Europe Water Recycle and Reuse Market: By Component (Equipment (Water Quality Monitoring & Control Equipment, Aeration Equipment, Membrane Filters, Reactors, Processing Tanks & Mixers, and Others), Services (Installation Services and Repair and maintenance Services); Technology (Conventional Treatment and Recycling Technologies, Chemical Treatment and Disinfection Technologies, Membrane Filtration Technologies (Microfiltration, Ultrafiltration, Reverse and Forward Osmosis, Others); End Users (Industrial (Textile, Chemical, Food & Beverage, Healthcare, Paper, Others); Agricultural and Domestic and Commercial); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Mar-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA1023652 | Delivery: 2 to 4 Hours

| Report ID: AA1023652 | Delivery: 2 to 4 Hours

Market Scenario

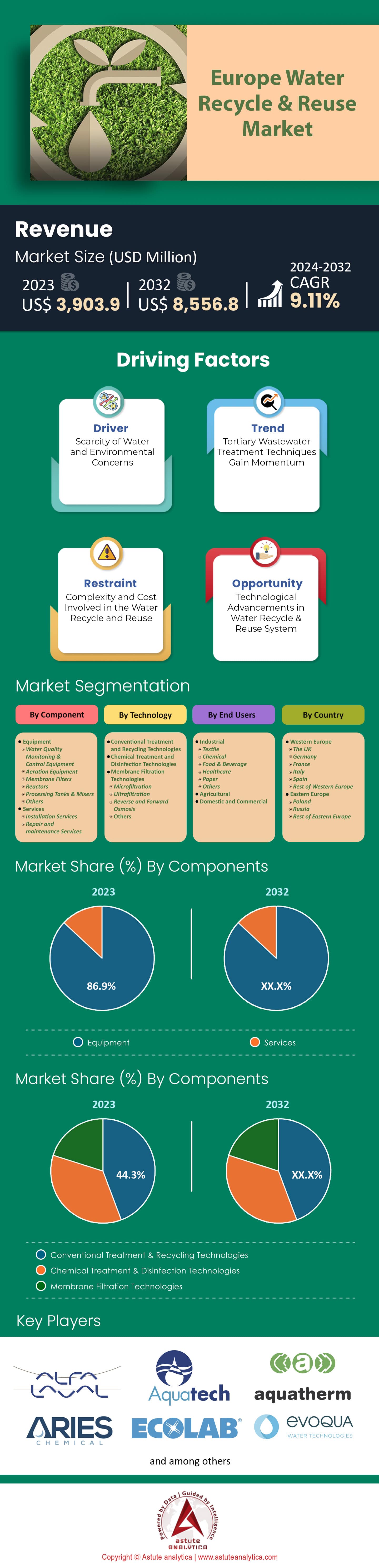

Europe Water Recycle and Reuse Market was valued at US$ 3,903.9 million in 2023 and is projected to reach a market size of US$ 8,556.8 million by 2032 at a CAGR of 9.11% during the forecast period 2024–2032.

As per the latest report by the European Union, they treat over 40,000 million cubic meters of wastewater annually. However, just 2.4% undergoes further processing to be suitable for farming. Given that about half of the EU's water consumption is for agriculture, these reclamation initiatives are anticipated to significantly benefit the environment by conserving biodiversity, diminishing contamination, and alleviating stress on vital water assets. As of 2022, around 11% of the European population and 17% of its territory had been afflicted by water scarcity conditions. With challenges on the horizon in the water recycling & reuse market, countries like Spain and Italy took the lead in adopting water reuse practices. Spain boasts over 2,000 wastewater treatment plants, of which more than 400 were designed specifically for water reuse. On the other hand, Italy had an ambition to reuse more than 300 million cubic meters of treated wastewater annually for agricultural purposes. With an average water reuse rate of only about 2.4% across the Europe water recycle & reuse market, the European Union's goal for 2020 targeted that at least 25% of wastewater treatment facilities adopt reuse practices. This intent was further backed by the EU's commitment of over €200 million in water reuse projects under the LIFE program. Another commendable pledge was from France, which aimed to double its water reuse capacity by 2025.

The financial aspects of water recycling were also noteworthy. For instance, desalination costs in Europe ranged between €0.50 to €3.00 per m³, whereas water recycling often presented a more cost-effective alternative, with costs between €0.10 to €2.50 per m³. About 20% of large industries had recognized this cost-saving potential and environmental benefits by 2022, with on-site wastewater treatment and reuse facilities. The EU recognized the urgent need for expansive water management, setting aside over €5 billion for water projects under the Cohesion Policy. Countries like Greece and Cyprus demonstrated their commitment through tangible results in the water recycle & reuse market; Greece managed to reuse about 7% of its treated wastewater by 2023, and Cyprus led the charge, recycling almost 90% of its treated wastewater, predominantly for agricultural use. This proactive approach was vital, especially when considering that tourist-rich Mediterranean areas saw a 20% increase in water demand during peak times, emphasizing the importance of efficient water management.

However, challenges were evident. By 2022, only half of European countries had implemented water-pricing policies that incentivized efficient water use and promoted recycling. Research was an area of strong focus, with European institutions investing over €100 million in novel technologies and solutions for water recycling by the early 2022 in the Europe water recycle & reuse market. Quality was not compromised, as over ten European countries set specific standards for reusing treated wastewater in agriculture. Infrastructure, a critical component, highlighted an investment gap of about €20 billion per year, encompassing recycling and reuse facilities. This was against the backdrop where Europe had the capacity to treat an impressive 70 billion m³ of urban wastewater annually.

Countries like Portugal were not far behind in their ambitions, targeting the reuse of 10% of their treated wastewater by 2025 in the Europe water recycle & reuse market. Urban solutions were also gaining traction. By 2022, over 19 significant European cities had embarked on pilot projects focusing on urban wastewater reuse for non-potable functions, showcasing the continent's comprehensive approach to water sustainability.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Water Scarcity and Rising Demand

Europe's struggle with water scarcity has become an alarming driver pushing the demand for solution in the water recycle & reuse market. Around 130 million people and 13 million hectares of the EU's agricultural lands in Europe were affected by water scarcity by 2022. This concern intensified as the Southern European countries, which comprise over 15% of the European Union's total area, experienced frequent and prolonged drought periods, leading to annual economic losses estimated at €100 billion. Groundwater sources, which provide drinking water for approximately 75% of the European population, were depleting, with some regions over-exploiting by around 40%. Additionally, by 2021, over 60% of European freshwater bodies were reported not to be in a good ecological status or potential, emphasizing the imperative need for better water management. This scarcity issue further compounds with the continent's agricultural sector consuming nearly 33% of the total water used, revealing the increasing demand for alternative water sources. As urbanization continues its trajectory, with urban areas projected to house over 75% of Europeans by 2050, the pressure on water resources is expected to rise exponentially. The escalating demand in combination with decreasing natural supply unequivocally drives the need for water recycling and reuse solutions in the European market.

Market Trend: Technological Innovations in Water Treatment

The evolution of technology has marked a significant trend in the Europe water recycle & reuse market. By 2021, the implementation of advanced treatment systems like Membrane Bioreactors (MBR) and Advanced Oxidation Processes (AOP) witnessed an adoption increase of around 18% compared to the previous five years. These technologies enhance water purification, with MBRs achieving almost 99.9% removal of bacteria and solid particles. Additionally, the market for smart water management in Europe, powered by IoT and AI, was expected to grow at a CAGR of 12.4% between 2022 and 2035. The rise of decentralized water treatment systems, which increased by approximately 20% in installations by 2021, further underscores the trend towards localized, efficient water treatment solutions.

The European Commission's Horizon 2020 program, which had earmarked over €450 million for water innovation projects, played a pivotal role in fostering these technological advancements. Furthermore, the digitization of water infrastructure and utilities saw an impressive investment surge of over €3 billion between 2018 and 2022. As the need for high-quality recycled water grows, spurred by the stringent European regulations which require 95% of urban wastewater to be treated, the adoption of cutting-edge technologies in water treatment and management becomes an unmistakable trend in the region.

Restraint: Infrastructure and Investment Challenges

The challenge surrounding infrastructure and the associated investments is one of the primary restraints in the Europe water recycle & reuse market. As of 2021, it was estimated that Europe's water infrastructure was, on average, over 40 years old, with some parts even surpassing a century. This aging infrastructure, ill-equipped to handle modern water recycling and reuse practices, required significant retrofitting or replacement. The European Investment Bank (EIB) had estimated that to modernize and expand the continent's water infrastructure, an investment of approximately €275 billion was necessary over the next two decades. In 2022, EID had invested over €2.2 billion for making water security and climate change adaptation.

However, despite the glaring need, funding had been a persistent hurdle in the Europe water recycle & reuse market. By 2022, there was an observed investment gap of about €20 billion annually for water infrastructure projects across Europe, hindering the swift transition to efficient water recycling and reuse systems. Moreover, the UN Department of Economic and Social Affairs reports a funding gap of 61% for achieving water and sanitation targets.

The disparity in investment became more pronounced when scrutinizing individual countries. While Western European countries like Germany and France had allocated over 1.5% of their GDP towards water infrastructure, some Eastern European nations struggled to allocate even 0.5%. Furthermore, municipalities, responsible for over 70% of public water supply and wastewater services, faced budgetary constraints. By 2022, nearly 45% of European municipalities reported insufficient funds to address urgent water infrastructure needs. This lack of adequate infrastructure and the financial challenges associated with updating it stands as a significant restraint, slowing down the adoption and expansion of water recycling and reuse practices in Europe.

Segmental Analysis

By Technology

Based on technology, the European water recycle & reuse market showcases a pronounced dominance of the conventional treatment and recycling technologies segment. In 2023, this segment had captured a substantial market share of over 44%, signifying its pivotal role in the Europe's water management framework thanks to its tried-and-tested nature, making it a go-to choice for many European nations and is projected to keep growing at an impressive CAGR of 9.27%, underlining the consistent confidence stakeholders have in conventional treatment and recycling technologies.

While other segments, such as chemical treatment and disinfection technologies and membrane filtration technologies, play essential roles in the market, the unwavering trust in conventional methods is clear. The steady and robust growth of this segment illustrates that while innovations are crucial, traditional technologies remain foundational in Europe's journey towards sustainable water recycle & reuse market.

By Component

The European water recycle & reuse market, when segmented by component, reveals a pronounced dominance of the equipment sector. In 2023, the equipment component constituted a staggering 86.9% of the market share ensuring efficient water recycling and reuse practices across the region. By 2032, while there's a slight decrease, equipment still holds a robust 87.7% market share, valued at an estimated US$ 7,843.97 Mn.

On the other hand, services, though essential for the optimal functioning of recycling systems, held a smaller portion of the market. Starting at 13.1% in 2023, it is projected to decline slightly to 12.3% by 2031. This showcases a modest yet essential role of services in the overarching water management framework in Europe. The equipment segment is projected to exhibits a CAGR of 9.22%, while services to grow at a CAGR of 8.38%. Though equipment holds a more significant market presence, services maintain their relevance with steady growth, ensuring the holistic development of the water recycling and reuse landscape in Europe.

By End Users

Increasing problems of water scarcity, stringent regulations and the economic benefits of sustainable water management are compelling industrial players across textile, fnb, chemical, paper, and agricultural sectors to opt for recycling activities. In 2023, industrial users accounted for 41.6% market share in the Europe water recycle and reuse market, which is the second largest after domestic and commercial users. The chemical industry alone could save up to 30% of its current water consumption, which would benefit both costs and risks. While revenue contribution from the Food & Beverage sector is expected to be around 709.3 million by 2032.

The EU’s Water Reuse Regulation that came into effect in June 2023 along with policies like Industrial Emissions Directive and Eco-design for Sustainable Products Regulation are key drivers for adoption in Europe. Although limited awareness and regulation gaps pose as barriers, wastewater has started being perceived as a reliable resource more than ever before – leading to much needed investments in water recycling and reuse infrastructure. Sustainable water practices will be seen as imperative for competitiveness and environmental compliance as numerous companies in the European region pushing forward to reduce emissions while maintaining economic output,

As freshwaters become costly and the opportunity of resource recovery becomes visible, industries in the Europe water recycle and reuse market are finding that treated wastewater often holds valuable nutrients that can make fertilizers - creating new revenue sources. Additionally, circular economy principles have encouraged businesses to view wastewater differently; now seen more as a source rather than waste material. This sudden change will improve integration of recycling and reuse technologies into industrial processes while promoting efficiency between different sectors involved with water use.

To Understand More About this Research: Request A Free Sample

Top Players in Europe Water recycle & reuse market

- Alfa Laval Corporate AB

- Aquatech International LLC

- Aquatherm GmbH

- Aries Chemical Inc.

- Ecolab Inc.

- Evoqua Water Technologies LLC

- Fluence Corp. Ltd.

- Grundfos Holding AS

- Komline Sanderson Corp.

- Lenntech BV

- Praj Industries Ltd.

- Samco Technologies Inc.

- Siemens AG

- Veolia Environment SA

- Other Prominent players

Market Segmentation Overview:

By Component

- Equipment

- Water Quality Monitoring & Control Equipment

- Aeration Equipment

- Membrane Filters

- Reactors

- Processing Tanks & Mixers

- Others

- Services

- Installation Services

- Repair and maintenance Services

By Technology

- Conventional Treatment and Recycling Technologies

- Chemical Treatment and Disinfection Technologies

- Membrane Filtration Technologies

- Microfiltration

- Ultrafiltration

- Reverse and Forward Osmosis

- Others

By End Users

- Industrial

- Textile

- Chemical

- Food & Beverage

- Healthcare

- Paper

- Others

- Agricultural

- Domestic and Commercial

By Country

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA1023652 | Delivery: 2 to 4 Hours

| Report ID: AA1023652 | Delivery: 2 to 4 Hours

.svg)