Global Event and Exhibition Market: By Type (B2B, B2C, and Hybrid/Mixed); Revenue Stream (Exhibitor Fee, Sponsorship Fee, Entrance Fee, and Services); End Users (Consumer Goods & Retail Sector, Automotive & Transportation, Industrial, Entertainment, Real Estate & Property, Hospitality Sector, Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 06-May-2024 | | Report ID: AA0524826

Market Scenario

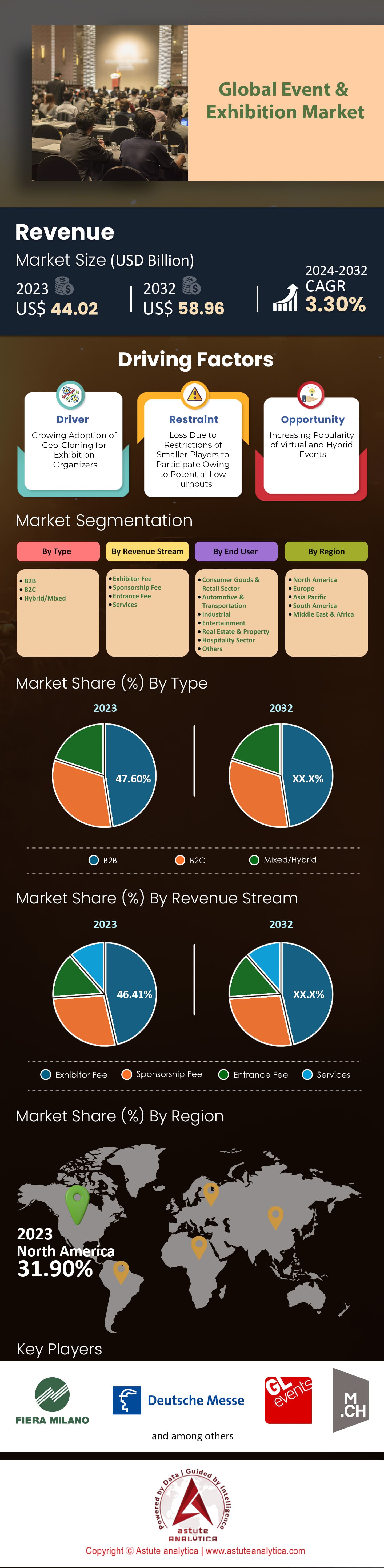

Global Event and Exhibition Market was valued at US$ 44.02 billion in 2023 and is projected to hit the market valuation of US$ 58.96 billion by 2032 at a CAGR of 3.30% during the forecast period 2024–2032.

The event and exhibition market is experiencing rapid growth, led by North America. Several things are contributing to this expansion such as the rise in corporate marketing spend (which is expected to increase by 72% for B2B budgets), adoption of new technology and continued popularity of experiential marketing. The industry is being driven forward by demand for live events that engage attendees and promote face-to-face interaction. In 2022 alone, there were over 62 thousand exhibitions held worldwide which attracted a massive 603 million visitors – with the US being the highest contributor. For example, in 2023, there were more than 41 thousand business events held in USA followed by UK having over 7,570 events according to a recent report from 10times.com.

Globalization also plays an important role since companies are expanding their territories seeking for different markets thus creating need for these gatherings where essential interactions can take place between them. The benefits of these functions extend beyond fostering relationships; through such avenues firms get chance to showcase products or services before wider audiences. Tech further fuels this growth whereby integration of trade shows with big data analytics enables exhibitors come up with targeted marketing programs as well as effective strategies. Virtual and hybrid events have been brought about by this approach powered by technology which meets changing demands in business environment hence providing sustainable substitute for traditional physical exhibitions.

Nonetheless, nothing beats face-to-face communication forever; marketers in the event and exhibition market know that trade shows offer something unique because they allow connections which cannot be created through digital platforms only. As it stands now however; let’s not forget about entertainment among others when talking about industries served by the events industry. Consumer goods fall under this too but what makes them even more diverse is variety or flexibility in terms of exhibited items at any given event thereby driving innovation across sectors. CES happens yearly at Las Vegas being one biggest show globally attracting participants from different countries numbering over one hundred fifteen thousand people who attend three thousand two hundred exhibiting companies from hundred forty countries.

Even though there may be challenges like limited venue capacities, long lead times and economic disruptions caused by COVID-19 pandemic which resulted into trillion dollars being lost worldwide last year – the event and exhibition market has shown great resilience. Virtual events are now becoming common with more emphasis put on tools that can effectively engage those attending through screens while exhibitors are also going eco-friendly i.e., 59% have reported their efforts in reducing carbon footprint during exhibitions. Therefore, it is clear that DE&I initiatives among 66% of event organizers should not come as a surprise since this reflects commitment towards inclusivity within the industry.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Growing Demand for Live, Immersive Experiences

The event and exhibition market is thriving as there is a growing appetite for “live” experiences. Consumers want to have engaging interactions with brands, and companies are responding by delivering them through events and exhibitions. And within these two areas of marketing, experiential marketing itself — the strategy that focuses on creating impactful brand-consumer connections — is also flourishing. According to a study conducted by the Event Marketing Institute (EMI), 74% of consumers are more likely to buy products after taking part in branded event marketing experiences. Moreover, EMI found 91% of consumers develop more positive feelings about brands after attending one – brands need to focus on creating shareable moments at them. This means budgeting accordingly too; according Freeman’s Global Brand Experience Study CMOs allocate between 21-50% live event spend from their total budgets on average.

Event and exhibition market provide the perfect platform for this kind of activity as they enable brands to create multi-sensory, interactive occasions that leave an impression. For example, at last year’s South by Southwest (SXSW) festival, HBO created an experience titled “Bleed for the Throne” which saw participants donate blood before being immersed into a world featuring actors and props from Game of Thrones. Although digital has risen up around it, face-to-face still remains at the heart of all good marketing. In fact, according to a CEIR survey 99% of marketers agree trade shows provide unique value not offered by other channels because they allow businesses to create personal relationships with clients face-to-face which can never be replicated online.

For instance, Google who had massive booth space during CES 2023, where they built out rides powered by google assistant that took you through a day in different locations generating massive amounts buzz and social posts. According to EMI research, 91% of consumers have more positive feelings towards brands after attending an event, with 85% likely to purchase afterwards, and over 70% converting into actual customers. They also amplify on social media too – a Splash study found events generate average 4.3 impressions per attendee, with 98% of consumers creating digital or social content at these events.

Trend: Continued Popularity of Hybrid Events

The event and exhibition market is experiencing a surge in hybrid events, which combine physical and virtual elements seamlessly. This trend continues even as Covid-19 restrictions ease because of the benefits offered by hybrid formats. Almost everyone (97%) expects the number of such gatherings to increase, and 70% believe they will be the industry’s mainstay by 2022, according to a study from Freeman. Over the past five years, search queries for “hybrid event” have increased 658%, reflecting this growing interest. To engage both in-person and remote audiences, event organizers are constantly coming up with new ideas. For example, interactive live-streams with on-demand content and networking opportunities can be provided for virtual attendees. Also, Q&A sessions and polling can be shared between people attending sessions remotely and those attending live.

There are virtual extensions of the live experience too — digital exhibit halls and gamified challenges for instance — while some events adopt a “hub-and-spoke” approach with a central in-person gathering complemented by regional satellite events held online. Salesforce’s “Dreamforce to You” is one such example in the global event and exhibition market as is next year’s Consumer Electronics Show (CES). In broader terms the market has strong foundations; it is expected to grow at a compound annual growth rate of 3.30% from 2023 to 2032, according to Future Market Insights data cited by Freeman. The financial health of the industry is evidenced by more than half (54.5%) of organizers having budgets over $500,000 with close to a quarter (22.3%) managing more than $1 million spend.

Though smaller gatherings appear to becoming more popular there remains plenty of purchasing power within the sector: over half (54%) organize more than eight events per year or have an annual budget larger than $100,000; only four per cent organize fewer than two events annually or have budgets less than $10k.

Challenge: Economic Uncertainty and Budget Constraints

The event and exhibition market is full of economic uncertainty at this time. Inflation rates all around the world are increasing rapidly, with the United States hitting a 40 year high at 9.1% in June 2022. This along with a potential upcoming recession (estimated by 72% of economists to hit America in 2024 according to NABE) causes financial decline which affects event budgets. Based on a survey done by PCMA, 36% of event planners expect their budgets to be cut for next year compared to this one. Businesses are looking for ways to cut costs and save money.

In response to these limitations, event planners are being creative in their strategies. One main approach is negotiating cheaper contracts with venues or suppliers based on less expensive locations, off-peak dates, or package deals. Another key point is that modifying the format itself can greatly impact cost savings as well. Shortening the length of an event or shifting between hybrid/virtual formats can help avoid travel expenses and accommodations fees coupled with reduced onsite operations costs too – it’s worth noting that while trying to balance scope creep some planners will still need some face-to-face time so finding the right mix here is critical; particularly when we consider that nearly six out every ten (59%) respondents said they’re going forward with hybrid events next year as per EventMB’s recent survey results.

Segmental Analysis

By Type

The B2B event and exhibition market is flourishing due to its undeniable effectiveness and is projected to dominate the market with over 47.60% market share.

In spite of the ascent of digital marketing, eye to eye interaction remains inimitable. Occasions cultivate relationship building, trust and individual connections – something that advanced communications can't imitate and subsequently advocate for significant amount spent by B2B enterprises on them. According to Astute Analytica, B2B events are successful in lead generation and sales; they allow businesses to present their products or services directly towards an intended audience who may become their customers. Events produce 277% more leads than social media networks do; a huge number (70%) of B2B decision makers are willing to spend big at events with an increasing number readying themselves up to $10 million for one purchase.

The desire for customization extends even to B2B buyers as they expect more tailored experiences when making purchases from vendors this year in the event and exhibition market. Events provide such opportunities through close engagement between sellers representatives or employees with potential buyers representatives within same booth space. This is a trend recognized by 73% of B2B executives who acknowledge increased demand among their clients/customers/prospects for personalization during sales calls etc., which leading companies address through use of “hyper-personalization” tactics during event outreach activities aimed at different individuals involved in decision making processes based on unique needs exhibited by each person over time.

By Revenue Stream

Driving the B2B event and exhibition market is the significant revenue generated through exhibitor fees. In 2023, the segment accounted for over 46.41% market share.

This segment's growth remains healthy because people still want to meet each other in person and events are effective at creating new leads. As evidence, 84% of exhibitors indicated that they would pay for more space if it meant they could attract higher quality leads. In fact, in 2023 alone, exhibitor fees brought in over $20.42 billion dollars. Similarly, exhibitors also pony up big bucks for booth space and sponsorships; on average spending about twenty-five thousand dollars per show for big companies. Moreover, signifying worthiness, many (70%) b2b buyers are willing to spend big money at events– sometimes even exceeding half a million dollars on one purchase.

Knowing how crucial it is that exhibitors have a good experience at their shows or conventions, event organizers work tirelessly towards ensuring value delivery as well as maximizing return on investment from these gatherings for them. However, only 34% of visitors in the event and exhibition market say they were satisfied according to surveys which means there’s still room for improvement somewhere down the line with regards to this particular issue area. Generating leads continues being an important aspect too where after attending 81% of businesses use emails as follow-ups methods but none should ever forget about additional revenue streams like sponsored speaking slots among others which can be used during such exhibitions or conferences. This approach could see the global trade fair industry $55 billion by 2025 driven mainly by charges imposed on those who exhibit their products during these fairs all over the world while sponsorship monies have been projected grow steadily above 3% annually until then.

By End Users

Based on end users, the entertainment industry is leading consumers of global event and exhibition market. In 2023, the entertainment industry contributed over 24.49% revenue to the global market.

The event and exhibition market is mainly powered by the entertainment industry. This industry, which includes everything from live concerts to esports tournaments, provides many options for event organizers, so they can cater to a wide variety of interests and create exciting experiences. Even though digital entertainment has been on the rise, there is still high demand for live events. For example, two 10,000-seat venues for Dota 2’s The International championship in Singapore were sold out immediately upon release of tickets, demonstrating how popular live events are. Consequently, this leads to substantial income through ticket sales and sponsorships. Esports consumer ticket sales is one of the fastest growing sub-sectors within the entertainment industry with a projected five-year CAGR of 13.8%. Additionally sponsors contribute when they want to reach engaged audiences at these events.

There are positive signs ahead for live entertainment as revenue from live music and cultural events is expected to exceed pre-pandemic levels in 2023. Cities all over the world are seeing an increase in concerts featuring international and local artists as well as new cultural centers like Mumbai’s Nita Mukesh Ambani Cultural Centre being opened up. Effective marketing plays a crucial part in attracting attendees and driving revenue generation. Premium entry fees are often relied upon by organisers to cover these marketing costs as poor promotion can have a significant impact on footfall and sales.

Entertainment events in the event and exhibition market do not only generate revenues but also have positive economic impacts on host regions by attracting tourists, boosting local businesses and creating employment opportunities. According to researches, various tourist attractions combined with well-organized events significantly increases tourism demand. The global nature of the entertainment industry enables events/exhibitions attract audience from different parts of the world. Moreover, technological advancements have further extended its reach where streaming platforms make it easier for people gain access into this sector. Thereby, helping generate revenue for filmmakers who may opt showcase their products online. Technology is also used during such gatherings so that people can have fun while at the same time making money. For example, there are now 3D projection cubes which create an immersive booth experience coupled with augmented reality or virtual reality to offer personalized recommendations to visitors.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America has the highest market share (31.90%) in the global event and exhibition market. In this regard, the United States is a record breaker with 41,400 B2B trade shows held only in 2023. These events had 158 million participants who spent $201 billion directly which further solidified their position as leaders in this field. The US alone takes more than 50% of net square foot sold worldwide for exhibitions. A number of things have contributed to North American dominance; additionally, the size of American economy which is above $27.36 trillion presents large market that cannot be satisfied without holding events. Moreover, USA boasts top-notch infrastructure with seven out of ten largest convention centers in north America being located there having over 10 million square feet combined exhibition space available. Thus, when one thinks about massive gatherings Las Vegas or Chicago might come into mind as they attract more than twenty million visitors each year.

Industry clusters in the event and exhibition market thriving across US also greatly contribute towards its success story. Silicon Valley harbors many technology powerhouses while Hollywood serves as home for entertainment giants like Disney and Warner Brothers. Furthermore, New York houses major financial institutions such as Wall Street banks including JP Morgan Chase among others all these regions create demand for specialized gatherings. The Consumer Electronics Show (CES) is a typical example where people flock from different parts of the world to see new releases in electronics industry which records attendance figures close to 170000 people together with over four thousand exhibitors showcasing their products.

European exhibitions attracted about 75 million customers who spent €38.6 billion during 2023 alone in the event and exhibition market. Europe’s strength lies on its rich history when it comes down to trade shows. Germany is leading country within Europe followed closely by France both having hosted international fairs since medieval times. Germany continues with this trend even today hosting two out five biggest worldwide industrial technology showcase known as Hannover Messe in addition to Bauma an event dedicated solely for construction machinery. However, besides traditional Europe also has several strong points. For instance; automotive industry in Germany alone accounts for more than 20% of the global revenue generated by this sector which attracts many events across that country year after year. Italy on other hand is regarded as fashion capital due to Milan Fashion Week where over one hundred thousand people attend every year. Lastly, European Union being biggest trading block with GDP of over €16 trillion helps foster trade among member states hence leading into emergence continental events like Barcelona Mobile World Congress held March 2024 which brought together more than 101000 visitors.

Europe and North America are solid powers, but Asia Pacific is growing fastest. In 2023, this region secured about 24.22% stakes from the world event and exhibition market. Many things contribute to this impressive growth rate; for one thing, it’s home some of the globe’s fastest growing economies such as China and India. In 2023 alone, China recorded a GDP worth $17.52 trillion which was second only behind United States’ $27.36 trillion; though it grew by 5.2% compared to India’s 7.6% where its rank among countries with highest GDPs is fifth while theirs is not even in top ten lists at all. Government support throughout these areas has also been instrumental during this time period – China recognized exhibitions as one their important strategic industries under the new Five-Year Plan (2016-2020) while India launched Champion Sector Scheme targeting MICE industry in particular among others like conferences expos.

Top Players in the Global Event & Exhibition Market

- Fiera Milano SpA

- Deutsche Messe AG

- Messe Frankfurt GmbH

- MCH Group AG

- GL Events

- Koelnmesse GmbH

- RELX Plc

- Viparis Holding

- Other Prominent Players

Market Segmentation Overview:

By Type

- B2B

- B2C

- Hybrid/Mixed

By Revenue Stream

- Exhibitor Fee

- Sponsorship Fee

- Entrance Fee

- Services

By End User

- Consumer Goods & Retail Sector

- Automotive & Transportation

- Industrial

- Entertainment

- Real Estate & Property

- Hospitality Sector

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)