Data Center Cooling Market: By Component (Solution, Services); Data Centre Type (Tier 1, Tier 2, Tier 3, Tier 4); Type of Cooling (Room-based Cooling, Row/Rack-based Cooling); Industry (BFSI, IT & Telecom, Research & Academic, Government & Defense, Retails, Energy, Manufacturing, Healthcare, Others); Region— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 25-Dec-2024 | | Report ID: AA0423412

Market Scenario

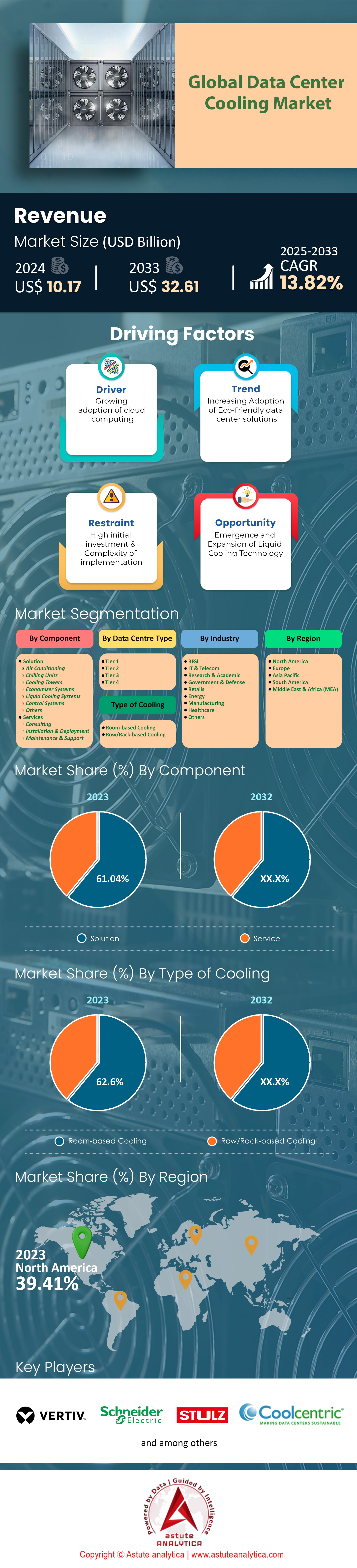

Data center cooling market was valued at US$ 10.17 billion in 2024 and is projected to attain a valuation of US$ 32.61 billion by 2033 at a CAGR of 13.82% from 2025-2033.

The expansion of global data center space has grown greatly in 2023 and now stands at almost 700 million square feet, which includes both conventional and hyperscale facilities. Data on energy use indicates that these facilities have surpassed more than 300 terawatts, with cooling being a key factor. Moreover, analysts from the industry claim that the global expenditure on data center cooling reached around US$ 40 billion as of 2023. Some providers report that new liquid cooling technologies have started to cut the cooling cost of a rack by $10,000. At the same time, a large colocation center is able to spent over US$ 40 million in a year on cooling. The average on PUE is around 1.55 for new builds which aim to achieve better power usage.

The rise of artificial intelligence workloads overcomes traditional gross cooling capabilities in the data center cooling market, resulting in the emergence of advanced approaches like water immersion and free air direct-to-chip liquid cooling. In some next-generation hyperscale facilities, there are more than 6 megawatts of heat reuse mechanisms incorporated to funnel recovered heat into district heating networks. High-density facilities that host artificial intelligence workloads tend to use water cooled systems else it can’t handle the thermal load surpassing 40 kw per rack. Several countries are implementing pilot projects with refrigerant-based approaches that cater edge data centers, cutting across 2 gigawatts of thermal capacity. Continuous advancements in temperature and humidity control can be observed with the incorporation of AI in data centers management.

Higher requirements for cooling solutions in the data center cooling market are attributed to a number of factors. The increased consumption of cloud services, rising AI-based workload, and progression of digital transition projects are the factors which are driving the upgrade and expansion of data center resources. Availability of technologies that are more energy efficient and enhanced government programs for green infrastructure are also increasing the adoption. There is great focus on operators’ sustainability for operational cost reduction and regulatory demands prompting innovations such as chilled water loops and evaporative cooling. The shift of workloads to off-site locations by companies increases the demand for colocation and cloud facilities creating the data center cooling market as an attractive target for investment, research, and design innovation.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing server densities demand more robust and efficient cooling infrastructures

The control of temperature is becoming the top priority in almost all data centers around the world. It is because the latest Artificial Intelligence and High-Performance Computing (HPC) servers being deployed have very high cooling capacity requirements. Ranging from 25kW and up to 50 kW per rack, many data centers are pushing the limits of cooling systems. This sudden increase in heat output explains the worldwide data center cooling market growth of US$ 10.18 billion in 2024. Many industry perspectives estimate that the impending immersion-based deployments would reach rack densities of over 100 kW by 2024. Immersion systems also upend AI’s great need for higher rack densities. Such growth pressure is further mirrored by the surge in IT construction, with more than 80 hyperscale data centers sites under active consideration internationally. Simultaneously, a shift toward installing sensors in more than 200 major data centers has been accelerated, as operators anticipate greater challenges in managing temperature, humidity, and airflow in data centers housing critical equipment.

It's necessary to implement inventive strategies that enhance the to the appropriate frameworks for how large the future growth will be for providing thermal management for high-density data centers cooling market. Liquid immersion for example requires sufficient heat removal strategies to be able to cater for the greatest server densities. This means that by ultra-dense data center environments the data center cooling market can exceed US$46.6 Billion by 2032. The second most direct approach to thermally manage liquid immersion cooled systems involves direct-to-chip cooling which has already been used in a range of initial projects and is proving effective on a similar basis Moreover, with the demand for HPC appliances going up there has been a greater volume in the need for bespoke, high-end cooling installations from data center suppliers with the average exceeding US$2 million for HPC facilities alone. Subsequently, the thermal install overhaul for density oriented cooling systems marks the new shape of data centers alongside optimal thermal management to the entire operational standard.

Trend: Implementation of liquid immersion techniques to enhance cooling performance substantially

The immersion cooling technique has proven to be an important technology for data center cooling market in the modern era. Users started reporting that submerging whole servers or components into specially designed dielectric fluids is far more efficient in eliminating hotspots than using air cooling methods. In 2023, the total value of the larger segment that includes liquid cooling in the form of direct-to-chip and immersion methods is roughly US$3.80 billion. Some industry blueprints show that the next generation of immersion solutions will support CPUs on the roadmap for more than 1000 W per chip which would be significant for the year 2024. This enhanced capability provides an opportunity for data centers to carry out AI tasks with very large heat signatures, especially those that are associated with deep learning tasks. There is also a healthy interest in immersion cooling within the cryptocurrency mining and blockchain server sectors, where a number of operators have spent over US$10 Million on immersion technology upgrades.

In addition to improvements in operations, the systems also offer many operational benefits, including reducing maintenance requirements and offering the option of heat recycling. According to recent market research, cumulative investment in liquid immersion deployments in the data center cooling market may exceed US$11 billion by 2033, which shows a large interest on the part of hyperscale and colocation providers. In Asia and North America, the capacities of data center operators claim that immersion technologies can eliminate tens of kilowatts of heat per rack that is essential for dense HPC clusters. In the technology of hyper con-concentration that encourages growth, immersion cooling is considered as an important component because helps to cut down on mechanical element. China’s data centers with chilling units costs up to $1 million a year to operate, and many facilities have begun using immersion cooling, meaning they don't need the large units.

Challenge: Balancing power density and estate limitations complicates thermal management strategies

Urban expansion results in a reduced area for data centers, hence giving rise to the issue of data center operators being faced with the demand of squishing more computing power into a smaller space. However, it is putting more stress on the data center cooling market. This concern is particularly highlighted in larger-scale cities such as those in the United States as they can charge up to $1000 per square foot for mortgage. The higher density in racks leads to excessive heat emission that common thermal management strategies such as HVAC systems tend to struggle with. Recent surveys indicate that in 2024, at least 40 major metropolitan facilities plan expansions where floor space is constrained, forcing them to deploy novel cooling topologies. There are big facilities located in Tokyo and Singapore where they are testing out compact thermal modules which are able to exceed heating requirements of up to 30 times kW per rack. Some Data Center operators and businesses do intend to limit the real estate availability constraints by splitting the load in different places but due to having tight spaces, they would still require strong cooling options.

The connection between density and space poses engineering challenges that could substantially increase the total ownership costs. Experts advocate that roughly 75 data centers around the world are currently redesigning their layouts to improve airflow pathways while keeping the facility footprint the same. A few of these projects in the data center cooling market have spent around US$2–3 Million on custom piping for new advanced liquid cooling systems. Co-located urban centers, particularly those that provide cloud services, tend to waste a lot of time and effort trying to find ways to balance vertical rack height and horizontal airflow. There are other approaches to solving these spatial issues such as direct liquid cooling or immersion-based setups that are now being more widely used because they provide more effective solutions for tighter spaces that need to handle higher heat densities. All in all, the struggle to achieve estate limitations with high power density outlines the necessity for better thermal management designs that account for building architecture, cooling systems and predictive analysis to ensure that operational stability is maintained.

Segmental Analysis

By Component

As per components, the solutions segment shall remain the dominant shareholder in the data center cooling market with over 61% revenue share. On this note, various cooling solutions such as air conditioning units, chilling systems, liquid cooling solutions, cooling towers, economizers, and control systems remain key components in the thermal management of data centers. These cater for a wide range of cooling requirements from server rooms to hyperscale and edge facilities. These components make up for over 61% of the total cost of data center cooling since each solution offers a unique thermoregulation solution to different sets of workload demands. The market for cooling systems used in data centers is reflective of the large scale maintenance systems required to deal with high heat loads of current environments. The sector has spent US$3.80 Billion on liquid cooling offerings in 2023 mostly due to high AI and HPC penetration. Several hyperscale centers have begun to deploy massive US$3.80 Billion worth chillers and control systems to meet new benchmarks for rack densities. Chillers in economizer systems allow center operators located in warm areas such as parts of Latin America and Asia to install these systems for over US$5 Million.

Electronics and control systems are tightly interlinked and control systems help to connect these disparate devices up, frequently employing advanced applications to regulate campus-wide airflow, temperatures and humidity. Larger data center facilities have reported areas of over 30,000 sq. ft of mechanical cooling having been already installed. And so, even a simple glance at the data center cooling market studies shows an impressive amount of money that has been dedicated to these systems. It follows that advanced chilling units could be worth over a million dollars each at locations that have a hyper scale design. Cooling towers, by contrast, are used as heat rejection devices for water cooled systems that drive up powerful shafts. But still a/c systems are the preferred option on small settings, where certain operators acquire systems for more than 50 new edge data centers every year.

By Data Center Type

Based on type of data center, Tier 2 accounts for 36.5% controlling share of data center cooling market due to the amalgamation of increasing server densities and the growing need for dependable digital infrastructure. In 2023, there were more than 4,700 tier two data center, providing a total of approximately 260 million square feet of operational floor space. These locations also have advanced airflow management systems to mitigate the high restriction on shocks and thermal for some expansions with single project delivering additional 15 megawatts of power. Additionally, otherwise normal operators invest almost twelve billion dollars yearly on equipment such as chilled-water loops and modular air handlers which reduce heat-induced downtime on critical servers to a reasonable amount. The average density of racks in select areas have reached 9kw per rack, indicating increase in the planning of larger data loads in the mid-level.

A significant driver behind the dominance of tier 2 data center cooling demand is the specific role of tier 2 offerings in the data center cooling ecosystem. These facilities typically cater to a wide range of customers – from government institutions to cloud businesses – and thus need horizontal and vertical solutions for maximum uptime. In addition, self-adaptive solutions that meet pace region requirements encourage more energy efficient designs, which in turn, have led to the adoption of adiabatic cooling cabinets and advanced real-time temperature monitoring systems in data centers. The mid-range work load specific cooling systems features along with reasonably priced redundancy approaches have turned tier 2 sites into places where organizations whose performance requirements have become increasingly more stringent are willing to spend money. In many instances, tier 2 developers are working with manufacturers that specialize in HVAC equipment that design improvements to chillers and heat exchangers so that the new halls better PUE. With increasing data storage needs, and increasingly demanding computing tasks, tier 2 data centers are able to maintain their market dominance in the global data center cooling market as they continue improving and diversifying thermal management strategies to address the varying needs of customers.

By Industry

The expansion of the global data center cooling market is highly impacted by the IT and telecom sector, which drives the demand for innovative cooling solutions. The share held by this industry was close to around 24.9% in 2024. These operators together own approximately 450 million square feet of data centers which range from basic enterprise concepts to the advanced work functions of the network. Numerous telecoms and technological corporations have large facilities that exceed 5 million square feet and frequently require over 30 megawatts of electricity for energy deployment of 5G alongside cloud supporting services. Because of this sharp growth, there is a consistent growth in the thermal management field. In one of the major campuses, it is right to say that more than US$ 25 million spent on advanced cooling system upgrades in 2023.

The industry's constant pursuit for reliable global connectivity aided by massive computational capacity is the primary reason for the increase in demand for data center cooling market. The supply of regionally deployed hyperscale cloud services, mobile data consumption, and streaming platforms have allowed for the deployment of advanced hardware within restrictive regulations. This momentum propels operators to adopt next-generation cooling strategies such as direct-to-chip liquid cooling or industrial-scale chilled water systems, all while meeting sustainability goals in diverse climates. Ultimately, the IT and telecom sector’s unwavering expansion underscores its crucial role in shaping not only digital infrastructure but also the trajectory of how data centers manage heat dissipation, driving innovation and investment in cooling technologies across every continent.

By Cooling Type

With a market share of more than 62.6%, the room-based cooling solutions have a dominant share in the data center cooling market ecosystem. Center operators make use of these solutions to achieve optimal thermal conditions while also ensuring management of the conditions. As per the latest evaluations of the market, there are over 3,000 dedicated projects for data center cooling where computer room air conditioning systems have been implemented. This is done to ensure there is stability in temperature and humidity required for optimum performance of server infrastructure. According to many extensive operators, units can cost around US$ 18,000 each depending on various features that are customized to fit the need like onboard sensors and variable speed controllers.

One of the major benefits of room-based cooling systems is their ability to cater to changing requirements of IT. Some manufacturers in the data center cooling market have recorded power usage effectiveness averages of approximately 1.60 for their more recent facilities, thus making this trend in the market an ideal option to pursue for data centers in search of lower cost and highly dependable services. One global operators during the last fiscal period was able to prevent roughly 800 incidences of heat related system downtimes simply by replacing the old room coolers with modern room cooler systems. Such deployments are frequently compatible with existing control systems, allowing them to measure environmental factors in real time and make dynamic changes when the rack temperature becomes too high. Facility operators are able to manage critical air conditioning problems, which would necessitate expensive renovations in older sites by ensuring cold air is distributed properly around the computer racks. As the data center industry continues to demand for higher and higher computing loads, there’s little doubt that room-based cooling technologies will continue seeing the kind of improvements necessary to ensure they remain a core cooling technology in not only established construction but newer ones too.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America remains the largest host in the data center cooling market with most recent market share is pegged at 39.41%. This can be attributed to the well developed technology and communications infrastructure as well as the presence of numerous technological firms in this region. United States is the largest single market owing to the given capacity of hyperscale and co-location data center providers that are expanding across areas like Virginia, Texas and California. In 2023, the data centers situated in North America are expected to use up to 7.4 gigawatts, almost a 2.5 gigawatt increase from 2022, many of which are used to cool the systems. These figures are quite large in comparison to those of CoreSite as they only own 28 data centers with a combined 253.1 megawatts of electrical capacity and 38,134 cross-connects. However, they still do get around 3.6 million net rentable sqft of space. Looking at the data from a different angle, the North American homes electricity that these structures consume could serve around 6,482,400 houses.

Numerous elements determine and preserve this dominance. Great capital reserves, vibrant M&A landscape, and well-functioning legal practices promote dominance in innovation in the United States and the Canadian markets. The North America data center cooling markets have a history of investing in and constructing new facilities, with low-cost and dependable energy, attracting even more business. This is especially true in areas like Texas, where per kilowatt hour cost is less than USD 0.05. Investing in lower cooling costs in regions with colder temperatures increases the cost-effectiveness of such investments. Vertiv, Stulz GmbH, Schneider Electric and Rittal are notable names who have developed cooling systems that can operate in higher density racks and are currently being used in green data centers. The US has a huge expansive land area and advanced fiber networks and this makes it the greatest contributor to the North American capacity. Those advancements, as well as the rising demand for cloud-based services, AI workloads, and edge computing, suggest that the region’s rich research environment and continuing advancements in cooling technology will help it remain a leader in the global data center cooling market in the years to come.

Top Players in Data Center Cooling Market

- Asetek Inc.

- Coolcentric

- Daikin Industries Ltd

- Green Revolution Cooling

- Iceotope

- Johnson Controls International PLC

- Liquid Cool Solutions Inc.

- LiquidStack

- Mitsubishi Electric Corporation

- Munters Group AB.

- Nortek Air Solutions

- Parker Hannifin

- Rittal GmbH & Co. KG

- Schneider Electric SE

- SPX Cooling Technologies, Inc

- STULZ GMBH

- Telx Holdings, Inc. (Digital Realty Trust, Inc.)

- Vertiv Co.

- Other Prominent Players

Market Segmentation Overview

By Component

- Solution

- Air Conditioning

- Chilling Units

- Cooling Towers

- Economizer Systems

- Liquid Cooling Systems

- Control Systems

- Others

- Services

- Consulting

- Installation & Deployment

- Maintenance & Support

By Data Centre Type

- Tier 1

- Tier 2

- Tier 3

- Tier 4

By Type of Cooling

- Room-based Cooling

- Row/Rack-based Cooling

By Industry

- BFSI

- IT & Telecom

- Research & Academic

- Government & Defense

- Retails

- Energy

- Manufacturing

- Healthcare

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The U.K.

- Germany

- France

- Italy

- Russia

- Spain

- Poland

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Taiwan

- South Korea

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- South America

- Argentina

- Brazil

- Rest of South America

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)