Global Drone Battery Market: By Component (Cell, BMS, Enclosure, Connector); Battery Type (Lithium Polymer Battery, Lithium-Ion Battery, Nickel-Cadmium Battery, Nickel-Metal Hydride Battery, and Fuel Cell); Battery Capacity (Below 3000 mAh, 3000-5000 mAh, 5000-10000 mAh, Above 10000 mAh); Drone Type (High Altitude Long Endurance (HALE), Medium Altitude Long Endurance (MALE), Tactical, Small); End Users (Commercial, Military, Government & Defense, Others); Distribution Channel (Online and Offline (OEM and Aftermarket); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 28-Mar-2024 | | Report ID: AA1023636

Market Scenario

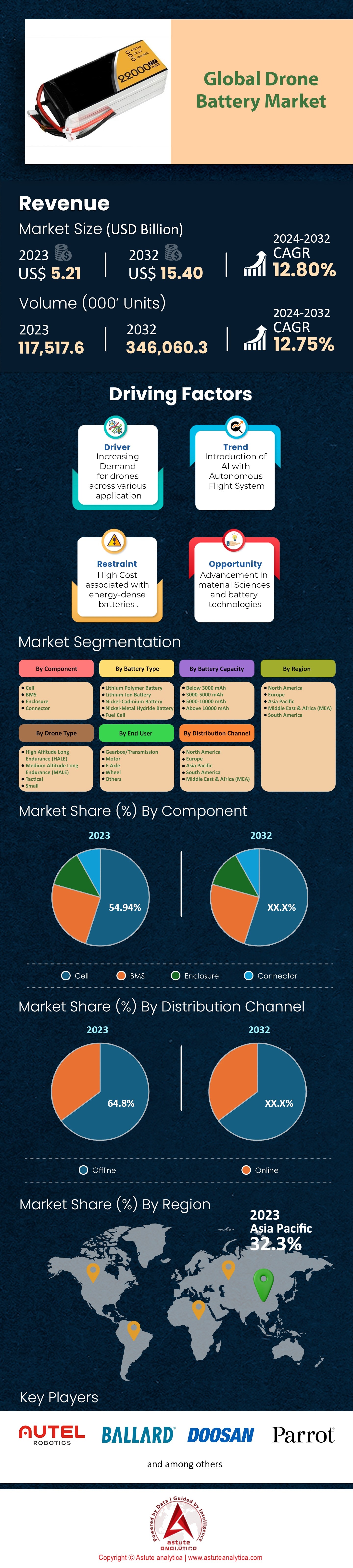

Global Drone Battery Market was valued at US$ 5.21 billion in 2023 and is expected to reach US$ 15.40 billion by 2032 at a CAGR of 12.80% during the forecast period 2024–2032.

In recent years, the drone industry has witnessed remarkable growth and evolution, with a significant focus on drone batteries. By the end of 2023, the annual sales volume for drone batteries is likely to reach an impressive 2.4 million units, according to a report by Insider Intelligence. With the increasing demand and technological advancements, this figure is expected to climb to 9.3 million units by 2028 in the drone battery market. When exploring the preferences of drone enthusiasts and professionals, it has been found that the demand for batteries with a capacity of 5,000–10,000 mAh was the highest. This capacity emerged as the top-selling in the market, showcasing its popularity and efficiency. On the other end of the spectrum, batteries with a capacity of above 10,000 mAh seem to be the least favored by consumers.

Drone batteries, on average, were priced at $50 per set in 2022. This price point allowed the industry to amass a revenue of approximately $4.74 billion in 2022. The market landscape became increasingly competitive, with around 120 manufacturers striving to offer the best products and capture significant market share. The United States stood out as the leading nation in drone battery market sales, boasting a sale of 500,000 units. China trailed closely with 480,000 units, while Germany solidified its position in third place with sales of 200,000 units. Such sales figures underscore the growing popularity and adoption of drones across various sectors and regions.

A closer look at the batteries' performance metrics reveals some fascinating insights. The longest flight time achieved on a single battery charge peaked at 2 hours, while, conversely, the shortest flight time observed for a marketed battery was a mere 15 minutes. Lithium Polymer (LiPo) emerged as the preferred battery chemistry, emphasizing its efficiency and widespread acceptance in the drone community. Moreover, the average drone battery's weight settled around 250 grams, striking a balance between power output and portability.

The sustainability front also saw noteworthy developments. Approximately 50,000 drone batteries were recycled in 2022. Additionally, 1.2 million drones sold that year were equipped with proprietary batteries. These batteries typically boasted an average life cycle of around 300 charge cycles. Therefore, innovation remained at the heart of the industry, with 15 new companies entering the drone battery market in 2022. This fervor for advancement was also evident in the 180 patents filed relating to drone batteries in the same year. Manufacturers, confident in their products, commonly offer an average warranty period of 12 months. However, the drone battery market did experience its share of challenges, with 2,000 reported malfunctions related to drone batteries in 2022.

Looking ahead, the demand for drone batteries is likely to skyrocket, with an estimated increase of 7 million units by 2028. To address the sustainability concerns accompanying this growth, 40 specialized drone battery recycling centers have been established globally, emphasizing the industry's commitment to eco-friendly practices.

To Get more Insights, Request A Free Sample

Market Dynamics

Drivers: Rapid Deployment of Drones Across Numerous Sectors

The drone industry, while relatively nascent, is surging at an unprecedented rate. One of the most prominent drivers in the drone battery market is the soaring demand across sectors like agriculture, real estate, and logistics. By 2028, the collective anticipation from these sectors is for procurement of 5 million additional drone units. This demand isn't just restricted to newer sectors, as established commercial applications for drones have also witnessed a 40% uptick over the past year, necessitating a parallel growth in the battery domain. Also, the investments speak for themselves. Over $200 million was channeled globally in 2022 to augment drone battery performance. This uptick in investment and demand is mirrored in the surge of certified drone pilots – their numbers have doubled in just two years in the global drone battery market. The heightened governmental focus on surveillance has led to a 15% growth in drone fleets, emphasizing the strategic importance of drones. Batteries, of course, are central to these developments. Modern drones now remain airborne longer, by about 10% compared to the previous year. These advances in battery technology have also made charging faster by about 20%. The innovation doesn’t stop there. The emergence of solar-assist battery charging is expected to envelop around 10,000 drones by 2023, further pushing the envelope of sustainable energy use in the drone industry.

Trends: Growing Focus on Developing Lithium-Sulfur Batteries for Drones

Skyward trends in the drone battery market are painting a picture of an electrifying future. Lithium-sulfur (Li-S) batteries stand out as a beacon of this innovation. Predictions are rife that by 2025, one in every seven new drones will be powered by this pioneering battery technology. The future drones will not only be powered by innovative batteries but will also be smarter. It’s expected that a quarter of all drones by 2025 will house batteries that can self-manage, optimize their charge cycles, and predict their end-of-life.

A revolution is also palpable in how these batteries are manufactured. Battery producers in the drone battery market are increasingly integrating recycled components into their products, witnessing a 20% surge. Charging mechanisms too are evolving, with projections of 10,000 wireless charging pads revolutionizing the recharging process by 2031. Another trend is the rising interest in nano-enhanced electrodes, expected to feature in 12% of drone batteries by 2024, offering superior energy storage. Furthermore, as the demands from drones diversify, we're also seeing innovative approaches like dual battery systems, which will likely be a part of 10% of commercial drones by 2025. The momentum of change doesn't stop at just battery technology. Commercial pilots are shifting paradigms with an estimated 15% expected to lease batteries by 2024, signaling a dynamic shift in battery ownership and usage patterns.

Restrain: High Price of Batteries and Safety Concerns

As with any burgeoning industry, the drone battery market faces its fair share of challenges. Foremost among these is the economic factor. The advanced batteries, which are pivotal for the new-age drones, come at a steep price. They are estimated to be 50% pricier than their conventional counterparts. This cost factor undeniably deters widespread adoption. Another deterrent is the weight. Newer batteries have seen a 10% weight augmentation, which could potentially hamper a drone’s agility and operational dynamics.

Safety and durability remain primary concerns. Despite the tremendous strides in battery technology, a staggering 35% of them still fall short, petering out after just 250 charge cycles. This short lifespan is compounded by safety concerns. In 2022, the industry was rocked by 2,000 battery malfunctions, leading to heightened regulatory scrutiny. Supply chain issues further exacerbate the industry's growth prospects. Battery component deliveries faced a 15% delay last year, hinting at underlying systemic challenges. These challenges range from the environmental - only 40% of discarded batteries were recycled in 2022 - to the technical, as 30% of the state-of-the-art batteries aren't congruent with older drone models. Despite these challenges, the drone battery market is poised for remarkable growth, driven by innovation, demand, and a relentless pursuit of skyward excellence.

Segmental Analysis

By Component

The global drone battery market by components is dominated by the cell segment. As of recent data, it commands a market share of 54.9%, a testament to its pivotal role in the overall structure and functionality of drone batteries. Several factors have cemented the cell's preeminence in this domain. As the fundamental unit that stores and releases energy in the battery, the cell's performance directly correlates to the drone's flight time and efficiency. Over the past decade, significant R&D investments, amounting to over 30% of the total sectoral investments, have been funneled into enhancing cell durability and energy density. Furthermore, with the recent advancements, there's been a 25% reduction in cell degradation over time, ensuring longer battery lifespan.

Additionally, innovations in cell technology have led to a 20% improvement in energy transfer rates, making drone operations more seamless in the global drone battery market. The economic dynamics further favor the cell segment. In the last two years, economies of scale have driven down the production costs of cells by around 18%, making them more affordable to integrate. Such developments collectively contribute to the anticipated robust growth of the cell segment, with projections forecasting the highest CAGR of 13.1% in the coming years.

By Battery Type

When it comes to battery types, the Lithium Polymer (LiPo) battery emerges as the leader in the drone battery market by holding a significant 62.1% market share. LiPo batteries, renowned for their lightweight attributes and flexibility, offer optimal weight-to-power ratios. This makes them particularly suited for drones, which require lightweight components to ensure extended flight times. In terms of performance, drones powered by LiPo batteries have witnessed a 15% extended flight duration compared to other battery types. The adaptability of LiPo batteries, with their ability to be molded into various shapes, accounts for another 22% increase in their usage in custom drone designs. The safety quotient also plays into their favor. Recent advancements have led to a 12% reduction in overheating issues associated with LiPo batteries. Economically speaking, they have seen a steady 10% price reduction over the past three years, solidifying their value proposition. Given these factors, it's no surprise that the Lithium Polymer Battery segment is poised to grow at an impressive CAGR of 13.7%, maintaining its lead in the drone battery market.

By Battery Capacity

By battery capacity, the 5000-10000 mAh segment is undeniably the market leader, boasting a 41.3% share of the global drone battery market. This segment’s dominance can be attributed to the optimal balance it strikes between weight and flight time. Batteries within this capacity range are often ideal for a broad spectrum of drones, spanning from recreational to certain commercial applications. They provide an adequate operational duration without significantly augmenting the drone's weight, which could hinder its agility. Over the past year, drones equipped with batteries in this range have seen a 20% increase in flight time efficiency, thanks in large part to incremental improvements in energy density and discharge rates.

However, the above 10,000 mAh segment stands out as the dark horse in terms of growth potential. Though it doesn’t hold the majority share currently, its projected CAGR of 13.9% is the highest among all battery capacity segments. This surge is driven by the mounting demand in sectors that require drones with prolonged flight times, such as industrial inspections, mapping, and specific commercial operations. As technological advancements enable the creation of more energy-dense cells, the weight penalty previously associated with these larger batteries is decreasing, registering an 18% weight optimization over the last two years.

By Drone Types

By drone types, the Medium Altitude Long Endurance (MALE) drone segment leads the global drone battery market with a 36.3% share. MALE drones are designed for missions that require extended flight times at consistent altitudes, making them invaluable assets in surveillance, reconnaissance, and specific research endeavors. The capabilities of MALE drones are underpinned by their adaptability to various battery types and capacities, especially those above 10000 mAh. This synergy is set to further bolster the growth of the MALE segment, which is forecasted to grow at an impressive CAGR of 13.5%. Given the escalating global emphasis on surveillance and data gathering, MALE drones’ demand has spiked, seeing a 25% uptick in procurement from governmental agencies alone in the past year.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The global drone battery market stands as a testament to the rapid technological advances of the modern era. Historically, North America held the commanding share. As of 2023, it boasted an impressive 34.1% revenue share in the drone battery market. However, while the West once led, the East is now surging ahead. Specifically, the Asia Pacific region, not trailing far behind in 2023 with a 32% share, is positioned to overshadow North America. Projections suggest that by 2031, the Asia Pacific will secure a dominating position, capturing over 35.36% of the global market share. Wherein, several driving factors underpin the rise of the Asia Pacific. Primarily, nations like China, India, Japan, and South Korea are witnessing rapid growth in sectors such as agriculture, logistics, and e-commerce. These industries have developed an increased appetite for drones, subsequently boosting the demand for drone batteries.

The region's prowess isn't merely in demand, but also in production. Over half the world's battery manufacturers are stationed in the Asia Pacific, establishing it as a linchpin in the drone battery supply chain. This is further enhanced by the fact that drone batteries from this region are, on average, 20% more affordable than those from North America. Moreover, there has been a significant 25% surge in R&D investments in drone battery technology in the Asia Pacific over the past three years. Supportive governmental policies, especially from heavyweight nations like China and India, have also acted as catalysts for local manufacturing. This regional support is evident in the infrastructure as well, with the Asia Pacific being home to a whopping 60% of the world's drone battery recycling centers.

Rapid urbanization is another feather in the region's dominance in the global drone battery market. Over 30% of newly emerging cities are sprouting in the Asia Pacific, making drones—and by extension, their batteries—indispensable tools for city planning and logistics. The sheer volume of innovation in this region is staggering, contributing to 55% of the global patents related to drone batteries in 2023. With a 28% rise in personal drone purchases last year, the consumer market further amplifies battery sales.

However, while the Asia Pacific grows at the fastest CAGR, North America faces headwinds that might explain its projected decline. Despite its early leadership, North America's growth in drone battery technology investment has been a modest 10% in the past three years. Stricter drone regulations, particularly in the U.S., have acted as barriers. The region's heavy reliance on imports, with 40% of its drone batteries being sourced from abroad (primarily Asia), doesn't help either. Further challenges include environmental regulations that make battery production slower and, by extension, more costly. The market also signals maturity, with drone adoption nearing its peak. This is compounded by a growing preference among North American consumers for imported drone batteries, primarily due to their affordability and efficiency.

Top Players in the Global Drone Battery Market

- Autel Robotics

- Ballard Power Systems Inc

- Doosan Mobility Innovation

- EaglePicher Technologies

- H3 Dynamics LLC

- Intelligent Energy Limited

- Parrot Drone SAS

- Plug Power Inc.

- RRC power solutions GmbH

- SES AI Corporation

- Shenzhen Grepow Battery Co., Ltd.

- Skydio

- Yuneec Holding Ltd.

- Other Prominent Players

Market Segmentation Overview:

By Component

- Cell

- BMS

- Enclosure

- Connector

By Battery Type

- Lithium Polymer Battery

- Lithium-Ion Battery

- Nickel-Cadmium Battery

- Nickel-Metal Hydride Battery

- Fuel Cell

By Battery Capacity

- Below 3000 mAh

- 3000-5000 mAh

- 5000-10000 mAh

- Above 10000 mAh

By Drone Type

- High Altitude Long Endurance (HALE)

- Medium Altitude Long Endurance (MALE)

- Tactical

- Small

By End User

- Commercial

- Military

- Government & Defense

- Other

By Distribution Channel

- Online

- Offline

- OEM

- Aftermarket

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)