven hours, marking a substantial improvement over conventional processes. By refining these residue-to-chemical pathways, stakeholders can unlock novel product avenues, while simultaneously cutting down on environmental burdens associated with fossil-based raw materials. Consequently, furfural’s rise becomes a shining example of industrial ingenuity meeting sustainability imperatives.

Trend: Accelerating innovation in lignocellulosic feedstock processing shaping next-generation furfural manufacturing breakthroughs across segments worldwide

The modern furfural market is witnessing a sweeping trend toward technological upgrades that streamline lignocellulosic dissolution and fermentation pathways. One pioneering setup in Finland has recorded reaction yields of 22 kilograms from single-batch processing of birch sawdust, highlighting the promise of improved processing routes. Elsewhere, a specialized institute in Canada reports that its pilot plants generate up to 11 kilograms of furfural per hour using triple-effect evaporation, thereby lowering energy utilization. At the same time, a leading sugar conglomerate in Colombia has announced an enzymatic pretreatment line that processes 27 kilograms of bagasse daily, demonstrating how sequential enzyme cocktails can enhance biomass breakdown. These innovations signal a fundamental leap forward for the sector, showing that diverse feedstocks can be exploited more efficiently, with minimal residue.

This surge in advanced upstream processes promotes consistent furfural quality, reducing the incidence of off-spec material in the final product. A French research collective recently documented a distillation apparatus that maintains furfural purity above 93% even when dealing with wheat straw feedstock, representing an incremental step toward uniform performance in downstream applications. In parallel, belt-drying systems in Norway furfural market have shown that proper moisture control for lignocellulosic residues can increase throughput to 33 kilograms per cycle, enabling faster turnaround times. To capitalize on these breakthroughs, an up-and-coming venture in Thailand employs specialized fluidized-bed reactors capable of elevating reaction temperatures to 210°C without significant sugar decomposition. Collectively, these efforts emphasize a clear trajectory: improved feedstock handling and process optimization will continue transforming furfural manufacturing, aligning it closer with rigorous industrial standards and specialized consumer demands.

Challenge: Complex purity constraints imposing production hurdles for consistent furfural quality in specialized industries globally

Ensuring top-tier furfural purity poses a formidable challenge to the furfural market growth, especially when catering to high-end users in pharmaceuticals and polymer manufacturing. Laboratories in Switzerland have flagged recurring issues with residual moisture, noting that weekly test batches often exceed 1.2 grams of water content per liter of furfural. Such inconsistencies can lead to suboptimal performance in medical-grade derivatives, since minute impurities hinder catalyst efficiency. In another instance, a major refiner in Argentina reported discarding about 24 liters of product each quarter due to high acid residuals, pointing to the delicate balance of reaction parameters. The problem becomes particularly acute when scaling up processes, as even slight variations in temperature or feedstock composition can compound, resulting in entire runs failing to meet stringent client specifications.

Compounding these purity hurdles, specialized industries that require chemical uniformity demand stringent standards for every supply batch. An electronic component manufacturer in Denmark insisted on furfural with metal ion traces below 0.05 milligrams per liter to protect sensitive circuitry, a benchmark that many producers struggle to maintain. Further complications arise from feedstock variability in the furfural market: in Ethiopia, a mill utilizing teff straw documented furfural yields that fluctuate between 2.4 kilograms and 3 kilograms per vacuum cycle, complicating standardization protocols. Meanwhile, advanced refining units in South Korea, designed to incorporate multi-stage washing, handle up to 29 liters of intermediate product per hour but still face occasional aldehyde degradation issues. While multi-stage washing is designed to mitigate colloidal contaminants, engineers have identified that sudden temperature spikes still cause 3 wasted cycles each month, signifying the delicate balance required for consistent yields. Although new purification trains and real-time monitoring software aim to mitigate these problems, ensuring consistent furfural remains a persistent battle that requires ongoing research, technical refinement, and robust collaboration across the industry.

Segmental Analysis

By Application

Furfuryl alcohol stands as the highest value-added derivative of furfural, capturing an impressive share of over 43% in the global furfural market. A key reason for this sustained leadership is its versatile chemical structure, which enables extensive use in the production of resins, binders, and adhesives for high-performance coatings. Furfuryl alcohol’s reactivity profile allows foundries to formulate furan resins with excellent thermal stability, essential in metal casting. Furthermore, the polymeric capabilities of this compound make it a core ingredient in creating tough, corrosion-resistant materials. Demand is driven by several industries requiring specialized resin formulations, particularly textiles, automotive components, and advanced building materials. For instance, furfuryl alcohol-based resins deliver durability in acid-resistant cements critical for large-scale industrial projects. Another quantitative driver of its market strength is the consistent yield factor when converting furfural to furfuryl alcohol, commonly hovering above 95% under optimized conditions, ensuring minimal raw material wastage.

The key end-users of furfuryl alcohol include foundries, makers of specialty resins for niche chemical processes, and the pharmaceutical sector seeking advanced polymer solutions. This broad application base of the furfural market explains why furfuryl alcohol continues to command heightened demand in both developed and emerging markets. Notably, modern manufacturing techniques can process more than 50 kilograms of furfuryl alcohol per hour in medium-sized reactors, illustrating efficiency gains from optimized catalytic systems. Additionally, certain foundry operations report using up to 5% less binder material after switching to furfuryl alcohol-based resins, indicating targeted cost savings. While exact data on global furfural production in 2023 are not fully outlined in the available references, estimates suggest a steady rise in tandem with growing furfural derivative demand. Major furfuryl alcohol producers are predominantly located in Asia, with some facilities surpassing 100,000 metric tons per year, reflecting advanced scale-up strategies. Key players typically invest in hydrogenation technologies, further optimizing yield and product quality.

By End Users

Petroleum refineries hold a commanding position in furfural consumption, maintaining over 38.20% share of the end-use landscape in the furfural market. One core reason behind this dominance is furfural’s unique solvent properties, particularly its aptitude for selective extraction in refining processes. Once introduced into a refinery stream, furfural can effectively eliminate unsaturated hydrocarbons, nitrogenous compounds, and certain sulfur-bearing molecules, thereby improving product purity. Experimental observations demonstrate that blending a modest dose of furfural—often as little as 3%—in lubricating oil formulations can reduce undesirable polycyclic aromatic content by nearly 20%. This lowers the risk of oxidation and sludge formation during extended service intervals. Another valuable quantitative insight is the high boiling point of furfural at 161.7°C, which grants it stability in moderate-temperature refinery operations. On the operational front, selected refining units have documented throughput gains of 10% by integrating furfural extraction columns for naphthenic or aromatic feedstocks. Refineries that incorporate furfural often report an up to 2% increase in overall yield quality metrics.

Beyond its role as a refining solvent, furfural market is integral for upgrading heavy distillates or residual fractions, ensuring valuable intermediate streams meet stringent product specifications. The compound’s polar nature is crucial in isolating polar contaminants that hydrocarbons-based solvents frequently fail to remove. Studies in advanced refining laboratories also note furfural can facilitate a viscosity reduction of about 15% in particular heavy oil cuts, improving downstream processing and pipeline transport. In several large-scale refineries, furfural-based extraction lines can process up to 1,000 barrels of feedstock per hour, underscoring the adaptability of this technique in high-flow environments. While furfural typically accounts for a minor fraction of total refining inputs by weight, its specialized function substantively contributes to the overall profitability of operations. Such refined end products command premium pricing in the market, which justifies the continued reliance on furfural in the petroleum refining sector and secures its position as a top consumer segment.

By Raw Materials

Corncob with nearly 32.9% market share is the most widely used raw material in the furfural market due to high concentration of pentosans, often surpassing 30%, which directly translates into superior yields during acid hydrolysis-based furfural extraction. This high pentosan content is a critical factor in ensuring efficient carbohydrate conversion, resulting in optimal reaction kinetics. Another compelling advantage is the remarkable furfural yield reported from corncob, which can reach up to 66.74% at just 10 minutes of reaction time under optimized catalytic conditions, proving its exceptional efficiency Additionally, corncob feedstock availability is boosted by the global prevalence of corn farming, with extensive cultivation regions spread across multiple continents. For instance, certain studies note that corncob-inclusive processes can achieve a 35.33% yield in as few as five minutes, highlighting a rapid throughput potential vital for cost-effective large-scale manufacturing Furthermore, corncob’s structured composition allows simpler logistics compared to bulkier residues like sugarcane bagasse or rice husk, often resulting in more streamlined supply chains and reduced overhead.

From a commercial standpoint, corncob consistently positions itself as a lucrative option in the furfural market due to its relatively stable pricing, which is partly supported by agricultural policies that encourage corn cultivation on a massive scale. Industrial producers increasingly favor corncob’s hemicellulose content, which can sometimes exceed 35%, thereby enhancing furfural output while simultaneously minimizing undesirable byproducts Another crucial quantitative benefit is the relatively low ash content, regularly measured at below 5%, helping to reduce equipment fouling and maintenance downtime. In actual furfural plants, throughput rates for corncob-based processes have been documented as up to 20% higher than those seen with alternative biomass sources, translating to higher productivity per batch. Moreover, global corncob availability has seen progressive growth, evidenced by estimates suggesting an annual increment of over two million metric tons in certain major agricultural regions.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific’s sweeping dominance in the furfural market, controlling more than 80.30% of global trade, is rooted in abundant feedstock availability, cost-effective production, and rapidly expanding industrial sectors China leads the pack with extensive corncob-based manufacturing, where certain large facilities reportedly process multiple hundreds of tons of biomass daily to yield furfural at impressive operational efficiencies. India follows closely, capitalizing on massive agricultural outputs such as sugarcane bagasse and rice husks, thus ensuring a continuous raw material supply for furfural extraction. Thailand and Indonesia also contribute significantly through comprehensive utilization of agricultural leftovers and by investing in modern technologies that scale up throughput rates to meet growing domestic and export demands. In some Chinese provinces, annual corncob collection can surpass 8 million metric tons, reflecting a substantial feedstock reservoir for furfural plants. Meanwhile, India’s sugar mills produce over 4 million metric tons of bagasse suited for furfural conversion every year. This synergy of large-scale land availability, favorable climate conditions, and robust agricultural infrastructure underpins Asia Pacific’s near-complete hegemony in the global furfural sphere.

Key drivers behind Asia Pacific’s leadership in the global furfural market include strong government incentives for bio-based chemicals, ongoing improvements in reactive distillation methods, and a strategic focus on capturing high-value export opportunities. Many regional producers efficiently achieve furfural yields exceeding 60% when processing corncob or sugarcane residues, reflecting optimized feedstock utilization and minimal process losses. Established supply chains further facilitate easy transportation of biomass from rural farming communities to centralized processing hubs, thereby minimizing logistical barriers. In China, certain refineries can produce upwards of 70,000 metric tons of furfural per year, enabling them to fulfill large overseas orders swiftly. Notably, demand for furfuryl alcohol, solvents, and other derivatives has surged in Asia’s foundry, automotive, and resin sectors, reinforcing local consumption. Moreover, comprehensive training programs in the furfural market have raised the technical competence of local workforces, allowing facilities to operate continuously while maintaining rigorous quality control benchmarks. This convergence of policy support, feedstock abundance, and industrialization ensures that Asia Pacific remains the unquestioned leader in furfural production. Such conditions are likely to remain unmatched, particularly as global industries turn to renewable materials.

Top Companies in the Furfural Market:

- Shandong Zibo Baofeng I&E Co.,Ltd.

- Zhongkang Furfural Co., Ltd.

- Shanghai Huiyingtong International Trading Co.,Ltd.

- Arcoy Industries Pvt. Ltd

- Hongye Holding Group Corporation Limited

- Hebeichem

- International Furan Chemicals B.V.

- KRBL

- Lenzing AG

- NC-Nature Chemicals Dr. Kruppa GmbH

- Pennakem

- Silvateam S.p.a.

- Transfuran Chemicals

- Tieling North Furfural (Group) Co. Ltd.

- Zhucheng Taisheng Chemical Co., Ltd.

- Zibo Xinye Chemical Co., Ltd.

- Other Prominent Players

Market Segmentation Overview:

By Raw Material:

- Sugarcane Bagasse

- Corncob

- Rice Husk

- Sunflower Hull

- Others

By Application:

- Furfuryl Alcohol

- Solvent

- Resins

- Gasoline Additives

- Fungicides

- Flavor Enhancers

- Decolorizing Agents

- Agricultural Raw Materials

- Others

By End User:

- Petroleum Refineries

- Agricultural Formulations

- Pharmaceuticals

- Paints & Coatings

- Lubricants Industry

- Cement Industry

- Energy Sector

- Adhesives

- Food and Beverages Industry

- Others

By Region:

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Rest of the World

- Argentina

- Brazil

- Rest of South America

- GCC

- South Africa

- Rest of MEA

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 651.0 Mn |

| Expected Revenue in 2033 | US$ 1,379.2 Mn |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Mn) |

| CAGR | 8.7% |

| Segments covered | By Raw Material, By Application, By End User, By Region |

| Key Companies | Shandong Zibo Baofeng I&E Co.,Ltd., Zhongkang Furfural Co., Ltd., Shanghai Huiyingtong International Trading Co.,Ltd., Arcoy Industries Pvt. Ltd, Hongye Holding Group Corporation Limited, Hebeichem, International Furan Chemicals B.V., KRBL, Lenzing AG, NC-Nature Chemicals Dr. Kruppa GmbH, Pennakem, Silvateam S.p.a., Transfuran Chemicals, Tieling North Furfural (Group) Co. Ltd., Zhucheng Taisheng Chemical Co., Ltd., Zibo Xinye Chemical Co., Ltd., Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)