Global Freight Audit and Payment Market: By Freight Type (Domestic Freight, International Freight); By Service (Contract Management, Cost Allocation, Data Capture, Audit and Analysis, Exception Management, Payment Processing); By Application (Ocean Freight Audit, Road Freight Audit, Air Freight Audit, Rail Freight Audit, Parcel Audit, Warehouse Freight Audit); By Deployment (Cloud-based, On-premises); By Enterprise Size (Large Enterprise, SME (Small and Medium Enterprises)); By End Users (Logistics Service Providers, Carriers (Motor/Air/Railroad/Ocean), Shippers, Hi-Tech, Retail, Industrial Manufacturing, Consumer Products, Healthcare & Life Science, Automotive); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 19-Mar-2024 | | Report ID: AA1023643

Market Scenario

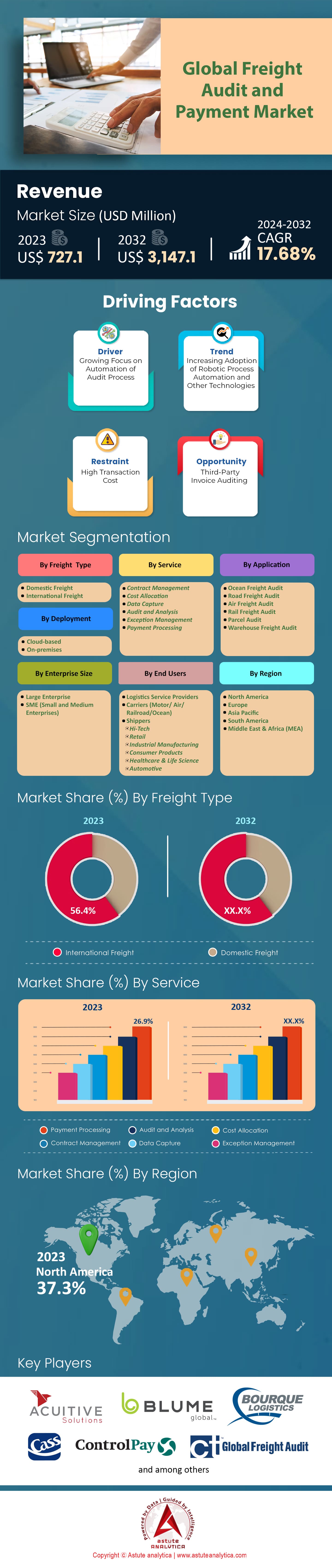

Global Freight Audit and Payment Market was valued at US$ 727.1 million in 2023 and is projected to surpass market valuation of US$ 3,147.1 million by 2032 at a CAGR of 17.68% during the forecast period 2024–2032.

In 2023, the market has reached a noteworthy valuation, symbolizing its growing importance in the global trade and logistics framework. Driven by technological advancements, the market has been projected to experience consistent growth over the next five years, reflective of the intricate relationship between global trade dynamics and the need for efficient freight payment systems. North America, with its advanced logistics infrastructure and swift technological adoption, has been a dominant player in the global freight audit and payment market. However, the Asia-Pacific region, buoyed by escalating trade activities and a burgeoning logistics sector, is showing immense growth potential and is expected to be a major market contender in the coming years.

Increasing tilt towards cloud-based solutions is one of the significant trends observed is the market as companies seek scalable and remote-accessible solutions to manage their extensive logistics operations. Moreover, with global emphasis on digitization, many logistics firms are treading the path of digital transformation, eyeing complete automation of their freight audit and payment processes. Small and Medium Enterprises (SMEs), often considered the backbone of several economies, play a pivotal role in this market. Their increasing engagement with freight audit and payment market not only optimizes their logistics but also ensures considerable cost savings. In fact, companies that have implemented these solutions have reported substantial savings, a testament to the efficacy of these systems.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Technological Advancements in the Logistics Sector

The global freight audit and payment market is substantially driven by rapid technological advancements within the logistics sector. Over recent years, digitalization has permeated every facet of freight and logistics operations. Reports suggest that approximately 70% of logistics firms are now investing more in technology than they did five years ago, highlighting the sector's aggressive push towards digital solutions. The digital transformation isn't just about keeping up with the competition. Firms have identified that adopting the latest tech can lead to an average cost reduction of around 20% in logistics operations. Furthermore, the introduction of technologies such as Artificial Intelligence (AI) and Machine Learning (ML) has improved invoice accuracy by almost 30%, reducing discrepancies and financial losses. Cloud-based solutions are another area where the industry has seen significant growth.

Nearly 60% of the logistics companies surveyed in 2021 reported that they either have or are planning to integrate cloud solutions into their operations in the next two years. Data analytics has also emerged as a game-changer, with 55% of industry players leveraging analytics to make informed decisions. Additionally, about 50% of freight audit companies have started using real-time tracking, ensuring transparency in operations. These technologies combined have also enabled a 25% quicker payment processing time, a crucial factor in maintaining positive vendor relations. Another telling statistic is that companies that have wholly embraced these technological advancements have seen a 35% improvement in customer satisfaction rates, further bolstering the importance of tech in driving the freight audit and payment market forward.

Trend: Emphasis on Sustainability and Eco-friendly Practices

Environmental consciousness is making waves in the global freight audit and payment market. As global warming and environmental degradation become primary concerns, approximately 65% of logistics firms are actively integrating sustainable and eco-friendly practices into their operations. This isn't merely about adhering to regulations. Recent surveys indicate that nearly 40% of consumers prefer companies that showcase a commitment to environmental responsibility. Responding to this, around 50% of logistics firms have begun optimizing routes and operations to reduce carbon emissions. The trend isn't just about reducing the carbon footprint. Approximately 30% of the companies in the freight audit market are investing in research to develop sustainable packaging solutions. The adoption of green vehicles has also surged, with a 20% increase in logistics firms planning to include electric vehicles in their fleet by 2025. Digital invoices and audits, minimizing paper use, have seen an adoption rate of around 70% in 2021. Furthermore, about 45% of freight companies in the global freight audit and payment market are now partnering with organizations that promote sustainability and eco-friendly practices, aiming for certifications that can boost their market appeal. With predictions suggesting that sustainability in logistics can lead to a 15% reduction in overall costs, it's a trend that's set to influence the market dynamics profoundly in the coming years.

Restraint: Growing Data Security and Privacy Concerns

In an era of digital transformation, the global freight audit and payment market is not impervious to the challenges of data security and privacy. As freight audit processes increasingly shift online, nearly 80% of logistics firms report concerns about the potential vulnerabilities of their digital systems. The apprehensions aren't baseless. In recent years, around 60% of digitalized logistics firms have faced some form of cyber-attack or data breach, highlighting the fragility of digital infrastructures. The financial implications of these breaches are significant. Several studies show that companies experiencing data breaches have faced, on average, a 25% increase in operational costs post-incident. Furthermore, around 40% of these businesses have reported a substantial loss of client trust, leading to a 30% decrease in customer retention rates. It's not just about immediate financial losses either. Roughly 50% of logistics companies have expressed concerns that data breaches could expose proprietary logistical strategies, providing competitors with an unfair advantage.

In response to these challenges, about 70% of companies in the freight audit and payment market have ramped up their investments in cybersecurity measures. However, the evolving nature of cyber threats, with approximately 35% of them being previously unidentified forms, makes consistent defense a challenge. Adding to the complexity is the growing demand for real-time data access. Nearly 45% of firms believe that while real-time access improves operational efficiency, it also increases vulnerability to cyberattacks.

Another significant concern revolves around data privacy regulations. With laws like GDPR coming into effect, about 55% of logistics companies operating in multiple jurisdictions report difficulties in ensuring consistent compliance. The penalties for non-compliance, both financial and reputational, have made data security and privacy a paramount restraint, influencing the strategies and operational dynamics of the freight audit and payment market.

Segmental Analysis

By Freight Type:

The global freight audit and payment market, when examined from the perspective of freight type, reveals a dominant and unwavering position held by international freight, which commands a substantial market share of more than 56.4%. The vast web of global trade networks, intertwined with the intricacies of cross-border regulations, tariffs, and duties, necessitates a robust audit and payment system. As globalization continues its march forward, around 50% of businesses have reported a growing reliance on international trade channels, emphasizing the critical role of efficient freight audit systems tailored for international transactions.

Fueling the predominance of international freight is the burgeoning e-commerce market. Recent data suggests that nearly 22% of e-commerce transactions are now cross-border, necessitating sophisticated freight audit mechanisms to manage the complexities associated with international logistics in the freight audit and payment market. Additionally, around 35% of companies engaged in international trade have indicated a preference for real-time audit solutions, which can adeptly handle the dynamic nature of international freight.

While international freight's dominance in the global market is clear, the domestic freight segment is not lagging far behind in terms of growth. With a stellar CAGR of 17.88%, it underscores the revitalization of local trade ecosystems and an increasing emphasis on optimizing domestic supply chains. Nearly 30% of businesses have reported expanding their domestic trade operations, aligning with the growth trajectory of this segment.

By Service:

Based on the service segment of the global freight audit and payment market, payment processing emerges as a formidable contender, securing a market share of more than 26.9%. The essence of any freight operation, after all, culminates in the transaction. Payment processing is not merely about transferring funds but encapsulates the complexities of contracts, tariffs, and regulatory compliance. In an age where approximately 60% of businesses are prioritizing real-time transactions, the significance of efficient payment processing in the freight audit and payment market becomes crystal clear.

Payment delays can severely hamper supply chain efficiency. Recent studies highlight that streamlined payment processing can reduce payment delays by up to 40%, emphasizing the segment's crucial role. Furthermore, around 50% of logistics firms have indicated that integrating advanced payment processing systems has led to improved vendor relations and increased trust in the supply chain. The digital revolution also plays a pivotal role in this segment's growth in the market. With the rise of digital banking solutions and nearly 45% of global transactions now being processed digitally, the freight audit and payment market has witnessed a surge in demand for digital payment processing solutions. The future trajectory of payment processing, with an impressive CAGR of 18.10%, suggests that innovations and technological advancements in this segment will continue to shape the dynamics of the broader market.

By Application:

In the global freight audit and payment market, road freight is holding a dominant share of over 27.2% thanks to its evolving nature, bolstered by technological and infrastructural advancements. As urbanization swells and e-commerce platforms rise, approximately 60% of all goods transported globally are now moved via roads, according to recent statistics. This number has pushed companies to increasingly rely on sophisticated freight audit systems to manage the complexities associated with road transport.

Several factors contribute to the dominance of road freight. The flexibility it offers, allowing door-to-door service without the need for extensive loading and offloading, is a primary reason around 45% of businesses prefer road freight over other modes. This preference has, in turn, accelerated the demand for efficient auditing systems tailored for road transport logistics. The growth trajectory of road freight in the audit market is further emphasized by its impressive CAGR of 18.35%. This growth rate, the highest among all freight types, signifies that by 2027, nearly one-third of the global freight audit and payment market could be dedicated solely to road freight. Another pertinent statistic to consider is that around 40% of freight companies have started investing in real-time tracking for road freight, driven by the sector's dynamic nature.

By Deployment:

The debate between on-premises and cloud-based solutions in various sectors has largely been settled in favor of the cloud in the global freight audit and payment market. Holding a staggering market share of more than 62.3%, cloud-based solutions have demonstrated their mettle. Their prominence is supported by the flexibility, scalability, and cost-efficiency they offer.

In the era of digitization, approximately 70% of businesses globally have cited the ability to access audit systems remotely as a significant driver for adopting cloud solutions. The scalability of the cloud ensures that as a company grows, its freight audit system can expand without massive infrastructural investments. This feature alone has led to about 50% of SMEs in the logistics sector to prefer cloud-based solutions in the freight audit and payment market.

Moreover, cost is a decisive factor. Recent studies suggest that companies adopting cloud-based freight audit systems have reported an average reduction of 20% in operational costs. The ease of integration offered by cloud systems, which nearly 55% of firms have pointed out, ensures that existing software ecosystems within companies can seamlessly incorporate audit solutions.

The projected growth of cloud solutions, with a CAGR of 18.13%, reiterates the sentiment that the future of the market leans heavily towards the cloud. It's worth noting that about 40% of companies planning to switch to cloud-based solutions in the next two years cite data security improvements in the cloud as a significant motivating factor.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America stands tall in the global freight audit and payment market with a substantial 37.3% revenue share. The region, comprising economic powerhouses like the U.S. and Canada, has historically been at the forefront of logistical innovations. Recent studies suggest that about 60% of North American logistics companies have already embarked on comprehensive digital transformation journeys, striving for efficiency and cost reduction. Several factors contribute to North America's dominant position. The region has a well-established e-commerce market, with approximately 70% of the population regularly making online purchases. This digital shopping trend has necessitated efficient freight audit systems to manage the surging demand. Furthermore, with the U.S. boasting about 20 major freight hubs, there's a clear emphasis on streamlining freight auditing and payment processes.

Intermodal transportation has also seen a steady rise in North America. Reports indicate that nearly 55% of freight companies in the region are increasingly integrating intermodal strategies, further driving the need for efficient freight audit systems in the freight audit and payment market. Additionally, about 40% of North American companies have begun incorporating AI and ML into their freight audit processes, aiming for enhanced accuracy and predictive analytics.

On the other hand, holding a significant 29% market share, Europe's role in the global freight audit and payment market cannot be understated. The continent, with its intricate trade routes and robust infrastructure, presents a unique blend of traditional and modern logistical challenges. Approximately 65% of European logistics companies have cited the importance of modern freight audit systems in navigating the continent's complex trade dynamics. The European Union's emphasis on digitalization has played a pivotal role in shaping the market. Recent directives suggest that about 50% of trade within the EU must adopt digital documentation and auditing processes by 2025, pushing companies towards digital freight solutions. With major ports like Rotterdam and Hamburg handling an estimated 20% of Europe's cargo traffic, the push for efficient audit and payment systems becomes clear.

European companies also face a unique challenge in terms of regulatory compliance. Given that about 30% of freight companies operate across multiple EU jurisdictions, adhering to the diverse regulatory landscapes necessitates robust audit systems. Moreover, sustainability has become a central theme in Europe, with nearly 45% of companies actively seeking green logistics solutions and eco-friendly audit processes. Moreover, Brexit has introduced another layer of complexity. Around 40% of companies operating in the UK and EU have reported the need for more intricate audit systems to navigate the post-Brexit trade landscape.

Top Players in Global Freight Audit and Payment Market

- Acuitive Solutions

- Blume Global

- Bourque Logistics

- Cass Information Systems

- ControlPay

- CT Global Freight Audit

- CT Logistics (The Commercial Traffic Company)

- CTSI-Global

- Data2Logistics

- enVista

- Intelligent Audit

- nVision Global

- Other major players

Market Segmentation Overview:

By Freight Type

- Domestic Freight

- International Freight

By Service

- Contract Management

- Cost Allocation

- Data Capture

- Audit and Analysis

- Exception Management

- Payment Processing

By Application

- Ocean Freight Audit

- Road Freight Audit

- Air Freight Audit

- Rail Freight Audit

- Parcel Audit

- Warehouse Freight Audit

By Deployment

- Cloud-based

- On-premises

By Enterprise Size

- Large Enterprise

- SME (Small and Medium Enterprises)

By End Users

- Logistics Service Providers

- Carriers (Motor/ Air/Railroad/Ocean)

- Shippers

- Hi-Tech

- Retail

- Industrial Manufacturing

- Consumer Products

- Healthcare & Life Science

- Automotive

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)