Global Disaster Restoration Services Market: By Type (Fire Restoration, Water Damage Restoration, Storm Damage Restoration, Mold Damage Restoration, and Flood Damage Restoration); End User Application (Commercial and Residential); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2033

- Last Updated: Sep-2024 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA0924923 | Delivery: 2 to 4 Hours

| Report ID: AA0924923 | Delivery: 2 to 4 Hours

Market Scenario

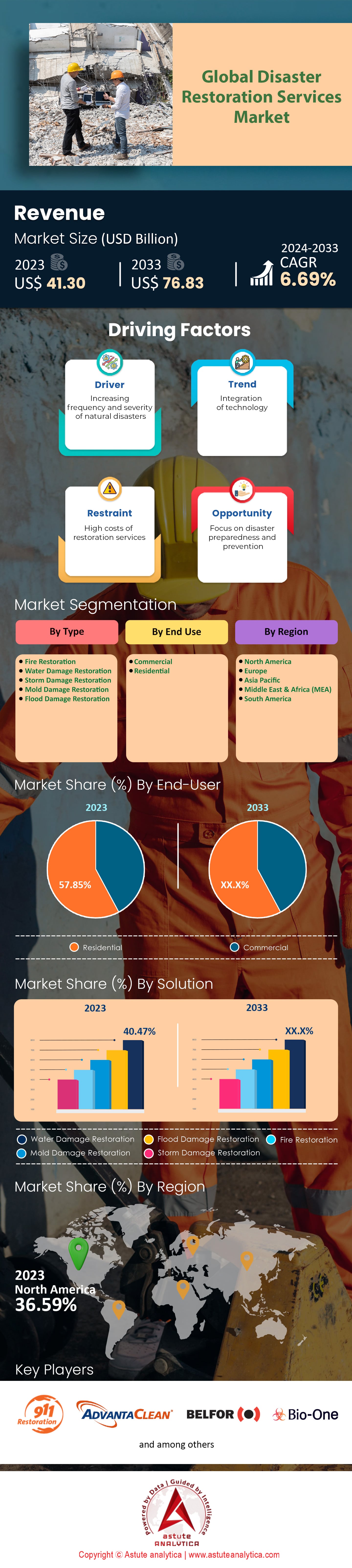

Global disaster restoration services market was valued at US$ 41.30 billion in 2023 and is projected to hit the market valuation of US$ 76.83 billion by 2033 at a CAGR of 6.69% during the forecast period 2024–2033.

The demand for disaster restoration services has surged globally due to the increasing frequency and severity of natural disasters. In 2023, around 370 natural disasters were recorded worldwide, resulting in significant financial losses estimated at $225 billion. Countries like the United States experienced approximately 22 weather and climate disaster events that caused damages exceeding $1 billion each. Furthermore, wildfires in regions such as California destroyed over 3.5 million acres, highlighting the urgent need for restoration services. The combination of urban expansion into vulnerable areas and climate change exacerbates these challenges, leading to a growing market for restoration services such as water damage restoration, fire damage repair, and mold remediation.

Key players in the disaster restoration services market, including Belfor, SERVPRO, and ServiceMaster Restore, are responding to these challenges with comprehensive solutions. SERVPRO alone operates 1,900 franchises in the United States, ensuring rapid deployment for localized services. Additionally, Belfor reported revenues exceeding $1 billion in 2022, indicative of its significant market presence. The scope of services has also expanded, with water damage restoration services accounting for nearly 40% of total market revenue. The integration of technological advancements, such as AI and IoT, is transforming the industry, with over 50% of restoration companies investing in these technologies for damage assessment and management.

The disaster restoration services market is ripe with opportunities, particularly in innovation and sustainability. In 2023, the global disaster recovery services market was valued at approximately $124 billion, with projections suggesting it could reach $210 billion by 2030. The demand for eco-friendly restoration practices is growing, with about 60% of consumers preferring companies that adopt sustainable methods. Additionally, the Federal Emergency Management Agency (FEMA) allocated $3 billion towards disaster preparedness and recovery, emphasizing the role of service providers in resilience planning. As governments and organizations prioritize disaster preparedness, companies that offer integrated solutions encompassing prevention, response, and recovery will likely thrive in this evolving market landscape.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing frequency and severity of natural disasters demanding immediate restoration services

The escalating frequency and intensity of natural disasters worldwide have underscored the urgent need for efficient disaster restoration services. According to the National Oceanic and Atmospheric Administration (NOAA), the United States experienced 18 weather and climate disasters in 2023, each resulting in over a billion dollars in damages. Globally, the Asia-Pacific region has witnessed a significant rise in natural calamities, with over 90 major weather events recorded last year. The increasing severity of these events is further highlighted by the fact that 2023 saw the highest number of Category 4 and 5 hurricanes over the Atlantic Ocean. As these disasters become more frequent and severe, the demand for rapid and effective recovery solutions has surged, driving the growth of the disaster restoration services market.

The financial impact of these disasters is staggering, with the global economic loss estimated at $280 billion in 2023 alone, as reported by Swiss Re Institute. The significant damages necessitate swift action to restore affected areas and infrastructure, which has fueled the demand for specialized restoration services. The Federal Emergency Management Agency (FEMA) reported allocating $16 billion for disaster relief in 2023, highlighting the critical need for restoration efforts. Moreover, the construction industry has seen an increase in demand for restoration projects, with over 1,200 new contracts issued in the aftermath of natural disasters in North America. With urban areas increasingly affected, city planners and governments are turning to disaster restoration services to ensure the rapid recovery of communities and economies.

Trend: Integration of advanced technologies like AI and drones in restoration processes

The integration of advanced technologies such as artificial intelligence (AI) and drones is revolutionizing the disaster restoration services industry. In 2023, the drone industry saw a 40% increase in usage for disaster assessment and recovery operations, facilitating quicker damage evaluations and improving response times. AI-driven analytics have enabled restoration companies to predict disaster impacts more accurately, enhancing preparedness and response strategies. According to a report by Astute Analytica, the use of AI in the disaster management sector reached $2.5 billion in 2023, illustrating the growing reliance on technology to streamline restoration processes. These innovations allow for more efficient allocation of resources, reducing downtime and costs associated with manual assessments.

Moreover, AI and drones play a crucial role in ensuring safety during disaster recovery operations. The deployment of drones for aerial surveys minimizes the risk to human life in hazardous areas by providing detailed and real-time imagery. The global market for drones in disaster management was valued at $1.6 billion in 2023, with over 4,500 units deployed in disaster-hit regions. AI has further enabled predictive maintenance of infrastructure, with over 300 cities worldwide adopting AI-based solutions to monitor and manage their critical systems. This technological trend not only accelerates the restoration process but also enhances the resilience of communities against future disasters, positioning technology as a pivotal element in modern disaster restoration efforts.

Challenge: Regulatory compliance and evolving standards impacting restoration service providers

Navigating regulatory compliance and evolving standards remains a significant challenge for disaster restoration service providers. The stringent regulations governing restoration activities, particularly in environmentally sensitive areas, require companies to adhere to a complex web of local, national, and international standards. In 2023, over 500 new environmental regulations were introduced globally, impacting restoration operations and necessitating continuous adaptation by service providers. The Environmental Protection Agency (EPA) in the United States reported an increase in compliance inspections, resulting in over $10 million in fines for non-compliance in the restoration sector. Such regulatory pressures demand extensive resources and expertise, often straining smaller restoration companies.

Additionally, evolving standards related to building codes and construction practices further complicate the restoration process. The International Code Council (ICC) updated its building codes in 2023, affecting over 850,000 construction and restoration projects worldwide. These changes require restoration companies to continually update their practices and training programs to meet new safety and sustainability standards. The administrative burden of compliance, coupled with the need for ongoing staff training and certification, can significantly impact the operational efficiency and cost-effectiveness of restoration services. As regulatory landscapes continue to evolve, restoration service providers must remain agile and proactive in adapting to new requirements to ensure compliance and maintain their competitive edge in the industry.

Segmental Analysis

By Type

Based on type, the water damage restoration segment is capturing over 40.47% market share. The surge in demand for water damage restoration services is largely driven by a confluence of environmental, technological, and societal factors. With an increase in extreme weather events, such as hurricanes and flooding, the frequency of water-related disasters has amplified. In 2023 alone, the United States experienced over 200 major flood events, significantly impacting residential and commercial properties. Additionally, aging infrastructure in many urban areas contributes to an increase in incidents of water damage from burst pipes and sewer backups. The global urban population is rising by 65 million people annually, exacerbating these infrastructural challenges. Moreover, the rise of smart home technology has made it easier for homeowners to detect water leaks early, prompting quicker intervention and fueling demand for restoration services. Insurance companies are also playing a pivotal role, processing over $13 billion in claims related to water damage yearly, encouraging homeowners to seek professional restoration services to mitigate costs.

The major revenue-generating segments in the water damage restoration industry include residential services, commercial restoration, and technological innovations like advanced drying equipment and water detection tools. Residential services account for a significant portion, as over 14 million American homes are at risk of flooding, necessitating regular restoration work. Commercial restoration is another key segment, with businesses facing average losses of up to $50,000 per water damage incident, driving them to invest in preventive and restorative services. The industry is also seeing growth in the adoption of specialized equipment; the market for industrial-grade dehumidifiers and air movers is valued at over $500 million. The integration of AI and IoT in water damage assessment and restoration is projected to grow to a $3 billion market by 2025. These technological advancements not only enhance service efficiency but also create new revenue streams, underscoring the dynamic and evolving nature of the water damage restoration market.

By Application

Based on application, the residential segment is generating more than 57.85% market revenue. The surge in demand for disaster restoration services among residential consumers is primarily driven by the increasing frequency and severity of natural disasters, along with the aging infrastructure of residential properties. In 2023 alone, over 2 million homes in the United States sustained damage from natural disasters, reflecting a growing trend that underscores the vulnerability of residential properties. Homeowners are increasingly aware of the potential for catastrophic events, leading to a heightened need for swift restoration services to mitigate secondary damages, such as mold growth, which can affect health and property value. The average cost of repairs for a single home after a flood event has reached approximately $40,000, emphasizing the financial burden and urgency for immediate restoration efforts.

Moreover, the rising number of insurance claims filed by homeowners has further propelled the market. Insurers now process an average of 3.5 million claims annually related to disaster damages, highlighting the critical role of restoration services in facilitating the recovery process. Another key factor is the trend toward urbanization, with over 4 billion people globally residing in urban areas, making residential spaces more susceptible to infrastructure stress and subsequent damage. This urban concentration correlates with a higher demand for efficient and rapid disaster response and restoration services, as urban dwellers prioritize quick recovery to maintain their lifestyles and economic stability.

Technological advancements and increased awareness about the importance of disaster preparedness also contribute significantly to market growth. The adoption of smart home technologies, which can alert homeowners to potential hazards, has risen to 30 million homes worldwide. As more homeowners integrate these technologies, the demand for complementary restoration services grows, creating a dynamic interplay between prevention and response. Furthermore, government initiatives and incentives aimed at bolstering community resilience have resulted in a $10 billion investment in disaster preparedness and recovery programs, indirectly boosting the demand for residential restoration services. These factors combined illustrate a complex landscape where necessity, technological evolution, and economic considerations drive the dominance of residential consumers in the disaster restoration services market.

To Understand More About this Research: Request A Free Sample

Regional Analysis

The dominance of North America in disaster restoration services market with 36.59% is characterized by its robust infrastructure and advanced technology deployment, making it the largest market globally. In 2023, the market value of disaster restoration services in North America reached $15.11 billion, driven by a series of natural calamities and increasing awareness about the need for swift restoration. The United States leads the region, accounting for over $13 billion of the total market value, largely due to its size and frequency of natural disasters such as hurricanes, wildfires, and floods. Canada, while smaller, has also seen growth, with a market size of $2 billion, propelled by similar climatic challenges and an increasing number of restoration companies offering specialized services. The demand for water damage restoration services is particularly high, with over 150,000 such claims reported in the U.S. alone this year, underscoring the need for rapid and effective response strategies.

Europe follows North America. The region has faced significant challenges, particularly from flooding and storm damage, which have driven the demand for restoration services. Germany and the United Kingdom are the key markets. The European Union has also been proactive in enhancing disaster preparedness and response, with initiatives like the EU Civil Protection Mechanism contributing to the region's market growth. The market is supported by a strong regulatory framework and the presence of major players who are investing in advanced technologies such as AI and IoT for efficient disaster management. In the past year, over 50,000 flood-related restoration projects have been reported across the continent, highlighting the critical need for effective restoration solutions.

The Asia Pacific region, the third-largest market, has seen a significant uptick in demand for disaster restoration services. This growth is primarily due to the region's vulnerability to a wide range of natural disasters, including typhoons, earthquakes, and tsunamis. The region is focusing on building resilient infrastructure and enhancing disaster response strategies, with governments and private sectors investing heavily in restoration technologies and services. In 2023, Japan reported over 70,000 restoration projects related to earthquake damage, illustrating the ongoing need for specialized services. Furthermore, the increasing urbanization and industrialization in countries like India have heightened the demand for restoration services, as infrastructure becomes more susceptible to natural and man-made disasters.

Top Players in Global Disaster Restoration Services Market

- 911 Restoration

- AdvantaClean

- BELFOR

- Bio-One, Inc.

- Duraclean Corporation

- Paul Davis Restoration, Inc.

- Restoration 1

- Servpro

- DKI Restoration

- Other Prominent Players

Market Segmentation Overview:

By Type

- Fire Restoration

- Water Damage Restoration

- Storm Damage Restoration

- Mold Damage Restoration

- Flood Damage Restoration

By End Use

- Commercial

- Residential

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- U.K.

- Germany

- France

- Spain

- Italy

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA0924923 | Delivery: 2 to 4 Hours

| Report ID: AA0924923 | Delivery: 2 to 4 Hours

.svg)