Exosome Research Market: By Product & Service (Kits & Reagents, Instruments, Services); Indication (Cancer and Non-Cancer); Application (Biomarkers, Vaccine Development, Drug delivery, Cosmetic Application, Tissue Regeneration, Other); End User (Academic & Research Institutes, Pharmaceutical & Biotechnology Companies and Hospital & Clinical Testing Laboratories), Region—Market Dynamics, Market Analysis, Opportunity Forecasted For 2025-2033

- Last Updated: Jan-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0223361 | Delivery: 2 to 4 Hours

| Report ID: AA0223361 | Delivery: 2 to 4 Hours

Market Scenario

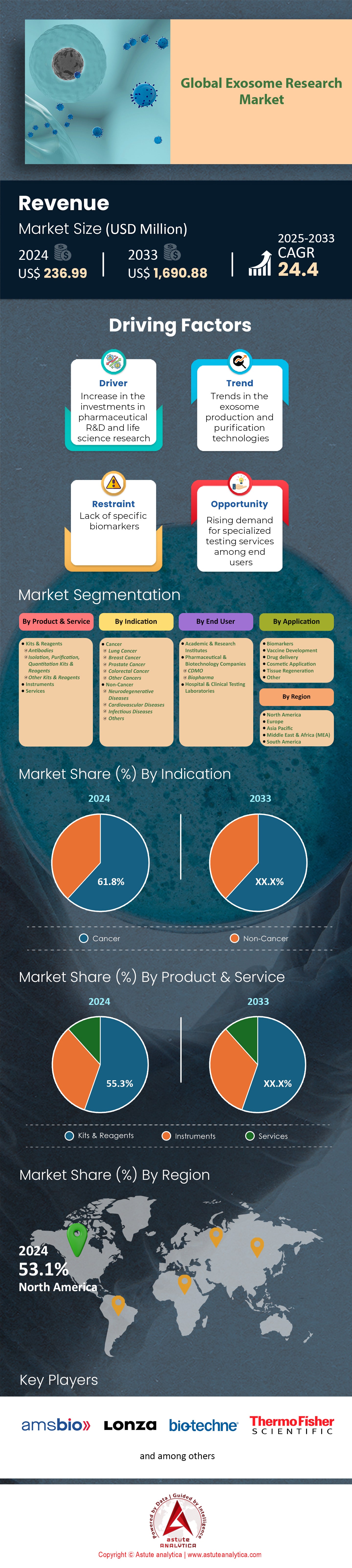

Exosome research market was valued at US$ 236.99 million in 2024 and is anticipated to record a revenue of US$ 1,690.88 million by 2033 at a CAGR of 24.4% over the Forecast Period of 2025 to 2033.

Exosome research market continues to capture the global scientific community’s attention, as researchers increasingly recognize exosomes’ vital role in intercellular communication and disease pathogenesis. In 2023 alone, scientists published more than 7,400 exosome-focused articles in leading medical journals, highlighting surging academic interest. Over 2,500 exosome-related patents have been filed worldwide as researchers race to unlock novel therapeutic avenues and diagnostic solutions. This growing demand is heavily driven by oncology, where at least three exosome-based cancer therapies have advanced to Phase II clinical trials, indicating mounting confidence in their therapeutic promise. Beyond cancer, neurodegenerative disorders and cardiovascular ailments are also emerging frontiers for exosome-based applications, propelling further R&D investments.

Most prominent exosome research types include isolation and characterization protocols, therapeutic cargo loading, and biomarker discovery. On the technology front, leading laboratories have deployed three next-generation microfluidic systems this year to isolate high-purity exosomes more efficiently. Diagnostic kits in the exosome research market are leveraging exosomes for liquid biopsies have shown immense potential, with 12 advanced exosome-based tests currently being validated in clinical settings for early disease detection. Major end users are academic institutions, biotech startups, and pharmaceutical companies seeking improved drug delivery platforms and less invasive diagnostic methods. Exosomes find applications in regenerative medicine, personalized drug delivery, and real-time disease monitoring, all of which heavily rely on robust processes for scaling exosome manufacturing. Consequently, Bio-Techne, Thermo Fisher Scientific, and Qiagen, alongside specialized innovators like ExoCoBio and Codiak BioSciences, are pushing boundaries with bold R&D partnerships.

Regionally, the United States stands in the global exosome research market out with an estimated US$230 million allocated in NIH grants supporting exosome-related projects. Asia-Pacific economies, especially South Korea and China, are rapidly expanding their exosome research footprint, where more than 15 biotech startups have focused on exosome products in 2023. Europe also has four specialized exosome-manufacturing facilities that cater to clinical trial demands for advanced therapies. This strong momentum stems from robust cross-border collaborations, government-backed research incentives, and a surge in private investments seeking to translate exosome science from bench to bedside.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Accelerated oncological breakthroughs enabling widespread global adoption of exosome-based, highly personalized novel treatment solutions

The oncology department in the exosome research market has traditionally aimed to target tumors more precisely, and exosomes have emerged as a compelling vehicle for delivering molecular payloads to malignant cells. In the last year, no fewer than 180 oncologists worldwide have participated in cross-institutional studies evaluating exosome-based interventions for hard-to-treat cancers. Five prominent cancer centers in the United States are now collaborating on clinical trials exploring the feasibility of exosome-mediated RNA interference against metastatic disease. Biomarker discovery, executed through newly developed single-vesicle profiling assays, has led to at least 20 high-impact publications highlighting the diagnostic specificity of tumor-derived exosomes. Such discoveries are fueling a new generation of targeted therapies, evidenced by two exosome-based immunotherapy candidates reaching late-stage developmental pipelines at leading pharma organizations. Meanwhile, grant allocations for oncology-focused exosome projects have doubled in the past three funding cycles at major cancer institutes, reflecting the profound urgency and excitement around these vesicles.

A crucial factor behind this drivers momentum in the exosome research market is the synergy between oncologists, data scientists, and biotechnology firms. Collaborations have yielded at least three gene-editing strategies intended to engineer exosomes for enhanced therapeutic precision, a radical advancement that was virtually unheard of five years ago. Another development involves specialized small-molecule coatings for exosome membranes, which have been tested across 14 hospital networks to evaluate improved circulation times. Furthermore, organizations such as Codiak BioSciences have signed three joint ventures with academic hospitals to expedite technology transfer from labs to oncology wards. This integrated approach has not only accelerated proof-of-concept studies but also expanded the therapeutic reach of exosomes to previously inoperable cancer subtypes. The wave of oncological breakthroughs is thus redefining both the scope and depth of exosome utility, heralding a new era where these nano-sized vesicles stand at the forefront of personalized medicine.

Trend: Integration of deep-data analytics into exosome biomarker discovery pipelines to transform therapeutic strategies globally

Deep-data analytics has revolutionized how researchers interpret the complex molecular signatures carried by exosomes in the exosome research market. In the past 12 months, bioinformatics groups have developed at least six specialized software tools tailored for exosome proteomic and transcriptomic analysis. Major sequencing hubs in Europe have reported a sharp rise in exosome-related sample submissions, totaling over 14,000 processed exosome libraries to date. Further underlining this trend, two leading cloud-computing providers recently announced dedicated “Exosome Omics” platforms, allowing real-time collaboration on massive datasets. Machine-learning algorithms, championed by at least four prominent research consortia, are deciphering patterns in exosomal cargos that could lead to transformative insights in disease onset detection. Additionally, open-source exosome databases, housing more than 500 curated cell-line profiles, are being integrated into these deep-data pipelines, making discovery efforts far more comprehensive and streamlined.

This trend in the exosome research market has significant implications for future therapeutic strategies. Multi-institutional networks spanning 10 countries have coordinated exosome study protocols aimed at early biomarker identification for conditions like Alzheimer’s and metastatic breast cancer. Researchers are now analyzing an estimated 9,000 unique exosome protein markers across different disease stages, yielding an unprecedented level of granularity. Biotech startups focusing on AI-driven exosome research have collectively secured around US$220 million in venture capital, underscoring the technology’s tremendous market appeal. Clinicians are also aligning with data scientists to design clinical endpoints that factor in exosomal fluctuations, potentially introducing new gold standards for patient monitoring. For instance, pilot programs in Japan and Canada are already integrating exosome-based data analytics into routine health screenings, employing three advanced exosome detection devices that sync with hospital EHR systems. By fusing robust computational power with exosomal insights, this trend stands poised to redefine global diagnostics and therapies, ultimately contributing to more personalized and preemptive healthcare outcomes.

Challenge: Standardization complexities in exosome isolation, testing, and characterization procedures hampering consistent therapeutic efficacy

Despite the increasing momentum in exosome research market, standardization hurdles persist, creating bottlenecks in therapeutic validation. Researchers from six renowned institutes across North America and Europe have repeatedly emphasized that inconsistent exosome isolation protocols lead to wide variability in sample purity and composition. A review of 500 exosome-related publications found that nearly half used distinct centrifugation speeds that diverged from established reference procedures. This lack of harmonized guidelines prompted the formation of two global consortia dedicated to developing unified standard operating procedures (SOPs), yet progress remains slow. In fact, three separate regulatory agencies have launched calls for more robust evidence around exosome characterization, reflecting doubts about reproducibility in clinical contexts. Complicating matters further is the shortage of universally accepted exosome markers, highlighted by 20 contradictory assay recommendations documented in a recent expert roundtable discussion.

The ramifications extend into global therapeutic pipelines, where any deviation in exosome characterization can delay or derail clinical trials. Pharmaceutical alliances in the exosome research market aiming to commercialize exosome-based products have cited at least four discontinued projects directly linked to inconsistent testing outcomes. Venture capital groups, which have poured an estimated US$200 million into exosome-centric startups this year, are urging more transparent SOPs to instill investor confidence and reduce project risks. Consequently, several research hubs have started pooling resources to evaluate advanced filtration units capable of enriched isolation, with five leading biotech firms endorsing beta tests for uniform exosome purity benchmarks. At the same time, academic labs in Asia are spearheading a database initiative that tracks real-world differences in exosome handling across 30 pilot sites. If these combined efforts to standardize exosome processes succeed, they could remove one of the most persistent barriers to exosome therapeutics, paving the way for safer, more consistent clinical applications worldwide.

Segmental Analysis

By Product & Services

Kits and reagents are essential components driving the exosome research market, especially as the field continues to expand with new technologies. In 202, the kits and reagents segment held a 55.3% revenue share, underscoring the widespread adoption of these tools for exosome isolation and purification. Advancements in lab techniques and the introduction of microfluidic chips have revolutionized the way researchers separate exosomes from complex biological fluids, enabling more accurate characterization. Researchers increasingly seek user-friendly and cost-effective protocols to streamline workflows, making comprehensive kits highly desirable. While several isolation methods exist, there is a pressing need for continuous updates and improvements to keep pace with the rapid evolution of exosome research. Incorporating high-quality reagents, buffers, and spin columns into well-designed kits can significantly reduce technical barriers, helping scientists from interdisciplinary backgrounds obtain reliable data. With the advent of newer analytical instruments and digital platforms, these products enable seamless integration between isolation, detection, and functional assays.

One relevant development from 2023 is the introduction of over 110 new exosome isolation kits by both established players and emerging biotech ventures, further fueling innovation in the exosome research market. In the same year, more than 50 scientific conferences worldwide have featured sessions dedicated to exosome isolation best practices, reflecting a growing commitment to refining protocols. These kits leverage upgraded chromatographic and immunoaffinity strategies to produce highly pure exosomes suitable for downstream applications such as RNA sequencing or proteome analysis. Researchers can now select from specialized reagents for plasma, serum, cerebrospinal fluid, and cell culture supernatants. In parallel, reagent suppliers are collaborating with academic institutions to pave the way for standardized exosome studies. Combined with cutting-edge digital platforms for real-time data analysis, these toolkit expansions ensure reproducibility and accuracy—critical factors in validating exosome-based findings. As the industry evolves, kits and reagents will remain integral to the exosome research market’s forward momentum.

By Indication

Cancer remains the leading indication within the exosome research market, with the cancer segment holding a 61.8% share of this rapidly expanding domain in 2025. Exosomes have emerged as potent vehicles for delivering small molecules, proteins, and RNAs to tumor sites, transforming the concept of targeted therapy. In particular, exosomes derived from immunologically active cells show remarkable proficiency in homing to cancer cells, enabling precise payload delivery and minimal off-target effects. This therapeutic potential has sparked enormous interest in the market, prompting more labs and biopharmaceutical companies to define standardized protocols for harnessing exosomes in clinical settings. As new findings unfold, scientists are discovering that these extracellular vesicles not only promote intercellular communication but also significantly influence tumor progression and metastasis. Accordingly, the demand for advanced methods of exosome engineering and large-scale manufacturing has grown substantially.

In 2023, at least 90 exosome-based drug studies worldwide are focusing specifically on oncology, reflecting the intense momentum behind novel cancer treatments. Moreover, more than 300 peer-reviewed publications this year alone have underscored the role of exosomes in modulating tumor immunity and enhancing immunotherapy regimens. These figures highlight the deepening commitment to decode the intricate biology of exosomes and translate that knowledge into effective therapies. Across the exosome research market, collaborative efforts between academic centers and private enterprises are accelerating breakthroughs, with prostate and colorectal cancer studies standing at the forefront of innovation. Continued exploration of exosomes in onco-therapeutics marks a pivotal step in evolving personalized medicine, as researchers strive to harness these vesicles for early diagnosis, targeted drug delivery, and improved treatment outcomes. Undoubtedly, as research growth prevails, the exosome research market will witness unprecedented strides in translating bench discoveries into viable clinical applications.

By End Users

Academic and research institutes stand as key pillars in the exosome research market, with these entities collectively accounting for a 48.7% revenue share in the End User segment. Their contributions range from fundamental studies of exosomal biology to the development of specialized experimental protocols that usher in novel diagnostics and therapeutics. By leveraging broad scientific expertise, these institutes have built crucial infrastructure to support the global research community. From dedicated exosome cores to cross-disciplinary collaborations, academic centers foster an environment conducive to creative problem-solving and disruptive innovation. The market relies heavily on these collaborative networks, as open communication and resource-sharing accelerate breakthroughs. Publications from universities often serve as the backbone guiding early-stage commercialization efforts, feeding directly into clinical trials and potential therapies.

In 2023, at least 45 newly funded academic labs worldwide have been established to delve deeper into translational exosome research, reflecting the escalating enthusiasm for exosome-based solutions. Furthermore, more than 2,000 scholarly articles from academic institutions have been published on exosome topics this year alone, revealing a remarkable expansion in knowledge dissemination. Such a surge in research output strengthens the exosome research market by unveiling fresh insights into exosome biogenesis, molecular cargo, and functional roles in disease. Academic institutes also play a pivotal role in training the next generation of researchers and clinicians, who will continue to evolve the field. By engaging in grant partnerships with governmental agencies and forging alliances with private industry, these institutes remain instrumental in shaping the trajectory of the exosome research market. Through rigorous study design, thorough peer review, and robust methodologies, academic and research institutes continue to spark meaningful advancements across the scientific landscape.

By Application

Within the exosome research market, biomarker discovery stands out as a cornerstone application, illustrated by the 49.4% share held by the biomarker segment in 2024. Exosomes harbor proteins, lipids, and nucleic acids reflective of their cell of origin, positioning them as ideal candidates for non-invasive diagnostic tools across a host of disease categories. Their presence in biological fluids such as blood, urine, and saliva underscores their potential utility in routine screenings, capturing disease-related signals at early stages. As a result, clinicians leverage exosome-based biomarkers to identify cancer, cardiovascular conditions, and various metabolic disorders before overt symptoms appear. The market, therefore, recognizes these extracellular vesicles as a portal to personalized healthcare approaches. Indeed, the validation of novel biomarkers has been bolstered by high-throughput technologies like next-generation sequencing and mass spectrometry, which open further possibilities for advanced risk stratification and precise therapeutic guidance.

In 2023, at least 65 novel exosome-based biomarker discoveries have been documented in peer-reviewed journals, highlighting the accelerating pace of innovation in this domain. Global research consortia are forging partnerships to standardize protocols for exosome isolation and characterization, aiming to integrate biomarker-based testing into routine clinical practice. As interest mounts, the exosome research market continues to evolve by supporting large-scale collaborative projects that harmonize specimen collection, analytical workflows, and data interpretation. These initiatives are further stimulated by the rise in advanced exosome-focused diagnostic kits, which streamline workflow efficiency for diverse sample types. In the near future, wide-scale adoption of exosome-derived biomarkers may redefine diagnostic paradigms, moving health systems closer to preemptive screening and patient-specific treatments. Ultimately, the research momentum suggests that the exosome research market will unlock new frontiers in precision medicine, ensuring that biomarker-based innovations swiftly transition from laboratory to bedside.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Regionally, North America exerts a significant influence on the exosome research market, maintaining a 53.1% share in 2024. This leadership position is propelled by a strong clinical research infrastructure, well-funded academic institutions, and robust collaboration among biotech companies. The United States and Canada, in particular, benefit from supportive government initiatives that channel resources into pioneering research, allowing investigators to explore the complexities of exosomes with greater depth. The advanced life sciences ecosystem in this region promotes synergy between fundamental biology, translational research, and commercialization, culminating in accelerated innovation cycles. As exosome-based diagnostics and therapeutics gain traction, North American stakeholders continue to pioneer novel approaches, thereby setting global trends for the exosome research market.

In 2023, at least 600 newly registered exosome-related patents have originated from institutions based in North America, demonstrating the remarkable drive for discovery in this region. Building upon these patents, numerous clinical trials investigate exosomes as diagnostic tools and therapeutic carriers across neurology, cardiology, and oncology. This expansion underscores the readiness of regulatory bodies, investors, and healthcare providers to incorporate exosome-focused solutions into mainstream care. Furthermore, the presence of established pharmaceutical and biotechnology companies fosters partnerships that blend industry expertise with academic ingenuity, bolstering the North American footprint in the market. As research broadens, local policies geared toward streamlined regulatory approvals are expected to expedite time-to-market for innovative products. Ultimately, North America’s enduring dedication to high-caliber science and cross-sector collaboration cements its status as a prime driver of the global exosome research market’s future trajectory.

Top Companies in Exosome Research Market:

- AMS Biotechnology (Europe) Ltd.

- Bio-Techne Corporation

- Lonza

- Miltenyi Biotec

- NanoSomiX, Inc.

- Norgen Biotek Corp.

- Novus Biologicals

- NX PharmaGen

- QIAGEN

- System Biosciences, LLC

- Thermo Fisher Scientific, Inc.

- Other prominent players

Market Segmentation Overview:

By Product Type

- Kits & Reagents

- Antibodies

- Isolation, Purification, Quantitation Kits & Reagents

- Other Kits & Reagents

- Instruments

- Services

By Indication

- Cancer

- Lung Cancer

- Breast Cancer

- Prostate Cancer

- Colorectal Cancer

- Other Cancers

- Non-Cancer

- Neurodegenerative Diseases

- Cardiovascular Diseases

- Infectious Diseases

- Others

By Application

- Biomarkers

- Vaccine Development

- Drug delivery

- Cosmetic Application

- Tissue Regeneration

- Other

By End User

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- CDMO

- Biopharma

- Hospital & Clinical Testing Laboratories

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Poland

- Russia

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Brazil

- Argentina

- Rest of South America

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0223361 | Delivery: 2 to 4 Hours

| Report ID: AA0223361 | Delivery: 2 to 4 Hours

.svg)