Global Electric Vehicle Bearing Market: By Type (Battery Electric Vehicle (BEV), Plug-In Hybrid Electric Vehicle (PHEV), Hybrid Electric Vehicle (HEV)); Product (Roller Bearing (Tapered Roller Bearing, Needle Roller Bearing, Cylindrical Roller Bearing, Others), Ball Bearing (Deep Groove Ball Bearing, Angular Contact Bearing, Self-Aligning Ball Bearing, and Others), Composite Bearing, and Others); Material (Steel, Ceramic, Polymer, Others); Sales Channel (OEMs and Aftermarket); Vehicle Category (Passenger Vehicle and Commercial Vehicle); Application (Gearbox/Transmission, Motor, E-Axle, Wheel, and Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 14-Mar-2024 | | Report ID: AA1023654

Market Scenario

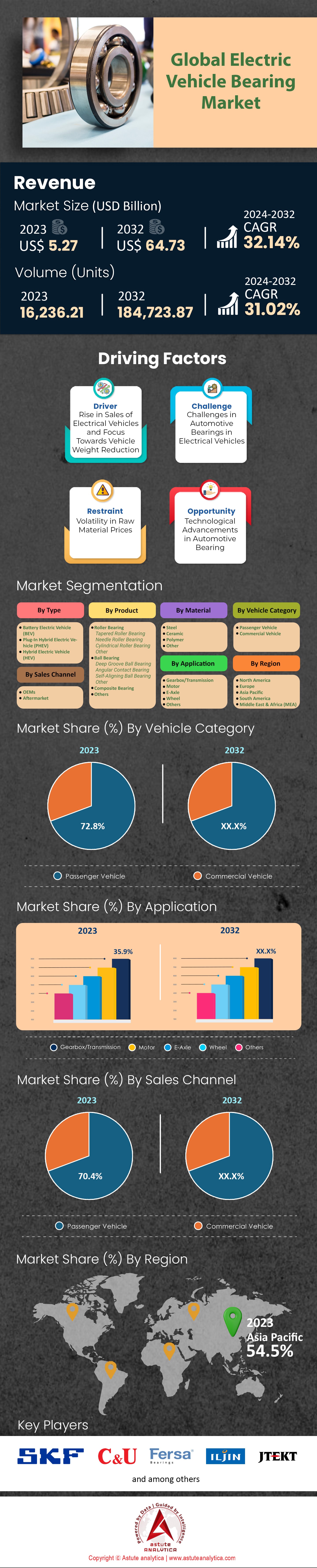

Global Electric Vehicle Bearing Market was valued at US$ 5.27 billion in 2023 and is projected to attain a market valuation of US$ 64.73 billion by 2032 at a CAGR of 32.14% during the forecast period 2024–2032.

In the last few years, the global electric vehicle bearing market witnessed a significant jump in the demand for the product across the globe. This is in line with the rapidly expanding demand for electric vehicle. In 2022, the global sales of EV reached around 10 million, wherein, China remained the largest contributor with more than 5.9 million units. However, it has been remained a great concern among manufacturers to adopt to the rapidly changing demand for EV bearings as most of the conventional or traditional ICE vehicle bearings are not suitable for the today’s EVs and they have to make the changes in the design with respect to speed, safety, and load capacity. As a result, manufactures or OEMs are redesigning and engineering the bearings for EVs to enhance the durability and power density of EVs, which is essential to avoid the premature and abrupt failures. Therefore, the global electric vehicle bearing market has started witnessing a significant growth in the demand for conductive bearings as well as ceramic bearings- which acts an insulator – are being used in electric powertrains.

As per Astute Analytica’s recent findings, on average EV has at least 8 bearings in powertrain and the same in the motors. The demand for the products is projected to keep growing with rapidly increasing adoption of the EVs around the globe. To meet the growing demand for the EV bearing several manufacturers are working and collaborating with most of the leading OEMs. Recently, in January 2023, Timken has signed a deal with Ford Motor for Providing Engineered Bearings for Ford Motor Company's Electric F-150 Lightning. Moreover, the company has also acquired a Engineered Solutions Group (iMECH) for expanding its engineered bearings portfolio. This strategic acquisition in the global EV bearing market would also enable the company to cater to the burgeoning demand for EV bearings and cross selling them. Similarly, NBC Bearings, one of the largest manufacturers of EV bearings in India, has also developed specialized low-noise bearings to facilitate reduced NVH levels for EV applications, including motor and wheel hubs, in electric two- and three-wheelers. The company would primarily cater to leading players such as Mahindra Last Mile Mobility, Altigreen, and Ather Energy among others.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Traditional or ICE Bearings are Not compatible with Electric Vehicle

The automotive industry is currently experiencing a significant transformation with the increasing adoption of electric vehicles (EVs). As these vehicles gain traction in the EV-bearing market, it becomes essential to understand the intricacies of their components, especially when contrasting them with their internal combustion engine (ICE) counterparts. Electric vehicle bearings are subjected to a temperature range that's approximately 20% higher than what traditional ICE bearings encounter. This increased temperature gradient is largely attributed to their close proximity to the electric motor and the high-speed rotations they undergo. Consequently, this necessitates a deviation in material composition and the type of lubrication used. When it comes to speed and load dynamics, a significant 85% of EVs operate at higher RPMs compared to traditional vehicles. This operational characteristic demands bearings that are adept at managing increased speeds and axial loads.

Our research indicates that when traditional bearings are deployed in an EV setting, they exhibit a 30% decline in their expected lifespan. This reduction can be attributed to the distinctive operational stresses that EVs impose on these components. Material composition is another domain witnessing a shift in the global EV bearing market. A substantial 70% of EV manufacturers are now gravitating towards ceramic hybrid bearings. Their preference stems from these bearings' superior ability to endure higher temperatures and their enhanced resistance to electrical arcing.

Apart from this, electric vehicles inherently have a quieter operational profile compared to ICE vehicles. This difference has set consumer expectations, with a whopping 90% anticipating a more silent ride from EVs. This expectation underscores the need for low-noise bearings in electric vehicles. Additionally, lubrication practices for EVs diverge from those of traditional vehicles. The greases that have been standard for ICE bearings don't cut EVs. A staggering 95% of EV manufacturers are now advocating the use of specialty lubricants to thwart premature wear and tear.

Challenges: Electrical Issues in Bearings of Electric Vehicles

Electric motors in vehicles consist of numerous parts, with bearings emerging as the most susceptible to electrical malfunctions. In recent times, electric vehicles (EVs) have reported an uptick in electrical complications within these bearings, leading to considerable concerns about the longevity of motor-based power systems. Central to every Battery Electric Vehicle (BEV) and hybrid is a 3-phase alternating-current (AC) traction motor/generator in the global EV bearing market. Given that batteries offer direct current (DC), inverters—also termed as variable frequency drives (VFDs)—are essential for the DC to AC conversion. However, these inverters inadvertently generate undesired voltages on motor shafts. Without consistent, long-lasting grounding, this voltage can corrode and ultimately lead to the deterioration of motor bearings.

This electrical damage to bearings presents a hidden predicament in EVs, prompting automotive engineers to tackle unprecedented challenges. The erratic nature of inverter-induced shaft voltages, which tend to follow the path of least resistance, means that solutions like insulated motor bearings might merely redirect the damage to other parts, including gearbox bearings or wheel bearings. Interestingly, even the bearings in a hybrid's internal combustion engine can face this issue when the vehicle runs in electric mode.

Trend: The Rise of Smart Bearings in EVs

Bearings have evolved from mere steel spheres to sophisticated devices equipped with integrated sensors in the bearing market. Modern EVs leverage these advanced bearings, using them as tools to gather and relay information regarding the powertrain's condition. For instance, the vibrational patterns of bearings can now offer insights into potential powertrain issues, and even provide data on usage and terrain conditions. The digital revolution has ushered in a shift from reactionary to anticipatory maintenance. Advanced Industry 4.0 tools, such as sensors affixed to automotive components, offer real-time performance insights which can be fed into manufacturers' monitoring systems. Among these innovations are smart bearings compatible with the Industrial Internet of Things (IIoT). These bearings possess the capability to self-assess and predict upcoming issues.

Being at the core of rotating mechanisms, smart bearings are optimally positioned to facilitate a forward-looking approach to maintenance. They can provide valuable data on aspects like bearing speed, direction, and the various forces affecting them.

As per data from ACS, EV motors can achieve up to 15,000 revolutions per minute (rpm), in contrast to a mere 8,000 rpm in internal combustion engines, with most consumer cars hovering around 6,000 rpm. The enhanced rpm in electric motors not only accentuates performance but also obviates the need for weighty, costly transmissions in the bearing market. However, this places stringent quality expectations on all powertrain components. Bearings in vehicles are exposed to immense stress and wear, contingent on their use. They must bear significant centrifugal forces while ensuring limited self-induced heating from swift rotation. Beyond the bearings, designers must also account for the vehicle's lifespan, which is expected to remain dependable over extensive distances and years ahead.

Segmental Analysis

By Type

By vehicle types, the global electric vehicle bearing market is dominated by Battery Electric Vehicles (BEV), representing 54.2% revenue share in 2023 and are forecasted to increase slightly to 55.0% by 2032. Hybrid Electric Vehicles (HEV) and Plug-In Hybrid Electric Vehicles (PHEV) follow closely, with shares of 35.7% and 10.1% in 2023, respectively.

Technologically, the need for bearings that accommodate high-speed rotations in EVs is paramount. Such bearings also address challenges like maintaining lubrication and safeguarding against contaminants. Furthermore, the introduction of hybrid bearings, combining steel rings with silicon nitride components, showcases innovation in addressing the potential hazards posed by robust electrical motors in EVs. This hybrid design not only ensures operational efficiency but also prolongs the lifespan of EV powertrains.

By Product

The global Electric Vehicle bearing market showcases a diverse product segmentation, prominently led by ball bearings. As of 2023, ball bearings dominate the market with a 44.6% share. Their pre-eminence is anticipated to continue, securing a 44.3% share by 2032 thanks to their reduced surface contact area, enabling them to minimize friction considerably, and versatility in both two- and four-wheeled vehicles ensures their relevance. Meanwhile, plain or sleeve bearings, though more rudimentary, offer robust load capacity and resilience against shock loads. Their demand is projected to grow steadily over the forecast period, emphasizing their utility in applications demanding resistance to oscillatory movements.

Apart from this, roller bearings, holding a substantial 37.0% market share in 2023. This can be attributed to their superior efficiency in supporting strong radial and axial loads while effectively reducing rotational friction. Industries spanning capital equipment, autos, home appliances, and aerospace particularly favor roller bearings, underlining their broad-based application.

By Material

By material, steel is holding a crown in the global Electric Vehicle (EV) bearing market. In 2023, steel secured the largest market share for EV bearings, a trend forecasted to persist through 2032. As of 2023, steel bearings constituted a substantial 40.8% of the market, with projections showing a marginal dip to 40.7% by 2032. The ubiquity of steel in EV bearings is attributed to its pivotal role in both roller and ball bearings' components and rings, meeting the escalating demands for performance and speed in powertrains, particularly electric motors.

Interestingly, ceramics, due to their inherent electricity-insulating properties, are emerging as a crucial segment. Their growth is particularly notable in high-speed applications and as an antidote to electrical discharge concerns. By incorporating ceramic balls, the creation of hybrid bearings has become an innovative solution. Despite their higher costs, the market for ceramic ball bearings is driven by their advantages such as 40% lower density than steel, reduced operational temperatures, and extended lifespans.

By Vehicle Category

The global Electric Vehicle (EV) bearing market witnesses a strong influx of demand coming from passenger vehicles. As of 2023, passenger vehicles account for a commanding 72.8% of the market share. This dominance is projected to sustain with a modest decrease to 71.9% by 2032. The upsurge in passenger vehicle sales, particularly in emerging nations, propelled by rising disposable incomes, has underpinned this segment's growth. However, the commercial vehicle category is earmarked for rapid expansion, with its market share expected to increase from 27.2% in 2023 to 28.1% by 2032.

The swift growth in the commercial segment can be attributed to the burgeoning popularity of electric buses, particularly in nations like China and India. As global commitments to combat climate change intensify, electric trucks are witnessing broader acceptance. Intriguingly, while only 0.3% of trucks sold in 2021 were electric, the broader vehicle market reported that nearly 10% of all sales were electric vehicles. The thrust towards electrifying long-distance trucks, in tandem with the need for enhanced grid infrastructures, offers a promising horizon for the commercial vehicle segment in the EV-bearing market.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The global electric vehicle-bearing market is undergoing a transformative phase, with different regions witnessing varying growth trajectories. Wherein, the Asia Pacific region stands out prominently in the market. By 2032, it is poised to command a market share surpassing 54% thanks to the sheer volume of electric vehicles (EVs) being produced and consumed in this region. China alone expects to have over 15 million EVs on its roads by 2025. This growth is matched by India's ambitious target to achieve 30% electric mobility by the end of the decade, translating to nearly 7 million new EVs. Japan, not to be left behind, aims to register at least 2 million new EVs by 2025. This impressive growth is supported by the establishment of over 5,000 charging stations in South Korea and more than 50,000 charging points in China. Furthermore, the Asia Pacific region is home to several major EV battery manufacturers, with over 120 production facilities in China alone. Automotive hubs like Thailand and Indonesia have invested over $1 billion collectively in the past two years to foster EV infrastructure.

Europe follows closely, contributing more than 27% to the global revenue of the electric vehicle bearing market. The region’s approach to sustainable transportation is exemplified by the fact that the UK plans to ban the sale of new petrol and diesel cars by 2030, paving the way for an EV-dominated future. Germany alone sold over 833, 000 EVs in 2022, with France trailing close at 346,000 units. Furthermore, Spain's EV sales recently surpassed the 100,000 marks annually. European automakers are also investing heavily in EV infrastructure, with over $10 billion pledged for the next five years.

Top Players in the Global Electric Vehicle Bearing Market

- AB SKF

- C&U Group Co., Ltd.

- Fersa Bearings S.A.

- ILJIN Co., Ltd.

- JTEKT Corporation

- Nachi-Fujikoshi Corp.

- NBC Bearings (NEI Ltd.)

- NMB Technologies Corporation

- NRB Bearings Limited

- NSK Ltd.

- NTN Corporation

- Schaeffler Technologies AG & Co. KG

- The Timken Company

- Zhejiang XCC Group Co., Ltd.

- Other prominent players

Market Segmentation Overview:

By Type

- Battery Electric Vehicle (BEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

By Product

- Roller Bearing

- Tapered Roller Bearing

- Needle Roller Bearing

- Cylindrical Roller Bearing

- Other

- Ball Bearing

- Deep Groove Ball Bearing

- Angular Contact Bearing

- Self-Aligning Ball Bearing

- Other

- Composite Bearing

- Others

By Material

- Steel

- Ceramic

- Polymer

- Other

By Sale Channel

- OEMs

- Aftermarket

By Vehicle Category

- Passenger Vehicle

- Commercial Vehicle

By Application

- Gearbox/Transmission

- Motor

- E-Axle

- Wheel

- Others

By Region

- North America

- The US

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)