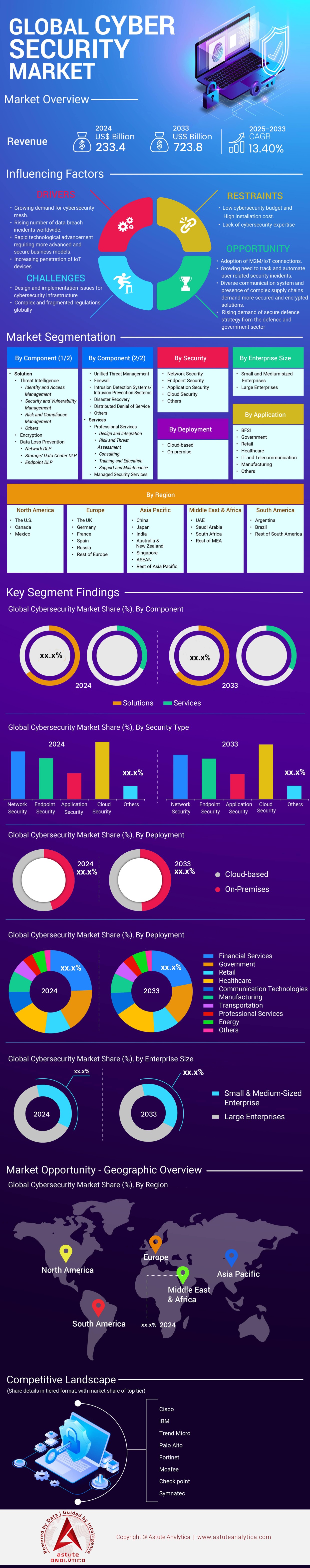

Cybersecurity Market: By Component (Solution and Services); Security (Network Security, Endpoint Security, Application Security, Cloud Security and Others); Development (Cloud-Based and On Premise); Enterprise Size (Small and Medium-Sized Enterprises and Large Enterprises); and Application (BFSI, Government, Retail, Healthcare, IT and Telecommunication, Manufacturing and Others) ; Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 28-Jun-2025 | | Report ID: AA1120007

Market Snapshot

Cybersecurity market was valued at US$ 233.4 billion in 2024 and is projected to reach US$ 723.8 billion by 2033 at a CAGR of 13.40% from 2025-2033.

The cybersecurity market is marked by a surge in both technological innovation and threat sophistication, driving organizations to adopt a diverse array of security solutions and deployment models. On-premise deployments remain vital for sectors with stringent compliance needs, with 2,400 organizations in finance and healthcare, 1,800 in retail and logistics, and 1,200 in government and defense maintaining on-premise security infrastructures. Manufacturing (900 organizations), energy and utilities (700), and education (500) also show strong on-premise adoption, while 400 healthcare and 300 financial organizations specifically use on-premise solutions for regulatory and data privacy requirements. Simultaneously, cloud and hybrid deployments are accelerating, with 4,200 organizations globally adopting managed SD-WAN for cloud security, 2,800 deploying Cloud Access Security Broker (CASB) solutions, 1,900 implementing Cloud Workload Protection Platforms (CWPPs), and 1,300 adopting Cloud Security Posture Management (CSPM) tools. The financial services sector leads in hybrid cloud security adoption, with 1,000 institutions deploying such solutions to balance flexibility and compliance.

Security Types and Solution Adoption Reflect Evolving Threats and Layered Defenses

Security types and solution adoption reflect the evolving threat landscape and the need for layered defenses in the cybersecurity market. In 2024, 1,500 organizations globally implemented zero trust architectures, while 2,000 adopted AI-driven anomaly detection to enhance threat response. Quantum-resistant security is gaining traction, with 1,200 organizations adopting quantum-resistant algorithms and 700 financial institutions implementing quantum-resistant encryption. Behavioral analytics for insider threat detection was adopted by 700 organizations, and 800 organizations deployed 5G and edge security solutions. Ransomware remains a critical concern, with 1,200 organizations reporting attacks, 900 experiencing supply chain attacks, and 1,000 deploying offline backup solutions for resilience. The financial sector, in particular, reported 1,200 ransomware incidents and 900 supply chain attacks, prompting 1,100 institutions to deploy AI-powered threat detection and 800 to implement behavioral analytics.

To Get more Insights, Request A Free Sample

Market Developments

Investment and Funding: Capital Flows and Startup Activity

The cybersecurity market attracted substantial investment in 2024, with startups raising a total of $9.5 billion across 304 funding rounds. The top 10 funding rounds alone accounted for $4.3 billion, with the largest single round reaching $800 million. Early-stage funding was particularly active, with 179 rounds, while late-stage rounds numbered 125 and accounted for $5.13 billion—54% of all dollars raised. The average deal size for late-stage rounds was $68 million, reflecting investor confidence in scaling cybersecurity ventures.

Sector-specific funding was robust: data security startups raised $1.2 billion, identity management startups $950 million, AI-focused cybersecurity startups $1.5 billion, detection and response startups $1.1 billion, and vulnerability management startups $800 million. AI and automation were key investment themes, with 6 M&A deals in 2024 driven by these technologies.

Private equity firms played a significant role in the cybersecurity market, participating in 22 cybersecurity deals. Regional activity was strong, with North America accounting for 48 M&A deals, Europe 19, and Asia-Pacific 12. Cross-border activity included 7 deals, while 4 deals specifically targeted cloud security companies, 3 focused on zero-trust architecture startups, and 2 involved quantum-resistant cybersecurity firms. The acquisition of European and U.S. cybersecurity unicorns was notable, with 5 and 3 such companies acquired, respectively, alongside 2 in Asia-Pacific and 1 in Latin America.

Mergers, Acquisitions, and Strategic Developments: Market Consolidation in 2024

Mergers and acquisitions (M&A) have reshaped the cybersecurity market landscape in 2024, with 79 M&A events recorded—down slightly from 91 in 2023. The total value of the top 10 global cybersecurity M&A deals reached $71.49 billion, with 5 of these deals exceeding $1 billion each. Notable transactions included Cisco’s $28 billion acquisition of Splunk, Thoma Bravo’s $5.3 billion purchase of Darktrace, Mastercard’s $2.65 billion acquisition of Recorded Future, CyberArk’s $1.54 billion acquisition of Venafi, and Alphabet’s $32 billion acquisition of Wiz in 2025.

Private equity firms led 8 major deals, reflecting their growing influence in the sector. Cloud security was a key focus, with 4 deals targeting cloud security companies, while zero-trust and quantum-resistant firms were also acquisition targets. The acquisition of 5 European, 3 U.S., and 2 Asia-Pacific cybersecurity unicorns, as well as 1 Latin American company, underscores the global nature of cybersecurity market consolidation.

These strategic developments are driven by the need for scale, technology integration, and access to new markets. AI and automation were central to 6 deals, while cross-border activity (7 deals) highlights the internationalization of cybersecurity innovation. The M&A landscape in 2024 reflects a maturing market where leading players seek to expand capabilities, address emerging threats, and capture new growth opportunities.

Market Dynamics

Hot Areas and Emerging Trends: AI, Quantum, and Ransomware Defense

The cybersecurity market in 2024 is defined by several hot areas and emerging trends:

- AI-driven anomaly detection was adopted by 2,000 organizations globally, while 1,500 implemented zero trust architectures and 1,200 adopted quantum-resistant algorithms. Offline backup solutions for ransomware resilience were deployed by 1,000 organizations, and 900 implemented segmented networks for ransomware defense.

- 5G and edge security solutions were adopted by 800 organizations, reflecting the growing importance of securing distributed and latency-sensitive environments. Behavioral analytics for insider threat detection was implemented by 700 organizations, while 600 adopted supply chain security solutions. Managed SD-WAN for secure cloud access was deployed by 500 organizations, and AI-powered phishing detection tools by 400.

- IoT security solutions were implemented by 300 organizations, quantum-resistant encryption by 200, and new firmware update management for edge devices by 100. Ransomware remains a pervasive threat in the cybersecurity market, with 1,200 organizations reporting attacks, 900 experiencing supply chain attacks, 800 facing phishing and social engineering incidents, and 700 reporting insider threat incidents. IoT-related security incidents were reported by 600 organizations, 5G and edge security incidents by 500, quantum computing-related concerns by 400, and AI-driven malware incidents by 300.

- Ransomware recovery costs exceeded $2.73 million for 200 organizations, while 100 reported successful defense against BlackByte ransomware. These trends underscore the dynamic and evolving threat landscape, as well as the industry’s commitment to proactive, multi-layered defense strategies.

Segmental Analysis

By Security Type

Cloud security has emerged as a dominant security type in the cybersecurity market with over 31% market share, reflecting the ongoing migration of critical workloads to cloud environments. In 2024, the U.S. cloud security market alone was valued at $10.0 billion, with projections to reach $31.2 billion by 2033. The financial services sector led cloud security spending with $6.8 billion, followed by IT & Telecom at $5.7 billion and healthcare at $4.1 billion. The hybrid cloud segment is expected to add $8.9 billion in new revenue by 2030, highlighting the increasing adoption of multi-cloud and hybrid strategies.

Zero trust architecture has become a foundational security paradigm, with 1,500 financial institutions and 1,500 organizations globally implementing zero trust frameworks in 2024. This approach is designed to address the limitations of perimeter-based security in a world of distributed users and assets. AI-driven anomaly detection is another hot area, with 2,000 organizations globally adopting such solutions to enhance threat detection and response.

Quantum-resistant security is gaining traction in the cybersecurity market as organizations prepare for the advent of quantum computing. In 2024, 1,200 organizations adopted quantum-resistant algorithms, and 700 financial institutions implemented quantum-resistant encryption. These developments reflect a proactive approach to future-proofing security architectures against emerging threats.

Other notable security types include behavioral analytics for insider threat detection (adopted by 700 organizations), supply chain security solutions (600 organizations), and 5G and edge security solutions (800 organizations). The breadth of security types being adopted demonstrates the industry’s commitment to layered, adaptive defense strategies.

By Component

Based on component, the cybersecurity market led by solutions with over 70% market revenue share. Solution adoption is robust across various technologies. Managed SD-WAN for cloud security was adopted by 4,200 organizations, CASB solutions by 2,800, CWPPs by 1,900, and CSPM tools by 1,300 organizations. In the financial sector, 1,100 institutions deployed AI-powered threat detection, 800 implemented behavioral analytics, and 700 adopted quantum-resistant encryption. Offline backup solutions for ransomware resilience were deployed by 1,000 organizations, while 900 implemented segmented networks for ransomware defense. These adoption figures highlight the market’s focus on comprehensive, multi-layered security solutions.

The dominance in the cybersecurity market is characterized by a mix of established leaders and innovative newcomers. Palo Alto Networks stands out with a market capitalization of $107 billion and FY 2024 revenue of $8.1 billion, including $4 billion in Next-Generation Security (NGS) annual recurring revenue. CrowdStrike follows with a $68 billion market cap and $3.8 billion in annual recurring revenue, while Fortinet, Zscaler, Checkpoint, Okta, and CyberArk round out the list of dominant vendors, with market capitalizations of $58 billion, $25 billion, $21 billion, $12 billion, and $11 billion, respectively.

The top 20 cybersecurity vendors collectively accounted for $159.65 billion in spending in 2024, with no single vendor exceeding $24.56 billion in market share, indicating a competitive and fragmented market. Major vendors have prioritized AI initiatives (5 vendors), expanded cloud security offerings (4 vendors), launched next-generation Security Information and Event Management (SIEM) platforms (3 vendors), and introduced new Secure Access Service Edge (SASE) solutions (2 vendors). Notably, one major vendor launched the Cortex XSIAM platform, reflecting the trend toward integrated, AI-driven security operations.

By Application

The financial services industry (BFSI) with over 24% market share remains the most significant application area for cybersecurity market, given its high-value assets and regulatory scrutiny. In 2024, the BFSI sector contributed $74 billion to the market, with end-user spending on security reaching $29.5 billion. Banks alone increased cybersecurity spending by $7.2 billion over the past two years, reflecting the sector’s commitment to safeguarding sensitive data and maintaining trust.

Despite these investments, only 31% of financial organizations (620 out of 2,000 surveyed) expressed confidence in their cybersecurity capabilities in 2024. The sector’s prevention effectiveness score was 68 out of 100, with a log score of 50 and an alert score of just 6, indicating ongoing challenges in detection and response. Ransomware remains a significant threat, with 1,200 financial institutions reporting attacks and 900 experiencing supply chain attacks. BlackByte ransomware, in particular, had a prevention rate of only 17 out of 100 in the BFSI sector.

To counter these threats in the cybersecurity market, 1,500 financial institutions adopted zero trust architectures, 1,100 deployed AI-powered threat detection, and 800 implemented behavioral analytics for insider threat detection. Quantum-resistant encryption was adopted by 700 institutions, while 600 deployed managed SD-WAN for secure cloud access. Offline backup solutions for ransomware resilience were implemented by 500 institutions, and 400 adopted segmented network architectures. The sector also saw 300 institutions deploy IoT security solutions, 200 implement supply chain security, and 100 adopt 5G and edge security solutions.

By Deployment

Deployment models in cybersecurity market have diversified significantly, with organizations balancing the need for agility, compliance, and control. In 2024, on-premise deployments remain critical for sectors with stringent regulatory and data privacy requirements. In fact, the on-premise deployment held over 51% market share. Specifically, 2,400 organizations in finance and healthcare maintained on-premise deployments, while 1,800 organizations in retail and logistics leveraged on-premises edge computing to support distributed operations. Government and defense sectors also showed a strong preference for on-premise security, with 1,200 organizations maintaining such solutions, and 900 manufacturing firms relying on on-premise security for operational technology environments.

The energy and utilities sector accounted for 700 organizations maintaining on-premise deployments, while 500 educational institutions continued to prioritize on-premise security for compliance and data protection. In healthcare, 400 organizations used on-premise solutions to meet regulatory requirements, and 300 financial organizations deployed on-premise security specifically for data privacy. Logistics and retail sectors also contributed, with 200 and 100 organizations, respectively, using on-premise edge computing and distributed security solutions.

Cloud and hybrid deployments have surged to a great extent in the cybersecurity market, driven by the need for scalability and remote access. The global cloud security market reached $35.84 billion in 2024, with private cloud security generating $17.2 billion, public cloud $12.1 billion, and hybrid cloud $6.5 billion in revenue. Hybrid cloud security adoption is particularly notable, with 1,000 organizations in the BFSI sector deploying such solutions, reflecting the sector’s need for both flexibility and compliance. Managed SD-WAN for cloud security was adopted by 4,200 organizations globally, while 2,800 organizations deployed Cloud Access Security Broker (CASB) solutions, 1,900 implemented Cloud Workload Protection Platforms (CWPPs), and 1,300 adopted Cloud Security Posture Management (CSPM) tools. These figures underscore the growing complexity and diversity of deployment strategies in the cybersecurity market.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America’s Cybersecurity Dominance Driven by Investment, Talent, and Innovation

North America, and particularly the United States, has solidified its position as the global powerhouse in cybersecurity market through a combination of robust investment, strategic mergers and acquisitions, and a relentless focus on innovation. In 2024, North American cybersecurity startups attracted $9.5 billion in venture capital across 304 funding rounds, with the top 10 rounds totaling $4.3 billion and the largest single round reaching $800 million. The region saw 79 mergers and acquisitions, including IBM’s $6.4 billion acquisition of HashiCorp, and private equity firms participated in 22 cybersecurity deals, highlighting the sector’s appeal to institutional investors. The US is home to industry giants like Palo Alto Networks, which reported $8.1 billion in FY 2024 revenue and $4 billion in annual recurring revenue from next-generation security, and Fortinet, which is growing at a rate of 14.6% annually. Cisco, another US leader, expanded its cybersecurity offerings through strategic acquisitions, particularly in cloud and zero-trust solutions.

United States: Strategic Leadership and Sectoral Adoption Propel Cybersecurity Growth

The United States stands at the forefront of the cybersecurity market, driving global trends through its strategic leadership, sectoral adoption, and regulatory advancements. In 2024, the US cybersecurity ecosystem was marked by significant funding activity, with startups securing billions in venture capital and private equity firms participating in 22 major deals. The US also led in high-value mergers and acquisitions, including IBM’s $6.4 billion acquisition of HashiCorp and Cisco’s expansion into advanced cloud and zero-trust solutions. Industry leaders like Palo Alto Networks and Fortinet continue to set benchmarks, with Palo Alto Networks achieving $8.1 billion in annual revenue and $4 billion in recurring revenue from next-generation security offerings.

Despite this growth, the US faces a critical talent shortage, with nearly 314,000 unfilled cybersecurity positions and 82% of employers citing a lack of skilled professionals. This gap has tangible impacts on the cybersecurity market, as 71% of organizations report measurable damage due to insufficient cybersecurity expertise. The US government has responded with updated regulations, such as the Cybersecurity Maturity Model Certification (CMMC) for federal contractors, and has increased investment in securing federal infrastructure. Sectoral adoption is strong: the financial sector has ramped up integrated security under FFIEC IT and SOC2, healthcare organizations are investing in HIPAA compliance, the energy sector is enhancing NERC CIP compliance, and the retail sector is focused on PCI DSS standards. US companies are also pioneering AI-powered security platforms, reinforcing the nation’s leadership in innovation and threat detection. These factors collectively ensure the US remains the key contributor to North America’s cybersecurity dominance.

Asia Pacific: Fastest-Growing Region Fueled by Adoption and Regulatory Change

Asia Pacific has emerged as the fastest-growing region in the global cybersecurity market, driven by rapid technology adoption, regulatory evolution, and a surge in both threats and solution deployments. The region is projected to reach $74.22 billion in cybersecurity activity by 2025 and $141.04 billion by 2030, with a compound annual growth rate of 13.7%. In 2024, the hardware segment led the market, accounting for over 55% of regional revenue, while the services segment saw a surge in demand for managed security services and consulting. Asia Pacific enterprises experienced the highest number of ransomware attacks globally in 2023, with 59.6% of organizations targeted, underscoring the urgent need for advanced security solutions.

Regulatory developments have been pivotal, with China’s State Council approving the Network Data Security Management Regulation in August 2024, setting new legal requirements for companies handling important data. The BFSI sector in the cybersecurity market accelerated adoption of blockchain and AI-powered cybersecurity solutions, while countries like China, Japan, and India led regional adoption of advanced technologies, spurred by government initiatives. The market remains highly fragmented, fostering innovation as no single vendor holds a dominant share. Cloud-based security deployments have rapidly increased, especially in financial and telecom sectors, and the adoption of emerging technologies—AI, machine learning, IoT, 5G, and edge computing—has enabled new cybersecurity solutions and business models. These trends position Asia Pacific as a dynamic, innovation-driven region, rapidly closing the gap with North America and shaping the future of global cybersecurity.

Top Companies in the Cybersecurity Market:

- MacAfee

- Trend Micro Incorporated

- IBM Corporation

- Microsoft

- BAE Systems, Inc.

- Check Point Software Technology Ltd.

- F5 Networks

- EMC Corporation

- FireEye, Inc.

- Proofpoint Inc.

- Sophos PLC

- Fortinet, Inc.

- Cisco Systems Inc.

- Symantec Corporation

- Juniper Networks

- Palo Alto Networks, Inc.

- Qualys Inc.

- Other Prominent Players

Market Segmentation Overview:

By Component

- Solutions

- Threat Intelligence

- Identity and Access Management

- Security and Vulnerability Management

- Risk and Compliance Management

- Others

- Encryption

- Data Loss Prevention

- Network DLP

- Storage/ Data Center DLP

- Endpoint DLP

- Unified Threat Management

- Firewall

- Intrusion Detection Systems/Intrusion Prevention Systems

- Disaster Recovery

- Distributed Denial of Service

- Others

- Threat Intelligence

- Services

- Professional Services

- Design and Integration

- Risk and Threat Assessment

- Consulting

- Training and Education

- Support and Maintenance

- Professional Services

- Managed Security Services

By Security

- Network Security

- Endpoint Security

- Application Security

- Cloud Security

- Others

By Deployment

- Cloud-based

- On-premises

By Application

- Financial Services

- Government

- Retail

- Healthcare

- Communication Technologies

- Manufacturing

- Transportation

- Professional Services

- Energy

- Others

By Enterprise Size

- Small and Medium-sized Enterprises

- Large Enterprises

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The UK

- Germany

- France

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- Singapore

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 233.4 Bn |

| Expected Revenue in 2033 | US$ 723.8 Bn |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Bn) |

| CAGR | 13.40% |

| Segments covered | By Component, By Security, Deployment, By Application, By Enterprise Size, By Region. |

| Key Companies | MacAfee, Trend Micro Incorporated, IBM Corporation, Microsoft, BAE Systems, Inc., Check Point Software Technology Ltd., F5 Networks, EMC Corporation, FireEye, Inc., Proofpoint Inc., Sophos PLC, Fortinet, Inc., Cisco Systems Inc., Symantec Corporation, Juniper Networks, Palo Alto Networks, Inc., Qualys Inc., Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)