Global Dielectric Fluids Market: By Type (PAO, Silicate Ester-Based Dielectric Liquids, and Others); Application (Closed Military Systems [Radar & Aircraft Avionics], Missiles, Ordnance System, Electronic Cooling Systems [Circulating Computer Coolant System], Transformers (Traction Transformers, Windmills Transformers, Off-Shore Transformers, Distribution Transformers), Circuit Breakers, Resistors, Reactors, Others); End Users (Defense, Space Agency, Electrical and Electronics, Power Generation, Telecommunications, Data Centre (Immersion Cooling Fluids (Single-Phase, Two-Phase) and Others), EV, and Others); Distribution Channel (Online and Offline); Region— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024–2032

- Last Updated: 06-Jun-2024 | | Report ID: AA0624845

Market Scenario

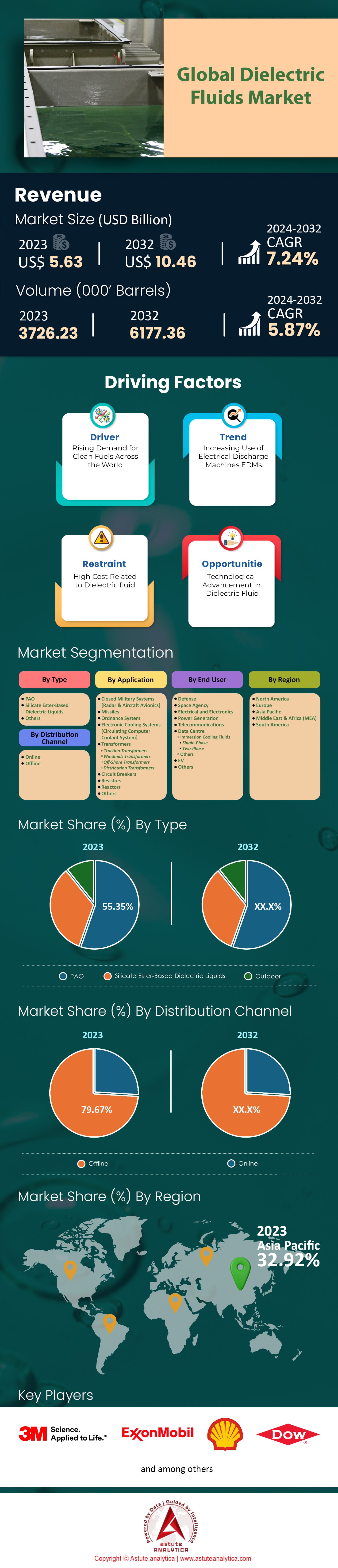

Global Dielectric Fluids Market was valued at US$ 5.63 billion in 2023 and is projected to hit the market valuation of US$ 10.46 billion by 2032 at a CAGR of 7.24% during the forecast period 2024–2032.

Technological improvements, growth of energy infrastructure and strong desire for cooling efficiency across many sectors have all contributed to an increase in demand for dielectric fluids market. The global data center market is expected to increase from $328.10 billion in 2023 to $792.29 billion by 2032 with the growing need for cloud services and data storage solutions driving advanced cooling systems that use insulating fluids heavily. Likewise, forecasts suggest the electric vehicle (EV) market will reach 34 million units by 2030 – up from 10 million in 2022 – which will require efficient battery and power electronic coolers therefore boosting fluid demand significantly.

The demand for dielectric fluids can also be attributed to renewable energy installations, set to rise by 50% between 2023 and 2028 alongside substantial investments into both wind power and solar energy. Such ventures rely on transformers as well as various other electrical components where dielectric or insulating liquids are vital for effective operation; furthermore, the world transformer market is predicted to grow at a CAGR of 6.5% from 2023-2028 finally reaching $80bn in total value terms over this period. These devices play key roles within distribution networks but still require insulation materials like oil so that they do not overheat during normal use.

Industrial automation is another factor fueling the growth of the dielectric fluids market since automated systems generate large amounts of heat thus necessitating more sophisticated cooling methods such as those involving dielectrics fluids. In addition, there is also the need for efficient cooling solutions within telecommunications infrastructure which should see continuous expansion until at least 2028 due its CAGR being projected at around +5%. The growth of various technologies including but not limited to fifth generation mobile networks calls for better management of heat dissipation capabilities related with associated electronic equipment.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Strong Growth in Data Center and Electric Vehicle Demand

Dielectric fluids market is mainly led by the expanding electrical vehicle (EV) and data center sectors. It is estimated that from 2016 to 2030, data center electricity needs will grow from 286 TWh to about 321 TWh and could reach 658 TWh by 2030 when accounting for Moore's law end and industrial Internet of Things (IoT) growth. This means cooling systems will need more dielectric fluids because their demand is growing rapidly in response to this higher energy consumption alone within the United States, where it is projected that although there may be a decline in data center power demands over the next few years due mainly towards meeting an upsurge in data service requirements, there will still not be any reduction of their use.

Another sector leaving positive impacts on the market is electric vehicles’ exponential rise worldwide; especially now as sales topped over 14 million units in 2023 alone and is projected to surpass 34 million by 2030. Furthermore, charging infrastructure as well battery production needs contribute towards boosting the dielectric fluids market even further. In Europe’s Net Zero Industry Act, it states its goal of having around 90% yearly battery demand met locally which translates into at least 550 GWh capacity being manufactured within EU borders by 2030.

Trend: Shift Towards Sustainable Dielectric Fluids

Ecologically sustainable substitutes are now the norm in the dielectric fluids market. This shift is caused by strict environmental guidelines and growing concerns over how traditional dielectric fluids affect earth’s atmosphere. According to analysts’ predictions, worldwide biodegradable dielectric fluid sales will increase at an average annual rate of 5.8% through 2028 and hit $3.2 billion. This growth can be attributed to demand from different sectors seeking environmentally friendly options.

One reason why sustainable dielectrics have become more popular recently is because people want to decrease greenhouse gasses emissions produced by these materials. Mineral oils used as dielectrics usually have large amounts of carbon dioxide embedded within it thus contributing greatly towards global warming compared with other kinds like biodegradables made from vegetable oils which are considered neutral when it comes down to CO2 levels recorded during their production cycle only. An investigation carried out at The University Of Manchester revealed that if we were substitute mineral oil based on vegetable ones then amount emitted into atmosphere could decrease even up till ninety percent.

Another driving force behind this transformation of the dielectric fluids market lies within our own need for renewable energy sources. As such, there has been an increased interest shown towards those items falling under category known as sustainable Dielectrics or Eco-friendly Liquid Insulators. They are designed exclusively for usage in power generation systems employing alternative resources such windmills farms. Moreover, consumers are becoming more aware about eco-friendly products and demanding them. In fact, according a survey results, 66% people worldwide would prefer buying sustainable brands over others even if they cost higher than non-sustainable ones. This change in attitude can be seen particularly well within automotive industry where now people want electric cars running on green energy sources which use biodegradable liquids for their batteries and cooling systems.

Challenge: Growing Ecological Concerns Among Consumers

Regarding the dielectric fluids market, there is no bigger challenge than the concern for traditional dielectric fluids’ ecological impact. A number of these, like silicone fluids and mineral oils, cannot be broken down by living organisms; thus, posing great threats to our environment. In fact, research carried out in the University of California revealed that within their lifetime up to 50% of all transformer oils or other electrical equipment containing dielectric liquids may escape into surrounding areas. These environmental issues become especially problematic with fluorochemicals which serve as dielectrics in high-voltage applications because they have very strong global warming potentials (GWPs). Some fluorocarbons can be 23500 times more potent GHGs than CO2 on a per molecule basis. Thus, manufacturers are under increasing pressure to stop using environmentally harmful substances such as this one which contribute greatly towards climate change.

Another reason why people worry about pollution caused by dielectrics is due to their ability to contaminate ground and water resources. Dielectric leaks from electrical appliances seep through soil, affecting underground reserves thereby endangering humans’ lives plus damaging ecosystems around them too. EPA even indicates that approximately 1/5th (20%) of polluted sites in America are linked with discharged insulating liquids. In order to counteract these concerns over greenness many companies in the dielectric fluids market now invest in creating sustainable alternative forms of insulation fluids which degrade naturally over time without harming anything else around it either. For instance, some manufacturers use vegetable oil-based products instead; these not only biodegrade easily but also come at lower cost compared with mineral oils commonly employed today. Indeed, according Manchester University study – “The Utilization of Vegetable Oil Based Insulating Liquids Can Reduce Environmental Impact by Up To 80%”

However, sustainable development and adoption pose difficulties themselves; mainly because making eco-friendly options tends being more expensive during production stages than traditional ones hence making them uncompetitive within markets where prices matter most. In fact, according to NEMA survey 60% of respondents cited cost as top obstacle for using renewable energy sources in dielectric applications.

Segmental Analysis

By Type

Having more than 55.35% of the market revenue share, polyalphaolefin (PAO) is the top choice in dielectric fluids market due to its excellent features and performance. The reason why it is frequently used as a heat transfer fluid lies in its unusual capacity of reducing environmental impact by 80% as against traditional mineral oils in electricity-consuming devices with compact designs that dissipate high levels of heat energy. This apart, PAO remains stable within more rigorous environments which explains why they are preferred for use in military computers systems or any other device that operates at very high temperatures and voltages.

When talking about insulators such as transformers, capacitors among others, we cannot fail to mention about good dielectric properties possessed by PAOs; including but not limited to having a low dielectric constant ranging typically between 2.1 – 2.4 as well high dielectric strength which makes them perfect for this application. It also has self-healing abilities making sure there’s always reliable performance even when it comes into contact with different types of materials over time thereby extending lifespan for this equipment too. PAOs have no rings double bonds sulfur nitrogen atoms waxy hydrocarbons; hence they exhibit higher stability under conditions characterized by both elevated pressures and temperatures since oxidation doesn’t occur easily.

PAO is witnessing a strong demand across the global dielectric fluids market because it is more eco-friendly than other insulating oils. For example, perfluorocarbon liquids have received criticism due to their high global warming potentials (GWPs) while PAO presents a greener option through biodegradability and less carbon footprint. In recent times, PAO-based nanofluids have been improved with respect to their dielectric and thermal properties by adding MgO nanoparticles into them. According to an article published in 2023 in the journal Coatings, PAO/MgO nanofluids show much higher dielectric strength, volume resistivity and relative permittivity than pure PAOs do. Technology will continue advancing alongside our increasing need for efficient and sustainable insulators; therefore, it is expected that demand for such fluids like PAOs should keep rising thereby making them remain dominant within this industry sector forever.

By Application

Based on application, the transformers segment held a market share of more than 27.64% in 2023. The reason why transformers are the main application in dielectric fluids market is because of their importance in thermal management as well as electrical insulation. The These fluids are needed to dissipate huge amounts of heat produced under high electric loads. For example, transformer oils with Al2O3 nanoparticles have thermal conductivity of 25.5 W/mK at 25°C which increases its capability to regulate heat effectively within the system. Also, such oils normally have dielectric breakdown voltage greater than 28 kV RMS that ensures protection against very strong electric fields and prevents any form of electric discharge.

Another major use for dielectric fluids in transformers is moisture control. Transformer oils should keep low levels of moisture content to avoid dielectric breakdown from occurring. As cooling takes place, dissolved water can be liberated thereby compromising insulating strength of the fluid. Moisture control therefore becomes important so as to enhance reliability and longevity aspects of these devices since they may fail due to degradation caused by high temperature combined with humidity where this occurs it is recommended that regular oil analysis be done during maintenance stage so that contaminants are identified early enough for corrective action while still maintaining optimum performance level.

Extensive use of dielectric fluids in transformers is also driven by environmental and safety reasons in the dielectric fluids market. Fire resistant rooms are required to be used for indoor liquid-filled transformers by regulations which may specify less flammable liquids. This development has resulted into adoption of bio-degradable substitutes with low flammability such as vegetable oils or synthetic esters thus making it safer for people while still conserving the environment. Dielectric fluids have been enhanced through nanotechnology thus allowing them handle larger voltages and facilitate more efficient power transfer within a transformer. These are some among other factors that make transformer applications account for the majority share in terms of demand volume within the dielectric fluid industry.

By End Users

Based on end users, the electrics and electronics industry are dominating the dielectric fluids market by capturing more than 22.96% market share in 2023. Components such as transformers which produce large amounts of heat require them most among other things. For example, dielectric fluids with added Al2O3 nanoparticles have a thermal conductivity of 25.5 W/mK at 25°C that ensures effective dissipation of heat energy.

One other important role that dielectrics play is moisture control. Transformer oils are made specifically for keeping moisture content low enough not cause dielectric breakdowns; even increasing humidity by just 1% can decrease its strength by up to 15%. Moreover, environmental regulations also contribute towards demand for these types of fluids. Many countries require use non-flammable or biodegradable liquid insulations indoors while others prohibit their application altogether due safety concerns. Synthetic esters along with natural oils offer safe alternatives hence reducing environmental pollution risks. Environmental concerns coupled with increased need clean fuel sources have prompted governments invest heavily in renewable energy technologies thereby creating new markets.

Additionally, breakthroughs achieved thanks nanotechnology have significantly boosted performance levels exhibited by various types electrical insulation liquids currently available on market. Thus, enabling them handle much higher voltages power ratings effectively than ever before realized. For instance, introduction nano-fluids into such materials can raise their dielectric strengths value 40% or even higher. This shows clearly how much control over electric energy flows through modern systems is ensured simply through use dielectrics.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

As of 2023, the Asia Pacific region controls over 32.92% share of the dielectric fluids market. The dominance is driven by breakthroughs and development in most prominent end use sectors like defense industry, space agency programs, electrical and electronics enterprises, power generation plants among others areas that are considered high-tech. China together with India have increased their defense budgets hence leading to increase consumption of military electronic devices and communication systems within which dielectric fluids are used as coolants or insulators. Advanced dielectric fluid is also needed for satellite and spacecraft electronic components because Indian Space Research Organization (ISRO) has expansive missions while Chinese National Space Administration (CNSA) needs more advanced ones due to its ambitions in space explorations.

The electronics manufacturing industry is highly concentrated in the Asia Pacific dielectric fluids market, with countries such as China, Japan and South Korea accounting for more than 60% of the world’s production. Because of this superiority complex over others, it creates a huge demand for dielectric fluids in capacitors and transformers. From 2023 to 2028, consumer electronics market is predicted to have an CAGR of about 7.5% in this area which means there will be even higher consumption needs on them during these years. At present time, renewable energy sector is rapidly expanding its power generation capacity not only across various provinces within China but also throughout Southeast Asian nations. Wherein, it has been reported that they are installing around 21 gigawatts (GW) per annum until 2030.

Moreover, the Asia Pacific EV market is also increasing rapidly and is expected to grow at a CAGR of 29.6% from 2023 to 2028, driven by government incentives and rising consumer demand. Being leading in battery manufacturing in the world, it creates a need for dielectric fluids market in battery cooling systems as well and most of this is happening in China which dominates global lithium-ion battery market. This shows through numbers – more than 40% of worldwide electric power transmission lines use Chinese-made insulating oils or transformers filled with them (Quantitative Insights). It’s not only about scale though – China has one of the biggest industrial bases and fastest growing technologies on Earth. This is why Asia Pacific countries invest heavily in R&D for advanced dielectric fluids each year spending over $500m annually; regionally produced quantities are predicted to rise by roughly a quarter every twelve months given both internal needs plus external ones too. Hence, all these different aspects contribute towards making APAC region an important player within global electrical power distribution industry.

Top Players in Global Dielectric Fluids Market

- 3M

- Arkema S.A.

- Cargill, Incorporated

- Castrol Limited (BP Group)

- Clearco Products Co., Inc.

- Dow, Inc.

- Ergon, Inc.

- Exxon Mobil Corporation

- Lanxess AG

- Nyco Group

- Radco Industries, Inc.

- Shell plc

- Sentinel Canada

- Sodick

- Other Prominent Players

Market Segmentation Overview:

By Type

- PAO

- Silicate Ester-Based Dielectric Liquids

- Others

By Application

- Closed Military Systems [Radar & Aircraft Avionics]

- Missiles

- Ordnance System

- Electronic Cooling Systems [Circulating Computer Coolant System]

- Transformers

- Traction Transformers

- Windmills Transformers

- Off-Shore Transformers

- Distribution Transformers

- Circuit Breakers

- Resistors

- Reactors

- Others

By End User

- Defense

- Space Agency

- Electrical and Electronics

- Power Generation

- Telecommunications

- Data Centre

- Immersion Cooling Fluids

- Single-Phase

- Two-Phase

- Immersion Cooling Fluids

- Others

- EV

- Others

By Distribution Channel

- Online

- Offline

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The U.K.

- Spain

- Netherlands

- Italy

- France

- Germany

- Poland

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)