Cyber Warfare Market: Component (Solution and Services); Cyber Warfare Type (Cyber Attacks, Espionage, Sabotage, Others); Application (Defense, Government Agencies, Aerospace, Homeland Security, Enterprise, Others); Region–Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: Mar-2025 | Format:

![pdf]()

![powerpoint]()

![excel]() | Report ID: AA03251246 | Delivery: Immediate Access

| Report ID: AA03251246 | Delivery: Immediate Access

Market Scenario

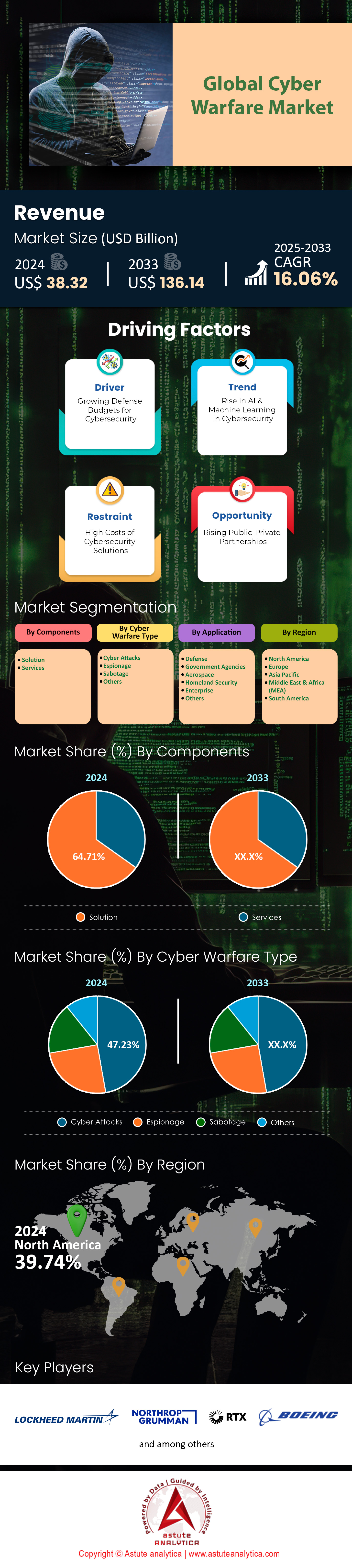

Cyber warfare market was valued at US$ 38.32 billion in 2024 and is projected to hit the market valuation of US$ 136.14 billion by 2033 at a CAGR of 16.06% during the forecast period 2025–2033.

The global cyber warfare market has witnessed an unprecedented surge in both value and complexity, largely spurred by the rising number of high-profile cyber-attacks and the rapid adoption of digital technologies. This growth is influenced by the increasing frequency of sophisticated attacks, highlighted by significant incidents like the Change Healthcare breach, which led to a US$ 2.87 billion loss for UnitedHealth Group, and the Snowflake data breach affecting over 100 customers. Such events underscore the grave financial and operational risks faced by organizations globally and the critical need for advanced cyber defense measures.

Key players such as Airbus SE, BAE Systems plc, Booz Allen Hamilton Inc., Cisco Systems Inc., IBM, Lockheed Martin Corporation, and Northrop Grumman Corporation dominate cyber warfare market through their development of cutting-edge threat intelligence, data protection, and managed security solutions. While North America leads the market, fueled by considerable U.S. federal spending in the US$ 20+ billion range, other regions like Asia-Pacific and the Middle East are also witnessing rapid growth due to escalating cyber threats. Regulatory frameworks worldwide, including the U.S. Executive Order on Improving the Nation’s Cybersecurity and the EU’s GDPR, have further accelerated investments in cybersecurity infrastructure and driven the adoption of zero trust architectures. At the same time, a 4 million-strong workforce deficit worldwide poses a serious challenge to organizations’ ability to keep pace with sophisticated cyber threats.

Looking ahead, emerging technologies like artificial intelligence (AI) and quantum computing are expected to shape the cyber warfare market landscape significantly, enhancing both defensive and offensive capabilities. AI-driven solutions facilitate real-time threat detection, closing the skills gap by automating complex tasks, while quantum computing holds the potential to break traditional encryption systems, necessitating urgent development of quantum-resistant cryptographic algorithms. Combined with the projected increase of 75 billion IoT devices by 2025, these technological shifts will redefine digital warfare strategies, placing ever-greater emphasis on innovation, regulatory compliance, and workforce development in the pursuit of robust cyber defenses.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Escalating geopolitical tensions fueling investment in offensive and defensive cyber capabilities

The escalation of geopolitical tensions in the cyber warfare market has led to a significant increase in state-sponsored cyberattacks and subsequent investments in cyber capabilities. In 2024, Russian cyberattacks on Ukraine reached an alarming 4,315 incidents, primarily targeting critical infrastructure such as government services, energy sector, and defense-related entities. These attacks aimed to steal sensitive data and disrupt operations through tactics like malware distribution and phishing. Similarly, Chinese cyberattacks on Taiwan surged to 2.4 million daily attempts in 2024, focusing on government systems and telecommunications firms. These numbers underscore the growing use of cyber warfare as a tool for geopolitical influence and strategic advantage.

In response to these threats, nations have significantly boosted their cyber defense budgets and capabilities in the cyber warfare market. The U.S. federal budget for FY 2025 allocated substantial funds for countering emerging cyber threats and enhancing federal cybersecurity measures. This investment includes funding for modernizing security policies and infrastructure, such as adopting memory-safe programming languages and improving BGP security. The focus has shifted towards eliminating entire classes of vulnerabilities and strengthening national cyber resilience. Additionally, the emphasis on public-private partnerships and skill-based training initiatives addresses the critical need for a skilled cybersecurity workforce. These investments aim to develop both defensive measures and offensive capabilities as a deterrent and strategic asset in the evolving landscape of cyber warfare.

Trend: Adoption of quantum-resistant cryptography to counter future quantum computing threats

The adoption of quantum-resistant cryptography has gained momentum as organizations prepare for the potential threats posed by quantum computers in the cyber warfare market. As of 2025, over 200 organizations worldwide, including major tech companies like IBM and Google, have initiated pilot projects to test quantum-resistant algorithms in real-world scenarios. These implementations focus on algorithms selected by the National Institute of Standards and Technology (NIST), such as CRYSTALS-Kyber for general encryption and CRYSTALS-Dilithium for digital signatures. The urgency of this transition is underscored by the "Harvest Now, Decrypt Later" threat, where adversaries could intercept and store encrypted data today, waiting for quantum computers to become powerful enough to decrypt it in the future.

Concrete deployment cases of quantum-resistant cryptography are emerging across various sectors in the cyber warfare market. The European Union's Quantum Flagship initiative has invested €1 billion in developing quantum technologies, including cryptography. In the financial sector, JPMorgan Chase has initiated trials of quantum-resistant cryptographic systems to secure transactions and protect sensitive customer data. Google has implemented a hybrid approach in the Chrome browser, combining classical and quantum-resistant algorithms to secure Transport Layer Security (TLS) connections using X25519Kyber768. This approach demonstrates the industry's commitment to preparing for the quantum era while maintaining compatibility with current systems. As awareness of the quantum threat increases, 2024 has marked a pivotal year for the development and implementation of quantum-resistant solutions, with expectations of finalized NIST standards driving further adoption across industries.

Challenge: Rapidly evolving threat landscape outpacing traditional security measures and strategies

The rapidly evolving cyber warfare market presents a formidable challenge to organizations and governments in the market, consistently outpacing traditional security measures and strategies. In 2024, the United States alone reported over 2,000 ransomware incidents, resulting in financial losses exceeding $1.5 billion. These attacks targeted a wide range of sectors, including healthcare, education, and manufacturing, often crippling operations and demanding hefty ransoms for data recovery. Notable incidents include the ransomware attack on LoanDepot in January 2024, which exposed sensitive data of approximately 16.9 million customers and resulted in $27 million in response and recovery costs. Similarly, Schneider Electric experienced a ransomware attack in January 2024, leading to a data breach of 1.5 terabytes, affecting high-profile clients and potentially incurring significant financial and reputational damage.

To combat these evolving threats in the cyber warfare, organizations are increasingly adopting advanced security measures in the cyber warfare market. Over 5,000 companies have implemented advanced endpoint detection and response (EDR) systems to enhance their threat detection capabilities. The adoption of zero-trust architectures has gained momentum, with government agencies and private enterprises investing heavily in this security model to prevent unauthorized access and mitigate the risk of insider threats. Additionally, the integration of artificial intelligence in cybersecurity operations has become more prevalent, with major enterprises deploying AI-driven security solutions to automate threat detection and response. These measures reflect the industry's recognition of the need for more dynamic and adaptive defense strategies. However, the challenge remains in keeping pace with the rapid evolution of threats, requiring continuous innovation, investment in advanced technologies, and the development of skilled cybersecurity professionals capable of navigating this complex landscape.

Segmental Analysis

By Component: Solution segment dominance in the cyber warfare market (64.71% market share)

The solution segment's dominance in the cyber warfare market, controlling over 64.71% of the market share, is primarily driven by the escalating sophistication and frequency of cyber threats targeting critical infrastructure and sensitive data across various sectors. This dominance is reflected in the substantial investments made by organizations to protect their digital assets. For instance, in 2025, global spending on cybersecurity solutions reached $217.9 billion, with a significant portion allocated to advanced threat detection and prevention systems. The integration of cutting-edge technologies such as artificial intelligence (AI) and machine learning (ML) into cybersecurity solutions has been a key factor in this dominance. These AI-driven solutions have demonstrated remarkable efficacy, with studies showing a 60% reduction in breach identification and containment time compared to traditional methods.

Key solutions driving this dominance in the cyber warfare market include network security, endpoint security, and cloud security solutions in the market. Network security solutions have seen widespread adoption, with over 80% of large enterprises implementing next-generation firewalls and intrusion detection systems by 2025. Endpoint security solutions have become critical due to the proliferation of remote work, with 73% of organizations investing in advanced endpoint detection and response (EDR) systems. Cloud security solutions have experienced exponential growth, driven by the increasing adoption of cloud services. In 2025, 92% of enterprises reported using multi-cloud environments, necessitating robust cloud security measures. The demand for these solutions is further amplified by the growing trend of remote work and the use of personal devices for accessing corporate networks, which has increased the attack surface for cyber threats. This shift has led to a 35% increase in cloud security spending in 2025 compared to the previous year.

By Cyber Warfare Type: Cyber-attacks dominating 47% of warfare types

The dominance of cyber-attacks, accounting for more than 47% of cyber warfare market, is a testament to the evolving nature of modern conflict and the strategic advantages offered by cyber warfare. This shift is driven by several factors, including the cost-effectiveness of cyber operations compared to traditional military engagements, the ability to conduct covert operations with plausible deniability, and the potential for significant disruption with minimal physical risk. In 2025, state-sponsored cyber-attacks increased by 38% compared to the previous year, with over 70% of these attacks targeting critical infrastructure and government institutions. The Russia-Ukraine conflict has been a prime example of this trend, with Russian cyberattacks on Ukraine surging by 70% in 2024, primarily targeting government services, energy sector, and defense-related entities.

Key factors behind this dominance in the cyber warfare market include the increasing digitization of critical infrastructure, the interconnectedness of global systems, and the potential for asymmetric warfare. The vulnerability of digital systems has made cyber-attacks an attractive option for both state and non-state actors seeking to gain strategic advantages. In 2025, 65% of major military operations included a cyber component, highlighting the integration of cyber warfare into broader military strategies. The rise of advanced persistent threats (APTs) has further contributed to this trend, with a 45% increase in APT activities targeting defense and aerospace sectors in 2025. Additionally, the development of offensive cyber capabilities by nations as a deterrent and strategic asset has fueled this dominance. For instance, the U.S. Cyber Command reported conducting over 2,000 cyber operations in 2025, demonstrating the increasing reliance on cyber warfare as a tool for national security and geopolitical influence.

Application: Defense application controlling 28.22% of cyber warfare market revenue

The defense application's control of 28.22% of the cyber warfare market revenue is driven by the critical need to protect national security interests and military assets from increasingly sophisticated cyber threats. This dominance is reflected in the substantial investments made by governments and defense organizations in cybersecurity. In 2025, global defense cybersecurity spending reached $56.1 billion, representing a 14.1% compound annual growth rate (CAGR) from 2023. The U.S. Department of Defense alone allocated $11.2 billion for cybersecurity in its FY 2025 budget, a 15% increase from the previous year. This significant investment underscores the recognition of cybersecurity as a pivotal component of national defense strategies.

Key factors shaping the demand for defense applications in cyber warfare market include the rise of state-sponsored cyber activities, the need to protect critical military infrastructure, and the integration of cyber capabilities into traditional warfare strategies. The increasing frequency of cyber espionage and attacks targeting defense systems has necessitated robust cybersecurity measures. In 2025, defense organizations reported a 40% increase in attempted cyber intrusions compared to the previous year, with 60% of these attempts attributed to state-sponsored actors. The adoption of advanced technologies such as artificial intelligence (AI) and machine learning (ML) in defense cybersecurity has been a significant trend, with 75% of defense agencies implementing AI-driven threat detection systems by 2025. These systems have proven highly effective, reducing the average time to detect and respond to cyber threats by 35%. Additionally, the shift towards Zero Trust Architecture (ZTA) in defense networks has gained momentum, with 80% of defense organizations implementing or planning to implement ZTA by the end of 2025, significantly enhancing their security posture against insider threats and unauthorized access attempts.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America: Cybersecurity Powerhouse: Leading Innovation and Strategic Defense Initiatives

The cyber warfare market has experienced significant growth and transformation across various regions, driven by escalating geopolitical tensions, technological advancements, and the increasing frequency and sophistication of cyber threats. In North America, the cybersecurity market is set to control over 39.74% market share in 2024. Wherein, the United States, accounting for 59% of all ransomware attacks globally, has intensified its focus on cyber warfare, with substantial investments in advanced cyber defense systems and comprehensive cybersecurity frameworks across federal agencies. The U.S. Department of Defense allocated $11.2 billion for cybersecurity in its FY 2025 budget, a 15% increase from the previous year, underscoring the critical importance of cyber capabilities in national defense strategies. Canada, while facing its own challenges with 72% of small to medium-sized businesses experiencing cyber-attacks in 2024, has launched strategic initiatives to bolster its national cyber defenses, including partnerships with private sector entities to foster innovation in cybersecurity solutions.

Europe: EU's Comprehensive Cybersecurity Framework: Collaboration and Regulatory Excellence

Europe cyber warfare market has taken a proactive stance in strengthening its cybersecurity infrastructure, with the European Union focusing on cross-border collaborations and regulatory frameworks to enhance regional cyber defense strategies. The implementation of the NIS2 Directive, the Cyber Resilience Act, and the Cyber Solidarity Act in 2024-2025 has established a comprehensive regulatory environment aimed at ensuring a high level of cybersecurity across the Union. These initiatives have contributed to a 49% decline in ransomware attacks in the EMEA region, indicating the effectiveness of coordinated mitigation strategies. The establishment of the European Cybersecurity Reserve and a Cyber Emergency Mechanism under the Cyber Solidarity Act demonstrates the EU's commitment to collective preparedness and response capabilities. Furthermore, the EU's investment in cybersecurity through programs like Horizon Europe and the Digital Europe Programme has significantly enhanced the region's cybersecurity infrastructure and capabilities.

Asia-Pacific: Rapid Growth and Technological Advancement in Cyber Warfare Capabilities

The Asia-Pacific region, representing 31% of all reported cyber incidents globally, has emerged as a critical battleground in the cyber warfare market landscape. China, Japan, and India are at the forefront of regional cyber capabilities, each investing heavily in advanced technologies and defense strategies. China's aggressive stance in cyber warfare, coupled with its investments in AI and 5G technologies, has positioned it as a formidable force in the digital domain. Japan and India have responded by strengthening their cybersecurity infrastructures, with Japan focusing on international collaborations and India developing comprehensive cyber defense strategies to counter threats from state and non-state actors. The region's cyber warfare market is projected to grow at a CAGR of 15.3% from 2023 to 2030, reflecting the increasing demand for cybersecurity solutions across various sectors.

Top Players in Cyber Warfare Market

- Lockheed Martin Corporation

- Northrop Grumman

- Raytheon Technologies Corporation

- The Boeing Company

- L3Harris Technologies, Inc.

- General Dynamics Corporation

- IBM Corporation

- Booz Allen Hamilton Inc

- Airbus SE

- BAE Systems

- Other Prominent Players

Recent Developments in Cyber Warfare Market

- March 2025: Mastercard acquired Recorded Future, a leading threat intelligence company, for $2.65 billion. This acquisition significantly enhances Mastercard's cybersecurity capabilities, particularly in threat intelligence, which is crucial for anticipating and mitigating cyber warfare threats.

- March 2025: Sophos acquired SecureWorks for $825 million, bolstering its managed security services offerings. This acquisition strengthens Sophos' position in providing comprehensive cybersecurity solutions, including those needed for cyber warfare defense.

- March 2025: SecureOps and DataDefend merged to form a combined entity valued at $1.5 billion. This merger aims to deliver end-to-end security solutions, focusing on small and medium-sized businesses, which are often targets in cyber warfare.

- February 2025: Alphabet announced its intention to acquire Wiz for $32 billion. Wiz's cloud security solutions are expected to significantly enhance Alphabet's cybersecurity offerings, particularly in protecting cloud infrastructures from cyber warfare threats.

- February 2025: Tines, an Irish cybersecurity firm, raised $125 million in a Series C funding round. This substantial funding reflects the increasing demand for automation and orchestration solutions in cybersecurity and cyber warfare.

- February 2025: Oligo Security, an Israeli cybersecurity and cloud computing company, received $50 million in a Series B funding round. This investment underscores the importance of cloud security in the evolving cyber warfare landscape.

- January 2025: Semgrep, a cybersecurity and analytics company, secured $100 million in a Series D funding round. This significant investment highlights the growing interest in cybersecurity analytics and advanced threat detection capabilities.

- December 2024: Axiado Corporation, a U.S.-based cybersecurity company, secured $60 million in a Series C funding round. This investment is focused on enhancing firmware security, a critical area in protecting hardware from cyber threats.

- November 2024: The U.S. Navy issued a solicitation for a $243.9 million contract to conduct research and build tactical electronic warfare and combat systems. This contract, managed by the Naval Research Laboratory, focuses on systems engineering, electronic warfare tactics development, and the integration of various electronic warfare capabilities.

Top Companies in the Cyber Warfare Market

- AIRBUS

- BAE Systems

- Booz Allen Hamilton Inc

- DXC Technology Company

- General Dynamics Corporation

- Intel Corporation

- IBM Corporation

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman

- Raytheon Technologies Corporation

- L3Harris Technologies Inc

- Other Prominent Players

Market Segmentation Overview

By Components

- Solution

- Services

By Cyber Warfare Type

- Cyber Attacks

- Espionage

- Sabotage

- Others

By Application

- Defense

- Government Agencies

- Aerospace

- Homeland Security

- Enterprise

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

View Full Infographic

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

| Report ID: AA03251246 | Delivery: Immediate Access

| Report ID: AA03251246 | Delivery: Immediate Access

.svg)