Global Four-Wheeler Tires Market: By Tire Type (Radial and Bias); Operation Type (Steer, Drive, Trailer); Application (Passenger Cars, Light Trucks, Truck, Bus, Off-Road Vehicles (Recreational Off-Highway Vehicles (ROV), Utility Task Vehicles (UTV), and All-Terrain Vehicles (ATV)); Weight (< 50 Kg, 50 - 80 Kg, 81 - 100 Kg, 101 - 150 Kg and > 150Kg); Distribution Channel (OEMs and Aftermarket (Brand Stores, Independent Tire dealers, Retail Tire Chains); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 30-Aug-2024 | | Report ID: AA0824905

Market Scenario

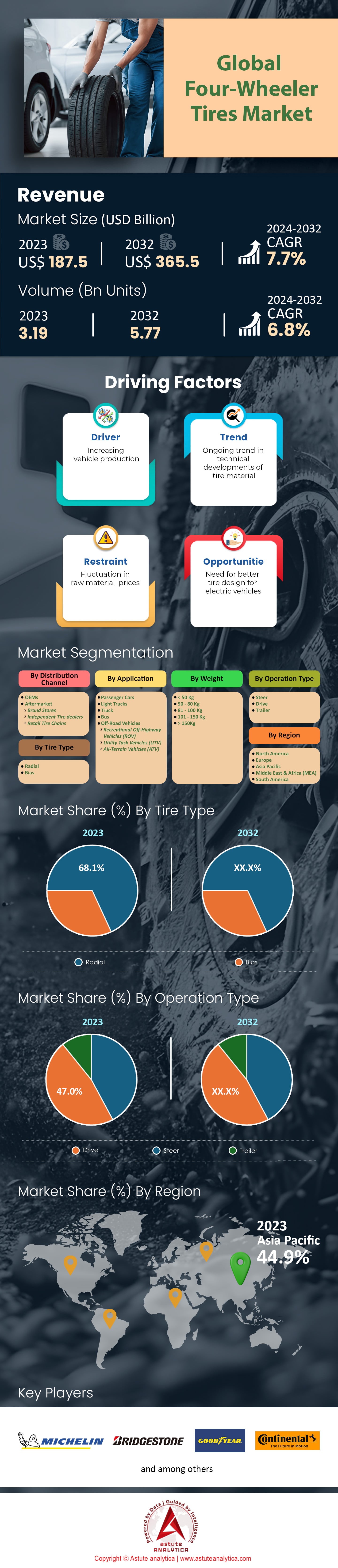

Global Four-wheeler tires market was valued at US$ 187.5 billion in 2023 and is projected to hit the market valuation of US$ 365.5 billion by 2032 at a CAGR of 7.7% during the forecast period 2024–2032.

The demand for four-wheeler tires is on the rise due to several interconnected factors. A primary driver is the continuous increase in the global automotive market, with over 90 million vehicles sold worldwide in 2024, marking a significant rebound from previous years. Key markets such as China and India have seen substantial growth, with China alone contributing to the sale of over 25 million vehicles annually. The shift towards more SUVs and electric vehicles (EVs) has also contributed to the rising demand for specialized tires, as these vehicles often require specific tire types that enhance performance and efficiency. Additionally, the trend of longer vehicle life spans means more frequent tire replacements, further fueling demand.

Prominent tire brands in the four-wheeler tires market like Michelin, Bridgestone, and Goodyear have strengthened their presence globally by innovating and expanding product lines to cater to diverse vehicle types. Michelin's focus on sustainability has led to the development of eco-friendly tires, while Bridgestone's investments in smart tire technology have made them leaders in the market. Goodyear has also made significant strides with its connected tire technology, enhancing vehicle safety and performance. These brands, along with Continental and Pirelli, account for a significant share of the market, collectively producing over 1.5 billion tires annually. The emergence of regional players in markets like Asia and Latin America has further diversified the landscape, introducing competitive pricing dynamics and innovation.

The aftermarket sector is playing a crucial role in influencing four-wheeler tires market. As vehicles are kept longer, often surpassing 200,000 kilometers in their lifetimes, the need for replacement tires increases. The aftermarket industry has seen a surge, with global sales reaching over $300 billion. This growth is driven by the availability of a wider range of tire options, from budget to premium, and the rise of e-commerce platforms facilitating easy access to tires. Furthermore, the popularity of personalized and performance-enhancing tires for specific conditions has led to more frequent tire upgrades. This trend signifies an evolving consumer mindset, where maintaining and customizing vehicles has become a priority, thereby continuously driving up the demand for four-wheeler tires.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Vehicle Production and Sales Boosting Tire Demand Worldwide

The global automotive industry has witnessed a significant surge in vehicle production and sales, which has been a major driver for the Four-wheeler tires market. In 2023, over 93 million vehicles were produced worldwide, marking a notable increase from previous years. China, the United States, and Japan collectively accounted for more than 50 million of these vehicles, underscoring their dominance in the automotive sector. India's automotive market saw a remarkable addition of 4 million vehicles, reflecting its growing influence. Meanwhile, Europe contributed approximately 20 million vehicles to the global tally, with Germany leading the charge. This increased production naturally escalates the demand for tires, as every new vehicle requires multiple sets throughout its lifecycle. The burgeoning demand is further accentuated by the commercial vehicle sector, which saw the addition of 25 million units globally, driven by the e-commerce boom and logistical needs.

The passenger vehicle segment of the four-wheeler tires market, accounting for nearly 75.5 million units, has been the primary contributor to this demand. The rise in electric vehicle (EV) production is also noteworthy, with EV sales reaching 14.2 million units, necessitating specialized tires to accommodate different performance characteristics. Additionally, the automotive aftermarket, valued at $723 billion, further amplifies tire demand as consumers seek replacements and upgrades. With the global tire market estimated to be worth $225 billion, the correlation between vehicle production and tire demand is evident. As the world marches toward an estimated 100 million vehicle productions annually by 2025, the tire industry stands poised for continued growth.

Trend: Increasing Popularity of All-Terrain Tires for Diverse Driving Conditions Worldwide

The growing popularity of all-terrain tires is reshaping the four-wheeler tires market landscape. As of 2023, the global all-terrain tire market reached a valuation of $16 billion, driven by the increasing preference for vehicles capable of tackling diverse driving conditions. In the United States alone, sales of light trucks and SUVs equipped with all-terrain tires exceeded 12 million units, reflecting a significant consumer shift towards versatile and rugged performance. The Asia-Pacific region saw an addition of 5 million vehicles fitted with these tires, catering to both urban and rural demands. Europe, known for its diverse terrains, contributed over 7 million units to the market, with countries like Germany and the UK leading the charge.

The rising demand for adventure tourism and off-road experiences has also fueled the popularity of all-terrain tires in the global four-wheeler tires market. In 2023, approximately 18 million tourists embarked on off-road adventures globally, a trend that continues to grow. The aftermarket for all-terrain tires, valued at $6 billion, further highlights the consumer inclination towards upgrading their vehicles for enhanced performance. With over 15 million vehicles in North America alone retrofitted with all-terrain tires, manufacturers are focusing on innovation to cater to this demand. The global vehicle fleet equipped with all-terrain tires is estimated to reach 100 million units by 2025, underlining their significance in the market.

Challenge: Fluctuating Raw Material Prices Impacting Tire Manufacturing Costs and Profitability

The four-wheeler tires market faces a formidable challenge in the form of fluctuating raw material prices, significantly impacting costs and profitability. Natural rubber, a key component in tire production, saw prices oscillate between $1,200 and $2,000 per metric ton throughout 2023. This volatility in the global tire market stems from unpredictable weather patterns affecting rubber plantations in major producing countries like Thailand, Indonesia, and Vietnam, which collectively supplied over 10 million metric tons of natural rubber last year. Additionally, synthetic rubber, derived from petroleum, faced cost variations due to geopolitical tensions affecting oil supply chains, with global petroleum production reaching 4.5 billion metric tons.

Carbon black, another essential raw material, experienced price fluctuations, with costs ranging between $1,100 and $1,500 per metric ton in the four-wheeler tires market. The global supply chain disruptions added to the complexity, with shipping container costs peaking at $6,500 in the global tire market. These factors have forced tire manufacturers to navigate a challenging landscape, impacting their profit margins. Despite a global tire production of over 2 billion units in 2023, manufacturers grappled with maintaining profitability amidst fluctuating costs. The impact is evident in the financial reports of major tire companies, with several reporting reduced profit margins due to these challenges.

In response, many manufacturers are investing in research and development to explore alternative materials and enhance production efficiency. The global tire industry's R&D expenditure reached $1.5 billion in 2023, reflecting the focus on innovation. Furthermore, collaborative efforts with agricultural sectors aim to stabilize natural rubber supply chains, ensuring consistent production. Yet, as the global market for tires continues to grow, reaching an estimated $220 billion, the industry remains vulnerable to raw material price fluctuations. Ensuring sustainable practices and stable supply chains will be pivotal in mitigating these challenges in the coming years.

Segmental Analysis

By Tire Type

Radial tires dominate the four-wheeler tires market with 68.1% market share due to their superior performance, longevity, and fuel efficiency. Their construction, which involves layers of cords placed at 90 degrees to the direction of travel, provides better road contact, enhancing grip and stability. This results in a smoother ride and reduced rolling resistance, leading to fuel savings. In 2023, the global automotive industry produced around 85 million passenger vehicles, with radial tires being the preferred choice for manufacturers due to these benefits. The demand is driven by the growing automotive sector, technological advancements in tire manufacturing, and the increasing emphasis on fuel efficiency and safety. Major car manufacturers like Toyota, Volkswagen, and Ford rely heavily on radial tires for their new models.

The primary end users in the global four-wheeler tires market of radial tires are passenger vehicles, commercial vehicles, and light trucks. The commercial vehicle sector, which includes over 25 million trucks and buses globally, particularly values the load-bearing and durability characteristics of radial tires. The market is expanding, with Asia-Pacific regions alone seeing the production of 45 million vehicles annually, where radial tires are predominantly used. Key factors behind their dominance include their adaptability to different terrains and climates, which is crucial for regions experiencing extreme weather conditions. Additionally, radial tires contribute significantly to the reduction of carbon emissions, aligning with global sustainability goals. The ongoing innovation in radial tire technology, such as run-flat capabilities and smart tire integration, is further propelling their demand. As of 2023, the global radial tire market is valued at over $200 billion, with projections indicating a steady growth trajectory fueled by increasing automotive production and replacement needs.

By Operation

Based on operation, the drive segment is leading the market with over 47% market share. The robust demand for drive operations in the four-wheeler tires market stems from the versatility offered by four-wheel-drive (4WD) systems, crucial for off-road and rugged terrain driving. These systems distribute torque to all four wheels, enhancing traction and stability, which is vital for vehicles in challenging conditions. This need for durability results in significant sales, evidenced by the fact that over 20 million SUVs and crossovers equipped with AWD or 4WD systems were sold globally last year, pushing the demand for specialized drive tires. The global tire market saw the production of over 3 billion units annually, with the drive segment being a substantial contributor due to its high durability requirements. Additionally, the average lifespan of a drive tire exceeds 50,000 miles, further underscoring the need for quality.

The drive segment outpaces steer and trailer operations in revenue generation in the four-wheeler tires market due to its critical role in vehicle performance and safety. Drive tires are integral for traction and handling, especially in adverse weather conditions such as snow and rain, where AWD and 4WD systems excel. This importance is reflected in the tire industry's revenue, which surpassed $200 billion, with drive tires being a major contributor to this figure. Technological advancements in tire manufacturing, such as improved tread designs and materials, have enhanced the performance and lifespan of drive tires, making them a favored choice. The rise in consumer preference for vehicles with advanced drivetrain systems, supported by the fact that over 70% of new vehicle launches include AWD or 4WD options, emphasizes the dominance of drive tires in the market. Consequently, the drive segment remains a leader in revenue generation, driven by the ongoing demand for superior traction and handling across diverse driving conditions.

By Weight

Based on weight, the less than 50 kg segment of the four-wheeler tires market is dominating the market with market share of over 64.6%. The increasing demand for four-wheeler tires weighing less than 50 kg is driven by several factors, including advancements in technology and shifts in consumer preferences. As of 2023, the global automotive industry has sold over 1.5 billion four-wheeler tires annually, with those under 50 kg making up a significant portion. This trend is largely attributed to the growing production of lighter vehicles, such as electric cars and compact SUVs, which prioritize efficiency and performance. The average weight of a compact electric vehicle has decreased by 200 kg over the past five years, leading manufacturers to seek lighter tire options to enhance range and efficiency. Moreover, the burgeoning electric vehicle market, which saw sales surpass 10 million units globally in 2022, has fueled the demand for specialized tires that cater to these vehicles' unique requirements.

Another factor contributing to the dominance of this weight segment in the four-wheeler tires market is the emphasis on sustainability and eco-friendliness. Tire manufacturers have increasingly adopted advanced materials like silica and renewable rubber, which not only reduce tire weight but also improve fuel economy and durability. As of 2023, over 40 million tires incorporate eco-friendly materials, aligning with the automotive industry's broader push for sustainability. Furthermore, the rise of online tire retail, which now accounts for an estimated 500 million tire sales annually, has made it easier for consumers to access a wider variety of lighter, more efficient tire options. Innovations in tire design, such as the use of 3D printing technology, have also enabled the production of lighter, custom-fit tires, with over 1 million units produced using this method in 2023 alone. These technological advancements, coupled with changing consumer demands and environmental considerations, continue to propel the growth of the sub-50 kg tire segment globally.

By Application

Passenger cars are the largest consumers of four-wheeler tires market globally due to several factors, primarily driven by the sheer volume of these vehicles on the roads. The passenger car segment generated more than 40.50% of the market share. As of 2023, global passenger car sales have reached approximately 75.5 million units, a figure that underscores their significant market presence. The demand for four-wheeler tires in passenger cars is driven by both the need for original equipment tires on new vehicles and the replacement tire market. On average, a passenger car requires a tire replacement every 3 to 4 years, leading to a continual cycle of demand. Additionally, the advent of electric vehicles, which accounted for 10 million units in sales in 2023, has further catalyzed tire demand, as electric vehicles often require specialized tires that can handle different loads and performance needs.

The rise in global urbanization has led to an increase in vehicle ownership in the four-wheeler tires market; countries like China and India are seeing millions of new car registrations annually, with China alone registering over 26 million new passenger cars in 2023. Apart from this, consumer preferences are shifting towards SUVs and crossovers, which require larger and more durable tires. The SUV market saw a jump with over 30 million units sold globally in 2023. Third, the technological advancements in tire manufacturing, including the development of more sustainable and long-lasting materials, have made frequent tire changes more common, further stimulating demand. The global automotive parts industry, valued at over $2 trillion, also supports this tire demand through extensive distribution networks and aftermarket services. The combination of these factors ensures passenger cars remain the largest consumers of four-wheeler tires in the world, driving a robust and dynamic market.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The Asia Pacific region is at the forefront of the global Four-wheeler tires market, buoyed by significant vehicle production and a rapidly expanding middle class. China stands out as a key player, having produced over 30 million vehicles in recent years, reinforcing its critical role in the tire industry. The region's economy heavily leans on its automotive industry, with governmental support fostering market regulation and development. Notably, countries like Indonesia are experiencing a surge in vehicle ownership, driving up radial tire sales. Thailand's substantial rubber production also provides a vital resource for tire manufacturing. In 2023, the Asia Pacific region reportedly saw a yearly increase of 1.5 million new vehicles, contributing to the higher tire demand. The demand for passenger vehicles remains strong, with nearly 42.2 million new cars sold across the region in 2023.

Technological advancements and R&D investments further propel the region's dominance in the global four-wheeler tires market. China is poised to lead in advanced tire technologies, including airless and 3D-printed tires. The rise of the middle class in Asia Pacific has resulted in unprecedented automobile demand. The market is projected to witness significant growth, with tire sales expected to reach nearly 1.9 billion units by 2024. This expansion is driven by the burgeoning light commercial vehicle sector, which saw an increase of approximately 300,000 units in 2023 alone. Furthermore, the regional rubber industry produced over 3 million metric tons in the past year, maintaining a steady supply for tire manufacturing.

The competitive landscape in the Asia Pacific four-wheeler tires market features a mix of prominent local and international manufacturers. Local companies often lead due to their ability to meet high-quality standards and safety regulations. The region's competitive edge stems from affordable labor and evolving industry standards, attracting investments from global market leaders. Notably, the electric vehicle sector is burgeoning, with over 500,000 new electric cars registered in 2023, highlighting the need for specialized tires. Despite the challenges of the COVID-19 pandemic, the demand for electric vehicles is expected to drive future tire market growth. Asia Pacific's strategic focus on sustainability and innovation enhances its position as a global leader, with significant investments in eco-friendly tire technologies reported at over $2 billion in 2023. Additionally, leading tire manufacturers have opened more than 150 new retail outlets across the region in the past year, further expanding their market presence.

Top Players in Global Four-Wheeler Tires Market

- Aeolus Tyres

- Bridgestone

- Cheng Shin Rubber

- Continental

- Cooper tire

- Double Coin

- Giti Tire

- Goodyear

- Hankook

- KUMHO TIRE

- Linglong Tire

- Michelin

- Pirelli

- Sumitomo Rubber

- Toyo Tires

- Triangle Tire Group

- Xingyuan group

- YOKOHAMA

- ZC Rubber

- Other Players

Market Segmentation Overview:

By Tire Type

- Radial

- Bias

By Operation Type

- Steer

- Drive

- Trailer

By Application

- Passenger Cars

- Light Trucks

- Truck

- Bus

- Off-Road Vehicles

- Recreational Off-Highway Vehicles (ROV)

- Utility Task Vehicles (UTV)

- All-Terrain Vehicles (ATV)

By Weight

- < 50 Kg

- 50 - 80 Kg

- 81 - 100 Kg

- 101 - 150 Kg

- >150Kg

By Distribution Channel

- OEMs

- Aftermarket

- Brand Stores

- Independent Tire dealers

- Retail Tire Chains

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- U.K.

- Germany

- France

- Spain

- Italy

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)