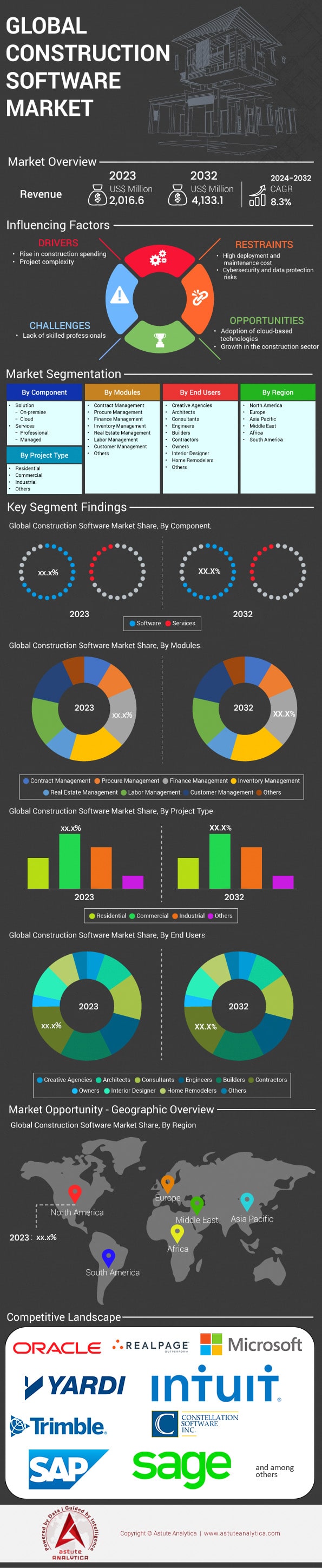

Global Construction Software Market: By Component (Solution and Services); Modules (Contract Management, Procure Management, Finance Management, and Others); Project Type (Residential, Commercial, Industrial, and Others); End User (Creative Agencies, Architects, Consultants, and Others); and Region—Industry Dynamics, Market Size and Opportunity Forecast for 2024–2032

- Last Updated: 17-Sep-2024 | | Report ID: AA0222131

Market Scenario

Global Construction software market is anticipated to reach US$ 4,133.1 million by 2032 from US$ 2,016.6 million in 2023, registering a CAGR of 8.3% during the forecast period 2024-2032.

The demand for construction software is on the rise due to the increasing complexity of projects, the need for enhanced efficiency, and the industry's digital transformation. Modern construction projects often involve multiple stakeholders, intricate designs, and tight schedules, necessitating advanced software solutions to manage these challenges. The global construction industry is substantial, with forecasts predicting it could reach a value of $14 trillion by 2025. Correspondingly, the construction software market is expanding, with valuations estimated around $2.5 billion in recent years. Urbanization continues to drive demand, with the United Nations estimating that approximately 4.4 billion people lived in urban areas as of 2020, a number expected to grow, increasing the need for efficient construction practices supported by software. The industry employs over 100 million people worldwide, highlighting its scale and importance.

Prominent construction software includes Autodesk's Revit and AutoCAD for design and Building Information Modeling (BIM), Procore's project management platform, Oracle's Aconex for project collaboration, and Trimble's Tekla Structures for structural engineering. Leading providers in this space are Autodesk Inc., Procore Technologies Inc., Oracle Corporation, Trimble Inc., and Bentley Systems. Major applications of construction software encompass project management, design and modeling, scheduling, cost estimation, and field service management. The primary end users are construction firms, contractors, architects, engineers, and project managers. Procore reported that its platform has been used to manage over one million construction projects globally. Autodesk has millions of users across more than 180 countries, reflecting its widespread adoption. BIM adoption is becoming mandatory in many regions; for example, the UK government mandated the use of BIM Level 2 for all public-sector construction projects.

Construction software market significantly impacts end users by enhancing efficiency, reducing costs, and improving overall project outcomes. Firms adopting BIM have reported substantial cost savings due to reduced errors and minimized rework, with some projects saving hundreds of thousands of dollars. The use of project management software allows companies to better coordinate resources, often leading to time savings measured in weeks or months on large projects. Mobile device usage on construction sites has increased, with estimates suggesting that millions of construction professionals now utilize mobile apps for on-site data access and communication. Investment in cloud-based construction solutions has grown, with the market seeing significant capital inflows as firms seek scalable and accessible tools. The average large construction project involves coordination among over 30 different subcontractors, underscoring the need for integrated software solutions. Overall, construction software empowers industry professionals to meet the challenges of modern projects more effectively, leading to improved productivity and profitability.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing demand for real-time collaboration boosts construction software adoption among firms

The construction industry is experiencing a significant shift towards real-time collaboration, which is fundamentally transforming project management and execution, giving a boost to the construction software market. Real-time collaboration tools enable stakeholders to communicate efficiently, share updates instantly, and resolve issues promptly, leading to enhanced productivity. With construction projects often involving multiple teams across various locations, real-time collaboration ensures that all parties are aligned and informed. Recent statistics indicate that the average construction project involves over 20 different stakeholders, highlighting the need for seamless communication. Furthermore, studies suggest that over 60% of construction firms have adopted some form of real-time collaboration software to enhance their workflows. The average time saved per project due to these tools is estimated to be around 10 hours weekly, underscoring their impact on efficiency.

Additionally, the adoption of real-time collaboration software is driven by the need to reduce costly errors and rework. On average, construction projects experience delays of approximately 20 days, often due to miscommunication. By implementing software solutions that facilitate real-time updates, companies can significantly reduce these setbacks. Data shows that firms utilizing such tools report a decrease in project delays by up to 30%. The construction software market has seen a substantial increase in investments, with over $1 billion allocated to developing advanced collaboration tools in the past year. This trend aligns with the industry's growing recognition of the value of real-time collaboration in enhancing project delivery and client satisfaction. As the demand for these solutions continues to rise, the construction sector is poised for increased efficiency and innovation.

Trend: Growing adoption of cloud-based solutions facilitates seamless access and data sharing

The construction industry is witnessing a growing trend towards cloud-based solutions, which are revolutionizing how data is accessed and shared among stakeholders. Cloud technology in the construction software market allows for the centralized storage of project data, making it accessible to authorized users anytime and anywhere. This accessibility is crucial in an industry where teams often work in remote locations. Statistics reveal that over 70% of construction firms have migrated some or all of their operations to the cloud, reflecting the widespread acceptance of this technology. The average construction project generates around 56 gigabytes of data, emphasizing the need for robust cloud solutions to manage and share this information effectively. Additionally, cloud-based systems have been shown to reduce IT maintenance costs by up to $175,000 annually for large construction firms.

Moreover, cloud-based solutions offer significant scalability and flexibility, allowing construction companies to adapt quickly to changing project needs. With the ability to integrate with other digital tools, such as BIM and project management software, cloud platforms enhance collaborative efforts and streamline operations. Reports indicate that the use of cloud technology has contributed to a 15% increase in overall project efficiency and a reduction in project completion times. The construction software market is responding to this trend, with over 200 new cloud-based applications introduced in the last year alone. As firms continue to embrace these solutions, they are better positioned to meet the demands of modern construction projects, including real-time updates and data-driven decision-making. The shift towards cloud-based systems is not just a trend but a critical evolution in the construction industry's digital transformation journey.

Challenge: Complex Implementation Processes Lead to Prolonged Integration Times and Increased Operational Disruptions

The implementation of construction software market often involves complex processes that can significantly disrupt existing operations. This challenge is particularly pronounced in large firms where integrating new systems with legacy infrastructure is intricate and time-consuming. On average, the integration of new construction software can take anywhere from six months to a year, depending on the complexity of the existing systems. Reports indicate that the average construction firm dedicates approximately 120 hours of IT resources per month during the integration phase to address technical issues and ensure compatibility. Moreover, the cost of implementation can range from $50,000 to over $500,000, which is a substantial investment, especially for medium-sized companies. During this period, firms often experience operational disruptions, with an average of 15 workdays affected due to system downtimes and workflow adjustments.

In addition to the lengthy integration times, the complexity of these processes often leads to unforeseen challenges in the construction software market that further delay implementation. For instance, data migration from old systems to new platforms can be a significant hurdle, with firms reporting an average data migration time of 45 days. Additionally, over 40% of firms encounter unexpected compatibility issues that require additional custom development, adding another layer of complexity. The construction industry is also grappling with a shortage of skilled IT professionals, which exacerbates these challenges. Statistics show that the demand for IT specialists in construction software implementation has increased, with over 10,000 job openings reported in the past year. These challenges underscore the need for more streamlined implementation processes and better support from software vendors to ensure a smoother transition. As construction firms continue to adopt advanced technologies, addressing these integration hurdles is crucial for maximizing the benefits of construction software solutions.

Segmental Analysis

By Component

By component, the software segment capturing more than 63% market share. The segment is increasingly outpacing the hardware segment due to several key factors that highlight the importance of digital transformation in the industry. One of the primary reasons for software's prominence is the necessity for advanced project management solutions to handle the growing complexity and scale of construction projects. For instance, over 75% of construction companies now utilize software platforms for project management and financial management, which streamline operations, enhance efficiency, and reduce costs. Furthermore, the industry has seen a significant rise in the use of cloud-based solutions, with more than 60% of firms adopting these technologies to enable remote collaboration and real-time data analytics. The integration of smart devices and AI-driven analytics further enhances the appeal of software, with over 45,000 construction firms globally implementing AI tools to improve decision-making processes.

Key software solutions in the construction software market like Building Information Modeling (BIM) have become dominant forces in the industry, adopted by over 40% of construction firms to facilitate collaboration and improve project outcomes. In addition, the demand for mobile construction apps has surged, with more than 35 million downloads recorded globally in the last year, reflecting the industry's shift towards mobile-first strategies. The adoption of digital twins has also increased significantly, with more than 10,000 large-scale projects currently utilizing this technology to optimize planning and execution. Moreover, construction firms are increasingly investing in cybersecurity measures, with over 50,000 companies prioritizing software solutions to protect their digital assets. As businesses and investors continue to focus on construction technology, the software segment is poised for further growth. This is supported by the increasing adoption of digital tools and platforms that enhance productivity and project delivery, collectively underscoring the software segment's prominence over hardware in the construction market.

By End Users

Contractors are the largest end users of construction software market with 17% market share, driven by their critical role in managing intricate construction projects. The software equips them with essential tools for collaborative management, streamlining communication from bidding to project completion. This capability is indispensable for coordinating multiple stakeholders and ensuring timely, budget-friendly project delivery. A recent industry report highlighted that contractors are utilizing construction software to complete projects up to 30% faster than traditional methods. Additionally, cloud technology integration offers real-time data access, essential for swift decision-making. It has been observed that over 70% of contractors are now using mobile devices to access construction software on-site, enhancing flexibility and responsiveness. Automation features help reduce manual documentation, allowing contractors to manage larger workloads efficiently. Contractors have reported a significant decrease in project delays due to the predictive analytics capabilities of advanced construction software.

The dominance of contractors in construction software market is also influenced by their need to align with industry trends like sustainability. As the construction industry increasingly prioritizes eco-friendly practices, contractors utilize software to optimize resource use and minimize waste. Recent insights reveal that contractors using advanced software have seen a notable reduction in material waste, contributing to more sustainable building practices. Moreover, construction software has enhanced productivity by automating routine tasks and improving project management efficiency, making it indispensable for contractors aiming to maintain a competitive edge. Building Information Modeling (BIM) adoption among contractors is rising, with many reporting improved project visualization and planning. Contractors also benefit from enhanced risk management, as software provides advanced analytics and predictive insights. In terms of safety, contractors have found that software aids in significantly reducing on-site accidents by improving hazard identification and communication. This technological adoption is not merely keeping pace with industry standards but also about gaining a competitive advantage by delivering projects more efficiently and effectively.

By Module

Finance management has emerged as the most significant revenue-generating module in the construction software market by capturing over 18.9% market share, driven by the industry's growing complexity and the critical need for precise financial control. With global construction projects accounting for expenditures exceeding $11 trillion annually, the pressure to manage costs, budgets, and financial risks effectively has never been higher. This necessity is magnified by large-scale infrastructure initiatives, such as the $1.2 trillion Infrastructure Investment and Jobs Act in the United States, which have fueled demand for comprehensive financial management solutions. The global construction software market was valued at $9.6 billion in 2021, with a substantial portion of this value attributed to finance management tools that provide real-time financial analytics, streamline accounting processes, and ensure regulatory compliance. Notably, more than 200,000 construction firms worldwide have integrated finance management modules into their operations, reflecting the widespread adoption and critical nature of these tools in maintaining financial health and operational efficiency.

Supporting the dominance of finance management software are several compelling statistics. The industry faces annual losses exceeding $120 billion due to cost overruns, underscoring the need for robust financial oversight. Companies utilizing advanced financial tools report saving up to $7 million on average per large project, highlighting the tangible benefits of these solutions. Furthermore, firms have avoided regulatory fines totaling $2.5 billion by ensuring compliance through finance management software. Integration capabilities are crucial, with over 70% of construction firms requiring their finance software to work seamlessly with existing project management and procurement systems, driving further software adoption. The demand for on-site financial management is evident, with sales of finance management apps for mobile devices reaching $500 million. The growth of cloud-based finance solutions, now a $3 billion market, offers scalability and remote access. Additionally, investments in AI-driven finance tools have surpassed $1 billion, enhancing forecasting and decision-making capabilities. Collectively, these statistics not only demonstrate the critical role finance management plays in the construction industry but also underscore its position as the leading revenue-generating module in the construction software market.

By Project Type

Based on project type, the commercial segment is leading the market with over 37% market share. The prominence of the commercial segment in the construction software market can be attributed to several key factors that underscore its significance. One of the primary reasons is the increasing complexity and scale of commercial projects, which necessitate advanced software solutions to manage timelines, budgets, and resources effectively. The demand for integrated project management tools is further fueled by the rise of smart building initiatives and the need for sustainable construction practices. Commercial projects often involve multiple stakeholders, ranging from architects and engineers to contractors and facility managers, each requiring seamless communication and collaboration platforms. According to a recent survey, there are over 20 million construction professionals worldwide utilizing software solutions to enhance project efficiency and accuracy. Moreover, more than 15,000 large-scale commercial buildings are constructed globally each year, creating a substantial need for specialized software to handle intricate project requirements.

Major end users in the commercial construction segment of the construction software market include real estate developers, large corporations, and government entities, all of whom seek to optimize their investment in infrastructure. Real estate developers, for instance, are increasingly adopting Building Information Modeling (BIM) software, with over 30,000 projects globally leveraging this technology for enhanced design and construction efficiency. Large corporations are also investing in software solutions for their headquarters and operational facilities, as seen with more than 10,000 corporate office projects annually utilizing advanced project management tools. Government entities, responsible for public infrastructure projects such as hospitals and schools, are another significant group of end users, with over 5,000 government-backed projects integrating construction software for improved oversight and accountability. The commercial segment's dominance is further reinforced by the adoption of cloud-based solutions, with over 25,000 construction professionals using these platforms for real-time data access and decision-making. This collective demand from diverse end users propels the commercial segment to the forefront of the construction software market.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America, particularly the United States, stands as the largest construction software market globally due to several interlinked factors. The region's advanced technological infrastructure, robust construction industry, and high adoption rates of digital solutions contribute significantly to its leading position with revenue share of 31.2%. However, the region is projected to lose its dominance to Asia Pacific region by the end of 2030. In 2023, the construction industry in North America was valued at over $2 trillion, with software solutions playing a crucial role in streamlining operations and improving efficiency. The U.S. construction sector, in particular, has embraced technological advancements, with over 80% of firms now utilizing construction management software. The high demand for enhanced productivity, coupled with the necessity to adhere to stringent regulatory requirements, has fueled the adoption of software solutions that offer real-time analytics, project management, and risk assessment capabilities. The presence of major technology companies, coupled with substantial investments in research and development, further solidifies North America's leadership in this market.

In response to the escalating demand for construction software, the United States has witnessed a proliferation of innovative solutions tailored to meet diverse industry needs. The U.S. construction software market is projected to surpass $2.5 billion by 2025, driven by the increasing integration of artificial intelligence and IoT technologies. The adoption of Building Information Modeling (BIM) software has become a standard practice, with over 60% of construction companies using it to enhance collaboration and efficiency. Furthermore, the growing trend of remote work and the need for cloud-based solutions have accelerated the deployment of software platforms, with cloud-based construction software accounting for more than half of the market value. The U.S. government also plays a pivotal role by implementing favorable policies and investing in smart city projects, further boosting the demand for advanced construction technologies.

In contrast, the Asia Pacific region, while rapidly emerging, faces distinct challenges and opportunities in the construction software market. The region's construction industry is booming, with China and India being major contributors, as evidenced by the $1.3 trillion construction output reported in 2023. However, the adoption of construction software is still in its nascent stages compared to North America. The market size in Asia Pacific is estimated to reach $1 billion by 2026, driven by increased urbanization and infrastructure development. The primary focus is on mobile and cloud-based solutions to cater to the region's diverse and geographically dispersed projects. Despite the slower adoption rate, there is a growing recognition of the benefits of digitalization, with countries like Japan and Singapore leading the way in implementing smart construction technologies. The Asia Pacific market is poised for significant growth as awareness and investment in construction software continue to rise, supported by governmental initiatives aimed at modernizing the construction sector.

List of Key Companies Profiled:

- Sage Group PLC

- Oracle Corporation

- Autodesk, Inc.

- Roper Technologies, Inc.

- Trimble Inc.

- Constellation Software Inc.

- BIMobject AB

- RIB Software SE

- Comprotex Software Inc.

- Procore Technologies Inc.

- BuilderMT, LLC.

- PlanGrid, Inc.

- Heavy Construction Systems Specialists

- Jonas Construction Software Inc.

- ECI Software Solutions Inc.

- Other Prominent Players

Market Segmentation Overview:

By Component:

- Solution

- On-premise

- Cloud

- Services

- Professional

- Managed

By Modules:

- Contract Management

- Procure Management

- Finance Management

- Inventory Management

- Real Estate Management

- Labour Management

- Customer Management

- Others

By Project Type:

- Residential

- Commercial

- Industrial

- Others

By End Users:

- Creative Agencies

- Architects

- Consultants

- Engineers

- Builders

- Contractors

- Owners

- Interior Designer

- Home Remodelers

- Others

By Region:

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The U.K.

- Germany

- France

- Spain

- Italy

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- South America

- Argentina

- Brazil

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2023 | US$ 2,016.6 Mn |

| Expected Revenue in 2032 | US$ 4,133.1 Mn |

| Historic Data | 2019-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Unit | Value (USD Mn) |

| CAGR | 8.3% |

| Segments covered | By Component, By Modules, By Project Type, By End Users, By Region |

| Key Companies | Sage Group PLC, Oracle Corporation, Autodesk, Inc., Roper Technologies, Inc., Trimble Inc., Constellation Software Inc., BIMobject AB, RIB Software SE, Comprotex Software Inc., Procore Technologies Inc., BuilderMT, LLC., PlanGrid, Inc., Heavy Construction Systems Specialists, Jonas Construction Software Inc., ECI Software Solutions Inc., Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)