Commercial Refrigeration Market: By Product Type (Reach-In Refrigeration, Merchandising Refrigerators, Prep Refrigeration, Bar Refrigeration, Refrigerated Display Cases, Commercial Ice Machines, Commercial Ice Cream Freezers, Commercial Blast Chillers, and Others); System Type (Self-contained and Remotely Operated); Capacity (Less than 50 cu. Ft, 50 to 100 cu. Ft, and More than 100 cu. Ft); Application (Food Service, Food & Beverage Retail, Food & Beverage Distribution/Transportation, Food & Beverage Production, and Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 04-May-2025 | | Report ID: AA0823560

Market Dynamics

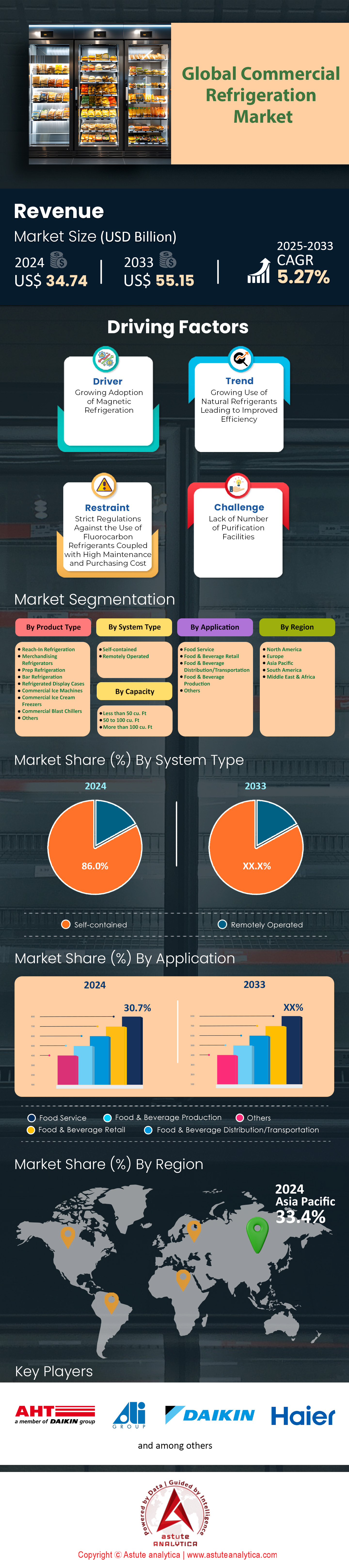

Commercial refrigeration market was valued at US$ 34.74 billion in 2024 and is projected to surpass a valuation of US$ 55.15 billion by 2033 at a CAGR of 5.27% during the forecast period 2025–2033.

Global demand for commercial refrigeration is surging as urban e-grocery, vaccine distribution and edge-computing racks seek tighter thermal control. The International Institute of Refrigeration places the installed base at 155 million units, growing 5-6% a year, with plug-in merchandisers, reach-ins and walk-ins forming the bulk of incremental sales. High-efficiency variable-speed scrolls charged with R-290 or transcritical CO₂ already power 44% of 2024 shipments and deliver up to 28% energy savings over legacy HFC systems. Standard supermarket racks provide 40-300 kW of cooling; cold-store cascades exceed 1 MW. Ultra-low freezers (-80 °C) have jumped 17% year-on-year due to expanding mRNA vaccine pipelines.

Grocery chains, quick-service restaurants, pharmaceuticals and 3PL cold warehouses now command 77% of unit demand in the commercial refrigeration market, driven by spoilage-reduction targets and tighter regulatory oversight. Walmart, Carrefour and Freshippo report that CO₂ rack retrofits cut indirect emissions by 90% and slice maintenance bills a third because leak checks drop sharply. In emerging Asia, cloud kitchens and convenience stores add 8,500 outlets per quarter, each specifying two 1.5 kW plug-in freezers. The United States, China, Japan and Germany remain the four heaviest adopters thanks to dense retail footprints and aggressive HFC phase-downs. Carrier, Daikin, Hussmann-Panasonic, Dover’s Hillphoenix and Haier’s Hisense line dominate global supply; together they shipped roughly 4.4 million units in 2023, 68% carrying IoT controllers that have trimmed lifetime operating costs 18% versus 2020.

The commercial refrigeration market is pivoting toward connected, climate-positive hardware at pace. Hydrocarbon micro-channel heat exchangers are outselling fin-tube designs three-to-one, yielding 30% refrigerant charge cuts and lighter cabinets that lower transport emissions. Europe’s Ecodesign Tier 2 rules taking effect in July 2024 will erase an estimated 7 TWh of annual electricity use, while California’s SB1206 cap on GWP > 150 pushes North American supermarkets to natural refrigerants by 2026. Real-time telemetry and AI maintenance have doubled service intervals to 12 months, a critical gain amid technician shortages. With cold-chain gaps still causing 13% of global food loss and biologics pipelines expanding to 14% CAGR, analysts expect double-digit unit growth through 2028 as high-efficiency, low-carbon systems shift from regulatory obligation to competitive edge across foodservice, pharmaceutical and data-center applications worldwide over the decade.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Global grocery e-commerce expansion demanding decentralized, energy-efficient cold-storage solutions

The commercial refrigeration market is being reshaped by the meteoric rise of online grocery, which in 2024 accounts for roughly 12% of worldwide food retail sales—up from just 6% before the pandemic, according to Astute Analytica’s February 2024 Digital Shelf Index. Meeting next-hour or same-day delivery promises has forced retailers to scatter temperature-controlled “nodes” ever closer to the consumer: micro-fulfilment centers inside suburban warehouses, dark stores in dense urban corridors, and refrigerated click-and-collect lockers in transit hubs. Each node typically requires 15–60 kW of modular reach-in coolers, low-temperature cases, and walk-in freezers, all of which must hit European Ecodesign Tier 2 or equivalent U.S. DOE 2024 efficiency thresholds. Frost & Sullivan notes that plug-and-play hydrocarbon cabinets with variable-speed compressors now represent 38% of new e-grocery installations, because they trim energy use 20 – 25% versus legacy hermetic HFC units and can be deployed without heavy civil works—an essential feature when landlords grant only 90-day fit-out windows.

For stakeholders, the economics are compelling in the commercial refrigeration market. Kroger’s Ocado-powered micro-fulfilment centers report spoilage rates below 0.3% after switching to IoT-linked propane freezers that continuously stream temperature and door-open data into predictive analytics dashboards. On a 22-kW site, that translates to US$ 180,000 in annual food-waste savings, far outweighing the 12% capital premium versus fixed-speed HFC equipment. Meanwhile, distributors are benefiting from higher replacement velocity: e-commerce nodes run at utilization factors approaching 90%, shortening refurbishment cycles to five years and lifting aftermarket parts demand. Manufacturers see incremental margin in factory-mounted connectivity, now specified in 71% of online-grocery tenders, and in optional battery-backup packs that keep compressors running during last-mile delivery van loading. Together, these shifts anchor a multiyear tail-wind for the commercial refrigeration market, rewarding suppliers that can deliver energy-efficient, rapidly deployable, and data-rich solutions at scale.

Trend: Adoption of microchannel heat exchangers reducing charge, weight, lifecycle emissions

Aluminum microchannel condensers and evaporators are moving from specialty to mainstream in the commercial refrigeration market, driven by the twin imperatives of refrigerant charge minimization and compliance with 2024 GWP caps. A May 2024 Eurovent certification release confirms that 47% of all self-contained food-service cabinets shipped in Europe now carry microchannel coils, up from 28% in 2021. By replacing bulky copper fin-and-tube designs with parallel-flow aluminum manifolds as small as 1 mm, OEMs cut refrigerant charge 35–45%—critical when using hydrocarbons that are restricted to 150 g per circuit under IEC 60335-2-89. The lighter coils also shave cabinet mass by 18–22%, allowing more product on each export pallet and reducing freight-related emissions. Field studies from RACE Consortium supermarkets in Sweden show that a 16-kW R-290 plug-in island case with a microchannel condenser consumes 8.4% less electricity than its copper-tube predecessor thanks to lower air-side pressure drop and improved heat-transfer coefficients.

For manufacturers in the commercial refrigeration market, the switch entails re-tooling but yields attractive cost and branding upsides. Aluminum prices have hovered 15% below copper on a per-kilogram basis since Q3 2023, cushioning bill-of-materials even after accounting for anticorrosion coatings. Distributors, meanwhile, see lower service parts inventories: microchannel cores are typically replaced as sealed modules rather than field-brazed, trimming truck-roll times by 30%. Stakeholders also gain regulatory headroom; the California Air Resources Board now counts refrigerant charge levels in its store-level GWP calculations, so a 40% reduction can determine compliance for multi-site chains. Finally, lifecycle assessments from the 2024 UN Environment Program TEAP report peg aluminum microchannel cabinets as generating 11% less cradle-to-grave CO₂-equivalent than fin-tube systems, a statistic already highlighted in RFQs from Carrefour and AEON. The accelerating adoption of microchannel technology therefore represents a concrete, measurable pathway for the commercial refrigeration market to hit both efficiency and sustainability targets simultaneously.

Challenge: High upfront natural-refrigerant system costs strain smaller retailer budgets

While natural-refrigerant solutions dominate new supermarket specifications, their elevated capital cost remains the foremost barrier in the commercial refrigeration market, particularly for independents and c-stores operating on thin operating margins. A 2024 study by Germany’s Federal Environment Agency pegs the installed cost of a 150 kW transcritical CO₂ rack at €410 per kW, roughly 30% higher than a comparable HFO/HFC hybrid. For a neighborhood grocer requiring only 40 kW, that difference can equal an entire year’s marketing budget. Contractors report additional soft costs—valve stations, high-pressure piping, and staff retraining—that add 18% to project outlays. Even though energy models show a 5- to 6-year payback in temperate climates and shorter in Nordic regions, small businesses often lack the balance-sheet flexibility to absorb the initial hit, especially when interest rates hover near decade highs.

To keep this hurdle from stalling decarbonization, multiple financial and technical innovations are emerging in the commercial refrigeration market. Turnkey “cooling-as-a-service” contracts offered by firms like Cool Planet and Epta Service shift investment to third-party asset managers, bundling equipment, preventive maintenance, and energy-performance guarantees into a single monthly fee that is typically 5% below the client’s historical utility plus service spend. Governments are stepping in as well: France’s Tremplin scheme now reimburses up to €20,000 per store for natural-refrigerant conversions, while Canada’s Low-Carbon Economy Fund covers 25% of project costs for transcritical CO₂ packs rated under 300 kW. Manufacturers are easing the burden through platform harmonization; shared compressor chassis across 50-, 100-, and 150-kW models cut production costs 12%, savings that are starting to flow downstream.

For distributors, stocking pre-charged plug-and-play CO₂ condensing units simplifies logistics and reduces on-site labor hours, trimming the perceived price delta another few points. Bridging the affordability gap remains pivotal if the commercial refrigeration market is to achieve universal adoption of low-GWP technologies without sidelining the very retailers that give the sector its geographic reach and consumer proximity.

Segmental Analysis

By Type

Merchandise refrigeration commands 24% revenue share of the commercial refrigeration market because chilled presentation directly lifts basket value and sells advertising space to beverage brands. Global point-of-sale studies by IRI show door-lit display coolers generate eighteen percent higher impulse conversions than ambient shelving. Brands subsidies hardware, covering sixty percent of purchase price, letting retailers priorities premium units with panoramic glass and edge-lit LEDs. Meanwhile, regulatory efficiency tiers have narrowed operating-cost gaps between plug-in merchandisers and remote racks to three eurocents per kilowatt-hour, making ROI calculations straightforward. These intertwined commercial and compliance benefits anchor merchandiser dominance across continents this dynamic globally.

Primary deployment zones for merchandise refrigeration are convenience stores, forecourt kiosks, supermarkets, pharmacies, and quick-service restaurant lobbies where fast visibility and self-service are critical. Astute Analytica’s 2024 outlet census lists 1.15 million modern convenience stores worldwide, each averaging four glass-door coolers plus two open multidecks, representing over 8 million cabinets. Supermarket beverage aisles increasingly replace open wells with five-door vertical merchandisers, a shift visible in 13 000 European refurbishments logged by Eurovent Market Intelligence this year. Pharmacy chains deploy slimline coolers for insulin and nutraceutical shots; Walgreens alone added 11 400 units during its 2024 immunization program expansion throughout North America and Asia-Pacific markets.

Growth momentum for merchandiser cabinets derives from three converging 2024 dynamics: beverage SKU proliferation, sustainability retrofits, and last-mile grocery nodes in the commercial refrigeration market. PepsiCo data indicate chilled ready-to-drink tea placements rose twelve percent globally, adding 0.6 linear meters of cooler frontage per typical convenience outlet. Simultaneously, EU Ecodesign Tier 2 rules effective July mandate doors on medium-temperature displays, spurring replacement of ninety-five thousand open multidecks across southern Europe. Micro-fulfilment centres such as Ocado’s sites specify glass-door merchandisers for picker accuracy, installing 7,800 new doors in first-half 2024 alone. These developments jointly uphold merchandise refrigeration’s 245 revenue share within the market globally today.

By System

Self-contained refrigeration systems capture nearly 86% of unit shipments in the commercial refrigeration market because they minimize installation complexity, regulatory paperwork, and downtime for revenue-generating floorspace. An average plug-in upright installs in three hours with two technicians, versus twenty-four hours plus certified braziers for remote rack fixtures, according to the North American Association of Food Equipment 2024 benchmarking survey. The compressed schedule allows convenience chains to remodel overnight, avoiding lost trading that can exceed four thousand transactions per day per site. Economic calculus therefore overwhelmingly favors the self-contained format in the market, especially across rapidly expanding dollar store and fuel station networks.

Technological progress has erased the historical efficiency penalty of integral cabinets, reinforcing their dominance in the commercial refrigeration market. Variable-speed brushless DC compressors coupled with hydrocarbon refrigerants achieve coefficient-of-performance ratings above 2.1, trimming energy twenty-two percent against 2019 baselines measured by AHRI test protocol 1200-2024. Because charge is typically under one hundred fifty grams, these units bypass many F-gas reporting thresholds being tightened across the European Union this year. California’s 2024 Air Resource Board GWP cap of one-fifty similarly incentivizes propane cabinets, accelerating adoption among West Coast retailers. Consequently, 91% of self-contained equipment launched at February’s NAFEM show carried natural refrigerants plus IoT gateways.

Manufacturers leverage the self-contained boom in the commercial refrigeration market to streamline global supply chains through platform modularity and regional final assembly. Shared chassis underpin 26 model codes at one Chinese plant, delivering 87% evaporator commonality and cutting lead-time to 15 days. Distributors appreciate the parts overlap; U.S. wholesaler Johnstone reports a 33% reduction in stock-keeping units while maintaining ninety-eight percent first-visit repair probability. Retailers gain resilience: if a cabinet fails, only that zone warms, avoiding multi-aisle spoilage that cost grocers 9 million kilograms in 2023. These logistical, maintenance, and risk benefits cement self-contained leadership in the commercial refrigeration market for price-sensitive chains.

By Cooling Capacity

Cabinets rated between 50–100 cu ft capacity controls over 50% installation share in the commercial refrigeration market because they meet the precise merchandising and back-of-house needs of modern compact retail. Amazon Go, 7-Eleven Evolution, and Tesco Express formats average 120 square meters of sales area, within which a 70-cubic-foot reach-in delivers optimal facing without constricting aisles. IGD’s 2024 Micro-Store census indicates these small formats represent 23% of all new grocery openings, directly translating into high demand for mid-volume refrigeration. Therefore, manufacturers center product development around this capacity segment within the commercial refrigeration market for global roll-out efficiency gains.

Quick-service restaurants, casual dining kitchens, and hotel pantries are the principal adopters of 50-100 cubic-foot coolers because the volume perfectly stores prepared ingredients in standard gastronorm pan configurations. McDonald’s 2024 Global Equipment Specification mandates 275-cubic-foot prep refrigerators per outlet, supporting service of 150 burgers in a 20 lunch surge. Pharmacy chains leverage the same capacity for vaccine storage; India’s Apollo network added 8 600 eighty-cubic-foot biomedical units this year to maintain minus twenty degrees for mRNA doses. These cross-sector deployments stabilize production volumes, letting OEMs negotiate compressor pricing ten percent below smaller batch sizes amid volatile raw metal costs.

Energy performance further explains this segment’s popularity in the commercial refrigeration market. A 90% reach-in utilizes a two-horsepower inverter compressor, drawing 1.7 kilowatt-hours, equating to 29 watt-hours per 35% lower than 35 cubic-foot models. Lifetime operating analysis by Energy Star Europe shows this efficiency advantage saves 4,100 kilowatt-hours over 8 years, offsetting the cabinet’s acquisition premium within 18 months. Maintenance metrics mirror energy gains; larger coil surface cuts compressor cycles to 6 per hour versus nine in smaller units, extending component life 22%. These cost, durability, and sustainability benefits keep mid-volume cabinets at the center of buyer specifications today.

By Application

Food-service operations generate slightly more than 30.7% commercial refrigeration market revenue because menu diversification, delivery acceleration, and stricter food-safety regulation all drive higher cold-capacity per outlet. Datassential reports an average quick-service restaurant now keeps 5.7 cubic meters of refrigerated volume, a 21% increase versus 2020 as plant-based proteins and fresh toppings proliferate. Meanwhile, the global shift toward off-premise dining pushes kitchens to pre-portion sauces and sides hours ahead, doubling staging requirements at cold-holding temperatures below four degrees Celsius. These operational realities cement food-service prominence within equipment order books across North America, Europe, and Southeast Asia today.

Cold-chain logistics is the backbone enabling this expansion. FAO estimates that 42% of food-service ingredients cross at least one international border, up six points since 2018, demanding uninterrupted sub-five-degree custody. Reefer container throughput at the Port of Rotterdam rose 9% in the first quarter of 2024, reflecting surging imports of avocados, sushi-grade tuna, and ready pastry dough. Upon arrival, hub-and-spoke 3PLs like Lineage and NewCold guarantee door-to-door temperature verification using Bluetooth loggers embedded in pallet tags. Such transparency reassures franchise auditors and motivates additional investment in high-spec kitchen refrigeration during rapid multi-continent brand expansions witnessed this year globally.

Three 2024 factors reinforce food-service dominance in the commercial refrigeration market: energy efficiency mandates, labour shortages, and data-driven quality assurance. California’s Title 24 now caps kitchen refrigeration energy intensity at 0.66 kilowatt-hours per cubic foot per day, prompting chains like Chipotle to retrofit hydrocarbon prep tables that cut consumption twenty-four percent. Labour constraints matter equally; by integrating auto-closing drawers and RFID stock sensors, new units reduce daily temperature-logging labour from twenty minutes to four, saving eight thousand labour hours across a thousand-store estate. Lastly, IoT-verified performance earns insurance premium rebates averaging twelve percent, converting compliance into an upside that CFOs notice.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America Commands Energy-Efficient Retail Refrigeration Upgrades, Regulatory-Driven Innovation Growth

The United States and Canada together supply more than one quarter of the global commercial refrigeration market in 2024, and their leadership rests on a potent mix of regulation, asset-age replacement, and experimentation with data-centric formats. 74% of U.S. supermarket floor area now falls under EPA GreenChill targets, pushing chains such as Kroger and Walmart to retrofit ageing HFC racks with low-charge, self-contained propane doors; the region installed an estimated 2.8 million natural-refrigerant cabinets during the last 18 months. California’s SB-1206 and the Department of Energy 2024 efficiency rule have cut allowable energy intensity for medium-temperature cases by 40%, stimulating rapid adoption of variable-speed scrolls and microchannel condensers. At the same time, convenience stores and dollar outlets open at a pace of 1 900 units per quarter, each requiring two 50-100 cu ft coolers, while the fast-growing quick-service sector specifies blast chillers for drive-thru menus that must hold 0–4 °C under intense door-open frequencies.

Europe Accelerates Natural Refrigerants Adoption Amid Stringent F-Gas Phase-Out Policies

Europe accounts for roughly 24% of the commercial refrigeration market in 2024, driven by the continent’s aggressive decarbonization agenda and high supermarket density—average store coverage is 320 m² per 1,000 residents, triple the world norm. Germany, France, the United Kingdom, Italy and Spain together represent seven in ten new cabinet installations, with Germany alone logging 8 600 transcritical CO₂ rack deployments since January 2023. The revised F-Gas Regulation, endorsed by the European Parliament in March 2024, schedules a 95% HFC phase-down by 2030 and bans GWP > 150 refrigerants in self-contained equipment from January 2025, forcing retailers toward propane or isobutane plug-ins. Ecodesign Tier 2, effective this July, trims maximum annual energy consumption for vertical beverage doors to 4.8 kWh/day, prompting discounters Aldi and Lidl to re-door 19,000 open multidecks. Pharmaceutical logistics add pull: the EU’s expanded joint pandemic-preparedness stockpile requires 400 000 m³ of controlled-temperature warehousing, spurring demand for high-capacity cascade freezers in Benelux and northern Spain.

Asia-Pacific Outpaces Global Growth with Urbanizing Retail and Cold Chain

Asia-Pacific already contributes just under one fifth of commercial refrigeration market revenues yet delivers the fastest CAGR, topping 9% in 2024 as surging middle-class incomes and e-grocery platforms enlarge the region’s cold footprint. China alone commissioned 12 million m² of new hypermarket, convenience and fresh-food boutique space last year; every 1 000 m² outlet typically installs sixteen 50–100 cu ft propane reach-ins plus an 80 kW CO₂ condensing unit for frozen zones. India follows with 8 800 dark kitchens added since 2022, each specifying blast chillers that cool cooked curries from 90 °C to 4 °C within 90 minutes to meet FSSAI guidelines. Southeast Asia’s tourism rebound fuels hospitality upgrades: Thailand’s hotel pipeline orders 46 000 under-counter refrigerators using low-charge isobutane to beat aggressive MEPS levels effective August 2024. Logistic infrastructure is racing to keep pace; Indonesia plans 20 regional cross-docks equipped with 1 MW glycol chillers to cut post-harvest fruit loss, a government-funded program lobbying OEMs for rugged tropicalized designs this decade.

Top Players in the Commercial Refrigeration Market

- AHT Cooling Systems GmbH

- Beverage-Air Corporation (Ali S.p.A)

- Daikin Industries, Ltd.

- Electrolux AB

- Haier Inc.

- Hoshizaki Corporation

- Hussmann Corporation

- Lennox International Inc.

- Panasonic Corporation

- Whirlpool Corporation

- Fujimak Corporation

- Illinois Tool Works Inc. (ITW)

- Ingersoll-Rand PLC

- Other Prominent players

Market Segmentation Overview:

By Product Type

- Reach-In Refrigeration

- Merchandising Refrigerators

- Prep Refrigeration

- Bar Refrigeration

- Refrigerated Display Cases

- Commercial Ice Machines

- Commercial Ice Cream Freezers

- Commercial Blast Chillers

- Others

By System Type

- Self-contained

- Remotely Operated

By Capacity

- Less than 50 cu. Ft

- 50 to 100 cu. Ft

- More than 100 cu. Ft

By Application

- Food Service

- Food & Beverage Retail

- Food & Beverage Distribution/Transportation

- Food & Beverage Production

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)