Europe Bike Rental For Tourism Market: By Vehicle Type (Motorcycles (ICE and Electric), Scooters (ICE and Electric); Bicycles (Manual/Pedal Assisted and Electric); Type (Mountain Two Wheeler, Road Two Wheeler, Hybrid Two Wheeler, Specialty Two Wheeler); Rental Mode (Hourly Rentals, Daily Rentals, Weekly Rentals); Operation Mode (Docked Systems and Dockless Systems); Pricing Model (Pay-Per-Use, Membership & Subscription Plans, Tour Package Inclusion); End Users (Tourist (City Tourists ( Leisure Tourists and Business Tourists), Adventure & Eco- Tourists, Cultural & Heritage Tourists, Other Tourists), Resorts and Hotels, Tour Operators & Travel Agencies); Distribution Channel (Online Booking Platforms, Offline Rental Shops, Hotel Partnerships, Third-Party Vendors); Country—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Feb-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA02251208 | Delivery: Immediate Access

| Report ID: AA02251208 | Delivery: Immediate Access

Market Scenario

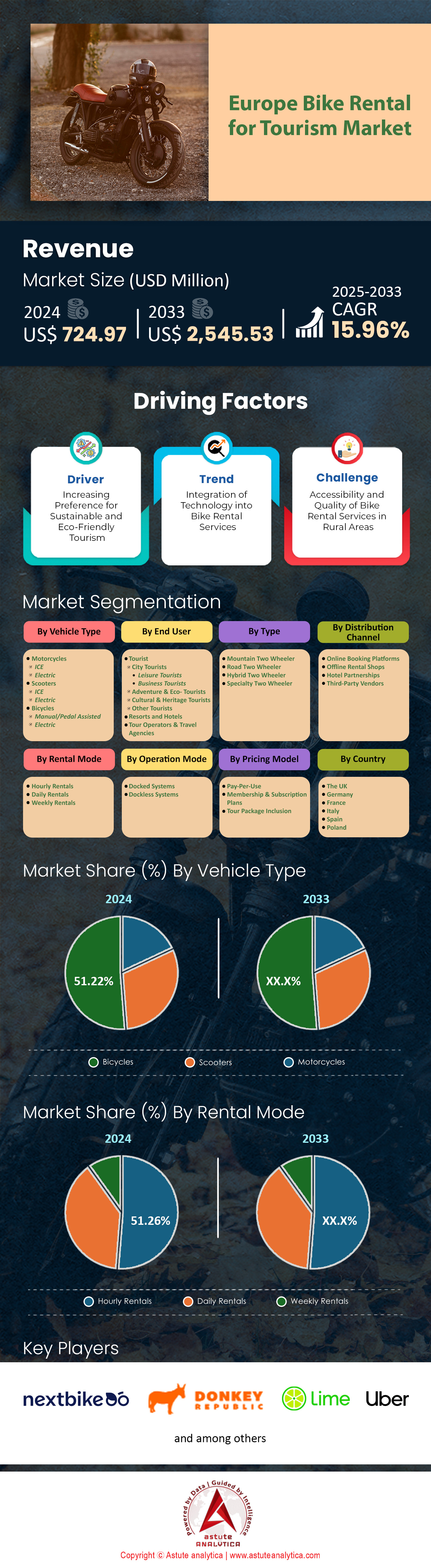

Europe Bike Rental For Tourism Market was valued at US$ 724.97 million in 2024 and is projected to hit the market valuation of US$ 2,545.53 million by 2033 at a CAGR of 15.96% during the forecast period 2025–2033.

The Europe Bike Rental For Tourism Market is experiencing robust growth, driven by the increasing popularity of cycling as a sustainable and immersive way to explore destinations. In 2024, the domestic European cycling tourism market alone has generated an economic impact of €44 billion, highlighting its significance. The most prominent forms of bike rentals include traditional city bikes, e-bikes, and mountain bikes, with e-bikes gaining rapid traction due to their ease of use and ability to cover longer distances. Key applications include urban tourism, long-distance cycling tours, and adventure tourism, with cities like Amsterdam, Barcelona, and Berlin leading the charge. The rise of one-way bike rentals, which allow tourists to pick up a bike in one location and drop it off in another, has further fueled demand. Major end-users include international tourists, domestic travelers, and cycling enthusiasts seeking eco-friendly travel options.

The integration of technology into bike rental services is a significant trend shaping the Bike Rental For Tourism Market in the European region. In 2024, over 50% of bike rental companies in Europe have adopted digital platforms for seamless booking and payment processes. The use of GPS-enabled bikes, which allow tourists to navigate routes easily, has also increased, with over 100,000 such bikes now available across the continent. Another trend is the growing demand for high-quality bikes that match the standards of what cyclists use at home. In France, over 30,000 e-bikes have been rented for long-distance tours, reflecting the shift toward premium offerings. The market is also being driven by the expansion of cycling infrastructure, with over 70,000 kilometers of dedicated cycling paths now available in Europe, making it easier for tourists to explore safely and comfortably.

The key applications enabling strong demand for Bike Rental For Tourism Market include urban exploration, long-distance cycling routes like EuroVelo, and adventure tourism in mountainous regions. In urban tourism, cities like Copenhagen and Paris have seen over 1 million bike rentals annually, driven by the convenience of bike-sharing systems. For long-distance tours, the EuroVelo network, which spans 17 routes across Europe, has attracted over 2.5 million cyclists in 2024, many of whom rely on rental services. Adventure tourism is also booming, with over 500,000 mountain bike rentals recorded in the Alps and Pyrenees. The demand is further supported by the increasing preference for sustainable travel, with over 60% of tourists opting for bike rentals to reduce their carbon footprint. End-users include international tourists from the US and Asia, as well as European travelers seeking active holidays.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Preference for Sustainable and Eco-Friendly Tourism

The growing emphasis on sustainable tourism is a primary driver of the bike rental for tourism market in Europe. In 2024, over 60% of tourists have chosen bike rentals as a way to reduce their carbon footprint while exploring destinations. The European Green Deal, which aims to make Europe the first climate-neutral continent by 2050, has further accelerated this trend. Cities like Amsterdam and Copenhagen have seen a 25% increase in bike rentals, as tourists seek eco-friendly alternatives to traditional transportation. The rise of e-bikes, which allow tourists to cover longer distances without emissions, has also contributed to this shift, with over 30,000 e-bikes rented in France alone for long-distance tours. The increasing awareness of environmental issues and the desire for sustainable travel experiences are expected to continue driving demand for bike rentals across Europe.

The demand for bike rentals is also being fueled by the expansion of cycling infrastructure across Europe Bike Rental For Tourism Market. In 2024, over 70,000 kilometers of dedicated cycling paths have been developed, making it safer and more convenient for tourists to explore by bike. The EuroVelo network, which spans 17 routes across the continent, has attracted over 2.5 million cyclists, many of whom rely on rental services. The availability of bike-sharing systems in major cities has also played a crucial role, with over 1 million bike rentals recorded annually in cities like Paris and Berlin. The combination of sustainable tourism trends and improved infrastructure has created a favorable environment for the growth of the bike rental market, as more tourists opt for cycling as their preferred mode of travel.

Trend: Integration of Technology into Bike Rental Services

The integration of technology into the Bike Rental for Tourism Market is a major trend shaping the market. In 2024, over 50% of bike rental companies in Europe have adopted digital platforms for seamless booking and payment processes. The use of GPS-enabled bikes, which allow tourists to navigate routes easily, has also increased, with over 100,000 such bikes now available across the continent. The trend is further supported by the development of mobile apps that provide real-time information on bike availability, rental prices, and nearby cycling routes. In cities like Barcelona and Berlin, over 70% of bike rentals are now conducted through digital platforms, reflecting the growing reliance on technology in the tourism sector.

The trend is also evident in the rise of smart bike-sharing systems, which use IoT technology to track bike usage and optimize distribution. In 2024, over 200 cities in Europe Bike Rental For Tourism Market have implemented smart bike-sharing systems, making it easier for tourists to access rental services. The use of e-bikes, which are equipped with advanced features like battery monitoring and route planning, has also gained traction, with over 30,000 e-bikes rented in France alone for long-distance tours. The integration of technology into bike rental services is expected to continue growing, as companies seek to enhance the user experience and meet the evolving needs of tech-savvy tourists.

Challenge: Accessibility and Quality of Bike Rental Services in Rural Areas

While urban centers like Amsterdam and Paris have well-established bike-sharing systems, rural regions in the Europe Bike Rental For Tourism Market often lack the infrastructure and resources to support bike rentals. In 2024, over 70% of bike rental services are concentrated in urban areas, leaving rural destinations underserved. The lack of bike rental options in rural areas has limited the potential for cycling tourism in regions like the Scottish Highlands and the Carpathian Mountains, where demand for adventure tourism is growing.

The challenge is further compounded by the uneven quality of bike rental services across Europe. While cities like Copenhagen and Berlin offer high-quality bikes and seamless rental processes, rural areas often struggle to provide the same level of service. In 2024, over 30% of tourists in rural areas have reported difficulties in finding reliable bike rental options, with issues ranging from limited bike availability to poor maintenance. Addressing these challenges is critical for the long-term growth of the bike rental market, as rural destinations offer significant potential for cycling tourism. The development of partnerships between urban and rural bike rental providers, along with investments in cycling infrastructure, could help bridge this gap and unlock new opportunities for the market.

Segmental Analysis

By Vehicle Type

Bicycles hold a significant 51.22% market share in Europe’s Bike Rental For Tourism Market, driven by several key factors. Firstly, bicycles are more accessible and user-friendly compared to motorcycles and scooters, requiring no special licenses or training. This ease of use attracts a broader demographic, including families and older tourists. Secondly, bicycles are more cost-effective, with rental prices averaging €5-€10 per hour, compared to €15-€25 for scooters. Additionally, bicycles are environmentally friendly, aligning with Europe’s strong sustainability ethos, where over 60% of tourists prefer eco-friendly transport options. Cities like Amsterdam and Copenhagen have invested heavily in cycling infrastructure, with over 500 km of dedicated bike lanes, further boosting bicycle rentals. The health benefits of cycling also appeal to tourists, with studies showing that 70% of tourists prefer active travel options during vacations. Lastly, bicycles are safer for short-distance travel, with accident rates significantly lower than motorcycles, making them a preferred choice for tourists exploring urban areas.

By Type

Mountain two-wheelers account for 37.55% of the Europe Bike Rental For Tourism Market, driven by the region’s diverse terrain and growing interest in adventure tourism. Europe is home to over 200 mountain biking trails, with countries like Switzerland, Austria, and France offering some of the most scenic routes. The demand for mountain bikes is fueled by the increasing popularity of outdoor activities, with over 40% of tourists seeking adventure-based experiences during their trips. Mountain bikes are designed for rugged terrains, offering durability and stability, which are essential for off-road trails. The average rental cost for mountain bikes is €20-€30 per day, making them affordable for adventure enthusiasts. Additionally, the rise of eco-tourism has contributed to the demand, with 55% of tourists preferring sustainable outdoor activities. The availability of guided mountain biking tours, which attract over 1 million participants annually, further boosts this segment. The health benefits of mountain biking, such as improved cardiovascular fitness and muscle strength, also appeal to tourists, with 65% of users citing health as a key motivator.

By Rental Mode

Hourly rental services dominate the Europe Bike Rental For Tourism Market, primarily due to their flexibility and affordability. Tourists often prefer short-term rentals for quick explorations, with hourly rates averaging €3-€5, making it a cost-effective option. Over 60% of tourists rent bikes for less than 3 hours, primarily for sightseeing in urban areas. Cities like Paris, Berlin, and Barcelona have extensive bike-sharing systems, with over 50,000 bikes available for hourly rentals. The convenience of hourly rentals is a significant driver, with 75% of users citing ease of access as a key factor. Additionally, hourly rentals cater to spontaneous travel plans, allowing tourists to explore without long-term commitments. Germany has the strongest demand for hourly rentals, with over 10 million hourly bike rentals recorded annually. The integration of digital payment systems has further streamlined the process, with 80% of hourly rentals completed via mobile apps. The growing trend of micro-mobility, where tourists prefer short-distance travel options, has also contributed to the dominance of hourly rentals, with over 70% of users opting for bikes over other transport modes for short trips.

By Operation Mode

Docked systems account for over 66.80% of the revenue share in the Europe Bike Rental For Tourism Market, driven by their reliability and infrastructure advantages. Docked systems offer a structured approach to bike rentals, with designated parking stations ensuring easy access and return. Over 80% of tourists prefer docked systems due to their predictability, with bikes available at over 10,000 docking stations across Europe. The maintenance of docked bikes is more efficient, with a 90% operational rate compared to 70% for dockless systems. Cities like London and Amsterdam have invested heavily in docked systems, with over 20,000 bikes available in each city. The security of docked systems is another key factor, with theft rates 50% lower than dockless systems. Additionally, docked systems integrate seamlessly with public transport, with 60% of users combining bike rentals with trains or buses. The environmental benefits of docked systems, such as reduced clutter and better bike management, align with Europe’s sustainability goals, attracting eco-conscious tourists. The availability of real-time data on bike availability and station locations further enhances user experience, with 85% of tourists citing convenience as a key advantage.

By Pricing Model

The pay-per-use pricing model holds a 54.76% market share in the Europe Bike Rental For Tourism Market, driven by its flexibility and cost-effectiveness. Tourists prefer pay-per-use models as they only pay for the time they use, with average costs ranging from €1-€3 per hour. Over 70% of tourists opt for pay-per-use models for short trips, as they avoid long-term commitments. The model is particularly popular in urban areas, where tourists rent bikes for quick explorations, with over 15 million pay-per-use rentals recorded annually. The integration of digital payment systems has streamlined the process, with 90% of transactions completed via mobile apps. The pay-per-use model also appeals to budget-conscious travelers, with 60% of users citing affordability as a key factor. Additionally, the model offers transparency, with users able to track their usage and costs in real-time. The growing trend of micro-mobility has further boosted the demand for pay-per-use models, with over 80% of users preferring bikes for short-distance travel. The model’s simplicity and ease of use make it a preferred choice for both locals and tourists, contributing to its dominance in the market.

To Understand More About this Research: Request A Free Sample

Country Analysis

Germany controls over 26.58% of the Europe Bike Rental For Tourism Market, driven by its robust infrastructure and high tourist inflow. The country attracts over 40 million tourists annually, with a significant portion opting for bike rentals. Germany has over 80,000 km of cycling routes, including the popular Elbe River Cycle Path, which attracts over 1 million cyclists annually. The country’s bike-sharing systems are highly efficient, with over 50,000 bikes available for rent in cities like Berlin and Munich. The average daily rental cost in Germany is €10, making it an affordable option for tourists. The integration of bike rentals with public transport has further boosted demand, with 70% of users combining bike rentals with trains or buses. Germany’s strong emphasis on sustainability aligns with the preferences of eco-conscious tourists, with 65% of users citing environmental benefits as a key motivator. The availability of guided bike tours, which attract over 500,000 participants annually, also contributes to the market’s growth. The country’s well-maintained cycling infrastructure, including over 10,000 bike parking stations, ensures a seamless experience for tourists, making Germany the largest bike rental market in Europe.

Top Players in the Europe Bike Rental For Tourism Market

- Bolt Technology OÜ

- Uber Technologies, Inc.

- Cycle Europe

- CCT Electric Bike Rental

- France Electric Bike Rentals

- Bcyclet

- nextElectric Bike GmbH

- Donkey Republic

- Lime

- Other Prominent Players

Market Segmentation Overview:

By Vehicle Type

- Motorcycles

- ICE

- Electric

- Scooters

- ICE

- Electric

- Bicycles

- Manual/Pedal Assisted

- Electric

By Type

- Mountain Two Wheeler

- Road Two Wheeler

- Hybrid Two Wheeler

- Specialty Two Wheeler

By Rental Mode

- Hourly Rentals

- Daily Rentals

- Weekly Rentals

By Operation Mode

- Docked Systems

- Dockless Systems

By Pricing Model

- Pay-Per-Use

- Membership & Subscription Plans

- Tour Package Inclusion

By End User

- Tourist

- City Tourists

- Leisure Tourists

- Business Tourists

- Adventure & Eco- Tourists

- Cultural & Heritage Tourists

- Other Tourists

- City Tourists

- Resorts and Hotels

- Tour Operators & Travel Agencies

By Distribution Channel

- Online Booking Platforms

- Offline Rental Shops

- Hotel Partnerships

- Third-Party Vendors

By Country

- The UK

- Germany

- France

- Italy

- Spain

- Poland

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA02251208 | Delivery: Immediate Access

| Report ID: AA02251208 | Delivery: Immediate Access

.svg)