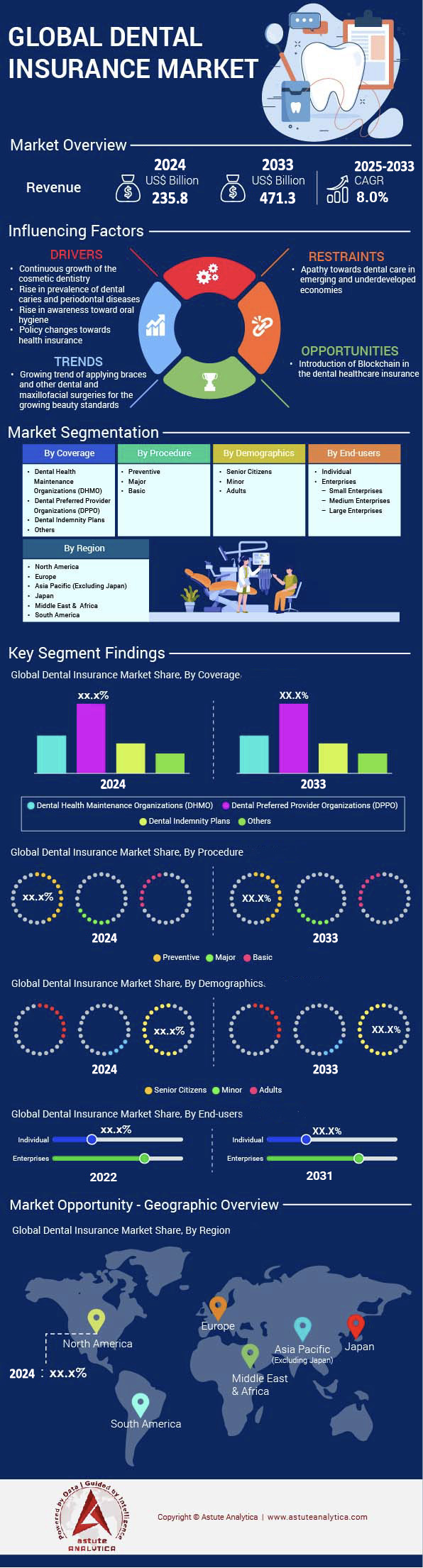

Dental Insurance Market: By Coverage (Dental Preferred Provider Organizations (DPPO), Dental Health Maintenance Organizations (DHMO), Dental Indemnity Plans, Others); Procedure (Major, Basic/Minor, Preventive); Demographics (Senior citizens, Adults, Minor); End User (Individual, Enterprises (Small, Medium, Large)); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 24-Dec-2024 | | Report ID: AA1221109

Dental insurance market generated a revenue of US$ 235.8 billion in 2024 and is estimated to reach a valuation of US$ 471.3 billion by 2033, at a CAGR of 8.0% during the forecasted period, 2025–2033.

Demand for dental insurance is growing globally due to heightened awareness of oral health’s impact on overall wellbeing, rising treatment costs, and the expanding range of services covered. More people recognize that comprehensive dental care can prevent complicated procedures, reducing both pain and expenditure. This awareness is underlined by the fact that over 450 million dental visits are recorded worldwide each year, indicating a significant need for coverage. Employers, too, are increasingly offering dental benefits, with over 60 million group dental policies purchased globally in the last year. Additionally, many countries are broadening basic health systems to include oral health, reflecting a shift in policy priorities.

Most prominent coverage provided in the dental insurance market includes preventive services such as routine checkups and cleanings, basic treatments like fillings and extractions, and major procedures including crowns, bridges, or dentures. Some plans extend their offerings to orthodontic and cosmetic services, although these can vary widely based on providers. Globally, an estimated 35 billion dollars are spent annually on dental treatments, with out-of-pocket expenses often making up a large chunk. In many developed nations, insurers now support teledentistry solutions, allowing up to 5 million remote consultations per year. Leading private insurers have introduced policies that reimburse digital oral scanning, highlighting technology’s growing influence in the sector.

Several major players dominate the dental insurance market, ranging from multinational insurers that partner with large healthcare networks to smaller regional firms specializing in local communities. Insurers in the United States alone underwrite close to 100 billion dollars in annual dental claims. Countries like Japan, Germany, and the United States exhibit higher penetration because of well-established healthcare infrastructures and strong employer-based coverage systems. On a global scale, an estimated 420 million people hold some form of dental insurance. However, a significant share of the population still pays out-of-pocket, incurring over 15 billion dollars each year on uncontrolled dental expenses. Recent developments include the integration of artificial intelligence for claims processing and personalized wellness apps that track oral hygiene routines, paving the way for more affordable, tech-driven solutions.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Expanding oral healthcare awareness fosters higher demand for comprehensive dental insurance

Oral healthcare is increasingly recognized as a cornerstone of overall wellbeing, prompting individuals and families to seek better coverage options in the dental insurance market. Globally, close to 270 million people sought at least one professional dental consultation last year, highlighting a shift toward preventive care. As awareness grows, the cost of advanced procedures like root canals can reach several thousand dollars, driving more consumers to look for policies that cover high-expense treatments. In 2022, around 25 million claims for complex dental surgeries were filed worldwide, signaling consumers’ broader understanding of the value insurance brings. With the World Health Organization estimating that untreated dental issues can lead to productivity losses running into billions of dollars, stakeholders in government and private sectors are amplifying oral health campaigns.

Businesses increasingly incorporate dental insurance into employee benefits for both retention and productivity reasons. Over 18 million small-business employees gained access to new dental plans in the last two years, reflecting heightened demand in the dental insurance market. Education initiatives emphasizing fluoride treatments and regular cleanings have resulted in nearly 80 million people scheduling routine exams more frequently. Public health institutions have also collaborated with insurers to roll out community-based seminars, resulting in over 4 million new policy sign-ups. Greater global connectivity, including cross-border health awareness campaigns and digital platforms, continues to reinforce the push toward adopting comprehensive dental insurance. This convergence of forces underscores the importance of oral health in maintaining a productive, healthy society.

Trend: Growing digital solutions revolutionizing consumer experiences and simplifying claims processes

The rapid integration of digital tools has begun reshaping the dental insurance market, making enrollment and claims filing more convenient for policyholders. In the past year, over 10 million online dental insurance applications were processed globally, demonstrating how digital access is removing traditional barriers such as paperwork and in-person appointments. Many insurers now use cloud-based systems to store, analyze, and expedite claims, creating a swift turnaround time that pleases both consumers and providers. This streamlined approach has saved the industry billions of dollars in administrative costs, encouraging widespread adoption of innovative technologies.

Beyond administrative tasks, digital platforms in the dental insurance market also enable policyholders to schedule appointments instantly, compare treatment costs across various clinics, and access telehealth services. In the last twelve months, over 30 million virtual dental consultations were conducted worldwide, offering an efficient triage option for non-emergency issues. Several leading insurers have introduced apps that provide reminders for routine checkups, with more than 5 million downloads recorded in that category. Additionally, secure patient portals allow real-time access to coverage details, with over 45 million policyholders using such portals to track usage and manage claims. As global internet connectivity improves, these digital solutions are expected to further boost consumer engagement and reshape the insurance experience.

Challenge: Soaring premium costs limiting affordability for low-income groups across many regions

Affordability remains a critical challenge as insurance providers in the dental insurance market grapple with rising treatment costs and overheads. Dental procedures such as full-mouth reconstructions can exceed tens of thousands of dollars, pushing insurers to adjust premiums for long-term sustainability. In 2023, more than 8 million individuals in developing economies discontinued their dental insurance due to financial constraints, revealing how cost pressures displace those who may need coverage the most. Meanwhile, philanthropic healthcare initiatives reported that nearly 12 million underserved people delayed essential oral care last year, citing high insurance costs as a contributing factor.

Insurance regulators in some regions have attempted to cap premium increases, yet these interventions often lag behind market realities. Over 3 million policyholders in the dental insurance market surveyed by consumer advocacy groups reported dissatisfaction with premium hikes, despite acknowledging the value of dental coverage. Government-sponsored subsidies in select nations covered dental treatments worth over 900 million dollars in recent times, highlighting a stopgap solution. However, bridging the affordability gap is far from straightforward, as insurers must remain financially viable while offering competitive benefits. The confluence of rising medical expenses, operational costs, and limited budgets for subsidies continues to shape this significant challenge in the dental insurance market.

Segmental Analysis

By Coverage

Dental Preferred Provider Organizations (PPOs) have gained significant traction by offering policyholders the flexibility to visit both in-network and out-of-network dentists. This model addresses a major consumer need for choice, while also maintaining negotiated rates that help reduce expenses for those who remain within the network. In 2023, dental PPOs have recorded well over 60 million total enrollees in the United States alone, reflecting a steady rise in membership among families and employers. Many PPO plans also come with robust preventive and diagnostic benefits, making it easier for policyholders to keep routine appointments and stay on top of their oral health. Leading industry reports note that there are at least 120,000 dentists nationwide participating in PPO networks, further highlighting the scope of these plans.

Their dominance can be attributed to cost-management features that reward regular dental visits in the dental insurance market, thus encouraging early interventions and lower long-term expenses. Recent studies estimate the market worth of PPO-based dental coverage to exceed $40 billion, as more consumers demand comprehensive care offerings. At present, most PPO plans include at least two fully covered preventive visits per year, improving accessibility for those seeking basic checkups and cleanings. Heightened demand for advanced treatments, such as implants and orthodontics, also fuels PPO popularity because these networks often provide partial coverage for specialized procedures outside normal preventive care. Additionally, a notable study reveals that in 2023, over 2 million small enterprises in the United States offered PPO dental coverage as part of their benefits packages. By balancing coverage choices and reduced out-of-pocket costs, PPO plans maintain a prized position in the dental insurance market.

By Procedure Type

Preventive dental procedures with over 43% market share have taken center stage in modern dental insurance market portfolios, driven by the desire to curtail extensive treatments and manage overall health spending. In 2023, top insurers collectively expand coverage to more than 2 million new preventive claims each month, signaling a shift toward proactive healthcare. The total value of preventive oral services now exceeds $35 billion globally, reinforcing how these simple measures can effectively reduce long-term costs. Cleanings and checkups can detect up to 30 million cavities early each year, preventing more invasive procedures like root canals or crowns. Additionally, over 45,000 dental offices worldwide offer specialized preventive packages aimed at children, adults, and seniors seeking regular examinations, sealants, and fluoride applications.

Over 75 million preventive visits are projected to be covered by insurance providers in the dental insurance market, underscoring the wide acceptance of these services. The cost of a single preventive appointment often hovers around $100, making it an accessible option that helps avert higher expenses in the future. An estimated 4 out of every 5 dental insurance plans now include coverage for sealants, reflecting widespread emphasis on early cavity prevention. More than 5 million children in the United States alone rely on dental insurance for essential fluoride treatments, highlighting the impact on family-focused policies. Early diagnoses from X-rays are believed to save around $2 billion in advanced treatment spending annually, confirming that preventive care remains the most influential segment in the insurance marketplace.

By End Users

Enterprises consistently outpace individual buyers in acquiring dental insurance packages. In fact, enterprises accounts for over 68% market share of the dental insurance market largely due to the economies of scale they embody. Organizations spanning industries from technology to manufacturing frequently negotiate bulk agreements with insurance providers, securing discounted premiums that benefit entire workforces. As a result, over 400 million employees worldwide gain access to essential oral healthcare through corporate-sponsored plans in 2023. The corporate segment invests about $30 billion annually in these group policies, reinforcing its role as the main driver of dental insurance growth. In addition, large corporations often tailor benefits to match employee needs, bundling preventive care, orthodontics, and even cosmetic procedures within a single plan—options that might be cost-prohibitive for individuals seeking standalone coverage.

These group policies not only enhance staff well-being but also strengthen employee retention. Surveys reveal that companies in the dental insurance market offering robust dental coverage tend to attract high-caliber talent, reflecting the importance of comprehensive health benefits in a competitive job market. In 2023, more than 20,000 enterprises adopted new or improved dental insurance provisions, highlighting the growing reliance on these packages as a core workforce strategy. Large organizations can typically enroll up to 3,000 workers under one plan, demonstrating the scale at which group policies operate. The financial clout of enterprise clients often leads to advanced coverage features—like teledentistry visits and extended cleaning benefits—that support employees’ broader oral health needs. Thus, businesses remain pivotal in shaping and purchasing the world’s largest dental insurance portfolios.

By Demographics

Adults have emerged as the primary force in dental insurance market by accounting for the largest 53% market share of covered individuals, surpassing half of all policyholders worldwide. This shift stems partly from an increased awareness of oral health’s connection to systemic wellness issues such as diabetes and heart disease. Consequently, adults perceive dental coverage not merely as a perk but as an essential healthcare component. In 2023, the adult segment is valued at about $121.37 billion in total premiums, reflecting a powerful collective purchasing capacity that drives market expansion. Moreover, studies indicate over 100 million adult enrollees across major global markets, a figure that is on the rise as more companies cater to workforce demands for comprehensive dental benefits.

This dominance of this demographic in the dental insurance market is also attributed to evolving lifestyle factors and increasing dental needs among working professionals. Adults often file an estimated 70 million claims each year for preventive procedures, including routine cleanings and screenings. When cavities, tooth extractions, or more substantial interventions become necessary, insurance coverage ensures that costs remain manageable. In regions where employers bundle dental plans with core medical coverage, the adult uptake further intensifies. Notably, at least 60 million adult policyholders hold dental insurance in the United States alone, many of whom rely on these plans for everything from cosmetic enhancements to long-term periodontal care. By emphasizing routine checkups and proactive interventions, adults continue to propel the dental insurance market forward, underscoring their status as the most influential customer demographic.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America currently holds a prominent position in dental insurance market penetration due to robust employer-based benefits, well-developed healthcare infrastructure, and heightened awareness of oral health. In Canada, over 23 million residents maintain some form of dental coverage, illustrating a strong societal emphasis on preventive late-life care. The United States leads the region, with approximately 180 million individuals enrolled in dental insurance plans as of this year. Meanwhile, Mexico has seen nearly 16 million people sign up for policies, reflecting ongoing improvements in access to coverage and growing disposable income. Across North America, insurers reportedly processed over 200 million dental claims last year, a testament to the scale of the market.

The US stands out as the largest dental insurance market in North America, primarily because of its well-established network of private insurers and employer-sponsored plans. Over 50 major dental insurance companies operate within the country, underwriting claims that surpass 90 billion dollars annually. This scale allows for extensive marketing, diverse product offerings, and integrated provider networks that cater to a wide range of consumer preferences. Currently, the US sees around 2 million new enrollments in dental plans each year, driven by rising awareness of preventive care and the financial protection insurance provides against costly procedures. Many Americans opt for dental insurance to hedge against out-of-pocket expenses, which can reach thousands of dollars for complex treatments.

Annual premium expenditures in the United States are estimated to exceed 30 billion dollars, indicative of a significant financial commitment by individuals, families, and employers. The higher rate of dental insurance adoption in this region arises from historical precedence, longstanding employer-based benefits, and strong consumer trust in private insurance providers. The US also maintains a healthy environment for insurance competition in the dental insurance market, spurring innovation in bundling plans with medical coverage or offering add-ons like teledentistry services. Factors such as relatively high dental care costs, widespread oral health education, and proactive employer policies propel the market, solidifying the country’s dominance in North America’s dental insurance landscape.

Key Dental Insurance Market Companies:

- Aetna Inc.

- Aetna Inc.

- Allianz

- Ameritas

- AXA

- Cigna

- Delta Dental

- HDFC ERGO Health Insurance Ltd. (Apollo Munich)

- MetLife Services and Solutions, LLC

- United HealthCare Services, Inc

- OneExchange

- Envivas

- United Concordia

- Other Prominent Players

Market Segmentation Overview:

By Coverage

- Dental Health Maintenance Organizations (DHMO)

- Dental Preferred Provider Organizations (DPPO)

- Dental Indemnity Plans

- Others

By Procedure

- Preventive

- Major

- Basic

By Demographics

- Senior Citizens

- Minor

- Adults

By End-users

- Individual

- Enterprises

- Small Enterprises

- Medium Enterprises

- Large Enterprises

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The UK

- Germany

- France

- Scandinavia

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 235.8 Bn |

| Expected Revenue in 2033 | US$ 471.3 Bn |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Bn) |

| CAGR | 8.0% |

| Segments covered | By Coverage, By Procedure, By Demographics, By Region |

| Key Companies | Aetna Inc., Aetna Inc., Allianz, Ameritas, AXA, Cigna, Delta Dental, HDFC ERGO Health Insurance Ltd. (Apollo Munich), MetLife Services and Solutions, LLC, United HealthCare Services, Inc, OneExchange, Envivas, United Concordia, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)