Collaborative Robot Market: By Component (Hardware (Robotic Arm and End Of Arm Tool (EOAT) (Welding Guns, Grippers, Others), Robotic Screwdrivers, Sanding and deburring tools, Sensors, Batteries, Motors, Controllers, Others) and Software); Load Carrying Capacity (Less Than 5Kg, 5-9 Kg, 10-20 Kg, and Greater Than 20 KG); Application (Material Handling, Assembling & Disassembling, Welding & Soldering, Palletizing and De-palletizing, Dispensing, Positioning, Testing, Sorting, and Others); Industry (Electronics, Automotive, Manufacturing, Logistics, Food and Beverage, Chemicals, Pharmaceutical, Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 30-Apr-2025 | | Report ID: AA1223711

Market Scenario

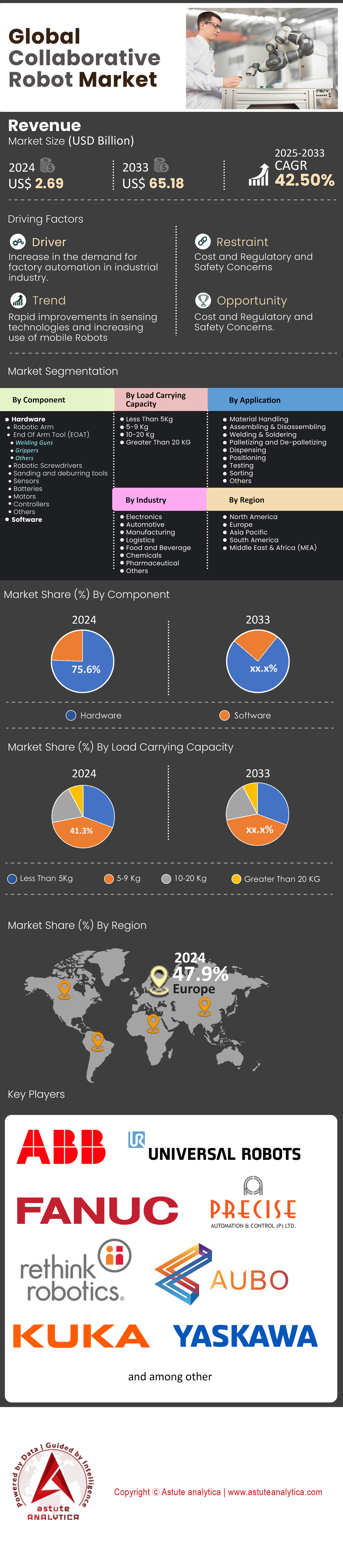

Collaborative robot market was valued at US$ 2.69 billion in 2024 and is projected to hit the market valuation of US$ 65.18 billion by 2033 at a CAGR of 42.50% during the forecast period 2025–2033.

The collaborative robot market is experiencing a paradigm shift as industries increasingly prioritize agility, precision, and human-robot synergy. Demand is surging due to persistent labor shortages—over 75% of manufacturers in the U.S. and EU reported workforce gaps in 2024—coupled with the need for automation that complements, rather than replaces, human workers. Cobots’ ability to handle repetitive tasks like screwdriving (achieving ±0.05mm accuracy) while enabling upskilling for roles like quality control drives adoption in sectors beyond traditional manufacturing. For example, aerospace firms use Doosan’s H-Series cobots for precision drilling in composite materials, reducing error rates by 30%, while pharmaceutical companies deploy Universal Robot’ UR10e for sterile lab workflows, cutting contamination risks. The rise of small-batch, high-mix production—evident in Nike’s use of cobots for customizable shoe assembly—further underscores their role in modern supply chains.

Advancements in AI-driven autonomy and modular design are critical growth accelerators for collaborative robot market. Cobots now integrate real-time environmental perception via Intel’s RealSense cameras, allowing adaptive navigation in chaotic settings like e-commerce warehouses. For instance, Amazon’s Sparrow cobot uses computer vision to handle 75% of warehouse items, up from 40% in 2023. Cybersecurity remains a pain point: 42% of industrial firms reported IoT-based breaches in 2024, prompting ABB to embed zero-trust architectures in its YuMi cobots, while startups like Veo Robotics offer blockchain-secured access controls. Simultaneously, lightweight cobots like Omron’s TM Series (payloads up to 14kg) are penetrating SMEs through Robotics-as-a-Service (RaaS) models, where firms like Formic provide cobots at $10/hour, slashing upfront costs by 60%. Partnerships such as Tesla’s integration of FANUC CRX cobots for battery module assembly highlight the shift toward hybrid ecosystems merging robotics with human expertise.

Market Leadership through Vertical Innovation and Open Ecosystem Evolution

Market leadership in the collaborative robot market hinges on vertical-specific innovation. The top four players—Universal Robot (35% market share), FANUC, Techman Robot, and ABB—dominate through tailored solutions: UR’s ActiNav kit automates bin picking in auto parts, while Techman’s AI+3D vision enables error-free PCB soldering. Emerging players like Elephant Robotics target niche applications, such as lab automation for genome sequencing. The market is diverging into two streams: low-cost cobots (<$25k) for SMEs and AI-enhanced cobots with “cognitive” abilities, like Yaskawa’s HC30XP detecting process anomalies via edge computing. As reshoring boosts demand in North America (40% YoY growth in automotive cobot deployments), vendors are prioritizing open-source SDKs and interoperability with 5G networks. With cobots now handling 15% of global food packaging and projecting to manage 25% of renewable energy component assembly by 2026, their role as enablers of sustainable, decentralized production is cementing long-term relevance.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Increasing Demand for Automation Across Various Industries and Labor Shortage

The collaborative robot market is experiencing a significant upswing, primarily driven by the increasing demand for automation in various industries. This surge is a direct response to the need for higher efficiency, precision, and flexibility in manufacturing processes. Cobots, with their unique ability to work alongside humans, offer an innovative solution by blending the best of automated efficiency and human ingenuity. The automotive sector, known for its stringent quality standards and high-volume production requirements, is one of the primary drivers of this market growth. Here, cobots are employed for tasks ranging from assembly to painting and welding, enhancing both productivity and quality. Similarly, the electronics industry leverages cobots for intricate tasks like circuit board assembly and testing, where precision is paramount.

Another significant driver in the global collaborative robot market is the labor shortage in key industries. Cobots fill this gap by taking over repetitive and labor-intensive tasks, freeing human workers to focus on more complex and creative aspects of production. This not only improves operational efficiency but also addresses worker safety by reducing the likelihood of injuries associated with manual labor. Moreover, the healthcare sector's burgeoning interest in cobots for surgical assistance and rehabilitation therapies underscores their versatility and wide-ranging applicability. This sector's adoption of cobots signifies a broader trend where industries traditionally hesitant to embrace automation are now recognizing the immense potential of these advanced robotic systems.

The push towards Industry 4.0, with its emphasis on smart factories and data-driven decision-making, further propels the cobot market. Cobots, integral to this industrial revolution, are rapidly evolving from mere tools to intelligent collaborators capable of learning and adapting, thus revolutionizing the dynamics of industrial automation.

Trend: Growing Integration of Artificial Intelligence (AI) with Cobots

In the collaborative robot market, growing integration of artificial intelligence (AI) with cobots is leading to the development of more intelligent and adaptive robotic systems capable of learning from their environment and refining their actions accordingly. AI-enabled cobots can analyze vast amounts of data to optimize workflows, predict maintenance needs, and even assist in complex decision-making processes. Apart from this, rapid miniaturization of cobots also witnessing an increased trend in the market. As industries seek more space-efficient solutions, smaller cobots are being developed to fit into tighter workspaces, offering the same level of functionality as their larger counterparts but in a more compact form. This trend is particularly beneficial for small and medium-sized enterprises (SMEs) that might have previously found robotic automation impractical due to space constraints.

Today, the cobot market is also witnessing a shift towards more user-friendly interfaces. The latest cobots come with intuitive programming interfaces, making them accessible to workers without specialized training in robotics. This democratization of technology enables a broader range of industries to adopt cobots, fostering a more inclusive approach to automation. In addition to this, customization and modularity are becoming key aspects as well. Cobots are increasingly being designed to accommodate a range of end-effectors and sensors, allowing for customization based on specific industry needs. This versatility makes cobots a valuable asset across various sectors, from logistics and packaging to agriculture and beyond.

Challenge: High Initial Investment Cost

Despite the rapid growth and promise of collaborative robots, certain restraints are impacting their market expansion. One of the primary challenges is the high initial investment required for cobot deployment in the global collaborative robot market. While the long-term benefits of cobots are clear, the upfront costs for purchase, installation, and integration can be prohibitive for small and medium-sized businesses. This financial barrier limits the widespread adoption of cobots, especially in sectors where budget constraints are a significant concern. The complexity of integration into existing systems poses another challenge. For businesses with established production lines, integrating cobots requires careful planning and often substantial alterations to existing workflows. This process can be time-consuming and resource-intensive, deterring some companies from embracing cobot technology.

Safety concerns, particularly in industries with stringent regulatory standards, also play a role in restraining the collaborative robot market. While cobots are inherently safer than traditional industrial robots, ensuring their safe interaction with humans in a shared workspace remains a critical consideration. Overcoming these safety challenges requires ongoing research and development, as well as stringent adherence to safety protocols and standards.

Segmental Analysis

By Component

In the collaborative robot market, the hardware component leads, holding an impressive 75.6% share. This dominance is attributed to the essential role hardware plays in the functionality of cobots. Components such as sensors, actuators, control units, and end-effectors are critical for the precise and efficient operation of cobots. The robustness and reliability of these hardware components ensure that cobots can perform a wide range of tasks, from delicate assembly to heavy lifting, with remarkable accuracy. The hardware's predominance is also linked to the ongoing advancements in materials and engineering, which have significantly improved the performance and durability of these components. This is crucial in industries like automotive and electronics manufacturing, where precision and reliability are paramount.

On the flip side, the software segment, though currently holding a smaller market share, is projected to grow at an astonishing CAGR of 43.9%. This growth is fueled by the increasing sophistication of cobot software, including machine learning algorithms and advanced analytics. Software upgrades enhance cobots' ability to learn from their environment, make decisions, and interact more seamlessly with human operators. The surge in software development reflects the shift towards more intelligent, adaptable, and user-friendly robotic systems in the collaborative robot market. As industries continue to embrace Industry 4.0, the demand for cobots that can be easily integrated and programmed is rising, driving the rapid growth of the software segment.

By Load Carrying Capacity

Based on load carrying capacity, the 5-9 Kg segment currently holds the lion’s share in the global cobot market, with a 41.3% share. This segment's popularity is largely attributed to its versatility. Cobots in this range are sufficiently powerful to perform a majority of industrial tasks while still being light and agile enough for delicate, precise operations. They strike a balance between strength and flexibility, making them ideal for a wide array of applications, from electronics assembly to material handling. The adaptability of the 5-9 Kg cobots to various industrial environments, without the need for major alterations to existing setups, also contributes to their market dominance. They fit perfectly into the collaborative space where human and robot work in tandem, enhancing productivity without compromising safety.

However, the 10-20 Kg segment is expected to grow at the highest CAGR of 44.6%. This projected growth is indicative of the increasing demand for cobots capable of handling slightly heavier loads, especially in industries like automotive and machinery manufacturing. As these sectors continue to evolve towards more automation, the need for cobots that can carry heavier components without sacrificing precision or efficiency becomes more pronounced.

By Application

Based on application, the material handling segment commands the collaborative robot market with a 34.5% share. This dominance is primarily due to the universal need for efficient material handling across various industries. Cobots designed for material handling can significantly optimize workflows, reduce labor costs, and enhance safety. They are capable of repetitively performing tasks like picking, placing, and packaging with high precision and speed, which is invaluable in sectors like logistics, e-commerce, and manufacturing. Material handling cobots are also highly adaptable, capable of being integrated into different production lines with minimal disruption. This flexibility is a key factor in their widespread adoption. As businesses strive for greater efficiency and reduced turnaround times, the demand for these cobots continues to rise.

The segment's projected growth at a CAGR of 43.5% reflects the increasing importance of automation in material handling. The continuous advancements in cobot technology, such as improved gripping and sensing capabilities, further drive this growth, making them even more indispensable in modern supply chains and production facilities.

By Industry

Automotive industry is the largest end use industry of the collaborative robot market as it controls more than 27.50% market share. Wherein, cobot reliance is now driven by EV and battery demand. Tesla’s Berlin gigafactory uses 800+ UR20 cobots for battery module welding, improving join consistency by 22%. Toyota’s "Karakuri" lean manufacturing integrates Kawasaki duAro2 cobots for just-in-time seat assembly, cutting inventory costs by 18%. Reshoring amplifies adoption: GM’s Indiana plant deployed 300 ABB GoFa cobots, reducing dependency on offshore suppliers by 40%.

Electronics manufacturing is leveraging collaborative robot market for semiconductor resilience. TSMC’s Arizona fab uses Precision Hybrid’s PH-TR4 cobots with 5μm precision for wafer handling, boosting throughput by 200 wafers/day. Apple’s suppliers like Flex deploy TECHMAN TM AI Cobots for iPhone 16 camera calibration, achieving ±0.01° alignment accuracy. Cobot-driven sustainability is a growth lever: Intel reduced e-waste by 12% using recycling cobots with AI-based component disassembly. The rise of “microfactories” in 2024, such as Panasonic’s IoT-driven PCB lines, relies on 9 kg cobots for 24/7 micro-soldering, achieving 0.3ppm defect rates. Additionally, government initiatives like the U.S. CHIPS Act are funneling $200M into cobot-driven semiconductor training centers, bridging the skills gap for 50,000 workers by 2025.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

Europe’s Innovation-Driven Cobot Ecosystem: Precision Manufacturing and SME Adoption

Europe leads the collaborative robot market by generating more than 47.9% of the market revenue due to its deep integration of cobots into high-value manufacturing, driven by Germany’s automotive and industrial machinery sectors. German Mittelstand SMEs, which contribute 52% of the country’s manufacturing GDP, deploy cobots from Universal Robot and KUKA for tasks like precision welding and CNC machine tending, offsetting a 500,000-worker skills gap. France’s aerospace industry uses Stäubli cobots for turbine assembly, while Italy’s food processing giants like Barilla employ cobots for packaging with <0.01mm repeatability. Spain’s renewable energy sector leverages Mobile Industrial Robot (MiR) for solar panel handling. The EU’s €15.4 billion Horizon Europe funding (2023–2027) supports AI-enhanced cobot R&D, with Fraunhofer IPA developing self-adjusting grippers for microelectronics. Demand stems from reshoring incentives, sustainability targets, and labor shortages, particularly in Germany, where 76% of automakers like BMW use cobots to achieve carbon-neutral production by 2030.

Asia-Pacific’s Rapid Industrial Expansion: Scalability and Tech-Driven Manufacturing

Asia-Pacific is the fastest-growing collaborative robot market, fueled by China’s electronics manufacturing and Japan’s aging workforce. China accounts for 43% of global cobot deployments, with Foxconn integrating 12,000+ Doosan cobots for smartphone assembly, reducing defects by 28%. Japan’s collaborative robotics penetration in electronics hit 34% in 2024, driven by Yaskawa’s dual-arm cobots for semiconductor wafer handling. South Korea’s Hyundai Robotics partners with Naver Labs to deploy AI-vision cobots in smart factories, optimizing battery production for EVs. Southeast Asia’s low-cost manufacturing hubs, such as Thailand’s automotive sector, use Techman Robot’s plug-and-play cobots to cut cycle times by 19%. Demand arises from labor cost inflation (+18% in China since 2022), India’s ₹1.8 trillion Production-Linked Incentive (PLI) scheme for automated factories, and ASEAN’s push for Industry 4.0 in textiles.

North America’s Agile Automation: Reshoring and Cross-Industry Flexibility

North America’s collaborative robot market growth is propelled by the U.S. automotive reshoring and Mexico’s nearshoring boom. U.S. manufacturers like Tesla deploy ABB’s YuMi cobots for battery module assembly, reducing human error by 32%, while Amazon’s fulfillment centers use Omron cobots for parcel sorting at 1,200 units/hour. Mexico’s aerospace clusters in Querétaro integrate KUKA’s IIoT-enabled cobots to meet FAA standards, achieving 99.5% compliance rates. Canada’s mining sector uses Kinova cobots for remote ore sampling, cutting safety incidents by 45%. Demand is driven by U.S. reshoring of EV and semiconductor production under the CHIPS Act and Canada’s $3.8 billion Advanced Manufacturing Strategy. Private equity firms, such as Thomas H. Lee Partners, invest in cobot startups like Flexxbotics for CNC interoperability, targeting 25% IRR in small-batch manufacturing. Scalability remains key, with Rethink Robotics’ Sawyer cobots achieving 7-month ROI in Midwest metalworking SMEs.

Top Players in Global Collaborative Robot Market

- ABB

- AUBO Robotics Inc.

- ComauS.p.A.

- DENSO Robotics

- EPSON Robots

- F&P Robotics AG

- Fanuc Corporation

- FrankaEmika GmbH

- KUKA AG

- Precise Automation, Inc.

- Rethink Robotics, Inc.

- Universal Robots A/S

- Yaskawa Electric Corporation

- Other Prominent Players

Market Segmentation Overview:

By Component

- Hardware

- Robotic Arm

- End Of Arm Tool (EOAT)

- Welding Guns

- Grippers

- Others

- Robotic Screwdrivers

- Sanding and deburring tools

- Sensors

- Batteries

- Motors

- Controllers

- Others

- Software

By Load Carrying Capacity

- Less Than 5Kg

- 5-9 Kg

- 10-20 Kg

- Greater Than 20 KG

By Application

- Material Handling

- Assembling & Disassembling

- Welding & Soldering

- Palletizing and De-palletizing

- Dispensing

- Positioning

- Testing

- Sorting

- Others

By Industry

- Electronics

- Automotive

- Manufacturing

- Logistics

- Food and Beverage

- Chemicals

- Pharmaceutical

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2024 | US$ 2.69 Bn |

| Expected Revenue in 2033 | US$ 65.18 Bn |

| Historic Data | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Unit | Value (USD Bn) |

| CAGR | 42.5% |

| Segments covered | By Component, By Load Carrying Capacity, By Application, By Industry, By Region |

| Key Companies | ABB, AUBO Robotics Inc., ComauS.p.A., DENSO Robotics, EPSON Robots, F&P Robotics AG, Fanuc Corporation, FrankaEmika GmbH, KUKA AG, Precise Automation, Inc., Rethink Robotics, Inc., Universal Robots A/S, Yaskawa Electric Corporation, Other Prominent Players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)