Digital Twin in Oil & Gas Market: By Type ( Descriptive twin, Informative twin, Predictive twin, Comprehensive twin, Autonomous twin); Type (Functional Digital Twins; Process Digital Twins; System Digital Twins); Application (Drilling; Emergency evacuation; Pipelines; Intelligent Oil fields; Virtual Learning and Training; Asset Monitoring and Maintenance; Project Planning and lifecycle management; Collaboration and knowledge sharing; Offshore platforms and infrastructure; Exploration and geological study); Deployment (On-Premise; Cloud); Enterprise Size (Large Enterprises; Small and Medium-sized Enterprises (SMEs))—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 04-Nov-2025 | | Report ID: AA1023630

Market Snapshot

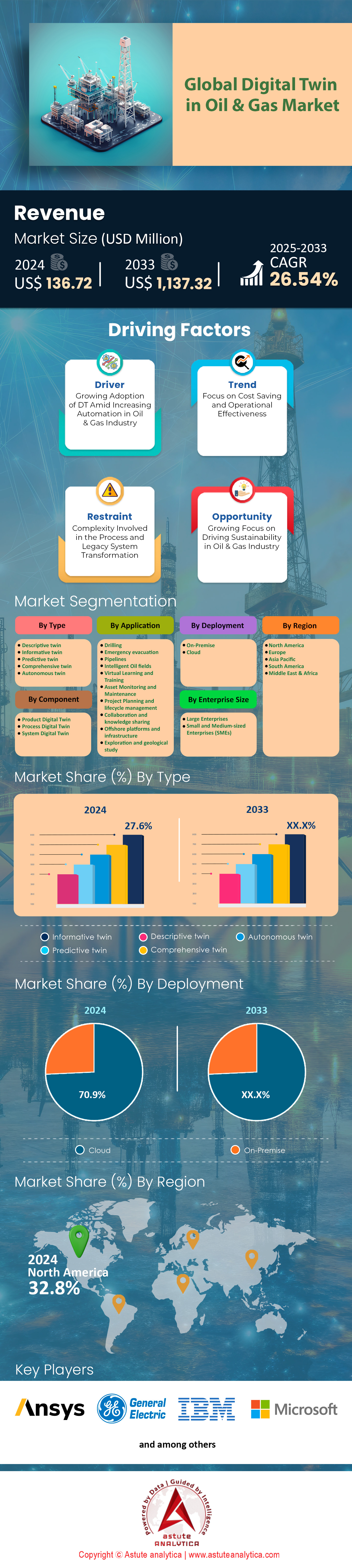

Digital twin in oil & gas market was valued at US$ 136.72 million in 2024 and is projected to attain a market valuation of US$ 1,137.32 million by 2033 at a CAGR of 26.54% during the forecast period 2025–2033.

Key Findings

- By type, informative twin segment is dominating the global market by capturing over 27% market share.

- By component, the process digital twin segment takes the lead in the market by holding more than 46% of the market's revenue share.

- Based on applications, the 'asset monitoring and maintenance' segment asserts its dominance by securing over 19% of the market share.

- When it comes to deployment, the cloud segment emerges as the undisputed leader in the digital twin in oil & gas market by holding a staggering market share of over 70%.

- North America enjoys the dominant position with over 32.80% market revenue contribution.

A powerful combination of financial, operational, and strategic drivers is fueling the intense demand shaping the digital twin in oil & gas market. The most compelling factor remains the severe economic penalty of operational disruptions. For instance, upstream companies face average annual losses of $38 million from unplanned downtime, while every hour a facility is offline can potentially cost $500,000. In response, operators are scaling their digital deployments massively. Shell's predictive maintenance program, for example, now covers over 10,000 assets. Similarly, Aramco has deployed over 65 individual digital solutions at its North Ghawar complex alone. Consequently, this aggressive adoption is validated by significant returns, such as Aramco achieving $4 billion in technology-realized value in 2024.

Moreover, demand is intensified by proven gains in production and exploration. Tangible results, such as BP producing an additional 30,000 barrels of oil in the first year of its digital twin implementation, are creating a competitive necessity for investment. This success is mirrored in complex process environments, where Yokogawa's AI has autonomously controlled a chemical plant for over three years, thereby demonstrating the technology's reliability and long-term value. As a result, the ability to directly enhance core business outcomes is making digital twin adoption a top priority for operators seeking to maximize asset value and operational output in a fiercely competitive landscape.

Finally, long-term strategic imperatives are cementing the technology's role in the digital twin in oil & gas market's future. Major operators are securing multi-year partnerships, such as BP’s four-year global contract with Aize awarded in January 2025 and Shell's 2024 agreement with Akselos. In addition, this is coupled with a significant focus on future-proofing the workforce, evidenced by Aramco training over 6,000 AI-enabled professionals. With substantial capital like the UK government's £20 billion earmarked for CCUS projects, digital twins are therefore becoming essential tools for managing the energy transition, ensuring their sustained and growing demand for years to come.

To Get more Insights, Request A Free Sample

Quantum Simulation and Decommissioning Twins are Unlocking New Value Chains in Digital Twin In Oil & Gas Market

- A major opportunity is emerging from the application of quantum-inspired computing to solve highly complex optimization problems within digital twins. For instance, companies are exploring these advanced algorithms to optimize catalytic cracking processes in refineries, which involve thousands of variables impossible for classical computers to solve in real time. Similarly, this approach can drastically refine seismic data interpretation for reservoir modeling. Consequently, the ability to solve these previously intractable problems offers a powerful competitive advantage and a high-value niche for specialized service providers.

- A substantial new market is being created for digital twins in asset decommissioning. The industry faces the monumental task of safely retiring thousands of aging offshore and onshore assets. Digital twins provide an unparalleled opportunity to meticulously plan and simulate the entire decommissioning lifecycle. This includes modeling structural disassembly, planning subsea well plugging and abandonment with 4D precision, and forecasting long-term environmental impacts. Therefore, operators can significantly de-risk these multi-billion-dollar projects, ensure regulatory compliance, and optimize costs.

Dynamic Subsurface Twins are De-Risking High-Stakes Exploration Decisions

A primary factor defining current demand in the digital twin in oil & gas market is the intense focus on reducing subsurface uncertainty during exploration. The cost of drilling a single deepwater dry hole can exceed 150 million dollars, creating an urgent need for more accurate geological models. In response, next-generation subsurface digital twins now integrate over 50 different types of geological and geophysical data streams simultaneously. These dynamic models are immense, with a single high-resolution reservoir simulation now containing over 100 million active grid cells to ensure granular accuracy.

Furthermore, these systems are built for real-time updates. A leading operator’s twin now ingests and processes 5 terabytes of new seismic and drilling data every week from active exploration sites. This living model has successfully reduced well planning cycles from 6 months down to just 45 days. Consequently, geoscientists can test over 200 different drilling scenarios in a single day, a task that was previously impossible. This capability led one company to precisely reposition 3 planned wells in 2024, unlocking an estimated 25 million barrels of additional reserves.

Robotics Integration Is Fueling Demand for Autonomous Operational Twins

Another critical aspect shaping the digital twin in oil & gas market is the accelerated drive toward autonomous operations, enabled by robotics. Demand is shifting from passive monitoring twins to active command-and-control systems. A new North Sea platform, for example, is designed for just 15 on-site personnel, with a digital twin orchestrating a fleet of 20 autonomous robots for routine tasks. These robotic platforms are data powerhouses; a single drone inspection mission of a flare stack now captures over 80,000 high-definition images and thermal data points.

This integration is delivering quantifiable safety and efficiency gains, further fueling demand for the digital twin in oil & gas market. One company has already eliminated 5,000 hours of high-risk manual inspections in 2025 by using twin-directed robotic crawlers. These crawlers can access and inspect over 2 kilometers of complex internal pipework without human intervention. The digital twin processes the incoming data, updating the asset’s health status in under 10 minutes. As a result of these systems, one operator successfully reduced its annual maintenance-related insurance premiums for a key asset by 2 million dollars, providing a clear financial justification for investment.

Segmental Analysis

Informative Twins Deliver Unmatched Insights for Strategic Decision-Making

The informative twin segment is dominating the global digital twin in oil & gas market by capturing an impressive 27% market share, primarily because it empowers companies to translate raw data into actionable intelligence. These sophisticated digital replicas provide a comprehensive, contextualized view of assets and operations, seamlessly integrating historical and real-time data to forge a holistic understanding. Consequently, this enables engineers and decision-makers to simulate various scenarios, anticipate future performance, and make more informed strategic choices, which is invaluable in a capital-intensive industry. The capacity to visualize and analyze complex information in an easily digestible format drives significant improvements in both efficiency and safety.

By offering a single source of truth, informative twins in the digital twin in oil & gas market effectively dismantle data silos that often exist between departments, from exploration and production to finance. This collaborative environment fosters better communication and strategic alignment, which in turn leads to optimized resource allocation and streamlined project execution. The core value of providing deep context, rather than just isolated data points, is what makes this segment so crucial for companies aiming to secure a competitive advantage. Furthermore, the integration of AI and machine learning enhances the predictive capabilities of informative twins, allowing for the early detection of potential issues.

- A leading multinational oil and gas company's digital twin monitors its offshore platform's equipment for timely predictions.

- Informative twins can simulate reservoir conditions to predict production rates and develop optimal extraction strategies.

- Digital twins are being used to create virtual models of oil and gas reservoirs to simulate different exploration scenarios.

Process Digital Twins Spearhead Operational Excellence and Efficiency

Holding more than 46% of the market's revenue, the process digital twin segment leads the global digital twin in oil & gas market by allowing companies to simulate and optimize entire operational workflows. Unlike twins that focus on individual assets, process twins replicate complex, interconnected systems such as drilling operations, refining processes, or entire liquefied natural gas (LNG) production chains. This holistic perspective allows operators to identify bottlenecks, test new strategies in a risk-free virtual environment, and fine-tune parameters to maximize output while minimizing energy consumption and emissions, showcasing a clear path to operational superiority.

The dominance of this segment across the global digital twin in oil & gas market is directly linked to the substantial cost savings and efficiency gains it provides. For example, a major industry player utilized a process twin to create a replica of its full LNG operations, enabling simulations that successfully identified and resolved critical inefficiencies. Similarly, by modeling the entire drilling process, companies can optimize parameters like mud flow and torque in real-time, which significantly reduces operational risks and improves drilling speed. The revolutionary ability to run "what-if" scenarios for complete production systems without any physical risk is a game-changer for the digital twin in oil & gas market.

- Process twins can model the impact of pressure, temperature, and flow rate on well management.

- Simulations of LNG operations using process twins help in identifying and eliminating bottlenecks.

- By modeling various drilling parameters, companies can identify optimal strategies before deploying resources.

Asset Monitoring and Maintenance Drives Uptime and Reduces Costs

The 'asset monitoring and maintenance' segment asserts its dominance in the digital twin in oil & gas market by securing over 19% of the market share and directly addressing one of the industry's most significant challenges: unplanned downtime. Digital twins in this segment create virtual replicas of critical equipment like pumps, turbines, and pipelines, then use real-time sensor data to continuously monitor their health and performance. This persistent surveillance, when combined with predictive analytics, allows companies to anticipate equipment failures before they occur, enabling a pivotal shift from reactive to proactive maintenance strategies. This capability dramatically reduces costly production stoppages and extends the lifespan of valuable assets.

The financial impact of predictive maintenance is truly substantial; for a single rig, avoiding unexpected work stoppages can save an estimated €3.03 million every month. BP’s successful use of digital twin technology in the digital twin in oil & gas market to monitor its offshore equipment has resulted in reduced maintenance costs and increased operational efficiency. By creating a detailed, data-rich virtual model, maintenance teams can diagnose problems remotely, plan interventions more effectively, and ensure that the right parts and personnel are available when needed. These benefits further fuel the growth of the digital twin in oil & gas market.

- Implementation of digital twins in North Sea offshore projects resulted in project cost reductions of over 2 million euros for certain assets.

- Chevron is leveraging digital twins to address critical maintenance issues, potentially saving millions of dollars annually.

- A study showed that from 2015 to 2022, over 2,100 severe injuries in the oil and gas sector could have been prevented with better maintenance practices, a gap digital twins can fill.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

Cloud Deployment Offers Unparalleled Scalability and Accessibility

Emerging as the undisputed leader with a staggering market share of over 70.9%, the cloud segment’s dominance in the digital twin in oil & gas market is rooted in its inherent scalability, cost-effectiveness, and ability to support remote operations globally. Cloud platforms provide the immense computational power and data storage needed to run complex digital twin simulations without requiring massive upfront investments in on-premise hardware. As a result, this democratizes access to digital twin technology, allowing even smaller operators to leverage its powerful benefits and compete more effectively.

Moreover, cloud-based digital twins facilitate seamless real-time data integration and collaboration among geographically dispersed teams, which is a crucial feature for multinational oil and gas companies with assets spread across the world. Engineers in a central office can monitor an offshore platform, collaborate with on-site technicians, and run simulations using live data, all through a shared and secure cloud environment. The flexibility to quickly scale resources up or down based on project needs provides a significant operational advantage and is a primary reason for the widespread adoption of cloud deployment.

- Cloud platforms enable rapid updates and improvements to digital twin models based on user feedback.

- The scalability of the cloud is essential for handling the massive data volumes generated by IoT sensors on oil and gas assets.

- Cloud solutions reduce the need for significant upfront IT infrastructure investment, lowering the barrier to entry.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America’s Market Dominance Is Driven by Unmatched Scalability

North America commands the Digital twin in oil & gas market with an commanding market share of over 32.80%. A key factor is the sheer scale of deployment in US shale plays. In the Permian Basin, Chevron is rolling out its "digital factory" model, aiming to connect over 10,000 active wells to a central analytics platform by 2025. Similarly, a major operator in the region now processes over 20 terabytes of production data daily from its shale operations. The Houston technology ecosystem is a critical enabler, with over 50 specialized digital twin startups receiving venture funding in 2024 alone.

Furthermore, Canadian operations contribute significantly to this leadership in the North America digital twin in oil & gas market. Suncor’s oil sands upgraders in Alberta are being equipped with digital twins that monitor over 50,000 individual asset health parameters in real time. In another example, a new Canadian LNG facility’s digital twin will integrate data from a network of over 100,000 sensors upon its launch in 2025. Offshore, the momentum continues. ExxonMobil's operations in Guyana now utilize a digital twin that simulates over 500 operational scenarios for its FPSOs. Meanwhile, Baker Hughes opened a new Houston facility in 2024 dedicated to testing and deploying remote operational twins for at least 30 offshore clients.

Asia Pacific’s Rapid Adoption Is Fueled by National Oil Champions

The Asia Pacific region is demonstrating remarkable agility, driven by strategic national initiatives. China’s national oil companies are at the forefront of the Digital twin in oil & gas market in the region. For instance, CNOOC's Bohai Bay smart field now has over 3,000 wells connected to an integrated digital platform. PetroChina’s Tarim oilfield is also a key site, with a digital twin project aiming to increase gas recovery by 40 billion cubic meters. In Australia, Woodside Energy’s remote operations center in Perth now manages over 25 offshore and onshore assets through a centralized digital twin.

Moreover, Southeast Asia is emerging as a critical growth hub in the regional digital twin in oil & gas market. PETRONAS is developing a sophisticated digital twin for its Kasawari Carbon Capture and Storage (CCS) project, which is designed to capture 3.3 million tonnes of CO2 annually. The company also uses twin-guided robotics that have already performed over 500 successful internal pipeline inspections without human entry. In another development, a new refining complex in Singapore launched in 2025 features a process digital twin that optimizes over 1,500 critical control loops simultaneously, showcasing the region's focus on downstream efficiency.

Europe’s Market Focuses on Complex Offshore and Subsea Innovation

Europe’s position in the global digital twin in oil & gas market is defined by its deep expertise in managing complex offshore environments, particularly in the North Sea. Norway’s Equinor is a leader, with its Johan Sverdrup field digital twin processing data from more than 30,000 sensors to optimize production. In a similar vein, Aker BP is pioneering a fully unmanned production platform concept for its NOAKA field development, which will be entirely managed via a shore-based digital twin. The United Kingdom is also a major player; the Net Zero Technology Centre in Aberdeen has funded 12 new digital twin projects in 2024 aimed at reducing offshore operational emissions.

Furthermore, the region excels in applying the technology to extend the life of aging assets and de-risk new projects. A digital twin was used to plan the successful removal of a 24,000-tonne platform topside in the UK North Sea in 2025. TotalEnergies is also deploying structural digital twins to monitor the real-time integrity of over 50 of its aging offshore platforms. On the innovation front, a Norwegian startup secured 15 million euros in 2024 to develop a subsea digital twin that integrates data from 10 different types of autonomous underwater vehicles (AUVs).

Top Recent Developments in Digital Twin in Oil and Gas Market

- Cognite Secures Major Investment from Saudi Aramco (February 2024)

Saudi Aramco's venture arm, SAEV, made a strategic investment in industrial DataOps leader Cognite, deepening the partnership to accelerate the digitalization and creation of digital twins within Aramco's operations and the broader Saudi Arabian industrial ecosystem. - Ovarro Acquires ControlPoint to Bolster Pipeline Monitoring (June 2024)

Ovarro, a provider of remote monitoring and control technologies for critical infrastructure, acquired ControlPoint, enhancing its data collection capabilities for pipeline digital twins by integrating advanced data logging and asset management for gas and water utilities. - Cenosco Receives Investment from Fortino Capital (February 2025)

- Cenosco, a developer of Asset Integrity Management and digital twin software for asset-heavy industries, received a significant investment from Fortino Capital to accelerate its product roadmap and global expansion, targeting oil and gas clients.

Top Players in Global Digital Twin in Oil & Gas Market

- Ansys, Inc.

- General Electric

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- PTC Inc.

- Robert Bosch GmbH

- SAP SE

- Siemens AG

- SWIM.AI

- Other prominent players

Market Segmentation Overview:

By Type

- Descriptive twin

- Informative twin

- Predictive twin

- Comprehensive twin

- Autonomous twin

By Application

- Drilling

- Emergency evacuation

- Pipelines

- Intelligent Oil fields

- Virtual Learning and Training

- Asset Monitoring and Maintenance

- Project Planning and lifecycle management

- Collaboration and knowledge sharing

- Offshore platforms and infrastructure

- Exploration and geological study

By Component

- Product Digital Twin

- Process Digital Twin

- System Digital Twin

By Deployment

- On-Premise

- Cloud

By Enterprise Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Region

- North America

- The US

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Brazil

- Argentina

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)