Europe Roll Cover Market: By Material Type (Elastomer Roll Covers, Polyurethane Roll Covers, Composite Roll Covers, Ceramic Roll Covers, Metallic Roll Covers); Roller Type (Hard Roll Covers, Soft Roll Covers); By Functionality (Heat Resistant Roll Covers, Chemical Resistant Roll Covers, Abrasion Resistant Roll Covers, Corrosion Resistant Roll Covers, Anti-Stick Roll Covers, Impact Resistant Roll Covers); Application (Pulp and Paper, Textile, Metal Processing, Printing, Packaging, Food and Beverage, Wood Processing, Plastic Film and Foil Processing); Industry (Manufacturing, Automotive, Consumer Goods, Construction, Mining); Country—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Jan-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA01251126 | Delivery: Immediate Access

| Report ID: AA01251126 | Delivery: Immediate Access

Market Scenario

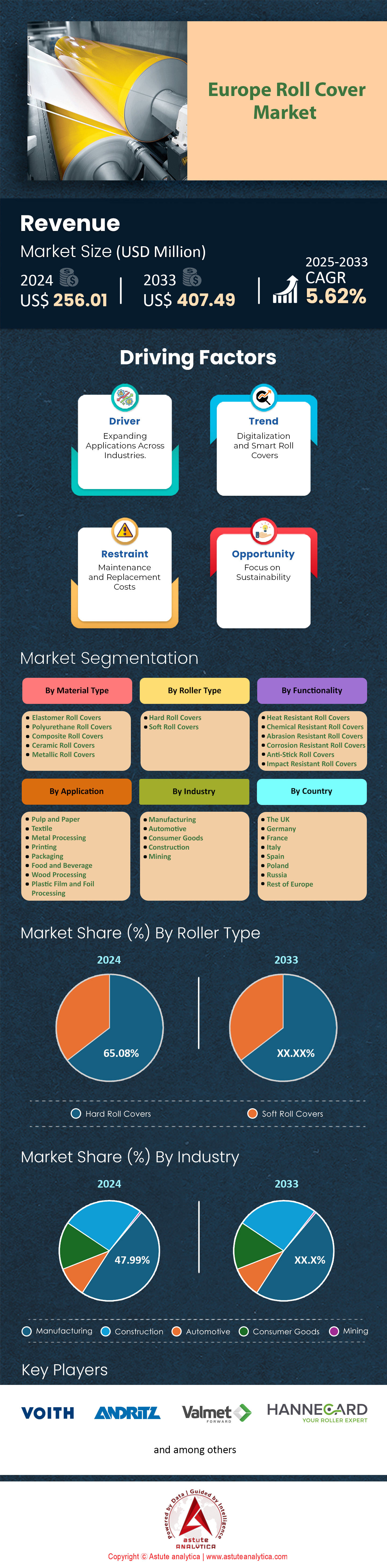

Europe roll cover market was valued at US$ 256.01 million in 2024 and is projected to hit the market valuation of US$ 407.49 million by 2033 at a CAGR of 5.62% during the forecast period 2025–2033.

Roll covers, advanced protective layers for industrial rollers, are seeing growing traction across Europe due to their ability to optimize performance, longevity, and final product quality in multiple industrial settings. In 2024, Germany stands at the forefront of the roll cover market in the region with 68,400 industrial rollers employing these covers, spurred by its robust manufacturing and automotive base. France follows with 44,200 coated rollers powering key sectors like packaging and textiles, while Italy uses 39,100 rollers in the paper and printing domains. The demand for roll covers is increasing in tandem with the need for corrosion resistance, thermal stability, and abrasion-proof surfaces, particularly in the pulp and paper, steel, and plastics segments. Europe’s paper industry alone utilizes 32,000 roll covers each year, a substantial figure propelled by an emphasis on sustainable materials such as polyurethane and rubber.

The predominant varieties of roll covers are rubber, polyurethane, and composite-based options in the Europe roll cover market. Notably, polyurethane stands out, with 48,600 industrial rollers now featuring this high-durability material for enhanced wear resistance and operational flexibility. Composite roll covers, revered for their light weight and high strength, are used in 17,200 rollers annually, particularly within aerospace and automotive industries. Meanwhile, the food processing sector leans heavily on rubber covers, with 21,000 rollers meeting stringent hygiene requirements. Companies adopting automation have also spurred a notable uptick in roll cover use: approximately 27,000 rollers in automated production lines now incorporate these covers to support reliability and throughput.

A clear trend in the European roll cover market is a pivot toward eco-friendly roll cover alternatives. Over 14,800 rollers now use bio-based polyurethane covers, demonstrating an increased focus on sustainability. Concurrently, smart roll covers equipped with sensors have been adopted by 11,300 rollers across steel and paper industries to enable real-time monitoring. This move aligns with Industry 4.0 initiatives emphasizing data-driven performance optimization. With technical advancements and a push for enhanced product quality, Europe’s roll cover consumption remains vibrant and poised for further expansion.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Growing Demand for Enhanced Efficiency in Paper and Pulp Manufacturing Processes

The paper and pulp manufacturing sector in Europe roll cover market plays a pivotal role in driving the roll cover market forward. With 32,000 rollers reliant on roll covers for consistent operation, companies in this sector face harsh conditions involving high temperatures, moisture, and constant wear. Germany’s paper mills alone incorporate 13,400 roll covers each year to reduce machinery downtime and enhance production reliability. Polyurethane continues to be the top choice here, with 18,200 rollers leveraging its friction-reducing qualities. Sustainability concerns have accelerated the use of bio-based polyurethane in 6,700 rollers, helping paper mills meet regulatory mandates and corporate sustainability goals.

In France, an additional 8,400 rollers utilize roll covers in the fast-evolving paper segment in the roll cover market, driven by expanding consumer demand and heightened emphasis on efficient resource utilization. Italy demonstrates a similar growth pattern, with 5,900 rollers in packaging lines harnessing specialized covers designed for high-speed operations and minimal maintenance. This focus on efficiency and eco-consciousness underscores the instrumental role roll covers have in modern paper and pulp processes. By investing in advanced technologies, manufacturers can further optimize production, making roll covers an indispensable component of Europe’s vibrant paper and pulp sector.

Trend: Emergence of Smart Roll Covers with Embedded Sensors for Real-Time Performance Monitoring

One of the most impactful trends shaping the European roll cover market is the surge in smart roll covers equipped with embedded sensors for real-time performance tracking. In 2024, Germany’s steel and paper industries collectively deployed 6,300 sensor-enabled roll covers, leveraging data-driven maintenance to avoid costly production downtimes. France’s packaging sector exhibits a similar adoption curve, with 2,400 rollers outfitted with intelligent covers that monitor temperature fluctuations, pressure levels, and operational inconsistencies. Meanwhile, Europe’s steel sector on its own accounts for 3,500 sensor-based roll covers, focusing on optimizing temperature management and wear detection. These innovations signify an escalating emphasis on predictive maintenance, a key ingredient for heightened operational efficiency and reliability.

Beyond Germany and France, Italy has also emerged as a front-runner in the roll cover market, incorporating 1,800 sensor-equipped covers within textile lines to uphold quality benchmarks and reduce waste. The paper manufacturing segment across Europe integrates an additional 2,100 smart roll covers that monitor abrasion and friction in real time, helping detect potential issues before they escalate. Over time, the average lifespan of polyurethane roll covers has surpassed 9 years when maintained with sensor-driven data, solidifying their cost-effectiveness. As Industry 4.0 continues reshaping European manufacturing, smart roll covers are rapidly becoming indispensable, paving the way for new levels of automation and analytics-driven productivity.

Challenge: High Complexity in Manufacturing Customized Roll Covers for Diverse Industrial Applications

Customization demands present a formidable challenge in the European roll cover market, where over 14 distinct industries each impose specialized requirements. For instance, the steel sector alone operates 7,500 rollers that must endure extreme heat conditions in excess of 800°C, which necessitates high-specification covers with advanced thermal properties. In parallel, food processing operators rely on 11,200 FDA-compliant rubber roll covers designed to meet strict hygiene parameters. This complexity can strain manufacturers as they are obliged to engineer bespoke solutions that cater to drastically divergent needs across the region.

The petrochemical industry introduces an additional layer of complexity, as 3,200 rollers require composite roll covers capable of resisting aggressive chemicals. Aerospace applications, with 1,700 rollers demanding advanced dimensional accuracy and reduced weight, further raise the bar for precision engineering. Meeting these rigorous standards often entails employing rapid prototyping techniques, a process that becomes even more daunting when 4,600 custom-fit roll covers are needed annually by textile and packaging firms. Striking a balance between high-performance engineering and cost management remains pivotal, emphasizing the difficulties manufacturers face while addressing Europe’s diverse roll cover landscape.

Segmental Analysis

By Material Type

Elastomer-based roll cover market with over 41.95% market share have remained the most preferred solution in European industrial settings mainly because of their exceptional elasticity and robust mechanical properties. Elastomers, by definition, contain flexible molecular chains that can stretch significantly while maintaining dimensional stability, which is a key requirement for roll covers used in high-speed processes This inherent viscoelasticity dampens vibration and ensures minimal damage under repeated mechanical stress, a valuable trait for applications like metalworking or textile finishing, where surface uniformity must remain intact. Major providers such as Trelleborg AB and Voith Group have specialized production lines for elastomer covers, emphasizing heat resistance and precision tolerances that keep downtime low for end users across diverse sectors. Furthermore, elastomers can be formulated to withstand aggressive chemicals, making them ideal for heavy-duty usage in printing and lamination lines where frequent contact with solvents is unavoidable.

Another major factor underlying elastomer’s dominance in the roll cover market is cost-effectiveness combined with ease of maintenance. Unlike materials such as ceramic or carbon fiber, elastomer roll covers can be refurbished relatively easily, extending service life for operators who often face prohibitive replacement expenses if they opt for less forgiving alternatives. In Western European countries, including France and Italy, leading steel mills leverage elastomer roll covers to absorb high-impact loads on production lines where even minor surface defects can jeopardize entire batches. In the packaging industry, multinationals like Mondi Group rely heavily on elastomer covers to optimize friction properties during film stretching and lamination processes. These covers also appeal to sustainability-focused end users, as certain elastomer compounds can be recycled or reprocessed, aligning with stricter environmental directives in the European Union. Collectively, these dynamics make elastomer roll covers the prime choice for performance-critical tasks, with organizations throughout Europe consistently citing higher impact resistance, reduced maintenance demands, and superior lifespan as the principal reasons for their sustained adoption.

By Functionality

Abrasion-resistant roll covers market with more than 30.44% market share hold strong appeal in Europe because they mitigate the rapid surface wear commonly induced by frequent contact with coarse or sharp-edged materials. In sectors such as converting, pulp & paper, and metal polishing, rolls frequently face harsh friction that could compromise roll integrity if not addressed with suitably robust materials. With abrasion-resistant coatings—ranging from ceramic-infused layers to fortified rubber compounds—a single roll cover can endure significantly longer operational cycles, reducing the need for frequent refurbishments. In Finland’s paper industry, for instance, mills run around the clock producing specialty papers where unrelenting fiber streams would otherwise erode less resilient coverings. By opting for surfaces designed to tolerate continuous scuffing, plant managers maintain stable line speeds and avoid shutdowns that could cost millions in delayed shipments.

Functionally, abrasion-resistance in roll covers also preserves product quality. Felt finishes in textile mills or gloss finishes in packaging rely on uniform roll surfaces that do not scratch or imprint undesired textures. Providers like Andritz AG have developed proprietary coating formulas that resist micro-tearing even under high tension. This resistance in the roll cover market of Europe helps operators achieve consistent material thickness, uniform gloss levels, and minimal contamination. Moreover, greater emphasis on processing recycled materials in Europe puts added stress on roll covers, as reclaimed inputs can contain unexpected particulates or contaminants. Abrasion-resistant solutions thus become a vital safeguard against production disruptions. Whether in Belgian laminating lines or Dutch print operations, end users are adopting covers engineered for heavy-duty tasks to preserve line efficiency and final product standards. As environmental regulations intensify and recycled feedstocks continue growing, the need for surfaces that can hold up under harsher process conditions makes abrasion resistance one of the most sought-after functionalities across European industries.

By Application

Pulp & paper production accounts for nearly 39.50% market share in Europe roll cover market because the sector itself is deeply entrenched in economies like Sweden, Finland, and Germany, where major companies such as Stora Enso and UPM Communication Papers operate mills with massive daily outputs. Processing high volumes of pulp requires dependable rollers capable of withstanding continuous mechanical stress, water exposure, and chemical additives. Roll covers that maintain a uniform grip on wet pulp while resisting the corrosive influence of bleaches and other processing agents are indispensable for these mills. Thermal stability is also key, as certain stages of the paper-making process involve elevated temperatures for drying, and covers must resist both expansion and warping. Consequently, specialized elastomer or composite surfaces that balance chemical resistance with dimensional reliability are in great demand for these lines.

The sheer scale of these operations—where each production line can run for extended periods—drives demand for robust materials in the roll cover market that can tolerate large volumes of passing fiber. High capacity in the European paper sector, combined with tight margins and intense competition from global suppliers, pushes operators to minimize downtime. Roll covers designed with advanced rubber or polymer blends ensure longevity and consistent performance, an absolute necessity in a market where missed shipments risk losing major client contracts. Many mills integrate sensor-based monitoring systems on their covers, working closely with solution providers like Valmet to maintain real-time data on surface tension and wear levels. By rapidly replacing or refurbishing worn covers, mills keep up with production targets and consistently high paper quality. As such, the pulp & paper segment’s historical footprint, coupled with the need for precise, high-throughput equipment, has solidified its status as the largest consumer of roll covers in Europe, where reliability and application-specific functionality drive ongoing innovation.

By Roller Type

Hard roll covers with over 65.08% market share have surged in popularity across Europe roll cover market because they deliver the rigid support that numerous high-tension and high-pressure processes require. Industries like aluminum foil manufacturing or heavy-gauge steel rolling rely on covers that maintain a precise shape under intense operational loads. In Germany, companies such as ThyssenKrupp place special emphasis on roll accuracy and limited deflection; hard covers composed of materials like steel alloys and specially engineered composites provide minimal deformation throughout production. This rigidity is essential to keeping product thickness uniform, a critical issue when rolling high-value metals or advanced alloys designed for automotive components. Additionally, the greater hardness levels of these covers ensure longevity in abrasive settings, where continuous friction is a day-to-day reality.

Beyond the metal sector, European paper converters and plastic film producers also look to hard roll covers for stable tension control. Machinery in these segments often runs at high line speeds, leaving little margin for equipment flex or heat expansion. Hard roll cover—sometimes featuring a ceramic or hardened thermal-sprayed surface—excel at withstanding temperature spikes while maintaining a consistent diameter. The result is fewer instances of web handling issues, translating to less waste, smoother product finishes, and minimized downtime. British packaging firms in the roll cover market, for example, have reported that installing hard roll covers significantly cuts maintenance intervals on high-volume production lines. While elastomer covers still dominate many segments, the specialized uses that demand rigidity, abrasion resistance, and thermal stability position hard covers as an indispensable option for operations where dimensional accuracy and stable tension define profitability. Their adoption continues to climb, particularly within Northern Europe’s advanced manufacturing hubs, underscoring how material selection often hinges on process-specific technical needs rather than a one-size-fits-all approach.

To Understand More About this Research: Request A Free Sample

Country Analysis

Germany with more than 25% market share emerged as the largest contributor to Europe’s roll cover market primarily because of its extensive industrial landscape, underpinned by high-value segments such as automotive manufacturing, steel production, and a longstanding pulp & paper sector. German enterprises like Voith Paper—headquartered in Heidenheim an der Brenz—have played a pivotal role in driving innovations in roll cover technology. This leadership extends to the development of specialized coatings that address the stringent process requirements of local clients, who range from automotive part die cutters in Stuttgart to advanced paper mills in the Hamburg region. The country’s rigorous engineering heritage, exemplified by institutes like the Fraunhofer-Gesellschaft, further bolsters continuous research in polymer chemistry, tribology, and material science. Roll cover providers, operating in collaboration with these research bodies, can repeatedly test new formulas in realistic conditions, leading to breakthroughs in specialized elastomer blends or ceramic-based top layers well before these technologies reach the broader European market.

Another factor propelling Germany’s leadership in the Europe roll cover market is the robust support structure of raw material suppliers, mechanical engineering firms, and end user industries that require high-precision rollers on a large scale. BASF SE, based in Ludwigshafen, produces chemical intermediates used in advanced polymer formulations, while other German-based companies like Continental AG and Lanxess AG develop specialty elastomers that feed directly into roll cover manufacturing. The synergy among these stakeholders reduces lead times for product development, ensuring that new cover prototypes can swiftly transition from laboratory concept to commercial deployment. German regulations also impose strict standards for both safety and environmental performance, which compels roll cover producers to innovate sustainable solutions—such as solvent-free coatings or recyclable elastomer systems—that meet or exceed national and EU-wide directives. As a result, roll covers produced and procured in Germany are often cited for their high quality, extended service life, and alignment with the latest ecological guidelines. With large-scale buyers in the country’s packaging, steel, and automotive sectors consistently sourcing from domestic manufacturers, Germany’s role as a central node in Europe’s industrial chain secures its position as the top contributor to the continent’s roll cover market.

Top Companies in the Europe Roll Cover Market

- Voith GmbH & Co. KGaA

- ANDRITZ AG

- Valmet

- Hannecard

- Other Prominent Players

Market Segmentation Overview:

By Material Type

- Elastomer Roll Covers

- Polyurethane Roll Covers

- Composite Roll Covers

- Ceramic Roll Covers

- Metallic Roll Covers

By Roller Type

- Hard Roll Covers

- Soft Roll Covers

By Functionality

- Heat Resistant Roll Covers

- Chemical Resistant Roll Covers

- Abrasion Resistant Roll Covers

- Corrosion Resistant Roll Covers

- Anti-Stick Roll Covers

- Impact Resistant Roll Covers

By Application

- Pulp and Paper

- Textile

- Metal Processing

- Printing

- Packaging

- Food and Beverage

- Wood Processing

- Plastic Film and Foil Processing

By Industry

- Manufacturing

- Automotive

- Consumer Goods

- Construction

- Mining

By Europe

- The UK

- Germany

- France

- Italy

- Spain

- Poland

- Russia

- Rest of Europe

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA01251126 | Delivery: Immediate Access

| Report ID: AA01251126 | Delivery: Immediate Access

.svg)