Cut Flowers Market: By Type (Rose, Chrysanthemum, Carnation, Gerbera, Anthurium, Orchids, Gladiolus, Tuberose, Others); Application (Home, and Commercial); Flower Colors (White, Purple, Lavender or Blue, Yellow or orange, Red or pink); Distribution Channel (Online, Offline); and Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2026–2035

- Last Updated: 30-Dec-2025 | | Report ID: AA1022312

Market Scenario

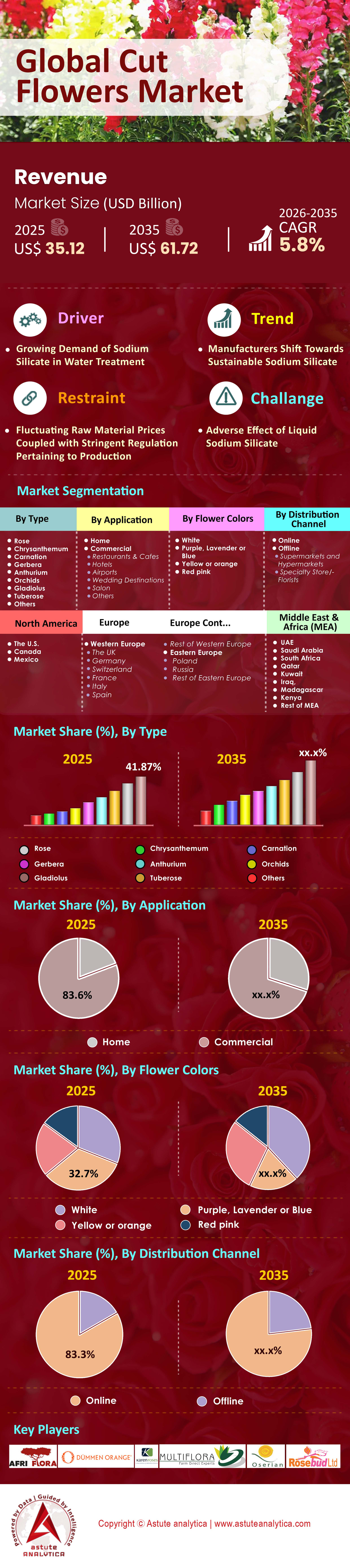

Cut flowers market generated revenue of US$ 35.12 billion in 2025 and is estimated to reach a valuation of US$ 61.72 billion by 2035 at a CAGR of 5.8% during the forecast period 2026–2035.

Key Findings

- Based on type, rose as emerged as a dominant cut flowers in the global market, capturing the nearly 41.9% market share.

- Based on application, over 83% of the cut flowers are mainly used for commercial application.

- Based on colors, purple, lavender, or blue colored flowers taking a prominent position with over 32.7% market share.

- Online distribution of cut flowers is witnessing strong demand.

- Europe is the powerhouse in the cut flower market with over 57.40% market share.

Cut flowers have evolved from simple aesthetic crops into a highly sophisticated, perishable currency within the global agrarian economy. Unlike potted plants that retain their biological systems, cut flowers are harvested specifically for their ephemeral beauty, creating a unique "fast-fashion" dynamic within agriculture. This commodity class encompasses fresh blooms, flower buds, and leaf-bearing stems that are processed, chilled, and transported under strict timelines to maintain vase life. The economic value of a cut flower is derived not just from its biological quality but from the logistical miracle of its delivery; a rose harvested in Kenya must reach a London supermarket within 48 hours to retain its commercial viability.

Consequently, the cut flowers market operates less like traditional farming and more like a high-velocity industrial supply chain, where cold-chain integrity and precision timing create the bulk of the final retail price. This transformation has turned the flower trade into a multi-billion-dollar global mechanism that supports entire national economies in the Global South while satisfying the emotional consumption habits of the Global North.

To Get more Insights, Request A Free Sample

How Emotional Spending is Shielding the Market From Recessionary Pressures?

The primary engine driving demand in the cut flower sector is a phenomenon often described as the "resilient gifting economy." Despite facing global inflationary headwinds in 2024 and 2025, consumer spending on flowers has defied broader retail slowdowns. Data from the US National Retail Federation indicates that consumers spent a record USD 3.2 billion on flowers for Mother’s Day 2024 alone, forcing retailers to adjust their inventory strategies to prioritize floral products over other gift categories.

Furthermore, the emotional necessity of flowers was cemented during Valentine’s Day 2024, which generated USD 2.6 billion in floral sales. This behavior in the cut flowers market suggests that consumers view flowers as an "affordable luxury"—a necessary emotional bridge that is prioritized even when disposable income tightens. Additionally, the post-pandemic resurgence of the events industry has stabilized bulk demand, with the average cost of wedding florals rising, further buoying the market. Retailers have capitalized on this by expanding floral sections, turning what was once a seasonal offering into a year-round revenue staple.

Which Varietals Are Dominating Global Trade Volumes and Why?

While the biological diversity of the cut flowers market is vast, commercial volume is heavily consolidated around a few resilient species that can withstand the rigors of air freight. Roses continue to be the undisputed hegemon of the trade, commanding approximately 42% of the global market share in 2024. Their dominance is driven by their dual utility as both a romantic symbol and a durable supermarket staple; during the 2025 Valentine’s season, red roses alone accounted for 55% of total rose sales.

However, consumer preferences in the global cut flowers market are subtly shifting toward "wilder" aesthetics, benefiting the trade of Carnations and Chrysanthemums. These distinct varieties have seen a resurgence not just as filler but as focal points in bouquets, particularly in the UK and US mass-market retail sectors. Simultaneously, the tulip market is undergoing a technical revolution. Advanced hydroponic forcing techniques have extended the tulip season significantly, allowing this formerly spring-exclusive bloom to capture market share year-round, with the category projected to grow faster than the overall market average through the end of the decade.

How is The Global Supply Chain Geographically Divided?

The global trade dynamics of cut flowers market are characterized by a stark bifurcation into two massive, distinct supply corridors that operate with clockwork precision. The Americas supply chain is dominated by Colombia and Ecuador, who function as the "greenhouse of North America." In 2024, Colombian exports reached a staggering valuation of USD 2.35 billion, with the vast majority of this volume flowing directly into Miami International Airport for distribution across the United States and Canada.

Conversely, the Euro-Afro axis connects the high-altitude farms of East Africa with the auction clocks of the Netherlands. Kenya remains the titan of this route, exporting 102,500 tonnes of cut flowers in 2024 to feed the European appetite. A third, rapidly emerging dynamic is the intra-Asian trade, anchored by China. The Dounan Flower Market in Yunnan Province has exploded in volume, transacting 14.18 billion stems in 2024. This signals a shift where Asian production is increasingly consumed by domestic and regional markets rather than being solely exported to the West, creating a more multipolar trade environment.

Who are The Titans Controlling The Floral Supply Chain?

The competitive landscape of the cut flowers market is defined by entities that have successfully integrated logistics, genetics, and sales. Royal FloraHolland remains the central nervous system of the global trade, functioning as the world's largest auction hub. In 2024, the cooperative facilitated €5.3 billion in product sales, proving that the Netherlands remains the primary price-setting mechanism for the industry.

On the production and distribution side, the Lynch Group has established itself as a dominant force in the Asia-Pacific cut flowers market. Reporting revenues of approximately AUD 397.7 million (USD ~265 million) for fiscal year 2024, Lynch Group exemplifies the vertically integrated model, managing everything from farms in China to supermarket shelves in Australia. In the realm of genetics, Dümmen Orange continues to lead the sector's R&D efforts. By focusing on breeding disease-resistant varieties, they influence the supply chain at the DNA level, employing over 6,000 people globally to ensure yield stability. Meanwhile, US-based giants like 1-800-Flowers.com, Inc., with fiscal 2024 revenues of USD 1.75 billion, demonstrate the massive power of the direct-to-consumer digital retail channel, effectively bypassing traditional florists to capture margin.

What Technological Shifts are Redefining Market Operations?

The most transformative trend in the cut flower market is the aggressive digitalization of the wholesale transaction process. The days of physical auction clocks are rapidly fading, replaced by remote buying platforms that decouple the trade from geography. Royal FloraHolland’s digital platform, Floriday, is the vanguard of this shift, facilitating €2 billion in direct trade during the 2023/24 period alone. This platform allows growers in Kenya to sell directly to buyers in Germany without the flowers physically passing through the auction floor, reducing handling costs and carbon footprints.

Simultaneously, there is a distinct trend toward "sustainable logistics." With air freight costs remaining volatile, major exporters are experimenting with sea freight for hardier flower varieties. This shift is not just cost-driven but is also a response to the "carbon labeling" trend in Europe, where retailers are increasingly demanding lower-emission transport methods for their floral inventory.

What Logistical and Environmental Hurdles Persist?

Despite the cut flowers market’s growth, it faces existential threats from climate volatility and logistical bottlenecks. The reliance on air cargo makes the industry uniquely vulnerable to energy markets; in 2024, the total value of flower exports transported by air was estimated at USD 3.7 billion, meaning that any fluctuation in jet fuel prices immediately erodes grower margins.

Furthermore, climate change is altering pest lifecycles, leading to increased sanitary rejections at border control points. Kenyan exporters faced a collective loss of €1.1 million in 2024 due to consignments being rejected at EU entry points for pest non-compliance. These biological barriers to trade are forcing producers in the cut flowers market to invest heavily in integrated pest management systems, raising the cost of production. Additionally, political instability in key production regions can disrupt the "just-in-time" nature of the supply chain, as seen with occasional freight delays that lead to millions of stems perishing before they even reach the retail shelf.

Where Is Consumer Demand Most Heavily Concentrated?

Geographically, the consumption of cut flowers is heavily skewed toward developed Western economies, though the map is slowly redrawing itself. The United States remains the single most valuable import cut flowers market absorbing USD 2.26 billion worth of cut flowers in 2024. This demand is characterized by extreme peaks around holidays, necessitating massive logistical surges. In Europe, the United Kingdom represents a highly mature market where flower purchasing is deeply ingrained in weekly grocery habits. The UK imported £635 million in cut flowers in 2024, sustaining high per-capita consumption rates despite economic sluggishness.

However, the most dynamic growth is occurring in Asia. The burgeoning middle class in China has driven the domestic market to new heights, with transaction values at the Dounan hub reaching 11.57 billion yuan (USD ~1.6 billion). This indicates that while the West holds the current wealth, the future volume growth of the cut flower market is pivoting toward the East, driven by urbanization and evolving cultural norms around gifting.

Segmental Analysis

By Type, Ecuadorian and Kenyan Rose Production Volumes Dominate the Global Floral Trade Landscape

The rose segment continues to anchor the global floral trade in the cut flowers market, maintaining a commanding 41.9% market share as the most traded variety worldwide. Growers in Ecuador solidified their leadership role by exporting USD 530.54 million worth of blooms in just the first half of 2024, capitalizing on their high-altitude advantages. In contrast, Kenyan exporters faced logistical hurdles yet still managed to ship 16,102 metric tons of stems during the peak month of February 2024. European trade hubs remain central to these movements, with the Netherlands reporting a massive USD 5.3 billion in flower exports for 2024, representing nearly half of the global total. Royal FloraHolland, the world's primary auction floor, recorded product sales reaching €5.3 billion for the year, driven by an 11% increase in average unit prices. Colombian growers also played a pivotal role, although their specific rose export value adjusted to USD 362.4 million amidst shifting agricultural focuses.

Infrastructure investments are critical to sustaining the Cut flowers market as volumes surge during key holidays. Miami International Airport, the primary entry point for the Americas, processed a staggering 90,154 tons of floral imports during the January and February 2025 season alone. These incoming shipments held a valuation of USD 450 million, underscoring the immense financial weight of the winter holiday rush. Daily operations at this gateway handled 1,500 tons of fresh product to ensure national distribution chains remained stocked. On a broader scale, Avianca Cargo successfully transported 18,000 tons of blooms specifically for the 2025 Valentine’s window. Despite these high volumes, market dynamics in Kenya showed volatility, with June 2024 export values dropping to KSh 5.2 billion. Nevertheless, the Cut flowers market remains resilient, supported by global logistical networks that connect equatorial farms to northern hemisphere consumers.

By Application, Corporate Events and Hospitality Sectors Fuel Massive Floral Consumption and Spending

Commercial applications dominate the cut flowers market, accounting for over 83% of total utilization through weddings, funerals, and large-scale corporate events. According to NRF survey, the 2025 Valentine’s Day season exemplifies this commercial power, with total consumer spending reaching a record-breaking USD 27.5 billion. Within this massive expenditure, direct purchases of flowers accounted for USD 2.9 billion, as 40% of all shoppers included bouquets in their gift-giving plans. The wedding sector remains another pillar of commercial stability, where the average national cost for floral arrangements in 2024 stood at USD 2,723. For high-end nuptials, floral budgets frequently escalated to an upper range of USD 4,500, driven by demands for elaborate installations and premium stems. Logistics providers like Miami’s port authorities processed 940 million stems ahead of the 2025 holiday peak to satisfy these commercial orders.

Broader economic factors also influence how commercial entities engage with the Cut flowers market, particularly regarding experiential spending. For instance, consumers allocated USD 5.4 billion toward "evening out" experiences in 2025, which indirectly drives hospitality venues to invest heavily in fresh decor. Retailers note that 56% of the population participated in Valentine’s Day celebrations, creating a vast audience for commercial floristry. However, competition from other gift categories is fierce, with jewelry spending hitting USD 6.5 billion during the same period. Despite this, the sheer volume of 18,000 tons flown by major cargo carriers suggests that floral demand remains non-negotiable for commercial planners. The Cut flowers market continues to thrive on these recurring, high-value commercial occasions that demand fresh inventory year-round.

By Color, Violet and Indigo Hues Command Premium Pricing In Specialized Floral Trade

Purple, lavender, and blue colored flowers have secured a prominent 32.7% market share in the global cut flowers market, driven by their rarity and association with luxury and tranquility. Wholesale pricing for these specific hues reflects their premium status, with high-quality Blue Hydrangea stems commanding USD 5.80 each for small quantity orders. Bulk purchasers can secure slightly better rates, paying USD 5.00 per stem when buying quantities of 80 or more, yet the cost remains significantly higher than standard varieties. Specialized distributors offer Select grade Blue Hydrangeas at a delivered price of USD 3.31 per stem, while larger Jumbo varieties trade at USD 9.76 per stem. The Cut flowers market relies on these unique shades to differentiate high-end arrangements from supermarket bouquets.

Further analysis of pricing structures reveals the value added by specific coloring processes and varietal rarity. A case of Select Blue Hydrangeas, typically containing 40 stems, retails for approximately USD 132.21, making it a substantial investment for florists. Tinted varieties also command high prices, with Lavender Dyed Hydrangeas selling for USD 119.98 for a 30-stem bunch. Comparisons with standard colors highlight the premium, as Jumbo White Hydrangeas trade at USD 145.00 for just 14 stems, proving that pure white and rare blues sit at the top of the price hierarchy. Demand is further evidenced by the availability of Royal Blue Painted Hydrangeas, which can cost USD 125.00 per box.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

Digital Platforms and Quick Commerce Revolutionize Floral Supply Chain Distribution

Online distribution channels are witnessing explosive growth, fundamentally altering how consumers access fresh blooms. The online flower delivery sector was valued at USD 7.70 billion in 2024, reflecting a massive shift away from traditional brick-and-mortar walk-ins. Industry giants like 1-800-Flowers reported fiscal 2024 revenues of USD 1.83 billion, proving the scalability of digital-first floral retail. The company’s flagship domain alone generated USD 496 million in revenue, underscoring the power of direct-to-consumer e-commerce. The Cut flowers market is increasingly defined by these digital transactions, which are projected to expand at a 7% CAGR through 2030. Furthermore, online merchants are seeing their specific segment grow by 11.8% annually, outpacing many physical retail counterparts.

Consumer behavior data for 2025 in cut flowers market indicates that 38% of Valentine’s Day shoppers specifically chose online platforms to purchase their gifts. This digital preference drives operational changes, although not all segments benefit equally; BloomNet saw a revenue decrease of 19.1%, highlighting the volatile nature of wire service models. Despite such fluctuations, 1-800-Flowers maintained a robust adjusted EBITDA of USD 93.1 million, validating the profitability of the online model. The average consumer spend for the holiday reached USD 188.81, a figure that online retailers aim to capture through personalized add-ons and subscription services. In developed markets, digital channels now account for 65% of all sales, driven heavily by mobile commerce. Consequently, the Cut flowers market is rapidly evolving into a technology-driven industry where logistics and digital user experience are paramount.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Europe's Unrivaled Hegemony Through Dutch Logistics and High-Value German Consumption

Europe continues to command a staggering 54.40% market share in global cut flowers market, a dominance anchored by the Netherlands' role as the world’s "flower shop." The region's grip on the market is not just historical but logistical; the Royal FloraHolland auction is currently trading over 34 million items daily, setting global price benchmarks. As of January 2025, Dutch export values surprisingly climbed by 7%, defying logistical cost pressures. This resilience is largely supported by Germany, which remains the top destination, absorbing €1.7 billion in Dutch floral exports annually.

The region’s strength lies in its intricate re-export network. While nations like Kenya and Ethiopia supply the volume, European hubs process and distribute these blooms with unmatched efficiency. Furthermore, consumer pressure is reshaping the landscape, with the Floriculture Sustainability Initiative (FSI) pushing for 90% sustainable sourcing by the end of 2025, effectively barring non-compliant competitors from entering this lucrative bloc.

Asia Pacific’s Rapid Rise Fueled by Urbanization and Chinese Production

Trailing Europe, the Asia Pacific cut flowers market is expanding aggressively, with a projected CAGR of 5.9% moving through 2025. This growth is bifurcated between Japan’s high-value maturity and China’s explosive volume. Japan’s market alone is valued at approximately $1.61 billion in 2025, driven by a cultural reverence for premium quality stems like chrysanthemums.

Meanwhile, China is transforming from a consumer to a production powerhouse. The Yunnan province is now churning out over 16 billion stems annually, supplying both domestic urban centers and neighboring markets. The transition here is seamless; rising disposable incomes in cities like Shanghai and Seoul are shifting flowers from occasional gifts to weekly lifestyle purchases, insulating the region from global volatility.

North America’s Import-Dependent Market Anchored by High US Holiday Spending

North America holds the third position, characterized by an immense reliance on imports—roughly 80% of cut flowers sold in the US in 2025 originate abroad, primarily from Colombia and Ecuador. The market remains heavily event-driven; for Valentine’s Day 2025 alone, US consumer spending on flowers hit a record $2.6 billion.

Despite supply chain hurdles, the US cut flowers market size has swelled to an estimated US$ 11.28 billion, supported by robust cold−chain logistics from Miami. Colombia continues to be the lifeline for this region, exporting over US$ 1.35 billion worth of blooms to satisfy North American demand. The trend in 2025 has shifted slightly toward supermarket sales, which saw a 1.2% volume increase, proving that convenience is becoming as vital as aesthetics for the American buyer.

Recent Developments in Cut Flower Market

- Target Corporation launched Good Little Garden, its first standalone floral brand on April 21, 2025. This offers over 60 fresh-cut roses, tulips, and potted plants starting at $6, targeting everyday and seasonal demand like Mother's Day, with in-store events and same-day delivery.

- Sakata Seed Corporation announced the Global Flower Business Division on April 30, 2025, effective June 1. This integrates sales and development for cut flowers amid climate shifts and market consolidation, boosting competitiveness worldwide.

- Ball Seed released its 2025-2026 Cut Flowers Catalog on September 2, 2025. The 82-page guide sorts varieties by breeders and classes, supporting consumer trends via partnerships and production resources.

- Floriexpo finalized its 2025 exhibitor list on May 27 for the June 4-6 event in Fort Lauderdale. Nearly sold-out, it features diverse floral suppliers, optimizing sourcing and networking for industry buyers.

Top Players in Global Cut Flowers Market

- Afriflora Sher

- Dümmen Orange

- Karen Roses

- MultiFlora

- Oserian

- Rosebud Limited

- Selecta one

- The Kariki Group

- The Queen's Flowers

- Washington Bulb Co., Inc.

- Other Prominent Players

Market Segmentation Overview:

By Type

- Rose

- Chrysanthemum

- Carnation

- Gerbera

- Anthurium

- Orchids

- Gladiolus

- Tuberose

- Others

By Application

- Home

- Commercial

- Restaurants & Cafes

- Hotels

- Airports

- Wedding Destinations

- Salon

- Others

By Flower Color

- White

- Purple, Lavender or Blue

- Yellow or orange

- Red pink

By Distribution Channel

- Online

- Offline

- Supermarkets and Hypermarkets

- Specialty Store/Florists

By Region

- North America

- The US

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia and New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2025 | US$ 35.12 Billion |

| Expected Revenue in 2035 | US$ 61.72 Billion |

| Historic Data | 2020-2024 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Unit | Value (USD Bn) |

| CAGR | 5.8% |

| Segments covered | By Type, By Application, By Flower Color, By Distribution Channel, By Region |

| Key Companies | Afriflora Sher, Dümmen Orange, Karen Roses, MultiFlora, Oserian, Rosebud Limited, Selecta one, The Kariki Group, The Queen's Flowers, Washington Bulb Co., Inc., Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

FREQUENTLY ASKED QUESTIONS

Absolutely. The market has proven to be highly recession-resistant, driven by the lipstick effect where consumers prioritize affordable luxuries. In 2024, despite economic headwinds, US consumers spent a record USD 3.2 billion on Mother’s Day flowers alone. Stakeholders can rely on the fact that emotional gifting remains a non-negotiable consumer habit, securing cash flow even during broader retail slowdowns.

While Roses remain the volume king, holding roughly 42% of global share, the highest growth potential lies in Tulips and wild-style summer flowers. Advances in hydroponic forcing have turned tulips into a year-round crop with a projected 9.4% CAGR. For volume growers, red roses remain the safest bet for February cash injections, accounting for 55% of sales during Valentine’s 2025, but diversification into disease-resistant, low-chemical varieties (like those from Dümmen Orange) offers better long-term margin protection.

Digitalization is compressing the supply chain and improving margins by reducing physical handling costs. Royal FloraHolland’s digital platform, Floriday, facilitated €2 billion in direct trade in 2024/25, proving that the future is hybrid. For exporters, this means direct access to European buyers without the volatility of the physical clock, allowing for better price forecasting and reduced intermediary costs.

Yes, it is now a license to operate rather than just a moral choice. Non-compliance is becoming financially punitive; Kenyan exporters lost €1.1 million in 2024 due to sanitary rejections at EU borders. Conversely, certified ethical blooms command a premium and ensure shelf space in major UK and EU supermarkets. With €222.8 million generated in Fairtrade Premiums globally, the market clearly favors—and pays for—supply chain transparency.

Definitely. While the US and UK provide stability, the explosive volume growth is in Asia. China’s Dounan Flower Market transacted 14.18 billion stems in 2024, signaling a massive internal consumption boom. Investors and breeders should view Asia not just as a production base, but as the next great consumer frontier, where a rapidly urbanizing middle class is adopting floral gifting at an unprecedented rate.

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)