Europe Doors Market: Analysis by Product Type (Hinged, Bi-Fold & Sliding Doors, French Doors, and Others); By Material (Wooden Doors (Solid Wood Doors, Engineered Wood Doors), Metal Doors (Steel Doors, Aluminum Doors), uPVC, Composite Doors, and Others); Application (Residential (New and Improvement & Repair) and Commercial (New and Improvement & Repair); Country— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: Mar-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0324802 | Delivery: 2 to 4 Hours

| Report ID: AA0324802 | Delivery: 2 to 4 Hours

Market Scenario

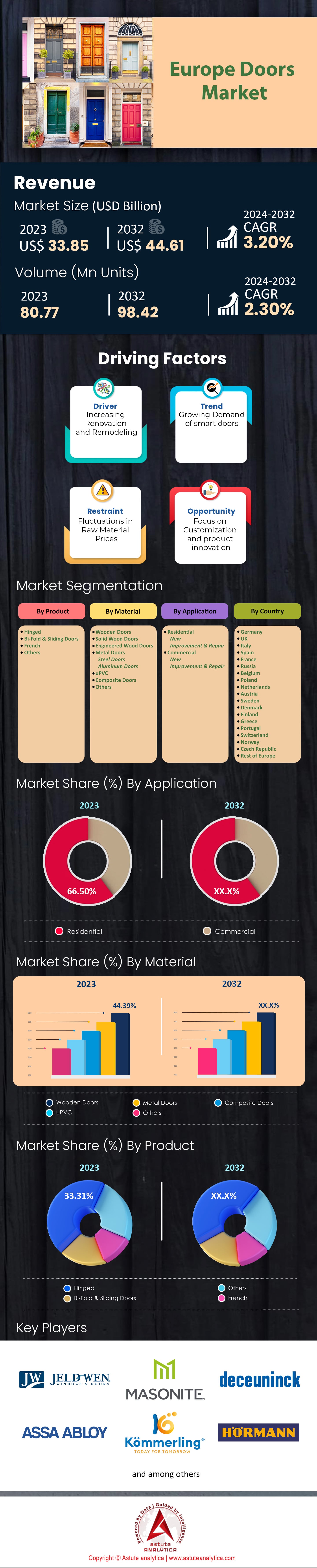

Europe Doors Market was valued at US$ 33.85 billion in 2023 and is projected to hit the market valuation of US$ 44.61 billion by 2032 at a CAGR of 3.20% during the forecast period 2024–2032.

The European doors market is closely connected to the broader construction and renovation industry, currently navigating through a period of economic uncertainty and modest market adjustments. As of 2023, the market is experiencing a stable phase, mirroring volumes seen before the pandemic. Despite economic headwinds, the order books of door manufacturers and suppliers are relatively full, providing a short-term buffer. A modest decline is anticipated in the door sector for 2023 and into 2024, aligning with a slowdown in overall construction activity. This is partly due to a decrease in building permits, confidence, and demand. The expected decline for the European market specifically in 2024 is estimated at around -1%. However, this decline is somewhat counterbalanced by the renovation market, which is less affected by economic cycles and represents a significant portion of door sales.

The renovation sector, driven by sustainability efforts and the need to upgrade existing buildings, is a crucial growth area for the market. Renovation and maintenance demands are more stable and are expected to continue to grow, providing a cushion against the decline in new door installations linked to new construction. Regional variations exist within Europe's doors market. Some areas may experience growth despite the broader trend of modest decline. Challenges faced by the industry include material price fluctuations and labor scarcity. High inflation and interest rates also contribute to the cautious outlook, with concerns that further tightening of monetary policy could dampen economic activity.

Investments in low-carbon energy and infrastructure renovation are expected to drive growth for certain door segments, particularly those focused on energy-efficiency and security. Looking beyond 2024, some analysts predict the European doors market could grow at a compound annual growth rate (CAGR) of around 2.9% from 2024 to 2032. This growth will be supported by an increasing population shift towards metropolitan areas, the need for modern and efficient residential constructions, and the aging infrastructure that requires renovation.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Strong Demand for Renovation Activities Driving Growth of Doors Market in Europe

The European market is experiencing significant growth driven by the expanding renovation sector. This market was valued at €109 billion in 2020 and is expected to grow at a CAGR of 3% until 2030. To meet the EU's climate goals, an additional €275 billion annually is needed for building renovations, creating substantial opportunities for door replacements and upgrades within existing structures. Currently, the EU's annual building renovation rate is only 1%. The Renovation Wave strategy aims to double this to 2-3% by 2030, further stimulating the doors market. The ultimate goal is an 80% reduction in energy demand from buildings by 2050, necessitating widespread door upgrades.

Financial support is crucial. The EU's Recovery and Resilience Facility provides €672.5 billion with a significant focus on building renovations. National Recovery and Resilience Plans (NRRPs) often include specific targets and funding for energy-efficient door installations. The energy-saving potential is immense. Buildings consume 40% of the EU's energy and emit 36% of its greenhouse gas emissions. Modern, energy-efficient doors included in deep renovations can reduce a building's energy consumption by 60-90%. A 3% renovation rate could save €80 billion in annual energy costs.

Beyond energy savings, renovations boost the economy. Every €1 million invested in renovations generates 18 jobs and up to €5 in additional GDP over 5 years. This economic activity strengthens the entire supply chain for the doors market.

Challenge: High Inflation and The Subsequent Tightening of Monetary Policy are Creating Significant Headwinds for the European Doors market

High inflation and the subsequent tightening of monetary policy pose significant challenges for the European doors market. Euro area annual inflation reached a concerning 8.6% in June 2023, with core inflation also above target at 5.4%. In response, the European Central Bank (ECB) has raised interest rates by 400 basis points since July 2022, with the main refinancing rate now at 4.00%, the highest since 2008. Further rate hikes are anticipated, with markets predicting a peak rate of around 4.20% by the end of 2023. This economic climate directly impacts the construction sector. The ECB projects a decline in euro area GDP growth to 0.9% in 2023, down significantly from 3.5% in 2022. Business confidence has weakened, with the S&P Global Eurozone Composite PMI falling to 48.9 in June 2023, signaling contraction. Consumer confidence also remains low at -16.1 in June 2023, as rising costs and interest rates strain household budgets.

These factors have adverse consequences for the doors market. The IHS Markit Eurozone Construction PMI dropped to 44.3 in June 2023, indicating the sharpest contraction in construction activity since January 2021. New construction orders have declined for 12 consecutive months. Rising borrowing costs and economic uncertainty lead to projects being delayed or canceled, suppressing demand for doors in both new builds and renovations. This is further evidenced by Germany's 27.0% year-on-year drop in building permits in April 2023, the steepest decline since 2006. Additionally, loans for house purchases in the euro area grew by only 1.2% year-on-year in May 2023, the slowest pace since 2014, making it harder for homeowners to finance renovations that might include new doors.

Trend: Growing Emphasis on Sustainable Living Giving a Boost to Eco-Friendly Door Across Europe

Eco-friendly doors market is gaining significant traction across European countries, propelled by an increasing focus on environmental sustainability. This report highlights crucial trends in materials, technologies, and industry practices shaping the market for eco-friendly doors in Europe. A commitment to sustainable materials is at the forefront of this trend. Timber, with the lowest embodied carbon among window materials, remains a popular choice, especially certified wood. Notably, 48.2% of European forests hold FSC® certification, underscoring responsible forestry practices. The use of reclaimed wood, recycled materials (such as wood fibers or plastic), and rapidly renewable resources like bamboo demonstrate a focus on minimizing environmental impact. Even durable and recyclable metals like steel and aluminum are highlighted, with aluminum's 100% recyclability contributing to circular economy principles.

Eco-friendly doors are not just about materials, but also incorporate energy-saving technologies. Insulation is crucial, with European-style doors designed to reduce energy consumption in homes. For example, timber windows and doors can offer impressive u-values up to 36% better than building regulation requirements. Resistance to weather and other environmental factors also contributes to longevity, further enhancing sustainability in the European doors market. These doors offer a variety of design choices, suitable for both residential and commercial applications. They come in various materials, styles, colors, and configurations, with customization options available. Importantly, eco-friendly doors prioritize security and technical features alongside their sustainability focus, integrating features like reinforced locks, water-repellency, and soundproofing.

Marketwide, eco-friendly doors are becoming increasingly influential. This trend aligns with green building practices that reduce environmental footprint and positively impact property values. Companies themselves are embracing responsible material choices and adopting energy-efficient finishing processes like Svedex's Superlak®. Certifications such as FSC, Energy Star, Cradle to Cradle, and GreenGuard® play a key role in empowering consumers to make informed, sustainable choices when selecting doors.

Segmental Analysis

By Product: Hinged Doors' Continued Dominance

Hinged doors have long been the leading segment in the European doors market, and their dominance is set to continue. In 2023, this segment was valued at over $11.28 billion and is projected to maintain its position with a projected CAGR of 3.46% in the coming years. Several factors contribute to hinged doors' enduring popularity. Firstly, their versatility makes them suitable for both interior and exterior applications within residential and commercial spaces. Secondly, advancements in technology and design have resulted in a wide range of styles, materials, and performance options making hinged doors appealing to a broad range of consumers and projects.

Notably, consumer preferences are shifting towards high-performance, energy-efficient hinged doors as sustainability and rising energy costs become greater priorities. Technological advancements have led to improved materials, insulation techniques, and weather sealing, resulting in hinged doors that significantly contribute to a building's overall energy efficiency. Increased demand for smart-home features is also influencing innovation in the hinged door segment, with options for integration and automation becoming more common. Overall, the adaptability, enhanced performance, and increasing design possibilities keep hinged doors in a leading position within the European market.

By Material: Wood Holds Strong Appeal

Wooden doors continue to dominate the European doors market with a valuation of over $15.03 billion in 2023 and a projected CAGR of 3.39% in the coming years. This preference is rooted in both traditional appeal and modern advancements. Wood is valued for its natural beauty, warmth, and the unique character it brings to a space. European consumers have a strong cultural affinity for wood as a building material, and the perception of warmth and quality keep it in demand.

However, modern wooden doors go beyond simply aesthetic appeal. Advances in timber technology and sourcing contribute to their popularity. Sustainable forestry practices and certifications like FSC are increasingly important to consumers, ensuring that wooden doors can be both beautiful and environmentally responsible. Improvements in manufacturing techniques have enhanced the durability, strength, and energy efficiency of wooden doors, addressing past concerns regarding warping or maintenance. The versatility of wood allows it to be incorporated into both traditional and modern architectural styles, further expanding its market appeal within the European context.

By Application: Residential Sector as Key Driver

The residential segment holds the largest share of the European doors market exceeding $22.51 billion in 2023 and is expected to continue leading with a projected CAGR of 3.38% in the coming years. This sector is fueled by a combination of factors, including new housing construction, the focus on home renovation, and an aging housing stock in need of upgrades.

The European commitment to energy efficiency is a significant factor in the residential doors market. Renovations aimed at reducing energy consumption often include replacing older, poorly insulated doors with modern high-performance options. Government incentives and funding programs in some countries further support these upgrades. Additionally, an increasing focus on home security and the integration of smart features drive demand for new doors within the residential sector. Changing demographics also influence the market, with a growing elderly population creating a need for doors prioritizing accessibility and ease of use.

To Understand More About this Research: Request A Free Sample

Country Analysis

The pessimistic outlook for the European construction industry in 2023 has direct implications for the doors market. A predicted 2.5% decline in construction investment across most sectors directly translates to fewer new construction projects, hindering potential door sales. The particularly vulnerable residential housing sector, with its forecast 3.2% decrease in new homebuilding across Europe, is a significant concern for door manufacturers and suppliers as it represents a major source of demand. Sharp declines in residential construction projected for Sweden (-42.4%), Czech Republic (-25.8%), and Denmark (-20.3%) suggest particularly difficult market conditions in those areas.

Specific challenges facing individual countries further impact the doors market. Germany's downturn, driven by higher costs and an unfavorable financial climate, signals reduced demand for doors in both new builds and potentially renovations as homeowners may postpone projects. The UK's slowing construction activity across all subsectors, including the steep decline in homebuilding, also indicates a shrinking market for new doors within that region.

While France's construction industry isn't expected to experience as steep of a decline, factors like low economic growth, inflation, and high interest rates suggest consumers and developers may be cautious about building and renovation projects, potentially delaying door replacements or upgrades. Italy and Spain, though currently outperforming some peers, face rising interest rates and inflation, which could put pressure on the residential sector where door sales are closely tied to homebuilding and renovation activity.

Beyond the immediate outlook, the European doors market faces additional challenges stemming from this downturn. Elevated inflation erodes the purchasing power of builders and homeowners, potentially leading to cost-cutting measures that could impact the quality or quantity of doors incorporated into projects. Rising interest rates make financing more expensive, hindering potential construction projects or forcing compromises on budgets. Finally, ongoing labor shortages and supply chain disruptions could cause delays and increase costs, further impacting a market already facing economic headwinds.

Key Players in the Europe Doors market

- JELD-WEN Holding, Inc.

- Masonite International Corporation

- Deceuninck NV

- ASSA ABLOY Group

- Dierre S.p.A.

- Hörmann Group

- Kömmerling

- Vicaima Doors

- Solidor Ltd.

- SGM Windows

- Barausse

- Forster Systems

- Other Prominent Players

Market Segmentation Overview:

By Product

- Hinged

- Bi-Fold & Sliding Doors

- French

- Others

By Material

- Wooden Doors

- Solid Wood Doors

- Engineered Wood Doors

- Metal Doors

- Steel Doors

- Aluminum Doors

- uPVC

- Composite Doors

- Others

By Application

- Residential

- New

- Improvement & Repair

- Commercial

- New

- Improvement & Repair

By Country

- Germany

- UK

- Italy

- Spain

- France

- Russia

- Belgium

- Poland

- Netherlands

- Austria

- Sweden

- Denmark

- Finland

- Greece

- Portugal

- Switzerland

- Norway

- Czech Republic

- Rest of Europe

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0324802 | Delivery: 2 to 4 Hours

| Report ID: AA0324802 | Delivery: 2 to 4 Hours

.svg)