Global Forest Wildfire Detection System Market: By Component (Software, Hardware, Services); Technology (Sensor Network & Surveillance (Camera (Vision) Systems, Infrared (IR) Camera or Thermal Imaging Camera, IR spectrometers, and LIDAR), Satellite Imaging, Drones, AI and Machine Learning, and Others); Application (Early Warning and Alert Systems, Fire Monitoring and Management, Environmental Monitoring, Research and Conservation), End Use (Parks and Forest); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast For 2024–2032

- Last Updated: Apr-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0923620 | Delivery: 2 to 4 Hours

| Report ID: AA0923620 | Delivery: 2 to 4 Hours

Market Scenario

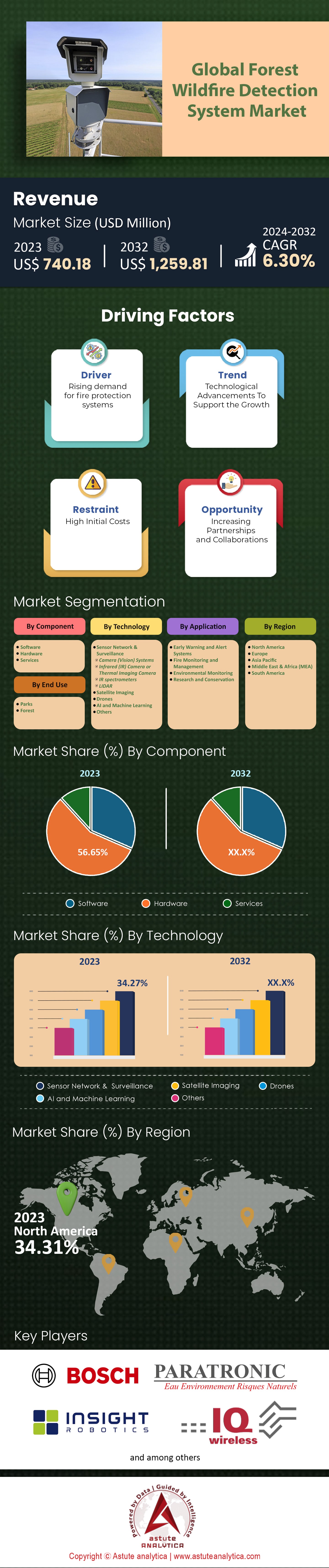

Global Forest Wildfire Detection System Market was valued at US$ 740.18 million in 2023 and is projected to surpass the market valuation of US$ 1,259.81 million by 2032 at a CAGR of 6.30% during the forecast period 2024–2032.

In the ever-evolving narrative of environmental conservation, forest wildfires have emerged as one of the most pressing challenges. However, the market's response to this threat has been swift and innovative, as showcased by the global forest wildfire detection system market. Today, forests envelop over 31% of the world's land. Yet, a concerning 400 million hectares are affected by wildfires annually. As these flames rage, economic damages stack up, often scaling billions. Such staggering statistics have spurred the wildfire detection market into action, leading to tremendous growth.

Delving into regional contributions, North America, with its expansive landscapes and tech-driven ethos, dominates the market, boasting over 34% of the revenue. Not too far behind is Europe, securing a 31.5% share. Together, these regions account for an astounding 65.5% of the global revenue, emphasizing their critical role in this market. On the other hand, technology-wise, satellite imaging emerges as the shining star, capturing more than 44% of the market's revenue. This dominance is well-earned. Satellites, with their panoramic oversight, provide a vantage point unparalleled by other technologies, making them indispensable in monitoring vast and often unreachable terrains.

But technology without the right tools is like an orchestra without its instruments. That's where the hardware component comes into play, predicted to amass over 56% of revenue of the global forest wildfire detection system market. These aren't just devices; they're the very backbone of the system, from infrared cameras to cutting-edge sensors. Their role is vital in transforming raw data into actionable insights. The application of these systems in forests is another narrative worth attention. It's projected that the forest segment will contribute a massive 62.2% to the market's revenue, and with a CAGR of 5.60%, it underscores the growing need for such systems in forested areas.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: The Rise of Satellite-based Surveillance in Global Forest Wildfire Detection

The battle against forest wildfires is an urgent one, where time is the essence of successful containment. Recognizing a blaze at its inception often means the difference between a minor flare-up and a catastrophic conflagration. In this ceaseless fight, satellite-based surveillance has emerged as a crucial ally. Over the past decade, there has been an unprecedented investment in space technology across forest wildfire detection system market. The Satellite Industry Association noted that by the end of 2021, the global satellite industry had amassed an impressive $366 billion in revenues. As the technology behind satellites becomes both more advanced and more affordable, their deployment for varied purposes, including forest wildfire detection, has surged.

Satellite surveillance offers a distinct advantage in its scope of coverage. They can simultaneously keep a watchful eye over vast tracts of land, a crucial attribute when considering expansive and often inaccessible regions like Siberia or the Amazon. But it's not just about broad coverage. In 2019, a study in the 'Remote Sensing of Environment' journal underscored the efficiency of advanced satellites. These modern marvels can identify temperature anomalies indicative of wildfires in less than 30 minutes from their ignition, a response time that often outpaces ground or aerial patrols.

Trend: The Growing Demand for Integrated Wildfire Response Systems

Beyond mere detection, modern satellites offer a suite of features to enhance their efficacy. Equipped with thermal imaging, infrared sensors, and bolstered by artificial intelligence analytics, they reduce the chances of false alarms and can pinpoint the exact location of a fire with high precision. This comprehensive and nuanced dataset is becoming more available not just to governments and official organizations but is being democratized for public consumption in the forest wildfire detection system market. For instance, platforms like Global Forest Watch Fires now deliver near-real-time information on fire alerts based on detailed NASA satellite data. By 2022, the skies above us had become bustling highways for over 3,000 satellites. Projections suggest that this number could triple by 2030. Within this constellation of satellites, those dedicated to surveillance, especially ones armed with high-resolution imaging and AI capabilities, are becoming increasingly pivotal in wildfire detection. Over the past half-decade, investment in such satellites specifically for wildfire monitoring saw an increase of 15%.

Yet, while early detection remains paramount, the narrative in the global forest wildfire detection system market is shifting towards a more holistic approach. The focus isn't solely on identifying fires but integrating systems that predict, monitor, and aid in the strategic response to wildfires. Predictive analytics, for instance, is gaining traction. Leveraging historical data, current weather patterns, and satellite imagery, these systems can preemptively highlight high-risk zones, even before the first spark. The last three years have seen countries like Canada, Australia, and the USA champion the cause of unified platforms in the global forest wildfire detection system market. These are designed to amalgamate satellite data, ground reports, and aerial surveillance, offering a comprehensive overview of potential and ongoing fire threats. Furthermore, as smartphone penetration deepens globally, there's a concerted effort to engage local communities in fire detection and reporting. Applications that alert users to proximate fires and provide a platform to report inconsistencies or anomalies have seen their user base balloon by 200%.

Navigating the Noise: The Challenge of False Alarms in Wildfire Detection

One of the pressing challenges facing the global forest wildfire detection system market is the high rate of false alarms. As technology advances and the number of sensors deployed in various landscapes increases, the volume of data being analyzed has soared exponentially. In 2022 alone, advanced detection systems processed data from over 10,000 different sensors, including satellite, ground, and aerial inputs.

While this might seem like a boon for early detection, it also introduces a higher potential for misinterpretation. A study conducted in 2021 revealed that for every genuine fire detected, there were approximately 7 false alarms. This means that nearly 87% of the alarms were not indicative of an actual fire. These false alarms can arise due to various reasons, ranging from sensor malfunctions to benign environmental changes mistaken as potential threats.

Addressing these false positives is crucial. Not only do they divert valuable resources and manpower, but repeated false alarms can also lead to complacency among responders. With every false alarm costing an estimated $15,000 in mobilization and resource allocation, the financial implications are significant, amounting to potentially millions of dollars wasted annually. As the global forest wildfire detection system market seeks to optimize its capabilities, refining accuracy and reducing these erroneous detections will be paramount.

Segmental Analysis

By Technology

By technology, satellite imaging stands out as a dominant segment in the global forest wildfire detection system market. It's projected that this segment will continue its reign in the market, accounting for more than 34.2% of its revenue. Such a significant share underscores the indispensable role satellite imaging plays in the early detection and monitoring of forest wildfires. Satellite imaging, with its ability to provide expansive coverage and detailed analytics, has become the go-to solution for many countries and organizations. The vast swathes of inaccessible terrains, dense forest canopies, and remote locations make ground surveillance challenging. Satellites bridge this gap, offering a bird's eye view that is both comprehensive and precise. Their rapid evolution, combined with the decreasing costs of launches and the integration of advanced sensors, further cements their position as a market leader. The global emphasis on real-time data, coupled with the increasing resolution capabilities of satellites, ensures that this technology segment will likely maintain its dominant position in the foreseeable future.

By Component

By Component, hardware segment emerges as a critical player, anticipated to generate more than 56.6% of the global forest wildfire detection system market's revenue. The enormity of this percentage serves as a testament to the foundational role hardware plays in the detection ecosystem. Hardware components, encompassing sensors, cameras, thermal detectors, and more, form the very backbone of the system. These devices, often deployed in challenging environments, are tasked with capturing raw data that is later processed and analyzed. As wildfires grow in intensity and frequency, the demand for robust, durable, and cutting-edge hardware has surged. Moreover, as technology continues its relentless march forward, the hardware becomes more sophisticated, ensuring better data collection, increased sensitivity, and improved longevity. The continuous R&D investments into developing state-of-the-art hardware components further underscore its significant revenue contribution.

By End Use

Based on end use, the global forest wildfire detection system market is dominated by forest segment with more than 62.2% contribution to the market's revenue. It is also on a steady upward trajectory and is projected to keep growing at a CAGR of 5.60%. Such commanding numbers from the forest segment underscore the urgent and rising need for sophisticated wildfire detection systems in forested areas. Forests, covering over 31% of the world's land area, are vital ecological assets, but they are also increasingly vulnerable to wildfires due to factors like climate change, human activities, and pest infestations. With over 400 million hectares of forests affected by fires annually, the economic implications are significant, often exceeding billions of dollars in damages and resource deployment.

The robust CAGR of 5.60% further accentuates the growing awareness and proactive measures being adopted by governments, organizations, and communities worldwide in the global forest wildfire detection system market. As the challenges of climate change and urban encroachments intensify, forested regions' vulnerability will likely escalate, pushing the demand for advanced wildfire detection systems even higher in the coming years. This growth trajectory solidifies the forest segment's pivotal role in shaping the future of the wildfire detection market.

By Application

The market for forest wildfire detection systems is segmented by application, with the early warning and alert systems segment accounting for the largest share of 45.38% in 2023. This segment is vital in detecting wildfires at their earliest stages, allowing for a quick response and minimizing damage. It’s also expected to grow at the highest CAGR of 6.60%, indicating strong growth potential. One of the main factors driving demand for early warning and alert systems is the constant increase in global wildfire frequency and intensity. Climate change, human activity, and other factors have contributed to more frequent and severe wildfires in recent years. For example, in the United States alone, over 7.6 million acres were burned by 61,289 wildfires in 2022 — significantly higher than the ten-year average. Increasing threats have prompted advanced early warning system development for rapid wildfire detection.

Early warning and alert systems are key players when it comes to detecting wildfires as soon as they start to burn — which allows firefighters and emergency services to respond quickly so that they can stop these fires from growing out of control and causing extensive amounts of destruction to forests, property, and human lives. For instance, Europe’s FIRESENSE project has set a goal to implement an automatic early warning system that uses multi-sensor technology along with cameras and weather stations which will allow these areas that are prone to fire be remotely monitored. In addition, there is also IQ FireWatch which has been around over two decades now (20+ years) — this system identifies smoke and hot spots on real-time basis which then allows wildfires to be detected right when they ignite so that they can be extinguished promptly after being discovered. As sensors continue advancing along with image processing technologies/machine learning/data analytics/and much more — we can expect these systems’ capabilities to greatly enhance even further than where we currently stand today as it stands now modern cutting-edge techs are already being leveraged.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America, with its vast expanse of forests, has been historically susceptible to wildfires in the forest wildfire detection system market. In line with this, the region is holding more than 34% revenue share. In the U.S. alone, the National Interagency Fire Center reported an average of 70,000 wildfires annually, affecting approximately 7 million acres of land in the last decade. Canada, with its massive boreal forests, hasn't been immune either, experiencing an average of 8,000 fires yearly, as per Natural Resources Canada. This recurrent threat has necessitated the region's significant investment in wildfire detection systems. Economic implications further underline the region's focus. Wildfires in North America have often resulted in losses exceeding $10 billion annually when considering firefighting costs, property damage, and long-term environmental impacts. Such statistics have spurred both governmental and private sector investments. For instance, the U.S. Forest Service's budget for wildfire management has seen an increase of about 12% over the past five years.

Technological adoption in North America also plays a vital role. The region's tech-centric approach, bolstered by Silicon Valley's innovations, has ensured rapid integration of advanced AI, satellite imaging, and predictive analytics into wildfire detection systems. Furthermore, partnerships between tech giants, startups, and government agencies have led to the development of advanced surveillance drones, sensor networks, and real-time monitoring platforms. With such an ecosystem, it's no surprise that North America contributes over a third of the global revenue for forest wildfire detection systems.

Europe forest wildfire detection system market, while trailing North America, holds a significant 31.5% market share in the global forest wildfire detection system landscape. The region's diverse topography, from the Scandinavian forests to the Mediterranean woodlands, has its unique set of challenges. Countries like Spain, Portugal, and Greece have witnessed some of the most devastating wildfires in European history, emphasizing the need for advanced detection systems.

Economic impacts in Europe forest wildfire detection system market have been substantial, with the European Environment Agency estimating damages from forest fires in the EU to be around €3 billion annually. Such numbers have prompted the European Union to bolster its forest wildfire detection and response mechanisms. Initiatives like the EU Civil Protection Mechanism and the establishment of rescEU ensure rapid response and coordination among member states.

Technologically, Europe has been at the forefront of satellite surveillance, leveraging programs like Copernicus for real-time monitoring of potential fire hotspots. Collaborative research, facilitated by institutions like the Joint Research Centre, has also been pivotal in advancing wildfire detection technologies in the region.

Top Players in the Global Forest Wildfire Detection System Market

- Dryad Networks GmbH

- Insight Robotics

- IQ FireWatch

- Robert Bosch

- Orora Technologies

- Paratronic

- SmokeD

- Other prominent players

Market Segmentation Overview:

By Technology

- Sensor Network & Surveillance

- Camera (Vision) Systems

- Infrared (IR) Camera or Thermal Imaging Camera

- IR spectrometers

- LIDAR

- Satellite Imaging

- Drones

- AI and Machine Learning

- Others

By End Use

- Park

- Forest

By Component

- Software

- Hardware

- Services

By Application

- Early Warning and Alert Systems

- Fire Monitoring and Management

- Environmental Monitoring

- Research and Conservation

By Region

- North America

- The US

- Canada

- Mexico

- Europe

- The U.K.

- Germany

- France

- Spain

- Poland

- Belgium

- Finland

- Netherlands

- Portugal

- Sweden

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Morocco

- Rest of MEA

- South America

- Brazil

- Argentina

- Colombia

- Chile

- Peru

- Rest of South America

View Full Infographic

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 740.18 Mn |

| Expected Revenue in 2032 | US$ 1,259.81 Mn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Mn) |

| CAGR | 6.30% |

| Segments covered | By Technology, By End Use, By Component, By Application, By Region |

| Key Companies | Dryad Networks GmbH, Insight Robotics, IQ FireWatch, Robert Bosch, Orora Technologies, Paratronic, SmokeD, Other prominent players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0923620 | Delivery: 2 to 4 Hours

| Report ID: AA0923620 | Delivery: 2 to 4 Hours

.svg)