Global Flue Gas Treatment Systems Market: By Pollutant Control System (Flue Gas Desulfurization (FGD) Systems, DeNOX Systems, Particulate Control Systems, Mercury Control Systems, Others); Process (Wet, Semi-wet, Dry); Industry (Industrial Boilers, Power, Chemical & Petrochemical, Iron & Steel, Non-Ferrous metal, Cement, Waste Treatment); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Aug-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0824888 | Delivery: 2 to 4 Hours

| Report ID: AA0824888 | Delivery: 2 to 4 Hours

Market Scenario

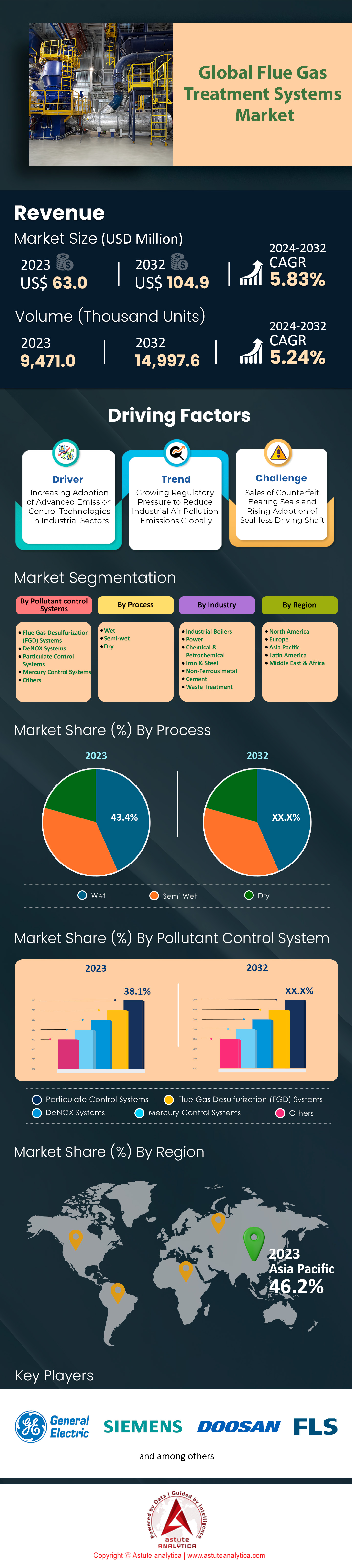

Global flue gas treatment systems market was valued at US$ 63.0 million in 2023 and is projected to hit the market valuation of US$ 104.9 million by 2032 at a CAGR of 5.83% during the forecast period 2024–2032.

The demand for flue gas treatment systems is experiencing a significant surge globally due to escalating environmental regulations and increasing awareness about air pollution control. Governments worldwide have imposed stringent emission standards, compelling industries to adopt efficient flue gas treatment technologies. In 2023, over 30 countries have implemented new or updated regulations to mitigate industrial emissions, pushing industries to invest in advanced treatment systems. Additionally, the rising health concerns related to air quality have heightened public and governmental pressure on industries to reduce their emissions. This has led to a notable increase in the installation of flue gas desulfurization (FGD) units in more than 500 power plants across Asia and Europe.

Recent developments in flue gas treatment systems market have further propelled their demand. Innovations such as the introduction of high-efficiency particulate air (HEPA) filters and selective catalytic reduction (SCR) systems have significantly improved the efficacy of these systems. For instance, in 2023, over 200 industrial facilities in North America adopted SCR technology to reduce nitrogen oxide emissions. The integration of IoT and AI in monitoring and optimizing flue gas treatment processes has also gained traction, with more than 150 installations reported in smart factories globally. These advancements not only enhance the performance of flue gas treatment systems but also reduce operational costs, making them more attractive to industries.

Looking ahead, the flue gas treatment systems market is poised for continued growth, driven by the increasing industrialization in developing economies and the global shift towards sustainable practices. The anticipated rise in the number of coal-fired power plants transitioning to cleaner technologies is expected to create substantial demand for flue gas treatment systems. By 2025, it is projected that over 1,000 new FGD units will be installed worldwide. Furthermore, the development of carbon capture and storage (CCS) technologies is set to revolutionize the industry, with over 50 pilot projects currently underway. As countries commit to achieving net-zero emissions, the flue gas treatment systems market is likely to witness exponential growth, ensuring cleaner air and a healthier environment for future generations.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Adoption of Advanced Emission Control Technologies in Industrial Sectors

The industrial sectors are progressively adopting advanced emission control technologies to mitigate the environmental impact of their operations. This trend is driven by the need to comply with stringent regulations and the growing awareness of sustainability. For instance, the global market for selective catalytic reduction (SCR) systems, a popular emission control technology, was valued at over $5.6 billion in 2023. In the same year, the installation of flue gas desulfurization (FGD) systems in new power plants reached 1,200 units globally.

The adoption of electrostatic precipitators (ESP) is also on the rise across the global flue gas treatment systems market, with sales reaching 80,000 units worldwide in 2023. Additionally, the market for activated carbon injection (ACI) systems, used to control mercury emissions, was valued at $1.4 billion in the same year. Baghouse filters, another crucial technology, saw an installation of 150,000 units in industrial facilities globally in 2023. In China, the number of industries adopting advanced emission control technologies increased by 15,000 units in 2023. The European Union saw a rise in the installation of low NOx burners, with 2,500 units added in 2023. The United States reported the deployment of 500 new dry sorbent injection (DSI) systems in the same year. Furthermore, Japan's adoption of carbon capture and storage (CCS) technologies in industrial applications reached 20 new projects in 2023. India saw a surge in the installation of wet scrubbers, with 1,800 units added to its industrial base in 2023. These statistics highlight the global shift towards advanced emission control technologies, driven by regulatory requirements and the push for sustainability.

Trend: Growing Regulatory Pressure to Reduce Industrial Air Pollution Emissions Globally

The growing regulatory pressure to reduce industrial air pollution emissions is a significant trend shaping the flue gas treatment systems market. Governments worldwide are implementing stricter regulations to curb emissions from industrial sources. In 2023, the United States Environmental Protection Agency (EPA) introduced new regulations targeting a reduction of sulfur dioxide (SO2) emissions, impacting 1,200 industrial facilities. The European Commission's Industrial Emissions Directive (IED) led to the adoption of 3,500 new emission control systems across various industries in Europe in 2023. China's Ministry of Ecology and Environment (MEE) mandated the installation of 2,000 advanced flue gas desulfurization (FGD) systems in its industrial sector in 2023. India’s Central Pollution Control Board (CPCB) enforced new norms, resulting in the addition of 1,800 new electrostatic precipitators (ESP) in the same year. The Japanese government’s stringent emission standards led to the deployment of 1,000 new selective catalytic reduction (SCR) systems in 2023.

Brazil introduced new regulations requiring the installation of 700 activated carbon injection (ACI) systems to control mercury emissions in 2023. South Korea’s Ministry of Environment (MOE) enforced stricter nitrogen oxide (NOx) emission standards, resulting in the addition of 1,500 low NOx burners in its industrial facilities in 2023, giving a boost to the flue gas treatment systems market growth. Canada implemented regulations targeting volatile organic compounds (VOC) emissions, leading to the installation of 600 new dry sorbent injection (DSI) systems in 2023. The Middle East saw the addition of 900 wet scrubbers in industrial plants due to new regulations enforced by the Gulf Cooperation Council (GCC) in 2023. Australia’s new air quality standards led to the deployment of 1,200 baghouse filter units in its industrial sector in 2023. These statistics demonstrate the global regulatory drive to reduce industrial emissions, significantly influencing the flue gas treatment systems market.

Challenge: Fluctuating Raw Material Prices Impacting Overall System Costs and Affordability

The flue gas treatment systems market faces significant challenges due to fluctuating raw material prices, impacting overall system costs and affordability. The price volatility of key materials such as steel, activated carbon, and rare earth metals affects the cost structure of these systems. In 2023, the global price of steel, a primary material for constructing flue gas treatment systems, increased by $100 per metric ton, impacting production costs. The cost of activated carbon, essential for mercury control technologies, rose by $200 per metric ton in 2023. Similarly, the price of rare earth metals, used in catalytic converters, saw an increase of $50 per kilogram in the same year. The fluctuating prices of these materials resulted in a 15% increase in the overall cost of selective catalytic reduction (SCR) systems in 2023.

The price of limestone, used in flue gas desulfurization (FGD) systems, increased by $10 per metric ton in 2023. The cost of ceramic materials, used in electrostatic precipitators (ESP), rose by $5 per kilogram in the same year. The price of fiberglass, essential for baghouse filters, saw an increase of $3 per kilogram in 2023 in the flue gas treatment systems market. Additionally, the cost of chemicals used in wet scrubbers, such as sodium hydroxide, increased by $50 per metric ton in 2023. The price of sorbents used in dry sorbent injection (DSI) systems rose by $30 per kilogram in the same year. The cost of manufacturing low NOx burners increased by 10% due to the rising prices of alloys in 2023. The fluctuating prices of these raw materials create financial challenges for manufacturers and end-users, impacting the affordability and implementation of flue gas treatment systems. Industries must navigate these cost fluctuations while ensuring compliance with environmental regulations, posing a significant challenge in the market.

Segmental Analysis

By Pollutant Control System

Particulate control system is currently dominating the market with over 38.1% revenue share. The dominance of the particulate control system segment in the flue gas treatment systems market can be attributed to its critical role in mitigating air pollution and ensuring compliance with stringent environmental regulations globally. With increasing industrialization, particularly in emerging economies, the emission of particulate matter has become a significant environmental concern. Particulate control systems, such as electrostatic precipitators (ESPs) and fabric filters, are highly effective in capturing fine particles and heavy metals from flue gas emissions. This effectiveness is a key driver behind their widespread adoption. In 2023, the launch of next-generation ESPs that offer higher efficiency and lower energy consumption has further propelled their market leadership. Recent studies have revealed that over 70% of coal-fired power plants in Asia have integrated advanced particulate control technologies to curb emissions, reflecting the growing emphasis on air quality.

Technological advancements are also shaping the demand for particulate control systems in the flue gas treatment systems market. The development of hybrid systems combining ESPs and fabric filters has shown to significantly enhance particulate capture rates, catering to industries with stringent emission standards. In Europe, the implementation of real-time monitoring systems in particulate control has enabled industries to optimize their operations and maintain compliance with regulatory limits. The growing awareness of health impacts associated with particulate matter exposure has driven investments in advanced flue gas treatment solutions in North America, with industries like cement, steel, and chemical manufacturing leading the charge. Additionally, the integration of IoT and AI in particulate control systems has provided predictive maintenance capabilities, reducing downtime and operational costs. A recent report highlighted that industries are now prioritizing sustainable practices, with over 60% of new installations in the past year being driven by corporate sustainability goals. The continuous evolution of regulatory frameworks worldwide and the push towards cleaner air are expected to sustain the dominance of particulate control systems in the foreseeable future.

By Process

Based on process, the wet process of flue gas treatment systems market stands out as the most dominant method with revenue share of over 43.4% due to its superior efficiency in removing sulfur dioxide (SO2) and other acidic gases from industrial emissions. One of the key advantages of the wet process is its ability to handle large volumes of flue gas with high moisture content, making it ideal for industries such as coal-fired power plants and cement manufacturing. The process involves scrubbing the flue gas with a liquid absorbent, typically a lime or limestone slurry, which reacts with the pollutants to form harmless byproducts like gypsum. This high removal efficiency, coupled with the capability to produce marketable byproducts, drives the preference for the wet process over semi-wet and dry alternatives.

Recent findings suggest that the wet process in the global flue gas treatment systems market is particularly effective in reducing nitrogen oxides (NOx) and particulate matter. Additionally, advancements in scrubbing technology have significantly reduced operational and maintenance costs, making it a cost-effective solution for large-scale industrial applications. The integration of wet scrubbers with other pollution control technologies, such as electrostatic precipitators and fabric filters, further enhances their effectiveness. The wet process also offers greater flexibility in handling fluctuations in gas composition and volume, which is crucial for industries with varying production rates. Furthermore, stricter environmental regulations worldwide, particularly in regions like Europe and Asia, mandate the use of highly efficient emission control systems, thereby boosting the demand for wet process flue gas treatment systems.

By Industry

By industry, power industry captured the highest revenue share of over 43.6% of the flue gas treatment systems market due to stringent environmental regulations and the increasing demand for cleaner energy production. The primary driver behind their widespread adoption is the need to control air pollution, specifically the emissions of sulfur dioxide (SO2), nitrogen oxides (NOx), particulate matter, and mercury from coal-fired power plants. Regulatory bodies such as the Environmental Protection Agency (EPA) and the European Union have set strict limits on these emissions, necessitating the installation of advanced treatment systems. Additionally, the rising public awareness and demand for sustainable practices have compelled power companies to invest heavily in these technologies. The implementation of the Best Available Techniques (BAT) and the focus on achieving net-zero emissions by 2050 are further propelling the demand for flue gas treatment systems.

Innovations such as the development of high-efficiency particulate air (HEPA) filters, advancements in selective catalytic reduction (SCR) systems, and the use of activated carbon injection (ACI) for mercury control are significant innovation in the flue gas treatment systems market. The integration of digital monitoring and IoT technologies enhances the efficiency and reliability of these systems. The shift towards biomass and waste-to-energy plants, which also require efficient flue gas treatment, is gaining traction. Furthermore, the adoption of hybrid systems combining multiple treatment methods, the increasing use of renewable energy sources, and the trend towards decentralizing power generation are influencing the market. The focus on carbon capture and storage (CCS) technologies to reduce CO2 emissions is another crucial factor. Research into new materials and catalysts for more effective pollutant removal is ongoing, highlighting the industry's commitment to innovation and environmental stewardship.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The Asia Pacific region stands as a dominant force in the flue gas treatment systems market due to its rapid industrialization and urbanization. Key factors driving this dominance include stringent environmental regulations, substantial investments in power generation, and the presence of major manufacturing hubs. China alone has over 3,000 coal-fired power plants, which necessitate extensive flue gas treatment solutions to mitigate emissions. India, another significant player, has 197 coal-fired power plants with a combined capacity of over 233 GW, further boosting demand. Additionally, Japan's commitment to reducing greenhouse gas emissions has led to the implementation of advanced flue gas desulfurization units across its 90 thermal power plants. South Korea's 60 thermal power plants also contribute to the regional demand for flue gas treatment systems. The region's strong economic growth, with countries like Vietnam and Indonesia ramping up their industrial output, further cements Asia Pacific's leadership in this industry.

North America's prominence in the flue gas treatment systems market is largely attributed to its advanced technological capabilities, strict regulatory framework, and significant investments in cleaner energy solutions. The United States leads the charge with over 1,000 coal-fired power plants, necessitating robust flue gas treatment systems to comply with the Clean Air Act. Canada, with its 80 thermal power plants, also prioritizes emission control technologies to meet environmental standards. The region benefits from the presence of leading companies specializing in flue gas treatment, such as General Electric and Babcock & Wilcox. The U.S. alone invests billions annually in air pollution control technologies, while Canada's commitment to reducing emissions is evident in its carbon pricing and stringent environmental policies. North America's focus on research and development, supported by federal and state grants, ensures continuous innovation in flue gas treatment technologies, maintaining its stronghold in the industry.

Europe's leadership in the flue gas treatment systems market is driven by its rigorous environmental policies, commitment to sustainable development, and significant investments in renewable energy. The European Union's stringent regulations, such as the Industrial Emissions Directive, mandate the use of advanced emission control technologies across its 300 coal-fired power plants. Germany, with 84 coal-fired power plants, leads the region in adopting flue gas treatment solutions. The United Kingdom's decommissioning of older coal plants and transition to cleaner energy sources has also spurred demand for advanced treatment systems. France, with its 58 nuclear reactors, utilizes state-of-the-art flue gas treatment technologies to minimize emissions. Italy and Spain, with their combined 40 thermal power plants, further contribute to the regional demand. Europe's emphasis on reducing carbon emissions and promoting sustainability, coupled with substantial funding for green technologies, ensures its continued dominance in the flue gas treatment system industry.

Top Players in Global Flue gas Treatment Systems Market

- General Electric

- Mitsubishi Hitachi systems

- Doosan Lenties

- Babcock & Wilcox Enterprises

- Clyde Bergemann Power Group

- FLSmidth

- Marsulex Environmental Technologies

- Thermax

- Other Prominent Players

Market Segmentation Overview:

By Pollutant control Systems

- Flue Gas Desulfurization (FGD) Systems

- DeNOX Systems

- Particulate Control Systems

- Mercury Control Systems

- Others

By Process

- Wet

- Semi-wet

- Dry

By Industry

- Industrial Boilers

- Power

- Chemical & Petrochemical

- Iron & Steel

- Non-Ferrous metal

- Cement

- Waste Treatment

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- U.K.

- Germany

- France

- Spain

- Italy

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0824888 | Delivery: 2 to 4 Hours

| Report ID: AA0824888 | Delivery: 2 to 4 Hours

.svg)