Digital Language Learning Market: By Language Type (English, German, Spanish, Mandarin, Others); Technology (VR, Artificial Intelligence, Big Data Analytics, Natural Language Processing, and Others); Operating System (Windows, Android, iOS, Others); End User (Individuals, Enterprises (Small and Medium, Large), Educational Institutes, Government Agencies, Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 08-Dec-2025 | | Report ID: AA0823582

Market Snapshot

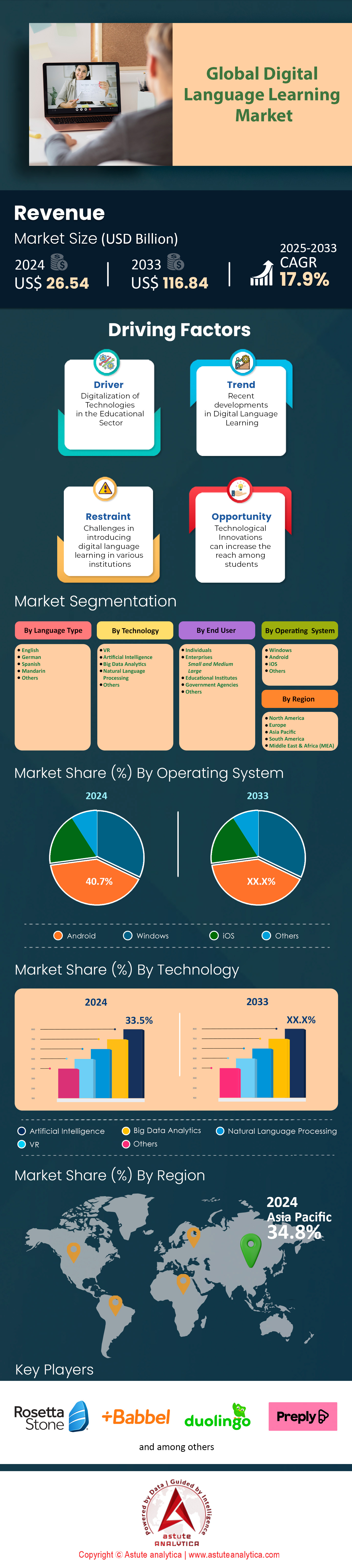

Digital language learning market was valued at US$ 26.54 billion in 2024 and is projected to surpass market valuation of US$ 116.84 billion by 2033 at a CAGR of 17.9% during the forecast period 2025–2033.

Key Findings

- By technology, Artificial Intelligence (AI) holds dominant position by accounting for a whopping 33.5% of the revenue share.

- Based on language, English remains a key contributor and is set to grow at a CAGR of 18.9%.

- Based on language, English is also projected to capture more than 53.8% market revenue share.

- Android is the most dominant operating system with over 40.70% market share.

- Based on end-user, individual users are holding the leading position in the market by accounting for 41.9% market share.

- Asia Pacific is the dominant region in the market as it control more than 34.80% market share.

The global digital language learning market has effectively consolidated into a massive digital ecosystem, now serving a total addressable market of over 1.5 billion English learners. Driving this unprecedented volume are the United States, India, China, and the United Kingdom, which currently stand as the top four nations fueling demand through intense migration and academic exchange. While English remains the overwhelming priority—ranking as the top language studied in 135 countries—interest has also surged for Spanish, French, German, and Japanese. This distinct shift in consumer behavior is best illustrated by Duolingo, which now commands 113.1 million monthly active users, proving that mobile platforms have successfully democratized access for a global audience.

Financial commitment in the digital language learning market has followed this spike in usage, marking a decisive transition from casual free-tier browsing to serious investment. Corporate entities are now aggressively funding this space, with the average training expenditure reaching USD 774 per learner annually. On the individual side, motivated learners are paying an average of USD 18.30 per hour for live human tutoring on platforms like Preply, valuing feedback over automation. Leading players have capitalized on this willingness to spend, with Duolingo generating USD 748 million and Babbel securing USD 370 million in annual revenue. The online impact is undeniable; digital platforms recorded 26.5 million aggregate app installs in just one month during late 2024, signaling that the primary classroom has shifted permanently to the smartphone.

To Get more Insights, Request A Free Sample

Where Does the Opportunity Lies?

Looking ahead, the most significant opportunities across the digital language learning market are concentrating within professional and migration-focused demographics, particularly among the 1.1 million international students navigating strict border policies. Current trends in late 2025 reveal a sharp pivot toward AI-led conversational mastery, a shift exemplified by Speak’s rapid rise to a USD 1 billion valuation with 10 million users. As enterprises project an incremental USD 4.9 billion spend on Business English by 2028, the market is moving away from simple vocabulary drills toward high-stakes, career-enabling proficiency. Stakeholders capable of bridging the gap between low-latency AI interaction and verified human fluency are best positioned to capture this expanding value.

Market Leaders Intensify Artificial Intelligence R&D Spending To Monopolize User Attention Spans

The competitive landscape of the digital language learning market in late 2025 is defined by a ruthless pivot toward AI-first ecosystems, where R&D efficacy dictates market share. Duolingo remains the apex predator, reporting a staggering 37.2 million Daily Active Users (DAU) and 113.1 million Monthly Active Users (MAU) in its Q3 2025 filings. Their strategy has shifted from pure gamification to high-margin personalization; the company converted 8.6 million of these users into paid subscribers by September 30, generating USD 192.6 million in quarterly revenue. Profitability is no longer theoretical, with Adjusted EBITDA hitting USD 47.5 million, fueling a war chest for acquisitions.

Challengers in the digital language learning market are responding with specialized, high-stakes capital deployments. Speak, having raised USD 78 million in Series C funding, has effectively utilized its USD 1 billion valuation to capture the conversation-practice niche, boasting 10 million registered users. Meanwhile, Babbel continues to dominate the serious learner segment with USD 370 million (EUR 352 million) in annual revenue, leveraging a workforce of 1,000 employees to refine its "human-in-the-loop" products. The disparity in R&D focus is clear: while incumbents optimize for retention, new entrants like Speak are optimizing for voice-processing latency, creating a bifurcated market of "casual engagement" versus "functional mastery."

Generative AI Integration And Low-Latency Voice APIs Are Redefining Technical Performance Benchmarks

Technology trends across the digital language learning market in late 2025 indicate that "good enough" voice recognition is no longer acceptable; stakeholders now demand near-native conversational fluidity. The industry standard for Natural Language Understanding (NLU) accuracy has surpassed 95%, a critical threshold that allows apps to provide nuanced grammatical feedback rather than simple binary corrections. Speak’s platform exemplifies this shift, having processed over 1 billion user-spoken sentences in 2024 alone, feeding proprietary models that reduce API response latencies to under 200ms. This speed is vital for maintaining the illusion of a live conversation, directly impacting user willingness to pay for premium tiers.

On the consumer front, gamification mechanics have evolved from simple leaderboards to AI-driven dynamic difficulty adjustments. Platforms deploying these adaptive algorithms in the digital language learning market report engagement uplifts of nearly 30% in daily active usage. Furthermore, the monetization of these tech stacks is aggressive. Duolingo Max, leveraging GPT-4 class models for "Roleplay," commands a price point of USD 29.99 per month (USD 168 annually), effectively anchoring the premium market. The technology stack has become the product, with investors closely scrutinizing cloud infrastructure costs and token usage efficiency as primary indicators of long-term gross margin sustainability.

Stricter Global Migration Policies And Visa Mandates Are Accelerating Proficiency Demand

The "Granular Drivers" of demand in the digital language learning market have shifted from casual travel interest to urgent, policy-driven necessity. By late 2025, changes in immigration frameworks across major English-speaking economies have established rigid language proficiency floors. The UK’s implementation of Level B2 (Upper Intermediate) requirements for Skilled Worker visas has forced thousands of applicants into structured digital courses. Similarly, Australia’s decision to set the guaranteed annual earnings threshold at USD 96,400 AUD exempts only high-earners, leaving the vast majority of migrants dependent on proving superior English skills to gain entry.

This regulatory pressure feeds in the digital language learning market directly into the international education pipeline, which remains the single largest upstream driver of high-value users. The US hosted 1,126,690 international students in the 2024/2025 cycle, with India (331,602 students) and China (277,398 students) dominating the intake. Crucially, the 294,253 students on Optional Practical Training (OPT) represent a captive audience for Business English platforms, as they must navigate American workplaces to secure H-1B sponsorship. Consequently, demand is least elastic among these demographic cohorts; for them, a subscription to a platform like Rosetta Stone or a tutor on Preply is not a discretionary expense but a mandatory investment in their migration eligibility.

Escalating Compliance Costs And Data Privacy Standards Challenge Operational Margins

Despite the bullish growth, the digital language learning market faces significant headwinds regarding data governance and localization economics. As platforms integrate deep-learning AI, they face rigorous scrutiny under evolving frameworks similar to GDPR. Maintaining compliance Service Level Agreements (SLAs) of 99.9% uptime while adhering to data sovereignty laws has become a major OPEX line item. Furthermore, the "human-in-the-loop" requirement for premium content has driven localization costs up by approximately 25%, as vendors must hire native speakers to audit AI-generated content for cultural nuances to avoid PR disasters.

Retention metrics also reveal cracks in the "freemium" armor. While download numbers are high—26.5 million aggregate installs in August 2024 alone— analysis suggests steep drop-off rates, with nearly 30% of casual users abandoning apps after Day 30. This churn in the digital language learning market necessitates aggressive user acquisition spending. Additionally, the shift to high-stakes testing, such as the Duolingo English Test (DET) with its USD 70 fee and 700,000 annual candidates, invites distinct security challenges. Preventing digital proctoring fraud requires sophisticated biometric monitoring, adding layers of technical complexity and cost that smaller entrants struggle to finance. Stakeholders must weigh these rising infrastructure and compliance costs against the potential for revenue growth.

Unit Economics And Learner Behavior Reveal A Shift Toward High-Yield Hybrid Models

Learner behavior analysis in late 2025 exposes a clear preference for hybrid consumption models in the digital language learning market, influencing unit economics and Average Revenue Per User (ARPU). While the average app session remains short—often under 15 minutes—users are increasingly supplementing these micro-lessons with paid live interactions. Preply’s ecosystem highlights this trend, where 40,000 tutors command an average of USD 18.30 per hour, with specialized Business English tutors earning USD 50.00+ hourly. This willingness to pay validates a tiered ARPU ladder where users start at zero (ad-supported), move to USD 10–15/month (subscriptions), and scale to USD 200+/month (live tutoring).

On the B2B side, unit economics are bolstered by corporate volume. Babbel for Business, one of the leaders in the digital language learning market, having signed 1,000 corporate clients, demonstrates that enterprise Life Time Value (LTV) far exceeds consumer metrics. With companies spending an average of USD 774 per learner annually on training, the "seat-based" revenue model offers higher predictability than monthly consumer subscriptions. Furthermore, the operational scale required to support this is immense; Babbel Live conducts 15,000 virtual classes monthly, and Preply employs 678 staff just to manage marketplace liquidity. Investors are increasingly valuing companies based on their ability to bridge this gap between low-cost algorithmic learning and high-value human instruction.

Corporate Training Budgets and B2B Acquisitions Offer the Strongest Liquidity Events

Strategic analysis of the digital language learning market suggests that the most immediate opportunities for liquidity and growth lie in the B2B corporate training sector. With 77% of employers citing multilingualism as a key hiring factor, the demand for "Business English" is projected to drive an incremental USD 4.9 billion in spend through 2028. Large enterprises, maintaining average training payrolls of USD 2.1 million, are actively consolidating their vendor lists, favoring platforms that offer unified analytics and demonstrable ROI. Speak’s rapid B2B adoption, with 200 corporate signatories, signals that AI-driven roleplay is becoming a valid substitute for expensive executive coaching.

For stakeholders in the digital language learning market, the recommendation is to prioritize platforms with robust API infrastructures capable of integrating into corporate Learning Management Systems (LMS). M&A activity is heating up around companies that own proprietary datasets; the value of Speak’s 1 billion spoken sentences or Duolingo’s 500 million downloads lies in their utility for training next-gen Large Language Models (LLMs). Investors should remain wary of generic vocabulary apps and instead capitalize on vertical-specific solutions (e.g., Medical English, Technical German) or platforms like Duolingo that have successfully diversified into adjacent verticals like Math and Music to increase total addressable market and reduce churn.

Segmental Analysis

AI Integration Driving Massive Revenue Streams Across Global Educational Technology Sector

Artificial Intelligence (AI) holds dominant position in the global digital language learning market, accounting for a whopping 33.5% of the revenue share. This massive financial footprint exists because adaptive algorithms have fundamentally solved the engagement problem that plagued early e-learning platforms. By analyzing distinct user error patterns, these systems deliver personalized feedback that feels remarkably human, prompting learners to stick with the program far longer than they would with static textbooks. Consequently, major industry players are pouring capital into generative AI to build virtual tutors capable of simulating natural, dynamic conversations. Duolingo leveraged this exact strategy to generate USD 748 million in revenue during 2024, proving that automated personalization drives monetization.

- Speak secured USD 78 million in Series C funding in December 2024 to enhance its AI conversation engine.

- Sunlands Technology Group integrated DeepSeek AI into its platform in February 2025 to serve adult learners.

- Coursera recorded 1.1 million enrollments in GenAI-related content in India alone during 2024.

Beyond simple grammar correction, the technology now enables immersive role-play scenarios that mimic real-world business interactions. OpenAI has partnered with various educational platforms to embed GPT-4 capabilities, allowing for complex dialogue training that was previously impossible without a human teacher. Such innovation has pushed the digital language learning market into a new era of efficiency and accessibility. The shift explains why Speak attained a valuation of USD 1 billion, as investors bet heavily on the scalability of automated tutoring over traditional methods.

English Proficiency Needs Fueling Extensive Course Enrollments In Developing Nations

Based on language, English remains a key contributor the global digital language learning market and is set to grow at a CAGR of 18.9% while capturing more than 53.8% market revenue share. This overwhelming demand stems largely from the corporate world, where English acts as the universal bridge for international trade and cross-border collaboration. As professionals scramble to upskill for roles in multinational corporations, they naturally flock to digital solutions that promise recognized certification and business fluency. Furthermore, universities in Anglophone nations continue to require proof of proficiency, driving millions of students toward apps that offer standardized test preparation.

- Duolingo English Test was administered in over 70,000 locations globally in 2024.

- British Council estimates the number of English speakers including learners at 2.3 billion.

- India ranks as the number one country for English certification test-takers globally.

Migration trends further amplify this growth trajectory as workforces move from Latin America or Southeast Asia to Western hubs. The need for immediate survival English makes accessible mobile solutions indispensable for these demographics. Platforms like Native Camp are capitalizing on this by offering instant access to tutors, resulting in record enrollment numbers. Consequently, the digital language learning market is witnessing a shift from casual vocabulary building to specialized modules designed to improve employability in competitive job markets.

Android Ecosystem Accessibility Powering Widespread Educational Application Adoption In Emerging Markets

Android is the most dominant operating system in the global digital language learning market and is holding over 40.70% market share. The primary engine behind this leadership position is the sheer affordability of Android devices in price-sensitive regions like Asia, Africa, and South America. Because manufacturers such as Samsung and Xiaomi flood these markets with budget-friendly hardware, they create an enormous entry point for educational apps that iOS simply cannot match. Developers recognize this volume game and prioritize the Google Play Store to reach billions of potential learners who lack access to premium hardware.

- Google Play Store hosted over 263,000 education-category applications in 2024.

- There are currently over 3 billion active Android devices in circulation worldwide.

- Google Play generated nearly 113 billion total app downloads in the recent annual cycle.

Accessibility drives the platform strategy, as the open ecosystem allows for easier distribution of lightweight apps in areas with spotty internet infrastructure. Users in countries like India and Indonesia rely heavily on these devices for their daily education, making the OS critical for market penetration. Consequently, the digital language learning market thrives here, with local developers creating region-specific content that runs smoothly on lower-end specifications.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

Direct Consumer Subscription Spending Generates Primary Revenue For Educational Platforms

Based on end-user, individual users are holding the leading position in the global digital language learning market by accounting for 41.9% market share. Busy lifestyles drive this trend, as working adults and students demand the flexibility to study on their own schedules rather than adhering to rigid classroom timetables. Simultaneously, the shift toward subscription economy models has lowered the barrier to entry significantly. Instead of paying thousands for a physical tutor, a learner can now access premium content for a nominal monthly fee, making education accessible to the masses.

- Busuu reached a milestone of 120 million registered users on its platform.

- Coursera served a total of 162 million learners worldwide by the end of 2024.

- Babbel has sold over 18 million subscriptions since its inception.

Gamification plays a crucial role in retaining these individual users and converting free users into paying customers. By using streaks, leaderboards, and virtual currency, apps convert a chore into a daily habit that users are willing to pay to maintain. This engagement directly translates to revenue, as consumers increasingly purchase ad-free experiences and certification courses. Thus, individual spending remains the financial backbone of the digital language learning market.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Asia Pacific Captures Dominant Market Share Fueled By Unprecedented Student Mobility Surge

Asia Pacific has firmly established itself as the world’s most aggressive growth engine for digital language learning market by holding a commanding 34.80% of the global market share. This dominance is not merely a function of population size but is structurally driven by an explosive outbound academic pipeline. India has emerged as the primary catalyst, with projections for the 2024/25 academic year indicating 363,019 students will head to US universities alone, creating a massive, renewable user base for English proficiency tools. Furthermore, the region’s appetite for advanced technology has allowed AI-first entrants to scale rapidly; Speak’s ascent to a USD 1 billion valuation was largely underpinned by its massive adoption in South Korea and Japan, contributing to its 10 million registered users. The region effectively acts as the world’s "supply side" for language talent, where digital proficiency is the non-negotiable first step toward global migration.

North America Commands Highest Revenue Per User Through Immigration and Corporate Innovation

North America digital language learning market excels in monetization, effectively converting urgent learner needs into high-yield revenue. As the premier destination for 1,126,690 international students, the region benefits from a captive audience that must maintain proficiency for survival and employment. This necessity is evident in the workforce, where 294,253 graduates on Optional Practical Training (OPT) actively use Business English tools to secure visa sponsorships. Consequently, consumer willingness to pay is significantly higher here; users readily embrace premium price points, such as Duolingo Max’s USD 168 annual fee, to gain a competitive edge.

The corporate sector further fortifies this position, with US companies maintaining an average training spend of USD 774 per learner, ensuring that North America remains the most lucrative geography for B2B contracts and high-ARPU subscriptions.

Europe Solidifies Position With Stricter Visa Policies and Profitable Legacy Platforms

Europe digital language learning market remains a powerhouse by combining rigorous policy enforcement with the financial stability of its legacy players. The United Kingdom has directly influenced market demand by mandating Level B2 proficiency for Skilled Worker visas, effectively forcing thousands of migrants into paid learning ecosystems. This regulatory pressure is perfectly serviced by local giants like Babbel, which generated EUR 352 million (approx. USD 370 million) in 2024 revenue, proving that the European subscription model is highly sustainable. The region also champions the hybrid learning model; Babbel Live now conducts 15,000 virtual classes monthly, while Preply’s network of 40,000 tutors—many based across the continent—supports this ecosystem. With 1,000 corporate clients already onboarded for Babbel for Business, Europe successfully balances consumer migration needs with deep corporate entrenchment.

Top 9 Recent Developments Shaping the Digital Language Learning Market

- Speak Achieves Unicorn Status: AI-first platform Speak secured USD 78 million in Series C funding led by Accel with OpenAI Startup Fund participation, reaching a USD 1 billion valuation to scale its proprietary voice-recognition engine.

- Duolingo Record Revenue: Duolingo announced Q3 2025 revenue of USD 271.7 million, with paid subscribers reaching 11.5 million amid 41% YoY growth.

- Babbel Enterprise Surge: Babbel for Business officially surpassed 1,000 corporate clients, recording a single-month intake of 5,000 new enterprise learners in November 2024.

- UK Visa Mandate: The UK Home Office formalized the Level B2 (Upper Intermediate) proficiency standard for Skilled Worker visas, effective January 8, 2026.

- Preply Supply Expansion: Gig-economy leader Preply expanded its global network to 40,000 active tutors, solidifying its dominance in the live-instruction vertical.

- Duolingo Curriculum Growth: Duolingo broadened its "Super App" ecosystem to integrate Math and Music alongside its 42 language offerings.

- Speak B2B Launch: Speak successfully penetrated the corporate sector, signing over 200 companies for its "Speak for Business" AI-training solution with 85% employee adoption.

- Testing Volume Milestone: The Duolingo English Test (DET) reported approximately 700,000 candidates for 2024, with acceptance expanding to over 5,500 academic programs.

- Rosetta Stone Pricing Pivot: Rosetta Stone restructured its consumer model, marketing a Lifetime Unlimited plan at USD 179.99-$219 (discounted from $399) to compete with subscription rivals.

Major Players in the Global Digital Language Learning Market

- Babbel

- Busuu, Ltd.

- Duolingo

- Fluenz

- Lingoda GmbH

- Pearson PLC

- Preply, Inc.

- Rosetta Stone, Inc.

- SANAKO

- Voxy

- Yabla, Inc.

- Other Prominent Players

Market Segmentation Overview:

By Language Type

- English

- German

- Spanish

- Mandarin

- Others

By Technology

- VR

- Artificial Intelligence

- Big Data Analytics

- Natural Language Processing

- Others

By Operating System

- Windows

- Android

- iOS

- Others

By End-User

- Individuals

- Enterprises

- Small and Medium

- Large

- Educational Institutes

- Government Agencies

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)