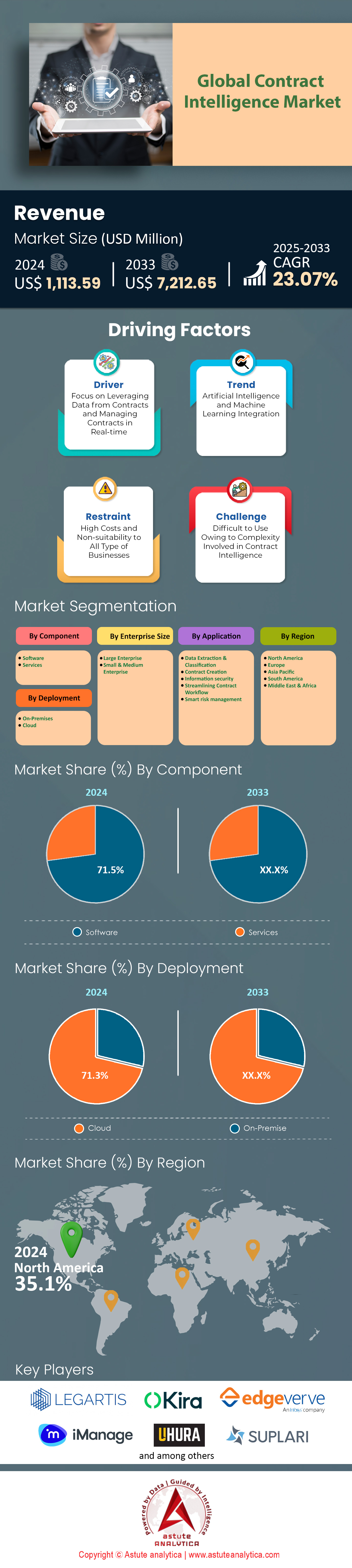

Contract Intelligence Market: By Component (Software and Services); Deployment (On-premise and Cloud); Enterprise Size (Large Enterprise and Small & Medium Enterprise); Application (Data Extraction & Classification, Contract Creation, Information security, Streamlining Contract Workflow, Smart risk management); Region— Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 08-Dec-2025 | | Report ID: AA0823578

Market Snapshot

Contract intelligence market was valued at US$ 1,113.59 million in 2024 and is projected to surpass market valuation of US$ 7,212.65 million by 2033 at a CAGR of 23.07% during the forecast period 2025–2033.

Key Findings in Contract Intelligence market

- Based on component, software component holds a significant 71.50% market share of the contract intelligence market.

- In terms of deployment, the global market is dominated by cloud-based solutions with an impressive 71.3% market share.

- Based on enterprise size, large enterprises emerged as the largest consumers of the contract intelligence by capturing the highest 71.20% market share.

- When it comes application, contract intelligences are primarily used for smart risk management. This application held a notable 29.2% market share in 2025.

- North America is market leader with over 35% market share.

Contract Intelligence refers to the application of advanced technologies—specifically Artificial Intelligence (AI), Natural Language Processing (NLP), and Machine Learning (ML)—to the management and analysis of legal agreements.

Unlike traditional contract management, which focuses on storing and organizing documents, contract intelligence focuses on understanding the content within them. It transforms contracts from static, unstructured text (like PDFs or Word docs) into dynamic, structured data that businesses can act upon.

How It Works

- Digitization & OCR: It uses Optical Character Recognition (OCR) to convert scanned paper documents or image-based PDFs into machine-readable text.

- Pattern Recognition (NLP): The software "reads" the contract to identify specific legal language, clauses, dates, and entities (e.g., identifying a "Termination for Cause" clause versus a "Force Majeure" clause).

- Data Extraction: It automatically pulls out critical metadata such as renewal dates, payment terms, liability caps, and party names without human data entry.

To Get more Insights, Request A Free Sample

The Strategic Shift: Why Contract Intelligence Demand Is Exploding

The demand for contract intelligence is no longer driven by a simple need to digitize paper, it is being propelled by an urgent financial imperative to stop value leakage and accelerate operational velocity. In 2024 and 2025, the market reached a tipping point where manual review became mathematically unsustainable. Standard commercial agreements that used to take human professionals 92 minutes to review are now processed by AI models in just 26 seconds. This massive time differential is the primary engine behind the demand surge in the contract intelligence market.

Beyond speed, the cost of inaction is driving adoption. With the average cost to process a simple contract sitting at USD 6,900—and skyrocketing to USD 49,000 for complex agreements—enterprises are bleeding capital through inefficiency. Manual contracting tasks are costing companies approximately USD 122 per hour in lost productivity. Companies like NetApp have proven the counter-argument, realizing USD 2.5 million in absolute savings in a single project by deploying intelligence tools. The market is growing because organizations can no longer afford the status quo.

The "Big Four": Providers and Their Major Offerings

The contract intelligence market has consolidated around four distinct powerhouses, each carving out a specific tactical niche.

- Icertis: The heavy-hitter for the Global 2000. With an Annual Recurring Revenue (ARR) surpassing USD 250 million and a valuation approximately 3 times the size of its nearest pure-play competitor, Icertis focuses on deep, enterprise-wide "Contract Intelligence (ICI)." They excel in complex vertical compliance, managing commercial agreements across 90 countries.

- DocuSign: The sleeping giant that awoke in 2024. Moving beyond eSignature, they launched the "Intelligent Agreement Management" (IAM) platform. This pivot has been successful, with 25,000 customers specifically adopting IAM and opting 150 million agreements into their new Navigator repository to unlock data.

- Ironclad: The agile innovator. Valued at USD 3.2 billion with an estimated ARR of USD 150 million, Ironclad is the preferred choice for modern, tech-forward legal teams. Their offering centers on "AI Assist" and rapid deployment, boasting a repository where users can tag and extract metadata from 97,000 contracts in mere minutes.

- Sirion: The risk specialist. With a USD 1 billion valuation and 7 million contracts under management, Sirion offers the deepest analytical capabilities. They achieved a 4.21 score (out of 5) for pre-signature capabilities in Gartner’s 2024 assessment, making their offering ideal for complex obligation management.

Major Applications: Where Intelligence Is Heavily Deployed

Contract intelligence market is currently seeing its heaviest deployment in three critical areas: Risk Mitigation, Supply Chain Visibility, and Regulatory Compliance.

In risk scenarios, the technology is used to instantly surface dangerous liabilities. Evisort’s AI, for instance, is now deployed to detect 230 distinct clause types out-of-the-box, allowing legal teams to audit thousands of documents for "force majeure" or "indemnity" risks instantly. Ironclad’s AI is similarly used to detect 175 standard clauses immediately upon setup.

Supply chain and procurement teams are arguably the most aggressive users. Sirion’s platform is currently used to manage relationships with 1 million suppliers, providing visibility into performance obligations that human managers miss. Furthermore, with regulatory pressures mounting, intelligence tools are used to track 30 distinct contracting performance metrics (as seen with Icertis clients) to ensure ESG and statutory compliance across borders.

Prominent Consumers and Geographic Concentration

The consumption of contract intelligence market is heavily concentrated in the Fortune 100 and regulated industries within North America and Western Europe, though the footprint is expanding.

33 Fortune 100 companies have standardized on Icertis, indicating that top-tier enterprise consumption is the current market reality. The banking sector is a massive consumer; JPMorgan, for example, utilized these workflows to save 360,000 legal work hours annually. Tech giants are also heavy users, with NetApp and other Silicon Valley staples driving the user base for platforms like Ironclad, which services approximately 2,000 customers.

Geographically, while the technology is developed primarily in US hubs (San Francisco, Seattle), consumption is global. Icertis supports intelligence operations in 40 languages, and Sirion handles extraction in 100 languages. However, the operational centers are global: DocuSign reaches 180 countries, and Sirion’s employees are spread across 6 continents, reflecting a consumption pattern that follows the global supply chain.

Trends, Opportunities, and Competition

The contract intelligence market is being reshaped by a trend toward "hyper-integration." It is no longer enough to manage contracts in a silo; the data must flow to ERPs and CRMs. Ironclad is capitalizing on this by offering connections to 8,000 enterprise applications via iPaaS, while Sirion has launched an "Integration Studio" to sync with 1,000 systems. The opportunity lies in turning contracts into data layers that feed the rest of the business.

Competition in the global contract intelligence market is fierce and fueled by massive capital injections. In 2024 alone, legal tech raised a record USD 4.98 billion across 356 deals. Players are competing primarily on "AI Depth" and "feature velocity." Ironclad, for instance, released over 100 new features in 2024 to stay ahead. They are also competing on talent; DocuSign maintains a massive army of 6,838 employees to dominate sales channels, while Icertis employs 2,336 staff to ensure high-touch service for large clients.

Recent Developments Changing the Market Image

The most significant shift in contract intelligence market is the move from "Contract Management" to "Agreement Intelligence."

DocuSign’s launch of the IAM platform is the biggest headline; they are betting their future on moving beyond the signature. By integrating with WhatsApp to reach 2 billion users, they are changing the image of contracts from formal legal documents to fluid, mobile-first agreements.

Simultaneously, Ironclad has aggressively moved to shed its image as just a "legal tool" by proving its technical scale. Their platform generated 10.5 million AI predictions in 2024, positioning them as a serious data analytics player in the contract intelligence market rather than just a workflow tool. Additionally, the launch of 19 default AI data properties signals a move toward standardization—trying to create a universal data language for contracts.

The market has evolved from a repository battle to a data arms race. With Icertis appearing on the Forbes Cloud 100 for the 6th consecutive year, and Sirion securing a 4.9-star rating from customer reviews, the winners are those who can prove that their intelligence is not just accurate, but financially transformative.

Segmental Analysis

Software Innovation Leads Industry via Agentic AI and Seamless ERP Integrations

Based on component, software component holds a significant 71.50% market share of the contract intelligence market. This dominance stems from the rapid deployment of Agentic AI, where autonomous agents now execute decisions rather than merely suggesting them. Major vendors currently prioritize "Copilot" features that draft legal language within seconds, fundamentally altering legal workflows. Furthermore, deep integration connectors for Salesforce and SAP Ariba have become standard, allowing sales teams to generate agreements without leaving their primary systems. Advanced Natural Language Processing now facilitates the bulk migration of legacy paper contracts into digital formats with high accuracy. Consequently, the contract intelligence market relies on software as the central nervous system for enterprise operations.

- No-code platforms empower legal teams to modify workflows without IT support.

- Native e-signature bundling significantly reduces total cost of ownership.

- Mobile application availability ensures approval cycles continue during executive travel.

Vendor consolidation strategies are reshaping the landscape, as buyers prefer comprehensive suites over fragmented point solutions. API-first architectures allow these platforms to communicate fluidly with HR and finance systems, creating a unified data ecosystem. Moreover, automated version control eliminates the risks associated with email-based negotiation. Thus, software remains the undisputed backbone of the contract intelligence market, driving efficiency through continuous feature updates.

Cloud Scalability Dominates Global Adoption via Multi-Cloud and Hybrid Strategies

In terms of deployment, the global contract intelligence market is dominated by cloud-based solutions with an impressive 71.3% market share. Organizations overwhelmingly favor hybrid and multi-cloud setups to balance flexibility with robust security needs. Data sovereignty requirements, particularly in Europe, drive the adoption of region-specific cloud hosting to ensure compliance with local laws. Additionally, the shift toward "cyberstorage" solutions protects sensitive legal data through fragmentation and distribution across multiple nodes. Real-time collaboration capabilities allow distributed legal teams to edit documents simultaneously, rendering on-premise delays obsolete. Therefore, the contract intelligence market expands rapidly as cloud infrastructure lowers barriers to entry.

- Browser-based access eliminates the need for complex local software installations.

- Automatic security patches ensure immediate protection against emerging cyber threats.

- Disaster recovery protocols in the cloud offer superior business continuity guarantees.

Scalable storage architecture effortlessly handles the exponential growth of enterprise data, supporting AI workloads that on-premise servers cannot manage. The operational expenditure model appeals to CFOs by removing heavy upfront hardware capital. Furthermore, remote work dynamics have permanently cemented the need for anywhere-access to legal repositories. As a result, cloud deployment remains the preferred delivery method within the contract intelligence market.

Large Enterprises Drive Consumption through M&A Velocity and Governance Needs

Based on enterprise size, large enterprises emerged as the largest consumers of the contract intelligence by capturing the highest 71.20% market share. These conglomerates utilize advanced tools to accelerate due diligence during cross-border Mergers and Acquisitions, processing data rooms in days rather than weeks. Global subsidiaries leverage centralized repositories to maintain consistent legal standards across diverse jurisdictions. Moreover, the establishment of Legal Centers of Excellence relies heavily on automation to handle massive procurement volumes efficiently. ROI realization happens quickly for these giants, as they automate thousands of sales agreements to improve deal velocity. Hence, large players fuel the contract intelligence market to maintain operational agility.

- "Guardian Agents" are deployed to autonomously oversee and audit AI actions.

- Automated ESG tracking enforces sustainability commitments across vast supply chains.

- Digitization of legacy archives unlocks hidden value in long-term agreements.

Complex inter-company agreements require the sophisticated mapping capabilities that only enterprise-grade solutions provide. High litigation costs drive the adoption of tools that ensure audit readiness at a moment's notice. Additionally, large firms prioritize "Sovereign AI" models trained on their proprietary data to protect intellectual property. The contract intelligence market continues to see its most significant revenue streams come from these massive organizational deployments.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

Proactive Risk Management Applications Lead via Inflation and Obligation Monitoring

When it comes application, contract intelligences are primarily used for smart risk management. This application held a notable 29.2% market share in 2024. Proactive mitigation strategies have replaced reactive firefighting, as systems now flag risks before contracts are even signed. Automated clause variance analysis instantly identifies deviations from standard terms, preventing unauthorized liability exposure. Furthermore, inflation-adjusted pricing clauses are now automatically triggered and monitored to protect margins during economic volatility. Supply chain disruptions are mitigated through real-time visibility into vendor obligations and force majeure conditions. Consequently, risk leaders prioritize the contract intelligence market to safeguard revenue.

- Credit monitoring integrations warn of counterparty financial distress pre-execution.

- Missed renewal deadline alerts prevent unwanted auto-renewals and revenue leakage.

- Fraud detection algorithms analyze payment terms to flag anomalous behavior patterns.

Regulatory alignment features track GDPR and CCPA obligations dynamically, reducing non-compliance penalties. Dispute reduction is achieved by clarifying ambiguous terms through AI scoring prior to execution. Moreover, liability cap analysis ensures the organization is never over-exposed in a single deal. Thus, smart risk management remains the critical value driver within the contract intelligence market.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America Dominates Global Contract Intelligence Market With Thirty Five Percent Share

North America remains the undisputed heavyweight of the contract intelligence landscape, commanding a decisive 35% market share in 2025. This dominance is structurally anchored by the region's massive capital injection into legal technology, evidenced by the record USD 4.98 billion raised by sector startups in 2024. The region is not just buying these tools; it is building them. With headquarters for giants like DocuSign, Ironclad, and Icertis clustered in US tech hubs, adoption is native and rapid.

The primary driver here is the prohibitive cost of human legal work; with complex agreements costing USD 49,000 to process manually, American enterprises are aggressively automating to protect margins. Consequently, 33 Fortune 100 companies have standardized on Icertis, proving that the US market views contract intelligence as a critical enterprise asset rather than optional software.

Asia Pacific Accelerates Past Europe To Claim Second Largest Market Position

Trailing North America, the Asia Pacific region has surged to become the second-largest hub for contract intelligence market consumption. This growth is fueled by complex supply chain dependencies rather than just legal compliance. With platforms like Sirion managing 1 million supplier relationships, a significant portion of this volume originates from manufacturing corridors in China, India, and Southeast Asia where visibility is paramount. The region is also the talent engine powering the industry; major providers like Icertis and Sirion house a vast majority of their combined 3,000+ workforce in India, creating a localized ecosystem of expertise.

Furthermore, the region’s mobile-first business culture is driving unique adoption patterns, where integrations like DocuSign’s WhatsApp connector—reaching 2 billion users globally—are seeing their highest functional utility in APAC markets that often bypass traditional desktop contracting workflows.

Europe Leverages Regulatory Complexity To Drive Steady Contract Intelligence Market Growth

Europe maintains a strong third position in the contract intelligence market, driven by a fractured regulatory environment that makes manual contract management legally perilous. The European market prioritizes "compliance-first" intelligence over pure speed. With the EU’s stringent data and AI regulations, organizations rely on platforms capable of identifying 230 distinct clause types to instantly audit for GDPR and ESG adherence across 27 distinct jurisdictions. The requirement for linguistic versatility is non-negotiable here, forcing demand toward platforms like Icertis that actively support 40 languages for intelligence operations.

While adoption volume is lower than in APAC, the complexity of European deployments is significantly higher. Enterprises here are utilizing intelligence tools to track 30 distinct performance metrics, ensuring that cross-border agreements do not violate the continent’s dense web of statutory obligations.

Top 10 Recent Developments in Contract Intelligence Market

- Sirion Launches AgenticOS: In October 2025, Sirion unveiled agentOS and AskSirion, shifting from static CLM to a "system of intelligence" where autonomous agents collaboratively handle drafting, negotiation, and risk assessment without human intervention.

- DocuSign IAM Expansion: DocuSign updated its Intelligent Agreement Management (IAM) platform in November 2025 with new Navigator APIs, allowing enterprises to ingest, structure, and search millions of legacy agreements from external ERP systems.

- Ironclad AI Agents: Ironclad released a new wave of "Agentic AI" in November 2025, featuring specific Intake and Redlining Agents alongside its Jurist assistant to fully automate the "front door" of legal requests.

- LegalOn Series E Funding: LegalOn Technologies raised USD 50 million in Series E funding in July 2025, using the capital to expand beyond contract review into full-scale Matter Management and accelerate US market penetration.

- ContractPodAi Leah AgenticOS: In October 2025, ContractPodAi launched Leah AgenticOS, a platform designed to orchestrate multiple AI agents across legal and finance functions, utilizing OpenAI’s latest reasoning models for complex logic in the contract intelligence market.

- Agiloft "AI Your Way": Agiloft introduced White Box AI capabilities in February 2025, giving users transparency into AI reasoning, alongside a GenAI Prompt Lab that allows legal teams to build custom, reusable prompt libraries.

- Thomson Reuters CoCounsel Updates: In November 2025, Thomson Reuters added agentic workflows to CoCounsel, enabling the "Bulk Document Review" of up to 10,000 documents simultaneously for rapid M&A due diligence.

- LinkSquares Autonomous Scoring: LinkSquares released Autonomous Risk Scoring Agents in April 2025, which proactively monitor contract portfolios for non-compliant clauses and renewal risks without requiring user-initiated queries.

- Icertis Vera AI: Icertis integrated Vera, a next-generation AI engine, into its platform in early 2025, utilizing an OmniModel strategy to leverage best-in-class LLMs for industry-specific vertical compliance.

- Icertis Strategic Recognition: By late 2025, Icertis was recognized as a Leader in the Forrester Wave for CLM, specifically cited for its Copilot adoption rates and ability to integrate agentic workflows into Microsoft Dynamics 365.

List of Key Companies Profiled:

- Adlib

- Brightleaf Solutions

- Conductiv

- Conga

- Cortical.io

- Deloitte (Taj)

- DocuSign (Seal Software)

- Donnelley Financial Solutions (eBrevia)

- Evisort

- FTI Consulting (FTI Technology)

- GEP

- Iceric

- iManage

- Infosys (EdgeVerve Systems)

- Kira Systems

- Knowable

- Legartis

- MRI Software (Leverton)

- Scry Analytics

- Uhura Solutions

- Suplari

- Wipro

- Other major players

Market Segmentation Overview:

By Component

- Software

- Services

By Deployment

- On-Premises

- Cloud

By Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

By Application

- Data Extraction & Classification

- Contract Creation

- Information security

- Streamlining Contract Workflow

- Smart risk management

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)