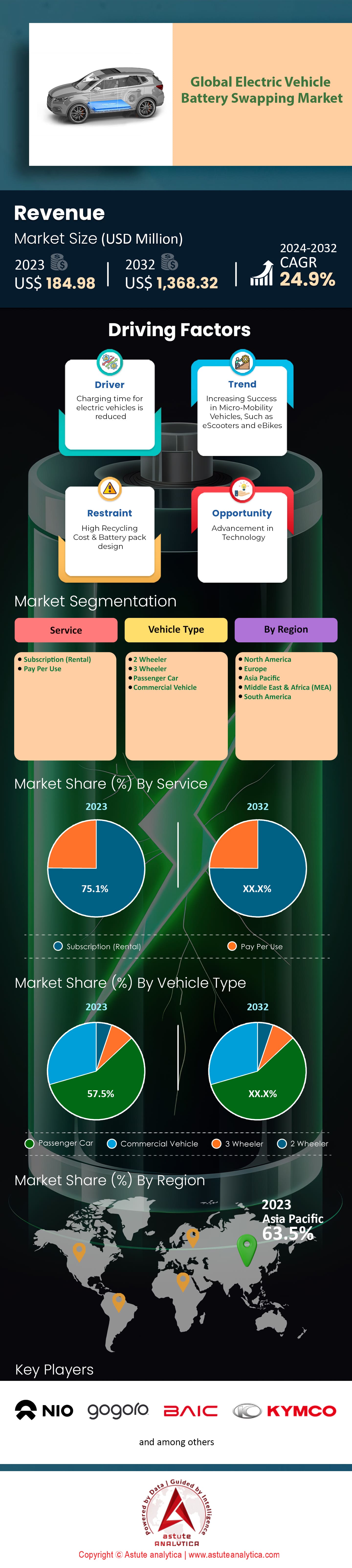

Global Electric Vehicle Battery Swapping Market: By Service (Subscription (Rental), Pay Per Use); By Vehicle Type (2-Wheeler, 3-Wheeler, Passenger Car, Commercial Vehicle), and Region—Industry Dynamics, Market Size, Opportunity, and Forecast till 2032

- Last Updated: 05-Oct-2024 | | Report ID: AA1122326

Market Scenario

Global electric vehicle battery swapping market was valued at US$ 184.98 million in 2023 and is projected to reach a valuation of US$ 1,368.32 million by 2032 at a CAGR of 24.9% during the forecast period 2024–2032.

Electric vehicle (EV) battery swapping is transforming the landscape of sustainable transportation by offering an efficient alternative to traditional charging. The technology allows for depleted batteries to be replaced with fully charged ones in under five minutes, significantly reducing downtime for users. Companies like Ample have developed modular solutions that are cost-effective and convenient. With over 2,300 battery-swapping stations globally, Nio leads the industry, having completed millions of swaps. The Asia-Pacific region, particularly China and Japan, spearheads this growth due to substantial investments in infrastructure and technology. In China alone, there are more than 1,200 battery-swapping stations. Strategic partnerships, such as Ample's collaboration with Stellantis to integrate swapping technology into their EVs, underline the growing acceptance and potential of this innovation.

Despite its promise, the electric vehicle battery swapping market faces several hurdles, including high initial setup costs and the need for standardization across different EV models. Currently, there are over 28,000 public charging locations in the U.S., but battery swapping offers an alternative that could alleviate some of the infrastructure burdens these stations face. Additionally, more than 70% of consumers in a recent survey expressed concern over charging times, highlighting the demand for faster solutions like battery swapping. Government policies in various countries are increasingly supporting electric mobility initiatives to reduce greenhouse gas emissions, which could further boost the adoption of battery swapping. Globally, over 40 million electric vehicles are on the road, emphasizing the need for innovative charging solutions to meet growing demand.

The integration of battery swapping with renewable energy sources presents an opportunity for sustainable and decentralized charging in the electric vehicle battery swapping market. By utilizing renewable energy, swapping stations can reduce their carbon footprint, aligning with the global push towards sustainability. The subscription-based swapping models are gaining traction, especially among ride-sharing and car-sharing services, offering flexibility and reducing range anxiety for drivers. Additionally, with over 400 million EVs projected to be on the road by 2040, the need for efficient and scalable charging solutions becomes critical. Overall, the advancements in battery swapping technology, coupled with strategic industry partnerships and supportive governmental policies, position it as a vital component in the future of electric mobility, addressing key challenges and opening new avenues for growth and innovation.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Quick, Convenient, and Efficient Solution to Extend Electric Vehicle Range

Electric vehicle battery swapping market is increasingly recognized as a quick, convenient, and efficient solution to extend the range of electric vehicles (EVs), addressing one of the major barriers to EV adoption: range anxiety. In 2023, the average time required for a battery swap is around 3 minutes, a significant improvement over the average 30-minute fast-charging session. This rapid turnaround is crucial for drivers who prioritize time efficiency, especially in urban environments where traffic congestion is common. The global demand for EVs is expected to reach 17 million units by the end of 2024, underlining the importance of convenient solutions like battery swapping. In China, the number of battery swapping stations has reached over 2,000, demonstrating a robust infrastructure that supports this quick service.

In 2023, the global EV sales surpassed 14.2 million vehicles. With battery swapping, EV drivers can avoid the degradation issues associated with frequent fast charging, thereby extending the life of their vehicles. Countries in the global electric vehicle battery swapping market like India are also investing in battery swapping technology, with plans to install 100 new stations in major cities by the end of the year. In Norway, a country leading in EV adoption, battery swapping has been integrated into public transportation, with buses using the technology to minimize downtime. Additionally, the average battery size for EVs has increased to 60 kWh, making efficient swapping solutions vital for maintaining energy supply without lengthy charging stops. Companies like Nio have completed over 15 million battery swaps, showcasing the real-world application and demand for this technology.

Trend: Collaboration Between Automakers and Battery Swapping Service Providers is Increasing

The collaboration between automakers and battery swapping service providers is significantly increasing as the market evolves. In 2023, major players in the electric vehicle battery swapping market such as Nio, BAIC, and CATL have formed strategic partnerships to expand battery swapping networks, enhancing service accessibility. Nio has announced plans to establish 3,000 additional swapping stations globally by the end of 2025. In India, Ola Electric and SUN Mobility are collaborating to develop an extensive battery swapping infrastructure, aiming to deploy 10,000 swapping stations by 2025. Such collaborations are pivotal as they combine automakers' expertise with service providers’ operational knowledge to deliver seamless customer experiences.

In China, the government has recognized 11 cities as battery swapping demonstration regions in 2023, promoting partnerships between local automakers and technology providers in the electric vehicle battery swapping market. This has led to over 100,000 battery swaps being conducted daily nationwide. European automakers like Renault are exploring similar collaborations, with pilot projects underway in France and Germany. These partnerships are not only facilitating the growth of the battery swapping ecosystem but also encouraging the development of standardized battery packs that can be utilized across different vehicle models. In Japan, partnerships between Nissan and several energy companies are underway to integrate battery swapping into commercial fleets, aiming to reduce emissions and operational costs. The rise of such collaborations highlights the industry's commitment to overcoming infrastructure challenges and accelerating the adoption of electric vehicles globally.

Challenge: Efforts to Standardize Infrastructure to Enhance Battery Swapping Efficiency

Efforts to standardize battery swapping infrastructure are crucial to enhancing efficiency and widespread adoption. In 2023, the lack of uniformity in battery design and swapping protocols continues to be a barrier in the electric vehicle battery swapping market, with over 40 different battery specifications across major EV manufacturers. The International Organization for Standardization (ISO) has formed a technical committee to develop global standards, aiming to streamline the process and reduce operational complexities. In China, where battery swapping is more prevalent, the government has introduced guidelines to standardize battery sizes and connector types, impacting more than 500,000 EVs currently utilizing this technology.

The need for standardization is further underscored by the diverse battery capacities, which range from 30 kWh to 100 kWh across different vehicle types. In Europe, the European Union is funding research initiatives to create uniform standards, with pilot projects in the Netherlands demonstrating potential models for standardization. Japan's Ministry of Economy, Trade, and Industry is also working on aligning domestic standards with international ones, aiming to facilitate cross-border cooperation and technology sharing. In the global electric vehicle battery swapping market, companies like Tesla, though focused on their proprietary Supercharger network, are in discussions with industry bodies to explore standardization opportunities that could integrate battery swapping into their service offerings. These efforts are critical to ensuring that battery swapping becomes a viable, efficient, and universally accessible solution for extending the range and usability of electric vehicles worldwide.

Segmental Analysis

By Service

The global electric vehicle battery swapping market is experiencing significant growth, driven primarily by the subscription (rental) services segment, which continues to command over 75% of the market share. This segment is recognized for its convenience and cost-effectiveness, attracting a diverse range of users. In 2023, the market saw a remarkable increase in the number of battery swapping stations across major urban centers globally, with over 5,000 new installations reported in Asia alone, contributing to a global total exceeding 12,000 stations. Additionally, several major automakers have announced partnerships with battery swapping companies to integrate this service into their EV offerings, highlighting the sector's expanding ecosystem. A notable development is the introduction of standardized battery designs, which facilitate easier swapping and promote cross-brand compatibility. As a result, subscription services are expected to handle over 80 million battery swaps annually by the end of the year.

Recent developments in the electric vehicle battery swapping market underscore the growing preference for subscription models. In the first quarter of 2023, a leading Chinese company reported over 20 million battery swaps, emphasizing the scalability of subscription services, which are anticipated to double in frequency by 2025. In Europe, a joint venture among key automotive players has resulted in the launch of a continent-wide network of battery swapping stations, projected to cover 75% of all major urban areas by next year. Meanwhile, in the United States, a start-up focused on urban mobility has successfully piloted a subscription model that allows users unlimited swaps for a flat monthly fee, showing a clear trend towards rental services. These initiatives are supported by government policies in several countries, which provide incentives for battery swapping infrastructure, further bolstering the subscription model's growth. By 2023's end, market analysts predict that subscription services will account for over 65% of all EV charging sessions globally.

Furthermore, the environmental benefits associated with battery swapping services contribute to their increasing popularity. Subscription models in the electric vehicle battery swapping market encourage the reuse and recycling of battery components, aligning with global sustainability goals. In addition, a recent study found that vehicles utilizing battery swapping emit significantly fewer pollutants compared to traditional charging methods, as swapping stations can optimize the charging process to use renewable energy sources. In 2023, the International Energy Agency reported that battery swapping could reduce the lifecycle emissions of EVs by more than 15 million metric tons annually. Moreover, the energy efficiency of swapping stations has improved by 20% over the past year, further reducing operational costs and emissions. This compelling environmental advantage, coupled with technological advancements and strategic collaborations, ensures that subscription services remain the preferred choice in the battery swapping market.

By Vehicle Type

In terms of vehicle type, the global electric vehicle battery swapping market is witnessing notable growth, particularly in the passenger car segment (57.5% market share). As of 2023, numerous countries have implemented supportive policies and incentives to boost electric vehicle adoption, directly impacting the battery swapping market. For instance, China has established over 1,000 battery swapping stations nationwide, which significantly supports the infrastructure for passenger cars. Meanwhile, Europe is seeing a collaborative effort between governments and private firms to set up extensive battery swapping networks, with Germany leading with a strategic plan to establish 500 stations by 2025.

In addition to infrastructure development, technological advancements are playing a crucial role in the growth of the electric vehicle battery swapping market. Automakers like Tesla and NIO are innovating battery swapping technology to make it more efficient and faster, reducing the time taken to swap a battery to under three minutes. Notably, NIO's recent launch of their third-generation battery swapping station marks a pivotal development, as it can handle up to 312 swaps per day. In India, companies like Ola Electric are focusing on creating integrated battery swapping solutions specifically tailored for their burgeoning electric two-wheeler market, which indirectly supports the broader ecosystem by enhancing battery technology and logistics for passenger cars.

Furthermore, significant partnerships and collaborations are shaping the market landscape. In the United States, automaker partnerships with energy firms are paving the way for large-scale battery swapping solutions. For example, a recent collaboration between General Motors and ChargePoint aims to develop comprehensive battery swapping stations across urban centers. Such initiatives are complemented by the global shift towards sustainable energy sources, with battery swapping stations increasingly powered by renewable energy. These developments not only reinforce the passenger car segment's dominance in the electric vehicle battery swapping market but also signify a transformative shift towards more sustainable and efficient electric mobility solutions worldwide.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The Asia Pacific region is rapidly becoming the forefront of the electric vehicle battery swapping market with over 63.5% market share, driven by a perfect confluence of factors. As of 2023, the region represents a substantial share of the global EV market, with China and India leading the way as major players. China, in particular, stands out with over 20.4 million electric vehicles on its roads, driven by substantial domestic production and government incentives that encourage the adoption of green technologies. India's EV market is also expanding, with over 860,362 electric two-wheelers sold in 2023, highlighting the region's burgeoning demand for battery electric vehicles (BEVs) and the necessity for efficient charging solutions.

Recent developments within the regional electric vehicle battery swapping market underscore the potential growth of the battery swapping model. Companies like Gogoro have established a network of over 12,000 battery-swapping stations across nine countries, showcasing leadership in the sector. NIO, a prominent Chinese EV maker, has deployed more than 2,000 battery swap stations, catering to the increasing number of electric vehicles. Geely and Aulton are also expanding their infrastructure, with Geely planning to set up 5,000 stations by 2025. In Southeast Asia, Selex Motors and Oyika are investing in the battery swapping ecosystem, recognizing the rising demand for quick and efficient charging alternatives. Governments are playing a crucial role, with subsidies and tax incentives promoting EV adoption, as seen in Indonesia's plan to have 2 million electric vehicles by 2025, supported by a network of swapping stations.

The strategic positioning of the Asia Pacific electric vehicle battery swapping market is further bolstered by its diverse economic landscape and supportive regulatory frameworks. The region's commitment to sustainability and digital innovation is propelling the transformation of the EV industry, with technological advancements and urbanization driving market dynamics. Projections suggest that the Asia Pacific battery swapping market will continue to experience robust growth, with expectations to reach a value of several billion dollars in the next few years. As the global demand for electric vehicles accelerates, the Asia Pacific region is poised to lead the battery swapping market, offering a sustainable and efficient solution to the challenges associated with traditional EV charging infrastructure. With continued support from governments and strategic investments by key players, the region is set to become a hub for innovation in EV battery technology.

Top Players in Global Electric Vehicle Battery Swapping Market

- Amara Raja

- Amplify Mobility

- BattSwap Inc.

- BYD Co. Ltd.

- ChargeMYGaadi

- EChargeUp solutions pvt Ltd

- Esmito Solutions Pvt Ltd.

- Gogoro Inc.

- Kwang Yang Motor Co. Ltd. (KYMCO)

- Leo Motors Inc.

- Lithion Power Private Limited

- NIO Inc.

- Numocity

- Oyika Pte Ltd.

- Panasonic Corporation

- SUN Mobility Private Limited

- Tesla Inc.

- Beijing Automotive Group Co., Ltd.

- Other Prominent Players

Market Segmentation Overview:

By Service

- Subscription (Rental)

- Pay Per Use

By Vehicle Type

- 2 Wheeler

- 3 Wheeler

- Passenger Car

- Commercial Vehicle

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The U.K.

- Germany

- France

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Latin America

- Argentina

- Brazil

- Rest of Latin America

- Middle East & Africa

- UAE

- Saudi Arabia

- Egypt

- Rest of Middle East & Africa

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 184.98 Million |

| Expected Revenue in 2032 | US$ 1,368.32 Million |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Mn) |

| CAGR | 24.9% |

| Segments covered | By Service, By Vehicle Type, By Region |

| Key Companies | Amara Raja, Amplify Mobility, BattSwap Inc., BYD Co. Ltd., ChargeMYGaadi, EChargeUp solutions pvt Ltd, Esmito Solutions Pvt Ltd, Gogoro Inc., Kwang Yang Motor Co. Ltd. (KYMCO), Leo Motors Inc., Lithion Power Private Limited, NIO Inc., Numocity, Oyika Pte Ltd., Panasonic Corporation, Honda Motor Co., Ltd., SUN Mobility Private Limited, Tesla Inc., Beijing Automotive Group Co., Ltd. , Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)